USDCHF – Falls as Swiss GDP Exceeds Expectations

The Swiss Q1 GDP data came at 0.50% Q1 versus 0.30% QoQ expected, beat the estimates. Annualised data came at 0.60% YoY versus 0.50% YoY forecasted. The Swiss Trade Surplus data came at $4316M in the April when compared to March month printed at $3737M. The Swiss Franc gets double treat today after the Positive data came. The Swiss Franc traded higher against counter pairs after beat estimated values.

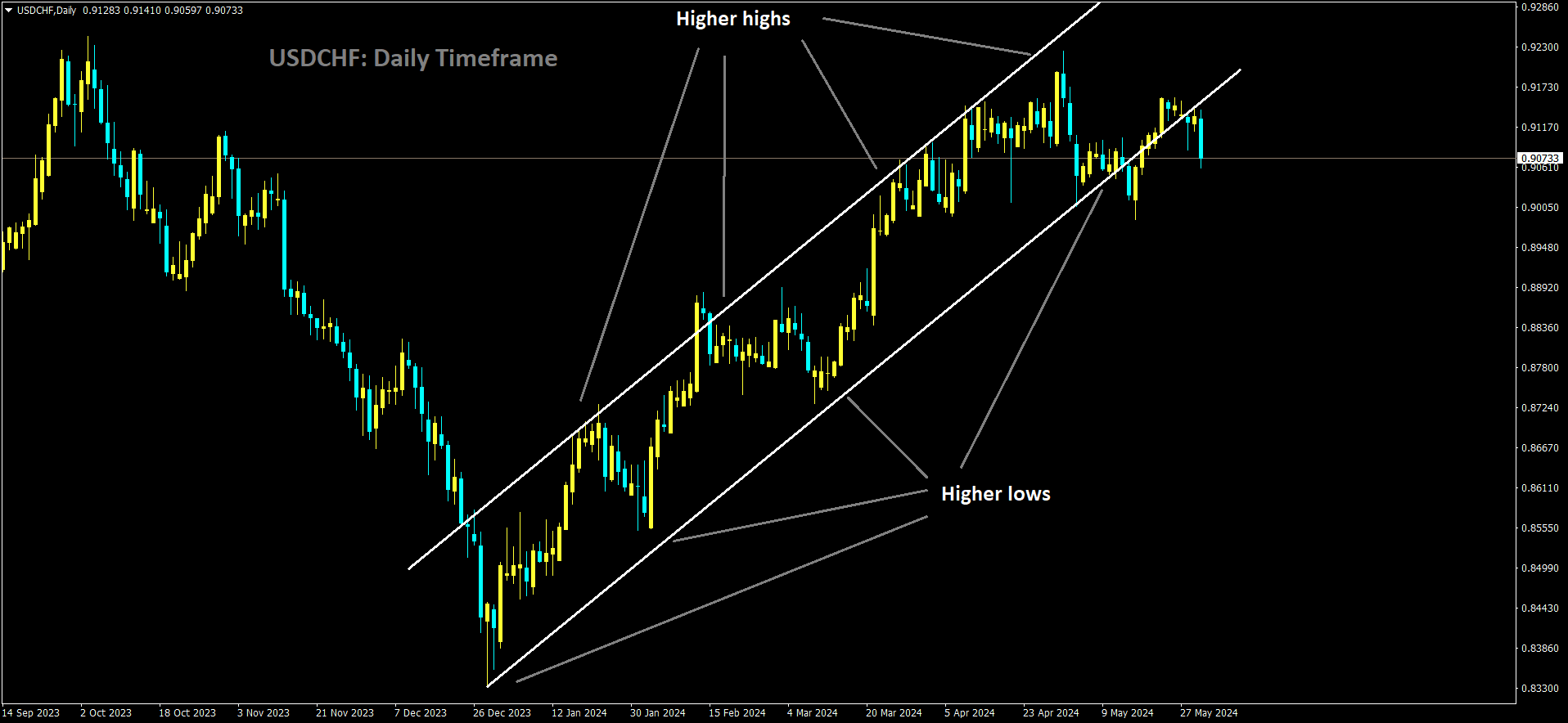

USDCHF is moving in Ascending channel and market has reached higher low area of the channel

This movement was driven by the Swiss Franc (CHF) gaining strength following the release of Switzerland’s Gross Domestic Product (GDP) report for the first quarter (Q1) of 2024, which exceeded expectations. As a result, USD/CHF is currently down by 0.32% for the day.

The State Secretariat for Economic Affairs (SECO) revealed on Thursday that the Swiss economy continued to grow in Q1. Switzerland’s GDP increased by 0.5% quarter-on-quarter (QoQ), surpassing both the forecast and the previous quarter’s 0.3% growth. On a year-on-year (YoY) basis, the GDP rose by 0.6% in Q1, exceeding the market consensus of 0.5%. This positive GDP report has strengthened the CHF, pushing the USD/CHF pair to its weekly lows.

In addition, Switzerland’s trade surplus rose to $4,316 million in April, up from $3,767 million in March, as reported by the Federal Office for Customs and Border Security (FOCBS) on Thursday.

Furthermore, rising geopolitical tensions in the Middle East might bolster safe-haven assets like the CHF. On Wednesday, the BBC reported that Israel’s military had taken control of the Philadelphi Corridor, a crucial buffer zone along the Gaza-Egypt border, thus securing Gaza’s entire land border.

On the US Dollar (USD) side, hawkish remarks from Federal Reserve officials and stronger-than-expected US economic data have led to expectations that the Fed will delay any interest rate cuts this year. On Wednesday, Fed Atlanta President Bostic expressed optimism that the high price pressures seen during the COVID-19 pandemic would diminish over the next year. He also indicated that the Fed still has significant work to do to curb substantial price growth.

According to the CME FedWatch Tool, financial markets now see a 50% chance that the Fed will maintain interest rates in September. This cautious stance by the Fed might support the Greenback and limit the downside for the USD/CHF pair. Investors are now focusing on the second estimate of the US GDP for Q1 2024, expected to show a 1.3% expansion.

Swiss Q1 GDP Grows 0.5%

The Swiss GDP data for the first quarter significantly surpassed expectations, with a quarter-on-quarter increase of 0.5% compared to the anticipated 0.3%. On an annualized basis, the GDP grew by 0.6%, exceeding the forecasted 0.5% year-on-year growth.

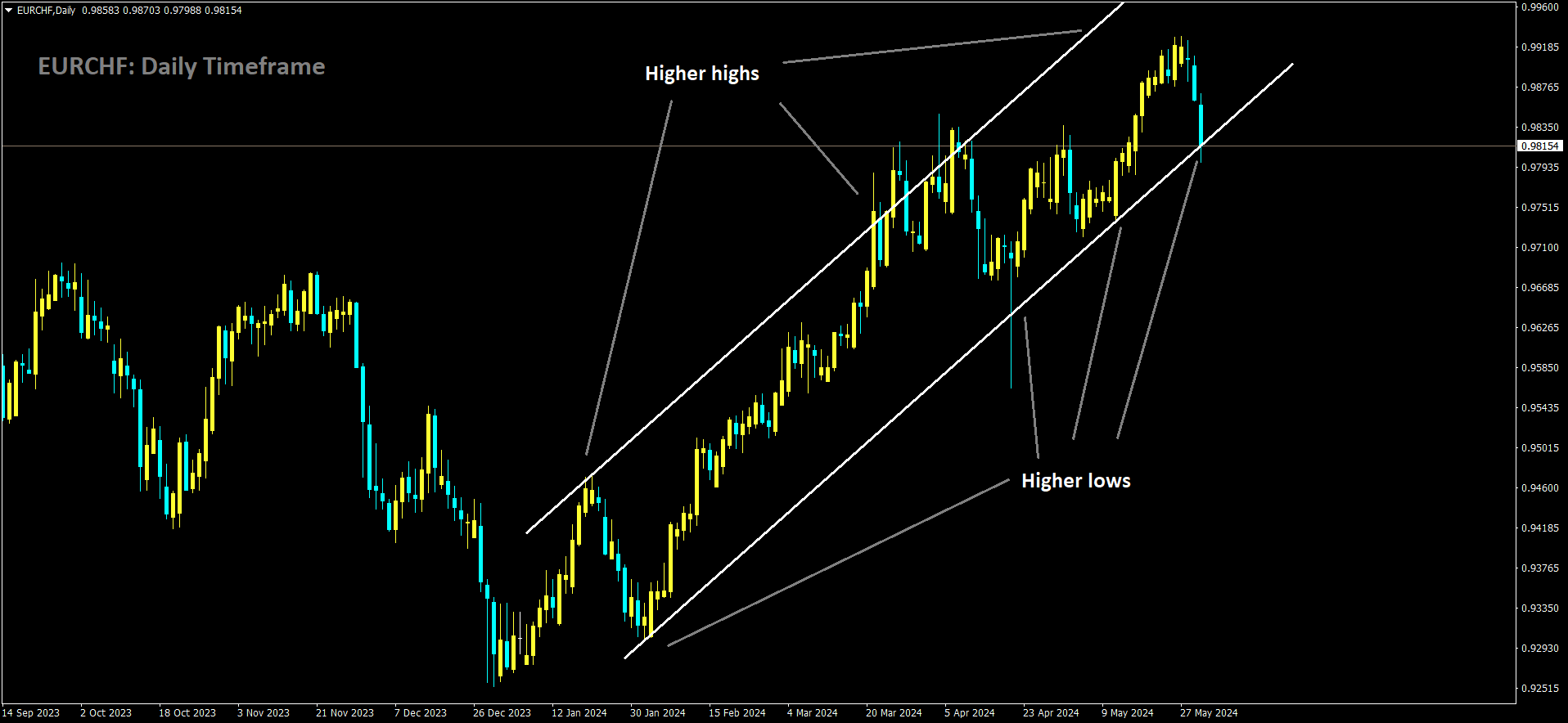

EURCHF is moving in Ascending channel and market has reached higher low area of the channel

Additionally, Switzerland’s trade surplus for April was reported at $4,316 million, a notable rise from the $3,737 million recorded in March. This positive economic data provided a substantial boost to the Swiss Franc, which traded higher against other currencies following these better-than-expected figures.

The Swiss Franc benefited from a “double treat” today, appreciating in value due to both the strong GDP report and the improved trade surplus. This positive momentum led to the Swiss Franc outperforming its counterparts in the forex market.

The Swiss Gross Domestic Product (GDP) for the first quarter rose by 0.5% compared to the previous three-month period, as revealed by the Swiss State Secretariat for Economic Affairs (SECO) in its report on Thursday. Year over year, the GDP increased by 0.6%.

Quarter on quarter, the manufacturing sector dipped by 0.2%, while the construction and trade sectors grew by 0.3% and 1.3%, respectively. On an annual basis, manufacturing saw a 4% decline, construction fell by 0.7%, and trade experienced a growth of 2.5%.

The report highlighted that private consumption grew solidly by 0.4%, driven mainly by spending on food, non-food items, housing, and health care, reflecting the positive performance in retail. General government consumption also saw a slight increase of 0.2%.

Swiss Growth Steady on Strong Services and Consumer Spending

Switzerland’s first-quarter GDP growth was 0.5% QoQ, surpassing the expected 0.3%. Annually, GDP increased by 0.6%, beating the forecast of 0.5% YoY. Additionally, the trade surplus in April rose to $4,316 million from $3,737 million in March.

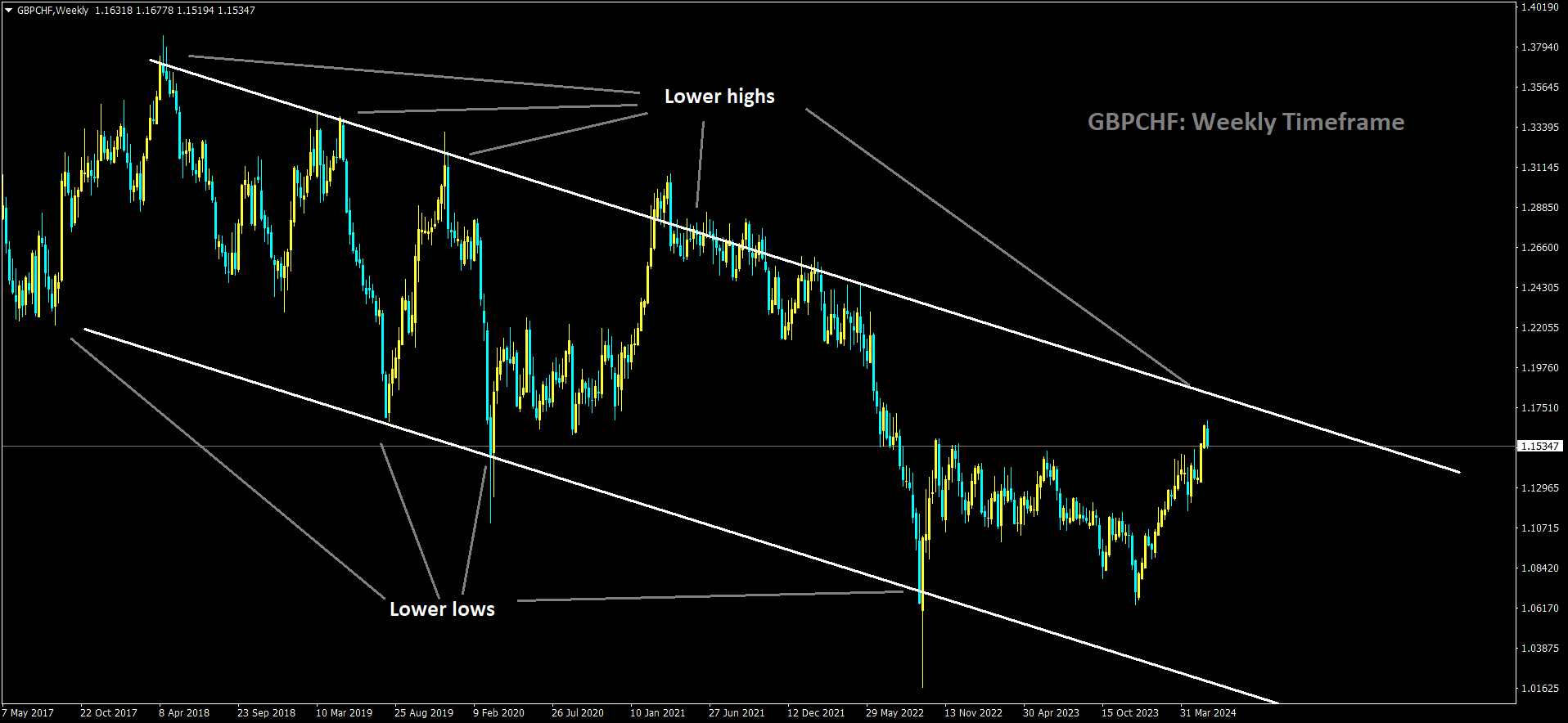

GBPCHF is moving in Descending channel and market has reached lower high area of the channel

These positive economic reports boosted the Swiss Franc, which traded higher against other currencies. The strong GDP and trade surplus data provided a significant uplift for the Swiss Franc in the forex market.

Switzerland’s economy unexpectedly maintained momentum at the start of the year, driven by strong performance in services and private consumption, while concerns about struggling exporters persist.

According to the State Secretariat for Economic Affairs (SECO) on Thursday, the gross domestic product (GDP), adjusted for large sports events, increased by 0.3% compared to the previous quarter. This figure is stronger than the government’s initial estimate of 0.2% and aligns with the median forecast from a Bloomberg survey.

SECO’s statement highlighted that “value added in manufacturing fell slightly in the first quarter, and the chemical and pharmaceutical industry continued the weak performance of recent quarters.” The services sector was the main driver of GDP growth during this period.

Private consumption expanded by 0.4%. However, a 3.3% drop in goods exports overshadowed the rise in services exports, leading to a “negative contribution” from trade.

While exports are currently a drag on Swiss industry, low unemployment rates are bolstering consumption, particularly in the services sector. Although the manufacturing purchasing managers index has been below the growth threshold for more than a year, there are slight improvements in expectations.

Exports might also benefit from the exchange rate, as the Swiss franc has been declining against the euro since the start of the year. The Swiss National Bank (SNB), which was the first Group-of-10 central bank to cut interest rates, may further influence the currency’s value.

The SNB, expected to lower borrowing costs again in their next meeting on June 20, has warned that growth will likely “remain modest” in the coming quarters and predicts the economy will expand by about 1% this year.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% OFFER for Trading Signals 😍 GOING TO END – Get now: https://forexfib.com/offer/