USDCAD Analysis:

USDCAD has broken Ascending channel in downside

Oil initially experienced a downward slide at the start of the day but later rebounded significantly during the latter half of the European session, trading approximately 1.37% higher for the day and nearing the $70 per barrel threshold. Today, several fundamental factors came into play, including the announcement of the COP28 deal in the UAE and noteworthy comments from OPEC+ regarding their outlook for 2024. The COP28 climate meeting held in the UAE finally reached a significant agreement today, with representatives from over 200 countries ratifying it. This landmark agreement is focused on reducing global fossil fuel consumption to mitigate the worst impacts of climate change, signaling a gradual transition away from the age of oil. However, it’s worth noting that this transition will take time, as oil, gas, and coal still constitute around 80% of the world’s energy consumption. Projections on when global demand for these fossil fuels will peak vary widely.

Concerns had arisen about how OPEC+ members and Gulf States, especially Saudi Arabia, would react to these measures. According to a source with knowledge of the matter, Saudi Arabia’s stance is that countries should have the flexibility to pursue their unique pathways toward these climate goals. This approach aims to accommodate the specific circumstances and sustainable development goals of each nation while still aligning with the global objective of limiting temperature increases to 1.5 degrees Celsius. The debate over phasing out fossil fuels, particularly in developing countries, remains ongoing and challenging. Developing nations will require substantial support to achieve meaningful progress in reducing their reliance on fossil fuels.

In contrast to the COP28 deal, OPEC+ reaffirmed its own forecasts for 2024, while the U.S. Energy Information Administration lowered its 2024 Brent projection, despite output cuts. OPEC+ also revised upward its estimate for global economic growth in 2023, based on its latest monthly report. The cartel predicts that oil demand will increase by 2.2 million barrels per day in the coming year, with cautious optimism regarding the fundamental factors influencing the oil market in 2024.

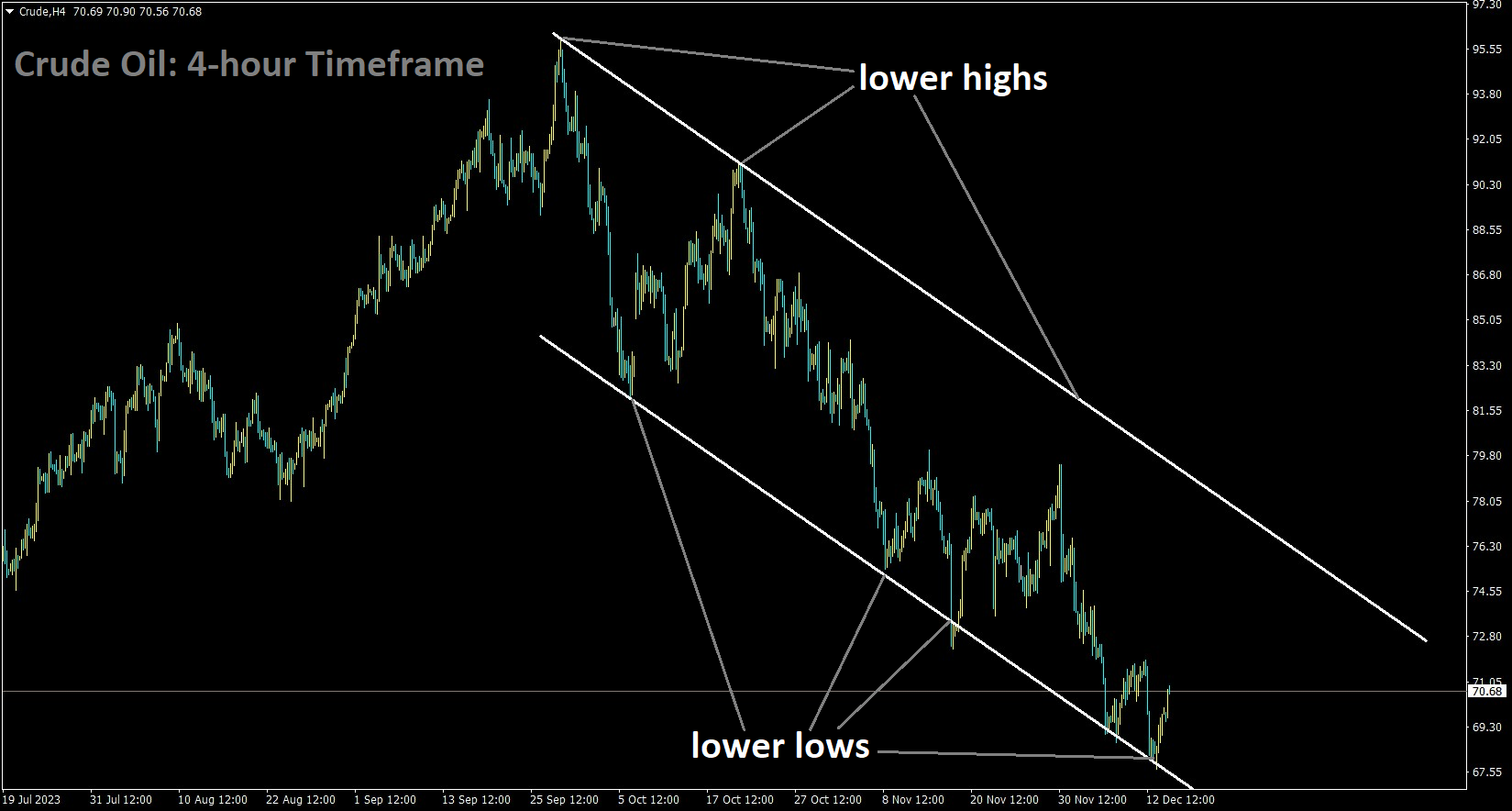

CRUDE OIL Analysis:

Crude is moving in the Descending channel and the market has rebounded from the lower low area of the channel

OPEC+ pointed to China’s continued recovery and improved performance in Europe as factors shaping its estimates. However, they do not anticipate that OECD countries will exceed their 2019 demand levels. OPEC+ attributed the recent dip in oil prices to exaggerated concerns about demand, which had an impact on market sentiment. Considering the positive demand outlook for 2024, it will be interesting to see how the International Energy Agency’s (IEA) updated forecast, set to be released tomorrow, aligns with OPEC’s perspective. Divergent outlooks between the IEA and OPEC for 2024 have been observed, and it is essential to monitor the extent of these disparities.

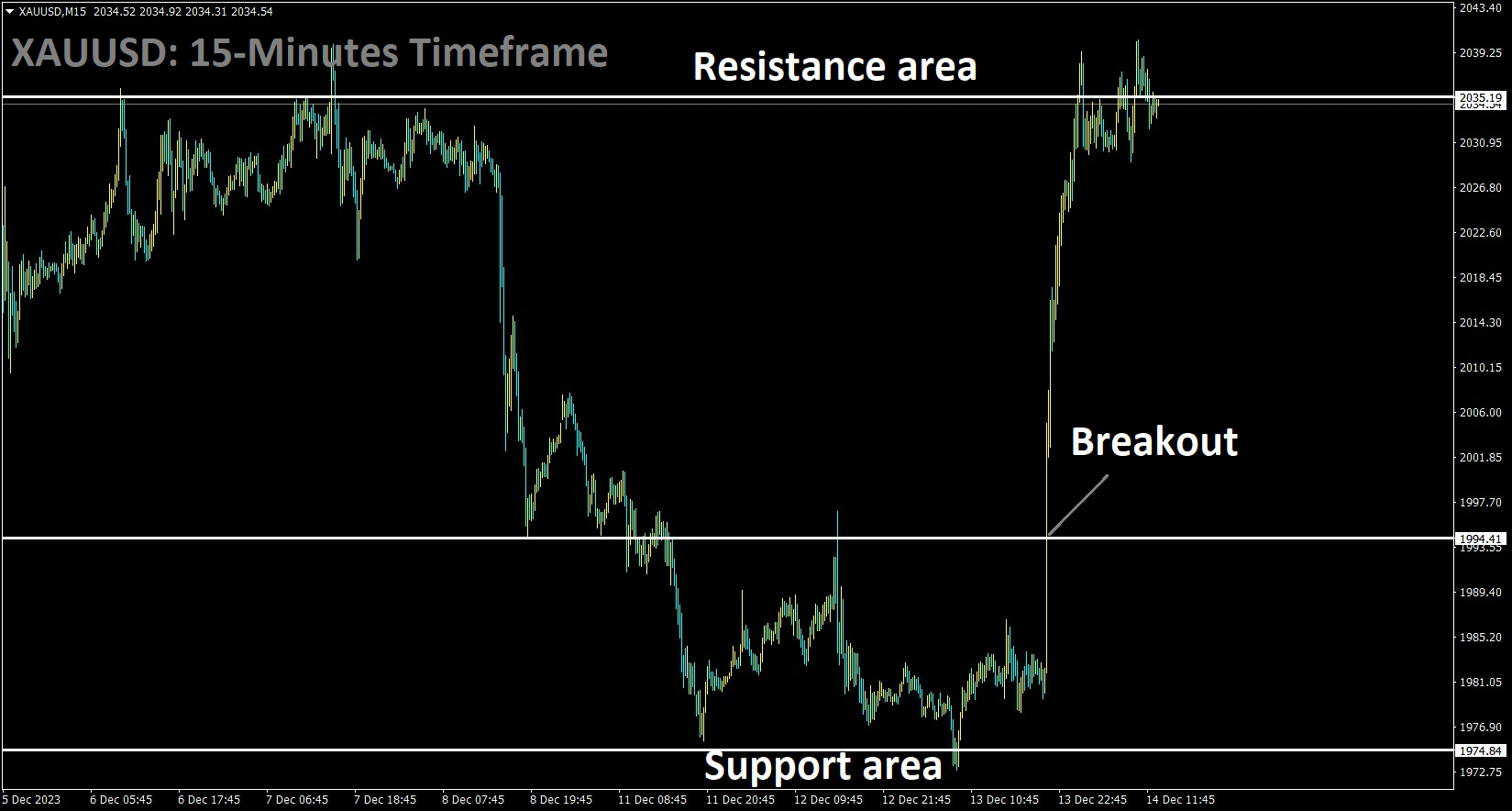

GOLD Analysis:

XAUUSD has broken the consolidation pattern and market has reached the horizontal resistance area pattern

In the latest update on the Federal Reserve’s monetary policy, the central bank has maintained its benchmark interest rate range of 5.25% to 5.50% during its final meeting of 2023. This decision aligns with expectations from Wall Street and marks the third consecutive meeting where the Fed has chosen not to alter interest rates. This cautious approach reflects the Fed’s stance in the later stages of the fight against inflation. Despite having increased rates by 525 basis points since 2022, the Fed now perceives a more balanced and two-sided risk environment.

In its statement, the Federal Open Market Committee acknowledged modest economic growth and expressed confidence in the labor market, noting strong employment gains despite some earlier moderation in the year. Regarding inflation, the committee recognized its elevated status but acknowledged a recent easing trend, signaling optimism about the future. Looking forward, the Fed maintained a mild tightening bias but introduced the word “any” in its message regarding additional policy firming, indicating less certainty about further rate hikes. This suggests that the era of rate hikes may be drawing to a close.

The December Summary of Economic Projections brought notable revisions compared to the September estimates. The GDP forecast for 2023 was adjusted upward to 2.6%, while the projection for the following year saw a slight dip to 1.4%. However, the labor market outlook remained stable, with unemployment rates of 3.8% for this year and 4.1% for the next year, indicating confidence in job stability. Core PCE, the Fed’s preferred inflation gauge, was projected to end the year at 3.2%, a decrease from the previous estimate of 3.7%, and was predicted to fall further to 2.4% in 2024.

The dot plot, illustrating the expected interest rate trajectory as perceived by Federal Reserve officials, witnessed significant adjustments. The year-end projection for 2023 dropped from 5.6% to 5.4%, reflecting the Fed’s recent pause in rate hikes. Additionally, the 2024 target range was lowered to 4.6%, implying 75 basis points of easing from a lower peak rate. These developments triggered swift market reactions, with gold prices rising and Treasury yields and the U.S. dollar facing downward pressure. This was primarily driven by the Fed’s projection of three standard quarter-point interest rate cuts in the following year and its more balanced stance on inflation. Traders now eagerly await Chairman Powell’s press conference for further clarity on the Fed’s outlook, as the central bank appears to be adopting a more dovish stance.

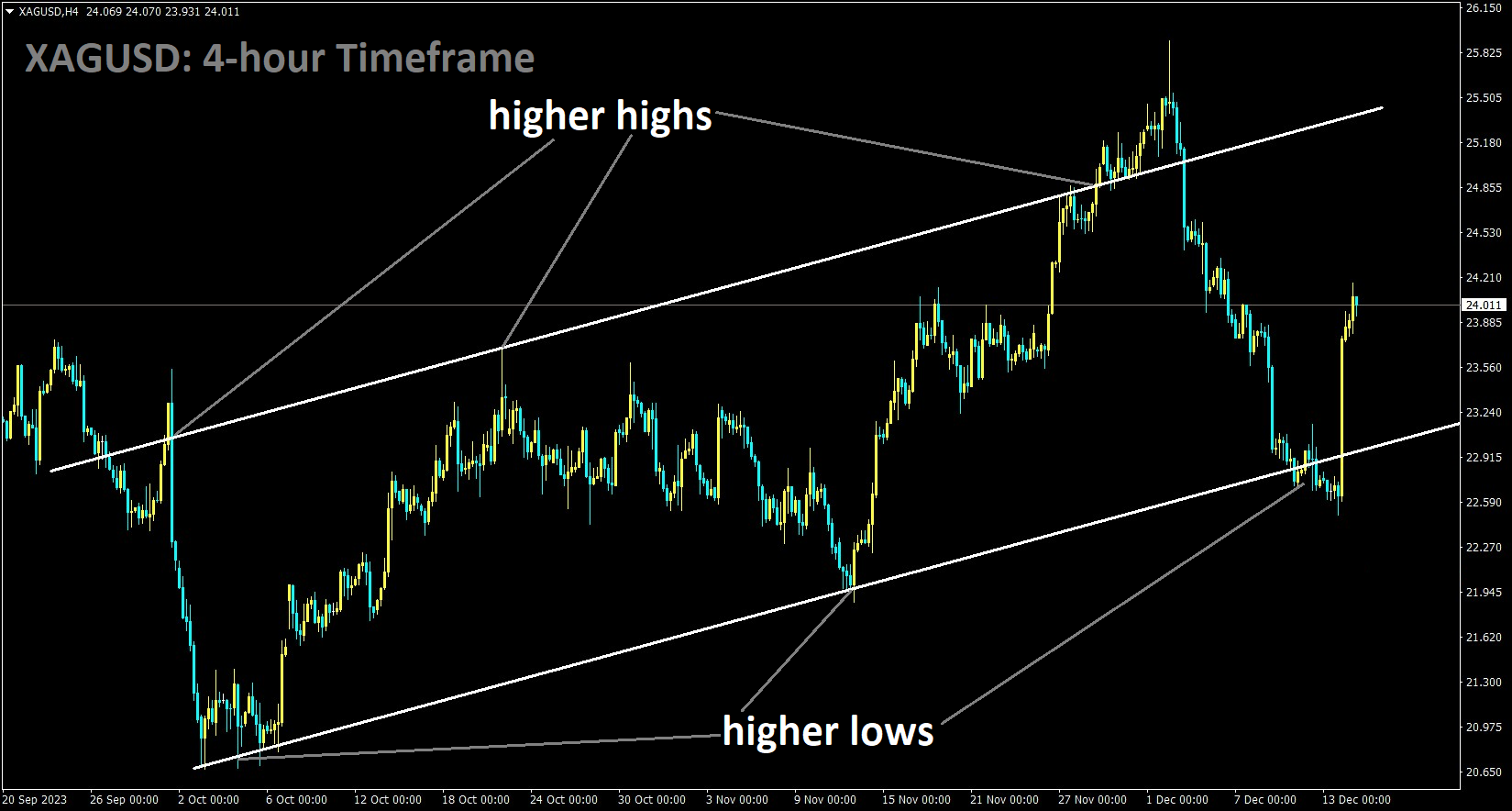

SILVER Analysis:

XAGUSD is moving in an Ascending channel and the market has rebounded from the higher low area of the channel

The U.S. Dollar continues to weaken against other currencies, following significant losses in the wake of the Federal Reserve’s recent event. On Thursday, several central banks, including the Swiss National Bank, the Bank of England, and the European Central Bank, are scheduled to announce their monetary policy decisions. Additionally, the U.S. economic calendar includes the release of weekly Initial Jobless Claims and Retail Sales data for November. ECB President Christine Lagarde will also hold a press conference to discuss the policy outlook.

As anticipated, the Federal Reserve chose to keep its policy rate unchanged at 5.25% to 5.50% following its final policy meeting of the year. The revised Summary of Economic Projections indicated that officials’ median view for the policy rate at the end of 2024 was 4.6%, signaling an expected reduction of 75 basis points in the next year. During the post-meeting press conference, Chairman Jerome Powell acknowledged that policymakers were actively discussing the appropriate timing for initiating interest rate cuts. Powell emphasized their focus on avoiding the mistake of keeping rates excessively high for an extended period, contributing to the dovish sentiment. These dovish comments, coupled with the dovish dot plot, led to a significant decline in U.S. yields. The benchmark 10-year U.S. Treasury bond saw a loss of more than 4% on Wednesday and continued to decline early on Thursday, putting further pressure on the U.S. Dollar. The 10-year U.S. yield reached its lowest level since early August, dropping below 4%, while the USD Index, which experienced a nearly 1% decline on Wednesday, was down 0.3% at 102.60.

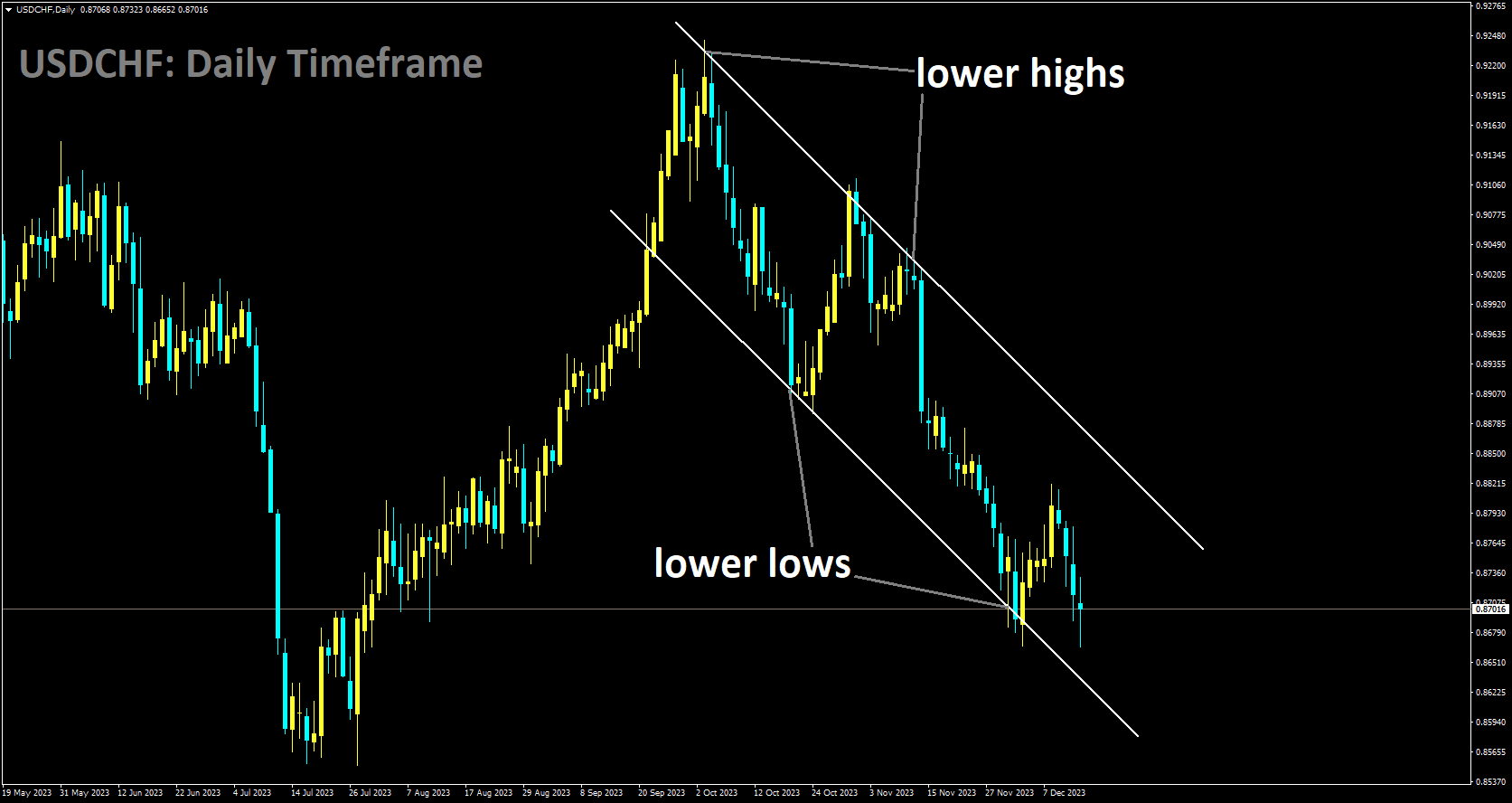

USDCHF Analysis:

USDCHF is moving in Descending channel and market has reached lower low area of the channel

The USDCHF pair is currently experiencing its fourth consecutive day of losses, ahead of the Swiss National Bank’s Interest Rate Decision. Most economists surveyed by Reuters expect the SNB to keep its key interest rate unchanged at least until the third quarter of the following year. Swiss inflation is projected to average 1.5% in 2024 and 1.3% in 2025, down from this year’s 2.2%. If these forecasts hold, the SNB may consider rate cuts, likely after the U.S. Federal Reserve, which is expected to maintain its rates until at least July, according to a separate Reuters poll. SNB Chairman Thomas Jordan has indicated a willingness to tighten monetary policy if necessary, despite the downward trend in inflation.

The Swiss central bank’s commitment to keeping rates elevated for an extended period could potentially strengthen the Swiss Franc against the U.S. Dollar. Meanwhile, the Federal Reserve’s decision to leave interest rates unchanged at 5.5% aligns with expectations and exerts downward pressure on the USDCHF pair. Additionally, the Fed’s dot-plot reveals a notable shift in Interest Rate Projections for 2024, with a 50 basis point decrease from 5.1% to 4.6%. This shift suggests a potential shift toward a more accommodative monetary policy in the future. The USDCHF pair faces further challenges due to discouraging Producer Price Index data for November, contributing to overall downward pressure. Market focus will now shift to the upcoming release of U.S. Retail Sales data.

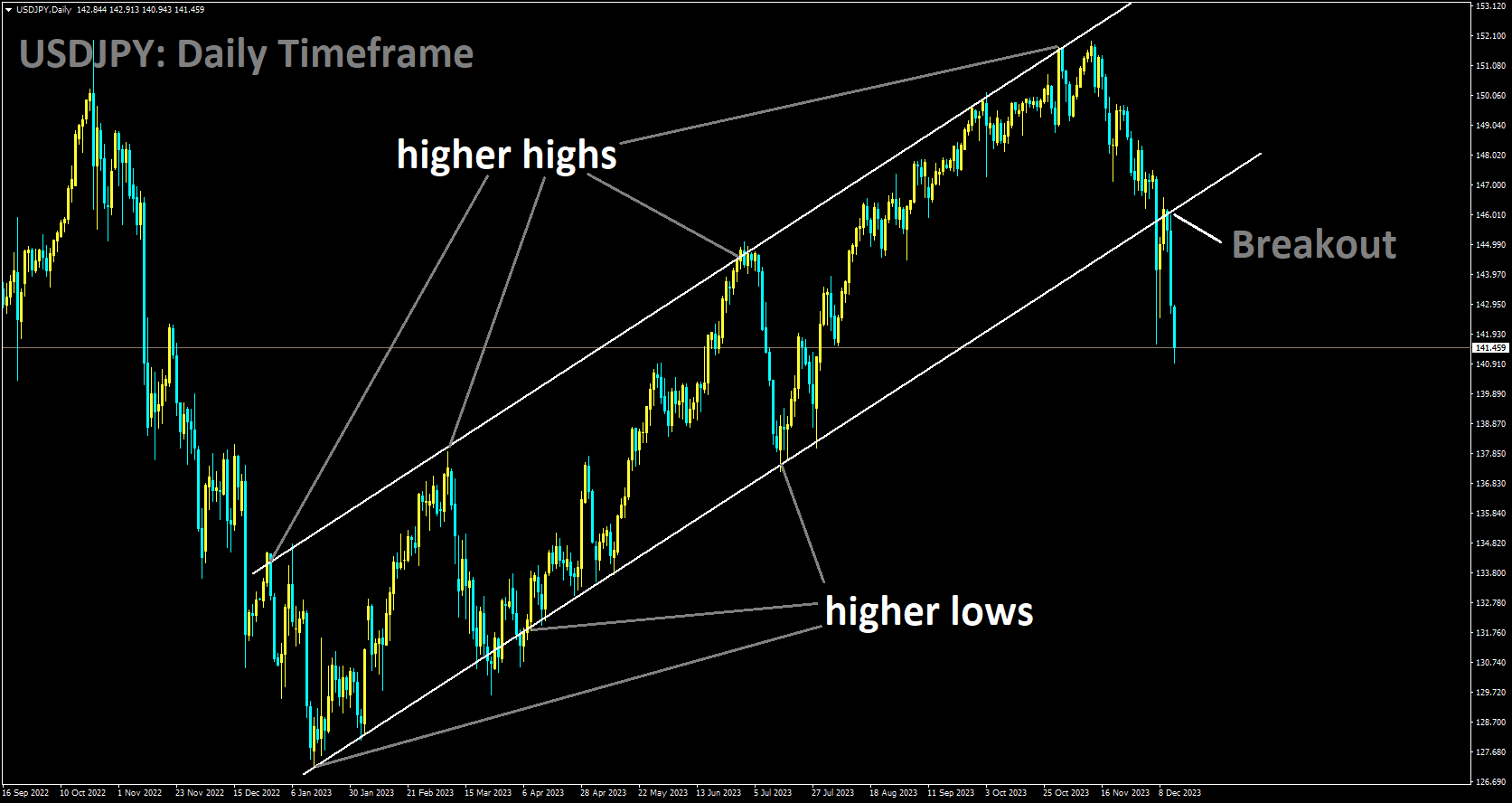

USDJPY Analysis:

USDJPY has broken Ascending channel in downside

Reuters reported on Thursday that Japan’s ruling Liberal Democratic Party’s tax reform panel is considering implementing income tax reductions to mitigate the impact of rising prices on households. The panel has decided to set a cap on annual household income for those eligible for income tax cuts and has postponed a decision to raise taxes to finance an increase in defense spending for the upcoming fiscal year. In an effort to promote a positive economic cycle driven by private sector demand, tax policymakers are increasing tax incentives for companies that raise wages. Furthermore, the tax panel has reached an agreement to establish a new tax scheme aimed at encouraging domestic investment in companies that produce essential materials from the perspective of decarbonization and economic security.

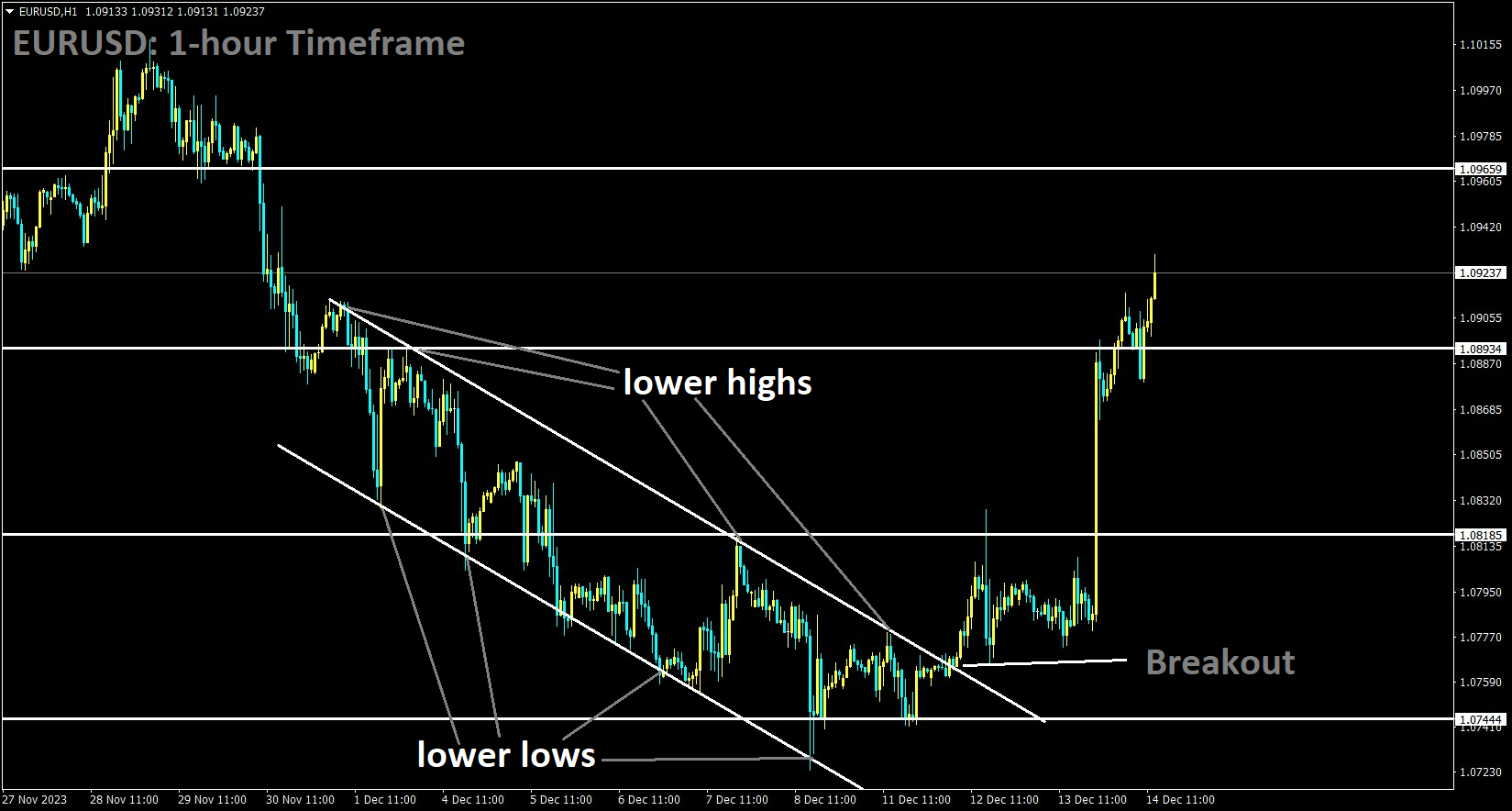

EURUSD Analysis:

EURUSD has broken the Descending channel in upside

EURUSD has been on an upward trajectory since Monday, influenced by the dovish sentiment surrounding the Federal Reserve’s Interest Rate Decision. As expected, the Federal Reserve chose to keep interest rates steady at 5.5%. Notably, the Fed’s “dot-plot” displayed a significant adjustment in Interest Rate Projections for 2024, indicating a decrease of 50 basis points from 5.1% to 4.6%. This shift in the projections hints at a potentially more accommodative future monetary policy stance. Consequently, the U.S. Dollar Index continues to slide, trading at approximately 102.60, driven by subdued U.S. bond yields. At the time of this report, the 2-year and 10-year U.S. Treasury yields stand at 4.34% and 3.97%, respectively.

In the United States, economic sentiment faces headwinds as discouraging Producer Price Index (PPI) data for November is released, exerting further downward pressure on the U.S. Dollar. According to the U.S. Bureau of Labor Statistics, year-on-year PPI growth slowed to 0.9%, falling short of the expected 1.0%. Similarly, the Core PPI registered a rate of 2.0%, below the anticipated 2.2%. Market participants are eagerly awaiting the release of U.S. Retail Sales data scheduled for Thursday.

On the European front, the seasonally adjusted Industrial Production index, reported monthly by Eurostat, indicates a 0.7% decline, surpassing the anticipated 0.3% decrease. The upcoming monetary policy meeting of the European Central Bank, also set for Thursday, is anticipated to maintain the status quo in terms of interest rates. Market attention is particularly focused on the ECB’s guidance for 2024, especially any signals regarding the potential timing of interest rate cuts.

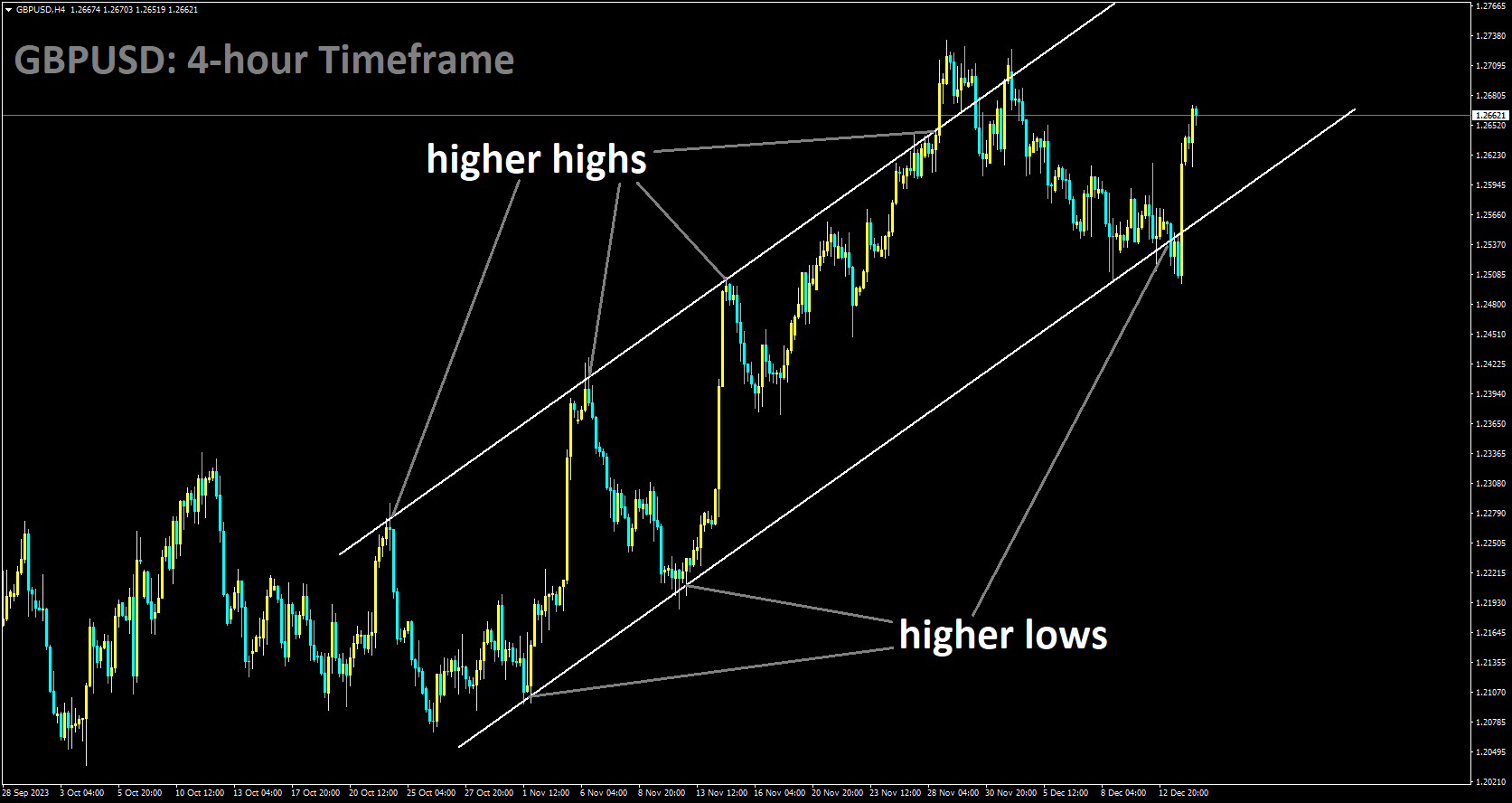

GBPUSD Analysis:

GBPUSD is moving in Ascending channel and market has rebounded from the higher low area of the channel

As we approach the end of 2023, the Bank of England is expected to maintain its key interest rate unchanged for the third consecutive meeting scheduled for Thursday. This event is anticipated to bring significant volatility to the Pound Sterling, as all eyes are focused on the central bank’s communication regarding the future path of interest rates, particularly with markets already pricing in rate cuts in 2024. The general consensus is that the Bank of England will keep the benchmark interest rate steady at 5.25% when it announces its decision. This particular meeting does not constitute a Super Thursday as there will be no release of the Monetary Policy Report or a press conference by Governor Andrew Bailey. With no rate hike expected this week, market probabilities are now reflecting a 10% chance of a rate cut for the meeting on March 21, increasing to nearly 45% for May 9 and nearly 90% for June 20, according to Bloomberg’s World Interest Rate Probability data.

As a result, the language used in the BoE’s policy statement will be crucial in assessing the interest rate outlook for the coming year, including when and how quickly the central bank might implement rate cuts. Economists and industry analysts anticipate the BoE to push back against expectations of rate cuts in the following year, particularly given the hawkish tone maintained by BoE policymakers in their recent speeches.BoE Deputy Governor for Markets and Banking, Dave Ramsden, has suggested that monetary policy may need to remain restrictive for an extended period to bring inflation back to its 2% target. This sentiment is echoed by BoE policymaker Catherine Mann, who emphasizes the need for tighter monetary policy in response to the prospect of more persistent inflation. BoE Governor Andrew Bailey also reiterated earlier in the month that interest rates are likely to remain at current levels. Rabobank’s macro strategists predict that the first reduction in the UK’s bank rate will likely occur in November 2024. They believe that the Monetary Policy Committee will require compelling evidence of significant improvements in labor market conditions and a clear reduction in domestically generated inflation pressures before considering a shift in their policy stance.

Recent data from the Office for National Statistics revealed a slowdown in UK wage growth for the quarter to October, although pay growth remained at a robust pace. This development may discourage the BoE from implementing rate cuts in the near term. Specifically, Average Earnings excluding Bonuses in the UK rose by 7.3% year-on-year in October, compared to September’s 7.8% increase and slightly below the expected 7.4%. Additionally, services inflation remains notably high at 6.6%. Meanwhile, the UK economy contracted more than anticipated, declining by 0.3% in October, primarily due to rising interest rates, which continue to impact household spending, according to ONS data released on Wednesday. Nevertheless, this data is unlikely to prompt the BoE to signal an imminent rate cut.

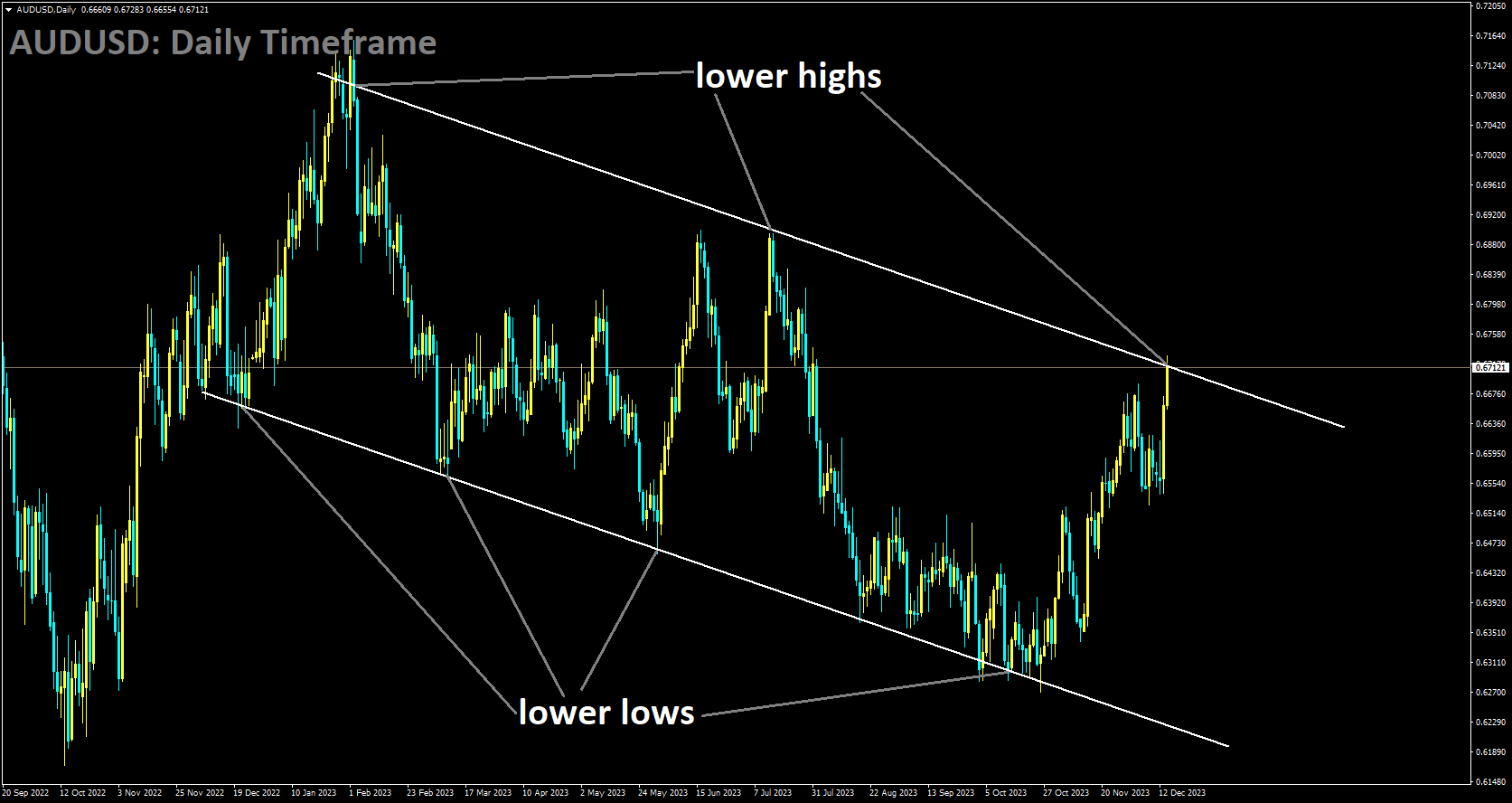

AUDUSD Analysis:

AUDUSD is moving in an Ascending channel and the market has reached the higher high area of the channel

The Australian Dollar extended its upward momentum for the second consecutive day on Thursday, delivering its strongest performance in four months. This surge was prompted by the release of moderate employment data from Australia. The AUDUSD pair took advantage of a significant weakening of the US Dollar following the recent Federal Reserve meeting. As expected, the Fed chose to keep interest rates at 5.5%, and market expectations are now leaning towards three rate cuts in 2024. Fed Chair Jerome Powell adopted a dovish stance, causing Treasury bond yields to decline and refrained from declaring victory over inflation. In Australia, Consumer Inflation Expectations for December decreased to 4.5%, down from the previous 4.9%. However, the seasonally adjusted Employment Change for November saw a substantial improvement, reaching 61.5K, surpassing the expected 11.0K. On the downside, the Unemployment Rate rose to 3.9% from its previous level of 3.7%. Meanwhile, the US Dollar Index faced downward pressure following the release of disappointing Producer Price Index data for November, showing growth of 0.9% instead of the expected 1.0%. The Core PPI also fell short, coming in at 2.0% rather than the expected 2.2%. Market observers are now eagerly awaiting the release of US Retail Sales data on Thursday.

In other economic indicators, the ANZ-Roy Morgan Australian Consumer Confidence weekly survey rose to 80.8 from the previous week’s 76.4, indicating improved sentiment. Westpac Consumer Confidence for December also showed improvement, rising by 2.7% after a 2.6% decline in the previous reading. Furthermore, the Australian government is anticipating a significantly improved budget outcome this year, as revenues are surpassing forecasts. According to the mid-year economic and fiscal outlook presented by Labor Treasurer Jim Chalmers, a budget deficit of just AUD 1.1 billion USD 721.4 million is projected for the year ending June 2024, down from the AUD 13.9 billion forecasted back in May. Lastly, the US Consumer Price Index for November increased by 0.1% month-on-month and 3.1% year-on-year, aligning with market consensus and meeting inflation expectations. The US Core CPI, which excludes volatile food and energy prices, rose by 0.3% month-on-month and 4.0% year-on-year, in line with expectations.

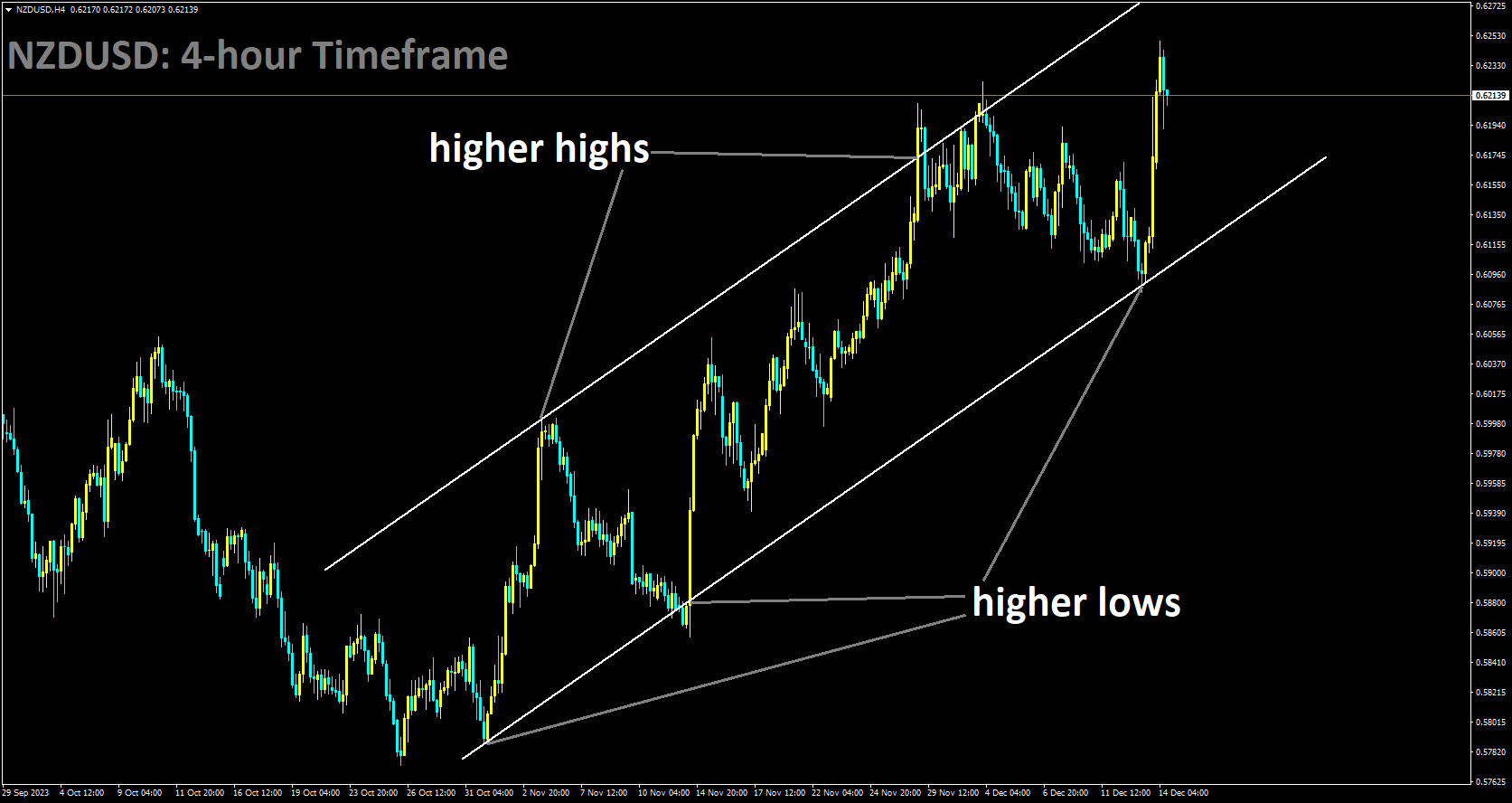

NZDUSD Analysis:

NZDUSD is moving in Ascending channel and market has rebounded from the higher low area of the channel

In the third quarter, New Zealand’s Gross Domestic Product contracted by -0.3%, a significant shift from the 0.5% growth reported in the previous quarter. This figure fell short of market expectations, which had anticipated a 0.2% expansion, according to the latest data released by Statistics New Zealand on Thursday. Moreover, the annual GDP for the third quarter recorded a contraction of -0.6%, a substantial drop compared to the 1.5% growth witnessed in Q2, and it also missed estimates of a 0.5% increase.

Federal Reserve Chairman Jerome Powell provided insights into the reasoning behind maintaining the policy rate, specifically the federal funds rate, within the 5.25-5.5% range during the post-meeting press conference. He also fielded questions from the audience. Powell emphasized the central concern of whether the current rates are sufficiently high, expressing skepticism about further rate hikes. Instead, policymakers are engaged in discussions regarding the appropriate timing for potential rate cuts. He pointed out the presence of robust economic growth, which appears to be moderating, and acknowledged tangible progress in managing inflation. Nevertheless, he underscored that there is still a considerable distance to cover on these fronts, and no one is prematurely declaring victory. Powell highlighted the uncertainty in making progress and stressed the need for a cautious approach when assessing whether additional measures are required. He concluded by suggesting that the question of when it might be suitable to implement rate cuts is starting to come into focus.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% FLAT OFFER for Signals 😍 GOING TO END – Get now: forexfib.com/discount/