CHF: USD/CHF remains under 0.9150 ahead of US GDP data

The Swiss ZEW Survey expecations reading came at 17.6 in the April month from 11.5 in the Previous month. Middle east tensions calm down makes Swiss Franc lower against counter pairs.

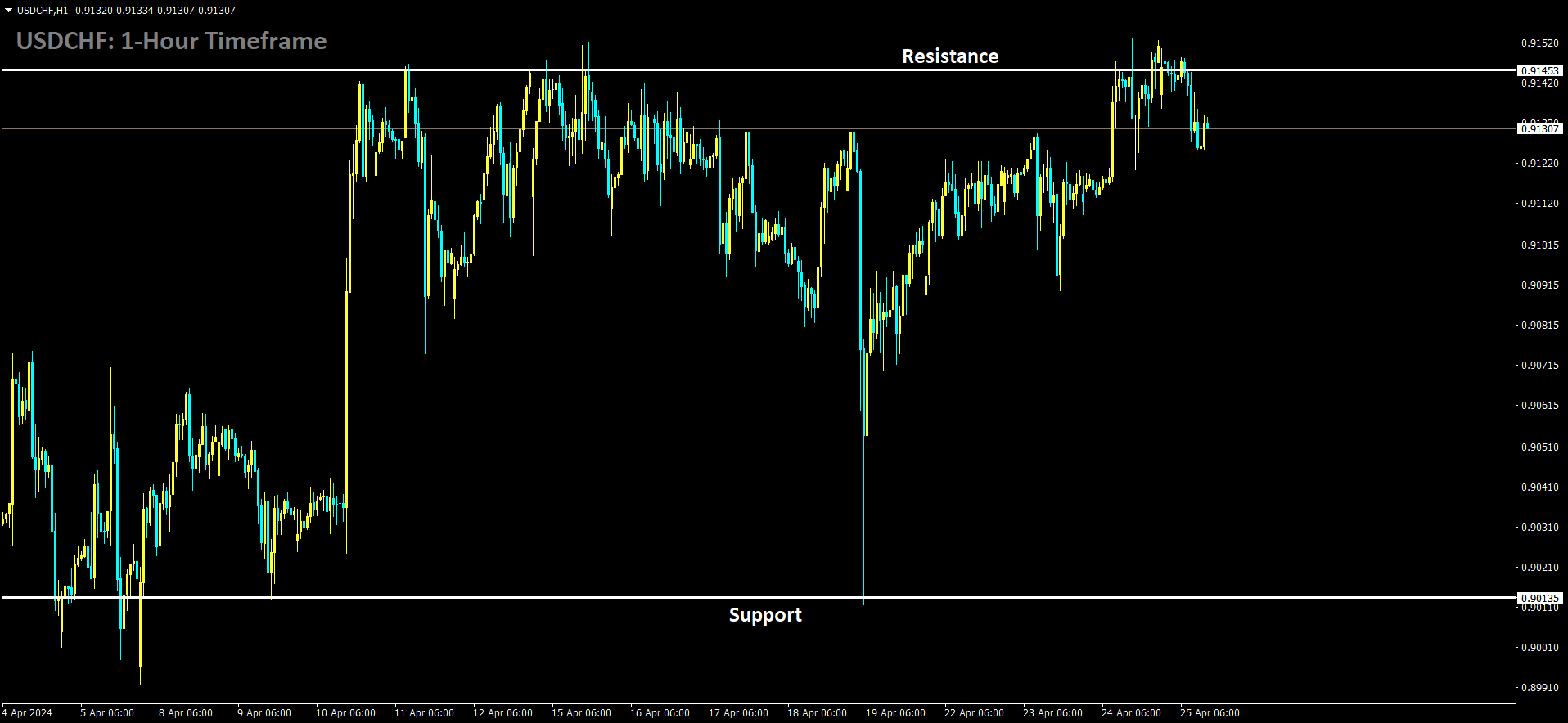

USDCHF is moving in box pattern and market has fallen from the resistance area of the pattern

US Q1 GDP is expected at 2.4% from 3.6% printed in the previous quarter. So US Dollar is moving in the flat against CHF in the market.

During the early European session on Thursday, the USD/CHF pair trades near 0.9145, reflecting a weaker stance. Traders are adopting a cautious approach as they await the release of the US preliminary Gross Domestic Product (GDP) Annualized data for the first quarter (Q1) later in the day. Any developments regarding escalating tensions in the Middle East could potentially boost safe-haven assets like the Swiss Franc (CHF).

The recent stance of the US Federal Reserve (Fed) policymakers, maintaining the current monetary policy, has lent some support to the Greenback in recent weeks. However, uncertainty prevails regarding the timing of any future monetary policy adjustments. The upcoming US GDP growth data for Q1 2024 might provide insights into the performance of the US economy during that period.

Initial estimates suggest that US GDP growth in Q1 is anticipated to be around 2.5% on an annualized basis, compared to the previous reading of 3.4%. A stronger-than-expected GDP figure could lead to speculation that the Fed might delay any potential rate cuts, thereby potentially boosting the US Dollar (USD).

Meanwhile, recent data from the Centre for European Economic Research indicated an improvement in Switzerland’s ZEW Survey Expectations to 17.6 in April from 11.5 in the previous reading. Additionally, ongoing geopolitical tensions in the Middle East may elevate the CHF, considered a traditional safe-haven currency, consequently putting downward pressure on the USD/CHF pair.

CHF: Swiss ZEW Expectations Climb to 17.6 in April 2024

The Swiss ZEW Survey expecations reading came at 17.6 in the April month from 11.5 in the Previous month. Middle east tensions calm down makes Swiss Franc lower against counter pairs.

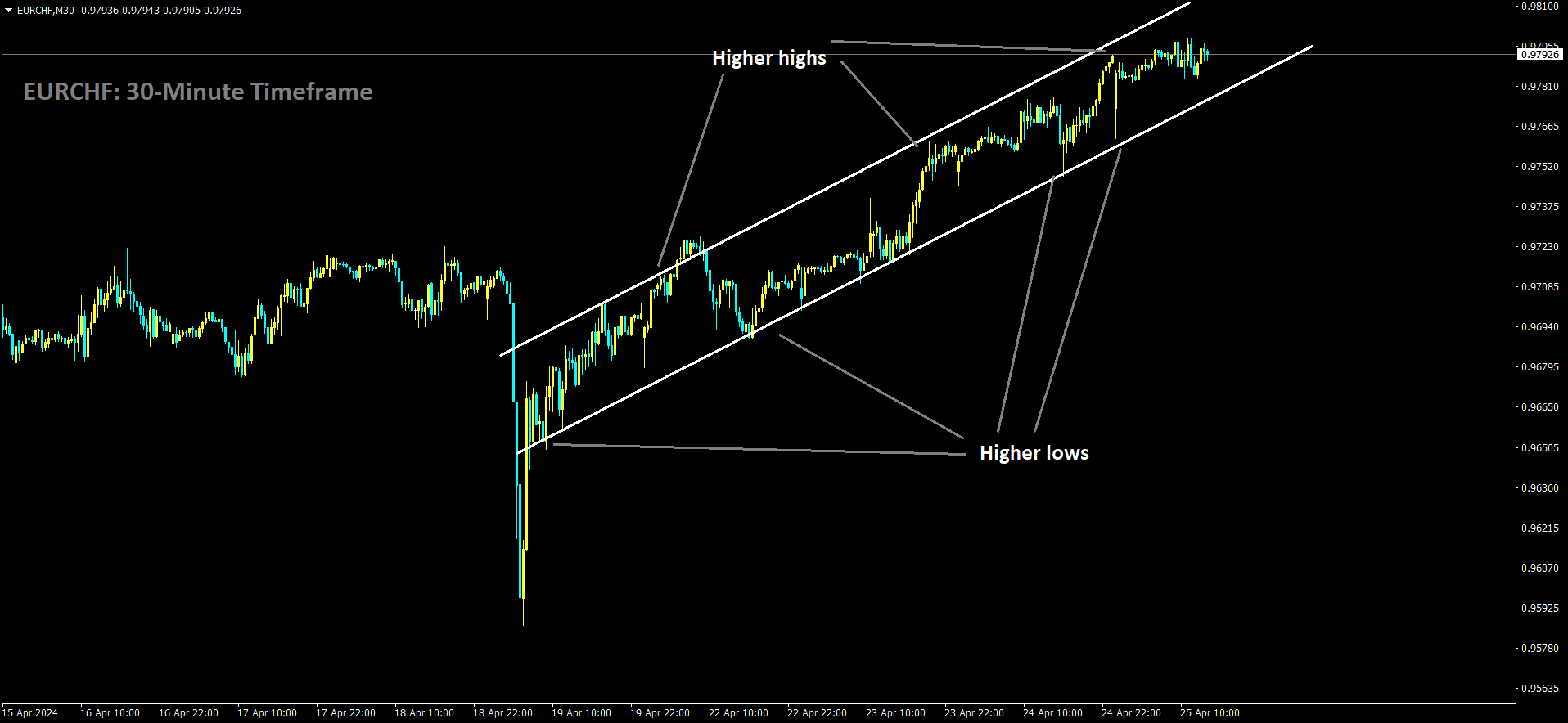

EURCHF is moving in Ascending channel and market has fallen from the higher high area of the channel

US Q1 GDP is expected at 2.4% from 3.6% printed in the previous quarter. So US Dollar is moving in the flat against CHF in the market.

In a significant development for Switzerland’s economic landscape, the ZEW Expectations indicator for the nation surged to 17.6 in April 2024, marking a notable increase from the previous month’s reading of 11.5 in March 2024. The ZEW Expectations survey is closely monitored by investors, policymakers, and analysts alike, serving as a crucial barometer for gauging future economic sentiment and growth trajectories.

The uptick in the ZEW Expectations indicator signifies a growing sense of optimism among financial market experts regarding Switzerland’s economic prospects. This surge in confidence could potentially spur heightened levels of investment and business activities across various sectors within the country, thereby laying the groundwork for sustained economic expansion in the ensuing months.

The latest data update, released on 24th April 2024, underscores the current sentiments and expectations prevailing within Switzerland’s financial markets. With the ZEW Expectations indicator on the rise, it signals a positive momentum for the Swiss economy, instilling hopes for a prosperous and thriving future ahead.

CHF: Switzerland CS-CFA Economic Sentiment Index

The Swiss ZEW Survey expectations reading came at 17.6 in the April month from 11.5 in the Previous month. Middle east tensions calm down makes Swiss Franc lower against counter pairs.

US Q1 GDP is expected at 2.4% from 3.6% printed in the previous quarter. So US Dollar is moving in the flat against CHF in the market.

AUDCHF is moving in Ascending trend line and market has rebounded from the higher low area of the pattern

In April 2024, the Swiss investors’ sentiment index, a measure of confidence in the country’s economic prospects, surged by 6.1 points compared to the previous month, reaching a notable 17.6. This figure represents the most optimistic outlook since September 2021. The heightened confidence in the Swiss economy stems from several factors, including the sustained recovery in export activities and the Swiss National Bank’s surprising move to implement monetary policy easing measures.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% OFFER for Trading Signals 😍 GOING TO END – Get now: https://forexfib.com/offer/