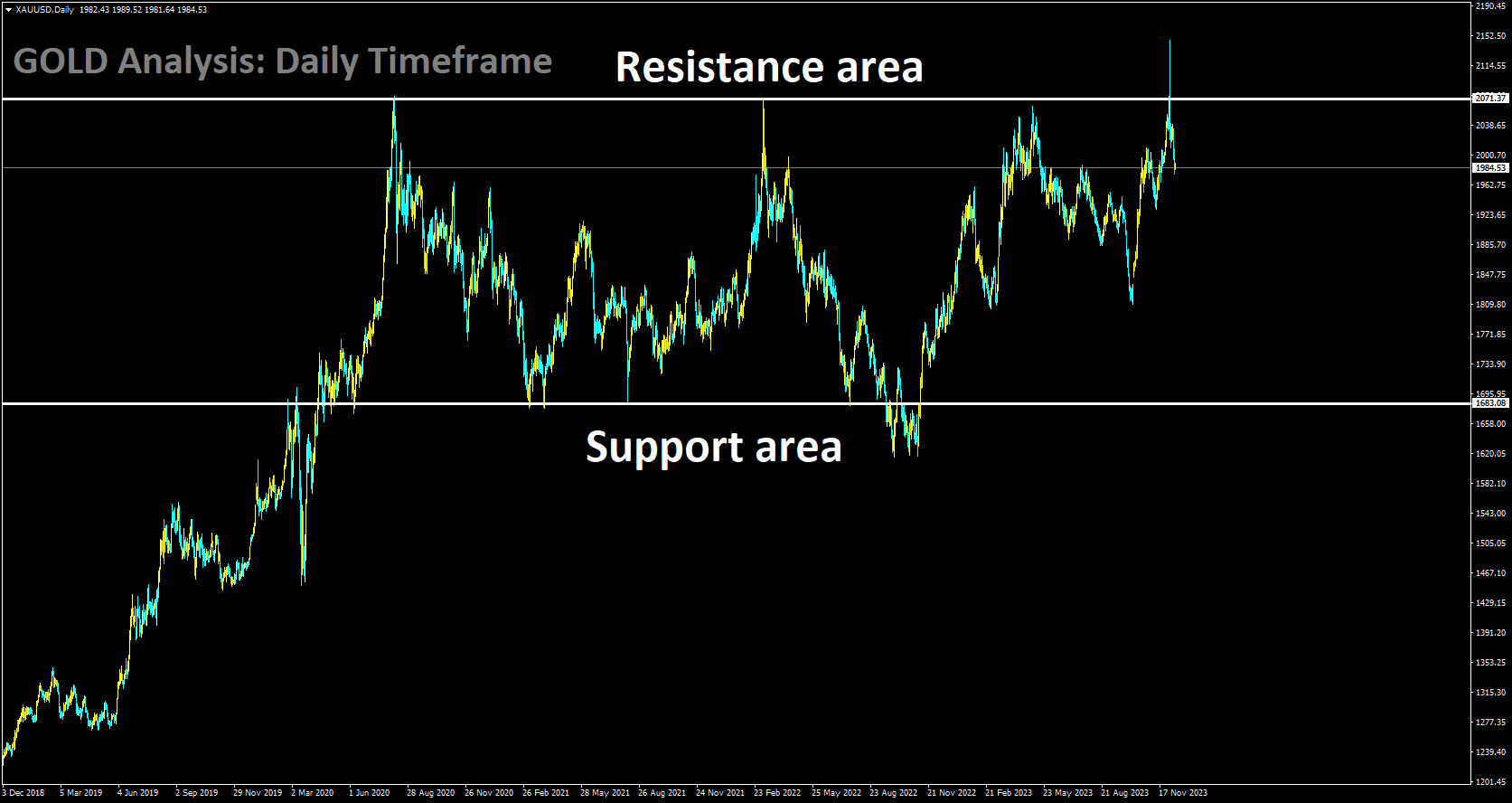

GOLD Analysis:

XAUUSD is moving in box pattern and market has fallen from the resistance area of the pattern

Tuesday saw gold prices attracting buyers as cautious traders opted to stay on the sidelines before the release of the latest US consumer inflation figures. These figures are expected to influence the Federal Reserve’s policy outlook and could provide significant support to the non-yielding precious metal. Meanwhile, there’s a growing consensus that the US central bank has concluded its policy tightening efforts and may even begin reducing interest rates by the first half of 2024. This perception is restraining the upside potential of the US Dollar, which had gained momentum from positive US jobs data. Additionally, concerns about potential escalation of geopolitical tensions in the Middle East are bolstering gold’s safe-haven status.

Nevertheless, XAUUSD appears to have broken a two-day losing streak for now, but its performance remains subject to the dynamics of the US Dollar as market participants await the Federal Open Market Committee decision scheduled for Wednesday. In related news, a US defense official reported on Tuesday that Iran-backed Houthi rebels in Yemen had launched a land-based cruise missile, further enhancing gold’s safe-haven appeal. Following the release of positive US employment figures last Friday, traders began speculating that the Federal Reserve might delay a series of interest-rate cuts until May of the following year, which acted as a headwind for gold.

However, a New York Fed survey on Monday indicated that consumers now anticipate inflation to be at 3.4% a year from now, down from 3.6% in October. This marked the lowest reading since April 2021 and raised hopes that inflation could continue to decelerate without pushing the economy into a recession. This development prompted investors to reduce their expectations for the first Fed rate cut, which was previously anticipated in March 2024. Market participants now increasingly believe that the US central bank has concluded its policy-tightening campaign and may start easing its monetary policy in the first half of the next year.

However, a New York Fed survey on Monday indicated that consumers now anticipate inflation to be at 3.4% a year from now, down from 3.6% in October. This marked the lowest reading since April 2021 and raised hopes that inflation could continue to decelerate without pushing the economy into a recession. This development prompted investors to reduce their expectations for the first Fed rate cut, which was previously anticipated in March 2024. Market participants now increasingly believe that the US central bank has concluded its policy-tightening campaign and may start easing its monetary policy in the first half of the next year.

According to the CME Group’s FedWatch Tool, investors are still pricing in a greater than 40% chance of a 25 basis point rate cut in March, and a nearly 75% chance of such a move in May 2024. However, this fails to boost the US Dollar’s position following the post-nonfarm payroll positive movement and instead supports the non-yielding precious metal. Nonetheless, bullish sentiment for gold appears cautious ahead of the release of US consumer inflation data. The headline Consumer Price Index is anticipated to rise by 0.1% in November, with the annual rate ticking down to 3.1%. The core CPI is expected to increase from 0.2% to 0.3% month-on-month and remain steady at a 4.0% year-on-year rate. Market focus will then shift to the outcome of the highly-anticipated two-day FOMC monetary policy meeting, which is scheduled to be announced during the US session on Wednesday.

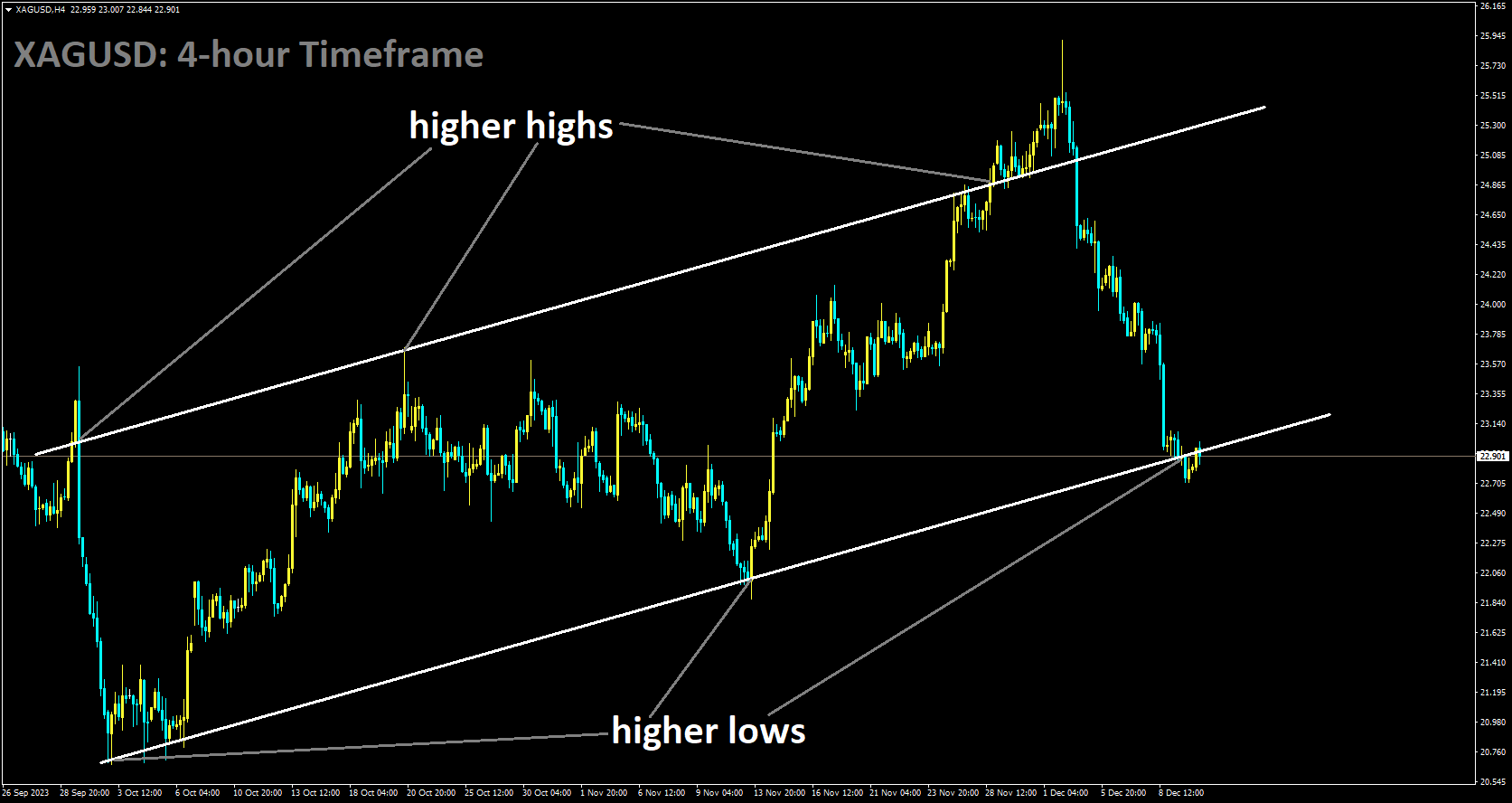

SILVER Analysis:

XAGUSD is moving in Ascending channel and market has reached higher low area of the channel

The eagerly awaited US Consumer Price Index inflation data for November is on the horizon. It is expected that inflation will continue to ease, reinforcing the belief that the Federal Reserve will refrain from raising interest rates ahead of its final meeting of the year. December has witnessed the US Dollar stabilizing after enduring significant losses against its major counterparts in November, during which the USD Index fell by nearly 3% on a monthly basis. While Federal Reserve officials maintain their commitment to a data-dependent approach to monetary policy, it is widely anticipated that the Fed will keep the interest rate unchanged within the 5.25%-5.5% range following the last monetary policy meeting of the year.

Nevertheless, the persistent decline in inflation and growing indications of a cooling labor market have led markets to anticipate a potential shift in policy. According to the CME Group FedWatch Tool, there is now a greater than 40% probability that the Fed may reduce the policy rate by 25 basis points as early as March.

The forthcoming US CPI inflation data has the potential to influence market sentiment concerning the timing of any policy adjustment and may trigger substantial fluctuations in the valuation of the USD before the Federal Reserve announces its monetary policy decisions and releases the revised Summary of Economic Projections on Wednesday. On a yearly basis, the US Consumer Price Index is projected to increase by 3.1% in November, indicating a slightly slower pace than the 3.2% upswing observed in October. The Core CPI figure, which excludes the volatile components of food and energy prices, is expected to remain steady at 4% during the same period. Monthly figures for CPI and Core CPI are expected to show increases of 0.1% and 0.3%, respectively.

In November, oil prices continued to decline, with West Texas Intermediate dropping by another 7%, following a roughly 10% decrease in October. Meanwhile, used car prices experienced a 2.1% decline in November, leading to an annual decline rate of 5.8% for that period, according to the Manheim Used Vehicle Index.

In anticipation of the US November inflation report, analysts from TD Securities anticipate a rebound in core CPI inflation to 0.3% month-on-month, up from the 0.2% figure recorded in October. They also expect the headline CPI to strengthen to 0.1%. They explain that the report is likely to reveal that inflation was driven by the core goods segment, while the components related to housing costs are expected to display mixed trends. It’s worth noting that their unrounded core CPI inflation forecast of 0.29% month-on-month suggests a largely balanced risk outlook for November. Additionally, the Prices Paid Index in the ISM Services PMI survey showed a slight decrease to 58.3 in October from 58.6, while the Price Index of the Manufacturing PMI rose to 49.9 from 43.8. These readings indicate that input price pressures in the service sector remained robust in November, while the deflation in manufacturing input costs slowed down.

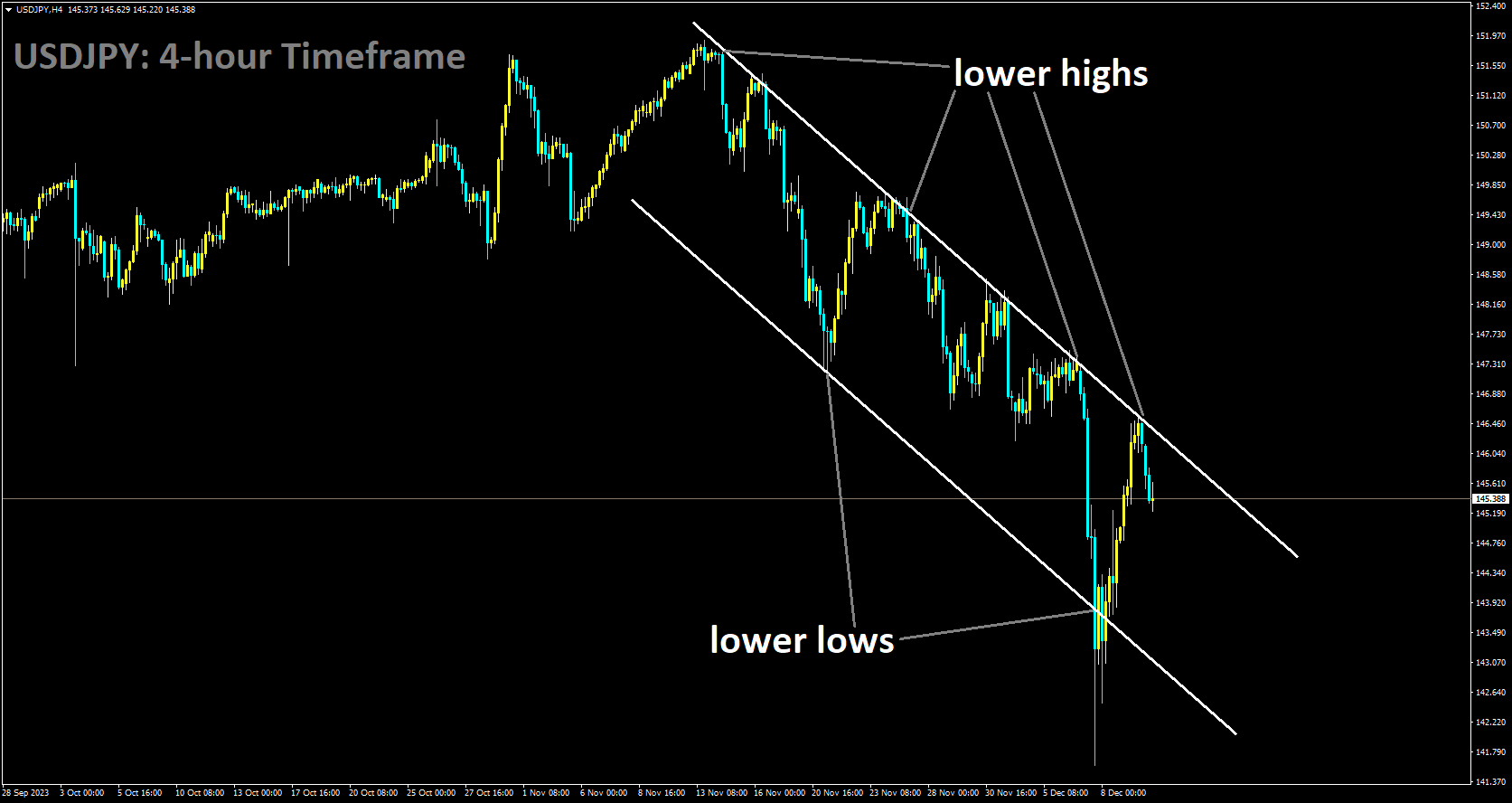

USDJPY Analysis:

USDJPY is moving in Descending channel and market has fallen from the lower high area of the channel

The recent movement of the Japanese Yen observed last week is likely to serve as a significant indicator signaling a potential shift in the trend of JPY depreciation. This trend had been in place since the global inflation shock. While we do not anticipate a Bank of Japan interest rate hike this month, it is important to note that any selling of JPY in the near term is unlikely to be sustained, given the alterations in the global macroeconomic landscape.

As tensions continue to mount between the United States and Iran-backed Houthi rebels in Yemen, a statement from a US defense official on Tuesday revealed that Houthi-controlled Yemen had launched a land-based cruise missile. This missile strike resulted in a commercial vessel catching fire in the Red Sea. The US Navy vessel Mason promptly arrived at the scene to provide assistance in the aftermath of the attack. Fortunately, there have been no reported casualties, the defense official confirmed. Notably, the Houthis had previously issued threats to disrupt shipping in the Red Sea, and just days before, on Friday, they had fired rockets at the US embassy in Baghdad.

USDCHF Analysis:

USDCHF is moving in Ascending channel and market has rebounded from the higher low area of the channel

The Swiss Franc experienced a rebound against most major currency pairs on Monday after initially weakening during the US morning session. The CHF initially faltered following robust US job data released on Friday, but it later regained ground as investors adjusted their positions in anticipation of upcoming policy decisions by several major central banks later in the week. On Monday, the Swiss Franc continued to decline relative to the US Dollar following the release of the US Nonfarm Payrolls report for November, which surpassed expectations in various key metrics. Notably, the Unemployment Rate dropped to 3.7% from the forecasted 3.9%.

These data points suggest that the US economy is in better health than previously anticipated, and it raises the possibility of new inflationary pressures emerging. Consequently, this development may prompt the US Federal Reserve to maintain higher interest rates for an extended period, potentially delaying any expected rate cuts in 2024 that had been anticipated by the market. Higher and more prolonged interest rates tend to attract increased capital inflows to the US Dollar, thereby benefiting its strength. The next significant data release for the US Dollar is the US Consumer Price Index (CPI) data for November, scheduled for today.

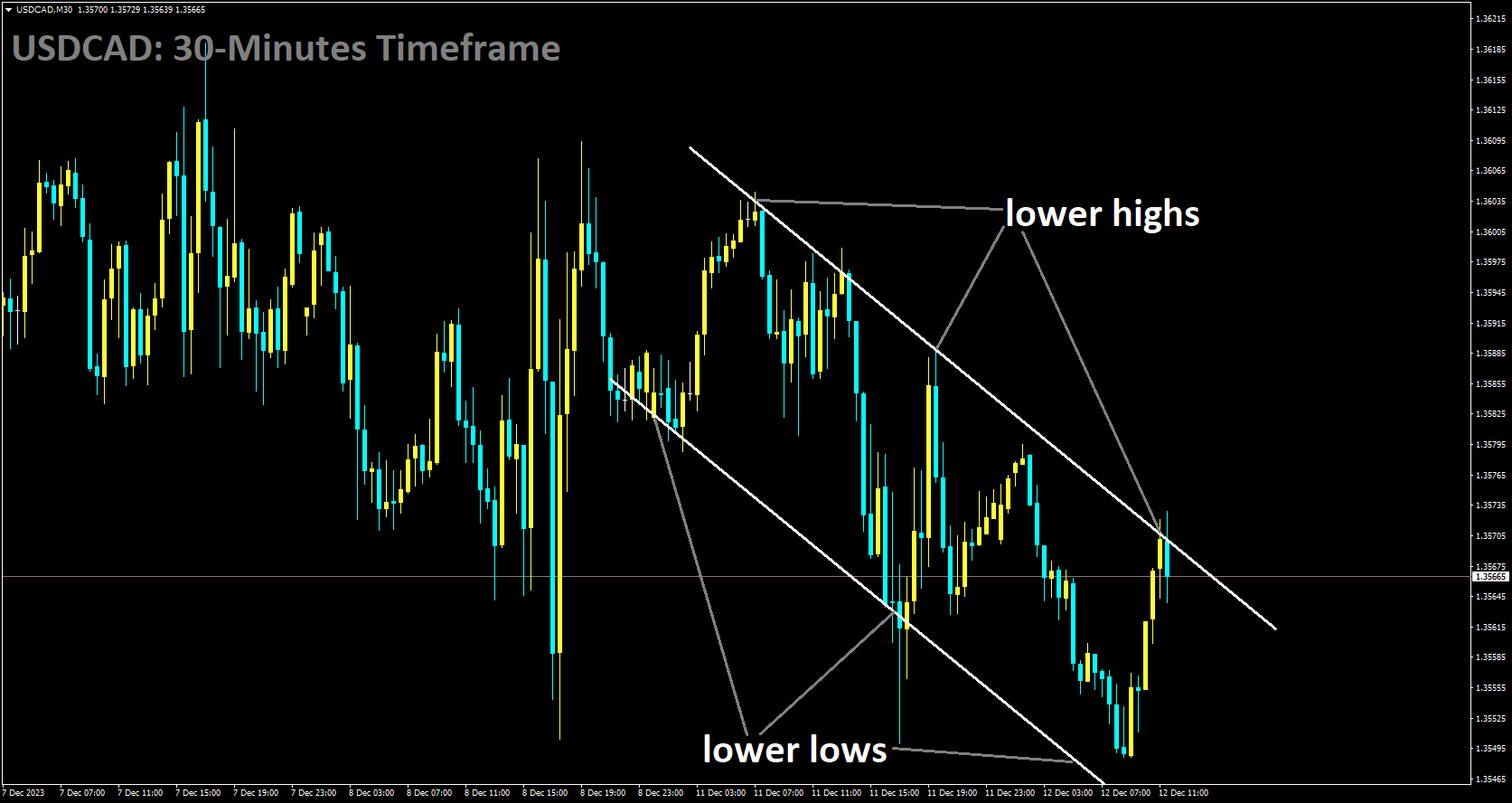

USDCAD Analysis:

USDCAD is moving in Descending channel and market has reached lower high area of the channel

Canadians are currently allocating a larger portion of their income to debt payments than Americans did just before the great financial crisis. The increasing burden of mortgage payments, particularly as homeowners renew their mortgages at significantly higher interest rates, has raised concerns among policymakers and politicians. Canada’s household debt, which stands at 187% of disposable income, is one of the highest among countries in the Organization for Economic Cooperation and Development.

It has long been regarded as the most significant vulnerability in the country’s economy. This debt burden has now reached $2.9 trillion, with mortgage debt accounting for 74% of that total, according to a recent study by TD Economics.

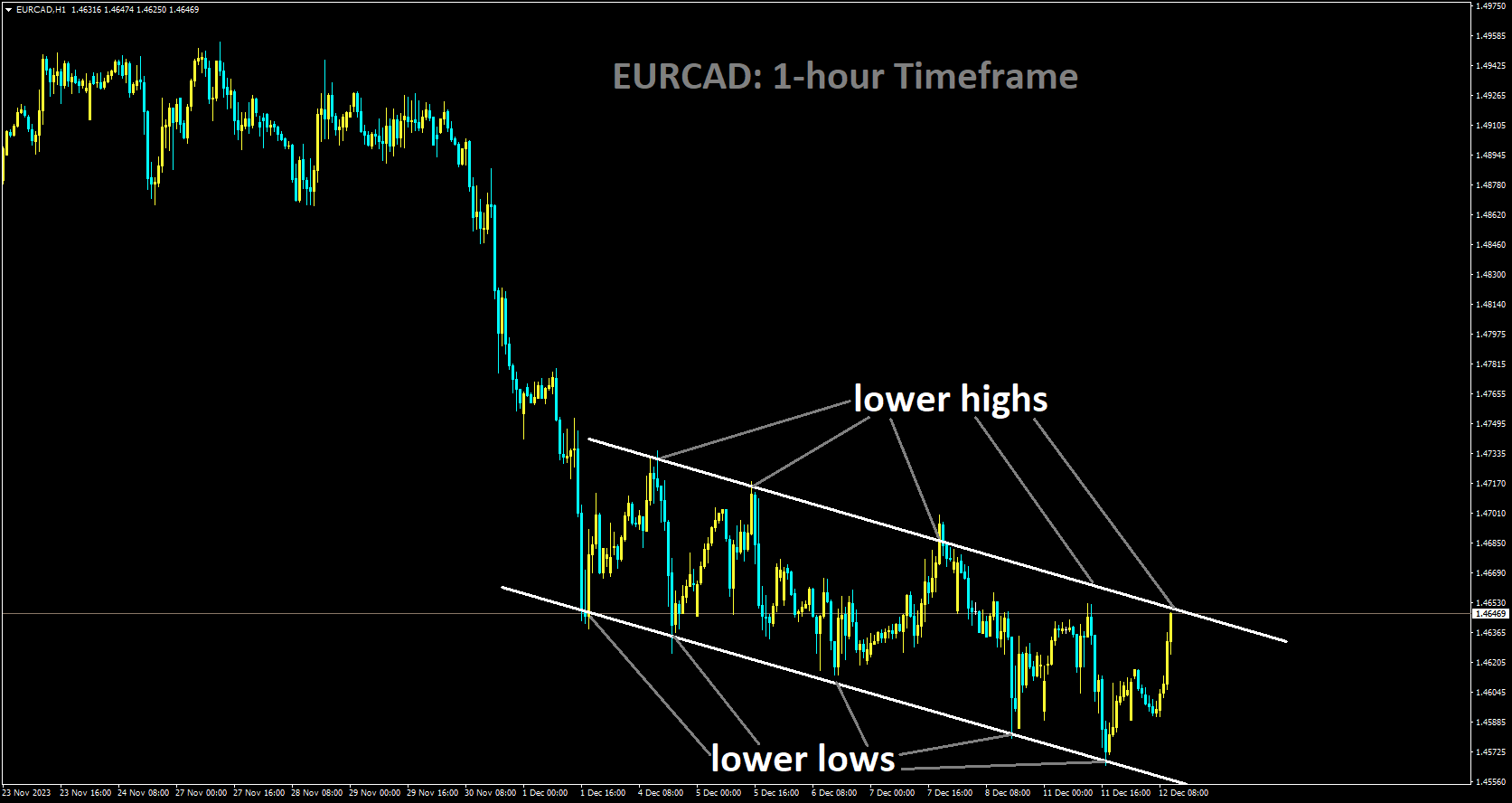

EURCAD Analysis:

EURCAD is moving in Descending channel and market has reached lower high area of the channel

With a 300 basis point increase in mortgage rates, Canadians are now allocating 15.4% of their income to debt servicing, up from 13.6% in 2020. This percentage is higher than the 13.2% that Americans were allocating to debt servicing at the peak of their indebtedness just before the Great Financial Crisis. So, how does this situation affect the economy? As more homeowners are compelled to renew their mortgages at higher interest rates, they have less disposable income available for spending on goods and services that drive economic growth. Consumer spending in Canada has been on the decline, but until now, the direct impact of increased mortgage debt on consumer spending was not well understood, noted James Orlando, senior economist at TD Economics and author of the study. To investigate this, TD Economics used internal anonymized credit card and mortgage data to track how borrowers were reacting to the higher interest rates. Orlando remarked, When the Bank of Canada first began raising its policy rate in early 2022, we knew that challenging times were ahead for Canadian households.

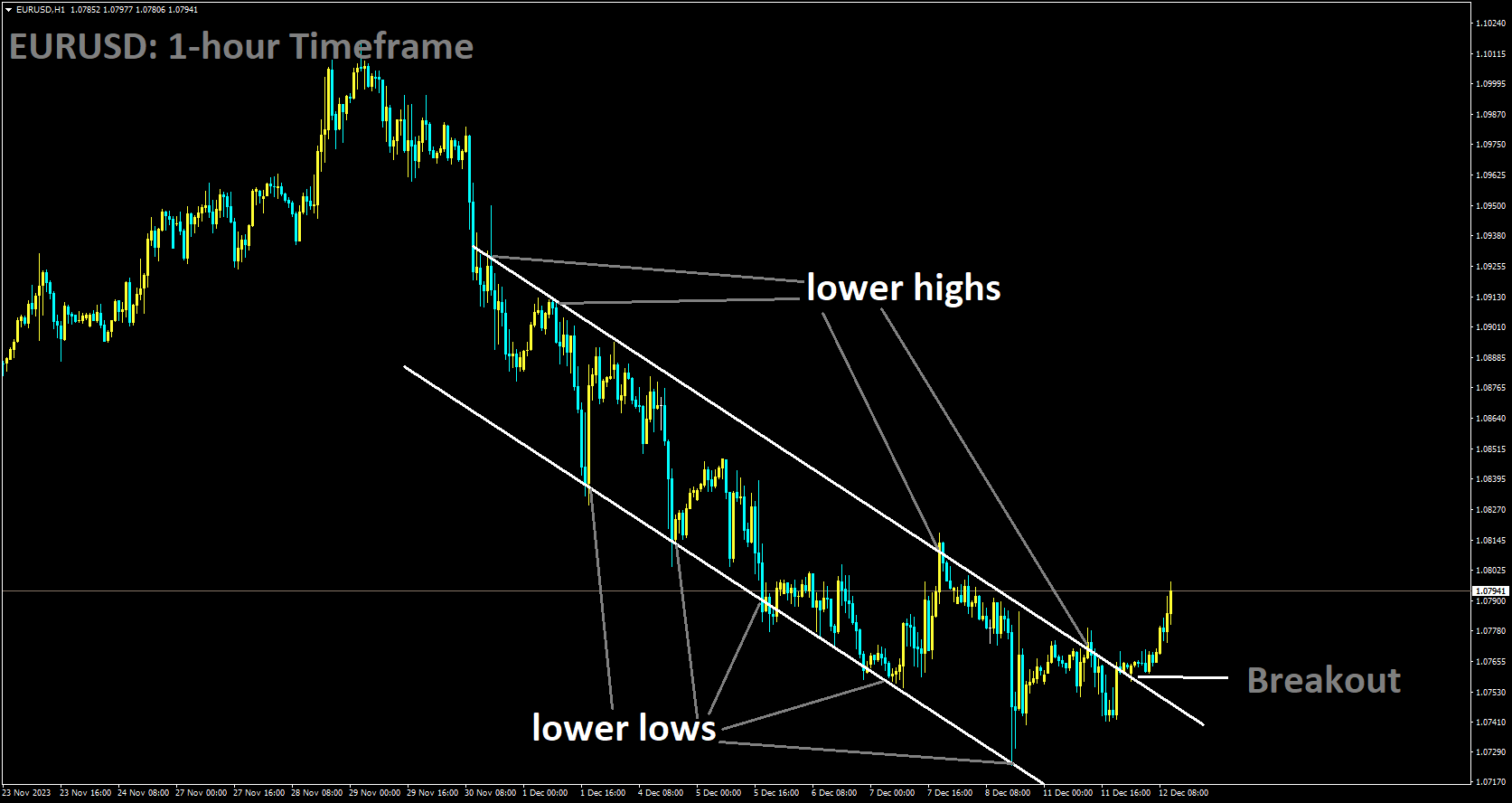

EURUSD Analysis:

EURUSD has broken Descending channel in upside

The upcoming week holds several significant events that will capture the attention of financial markets. On Tuesday, the US Consumer Price Index data is scheduled for release, followed by the US Producer Price Index and the US Federal Reserve’s interest rate announcement on Wednesday. Additionally, the European Central Bank will unveil its latest interest rate decision on Thursday.

On Tuesday, the US CPI inflation data is anticipated to show a slight increase in November, moving from 0.0% to 0.1%. This release will provide market participants with important information, particularly regarding the year-on-year figure, which is expected to decrease from 3.2% to 3.1%. And Wednesday will bring the US PPI figures for November, with expectations of an improvement from -0.5% to a modest 0.1%. However, the primary focus of the market’s attention will undoubtedly be on the US Federal Reserve, as it announces its latest interest rate decision.

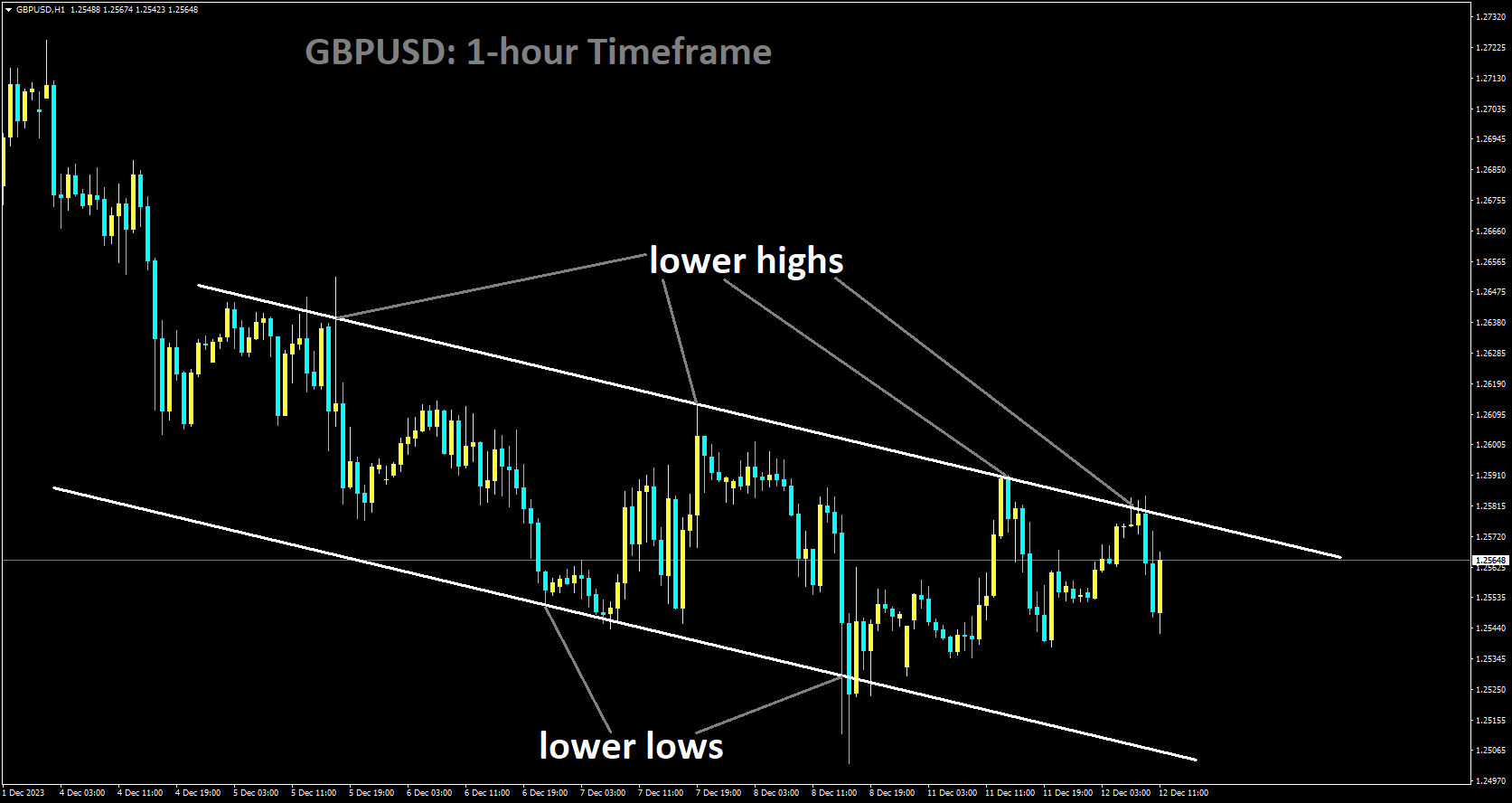

GBPUSD Analysis:

GBPUSD is moving in Descending channel and market has reached lower high area of the channel

According to the latest data released by the Office for National Statistics on Tuesday, the United Kingdom’s ILO Unemployment Rate remained stable at 4.2% for the three months leading up to October. This figure was in line with the market consensus, which anticipated a 4.2% rate for the October quarter. The report also revealed that the number of individuals claiming jobless benefits increased by 16,000 in November, surpassing the October rise of 8,900, although it fell short of the estimated 20,300.

In October, British Employment Change data showed a gain of 50,000, down from the 54,000 increase seen in September. Average Earnings excluding Bonuses in the UK saw a 7.3% year-on-year growth in October, compared to September’s 7.8% rise. Market expectations were for a slightly higher acceleration of 7.4%. Another gauge of wage inflation, Average Earnings including Bonuses, experienced a 7.2% increase during the reported period, down from the 8.0% surge in September and below the expected 7.7% rise.

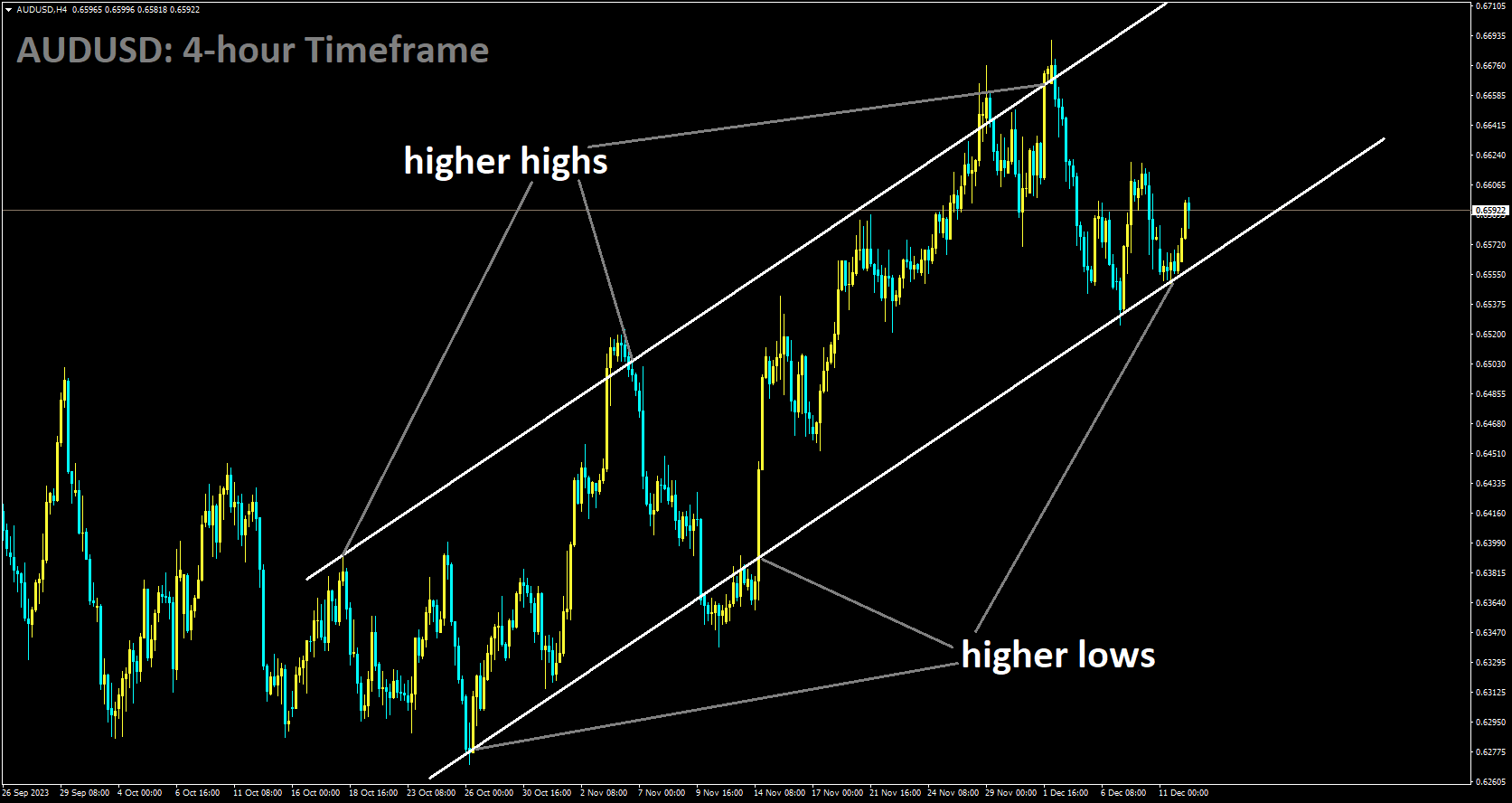

AUDUSD Analysis:

AUDUSD is moving in Ascending channel and market has reached higher low area of the channel

Michele Bullock, the Governor of the Reserve Bank of Australia, addressed a payments conference in Sydney. She emphasized that policymakers were adopting a prudent stance in their monetary policy decisions and would remain attentive to incoming data. Governor Bullock reassured the audience that they should not perceive Australia as lagging in the battle against inflation. Instead, she emphasized that the central bank was proceeding cautiously and keeping a close eye on relevant data.

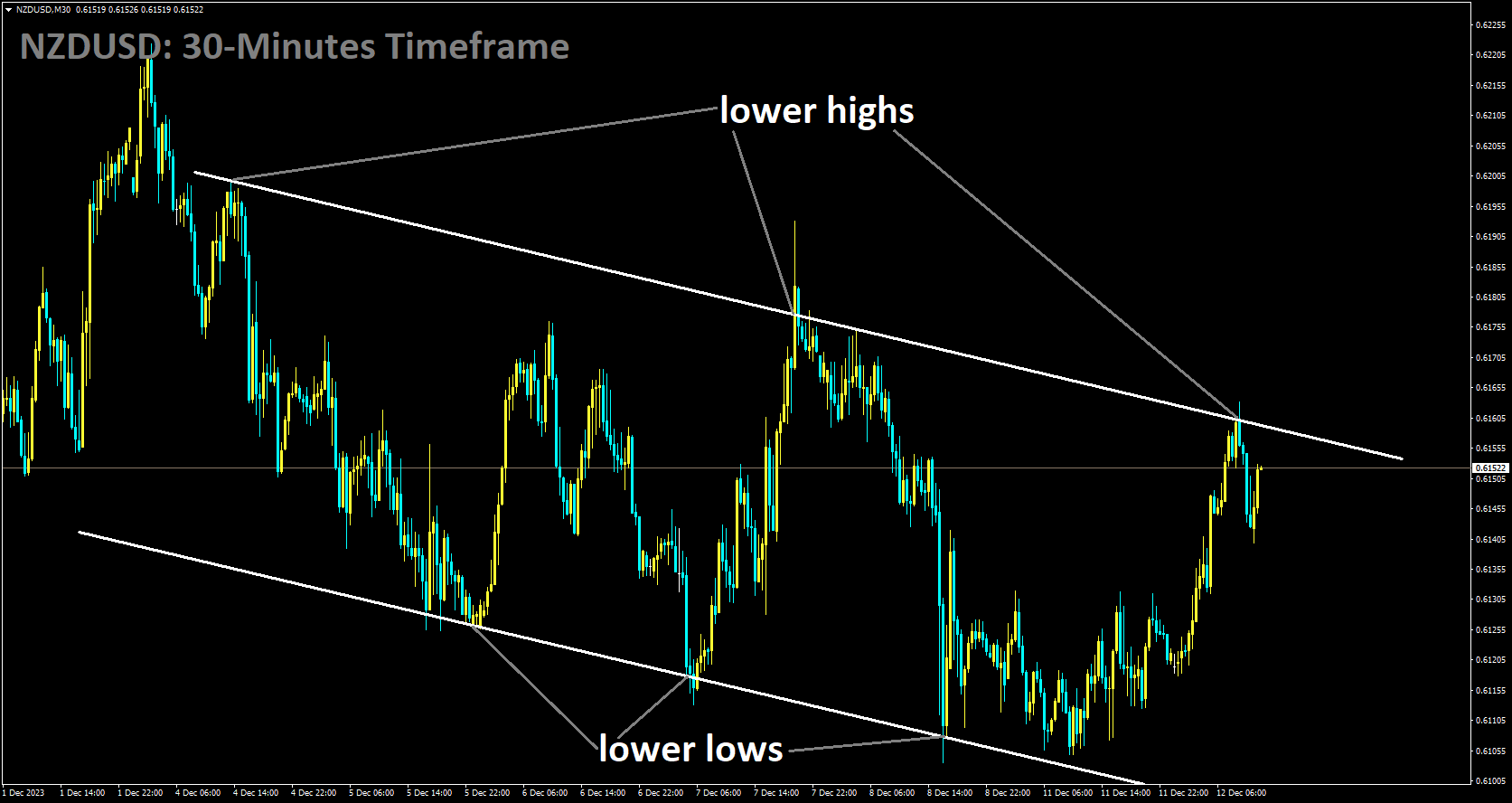

NZDUSD Analysis:

NZDUSD is moving in Descending channel and market has reached lower high area of the channel

In the most recent economic update, Kiwibank has acknowledged the somewhat underwhelming state of New Zealand’s economic growth. The bank’s economists are predicting a modest 0.2% growth in the third quarter, just slightly below the Reserve Bank’s expected 0.3% increase. Kiwibank’s Chief Economist, Jarrod Kerr, along with Senior Economist Mary Jo Vergara and Economist Sabrina Delgado, have pointed out that this revised outlook represents a departure from their initial estimate of a 0.2% contraction. However, they have emphasized that this shift is not due to a stronger-than-expected economy but is primarily driven by record-breaking net migration.

Over the past year, an astonishing 120,000 migrants have arrived in New Zealand, leading to a population growth rate of 2.7% by the end of September. While this influx has fueled increased demand and economic output, Kiwibank’s economists caution that this growth trajectory does not necessarily signal a robust economy. Per capita growth has consistently remained weak throughout the year, resulting in a less-than-impressive economic situation for the average citizen. Although the surge in migrants may temporarily postpone, mitigate, or even forestall a recession, the reality on the ground still resembles a recession, according to the economists.

Despite avoiding a technical recession, Kiwibank has issued a warning that New Zealand isn’t out of the woods yet. The current economic landscape, shaped by the Reserve Bank’s aggressive tightening of policy settings to combat inflation, points toward below-trend growth as part of a deliberate strategy. Kiwibank anticipates these stringent policies to persist until mid-2025, with the possibility of further interest rate hikes. In this context, their baseline scenario still involves New Zealand slipping into a recession later this year, albeit potentially starting a quarter later and being relatively shallow and short-lived, as the economists have clarified. There is accumulating evidence that domestic demand is responding to restrictive monetary policy, as intended, and Kiwibank does not foresee the need for additional interest rate hikes.

On the international front, Kiwibank’s attention shifts to the upcoming US Federal Reserve meeting. They anticipate a consensus favoring an unchanged cash rate, aligning with last week’s positive US payroll figures. The robust US labor market saw an increase of 199,000 jobs, a rise in average hourly monthly earnings, and a decrease in the unemployment rate to 3.7%. However, despite this strong labor market performance, the US Consumer Price Index (CPI) is expected to reveal a decrease in the annual headline inflation rate to 3.1%, with a flat monthly reading anticipated on Wednesday.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% FLAT OFFER for Signals 😍 GOING TO END – Get now: forexfib.com/discount/