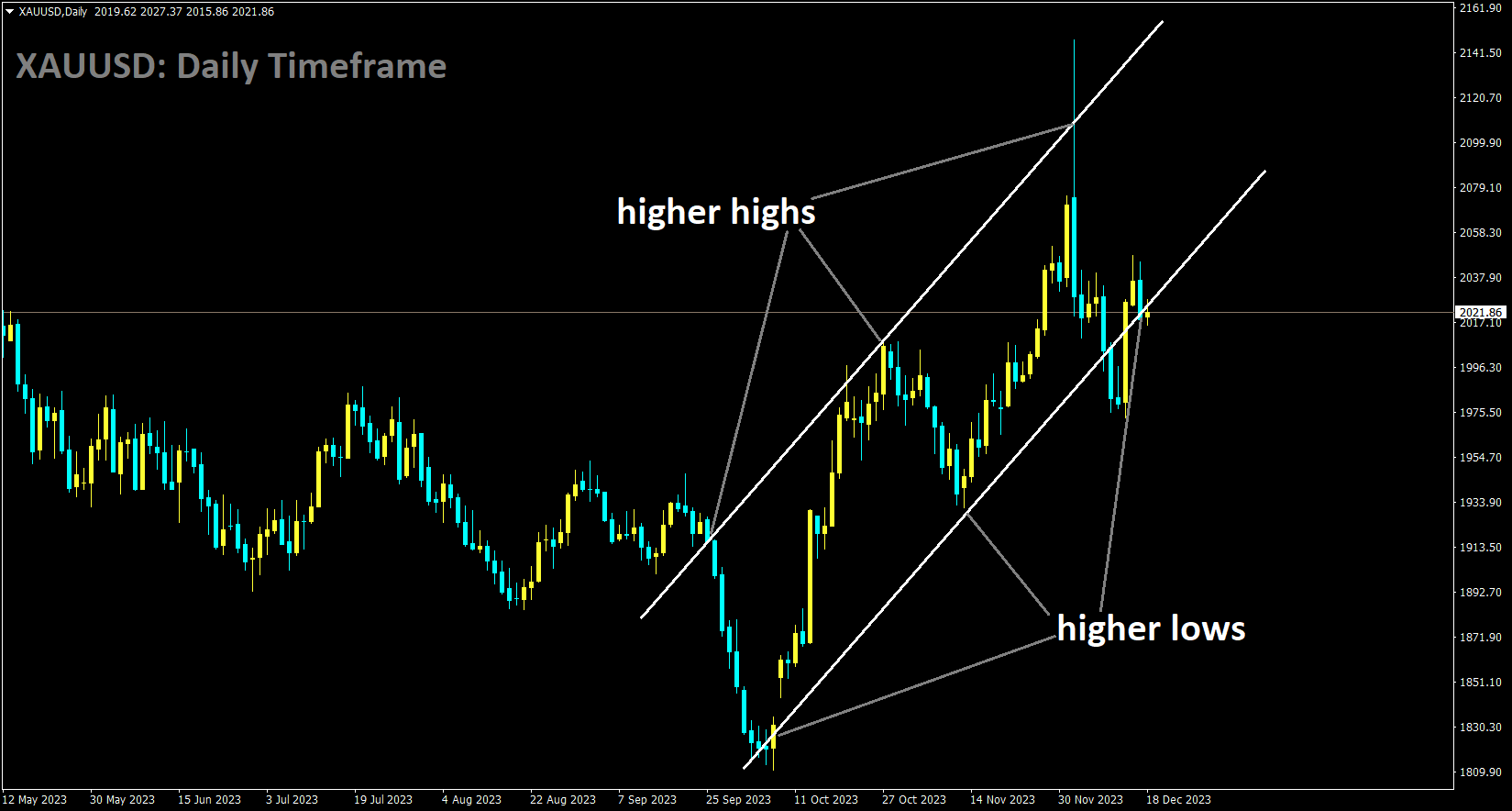

GOLD Analysis:

XAUUSD is moving in an Ascending channel and the market has reached the higher low area of the channel

Gold prices began the new week with positive momentum, maintaining modest intraday gains throughout the European session. However, sustaining significant upward movement proved challenging. The recent Federal Reserve announcement signaling the end of its tightening cycle and projecting 75 basis points in rate cuts for 2024 acted as a ceiling on the US Dollar’s rebound from its four-month low reached on Friday. This development provided support for gold, a safe-haven asset. Concerns about geopolitical risks and fears of a deeper economic downturn, particularly in China and the Eurozone, added further backing to gold’s appeal. Despite these factors, a couple of Federal Reserve officials tried to push back against market expectations for early interest rate cuts. Additionally, the recent strong rally in global equity markets, driven by the Fed’s more dovish stance and expectations of additional stimulus from China, limited substantial upward movement in gold prices. Traders also remained cautious, awaiting the release of the US Core PCE Price Index, the Federal Reserve’s preferred gauge of inflation, on Friday.

This crucial US inflation data will shape market expectations regarding the Fed’s policy adjustments and influence the next direction for gold, which does not provide yield. In the absence of significant economic data from the US on Monday, broader market sentiment and USD dynamics will likely continue to impact demand for XAUUSD. New York Federal Reserve President John Williams, in a recent CNBC interview, emphasized that rate cuts are not currently under discussion, and it’s too early to speculate about them.

He mentioned that economic data can surprise, and the central bank should be prepared to tighten policy further if inflation progress falters. Atlanta Fed President Raphael Bostic echoed a similar sentiment, suggesting that rate cuts are not imminent and might occur sometime in the third quarter of 2024. However, markets appear convinced that the Fed will ease its policy by the first half of 2024, which limits the US Dollar’s rebound from its four-month low and supports the price of gold.

On the economic front, the flash PMI data released on Friday indicated a deterioration in business activity in Germany in December, raising concerns about a possible recession in the Eurozone’s largest economy. Additionally, North Korea conducted missile tests, and China expressed optimism about its economic outlook for 2024. China’s favorable conditions, low prices, manageable government debt levels, and policies to strengthen monetary and fiscal measures, in conjunction with the Fed’s dovish stance, bolstered positive sentiment in global equity markets, thus restraining further gains in the safe-haven gold market.

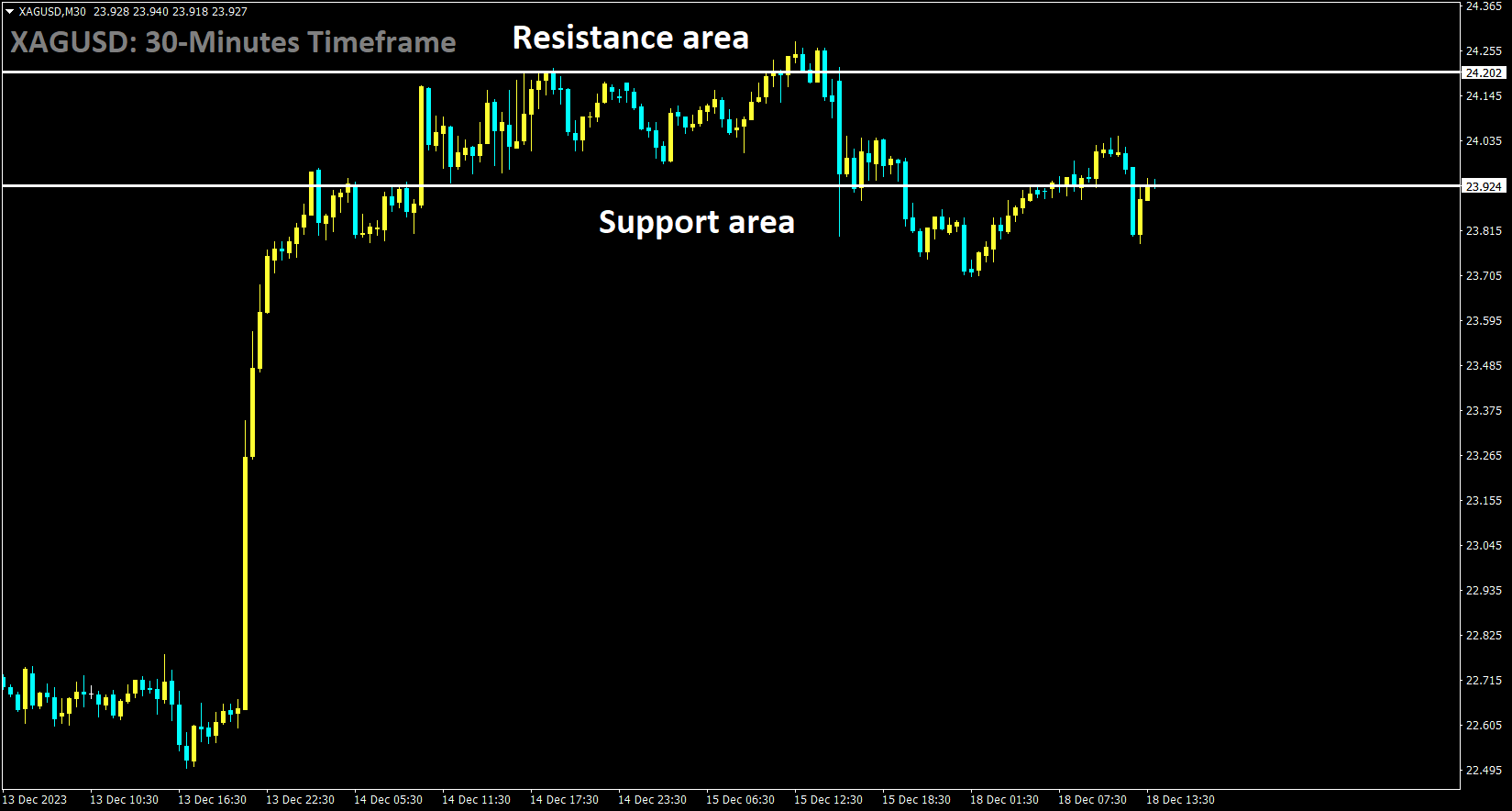

SILVER Analysis:

XAGUSD is moving in the Box pattern and the market has rebounded from the support area of the pattern

During the early European session on Monday, the US Dollar Index, which measures the value of the US Dollar against a weighted basket of currencies representing US trade partners, experienced a loss of momentum. The DXY rebounded from its multi-month lows at 101.77 and is currently trading near 102.45, showing a 0.15% decline for the day. While the stronger US Services PMI released on Friday provided some support for the Greenback, its upside remains constrained by expectations of three rate cuts from the Federal Reserve in the upcoming year. On Friday, data indicated that the flash reading of the US S&P Global Services PMI for December climbed to 51.3 from November’s 50.8, surpassing market expectations of 50.8. However, the Manufacturing PMI dropped to 48.2 in December, down from 49.4 in November and below market expectations of 49.3. The Composite PMI for December increased to 51.0, up from the previous reading of 50.7.

The Fed’s dovish stance prompted a rally in US equities and placed downward pressure on the US Dollar. Currently, money markets are reflecting a nearly 75.0% probability of at least a 25-basis point rate cut in March 2024, up from around 64.5% before the latest policy decision, according to CME Group’s FedWatch tool. Federal Reserve Bank of Chicago President Austan Goolsbee stated on Sunday that it is too early to declare victory in the battle against inflation, emphasizing that decisions regarding rate cuts will depend on upcoming economic data.

Atlanta Fed President Raphael Bostic also noted that rate cuts are not imminent, and the first cuts might materialize sometime in the third quarter of 2024. However, markets increasingly anticipate the possibility of rate cuts in the first half of 2024, which is limiting the US Dollar’s recovery from its four-month low and supporting silver prices.

The prospect of potential Fed rate cuts in the coming year is also weighing on US Treasury bond yields, with the US 10-year Treasury note yields reaching multi-month lows and currently standing near 3.90%. This development follows the Fed’s indication that it plans to implement three interest rate cuts in 2024 after its recent meeting. Traders will closely monitor the release of US Building Permits and Housing Starts on Tuesday. Later in the week, attention will turn to US Consumer Confidence and Existing Home Sales data scheduled for Wednesday. Additionally, the US Gross Domestic Product Annualized for Q3, which is expected to remain steady at 5.2%, will be released on Wednesday.

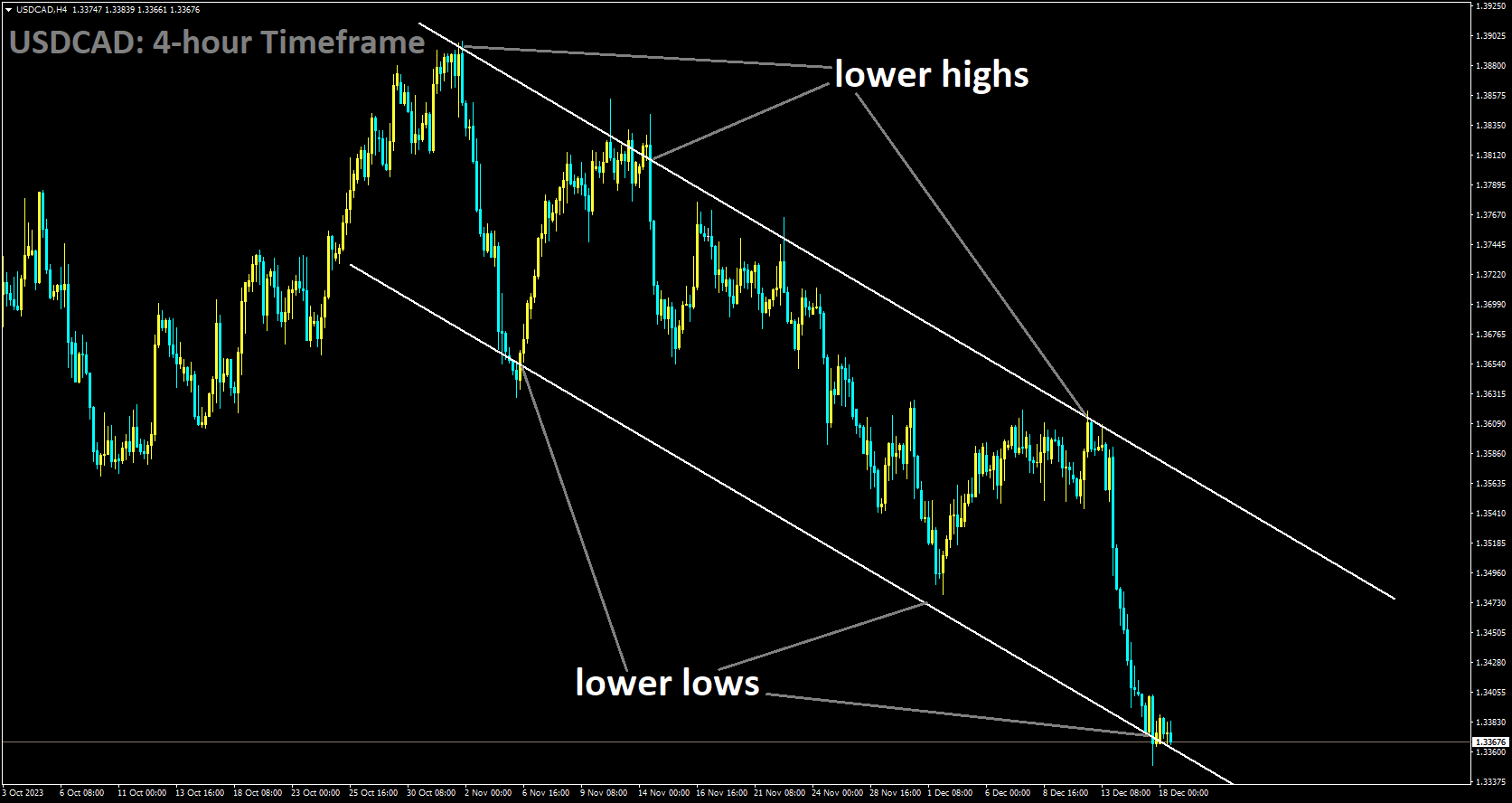

USDCAD Analysis:

USDCAD is moving in Descending channel and market has reached lower low area of the channel

Federal Reserve officials are strongly indicating that market expectations regarding rate cuts in 2024 may have exceeded the Fed’s own outlook. Bank of Canada Governor Tiff Macklem, speaking at the Canadian Club of Toronto, emphasized that it is still premature to consider or discuss rate cuts. Macklem’s remarks at this event represent the most notable item on the Canadian Dollar’s economic calendar for the week. New York Fed President John Williams also tempered the enthusiasm in the markets on Friday, stating that market expectations of rate cuts as early as March are premature. He revealed that rate cut discussions have not even been on the Fed’s agenda yet.

The Canadian Dollar was among the top performers on Friday, gaining ground against all major currency counterparts. It rose by over one percent against the Euro, a full percent against the British Pound, and a quarter of a percent against the US Dollar. BoC Governor Macklem: Premature to consider rate cuts. NY Fed President Williams: Rate cuts not under discussion at the Fed; market expectations regarding rate cuts are too early; Fed’s current policy stance is appropriate. Williams’ comments led to a market correction after a week of bullish sentiment following adjustments to the Fed’s dot plot, which now suggests three rate cuts totaling 75 basis points in 2024.

US economic data on Friday leaned towards the downside, with the NY Empire State Manufacturing Index unexpectedly dropping from 9.1 to -14.5 in December, well below the market’s forecast of 2.0. US Industrial Production for November also missed expectations, rising by 0.2% instead of the forecasted 0.3%, and October’s figure was revised downward from -0.6% to -0.8%. The US S&P Global Purchasing Managers’ Index prints delivered mixed results, with the Manufacturing component falling from 49.4 to 48.2 MoM, against a forecast of 49.3, indicating a deeper move into contraction territory. However, the US Services PMI for December exceeded expectations, reaching 51.3 compared to November’s 50.8, when markets had anticipated a slight decline to 50.6.

Crude oil markets faced some pressure following Fed President Williams’ appearance on CNBC, causing WTI crude to dip towards $70.50 before stabilizing below $72 per barrel. This limited support for the Canadian Dollar on Friday. Overall, the Canadian Dollar ended the week on a positive note against the US Dollar, with a gain of 1.6% from Monday’s opening levels.

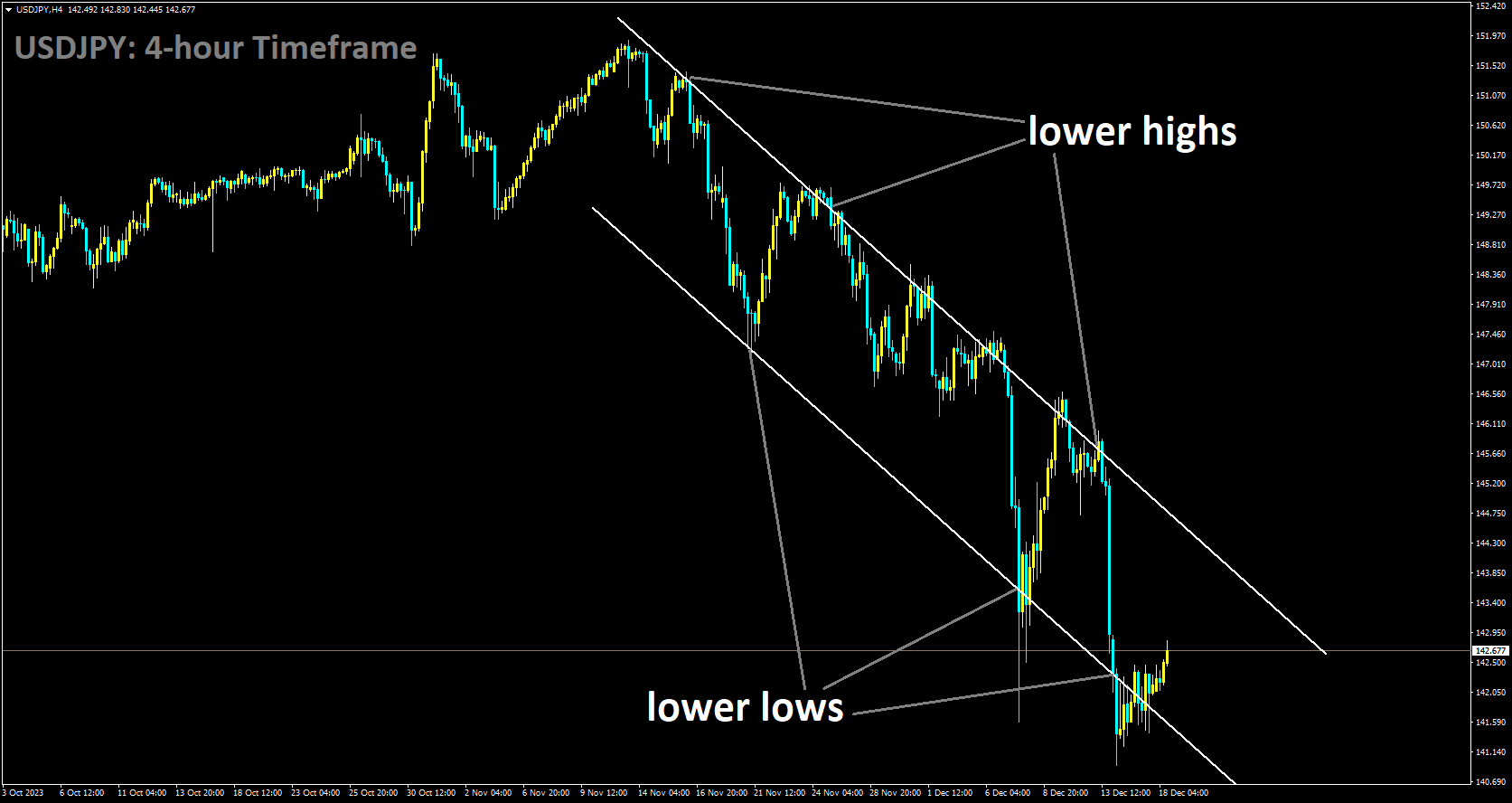

USDJPY Analysis:

USDJPY is moving in Descending channel and market has rebounded from the lower low area of the channel

The Japanese Yen has started the new week on a weaker footing and remains in a defensive position against the US Dollar during the early part of the European session. This marks the second consecutive day of declines, pulling the JPY away from its highest level since late July, reached last week. The backdrop of the Federal Reserve’s recent shift towards a more dovish stance, combined with China’s Central Finance Office expressing an optimistic outlook, is boosting investor confidence. Consequently, this is regarded as a significant factor undermining the safe-haven appeal of the JPY and providing tailwinds for the USDJPY currency pair. Despite efforts by two Fed officials on Friday to dampen speculation about early interest rate cuts, the markets appear convinced that the US central bank will initiate policy easing in the first half of 2024. This, in turn, restrains the US Dollar’s recovery from a four-month low recorded on Friday. Additionally, increasing expectations of a potential change in the Bank of Japan’s policy stance early next year contribute to limiting the upside for the USDJPY pair.

The prevailing risk-on sentiment in the market is undermining the safe-haven status of the Japanese Yen, alongside a moderate recovery in the US Dollar from its recent four-month low. State media Xinhua, citing a government statement, reported that China’s economy is expected to encounter more favorable conditions and opportunities than challenges in 2024. In an interview with CNBC, New York Fed President John Williams emphasized that the discussion about rate cuts is not currently a focus, and it is premature to speculate about them.

Williams added that economic data can exhibit unexpected trends, and the central bank needs to be prepared to tighten policy further if progress on inflation were to stall or reverse. Separately, Atlanta Fed President Raphael Bostic stated that rate cuts are not imminent, and the first cuts might materialize sometime in the third quarter of 2024.

On a different note, North Korea conducted a missile launch, including at least one unidentified type of ballistic missile on Monday, following a separate short-range missile launch late Sunday night. The flash PMI data released on Friday indicated a deterioration in German business activity in December, heightening the risk of a recession in Europe’s largest economy. Meanwhile, the S&P Global Composite PMI showed a slight increase to 51.0 from 50.7, suggesting that business activity in the US private sector continues to expand at a modest pace in early December. Nevertheless, the USDJPY pair faces challenges in moving back above the mid-142.00s, as market participants increasingly anticipate the possibility of the Bank of Japan exiting its negative interest rate policy early next year.

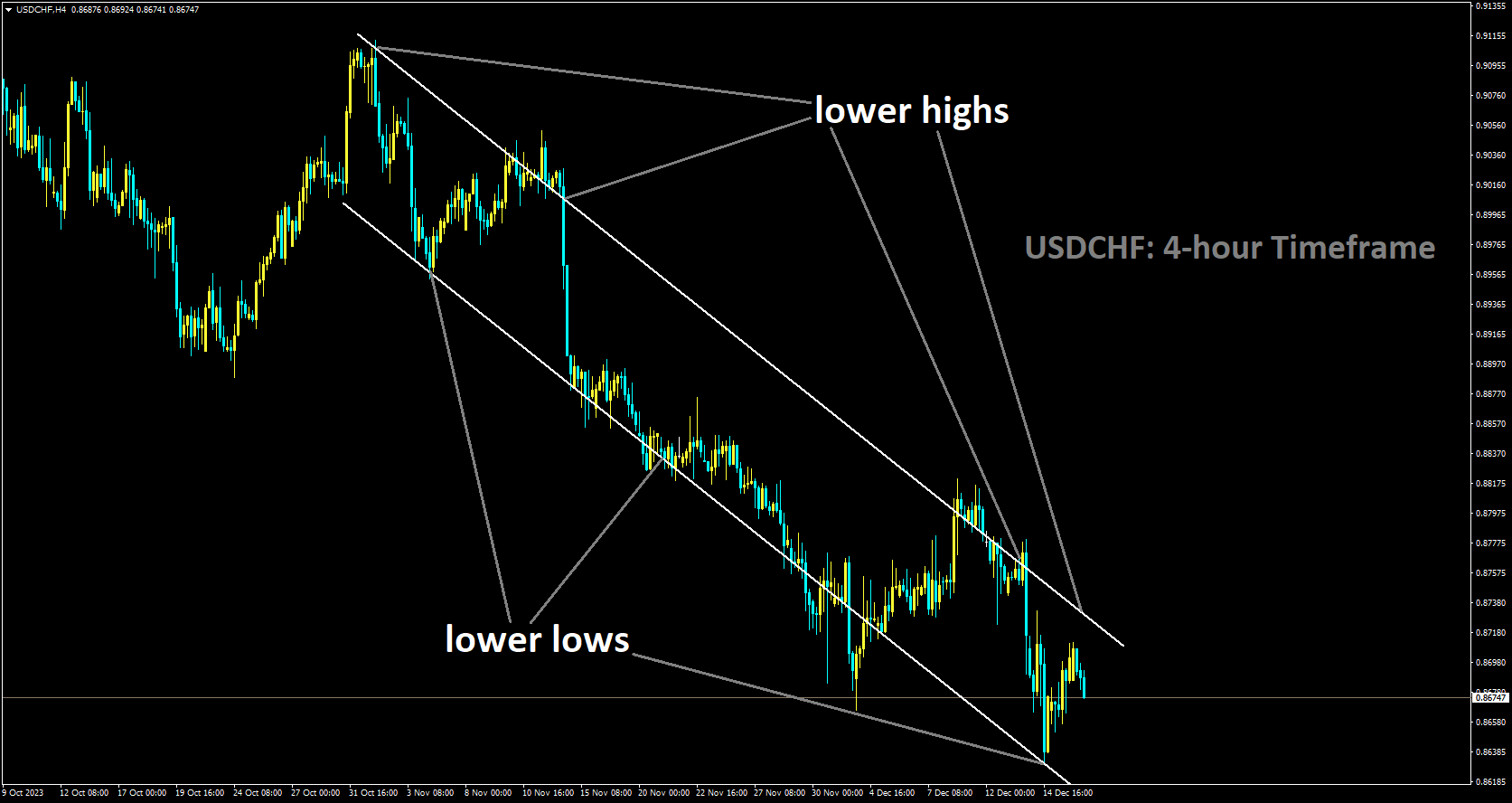

USDCHF Analysis:

USDCHF is moving in Descending channel and market has fallen from the lower high area of the channel

The Swiss National Bank finds itself in a challenging position, opting to maintain interest rates unchanged for the second consecutive rate decision. This decision comes as inflation gradually approaches the SNB’s targets, while the projection for Swiss Gross Domestic Product growth points to a slowdown. SNB Chairman Thomas Jordan remarked on Thursday that the SNB has shifted its focus away from direct forex operations aimed at preventing further appreciation of the Swiss Franc. Despite market expectations increasing for potential rate cuts as early as March, Chairman Jordan emphasized that, in terms of monetary policy, the SNB is more inclined to resume selling currency reserves directly before considering rate reductions.

On the economic front, US data on Friday showed a mixed picture. The S&P Global Manufacturing Purchasing Managers’ Index for December fell short of expectations, registering at 48.2 compared to November’s 49.4, missing the median market forecast, which had anticipated a slight decline to 49.3. Conversely, the US Services PMI exceeded expectations, posting a robust figure of 51.3, surpassing the market’s projection of a drop to 50.6 from the previous month’s 50.8.

Looking ahead to the coming week, the SNB is set to release its Quarterly Bulletin for the fourth quarter of 2023 on Wednesday, followed by US GDP figures on Thursday. The Federal Reserve’s policy shift and the updated dot plot of interest rate expectations will face their first test with the release of US Personal Consumption Expenditure data for November next Friday. The annualized US GDP for the third quarter is expected to remain stable at 5.2%, while median market forecasts suggest a slight decline in PCE for the year up to November, from 3.5% to 3.4%.

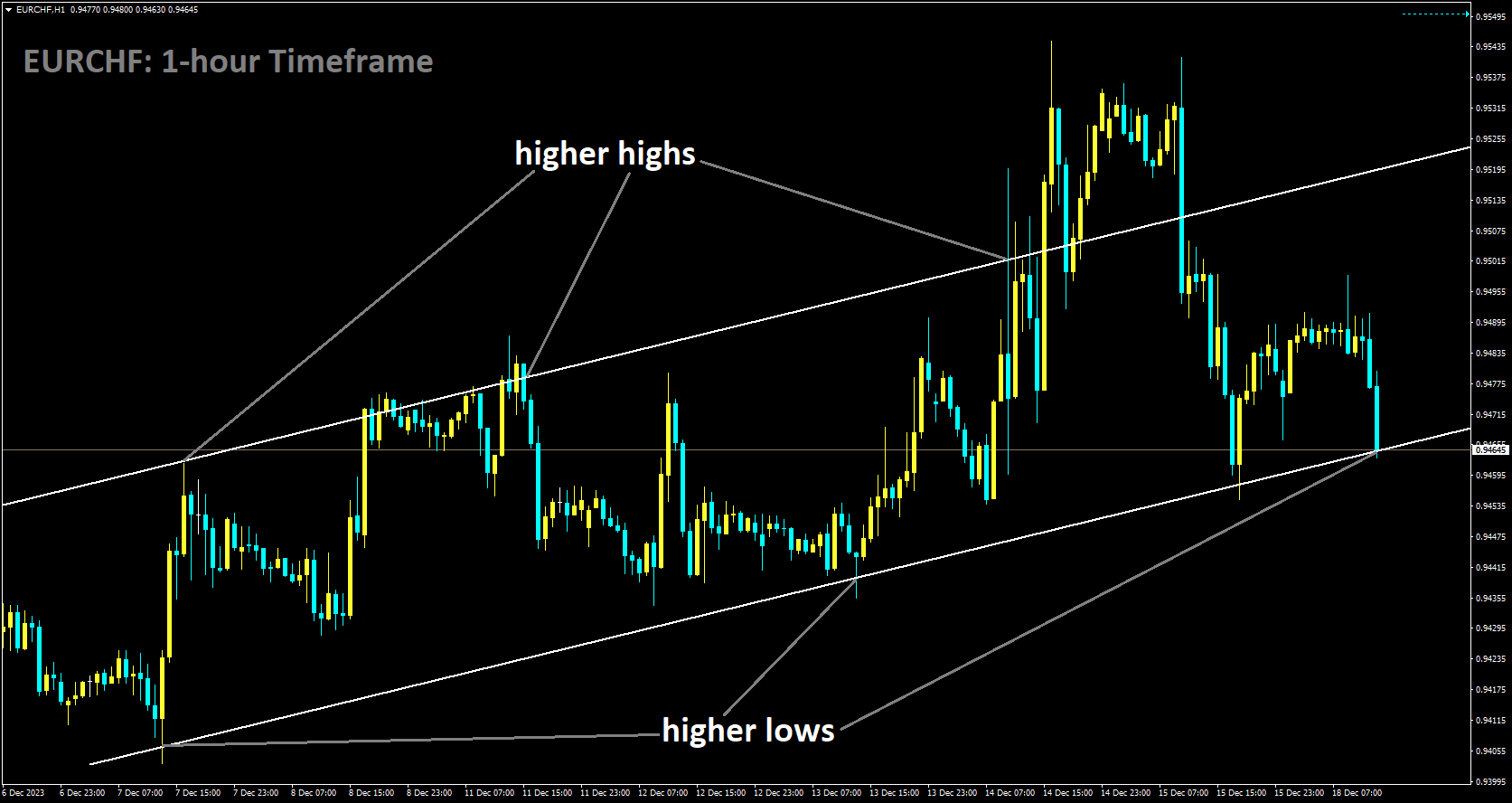

EURCHF Analysis

EURCHF is moving in Ascending channel and market has reached higher low area of the channel

During a news conference on Friday, European Central Bank policymaker Robert Holzmann expressed the view that it is increasingly probable that interest rates reached their highest point last month, according to Reuters. Holzmann further clarified that there have been no deliberations regarding interest rate reductions among policymakers. Additionally, he mentioned that a majority of policymakers perceive upside risks to inflation.

EURUSD Analysis

EURUSD is moving in an Ascending triangle pattern and the market has fallen from the resistance area of the pattern

The Euro Area’s economic challenges persist, with an impending entry into a technical recession expected in the coming weeks. Data from HCOB, a prominent data provider, reveals that business activity in the Euro Area declined even more sharply in December. This marks the conclusion of a fourth quarter characterized by the most rapid output decline in 11 years, with exceptions only for the early months of the 2020 pandemic. Dr. Cyrus de la Rubia, Chief Economist at HCOB, commented on the data, expressing dismay at the Eurozone’s inability to exhibit any clear signs of recovery. Instead, it has contracted for six consecutive months, heightening the likelihood of the Eurozone remaining in a recession since the third quarter.

During Thursday’s ECB meeting, the central bank pushed back against the market’s aggressive pricing of approximately 150 basis points in rate cuts for 2024. President Lagarde emphasized the intention to maintain interest rates at sufficiently restrictive levels for as long as necessary to bring inflation back to the target rate of 2%. She also noted that the governing council had not discussed a specific timetable for rate cuts.

However, if the Euro Area does indeed slip into a recession, as currently appears likely, and inflation continues to decline, the ECB may need to reconsider its stance on interest rates and prepare the market for a series of cuts in the upcoming year. Financial markets are already factoring in nearly five 25 basis point rate cuts in 2024.

The persistent weakness of the US dollar gained momentum late on Wednesday following the Federal Reserve’s decision to keep rates steady for the third consecutive month. Fed Chair Jerome Powell sent a strong signal that interest rates would be reduced in 2024, with the possibility of a 75 basis point cut next year. However, the market viewed this as a conservative estimate. After the conclusion of the FOMC press conference, market expectations for US rate cuts in 2024 surged to 150 basis points, with the first 25 basis point cut anticipated in March. These heightened expectations, coupled with the sell-off in US bond yields, further contributed to the decline of the US dollar.

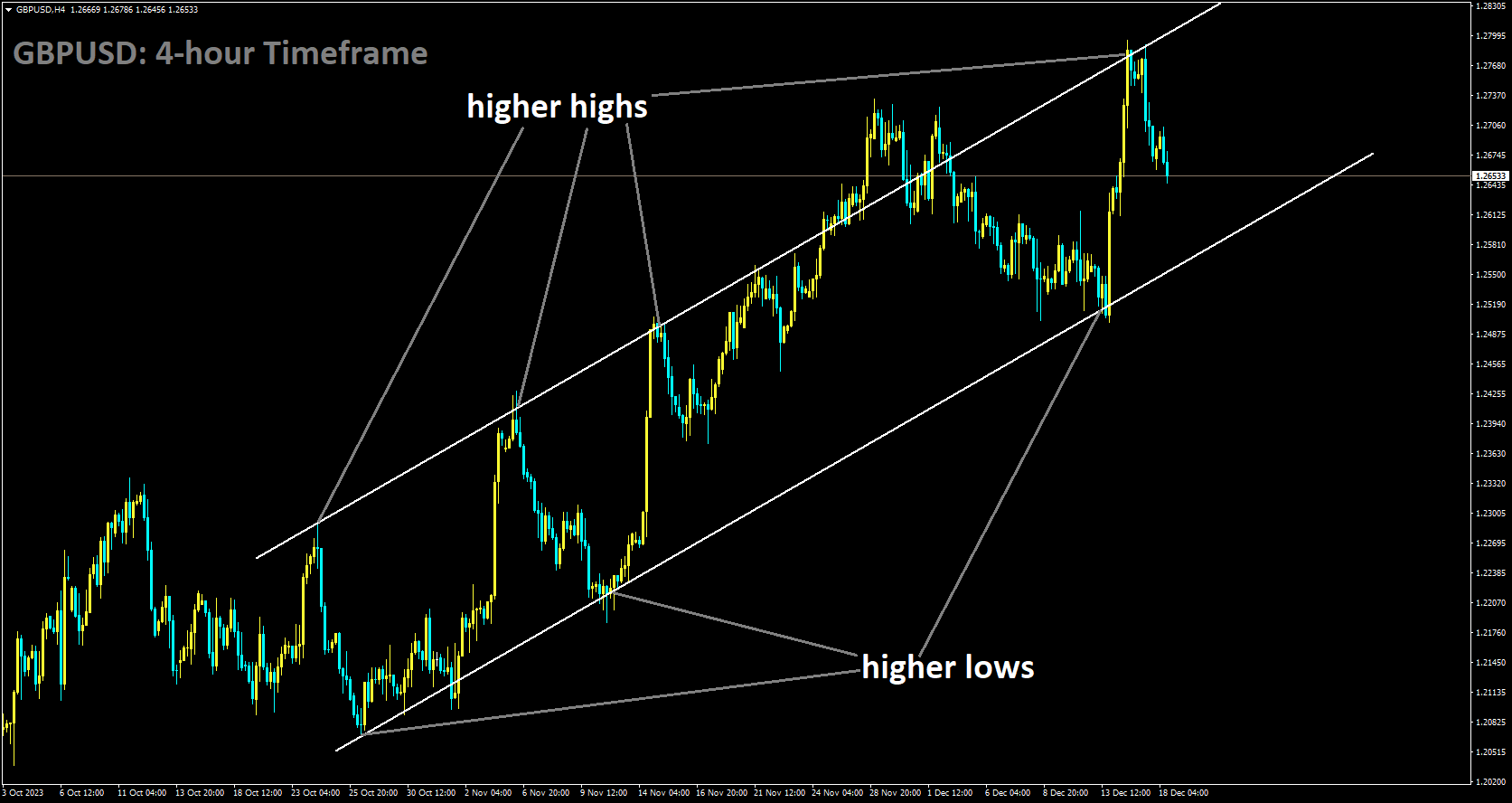

GBPUSD Analysis:

GBPUSD is moving in Ascending channel and market has fallen from the higher high area of the channel

Amid a week marked by significant central bank policy decisions, the Federal Reserve adopted a more cautious approach, in contrast to the Bank of England and the European Central Bank, which remained committed to an extended period of elevated interest rates. This divergence injected heightened volatility into the USD, Euro, and British Pound, as previously discussed. The focal point of the week was the Fed’s decision and accompanying statement on Wednesday, resulting in a sharp decline in the US dollar and US Treasury yields. While the British Pound initially rose, it is currently in a holding pattern, awaiting crucial inflation and GDP data, which represent the final high-importance releases in the UK before the seasonal break.

Despite the sluggish economic growth in the UK, the Bank of England will closely scrutinize the latest inflation figures. Last month witnessed a notable drop in inflation, and the UK central bank anticipates further progress in their efforts to combat persistently high price pressures when the ONS data is unveiled on Wednesday. If inflation falls below expectations, it could exert pressure on the Bank of England to consider implementing rate cuts sooner, potentially placing downward pressure on the British Pound in the coming weeks.

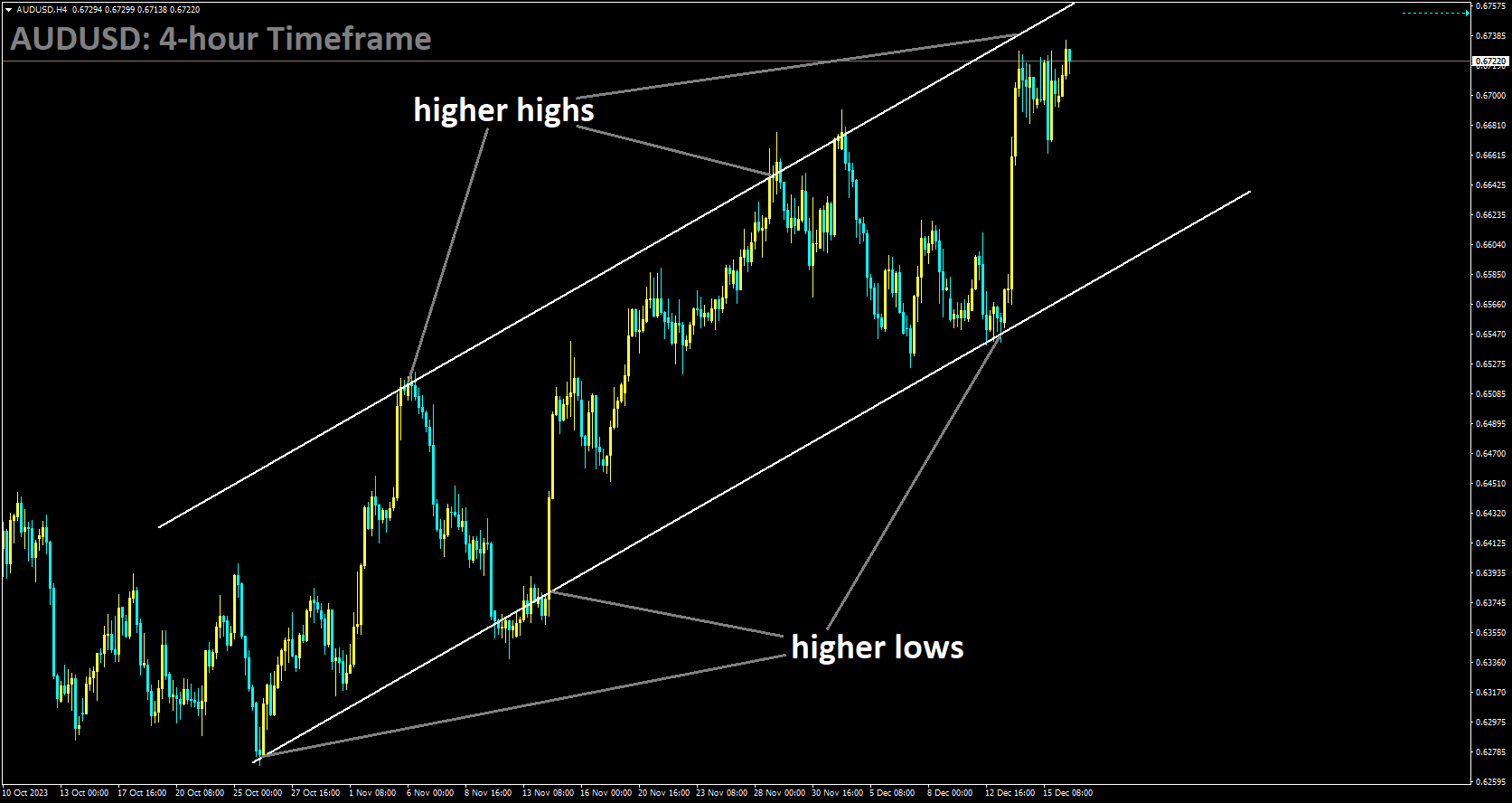

AUDUSD Analysis:

AUDUSD is moving in Ascending channel and market has reached higher high area of the channel

The prospect of rate cuts by Federal Reserve officials is exerting downward pressure on the US Dollar across the board, offering some support to the AUDUSD currency pair. Atlanta Fed President Raphael Bostic’s recent remarks on Friday indicated that the central bank could potentially initiate interest rate cuts in the third quarter of 2024 if inflation follows the expected trajectory. Additionally, Chicago Fed President Austan Goolsbee mentioned that he did not rule out the possibility of a rate cut at the Fed’s meeting in March. On the economic front, US business activity expanded at the quickest pace since July, as indicated by the data from the US S&P Global Purchasing Managers’ Index released on Friday. The preliminary Composite PMI for December rose to 51.0 from November’s 50.7. However, the Manufacturing PMI declined from 49.4 to 48.2, while the Services PMI increased from 50.8 to 51.3.

Meanwhile, the Chinese economy showed signs of modest growth in November, with factory output and retail sales registering increases, according to the National Bureau of Statistics of China’s report on Friday. However, the property market remained sluggish, despite the government’s promise of additional policy support. Market expectations include the implementation of further stimulus measures to boost demand in the property sector, as well as potential lending rate cuts in the first half of 2024. Positive developments related to the Chinese economy could have a favorable impact on the Australian Dollar, given China’s status as Australia’s largest trading partner. In the upcoming days, investors will closely monitor the release of the Reserve Bank of Australia’s meeting minutes on Tuesday, as well as US housing data, including Building Permits and Housing Starts. The highlight of the week will be the Core Personal Consumption Expenditure Price Index report, scheduled for release on Friday.

NZDUSD Analysis:

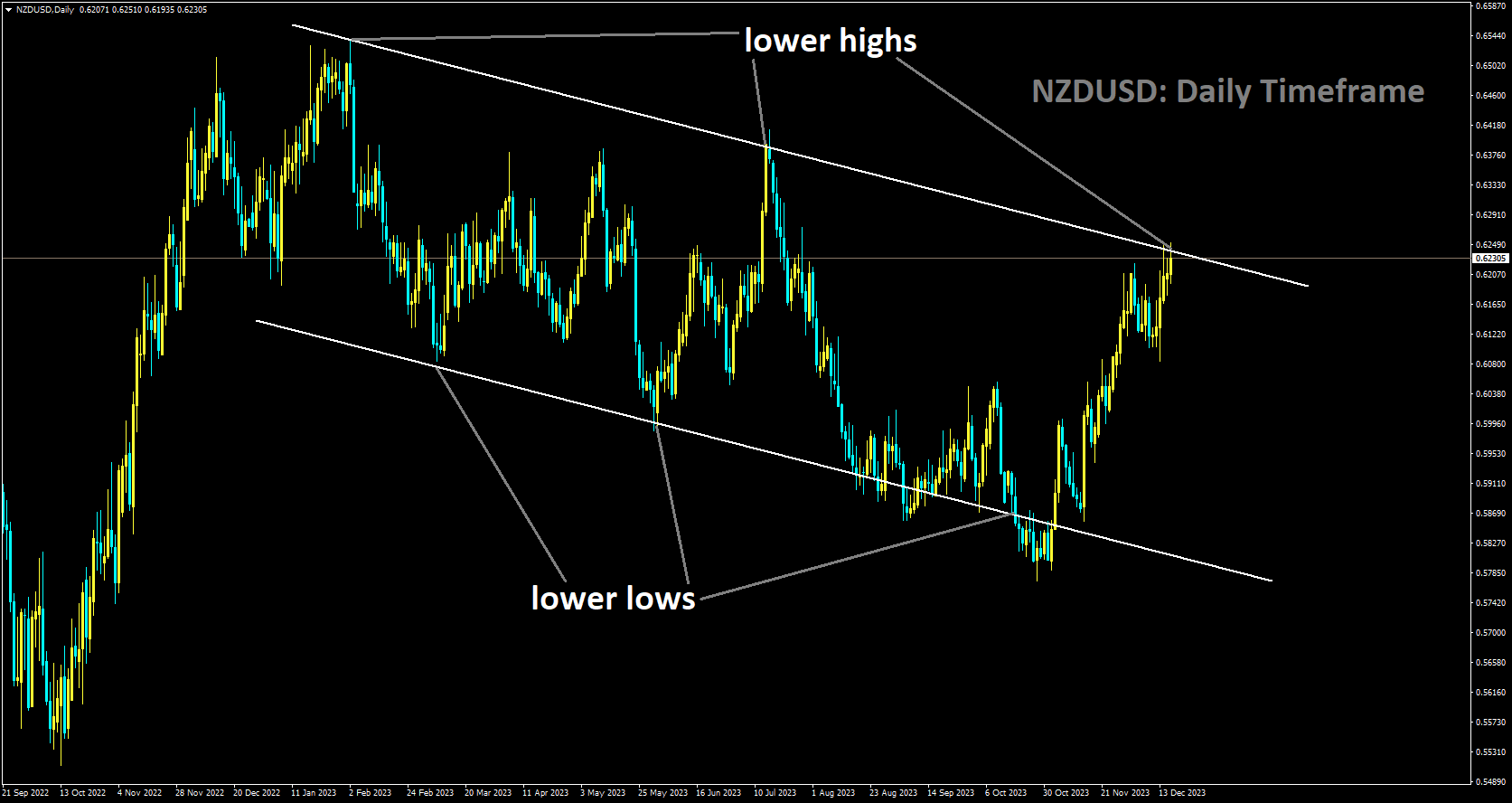

NZDUSD is moving in Descending channel and market has reached lower high area of the channel

Business NZ recently released data indicating that New Zealand’s Business NZ Performance of Services Index made a significant move into expansion territory, rising to 51.2 in November from the previous reading of 48.9. Additionally, the New Zealand Westpac-McDermott Miller Consumer Confidence Index for the fourth quarter of 2023 surged to 88.9, marking its highest level in two years. These positive developments have provided a boost to the New Zealand Dollar (NZD) and are serving as a favorable factor for the NZDUSD pair.

Conversely, Federal Reserve Bank of Chicago President Austan Goolsbee cautioned on Sunday that it is premature to declare victory in the battle against inflation, emphasizing that decisions regarding rate cuts will depend on economic data. Furthermore, Atlanta Fed President Raphael Bostic mentioned that the Fed could initiate interest rate cuts in the third quarter of 2024 if inflation behaves as anticipated.

Looking ahead, New Zealand is scheduled to release Trade Data and the NZ Business Confidence survey on Tuesday. Additionally, the United States will release housing data, including Building Permits and Housing Starts on the same day. Traders will closely monitor these data releases to identify trading opportunities in the NZDUSD pair.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% FLAT OFFER for Signals 😍 GOING TO END – Get now: forexfib.com/discount/