GOLD Analysis:

XAUUSD is moving in Ascending channel and market has reached higher low area of the channel

The analysis of gold indicates a rebound in U.S. Treasury yields, which followed remarks by San Francisco Federal Reserve President Mary Daly. Daly emphasized the premature nature of declaring victory against inflation and considering a reduction in borrowing costs for policymakers. This rebound in yields had far-reaching effects, including a strengthening of the U.S. dollar and exerting downward pressure on technology stocks and non-yielding assets. Notably, the Nasdaq 100 saw its second consecutive day of decline, and gold prices stalled at technical resistance.

Given the potential for increased volatility in the coming days, particularly with Federal Reserve Chair Powell’s scheduled fireside chat at Spelman College in Atlanta, Georgia, on Friday, traders are advised to closely monitor his statements. Powell’s remarks, in light of recent mixed signals from the central bank, carry significant weight and could shape market dynamics.

The potential scenarios include a hawkish stance from Powell, expressing support for prolonged higher interest rates. Such a stance might put upward pressure on U.S. yields, aiding the ongoing recovery of the U.S. dollar and adversely affecting gold prices and the Nasdaq 100. Conversely, a dovish outcome, marked by a lack of strong resistance against a dovish monetary policy outlook, could signal a potential policy shift and favor bullion and tech stocks.

To prevent a further easing of financial conditions, Powell may adopt a firm stance, pledging to maintain the current course and uphold a restrictive monetary policy for an extended duration. Such a position could disrupt the positive momentum observed in the equity market and precious metals complex in recent weeks.

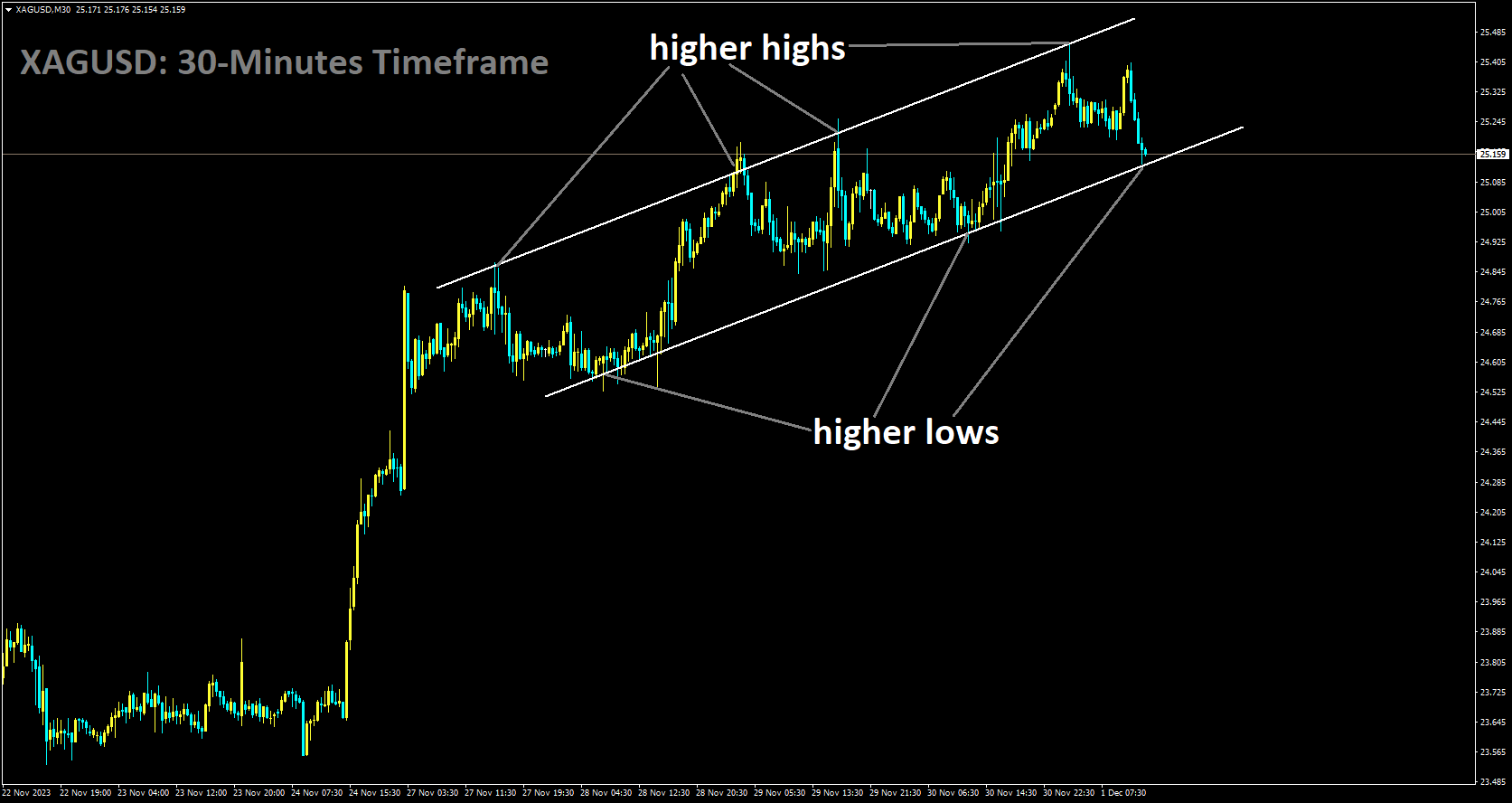

SILVER Analysis:

XAGUSD is moving in Ascending channel and market has reached higher low area of the channel

The analysis of silver focuses on the month of October, where the Core Personal Consumption Expenditures prices exhibited a deceleration in month-over-month growth. This marked a departure from the previous two months, which saw 0.4% increases. The October figure, aligning with expectations at 0.2%, represented the weakest reading since July 2022. The PCE price index showed an increase of less than 0.1%, while the index excluding food and energy rose by 0.2%. Annual growth rates eased to 3%, in line with forecasts, and core PCE inflation slowed to 3.5%, marking a new low since mid-2021.

The rise in current-dollar personal income for October was driven by increases in personal income receipts related to assets and compensation, partially offset by a decrease in personal current transfer receipts. Despite a robust labor market and services inflation, recent data consistently suggests a deceleration in the United States. Market participants are increasingly speculating on potential rate cuts in 2024, and the upcoming Non-Farm Payrolls (NFP) report holds significance in reinforcing the Federal Reserve’s stance heading into the December meeting.

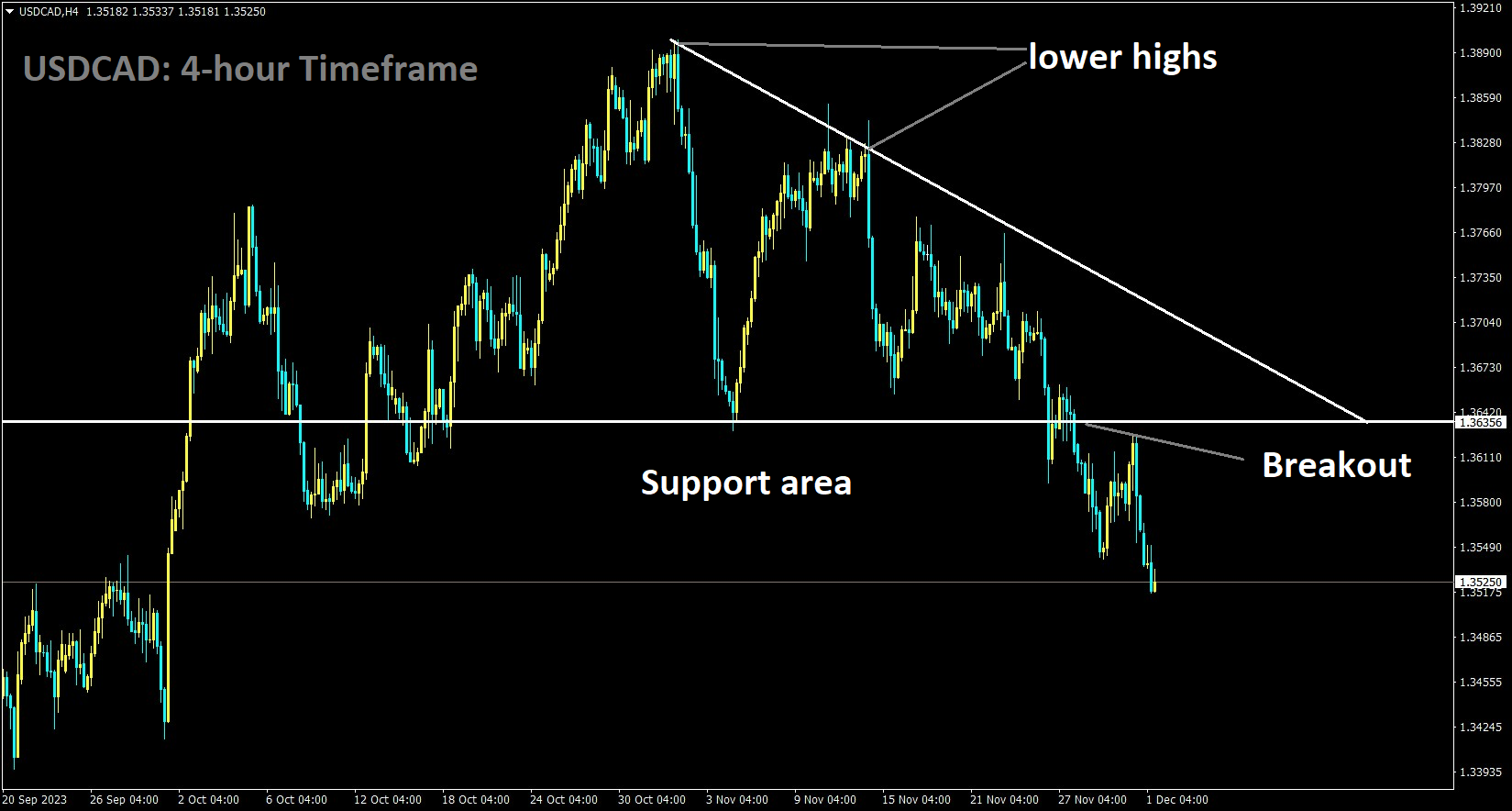

USDCAD Analysis:

USDCAD has broken the Descending triangle pattern in downside

The analysis of the USDCAD pair revolves around the Canadian Dollar’s boost from anticipated Crude Oil price increases. This boost is driven by additional OPEC production cuts extending into the first quarter of 2024. Currently, the Canadian Dollar stands out as the best-performing major currency, gaining against all its major counterparts. Canadian Gross Domestic Product (GDP) data presents a mix of positive and near-term indicators, while Crude Oil support adds strength to the fossil-fueled Loonie.

OPEC’s unanimous decision to implement further production cuts is expected to extend through the first quarter of 2024. Despite the positive aspects, the Canadian GDP figures for September exhibited a mixed performance. While the month-on-month increase surpassed expectations at 0.1%, the year-on-year figure reported a significant contraction of -1.1%, falling well below the market’s median forecast of 0.2% year-on-year growth. However, the previous period’s figure underwent a notable upward revision from -0.2% to 1.4%. Anticipated gains in Crude Oil prices due to supply cuts may be constrained by ample spare capacity in global energy demand. Attention now turns to Canadian labor data, particularly the Canadian Unemployment Rate, which is forecasted to see a slight uptick from 5.7% to 5.8% in November.

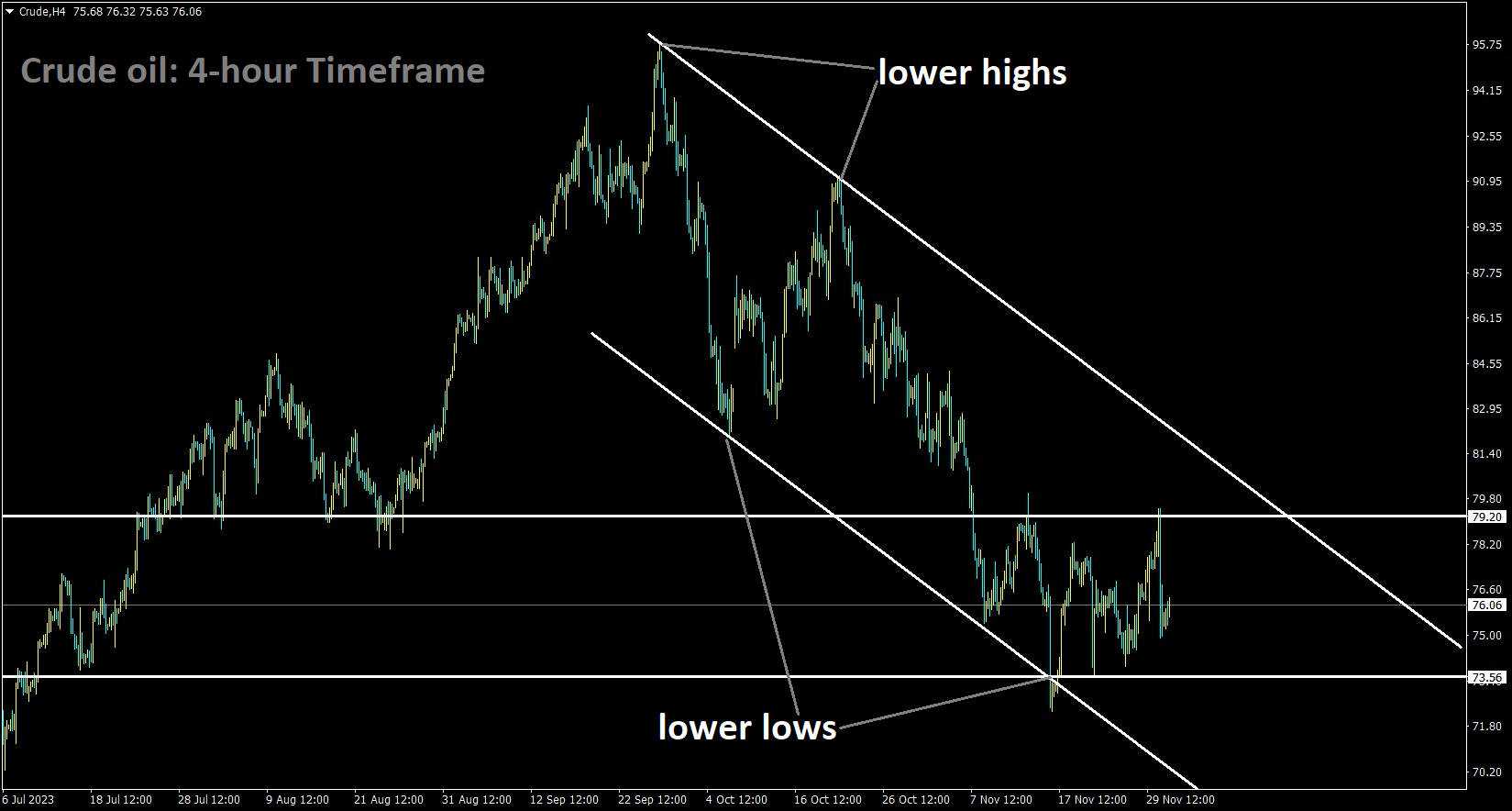

Crude Oil Analysis:

Crude Oil is moving in the Descending channel and the market has rebounded from the lower low area of the channel

The Crude Oil analysis delves into the recent surge in oil prices, nearly reaching the significant $80 per barrel threshold. This surge was observed in the morning but had an unexpected outcome following the OPEC+ meeting aimed at propelling prices above $80. The meeting faced challenges and conflicting perspectives, keeping the market on edge for a potential announcement on production cuts.

Ultimately, OPEC+ members agreed to implement voluntary cuts of approximately 2 million barrels per day for the first quarter of the following year. Saudi Arabia extended its voluntary output cuts, and members, including Saudi Arabia, Kuwait, Russia, Algeria, and Kazakhstan, agreed to gradually unwind the cuts after the first quarter of 2024. This surprising development included an invitation for Brazil to join the OPEC+ group, with the Brazilian Energy Minister expressing hope to join by January.

Adding to concerns, Energy Information Administration (EIA) data for September indicated a decline in Crude and Petroleum products supply to 20.09 million barrels per day, the lowest since April. This data raises worries about a potential global economic slowdown in 2024. Attention now turns to upcoming US data, which could impact oil prices. The decline observed today may be attributed, in part, to a strengthening US Dollar and rising US yields, influencing risk appetite. Tomorrow’s agenda includes manufacturing PMI data and speeches by Federal Reserve policymakers, with today’s hawkish tone possibly contributing to the rise in the US Dollar.

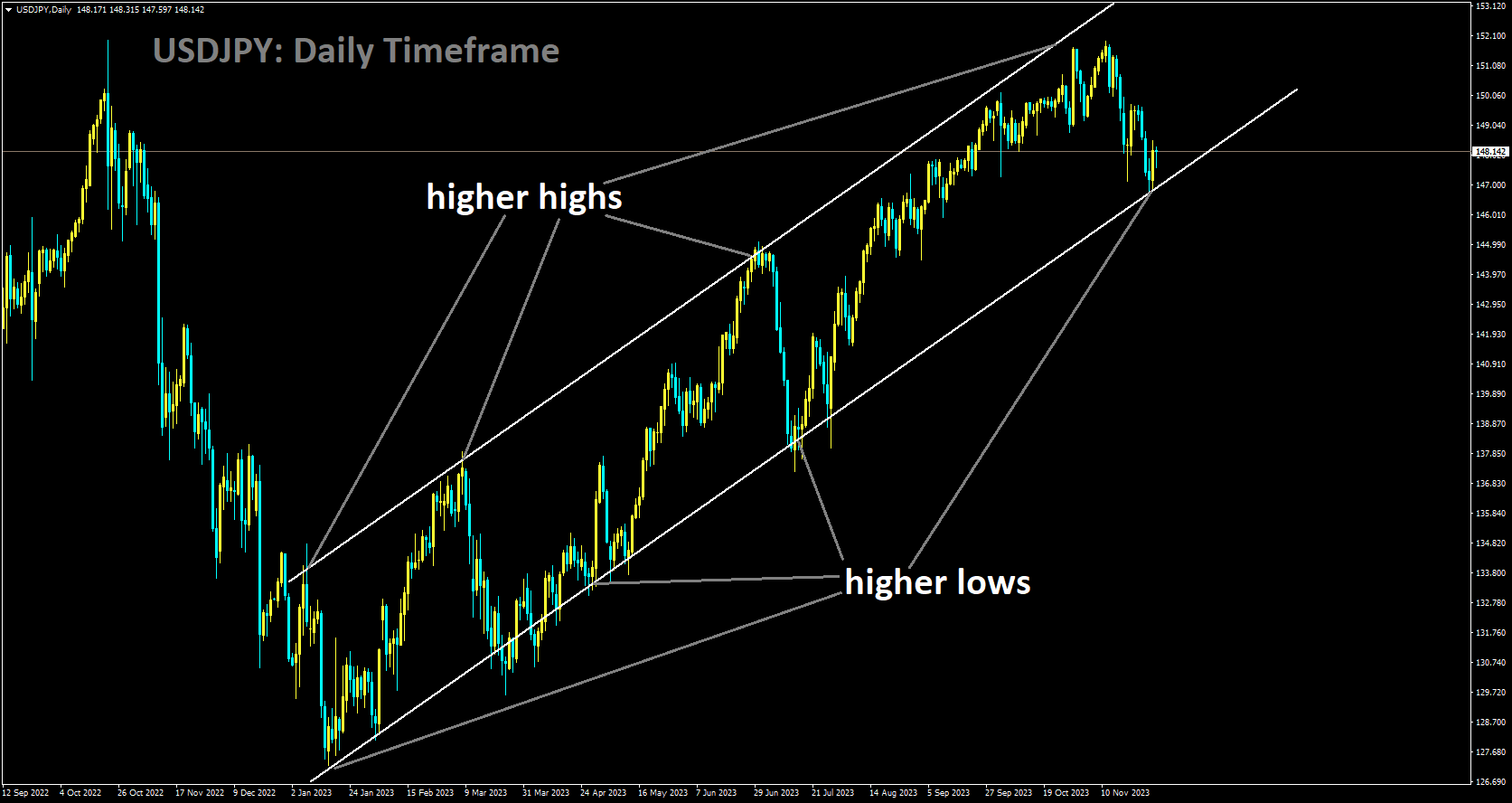

USDJPY Analysis:

USDJPY is moving in Ascending channel and market has reached higher low area of the channel

The analysis of USDJPY focuses on the slight decline experienced by the Japanese Yen against the United States Dollar on Thursday. This decline was attributed to recent statements from a Bank of Japan official, undermining the potential for a tighter Japanese monetary policy. The foreign exchange market had cautiously favored the outlook for both currencies since mid-November, anticipating lower US interest rates and a possible easing of Japan’s loose monetary policy.

Bank of Japan monetary policy board member Seiji Adachi explicitly stated that Japan’s economy had not reached a stage where a departure from current policy settings could be considered. He emphasized the need to patiently continue with monetary easing for the time being. Adachi’s comments have introduced uncertainty about the BoJ’s intentions, and caution is advised as the next monetary policy decisions from the Federal Reserve and the Bank of Japan approach in December.

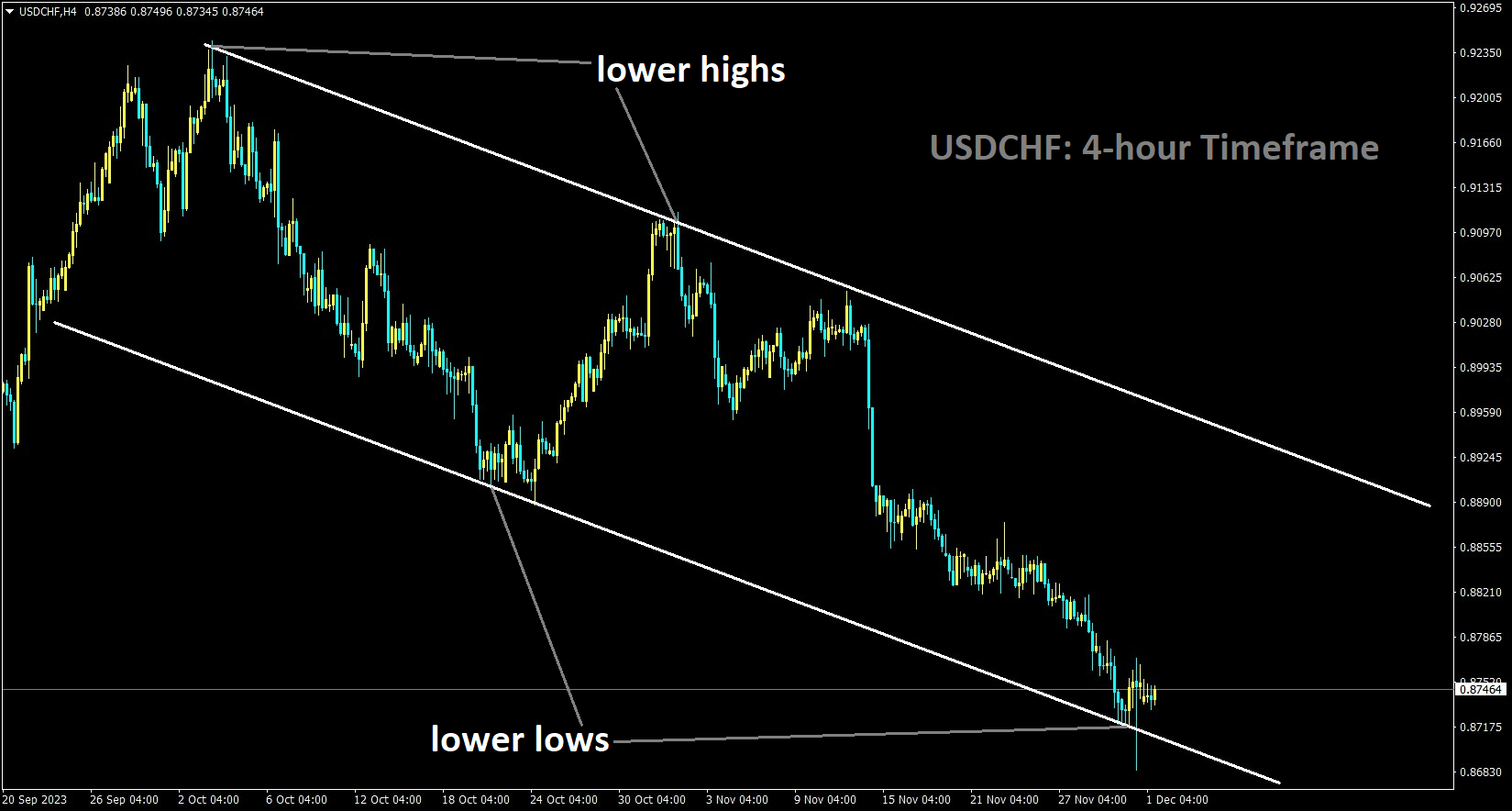

USDCHF Analysis:

USDCHF is moving in the Descending channel and the market has reached the lower low area of the channel

The analysis of the USDCHF pair emphasizes the downward pressure faced by the pair as the US Dollar weakens. This weakening is driven by the likelihood of the US Federal Reserve ending its interest rate hike. Swiss Real Retail Sales reported a decline of 0.1% in October, falling short of the expected 0.2% growth, contributing to pressure on the Swiss Franc.

Market attention now turns to Gross Domestic Product data scheduled for today. Despite this, Swiss National Bank Chairman Thomas Jordan has acknowledged the potential for future interest rate hikes, providing support for the CHF. The US Dollar Index encounters challenges as US Bond yields react modestly, offsetting recent gains. Mixed US data may have contributed to the Greenback’s recent resilience. Investors await the release of the US ISM Manufacturing PMI for November and the speech by US Federal Reserve Chairman Jerome Powell, events poised to influence market dynamics and impact the trajectory of the US Dollar.

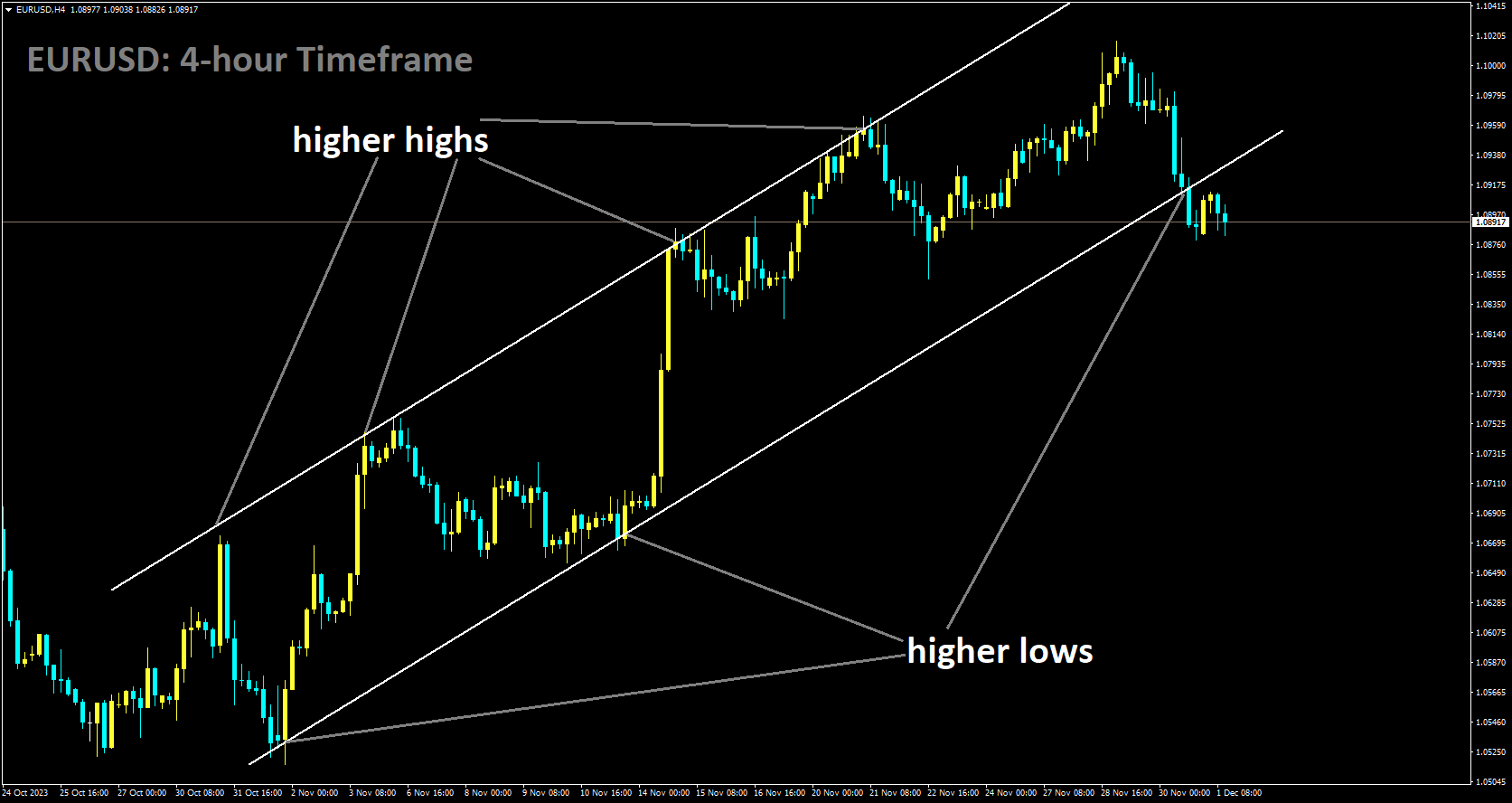

EURUSD Analysis:

EURUSD is moving in Ascending channel and market has reached higher low area of the channel

The analysis of EURUSD delves into the Euro Area’s inflation trends, indicating a descent from October’s figures. Core inflation declined by 0.6%, settling at 3.6%, while headline inflation dropped by 0.5%, reaching 2.4%. Both figures fell below market expectations, reinforcing the growing sentiment that the European Central Bank is likely to implement rate cuts sooner than initially anticipated. The latest projections for ECB rates indicate the possibility of a 25 basis point rate cut at the April meeting, with a total of 115 basis points of cuts priced in for the year 2024.

GBPUSD Analysis:

GBPUSD is moving in an Ascending channel and the market has fallen from the higher high area of the channel

The analysis of GBPUSD focuses on the significant impact of the US dollar on the British pound. Investors are adopting a less hawkish stance towards the Federal Reserve’s interest rate trajectory, influenced by recent weaker economic data in the United States and dovish commentary from the Fed. Despite an unexpected positive surprise in the second estimate of US GDP during yesterday’s trading session, the market continues to hold a bearish stance on the USD.

This persistent sentiment follows the Fed Beige Book’s revelation of slowing economic growth and indications of softened prices, trends expected to extend through the year 2024.

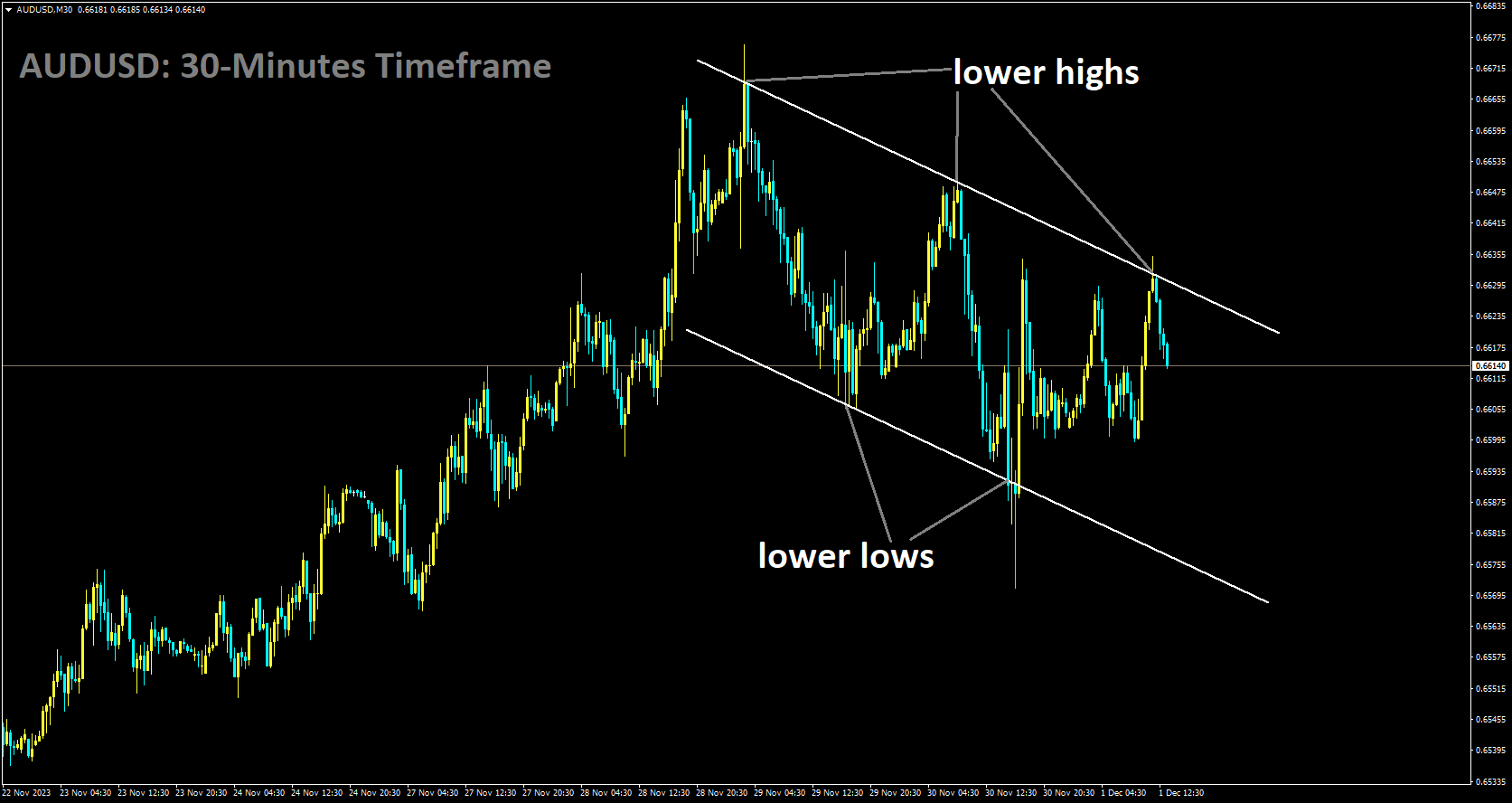

AUDUSD Analysis:

AUDUSD is moving in Descending channel and market has fallen from the lower high area of the channel

The analysis of AUDUSD centers around the Australian Manufacturing Purchasing Managers’ Index for November. The index experienced its ninth consecutive monthly decline, dropping to 47.7 from October’s official reading of 48.2. Both orderbook volumes and manufacturing production levels faced a twelfth consecutive month of decline, and a lack of capacity pressure resulted in sector employment decreasing for the first time in three years.

According to Warren Hogan, Chief Economic Advisor at Judo Bank, the Australian Manufacturing PMI recorded its lowest reading in the survey’s 8-year history outside of lockdown periods. The PMI fell below 48, indicative of an index level broadly associated with a soft landing for the manufacturing sector and the wider economy.

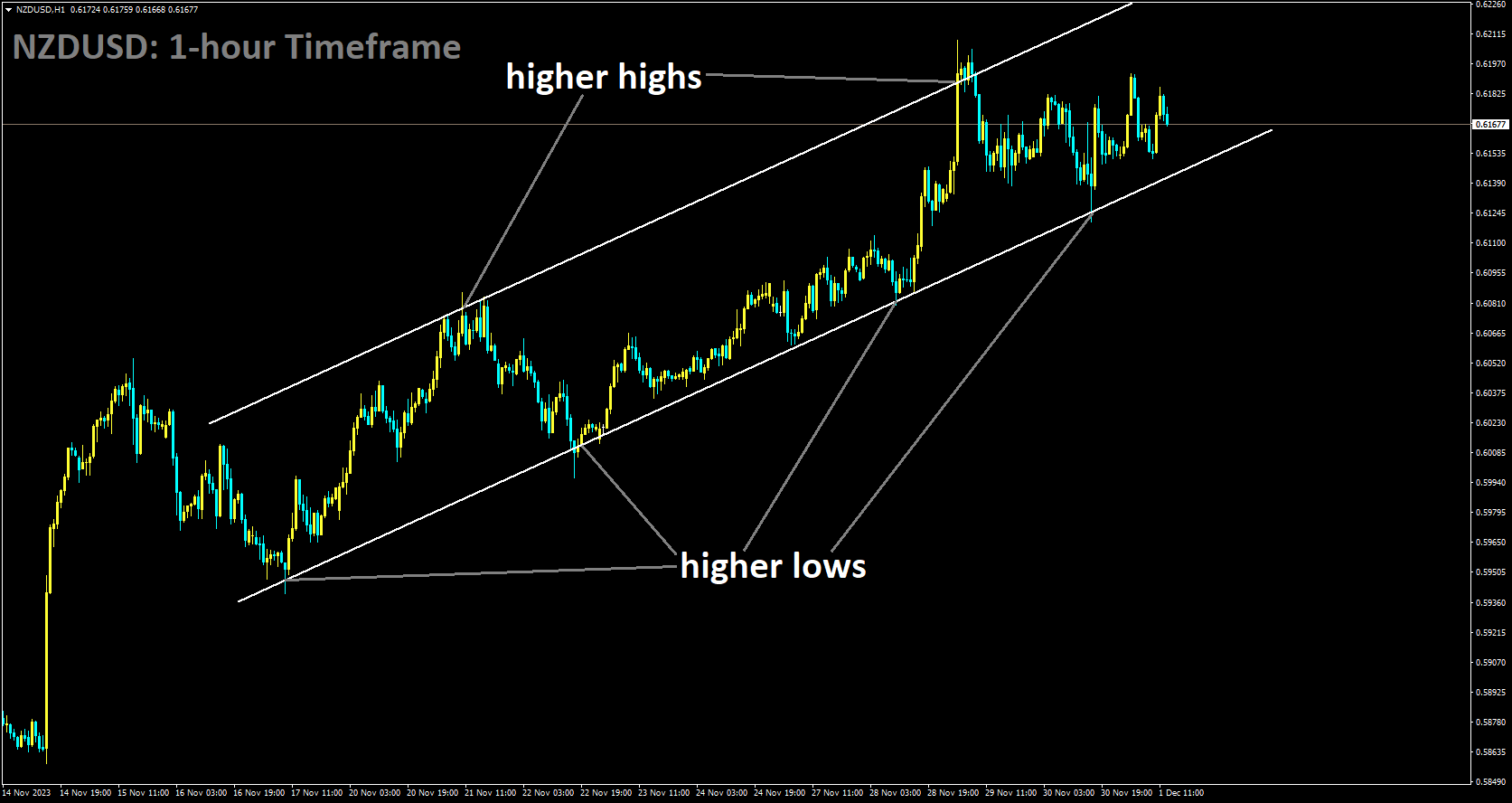

NZDUSD Analysis:

NZDUSD is moving Ascending channel and market has rebounded from the higher low area of the channel

The analysis of NZDUSD focuses on remarks by Deputy Governor Christian Hawkesby of the Reserve Bank of New Zealand. He emphasized the challenges posed by high and persistent core inflation, underscoring the limited margin for error.

The significance of taking seriously the uptick in certain inflation expectation measures and stressed the necessity for New Zealand to undergo a period of highly restrained spending. Additionally, he noted that the vast majority of borrowers are currently capable of servicing their debt at the prevailing interest rate levels.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% FLAT OFFER for Signals 😍 GOING TO END – Get now: forexfib.com/discount/