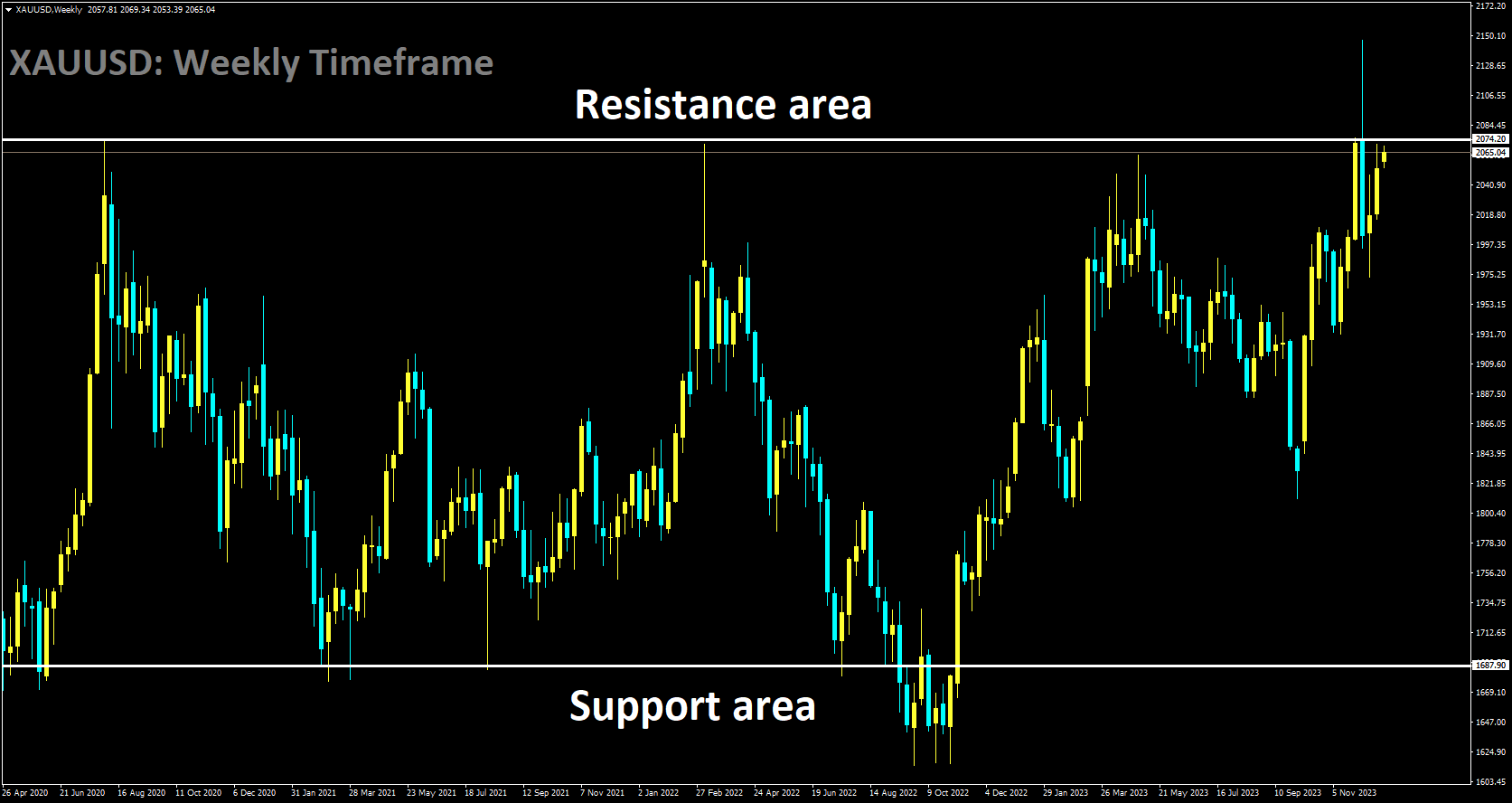

Gold Analysis:

XAUUSD is moving in box pattern and market has reached resistance area of the pattern

The recent surge in the price of Gold can be attributed to a combination of factors. One significant driver is the anticipation of potential interest rate cuts by the Federal Reserve. Traders are closely monitoring the Fed’s actions and statements, as there is a growing belief that rate cuts may be on the horizon. The market’s sentiment is further reflected in the World Interest Rate Probability, which indicates a 15% probability of a rate cut by January 31. Moreover, the market has fully priced in rate cuts by March 20, and there is even speculation of up to six rate cuts by the end of 2024. This anticipation of lower interest rates tends to make non-interest-bearing assets like Gold more appealing to investors. Geopolitical tensions in the Middle East are adding another layer of uncertainty to global markets. These tensions have contributed to a risk-off sentiment among investors, prompting them to seek safe-haven assets. Gold is often considered a safe-haven asset during times of geopolitical instability, and as a result, its demand has increased.

Despite these concerns, there have been positive developments in the shipping industry in the Red Sea. Major shipping companies like Maersk and CMA CGM have resumed their operations in the region, signalling a gradual return to normalcy. This positive shift has been facilitated by the deployment of a multinational task force in the area. However, there is still some uncertainty, as we await Hapag-Lloyd’s decision on resuming shipments, expected on Wednesday. It’s worth noting that while there are concerns about the potential closure of the Gibraltar Strait by Iran, many experts question the feasibility of such an action. These geopolitical dynamics continue to add an element of uncertainty to the global economic landscape. Turning our attention to the US Dollar Index, it currently remains below the 101.50 level. This decline in the DXY can be attributed to several factors. One key driver is the subdued US Treasury yields. Both the 2-year and 10-year yields on US bonds are trading lower, with rates at 4.29% and 3.88%, respectively, at the present time. Lower yields can erode the attractiveness of the US Dollar as an investment, as it reduces the potential return for currency investors.

Former Dallas Federal Reserve President Robert Kaplan has also weighed in on the situation. He has emphasized the Federal Reserve’s historical mistake of keeping interest rates excessively low for extended periods. To avoid repeating this error on the opposite end of the spectrum, the Federal Reserve is now proceeding cautiously. The central bank aims to strike a balance between stimulating economic growth and preventing overheating. Kaplan’s remarks have contributed to the downward pressure on the US Dollar. Additionally, the US Dollar has faced added pressure due to the US Bureau of Economic Analysis reporting softer Core Personal Consumption Expenditures (PCE) Index figures for November. US Core PCE Inflation grew by 3.2%, falling short of the expected 3.3% and the previous 3.4%. The Month-on-Month data remained consistent at 0.1%, slightly below the market’s expected 0.2%. These figures indicate that inflation may not be as robust as anticipated, which can impact the Federal Reserve’s monetary policy decisions. Looking ahead, Thursday is expected to bring the release of Initial Jobless Claims and Pending Home Sales data from the United States. These data points will provide further insights into the economic landscape and may influence the direction of the US Dollar.

SILVER Analysis:

XAGUSD is moving in an Ascending channel and the market has rebounded from the higher low area of the channel

Former Dallas Federal Reserve President Robert Kaplan’s recent comments are notable in the context of Silver analysis. Kaplan has expressed his anticipation that the central bank may initiate interest rate cuts in the near future to prevent the US economy from slipping into a recession. He emphasized the central bank’s desire to avoid repeating the mistake of maintaining excessively low interest rates for extended periods. The Federal Reserve is now taking a more cautious approach, aiming to strike a balance between stimulating the economy and avoiding over-restriction.

USDCAD Analysis:

USDCAD is moving in box pattern and market has reached support area of the pattern

The Canadian economy has been exhibiting signs of a slowdown, as indicated by economic data. The month-over-month Canadian Gross Domestic Product has failed to register any growth for the fourth consecutive month in October, remaining flat at 0.0%. This follows a downward revision of September’s GDP figure from a modest 0.1% to flat. This economic performance contrasts with the situation in the United States. However, the US Dollar is facing its own set of challenges, primarily due to increasing speculations about potential monetary easing by the US Federal Reserve. The expectation of lower interest rates in the US is constraining the upward movement of the USDCAD currency pair. The ongoing weakening sentiment is further exacerbated by the decline in US Treasury yields, which has been a contributing factor undermining the strength of the US Dollar.

Former Dallas Federal Reserve President Robert Kaplan has emphasized the Fed’s past mistake of maintaining prolonged excessive accommodation, even when the economy showed signs of improvement. Kaplan believes that the Federal Reserve is now proceeding with caution to avoid repeating this error on the opposite end, ensuring that they do not become overly restrictive, which could potentially hamper economic growth. Additionally, the US Dollar has come under additional pressure due to the US Bureau of Economic Analysis reporting softer Core Personal Consumption Expenditures Index figures for November. US Core PCE Inflation grew by 3.2%, falling short of the expected 3.3% and the previous 3.4%. Meanwhile, the Month-on-Month data remained consistent at 0.1%, slightly below the market’s expected 0.2%. Looking ahead, there are no scheduled economic data releases on the Canadian economic calendar for the week. Therefore, the direction of the USDCAD pair will likely be influenced by developments in the US economy, especially regarding the Fed’s monetary policy stance.

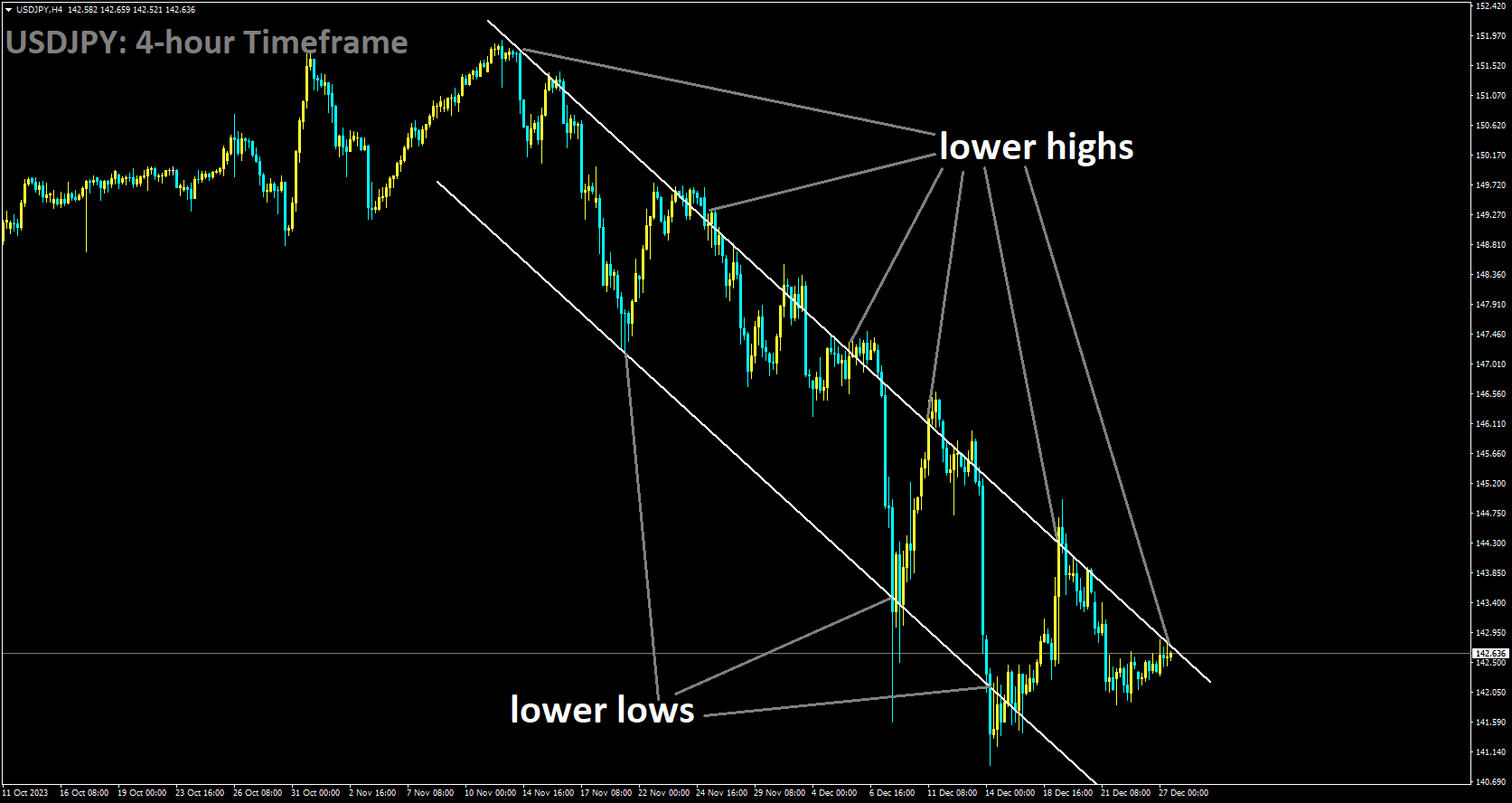

USDJPY Analysis:

USDJPY is moving in Descending channel and market has reached lower high area of the channel

The Bank of Japan recently released the Summary of Opinions from its December monetary policy meeting, providing insights into the central bank’s views and potential future actions. Several key points emerged from this release, One member emphasized the need to maintain monetary easing patiently. Another member stressed the importance of ensuring a sustainable and stable achievement of the price target before considering an end to negative rates and Yield Curve Control. A third member suggested closely monitoring wage and price movements under Yield Curve Control, particularly in light of strong upward price pressures. Yet another member expressed the view that even if wage hikes in the coming spring are significantly higher than expected, the risk of causing underlying inflation to significantly exceed 2% is minimal.

Additionally, one member stated that the BoJ is not currently in a situation where they would be behind in raising rates, even if they decide to wait and assess wage negotiation outcomes next spring. Clear communication regarding central bank balance sheet management and maintaining confidence in its ability to conduct monetary policy during the exit phase was highlighted. Lastly, one member noted that there is an increased momentum toward higher wage hikes compared to the previous year.

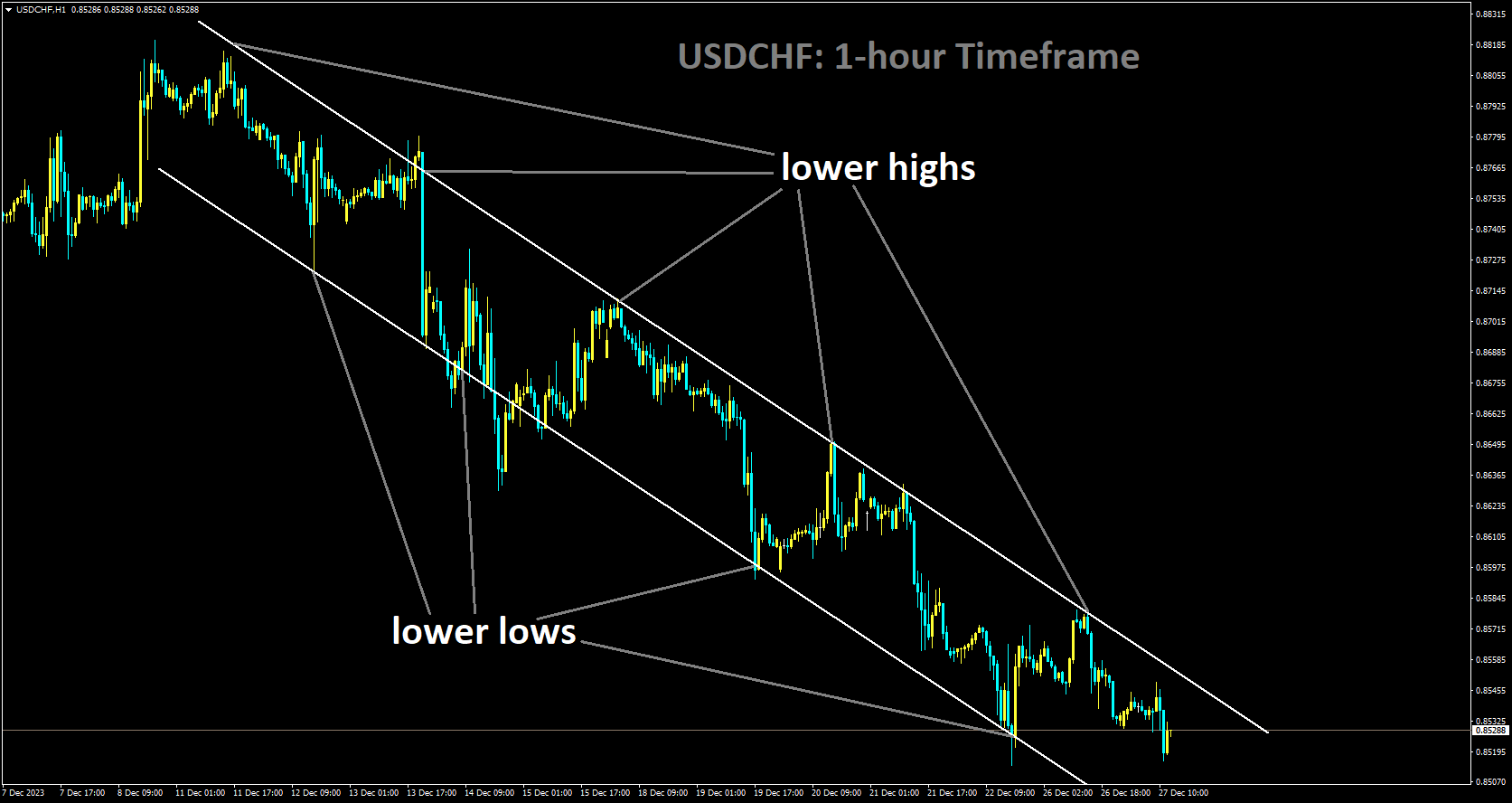

USDCHF Analysis:

USDCHF is moving in Descending channel and market has fallen from the lower high area of the channel

The USDCHF currency pair has been influenced by increased risk aversion in the markets, leading to greater demand for safe-haven currencies such as the Swiss Franc. Concerns have arisen regarding the potential closure of the Gibraltar Strait by Iran, although there is skepticism about the feasibility of such an action. Nevertheless, major shipping companies have begun returning to the Red Sea, suggesting a tentative return to normalcy with the presence of a multinational task force in the region. The Swiss National Bank has taken a proactive stance, as outlined in its recent Quarterly Bulletin. The SNB has communicated its preparedness to actively intervene in the foreign exchange market when necessary. This stance signals a hawkish approach and underscores the bank’s commitment to managing currency dynamics and supporting the Swiss Franc.

The US Dollar Index has risen above 101.50, even as yields on US 2-year and 10-year bonds have declined to 4.29% and 3.87%, respectively, at the time of reporting. This decrease in yields contributes to the overall subdued performance of the US Dollar in the market. Former Dallas Federal Reserve President Robert Kaplan’s sentiments align with the notion that the central bank is proceeding cautiously. Kaplan emphasizes the Federal Reserve’s historical error of maintaining prolonged excessive accommodation, even as the economy improved. According to Kaplan, the central bank is now exercising caution to avoid a similar mistake on the opposite end, ensuring it does not become overly restrictive.Looking ahead to Thursday, significant insights into the economic landscape are expected as the United States is set to release data on Initial Jobless Claims and Pending Home Sales. These indicators play a crucial role in assessing the labor market’s health and the real estate sector’s condition, providing investors with essential information for evaluating the overall economic outlook.

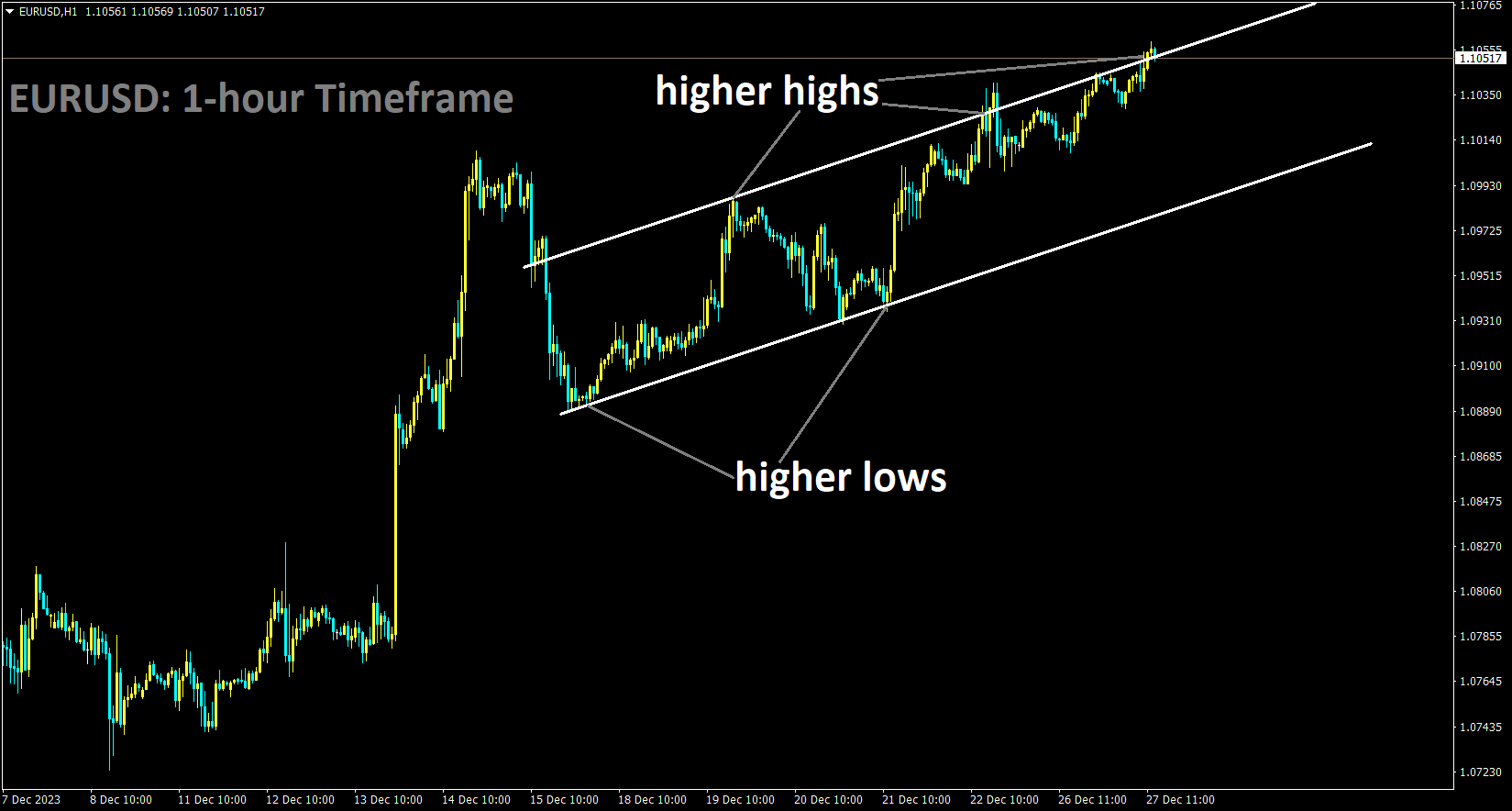

EURUSD Analysis:

EURUSD is moving in an Ascending channel and the market has reached the higher high area of the channel

The EURUSD currency pair is influenced by several key factors. First, the Federal Reserve’s preferred measure of inflation, the Core Personal Consumption Expenditures Price Index, grew slightly below expectations. The European Central Bank chose to leave its benchmark interest rates unchanged during its final meeting of the year. ECB President Christine Lagarde emphasized that the ECB’s policy decisions are contingent on economic data, rather than influenced by market expectations or rigid timelines. ECB Vice President Luis de Guindos stated that it is premature to consider easing monetary policy and expressed the central bank’s belief that a technical recession in the Eurozone is not anticipated. These more hawkish comments from the ECB could potentially bolster the Euro and limit downward pressure on the EURUSD pair.

Looking ahead, the US Richmond Fed Manufacturing Index for December is scheduled for release on Wednesday, followed by the Initial Jobless Claims report on Thursday. In the absence of significant economic data from both the Eurozone and the United States, market sentiment is expected to be the primary driver influencing the price movements of the EURUSD currency pair.

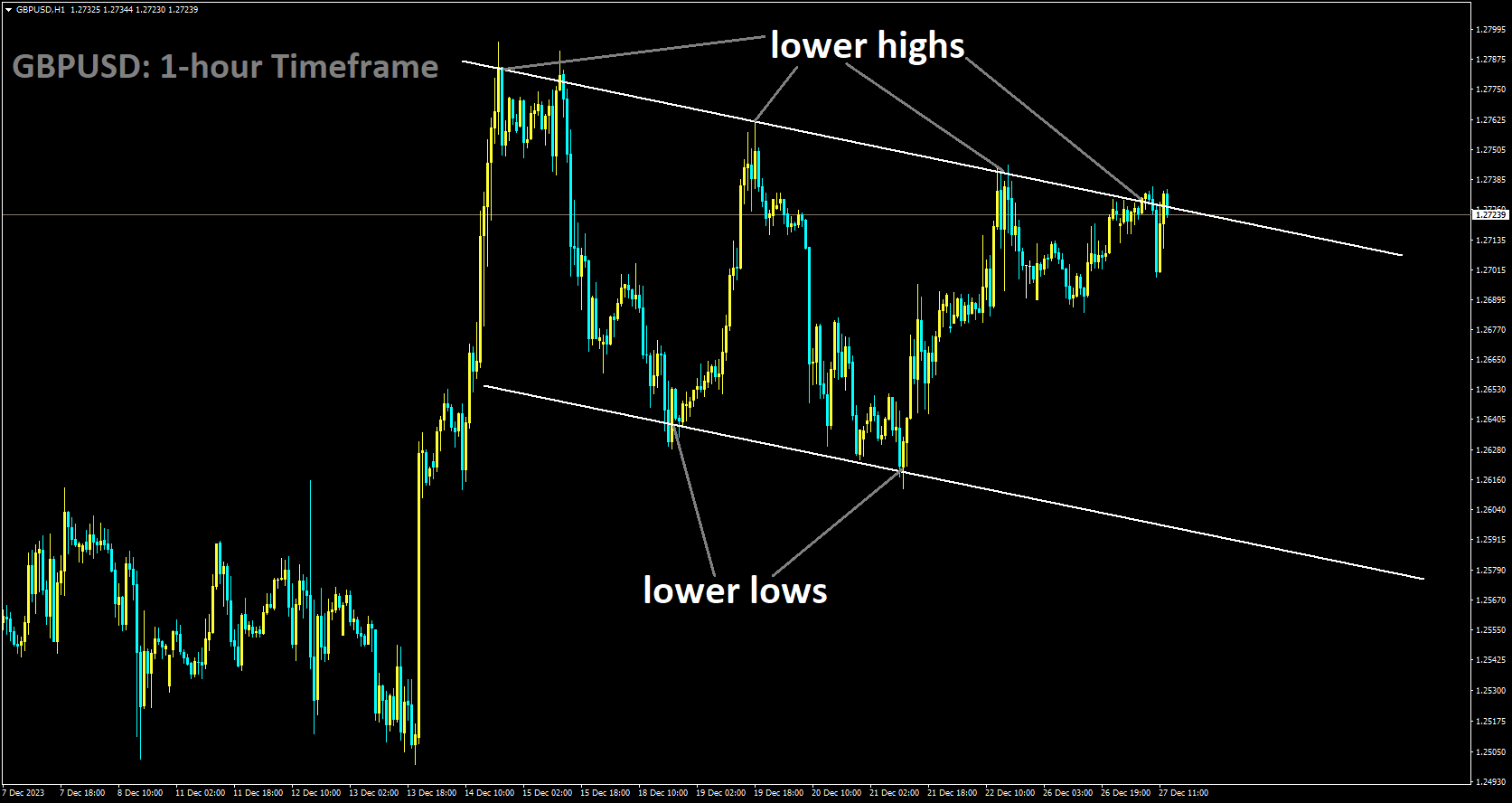

GBPUSD Analysis:

GBPUSD is moving in Descending channel and market has reached lower high area of the channel

The GBPUSD currency pair has been exhibiting reduced volatility in a week characterized by thin trading. Despite concerns about a potential recession in the UK economy, the Pound Sterling maintains a generally positive outlook. Investors anticipate that the Bank of England (BoE) will commence its rate-cutting measures later than the Federal Reserve, primarily due to declining inflationary pressures within the United States. Recent economic data indicates a contraction in the UK economy, with estimates suggesting a 0.1% contraction in the July-September period. According to the latest forecasts from the BoE, the economy is anticipated to remain stagnant in the final quarter of this year. If the UK economy contracts again, it would officially enter a technical recession.

However, the Pound Sterling continues to hold its ground against the US Dollar, benefiting from upbeat Retail Sales data for November. Robust sales at non-food retail stores, driven by higher discounts offered during Black Friday sales, contributed to a substantial increase of 1.3% in Monthly Retail Sales, surpassing expectations and the previous month’s stagnation. Surprisingly, annual sales at retail stores recorded a 0.1% increase, contrary to investor expectations of a 1.3% contraction.

The possibility of BoE rate cuts remains a topic of discussion. UK Finance Minister Chancellor of the Exchequer Jeremy Hunt mentioned the possibility of rate cuts if inflation continues to decrease. However, BoE policymakers have been cautious about implementing rate cuts, even with a significant decline in the price index. Barclays recently suggested that the BoE might initiate its rate-cutting campaign as early as May, contrary to the previous expectation of August. Early rate-cut expectations are driven by factors such as the anticipation of a recession in the UK economy and Chancellor Jeremy Hunt’s suggestion that the central bank consider rate cuts to stimulate growth.

Looking ahead, market sentiment is expected to remain subdued during this holiday-shortened week. The US Dollar Index is trading near a five-month low around 101.46, primarily due to a more significant than expected decline in the core Personal Consumption Expenditure price index for November. This has fueled expectations of early rate cuts by the Federal Reserve. The monthly US core PCE data grew by a mere 0.1%, falling short of the 0.2% growth rate recorded for October. On an annualized basis, underlying inflation has decelerated to 3.2%, below the consensus of 3.3% and the previous reading of 3.5%. The Federal Reserve, in its Summary of Projections released last week, forecasted core PCE to be at 3.2% by year-end.

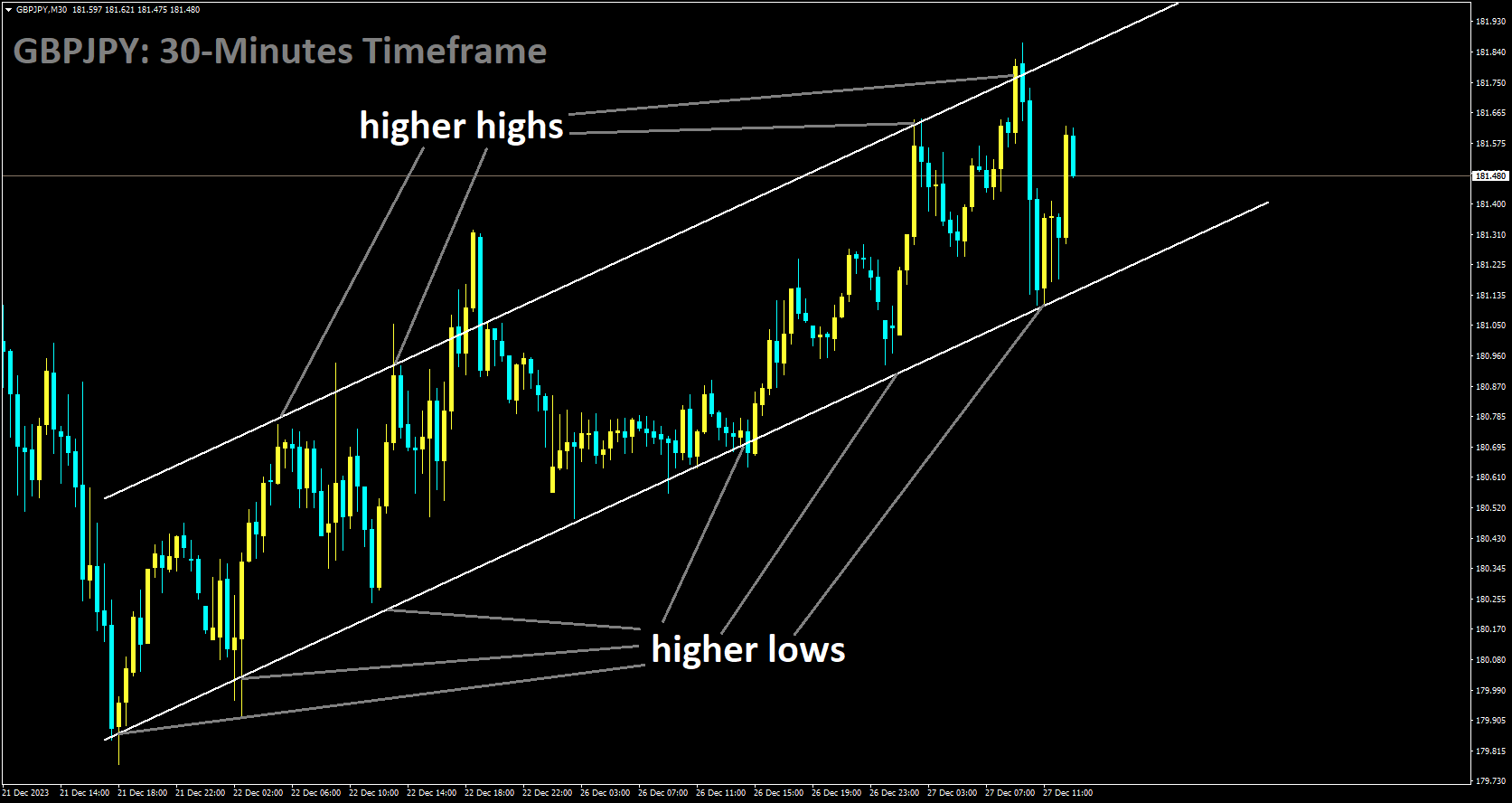

GBPJPY Analysis:

GBPJPY is moving in Ascending channel and market has rebounded from the higher low area of the channel

During a meeting with the Japan Business Federation on Monday, Bank of Japan Governor Kazuo Ueda discussed the prospects of achieving the central bank’s inflation target. Ueda noted a gradual increase in the likelihood of meeting the 2% target and expressed readiness to adjust monetary policy if the chances of consistent target achievement improved substantially. He observed a gradual acceleration in service prices, despite challenges in passing on rising labor costs for many firms. Ueda emphasized that a stronger positive wage-inflation cycle and a more favorable outlook for sustained price target achievement could lead to policy adjustments. He highlighted the need for flexibility in policy timing, which would be determined by close monitoring of economic developments, as well as wage and pricing behaviors of firms.

In an economy with sustained positive inflation, nominal interest rates would be higher, affording room for significant interest rate cuts when necessary, reducing the risk of a sharp economic downturn or deflation. The Bank of Japan aims to patiently maintain monetary easing to ensure the durability of changes in wage and pricing behavior among firms. Ueda reiterated their commitment to assess economic developments, including the strengthening of the positive wage-inflation cycle, and make suitable decisions for sustainable price target achievement. Although it may take time, the upward pressure from previous increases in import prices is expected to gradually diminish. Ueda emphasized the thoughtful approach to future monetary policy decisions through continuous examination of economic developments and firms’ wage and pricing behaviors.

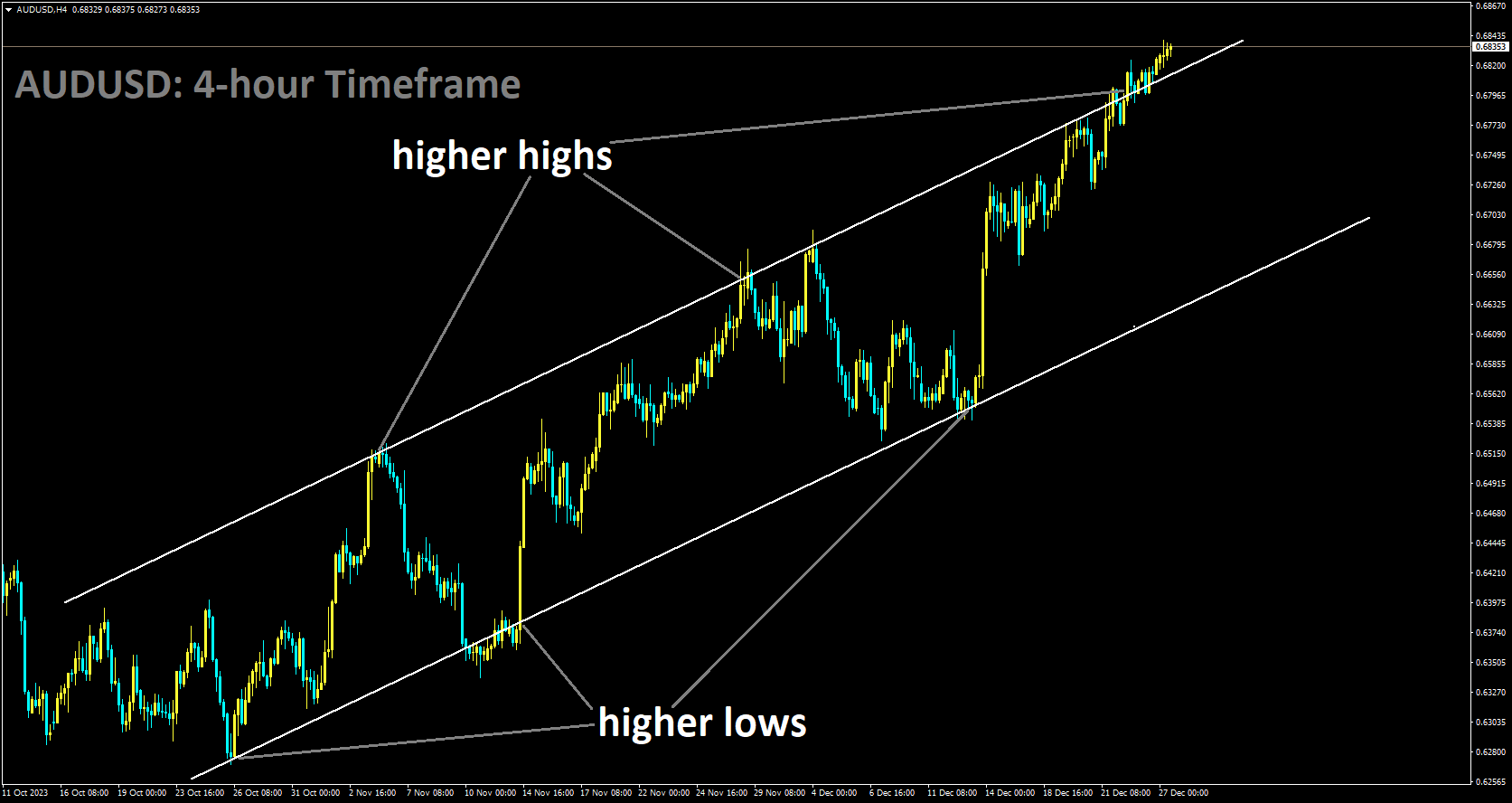

AUDUSD Analysis:

AUDUSD is moving in Ascending channel and market has reached higher high area of the channel

The Australian Dollar showed an upward trend on Wednesday, driven by improved risk sentiment, while the US Dollar displayed signs of weakness amid speculation about a dovish stance from the Federal Reserve regarding interest rates. Australia’s central bank maintains a hawkish outlook due to strong inflation and stable housing prices, bolstering the resilience of the Australian Dollar. The upcoming year may witness a struggle between expectations of rate cuts and the Reserve Bank of Australia’s resistance. With RBA forecasts nearing the upper range of the 2-3% inflation target by the end of 2025, the RBA may remain open to further deliberation. China’s Industrial Profits for January to November declined by 4.4% year-on-year, signaling a slowdown and highlighting the need for additional policy support from Beijing to stimulate growth in the world’s second-largest economy. China’s role in shaping the global economic landscape in 2024, characterized by stable inflation and low borrowing costs, is closely monitored. Such developments could influence the Reserve Bank of Australia to maintain its hawkish stance, influenced by trade relations with China.

Meanwhile, the US Dollar Index is under pressure due to increasing speculation of potential easing by the US Federal Reserve. This sentiment is further compounded by the decline in US Treasury yields, contributing to factors eroding the strength of the US Dollar. Former Dallas Federal Reserve President Robert Kaplan emphasized the need for caution in avoiding excessive accommodation for an extended period, as observed in the past, even as the economy shows signs of improvement. Kaplan believes the central bank is keen to prevent being overly restrictive. In economic data, RBA Private Sector Credit showed a 0.4% increase in November, surpassing the previous rise of 0.3%. However, year-over-year data indicated a decrease of 4.7% compared to the previous 4.8% rise. The RBA highlighted the need for additional data examination to assess risk balance before deciding on future interest rates. In the United States, the Housing Price Index contracted to 0.3% in October from the previous 0.7%, falling short of the expected 0.5%. The US Bureau of Economic Analysis reported that the Core Personal Consumption Expenditures – Price Index grew at 3.2% in November, missing the 3.3% expectations and the 3.4% previous figure. Meanwhile, the month-on-month data remained consistent at 0.1%, falling short of the market’s expected 0.2%. Lastly, US Gross Domestic Product Annualized grew at a rate of 4.9% in Q3, slightly below the expected 5.2%.

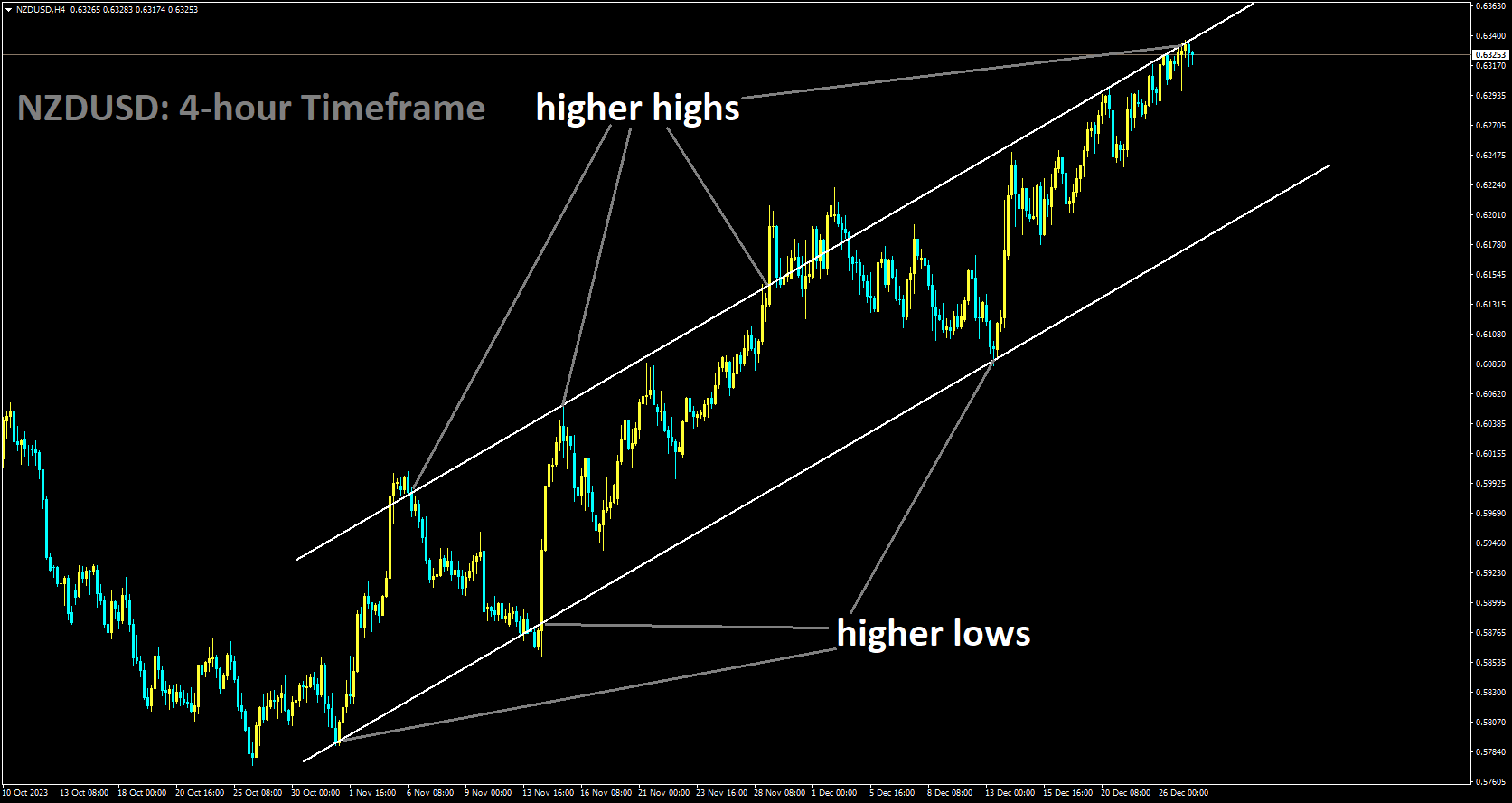

NZDUSD Analysis:

NZDUSD is moving in Ascending channel and market has reached higher high area of the channel

The dollar index weakened, and the euro reached its highest level in over four months as investors awaited signals regarding when the Federal Reserve might start cutting interest rates, with inflation approaching the central bank’s annual target of 2%. Trading activity remained subdued on the day after Christmas, with several markets, including the UK, Australia, New Zealand, and Hong Kong, observing public holidays. Additionally, many traders around the world are still on holiday until the New Year. The greenback is set to record its weakest performance since 2020 against a basket of currencies, primarily due to expectations of Fed rate cuts, which have reduced the US currency’s appeal relative to its counterparts. Many analysts anticipate a notable slowdown in the US economy in 2024. However, the Fed is also expected to take action to ensure that the gap between the fed funds rate and realized inflation does not widen significantly. If inflation declines more rapidly than the Fed’s benchmark rate, it can inadvertently tighten monetary conditions beyond what Fed policymakers intend, increasing the risk of a severe economic downturn.

Analysts at Action Economics noted that inflation is expected to continue cooling, providing policymakers with the flexibility to reduce rates by June to prevent inadvertent tightening in real interest rates. However, they disagree with the market’s expectation of a cut as early as March and the pricing of 154 basis points in easing by December. They believe such aggressive action is unlikely unless the economy slides into a recession in the coming months. Recent data showed that US prices declined in November for the first time in over 3.5 years, further pushing down the annual inflation rate. In contrast, annual home prices in October continued to rise, indicating the ongoing recovery of the housing market, according to data released on Tuesday. Additionally, a Mastercard report indicated that US retail sales increased by 3.1% between November 1 and December 24, as consumers sought last-minute Christmas bargains during significant promotions.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% FLAT OFFER for Signals 😍 GOING TO END – Get now: forexfib.com/discount/