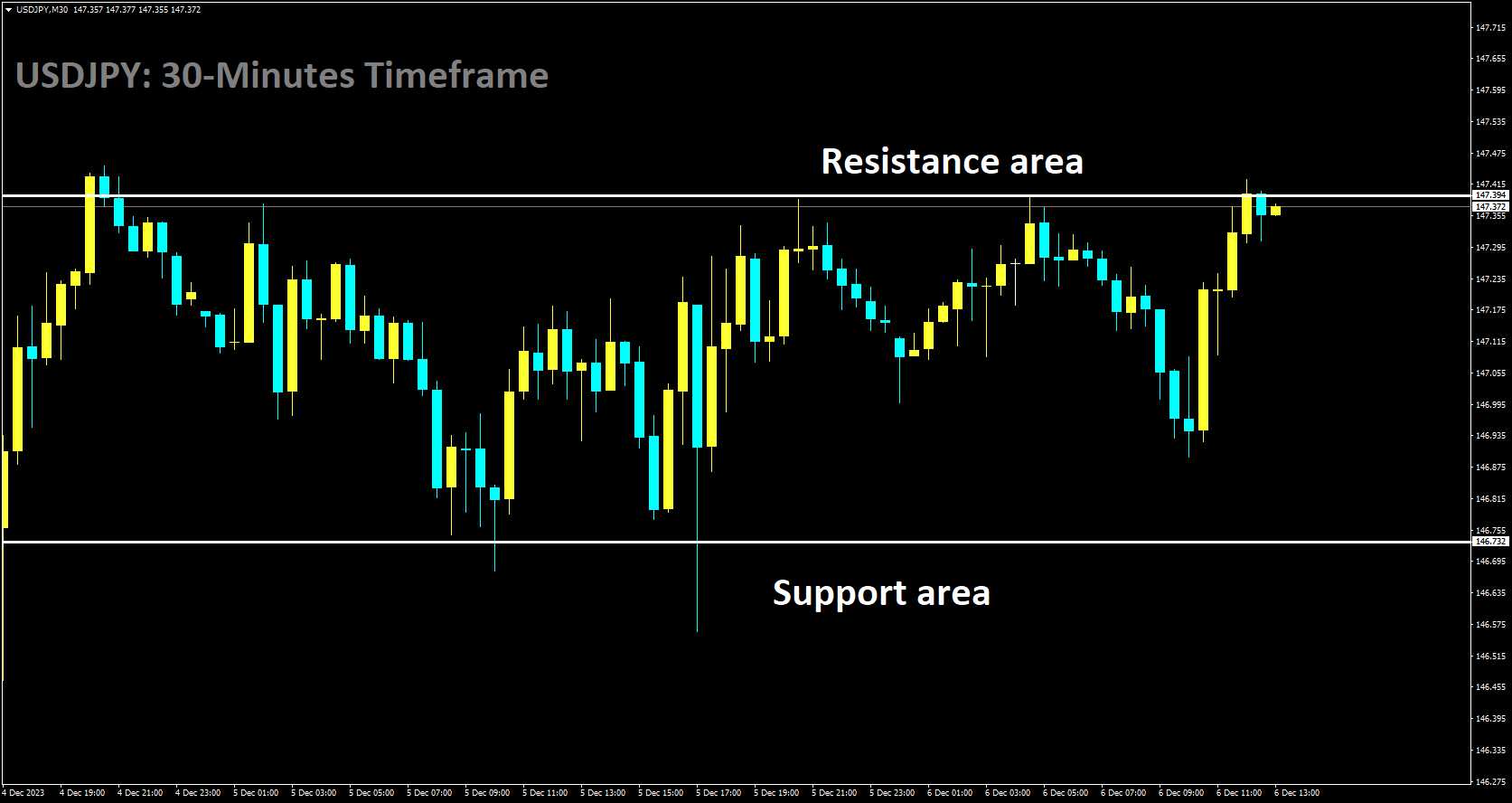

USDJPY Analysis:

USDJPY is moving in box pattern and market has reached resistance area of the pattern

On Wednesday, Bank of Japan Deputy Governor Ryozo Himino emphasized that he does not have a predetermined timetable for exiting the accommodative monetary policy. He expressed the view that it would be inappropriate to establish a predefined sequence for ending various forms of monetary easing. Himino stated that, apart from considering wage and price movements, it is essential to assess factors such as consumption, capital expenditure capex, and global developments when determining the timing of policy normalization.

He acknowledged that decisions regarding the exit from the easy policy would ultimately be made by evaluating a mixed set of signals emerging from the economy. Himino also mentioned that he is not in a position to provide an exact estimation of how close they are to achieving their price target in a sustainable manner.

Himino acknowledged the possibility that the adverse effects of the easy monetary policy might diminish upon its eventual exit. He pointed to Tokyo’s Consumer Price Index CPI data, which indicated a diminishing impact of import price increases. He further noted that it typically takes more than a year for the effects of monetary policy to fully manifest in the economy. This, in turn, explains the central bank’s patient approach in maintaining its accommodative policy stance. As of now, he does not have a specific prediction regarding when the Bank of Japan can confidently determine the sustained and stable attainment of its price target.

GOLD Analysis:

XAUUSD is moving in Ascending channel and market has reached higher low area of the channel

GOLD’s attempt to recover from the $2,020 level has faced resistance, stalling at $2,040. The reason behind this halt is the resurgence of the US Dollar, which is gaining strength due to cautious market sentiment. Investors are exercising caution as they await the release of crucial US macroeconomic data this week, with a particular focus on Friday’s Nonfarm Payrolls report. These figures are of great interest as they could confirm the Federal Reserve’s tightening cycle conclusion and raise expectations of rate cuts in the first quarter of 2024. Monday’s data showed that US Factory Orders contracted more than expected in October, adding to evidence of a slowdown in US economic growth in the final quarter of the year. On Tuesday, investors will closely monitor the US ISM Services PMI and JOLTS Job Openings data. Wednesday’s ADP Employment Change and Friday’s Nonfarm Payrolls will be the highlights of the week, providing insights into the labor market’s strength and influencing the Fed’s near-term direction.

The current market sentiment leans toward risk aversion, supporting the US Dollar and putting pressure on precious metals. Investors are hesitant to take on risky positions as they await the release of US employment data. Gold, however, remains steady above the psychological $2,000 mark, supported by soft US macroeconomic data, fueling expectations that the Fed may initiate rate cuts in early 2024. Eurozone and UK services PMI data have indicated an increase in sector activity, alleviating concerns about a sharp economic slowdown in the coming months. The CME Group FedWatch tool suggests a 54% probability that the US central bank will reduce its benchmark rate by 25 basis points in March. In October, US Factory Orders recorded a larger-than-expected decline of 3.6%, following a 2.3% increase in September, compared to the anticipated 2.6% drop. In China, the Caixin Services PMI accelerated to 51.5 in November from 50.4 in October, surpassing market expectations but remaining below pre-pandemic levels. The Israel-Gaza conflict and concerns about a new epidemic in China temper the optimism generated by the positive Caixin Services PMI data, which indicates an acceleration in business activity in November. The upcoming release of the US ISM Services PMI is anticipated to show a slight uptick to 52 in November from the previous month’s 51.8. Any deviation from this expectation could offer short-term trading opportunities. US JOLTS Job Openings are projected to have declined to 9.3 million in October from 9.55 million in the prior month, setting the stage for Wednesday’s ADP report and the highly significant NFP report scheduled for Friday.

SILVER Analysis:

XAGUSD has broken Ascending channel in downside

In November 2023, the US ISM Services PMI remained robust, surpassing expectations by registering a reading of 52.7, up from 51.8 in October. This marked the 11th consecutive month of expansion in the services sector. The growth in November was modestly driven by increased business activity and slight employment growth. Additionally, new orders remained strong, and inventories rebounded 55.4 vs. 49.5, while price pressures eased slightly 58.3 vs. 58.6. Furthermore, the backlog of orders reversed its trend 49.1 vs. 50.9, and the Supplier Deliveries Index indicated improved supplier delivery performance 49.6 vs. 47.5. Respondents’ comments varied by company and industry, with ongoing concerns about inflation, interest rates, and geopolitical events. Rising labor costs and labor constraints continue to pose challenges for employment.

In October, the number of job openings in the United States decreased to 8.7 million. The U.S. Bureau of Labor Statistics reported that over the month, the number of hires and total separations remained relatively stable at 5.9 million and 5.6 million, respectively. This decrease in job openings was largely attributed to declines in health care and social assistance -236,000, finance and insurance -168,000, and real estate and rental and leasing, with the only increase coming from the information sector.

With another round of key data released ahead of the FOMC Meeting and the NFP report still pending for Friday, the U.S. Dollar has continued its upward trajectory due to renewed safe haven demand and reduced expectations of rate cuts. The ongoing adjustment of Fed rate cut expectations for 2024 persists, with the minor adjustment this week not being driven by any specific data releases. This aligns with the mixed comments from Fed policymakers, many of whom acknowledge progress but believe that market participants may be getting ahead of themselves regarding rate cut expectations. While the ISM Services data may not align perfectly with the Fed’s goals, it remains a factor to consider in relation to inflation. However, any further decrease in the JOLTS job openings number may overshadow the ISM data, especially with the NFP report looming on Friday. This week’s employment data may continue to create uncertainty in expectations until Fed Chair Powell addresses the situation at the FOMC meeting.

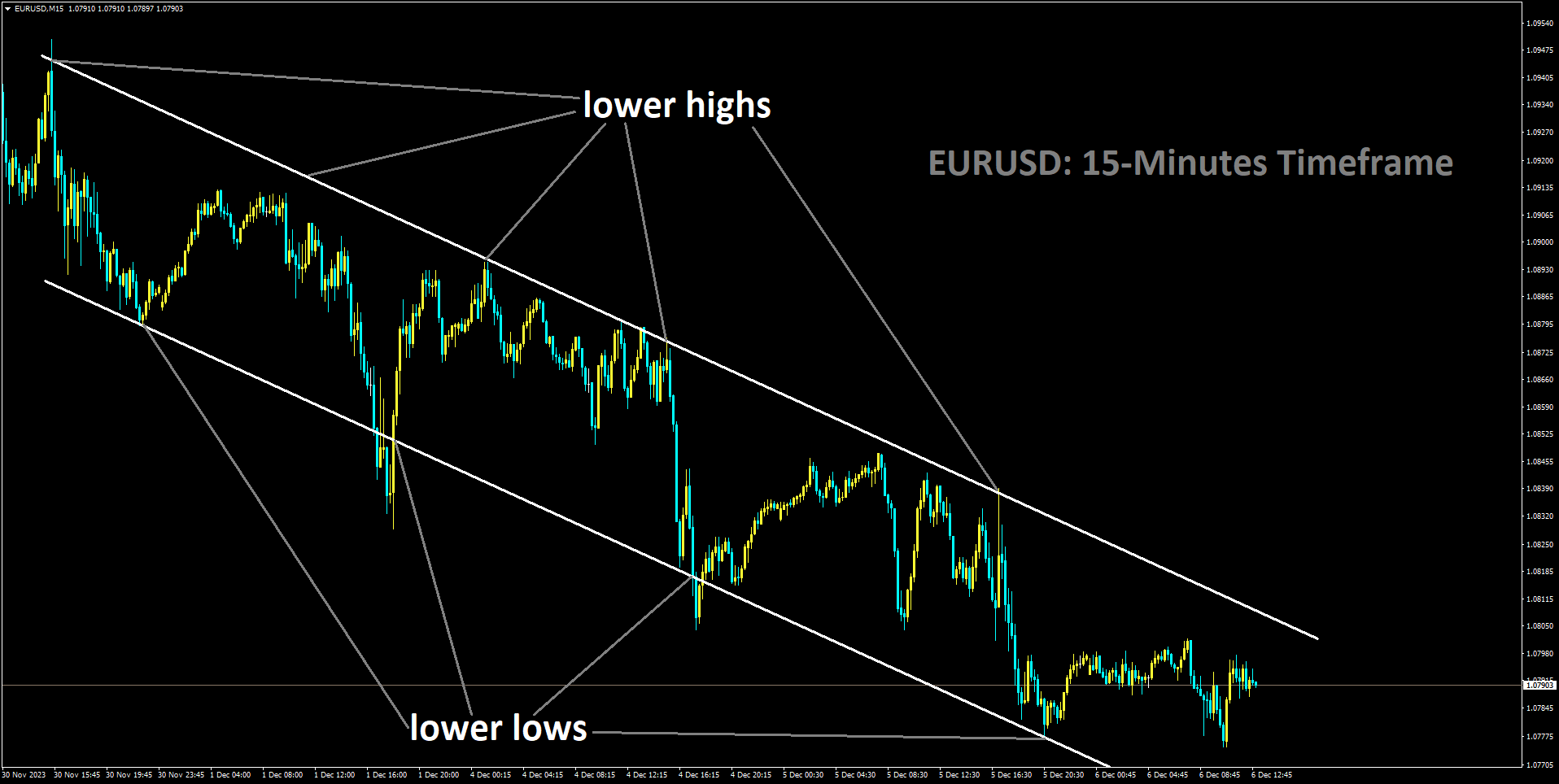

EURUSD Analysis:

EURUSD is moving in Descending channel and market has rebounded from the lower low area of the channel

In a recent Reuters interview, Isabel Schnabel, a member of the ECB’s executive board, expressed confidence in the central bank’s monetary policy, affirming their commitment to achieving the target inflation rate of 2%. Notably, prior to this interview, Ms. Schnabel was known for her hawkish stance, particularly during the ECB’s interest rate hikes.The interview began with a significant statement when Ms. Schnabel was asked about her reaction to the recent mild inflation data.

In response, she quoted Keynes, saying, ‘When the facts change, I change my mind, what do you do sir?’ Throughout the interview, Ms. Schnabel further elaborated that the ‘inflation developments have been positive,’ and the recent inflation figures have made the prospect of ‘further rate increases rather unlikely.’ She also noted that underlying inflation is now ‘decreasing at a faster pace than initially anticipated.Euro Zone’s annual inflation for November dropped to 2.4%, which was below market expectations and a notable decline from October’s 2.9%. Ms. Schnabel’s comments didn’t go unnoticed in the financial markets, as they led to adjustments in forecasts, with expectations of deeper rate cuts in 2024. The latest market projection anticipates more than 140 basis points of rate reductions in the coming year, with the first 25 basis point cut anticipated at the March ECB meeting.

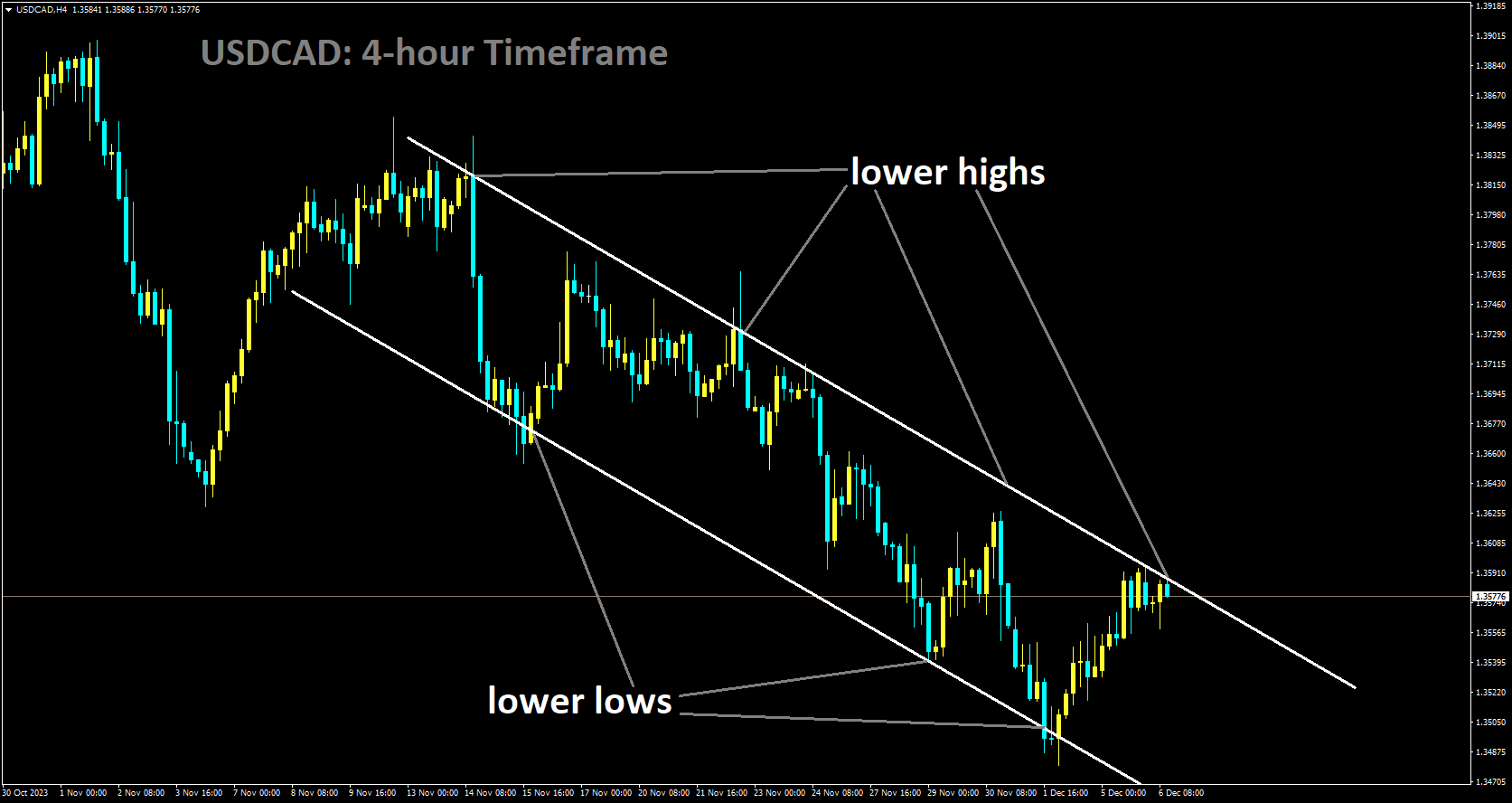

USDCAD Analysis:

USDCAD is moving in Descending channel and market has reached lower high area of the channel

On Tuesday, US data revealed that the ISM Services PMI for November surpassed expectations, coming in at 52.7 compared to the previous reading of 51.8, and surpassing the market’s anticipated 52.0. However, the US JOLTS labor data released on the same day painted a less optimistic picture. Job openings in the United States, as measured by the Job Openings and Labor Turnover Survey JOLTS, declined by 617,000 to 8.733 million in October, indicating a further loosening of labor market conditions.

The Federal Reserve has maintained its stance, acknowledging that the possibility of additional policy tightening cannot be ruled out. Nevertheless, market participants believe that the Fed has concluded its hiking cycle and is likely to commence rate cuts in March of the following year. This expectation could potentially limit the upside potential of the US Dollar and pose a headwind for the USDCAD pair.

On the Canadian front, the Bank of Canada BoC is scheduled to announce its interest rate decision on Wednesday. BoC Governor Tiff Macklem has stated that higher interest rates have cooled down the overheated economy and subdued inflation pressures. While Macklem believes that the central bank may have taken sufficient measures to control inflation, he also indicated that the BoC would consider raising rates again if inflation persists. Market expectations are leaning towards the BoC maintaining the interest rate steady at 5.0% during its December meeting.

Additionally, a rebound in oil prices could provide support to the Canadian Dollar, given that Canada is a leading oil exporter to the United States. Market participants will closely monitor key economic indicators such as the US ADP Employment Change and Unit Labor Costs Q3. The focus will later shift to the Bank of Canada’s interest rate decision on Wednesday. These events may introduce volatility to the market and offer clearer direction for the USD/CAD pair.

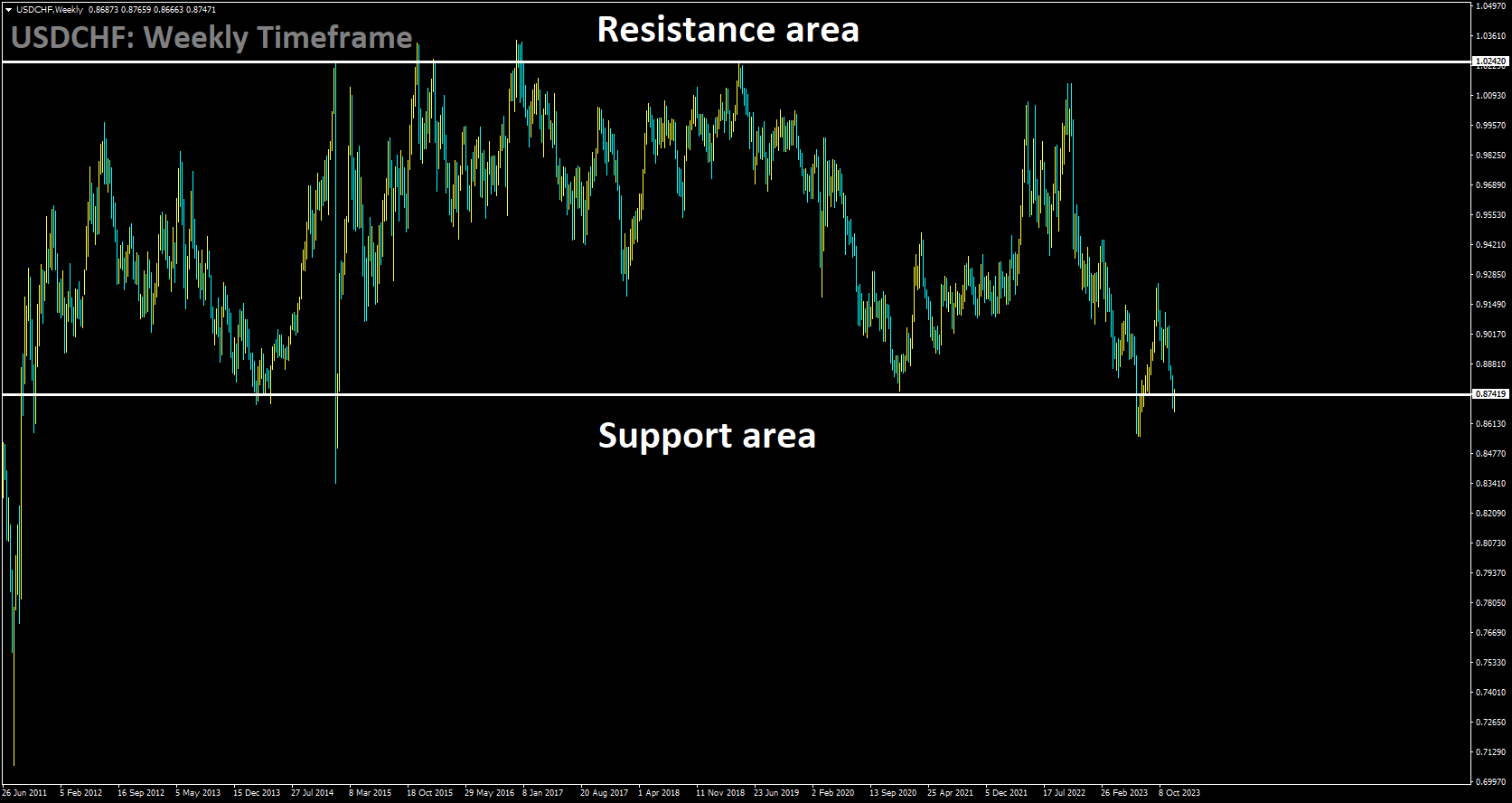

USDCHF Analysis:

USDCHF is moving in box pattern and market has reached support area of the pattern

The impact of the disappointing Swiss CPI reading observed on Monday continues to influence the market sentiment. This downturn is benefiting the safe-haven Swiss Franc while also acting as a restraint on the strength of the US Dollar. In the United States, the Factory Orders data released on Monday further confirmed that economic growth is decelerating in the fourth quarter of the year.

Coupled with the subdued inflation figures, this is fostering expectations that the Federal Reserve Fed has completed its rate hikes, which is exerting downward pressure on the USD. Today, the release of the US ISM Services PMI and the JOLTS job openings will provide additional insights into the US economic outlook. However, the highlight of the week remains Friday’s Nonfarm Payrolls report.

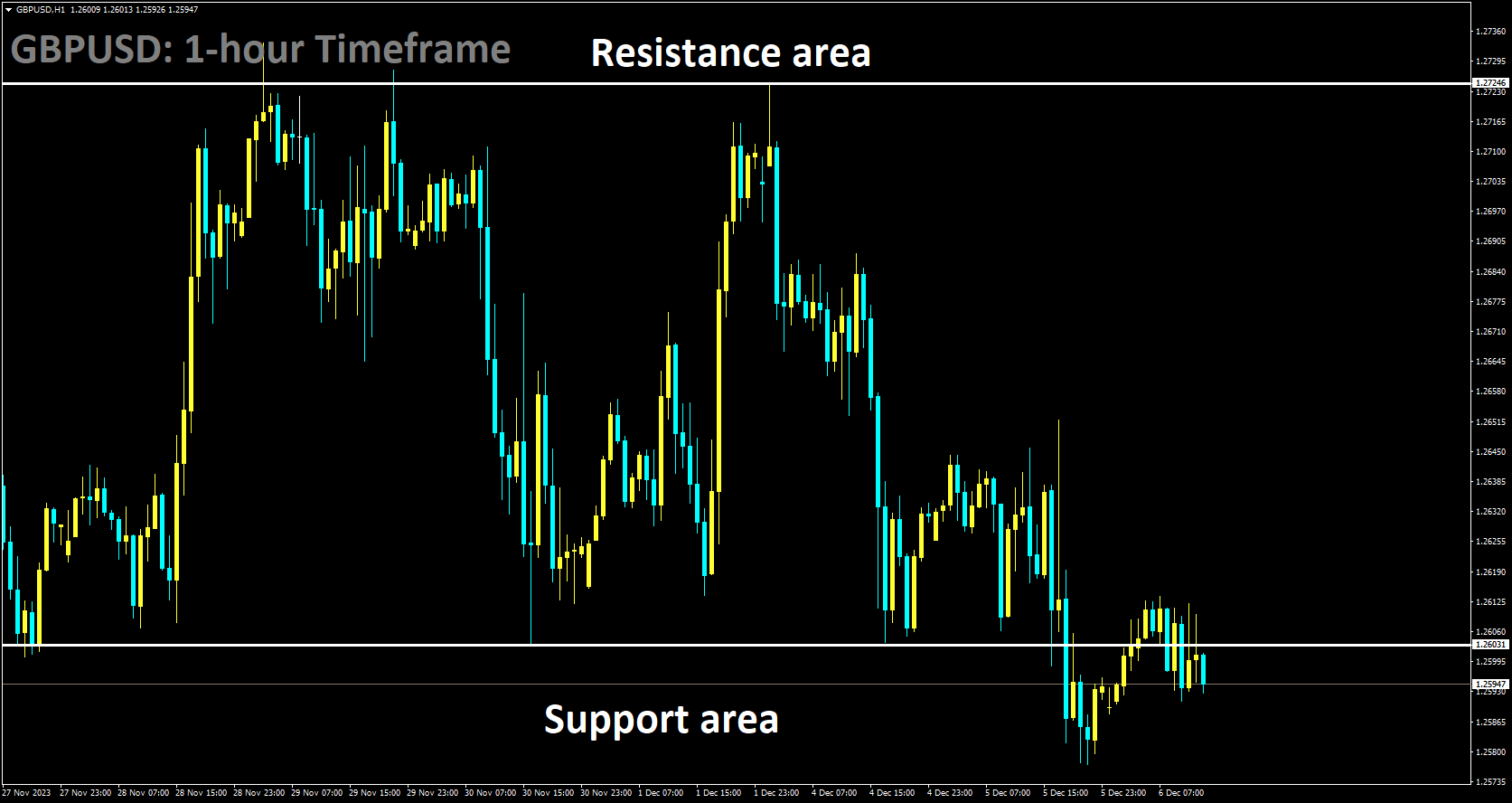

GBPUSD Analysis:

GBPUSD is moving in box pattern and market has reached support area of the pattern

On Tuesday, the US JOLTS labor data delivered disappointing results, with job openings, as measured by the Job Openings and Labor Turnover Survey JOLTS, declining by 617,000 to 8.733 million in October. This marked the lowest level recorded since March 2021. The focus now shifts to Wednesday’s release of the November ADP job report, which is expected to show an increase of 130,000. Furthermore, the US ISM Services PMI for November exhibited growth, rising to 52.7 from the previous reading of 51.8, surpassing market expectations. This week’s US employment data, including the ADP Employment Change and Nonfarm Payrolls NFP, will be closely watched as they could provide insights into the potential future interest rate trajectory. However, the prevailing market consensus suggests that the Federal Reserve is likely to maintain its current interest rates during its December meeting next week.

Turning to the British Pound, market sentiment is leaning toward the possibility of earlier interest rate cuts by the Bank of England. Financial markets have nearly fully priced in the likelihood of the BoE implementing its first rate cut by June 2024. On Wednesday, the BoE will release its monthly Financial Stability Report, which will offer investors valuable insights into the central bank’s inclination towards a hawkish or dovish stance. Traders will also keep a close eye on the UK S&P Global/CIPS Construction PMI for November, alongside the monthly Financial Stability Report. Additionally, the US ADP private employment and Unit Labor Cost data, scheduled for later on Wednesday, may provide clear directional cues for the GBPUSD pair.

In anticipation of the upcoming US Federal Reserve Fed monetary policy decision scheduled for next week, analysts from the Australia and New Zealand ANZ banking group have observed that there may be a potential reduction of 50 basis points or more in the dot plot. They expect that Chair Powell will have to maintain a hawkish stance during this shift towards lower economic growth and inflation, emphasizing the need for patience. Furthermore, they suggest that the long-run estimate for fed funds could see an increase.

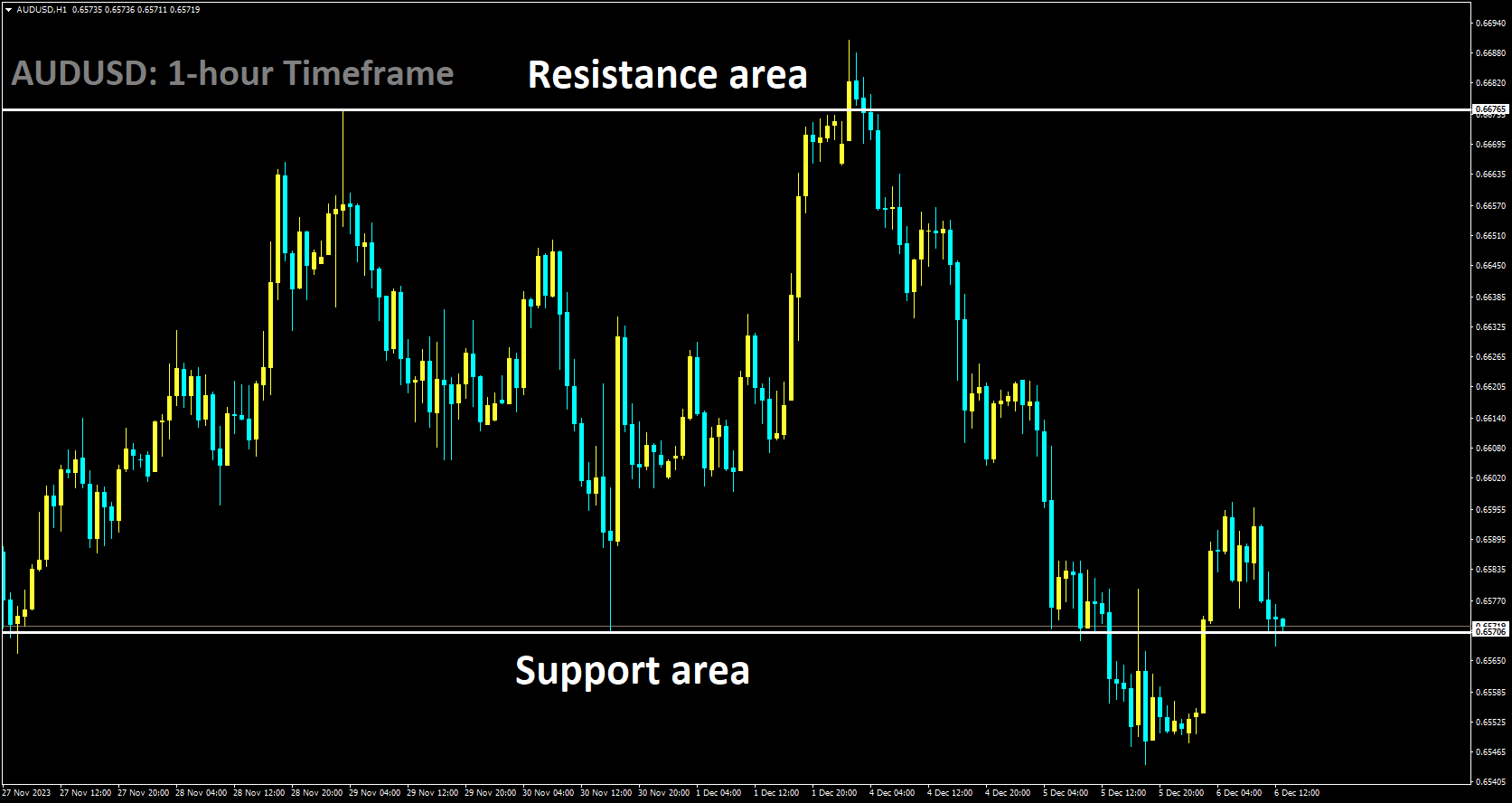

AUDUSD Analysis:

AUDUSD is moving in box pattern and market has reached support area of the pattern

Australia’s economy unexpectedly decelerated in the third quarter, influenced by higher interest rates affecting consumer spending and a shift to negative trade dynamics. The Australian Bureau of Statistics revealed on Wednesday that Australia’s Gross Domestic Product GDP grew by a mere 0.2% in the third quarter of 2023, a noticeable drop from the 0.4% growth seen in the second quarter. This figure fell short of the anticipated 0.4% expansion.

On an annual basis, the growth rate increased by 2.1%, compared to the 2.1% growth recorded in Q2, surpassing the market’s consensus of a 1.8% expansion.

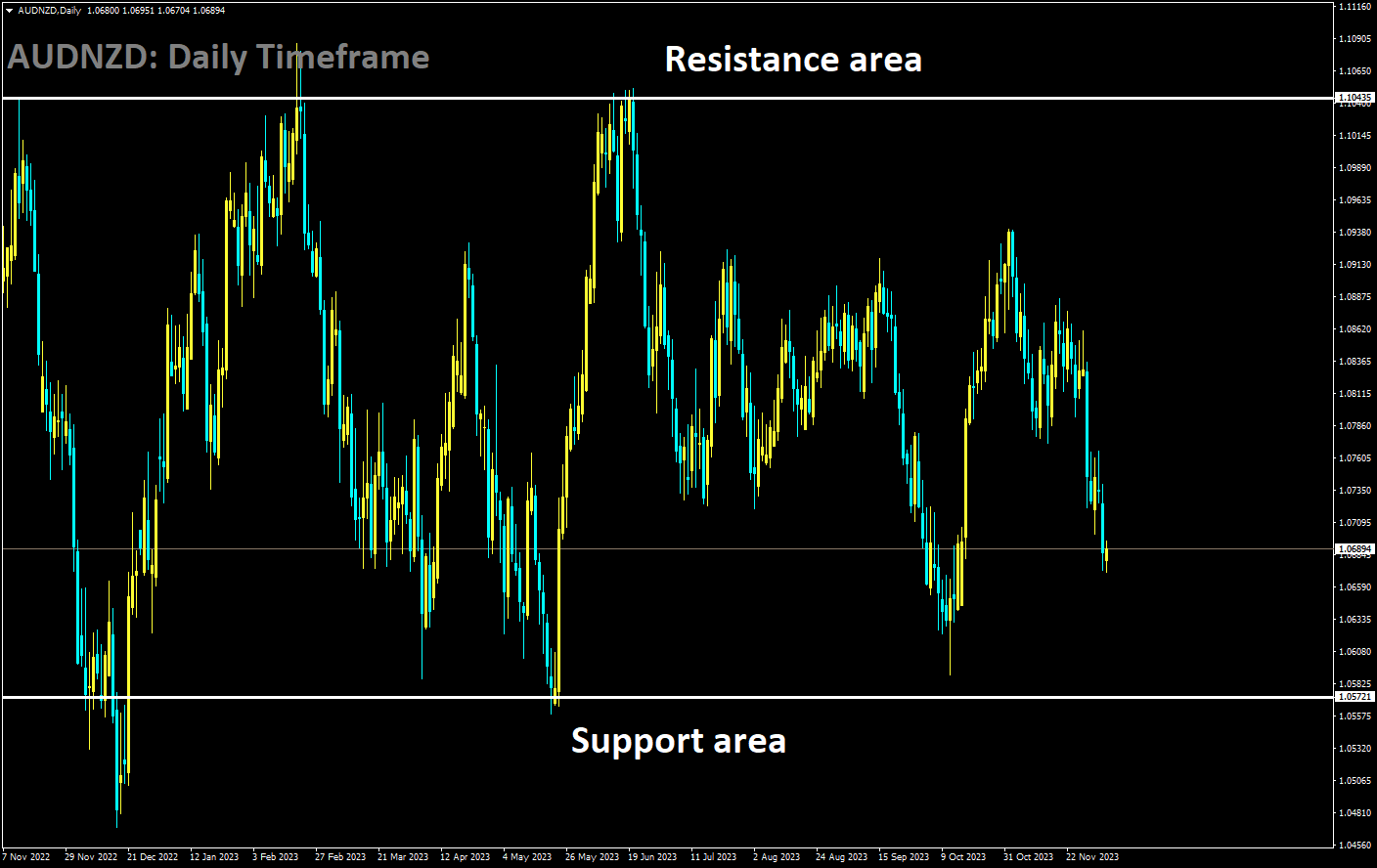

AUDNZD Analysis:

AUDNZD is moving in box pattern

However, the prevailing risk-averse sentiment and concerns about China’s economic prospects could limit the strength of the Australian Dollar, often viewed as a proxy for China’s economic performance. Moody’s, a credit rating agency, recently downgraded its outlook on China’s sovereign credit rating to negative, citing growing growth-related risks and a crisis in the country’s property sector. Investors will closely monitor key indicators such as the US ADP private employment data and Unit Labor Costs on Wednesday. Additionally, the release of Australia’s Trade Balance on Thursday will be of significant interest to market participants.

NZDUSD Analysis:

NZDUSD is moving in Ascending channel and market has reached higher low area of the channel

The New Zealand Dollar is experiencing a resurgence, thanks to a broad-based retreat of the US Dollar. This recovery is occurring despite sluggish Asian stocks and renewed buying interest in US Treasury bond yields. It follows the recent rebound of the US Dollar, driven by traders adjusting their positions ahead of the forthcoming US ADP Employment Change data, scheduled for release later in the American trading session on Wednesday.

The momentum of the US Dollar’s recovery has temporarily stalled, as financial markets reevaluate their expectations for potential interest rate cuts by the US Federal Reserve. This reassessment comes in the wake of a mixed bag of US economic data released on Tuesday. The Institute for Supply Management reported on Tuesday that its Services PMI bounced back from a five-month low of 51.8 to 52.7 in November. However, the Labor Department’s data revealed that JOLTS Job Openings for the month totaled 8.73 million, marking a decline of 617,000.

🔥 Stop Trading all the time, trade markets only at the best setups with Premium or VIP plan

🎁 60% CYBER MONDAY OFFER 🎁 for Trading Signals 😍 GOING TO END – Get now: https://forexfib.com/offer/