Analysis of GOLD:

XAUUSD is moving in Descending channel and market has reached lower low area of the channel

The recent intentions of the Federal Reserve to ease monetary policy in the coming year have put a damper on the recent recovery of the US Dollar, which had reached a multi-month low just last week. Additionally, concerns about China’s fragile economic rebound and geopolitical risks have attracted some investors towards safe-haven commodities. However, the uncertainties surrounding the timing of the Federal Reserve’s interest rate cuts, which led to a sharp overnight increase in US Treasury bond yields, pose a challenge for non-yielding Gold prices. As a result, the market will closely scrutinize the Federal Open Market Committee (FOMC) meeting minutes for insights into the Fed’s future policy directions, which will influence both the USD and the non-yielding precious metal. In the meantime, traders will keep a close eye on the US ISM Manufacturing PMI and JOLTS Job Openings data for potential short-term trading opportunities. The expectation of a Federal Reserve interest rate cut in March is a crucial factor bolstering the value of non-yielding gold.

Furthermore, the potential for an escalation of conflict in the Red Sea, coupled with China’s economic challenges, provides favorable conditions for the safe-haven metal. Over the weekend, the official Chinese Purchasing Managers’ Index indicated further deterioration in manufacturing activity, with little sign of recovery by the end of 2023. A private survey on Tuesday revealed that China’s factory activity expanded at a faster pace in December, but business confidence for 2024 remained subdued. The US Dollar is consolidating its robust overnight gains, reaching a level not seen in over a week, supported by a sharp rise in US bond yields, which is capping the commodity. Traders may also opt to remain cautious and observe from the sidelines ahead of the release of the US ISM Manufacturing PMI, JOLTS Job Openings data, and the crucial FOMC meeting minutes.

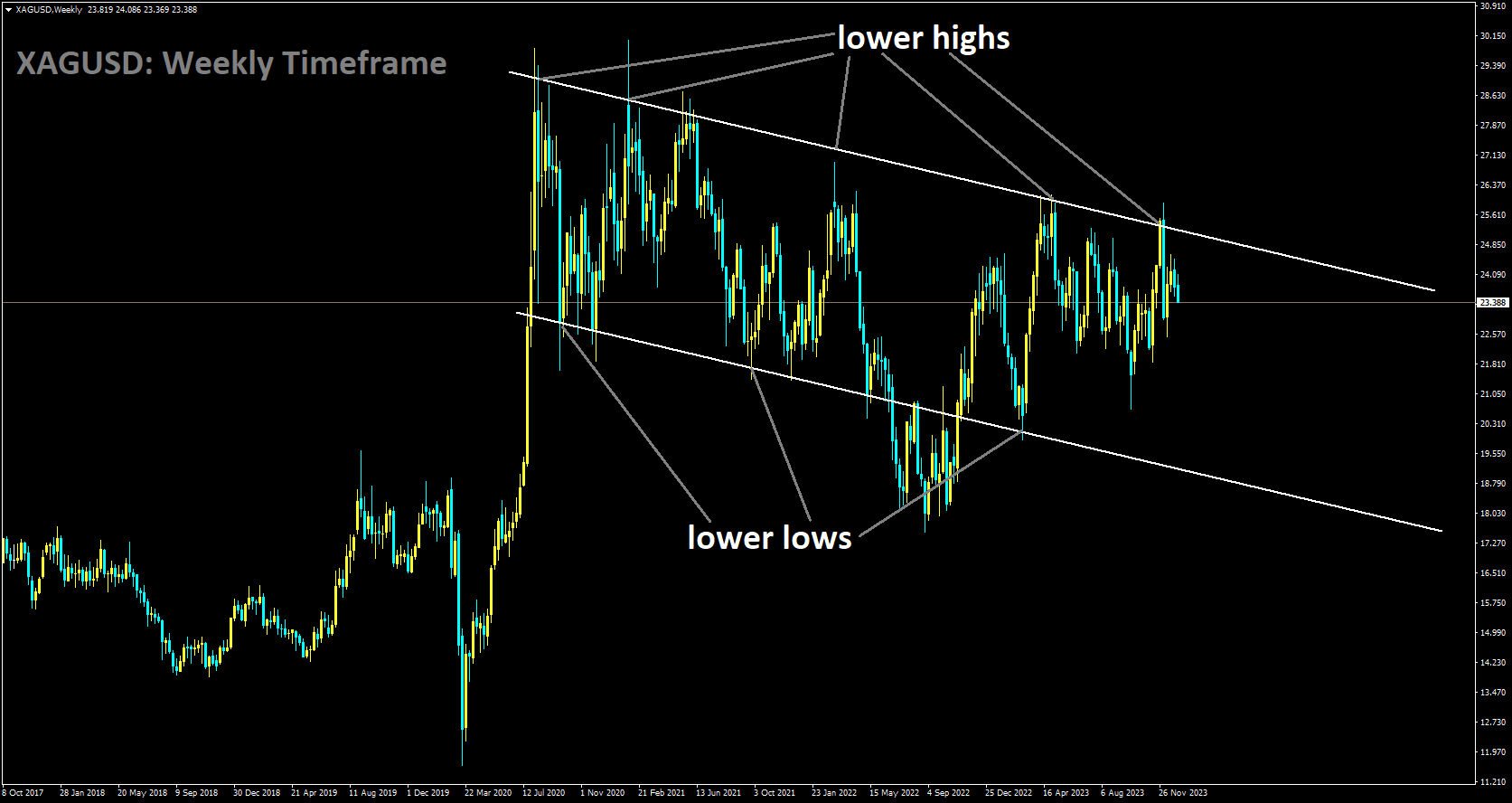

Analysis of SILVER:

XAGUSD is moving in Descending channel and market has fallen from the lower high area of the channel

The US Dollar Index appears to have stabilized above 102.00 early Wednesday. Key economic data, including November JOLTS Job Openings and December ISM Manufacturing PMI, will be featured in the US economic docket. Later in the American session, the Federal Reserve (Fed) will release the minutes of the December policy meeting.

During a recent interview with CNN, Kristalina Georgieva, the Managing Director of the International Monetary Fund, encouraged Americans to adopt an optimistic outlook regarding the US economy. She emphasized that inflation is expected to decrease further in 2024, despite a robust labor market and a moderation in interest rates.

Georgieva pointed out that people should find comfort in the fact that they will experience relief from rising prices, which, although painful, has achieved the desired outcome without pushing the economy into a recession. She conveyed a positive message, highlighting that people have jobs and can anticipate a decrease in interest rates due to declining inflation. She encouraged everyone to embrace the new year and focus on reducing obstacles, addressing genuine security concerns, and avoiding hasty actions that could harm the global economy. She stressed that such actions could lead to a smaller economic pie for everyone involved.

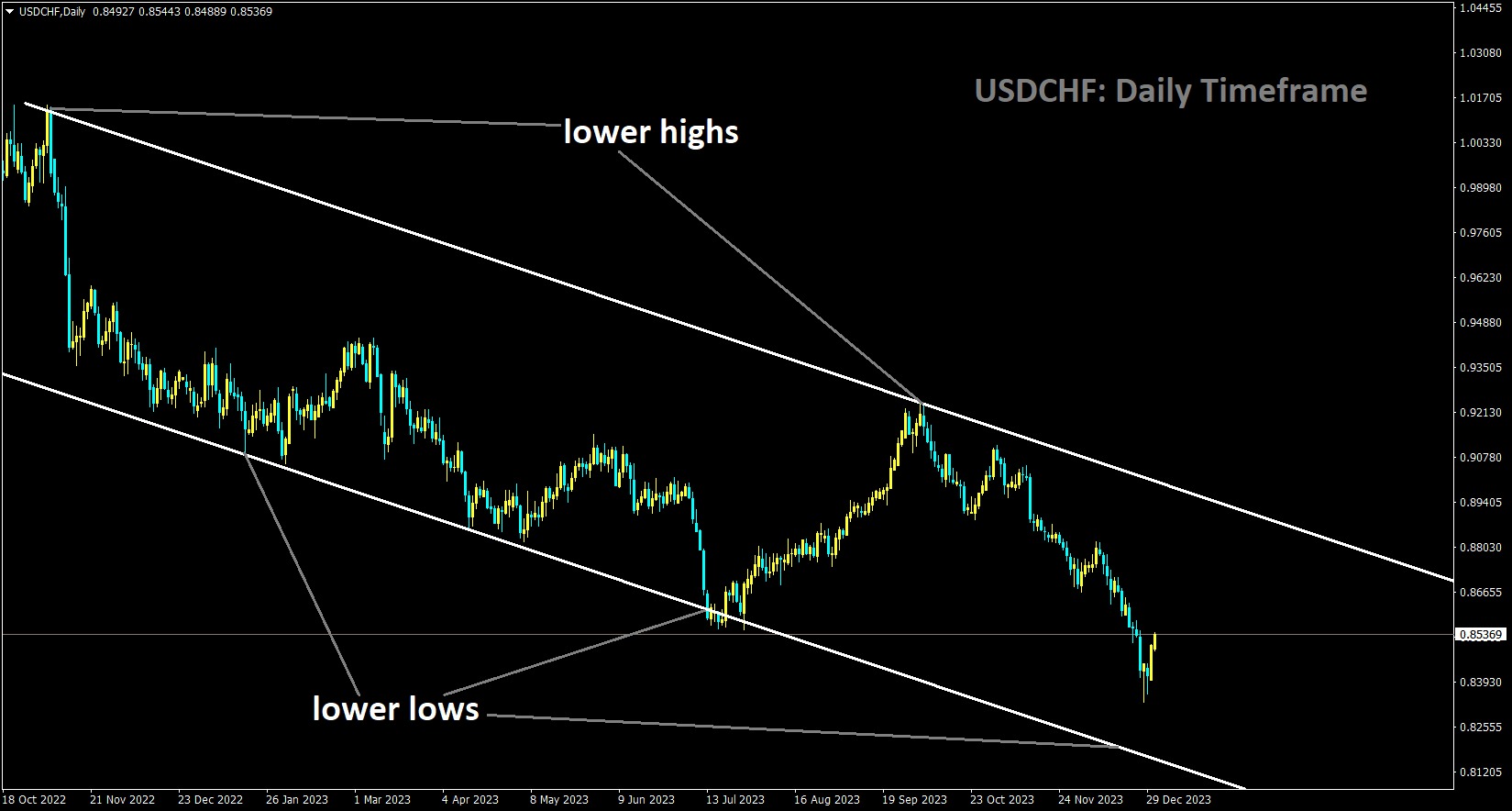

Analysis of USDCHF:

USDCHF is moving in the Descending channel and the market has reached the lower low area of the channel

The US S&P Global Manufacturing PMI has delivered noteworthy economic news with a figure of 47.9, falling short of the expected 48.2. Looking ahead, investors are poised to closely monitor a series of key US data points on Wednesday, including the December ISM Manufacturing PMI, November JOLTS Job Openings, and the release of the Federal Open Market Committee Minutes. The FOMC Minutes hold particular significance, given Chairman Jerome Powell’s recent mention of potential rate cuts following the latest Federal Reserve monetary policy decision. It is possible that the USD could face downward pressure following International Monetary Fund Managing Director Kristalina Georgieva’s moderate comments. Her optimism regarding the US economy and encouragement for Americans to remain positive suggest a less aggressive stance. Georgieva anticipates a moderation in interest rates in 2024 due to declining inflation, deviating from a more hawkish perspective and potentially impacting the USD negatively.

In Switzerland, the ZEW Survey Expectations for December recorded a further decline, signaling subdued economic sentiment. However, the KOF Swiss Leading Indicator surprisingly improved, defying expectations. The Swiss National Bank is expected to actively intervene in the foreign exchange market to bolster the Swiss Franc. Looking ahead, investors will closely monitor the SVME Manufacturing Purchasing Managers Index data on Wednesday for fresh insights into the Swiss economy.

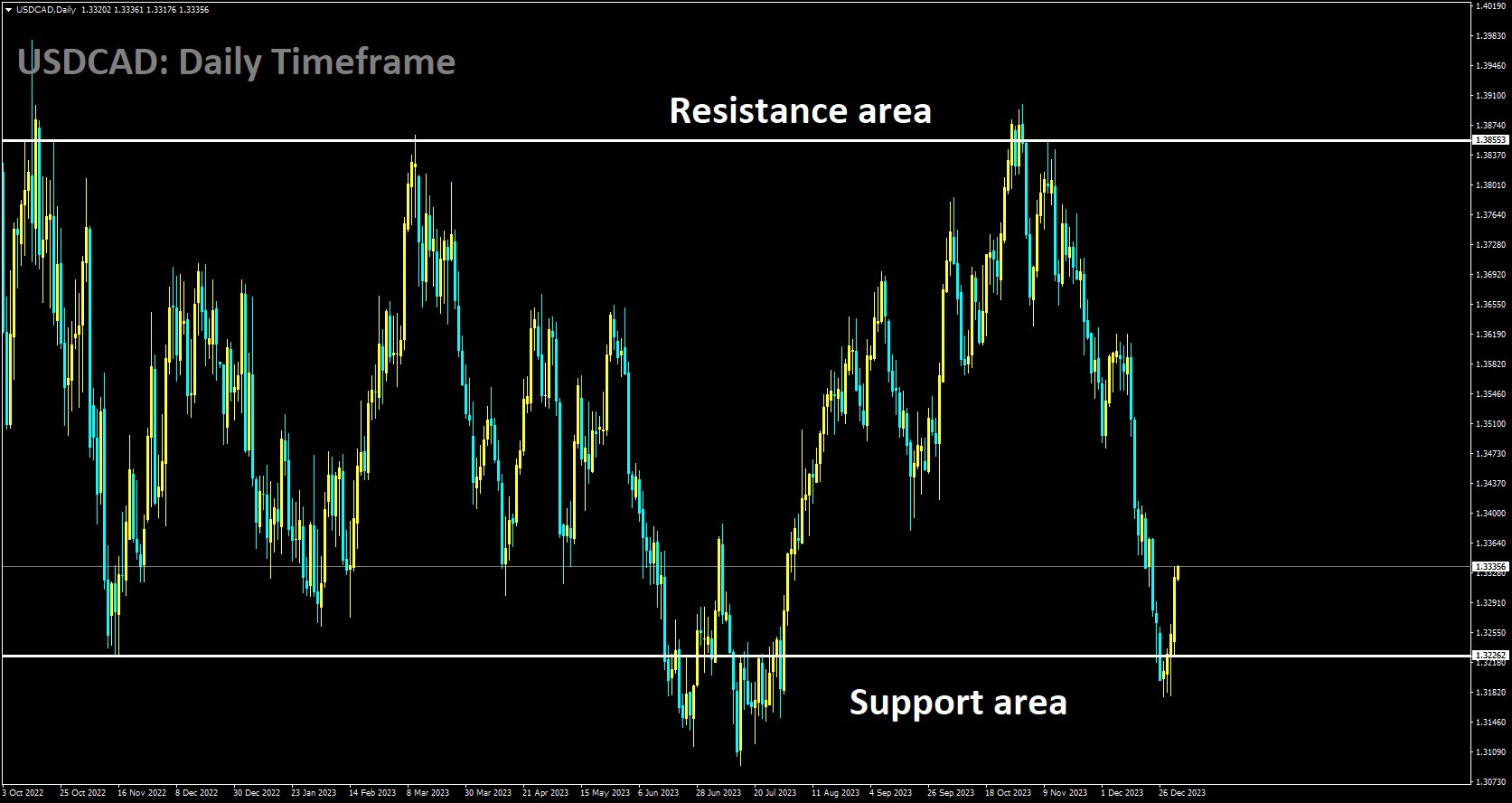

Analysis of USDCAD:

USDCAD is moving in Box pattern and market has rebounded from the support area of the pattern

Reduced concerns about tensions in the Red Sea disrupting supplies, coupled with underwhelming economic data from China, are keeping Crude Oil prices near a two-week low. Additionally, recent comments by Bank of Canada Governor Tiff Macklem, suggesting the possibility of rate cuts in 2024, have weakened the commodity-linked Canadian Dollar, providing support for the USDCAD pair. Conversely, the US Dollar has entered a phase of bullish consolidation following its most significant daily percentage gains since October on Tuesday. This resurgence is driven by uncertainties surrounding the Federal Reserve’s potential early interest rate cuts, amplified by the overnight surge in US Treasury bond yields and a cautious market sentiment. These factors are boosting the appeal of the safe-haven Greenback, consequently lending support to the USDCAD pair.

Investors are now turning their attention to the US economic calendar, which includes the release of the ISM Manufacturing PMI and JOLTS Job Openings data later in the North American session. However, the focal point remains the FOMC meeting minutes, which will be closely examined for insights into the timing of potential rate cuts by the Fed. This, in turn, will influence the demand for the US Dollar. Additionally, the dynamics of Oil prices are expected to have an impact on the USDCAD pair.

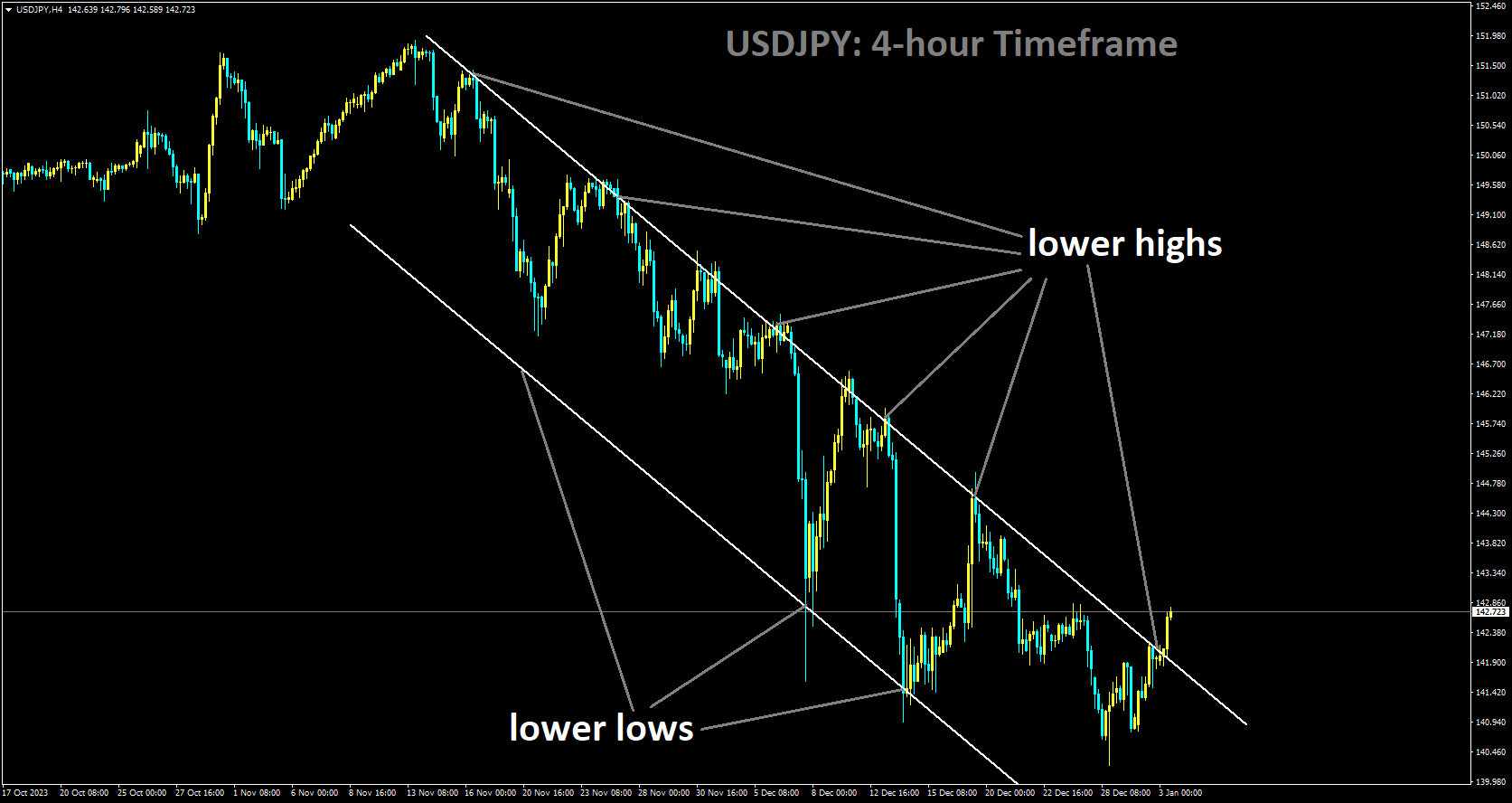

Analysis of USDJPY:

USDJPY is moving in Descending channel and market has reached lower low area of the channel

The US Dollar is struggling to capitalize on its strong rally from the previous day, where it reached a one-week high. This is due to a growing consensus that the US central bank will implement monetary policy easing this year. This perception is acting as a headwind for the USDJPY currency pair. However, traders are cautious about making aggressive directional bets ahead of the Federal Open Market Committee meeting minutes.

Investors will be closely watching the release of the US ISM Manufacturing PMI and JOLTS Job Openings data on Wednesday, which are expected to provide significant market momentum. The market’s attention will then shift to the US ADP report on private-sector employment, followed by the official Nonfarm Payrolls reports on Thursday and Friday, respectively. These key labor market reports will have a substantial influence on the Fed’s policy outlook, which in turn will impact the demand for USD and determine the short-term trajectory of the USDJPY pair. Despite these dynamics, the overall backdrop appears to favor JPY bulls, and caution is advised before making any significant positioning for an extension of the currency pair’s recent recovery from its lowest level since July 28th, which was reached last week.

It’s worth noting that there was an initial market reaction to the earthquake in Japan on Monday, but this was short-lived as market participants began to anticipate a potentially more hawkish stance from the Bank of Japan. The BoJ is expected to exit its ultra-loose policy in April, following annual wage negotiations in March, although the possibility of an earlier move in January cannot be ruled out. Meanwhile, the Federal Reserve is widely expected to start reducing interest rates as early as March and implement a cumulative rate cut of 150 basis points by the end of the year. However, the recent sharp increase in US Treasury bond yields has led to doubts in the market about whether the Fed will actually implement the extent of monetary easing that is currently priced in. The yield on the benchmark 10-year US government bond rose above 4.0% for the first time in two weeks on Tuesday, providing strong support to the US Dollar. This rise in US bond yields has negatively impacted growth stocks and caused a corrective decline in US equity markets. This situation has benefited the safe-haven Japanese Yen and has put a cap on the USDJPY pair.

As traders await further data and the FOMC minutes, they will closely scrutinize these economic indicators to gain insight into the potential timing of rate cuts. The market’s attention will then turn to the ADP’s US private-sector employment report on Thursday, with the focus ultimately remaining on the critical Nonfarm Payrolls report scheduled for Friday.

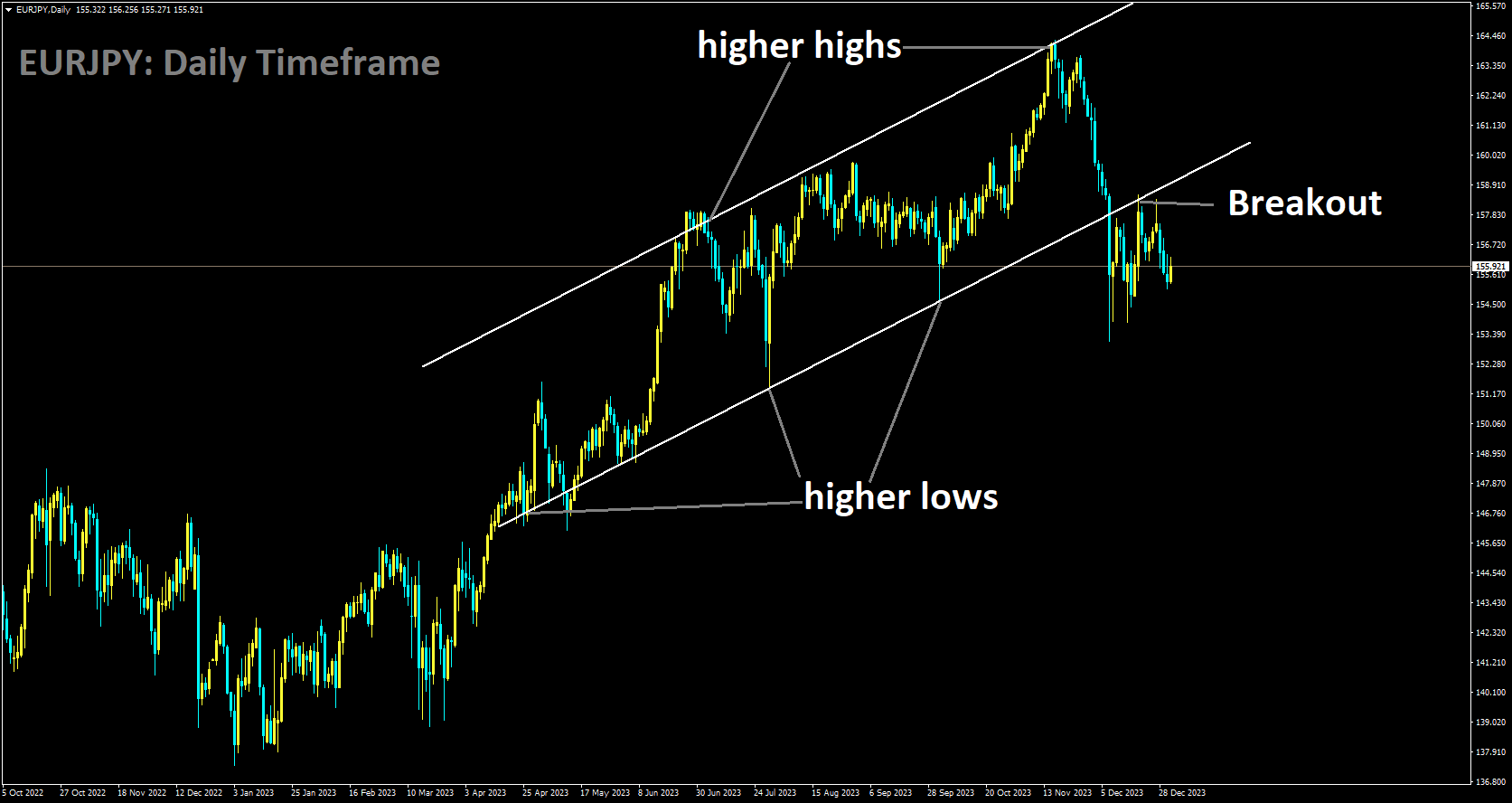

Analysis of EURJPY:

EURJPY has broken Ascending channel in downside

On New Year’s Day, Japan experienced a significant 7.6 magnitude earthquake, which had a notable impact on the domestic currency. However, there are several factors at play that are helping to limit losses for the safe-haven Japanese Yen. One of these factors is the expectation of a change in policy direction between the Bank of Japan and the Federal Reserve in 2024. Additionally, geopolitical risks and China’s economic challenges are contributing to the support for the JPY.

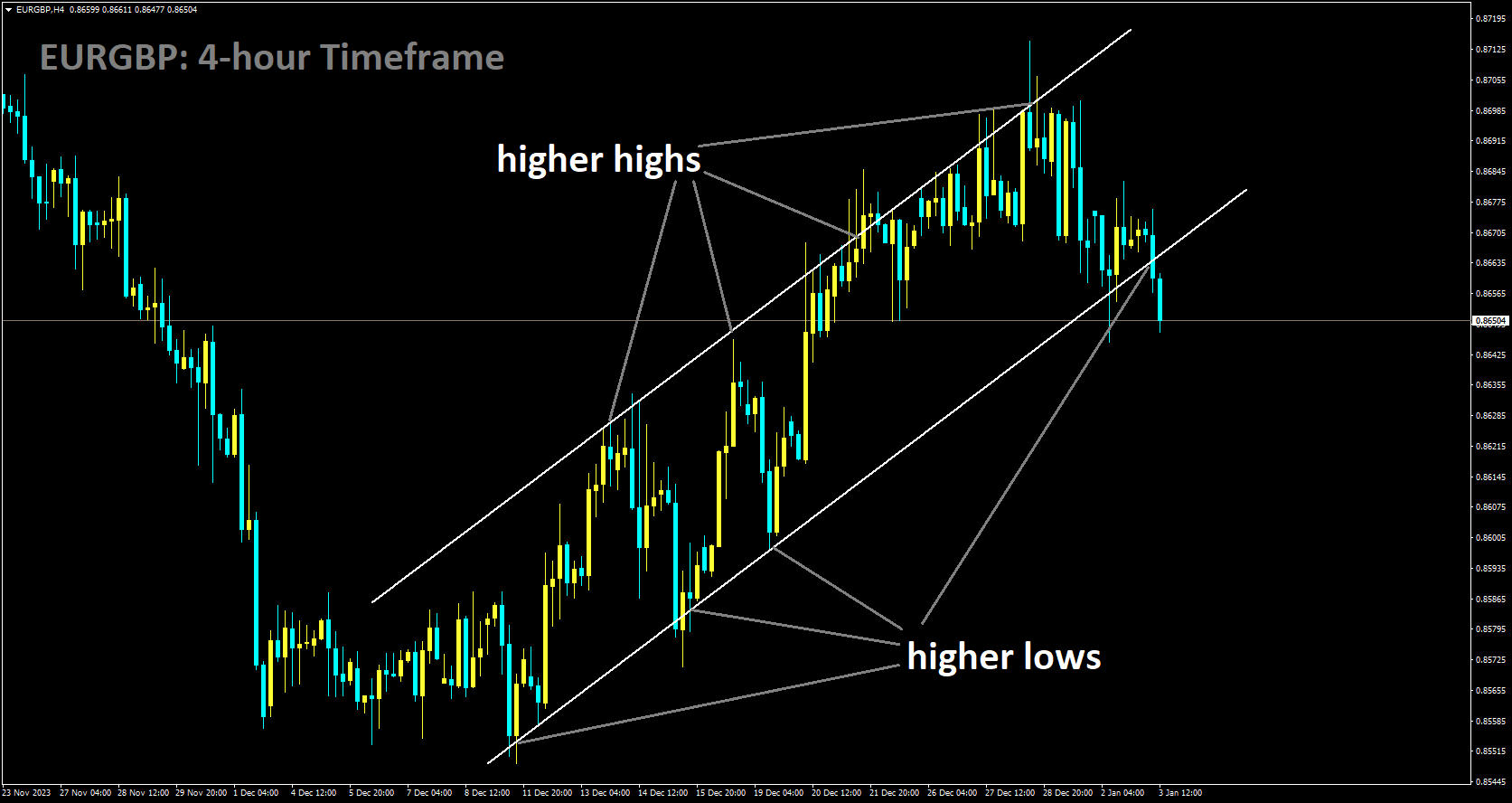

Analysis of EURGBP:

EURGBP is moving in Ascending channel and market has reached higher low area of the channel

The performance of the UK manufacturing sector deteriorated in December 2023, with the UK S&P Global PMI registering at 46.2, down from the previous reading of 46.4, falling below market expectations. Moreover, a pessimistic outlook for the British economy and concerns about the possibility of a technical recession are placing downward pressure on the British Pound, while simultaneously bolstering the EURGBP cross.

On the Euro side of things, the Eurozone HCOB Manufacturing PMI exceeded expectations, rising to 44.4 in December 2023 from the previous figure of 44.2 recorded in November. Additionally, the German Manufacturing PMI outperformed market projections, climbing to 43.3 in December, surpassing the previous reading of 43.1. Later on Wednesday, we anticipate the release of German employment data, including the Unemployment Rate and Unemployment Change. Moving into Thursday, the Eurozone HCOB Composite PMI, Services PMI, and Consumer Price Index (CPI) for December are scheduled to be published. These reports may provide clear insights into the direction of the EURGBP cross.

Analysis of GBPUSD:

GBPUSD is moving in Ascending channel and market has reached higher low area of the channel

One of the primary reasons behind the Pound Sterling’s strong performance against the US Dollar was the expectation that the Federal Reserve would begin cutting interest rates ahead of the Bank of England. However, the UK’s dim economic outlook, marked by increasing business pessimism amidst a deepening cost-of-living crisis, may prompt BoE policymakers to reconsider their strategy of maintaining elevated interest rates for an extended period. Following a significant sell-off, the Pound Sterling has found temporary support just above the 1.2600 level. The GBPUSD pair has come under pressure as a result of a swift resurgence in the US Dollar and growing concerns about a recession in the United Kingdom.

The UK Office for National Statistics recently reported a 0.1% contraction in Gross Domestic Product for the third quarter of 2023. The UK’s manufacturing sector remains susceptible, with reduced demand both domestically and internationally due to higher interest rates and an intensifying cost-of-living crisis. S&P Global reported a decline in the Manufacturing PMI to 46.2, down from the previous reading of 46.4, marking the 17th consecutive month of contraction in the Manufacturing PMI. S&P Global’s report indicated that British employers have significantly reduced inventory and employment, painting a bleak picture for the manufacturing sector. Additionally, the Institute of Directors Confidence Index revealed a continuous rise in the number of business leaders expressing pessimism about the economic outlook since June.

The institute highlighted the urgent need for measures that could stimulate meaningful economic growth in 2024. Given the vulnerable state of the UK manufacturing sector and deepening recession concerns, Bank of England policymakers may be compelled to reconsider their tight monetary policy stance and initiate discussions about interest rate reductions. These policymakers had been advocating for higher borrowing costs to ensure a timely return of inflation to the 2% target. While inflation pressures in the UK have moderated considerably, they remain higher than desired compared to other Group of Seven economies. The situation has reached a critical juncture as investors shift their attention to crucial US economic data scheduled for release this week.

A plethora of US economic data, including the Institute of Supply Management’s Manufacturing and Services PMI, job openings, and labor market statistics, is on the horizon. However, before these releases, all eyes will be on the Federal Open Market Committee minutes from December’s monetary policy meeting, set to be unveiled on Wednesday. These minutes will provide comprehensive insights into the rationale behind the FOMC’s decision to keep interest rates unchanged for the third consecutive time and offer guidance on the interest rate trajectory for 2024. The market’s diminished appetite for risk has increased the attractiveness of the US Dollar, as reflected in the US Dollar Index, which recently reached a fresh weekly high just above 102.00.

Analysis of AUDUSD:

AUDUSD is moving in Ascending channel and market has fallen from the higher high area of the channel

Bloomberg reported on internal documents from the Reserve Bank of Australia detailing the effects of increasing interest rates on households and businesses, indicating that private sector wage growth has stabilized at approximately 4.0%. There has been a decrease in domestic tourism demand from its previous high levels, with consumers opting for more affordable products or reducing their purchases due to the strains of rising living expenses. Community service organizations are noting that these cost-of-living pressures continue to affect their clients significantly, with an increased number of individuals, including wage earners and households with mortgages, seeking assistance from these organizations, particularly for obtaining food support.

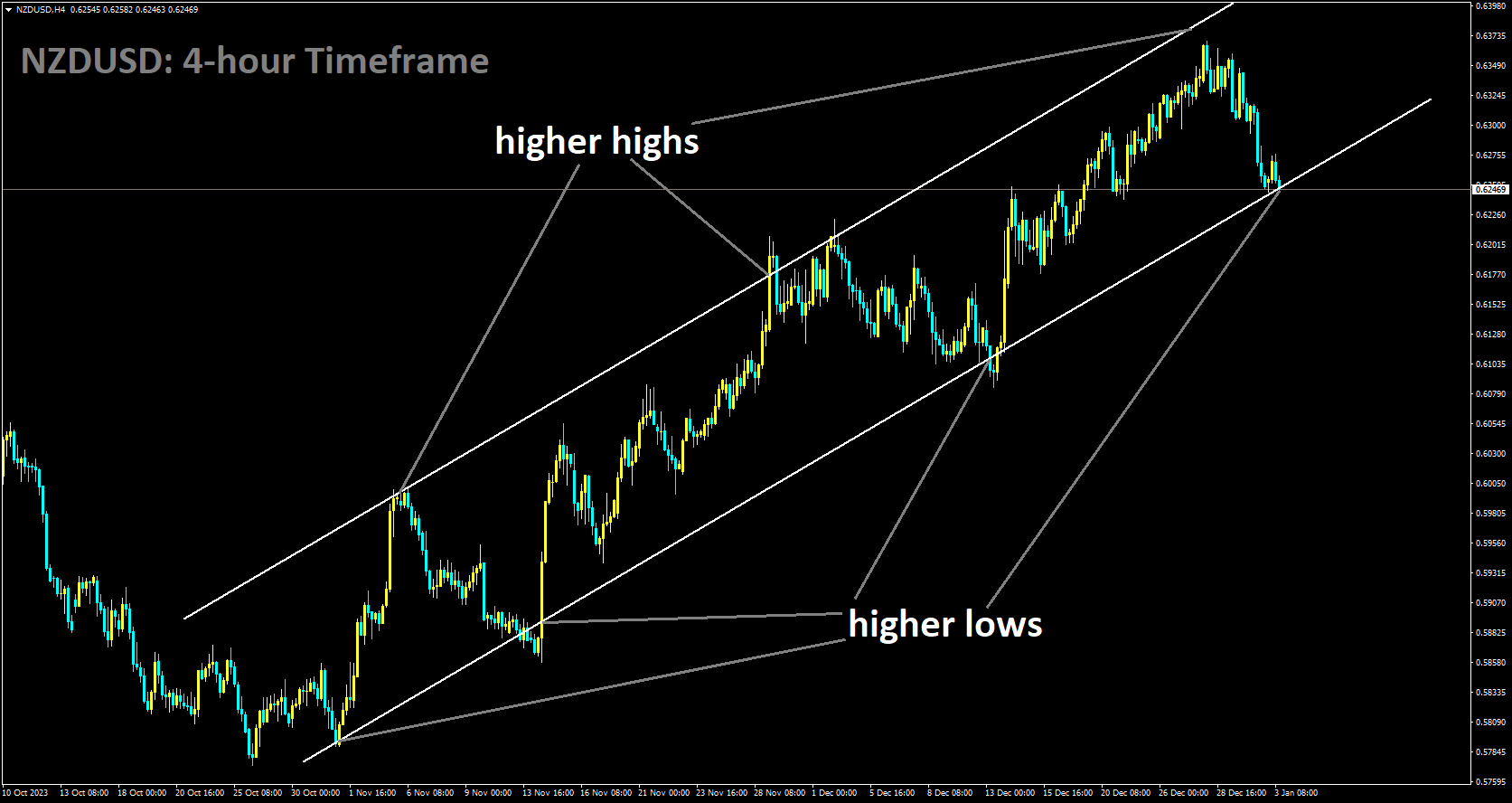

Analysis of NZDUSD:

NZDUSD is moving in Ascending channel and market has reached higher low area of the channel

During the December FOMC meeting, the committee indicated a likelihood of implementing approximately three 25 basis points rate cuts in 2024. According to the CME Fed Watch tool, market expectations for the January meeting do not include a rate hike, and there is a pricing-in of more than a 78% probability of rate cuts occurring in March 2024, based on the CME Fed Watch tool. The forthcoming release of the December FOMC meeting minutes, scheduled for late Wednesday, will offer further insights into the perspectives of policymakers. Additionally, traders will closely monitor US labor data for guidance. The Nonfarm Payrolls figure is projected to add 168,000 jobs to the US economy in December, down from 199,000 in November, with the Unemployment Rate estimated to rise to 3.8%. If the actual data surpasses expectations, it could challenge the market’s anticipation of rate cuts and potentially drive the USD higher against its currency counterparts.

The economic calendar for New Zealand remains relatively quiet this week. On Tuesday, China’s Caixin Manufacturing Purchasing Managers’ Index increased to 50.8 in December, surpassing November’s expansion figure of 50.7, exceeding market projections of 50.4. These positive developments related to the Chinese economy could provide support to the New Zealand Dollar, often considered a China-proxy currency, and act as a favorable factor for the NZDUSD pair. Looking ahead, market participants are awaiting the release of the Chinese Caixin Services PMI for December. Additionally, the final US ISM Manufacturing PMI

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% FLAT OFFER for Signals 😍 GOING TO END – Get now: forexfib.com/discount/