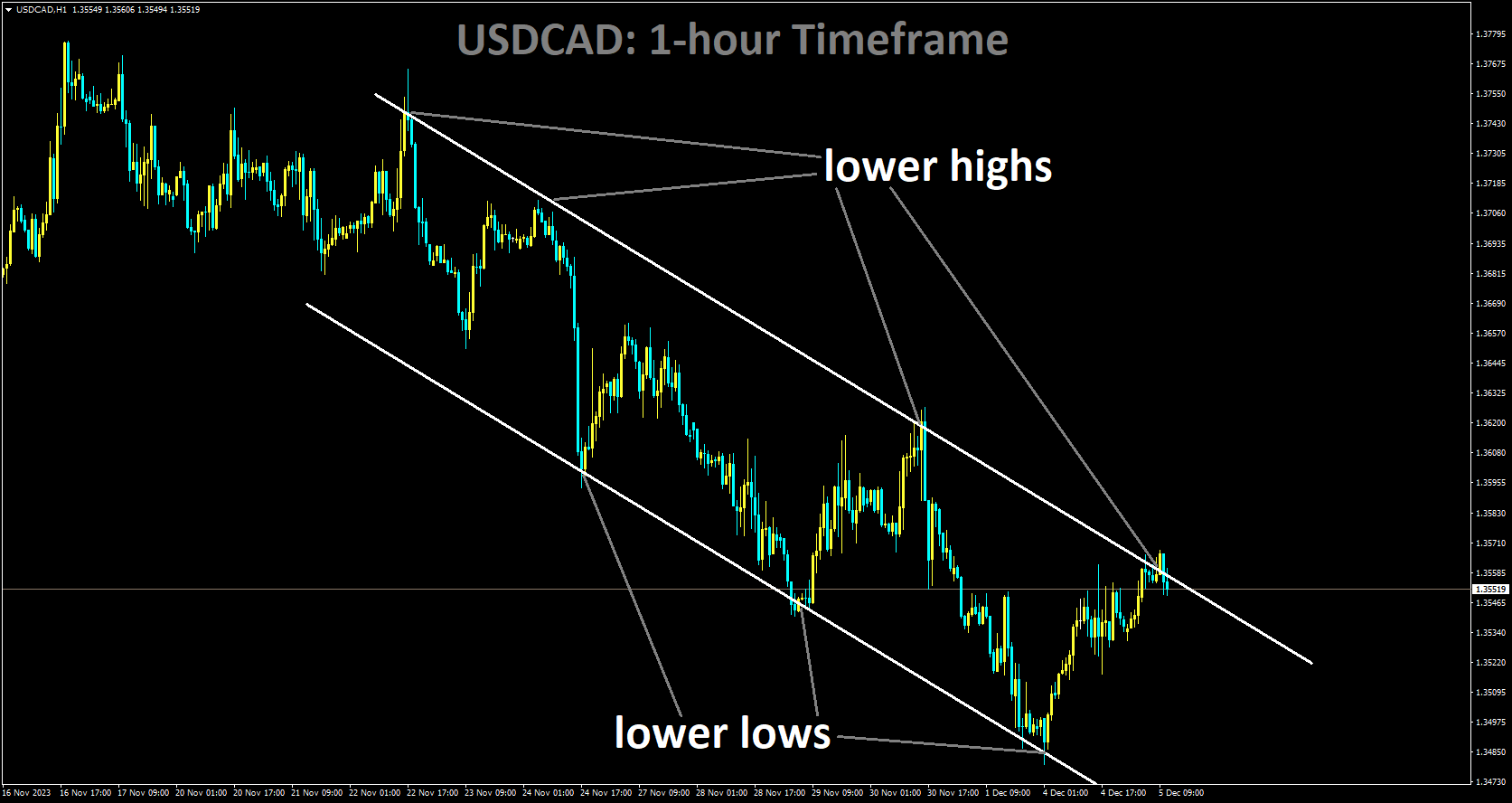

USDCAD Analysis:

USDCAD is moving in Descending channel and market has reached lower high area of the channel

The upward momentum of the Canadian dollar appears to be losing steam as a pivotal week unfolds with significant economic data releases for both Canada and the US. The US Dollar, buoyed by safe-haven demand amidst the Israel-Hamas conflict and a negative market response to the recent OPEC+ decision, has impacted crude oil prices, subsequently influencing the Canadian dollar.

Anticipation builds for the Bank of Canada’s interest rate decision later in the week, with money markets signaling an 88% probability of a rate pause. Recent Canadian economic indicators, including subdued growth, slightly higher unemployment, and weaker manufacturing PMI, paint a less favorable domestic outlook for the Canadian dollar. The week ahead is anticipated to be predominantly influenced by US factors, with a short-term focus on the ISM service PMI, and the outcome of these events could shape the direction of the USDCAD pair.

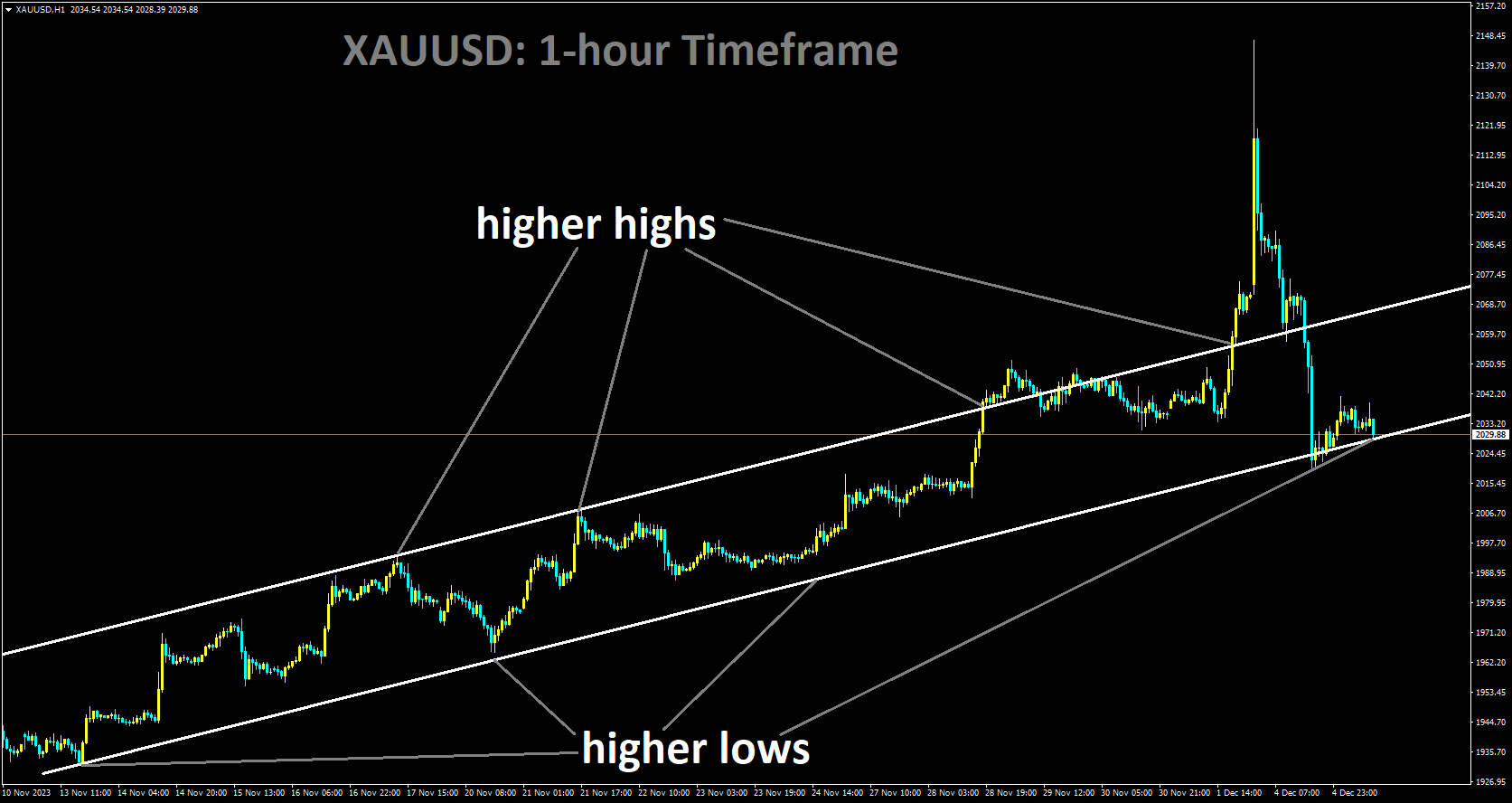

GOLD Analysis:

XAUUSD is moving in Ascending channel and market has reached higher low area of the channel

Gold prices experienced a notable surge, reaching unprecedented all-time highs as markets opened. This surge was attributed to escalating geopolitical tensions following the resumption of conflict between Israel and Hamas, despite a ceasefire just a week prior. Initially supported by the safe-haven appeal of gold, its value surpassed the $2100 mark. However, in the subsequent days, a retracement occurred, even in the face of a stronger US dollar.

The most recent weekly gold forecast indicates an implied path of Federal Reserve (Fed) funds futures aligning with expectations of cumulative interest rate cuts totaling around 125 basis points by December 2024. While US real yields are on an upward trend in line with Treasury yields, theoretically diminishing gold’s attractiveness due to an increased opportunity cost, the prevailing factor remains the demand for a safe haven.

The trajectory of gold prices is expected to be influenced by developments in Gaza and the upcoming economic indicators, particularly the ISM Services PMI and Non-Farm Payrolls (NFP). Analysts anticipate the potential for upside surprises in these economic metrics, which, if realized, could exert downward pressure on gold prices.

SILVER Analysis:

XAGUSD is moving in Ascending channel and market has reached higher low area of the channel

The US Dollar exhibited strength at the commencement of the trading week, benefiting from safe-haven flows and rising US Treasury bond yields. Despite a nearly 0.5% gain in the USD Index on Monday, it stabilized above 103.50 early Tuesday. Market sentiment turned risk-averse, leading to significant declines in major stock indexes and US stock index futures, reflecting concerns about the Israel-Hamas crisis potentially expanding into a broader conflict.

Investor attention is now directed towards key economic indicators, notably the JOLTS Job Openings data for October and the ISM’s Services PMI survey for November, as they seek insights into the future direction of silver prices.

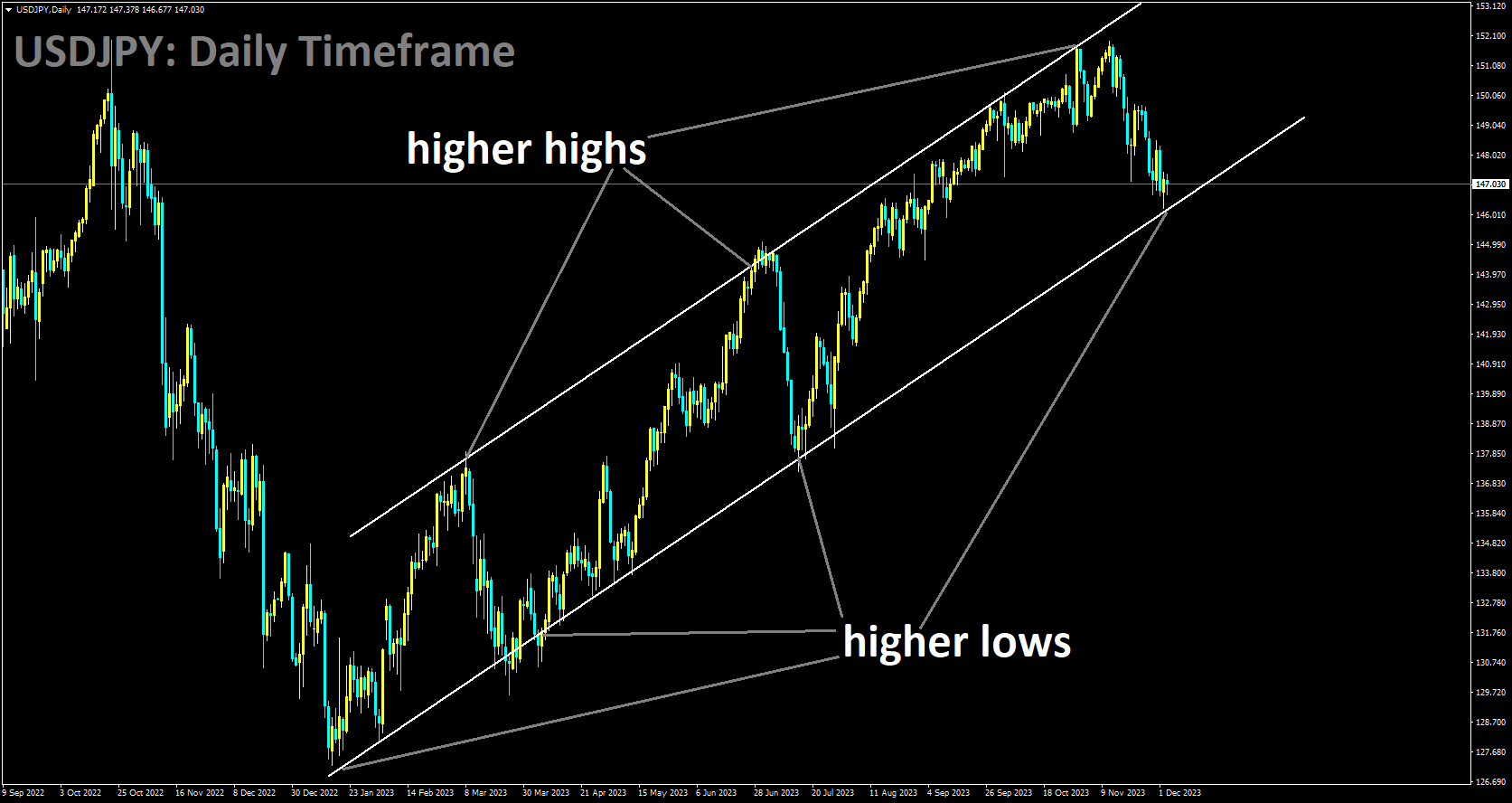

USDJPY Analysis:

USDJPY is moving in Ascending channel and market has reached higher low area of the channel

The Japanese Yen is staging a recovery against the US Dollar in the early European session on Tuesday. Global risk sentiment took a hit following an attack on US vessels in the Red Sea, raising concerns about a broader conflict in the Middle East. Additionally, a darkening global outlook and deteriorating economic conditions in China have dampened investors’ interest in riskier assets, benefiting traditional safe-haven currencies like the JPY.

Contrastingly, the USD is struggling to capitalize on its overnight rise to a one-week high, fueled by growing consensus that the Federal Reserve has concluded its interest rate hikes and may initiate policy easing as early as March 2024. This dovish outlook is contributing to a decline in US Treasury bond yields, acting as a headwind for the Greenback. Despite speculation about a potential shift in policy stance by the Bank of Japan, its board members downplayed such expectations last week, affirming the continuation of the negative interest rate regime.

Data released on a Tuesday revealed a more significant easing of consumer inflation in Tokyo, Japan’s capital city, for November than initially anticipated. While this may temper bullish sentiments for the JPY, it could also help limit losses for the USDJPY pair. Traders are now turning their attention to the US economic calendar, including the release of the ISM Services PMI and JOLTS Job Openings data, for potential market movements. However, the primary focus remains on the upcoming NFP report on Friday.

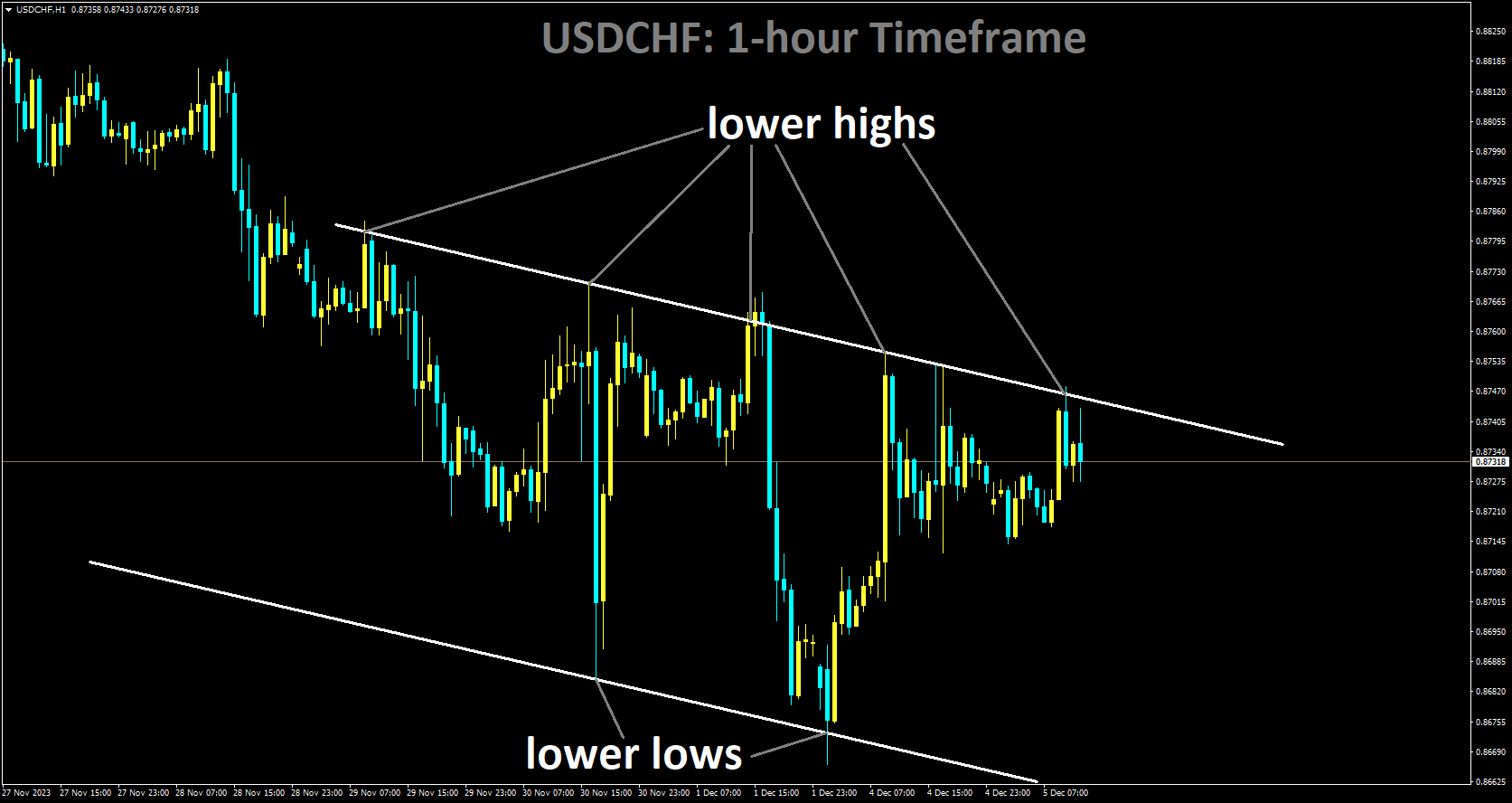

USDCHF Analysis:

USDCHF is moving in Descending channel and market has reached lower high area of the channel

The US Dollar is making gains against various currencies, driven by widespread risk-off sentiment, while the Swiss Franc faces downward pressure following a disappointing Swiss Consumer Price Index (CPI) reading. The global market’s risk appetite is further dampened by a more significant-than-expected decline in US Factory Orders for October, registering a decrease of 3.6%, compared to the market’s median forecast of -2.6%. September’s Factory Orders have also been revised downward from 2.8% to 2.3%.

Investors are growing increasingly apprehensive about the state of the global economy, observing a decline in economic indicators across the board and a shaky growth outlook in major markets. In Switzerland, the November CPI fell short of expectations, with the annualized CPI for November coming in at 1.4%, below the anticipated 1.6% and further dropping from October’s year-on-year figure of 1.7%. The decrease in Swiss CPI seems to be accelerating, particularly in the short term, as November’s month-on-month CPI slips by -0.2%, contrasting with October’s 0.1% reading.

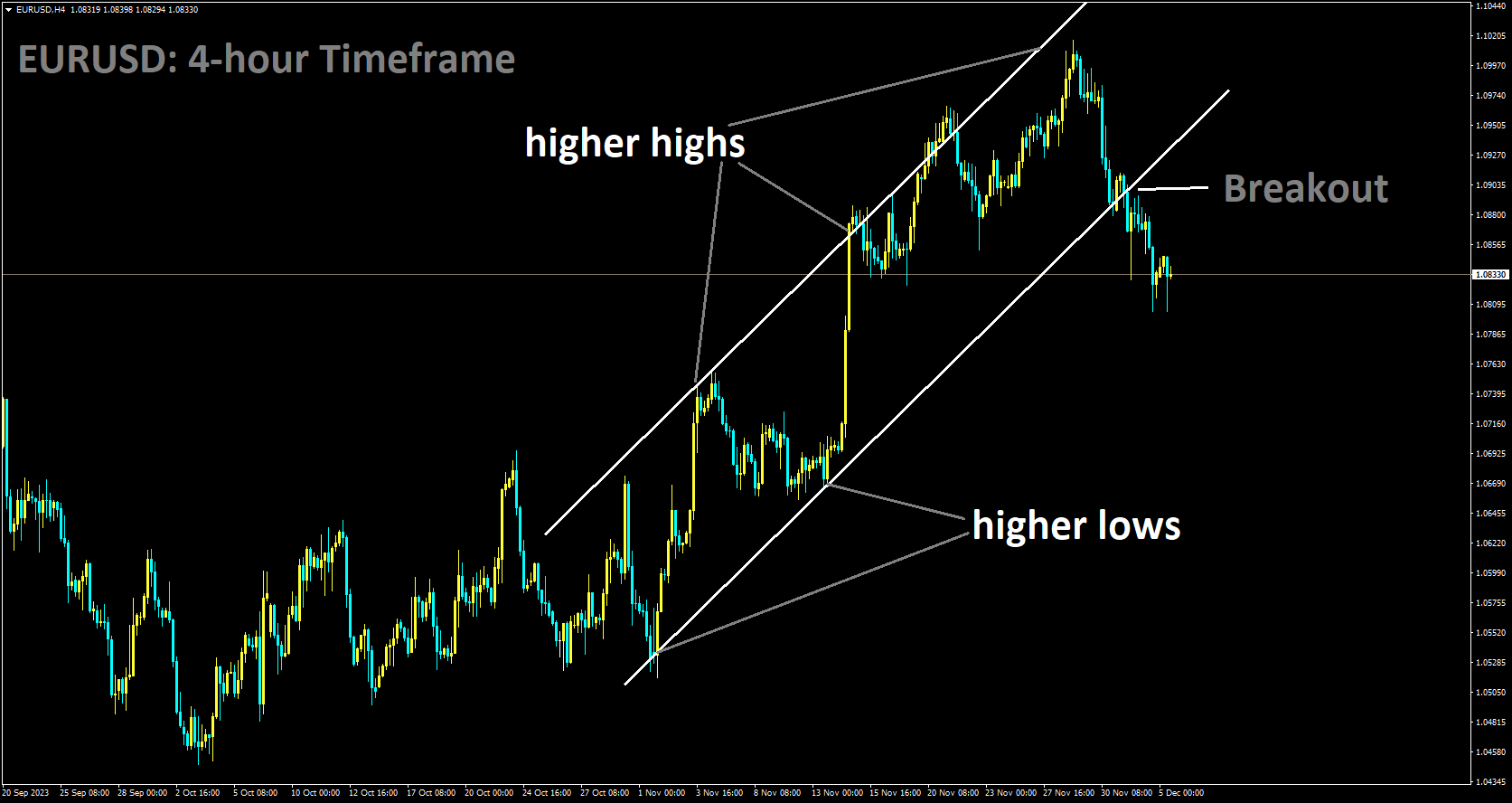

EURUSD Analysis:

EURUSD has broken Ascending channel in downside

Isabel Schnabel, a member of the Executive Board of the European Central Bank, remarked on Tuesday that additional rate hikes are unlikely following the latest inflation data. She expressed encouragement about the inflation developments, highlighting the notable decline in core prices. Schnabel emphasized the need for caution in guiding policy over an extended period and stated that the current level of restriction is deemed sufficient. This, in turn, has bolstered confidence that the 2% target will be achieved by 2025.

The executive board member reiterated the unlikelihood of further rate hikes post the November inflation data but cautioned against prematurely declaring victory. While acknowledging that inflation is moving in the right direction, Schnabel emphasized the necessity for further progress. Despite the positive trajectory, she assured that no prolonged recession is anticipated, and there are indications that the economy may be reaching a bottoming-out phase.

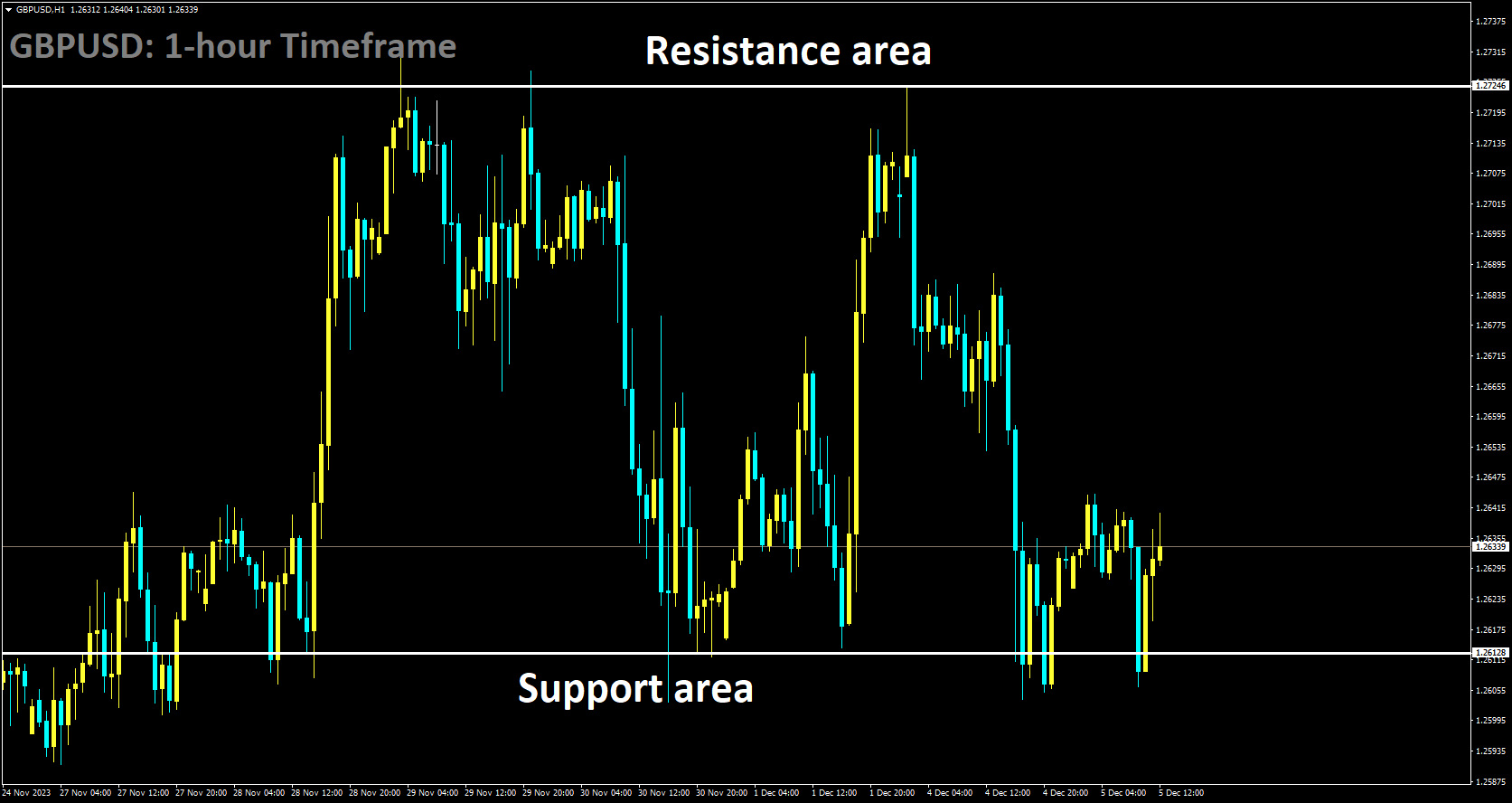

GBPUSD Analysis:

GBPUSD is moving in box pattern and market has rebounded from the support area of the pattern

The US Dollar is facing challenges in extending its recent strong performance, reaching a one-week high, as market expectations lean towards the Federal Reserve (Fed) refraining from further interest rate hikes and potentially initiating policy easing as early as March 2024. This has led to a decline in US Treasury bond yields, placing USD bulls on the defensive and providing support to the GBPUSD pair.

Conversely, the British Pound is buoyed by diminishing probabilities of an early rate cut by the Bank of England. BoE Governor Andrew Bailey’s recent caution against prematurely declaring victory over inflation and his projection that monetary policy will need to remain restrictive for an extended period contribute to the GBPUSD pair’s upward movement.

Despite this, a more cautious market sentiment is providing some support to the safe-haven US Dollar, limiting aggressive directional bets by traders. Investors appear hesitant, opting to wait on the sidelines, especially in anticipation of crucial US macroeconomic data scheduled for release later during the early North American session, starting with the ISM Services PMI. The focal point, however, will be the highly anticipated US NFP report scheduled for Friday.

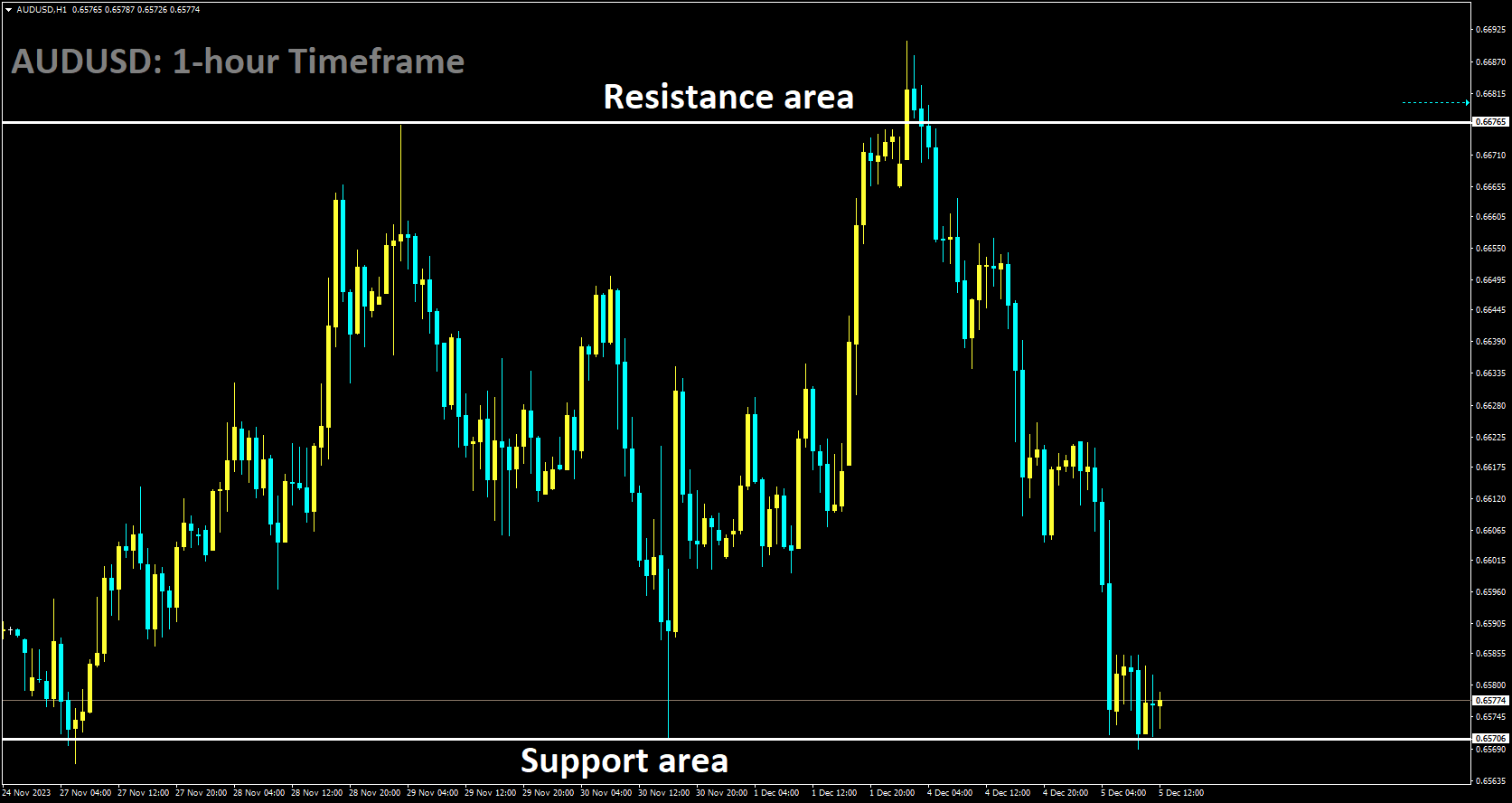

AUDUSD Analysis:

AUDUSD is moving in box pattern and market has reached support area of the pattern

Following its December monetary policy meeting on Tuesday, the board members of the Reserve Bank of Australia opted to keep the Official Cash Rate unchanged at 4.35%, aligning with market expectations. This decision followed a 25-basis-point interest rate hike in November. Governor Michele Bullock presented the monetary policy statement, outlining key points. The need for further tightening of monetary policy to bring inflation back to target within a reasonable timeframe will be contingent on evolving data and risk assessments. The board remains steadfast in its commitment to restoring inflation to the target range.

The limited information received on the domestic economy since the November meeting has generally met expectations. The outlook for household consumption remains uncertain, and the October monthly CPI indicator indicates a continuing moderation in inflation, primarily driven by the goods sector. However, the update did not offer significant insights into services inflation. Measures of inflation expectations align with the inflation target. While conditions in the labor market are gradually easing, they remain tight. There are domestic uncertainties regarding the time lags in the impact of monetary policy. The higher interest rates are actively working to establish a more sustainable balance between aggregate supply and demand in the economy. Maintaining the cash rate at this meeting allows time to evaluate the impact of the recent interest rate increases on demand, inflation, and the labor market.

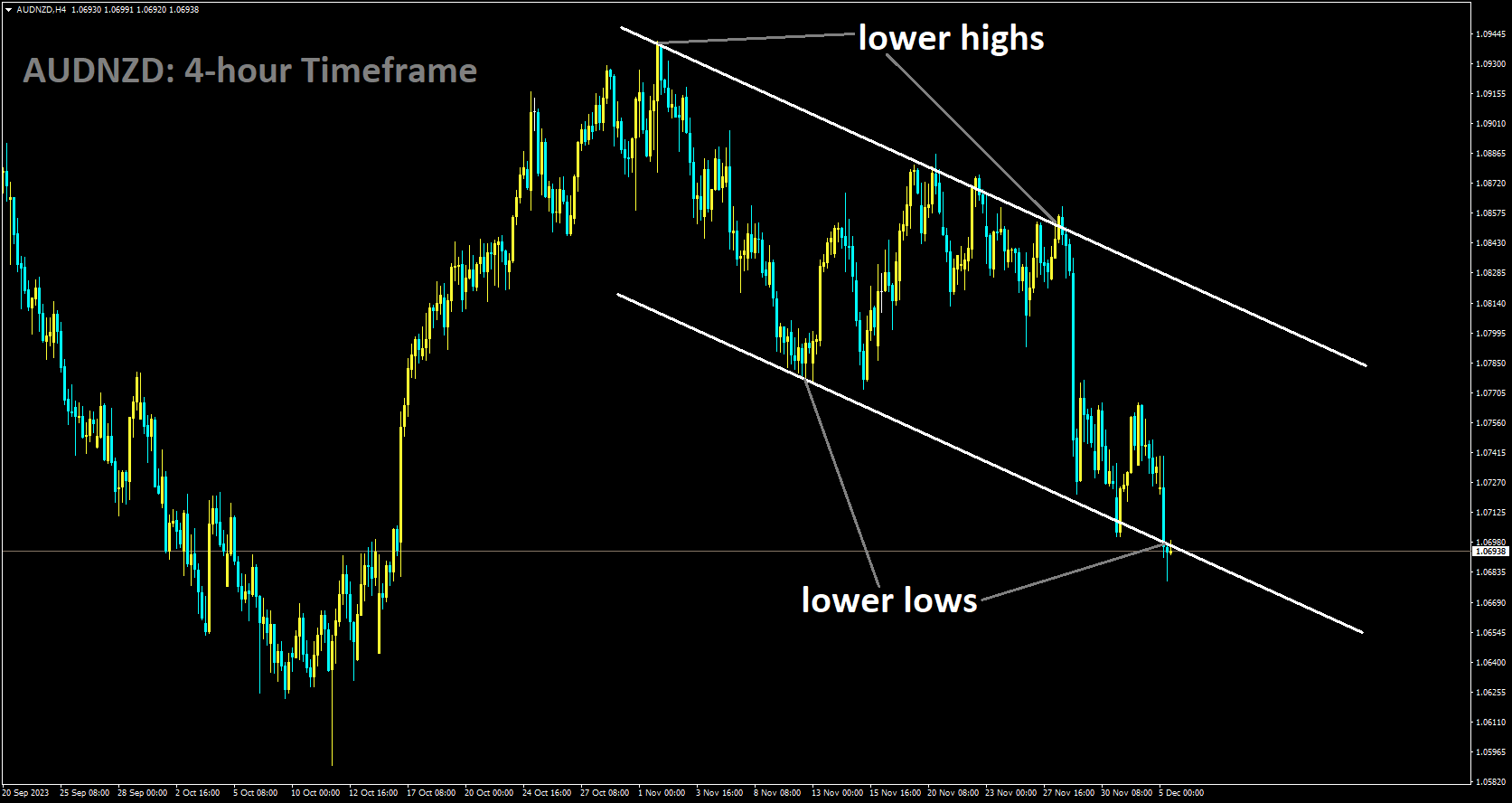

AUDNZD Analysis:

AUDNZD is moving in Descending channel and market has reached lower low area of the channel

According to the latest data released by Caixin on Tuesday, China’s Services Purchasing Managers’ Index surged to 51.5 in November, surpassing the October reading of 50.4. This exceeded market expectations, which had anticipated a print of 50.8. The report indicates that business activity and new orders experienced the fastest growth in three months.

Furthermore, there is an improvement in confidence regarding the year ahead, while inflationary pressures have weakened. Dr. Wang Zhe, Senior Economist at Caixin Insight Group, commented on the China General Services PMI data, stating that both services supply and demand expanded, contributing to the ongoing recovery of the market. The gauges for business activity and total new orders have remained above 50 for the 11th consecutive month, reaching three-month highs.

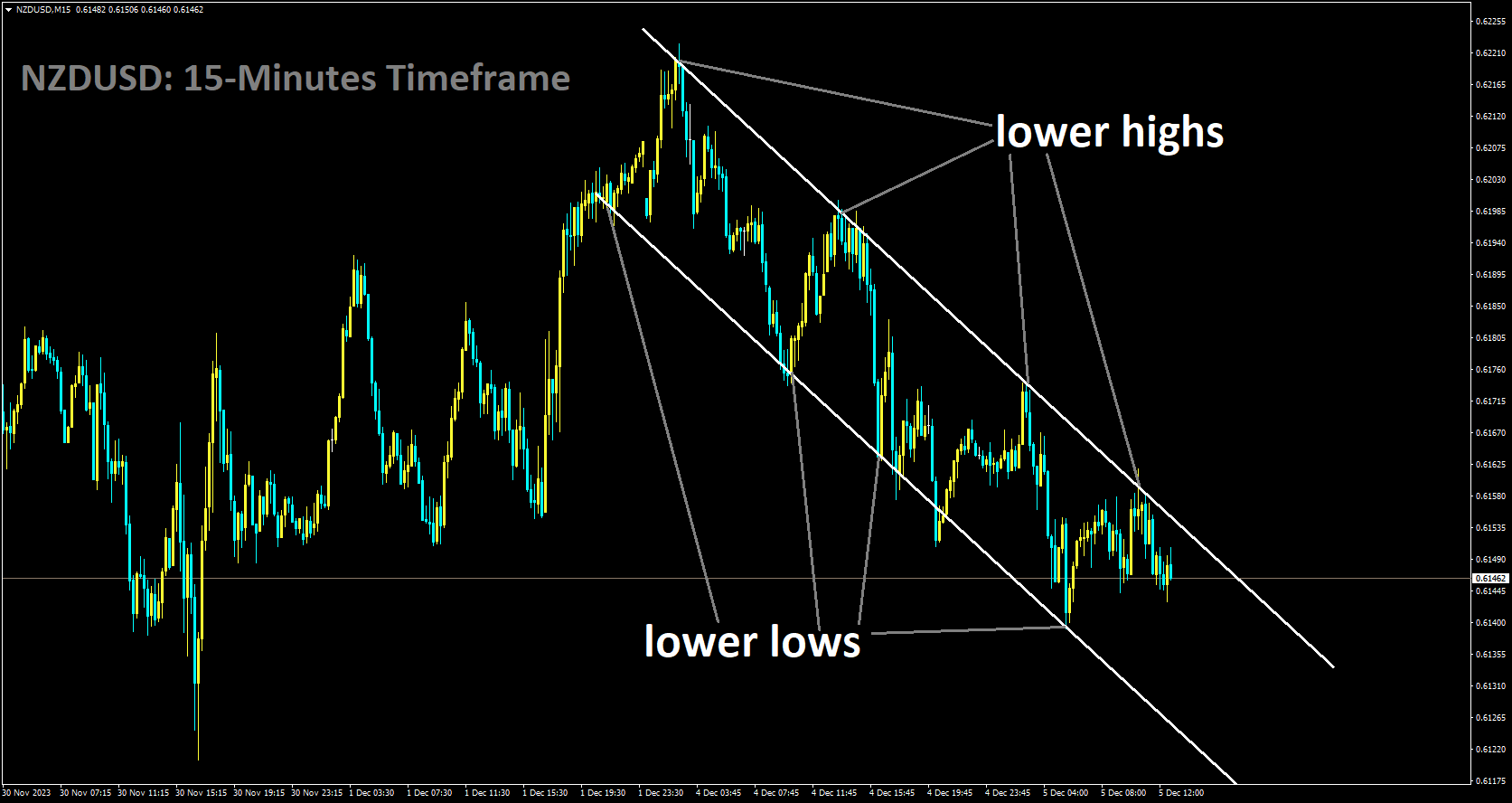

NZDUSD Analysis:

NZDUSD is moving in Descending channel and market has fallen from the lower high area of the channel

In New Zealand, numerous demonstrators have taken to the streets to voice their opposition to the policies of the newly elected government concerning Indigenous people. Protests unfolded in front of the parliament and on motorways on Tuesday, following a call for nationwide demonstrations by the Te Pati Maori party against the recently elected right-leaning government. These protests coincided with the commencement of New Zealand’s 54th parliament session, marking the end of six years of governance by the centre-left Labour Party after October’s elections. In a departure from tradition, the Te Pati Maori, holding six seats in parliament, took oaths of allegiance to the upcoming generation and the Treaty of Waitangi, a colonial-era pact between the British and the Maori people, before pledging allegiance to King Charles.

The new National Party-led coalition has committed to reviewing affirmative action policies, altering department names from Maori to English, and removing references to the Treaty of Waitangi’s principles from legislation. Te Pati Maori co-leader Rawiri Waititi addressed protesters in Wellington, emphasizing that this was not merely a protest but an activation of their voices. He urged the crowd to make their voices heard and be proud of their identity. New Zealand police reported two arrests in connection with the demonstrations, leading to traffic disruptions in several cities, including Auckland.

National Party leader Christopher Luxon, part of a coalition with the libertarian ACT New Zealand and populist New Zealand First, defended his government against the protesters’ criticism, describing it as pretty unfair. Luxon asserted that his government, in power for just a week, is dedicated to achieving positive outcomes for both Maori and non-Maori. David Seymour, the leader of ACT New Zealand, accused Te Pati Maori of prioritizing divisive theatrics over providing solutions for Indigenous people. Seymour emphasized that New Zealanders elected a government committed to treating all individuals equally, regardless of their race.

🔥 Stop Trading all the time, trade markets only at the best setups with Premium or VIP plan

🎁 60% CYBER MONDAY OFFER 🎁 for Trading Signals 😍 GOING TO END – Get now: https://forexfib.com/offer/