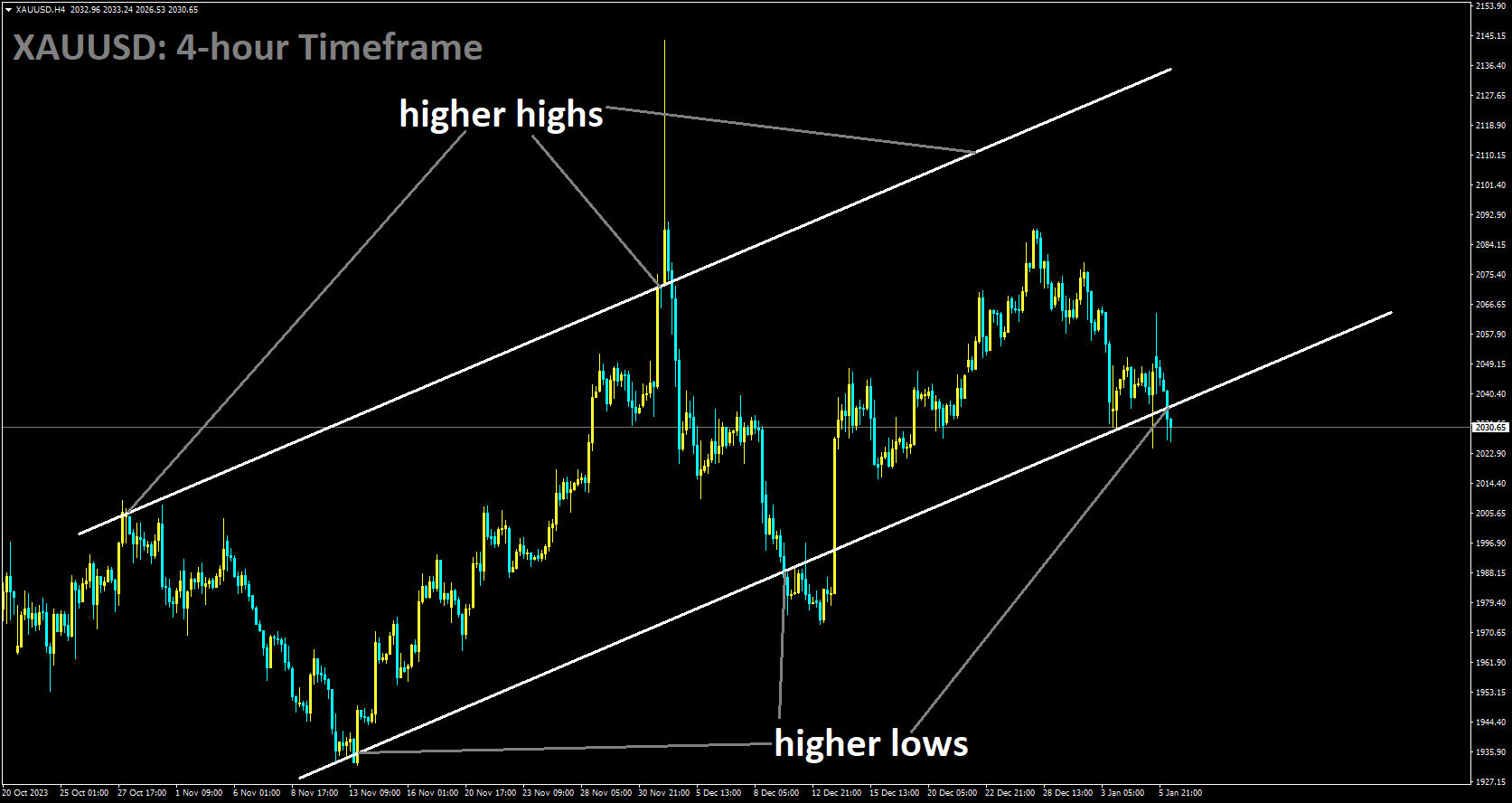

GOLD Analysis:

XAUUSD is moving in Ascending channel and market has reached higher low area of the channel

The price of gold, represented by XAUUSD, faced renewed selling pressure at the beginning of the week, edging closer to a two-week low reached after the positive US monthly employment data released on Friday. The widely watched Nonfarm Payrolls report indicated the resilience of the US labor market, giving the Federal Reserve more room to maintain higher interest rates for a longer duration. Moreover, recent hawkish comments from Fed officials have prompted investors to reduce their expectations for a more aggressive policy easing, which has supported higher US Treasury bond yields and led to capital outflows from gold, a non-yielding asset.

However, the market still factors in a higher probability of the Fed’s first interest rate cut at its March policy meeting and anticipates a total of five 25 basis points rate cuts for 2024. This outlook puts US Dollar bulls on the defensive and could provide some support for the price of gold. Additionally, a generally cautious market sentiment could act as a tailwind for the safe-haven precious metal. Investors may also opt to wait on the sidelines and assess the US consumer inflation figures scheduled for release on Thursday before committing to new directional trades. In the absence of significant US economic data, traders on Monday will closely follow a planned speech by Atlanta Fed President Raphael Bostic for potential market cues.

SILVER Analysis:

XAGUSD is moving in Ascending channel and market has reached higher low area of the channel

Federal Reserve Bank of Dallas President, Lorie Logan, conveyed on Saturday that the central bank may find it necessary to keep raising its short-term policy rate to prevent a recent decline in long-term bond yields from potentially rekindling inflation. Prematurely easing financial conditions could inadvertently stimulate demand, and if we fail to maintain sufficiently tight conditions, there is a potential risk that inflation might rebound, reversing the progress made thus far. It would be prudent to consider specific parameters to guide the decision to slow down the Fed’s balance sheet reduction.

Logan also mentioned that the labor market remains tight, although it continues to undergo adjustments. The financial system, on the whole, possesses more than enough bank reserves and liquidity, albeit no longer at levels considered super abundant. While inflation is in a significantly better position compared to the same period last January, the Fed’s mission is not yet complete. As a result, Logan suggested that the pace of asset runoff should be reduced, particularly as the Fed’s overnight reverse repurchase balances approach a lower level.

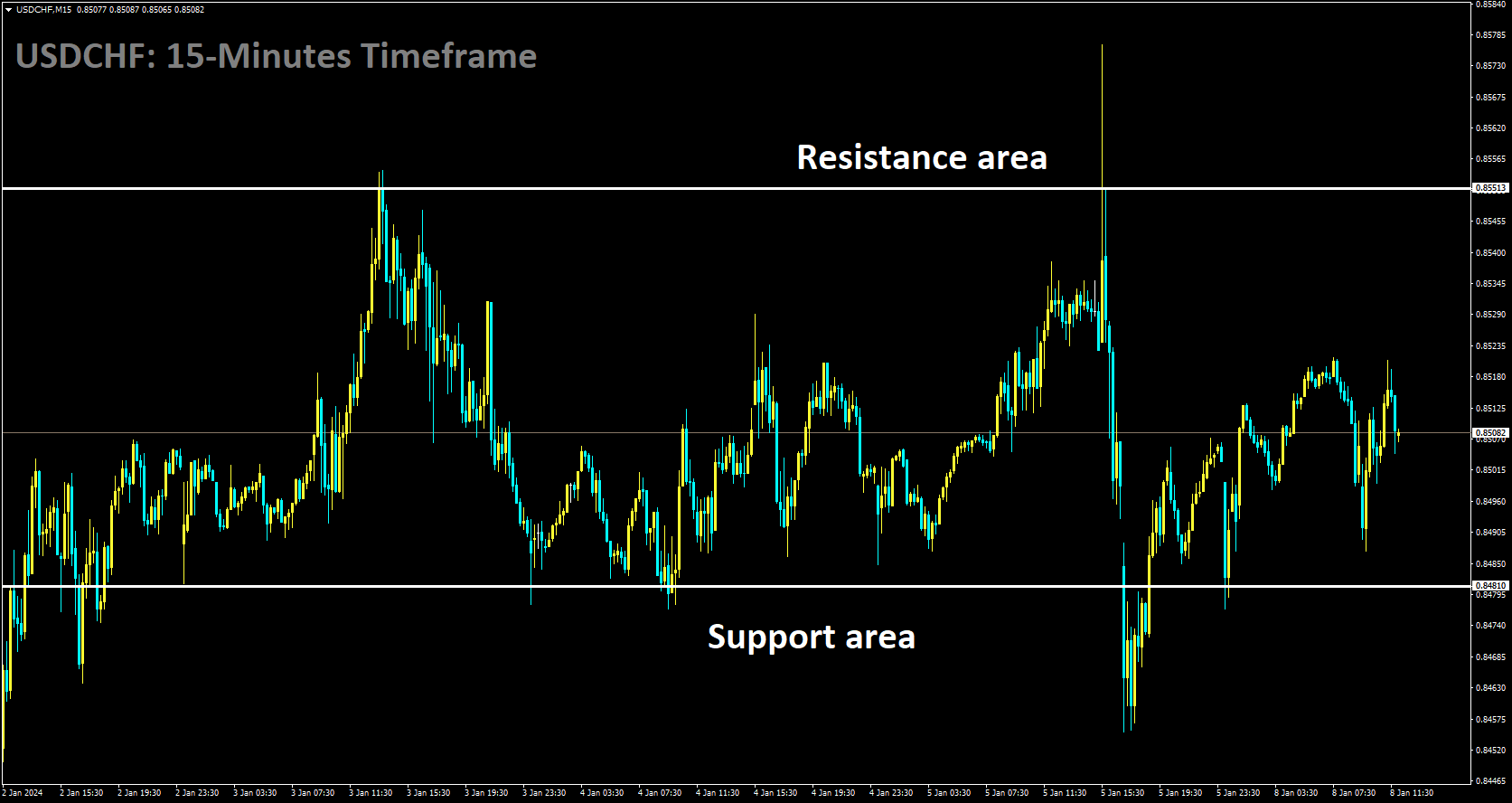

USDCHF Analysis:

USDCHF is moving in box pattern and market has rebounded from the support area of the pattern

The unexpectedly positive labor data in the United States from Friday has weakened the case for rate cuts by the Federal Reserve. According to the CME Fedwatch tool, traders are now estimating a probability of over 60% for rate cuts in the upcoming March meeting. In December, US Nonfarm Payrolls experienced robust growth, adding 216K jobs compared to 173K in November, surpassing the market consensus of 170K. Additionally, Average Hourly Earnings increased by 0.4% month-on-month, exceeding the estimated 0.3%, and the annual figure for December reached 4.1% year-on-year, up from the previous 4.0%, surpassing the expectation of 3.9%.

Investors will closely watch the Swiss Consumer Price Index for December, set to be released later on Monday. The annual CPI is anticipated to show a 1.5% YoY increase, up from the previous reading of 1.4%, while the monthly CPI is expected to remain unchanged at -0.2% MoM. The highlight of this week will be the release of US inflation data on Thursday. Market participants are forecasting that the headline Consumer Price Index will reflect a 3.2% YoY increase, while the Core CPI is expected to ease slightly from 4% to 3.8% YoY.

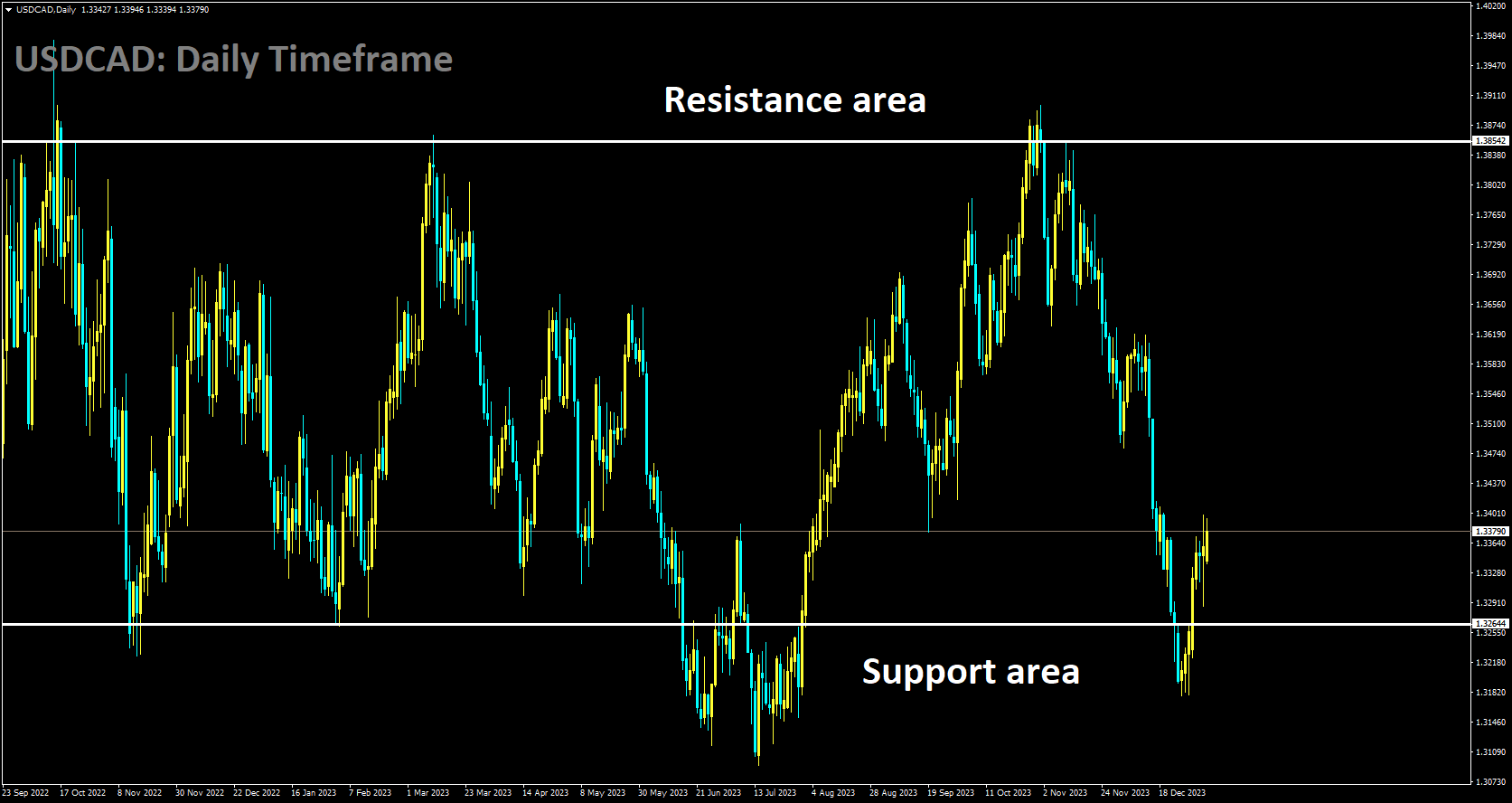

USDCAD Analysis:

USDCAD is moving in box pattern and market has rebounded from the support area of the pattern

The Canadian Dollar initially dropped to a new low for the week against the US Dollar but later surged to a three-day high as market sentiment fluctuated in response to a robust US Nonfarm Payrolls report that exceeded market expectations. Canada’s labor market appeared somewhat restrained, with a job addition figure that fell below expectations, and wage growth continued to accelerate, reaching a two-year high. The US Nonfarm Payrolls report took center stage as it added 216,000 net new jobs to the US employment landscape in December, surpassing the forecasted 160,000. However, data revisions remained a concern, with November’s figure being adjusted down from 199,000 to 173,000, and October’s revision showing a further decline from 150,000 to 105,000. Average Hourly Earnings in the US saw a slight increase from 4% to 4.1% for the year ending in December, while the US Unemployment Rate held steady at 3.7%, defying market expectations of a slight uptick to 3.8%.

Despite the generally positive US data, the US ISM Services Purchasing Managers’ Index (PMI) for December fell short of expectations, registering at 50.6 compared to the forecasted decline from 52.7 to 52.6. In Canada, the Unemployment Rate remained unchanged at 5.8%, contrary to the forecasted 5.9%. Canadian Average Hourly Wages experienced a surge, rising from 5.0% to 5.7% in December, reaching a two-year high. However, the forecasts for Canadian Net Change in Employment were far from accurate, as Canada added only 0.1K new jobs in December, compared to the predicted decline from 24.9K to 13.5K. Canadian December Ivey PMIs appeared positive in the seasonally-adjusted figure, increasing from 54.7 to 56.3. However, cyclically-adjusted factors played a significant role, as the non-seasonally adjusted PMI dipped into contractionary territory at 43.7, marking a 12-month low.

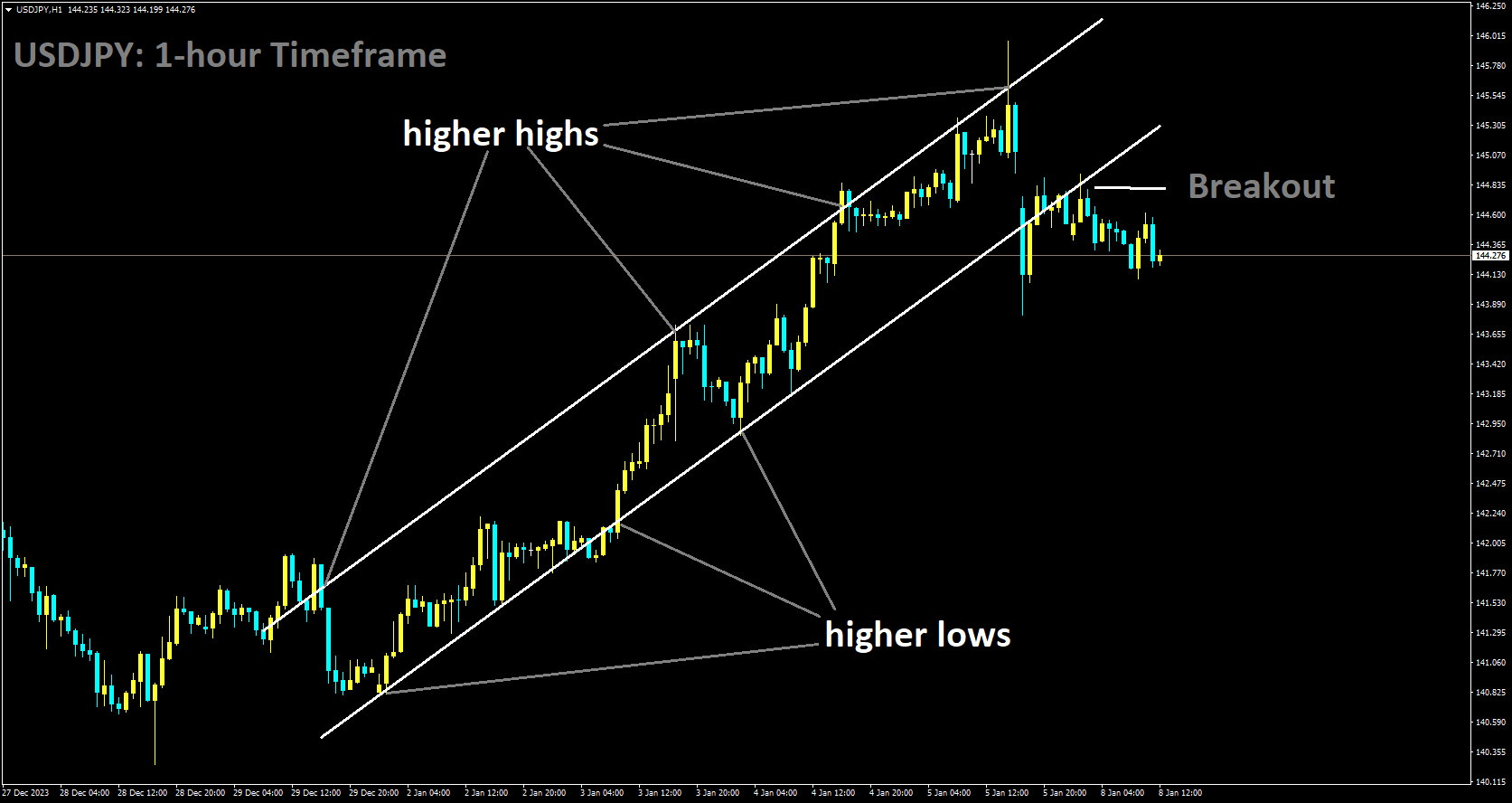

USDJPY Analysis:

USDJPY has broken Ascending channel in downside

Amid China’s economic challenges and geopolitical risks, the decreasing likelihood of a more aggressive policy easing by the Federal Reserve (Fed) is impacting investor sentiment and favoring the traditional safe-haven currency, the Japanese Yen (JPY). However, the JPY’s further gains are constrained by growing expectations that the Bank of Japan will not abandon its negative interest rates policy during its January 22-23 meeting, especially following the recent earthquake in Japan.On the other hand, the US Dollar is struggling to capitalize on its recent recovery from a multi-month low. Market sentiment is swayed by the belief that the Fed might initiate interest rate cuts as early as March. Nevertheless, incoming US economic data suggests that the economy remains resilient, providing the Fed with more room to maintain higher interest rates. This sentiment is reinforced by recent hawkish comments from Fed officials, contributing to elevated US Treasury bond yields.

The Japanese Yen experienced a significant decline of over 2% last week, marking its worst weekly performance since June 2022. This decline is attributed to diminishing hopes for an immediate change in the Bank of Japan’s policy later this month. The release of a robust December US jobs report added to the uncertainty regarding the Fed’s trajectory for rate cuts, leading to strength in the US Dollar and pushing the USDJPY pair to a three-week high on Friday.

The non-farm payrolls data showed that the US economy added 216,000 new jobs, surpassing the expected 170,000, while the unemployment rate remained steady at 3.7%, defying expectations of a rise to 3.8%. However, the positive data was offset by the Institute for Supply Management survey, revealing a decline in the US services sector, which accounts for a significant portion of the economy. The ISM’s Non-Manufacturing Index dropped to 50.6 in December, its lowest level since May, and the employment sub-component fell to 43.3, the lowest since July 2020, down from 50.7 in November.

Furthermore, US Factory Orders for November increased more than anticipated, rising by 2.6% after a 3.4% decline in October. Despite these mixed signals, the overall strength of the US economy has led investors to reduce their expectations for aggressive easing by the Federal Reserve. Dallas Fed President Lorie Logan emphasized the importance of maintaining sufficiently tight financial conditions to prevent a resurgence of inflation, while Richmond Fed President Thomas Barkin expressed confidence in the economy’s trajectory and the possibility of rate hikes. Nonetheless, the market still prices in a higher probability of the Fed’s first interest rate cut in March and anticipates a cumulative total of five 25 basis points rate cuts for 2024. These factors are restraining the USD bulls and limiting the upside potential for the USD/JPY pair, with the focus now shifting to US consumer inflation figures set to be released on Thursday. Additionally, an agreement on a topline spending level has been reached by House Speaker Mike Johnson and Senate Majority Leader Chuck Schumer, averting a government shutdown.

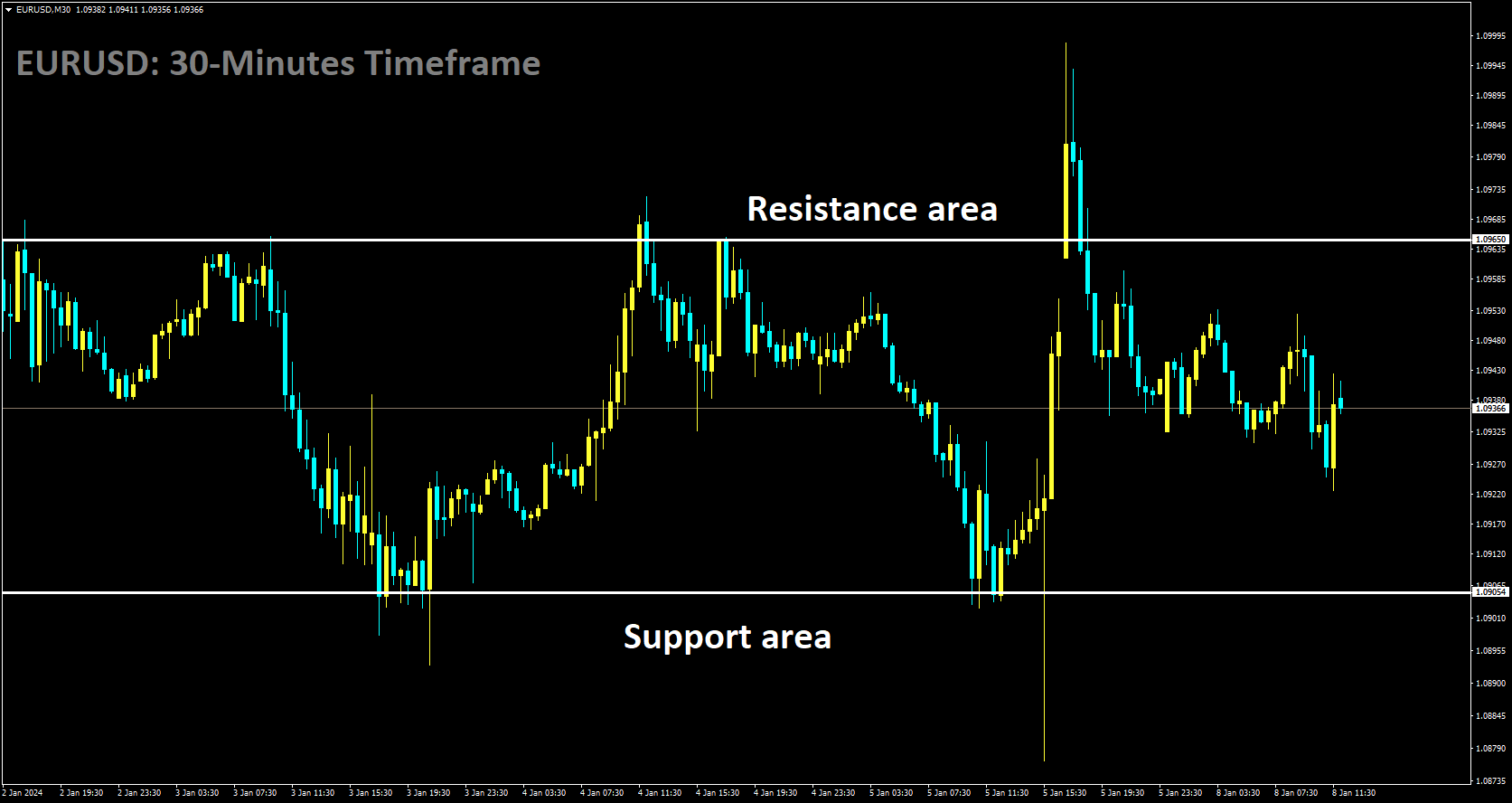

EURUSD Analysis:

EURUSD is moving in box pattern and market has fallen from the resistance area of the pattern

According to the Bundesbank’s report on Monday, Factory Orders in Germany increased by 0.3% in November compared to the previous month. This growth follows a significant 3.8% contraction in October and fell short of market expectations, which had anticipated a 1% rise. On an annual basis, Factory Orders experienced a decline of 4.4%.

In other economic indicators for Germany, Imports and Exports both saw positive monthly growth, with Imports expanding by 1.9% and Exports by 3.7%.

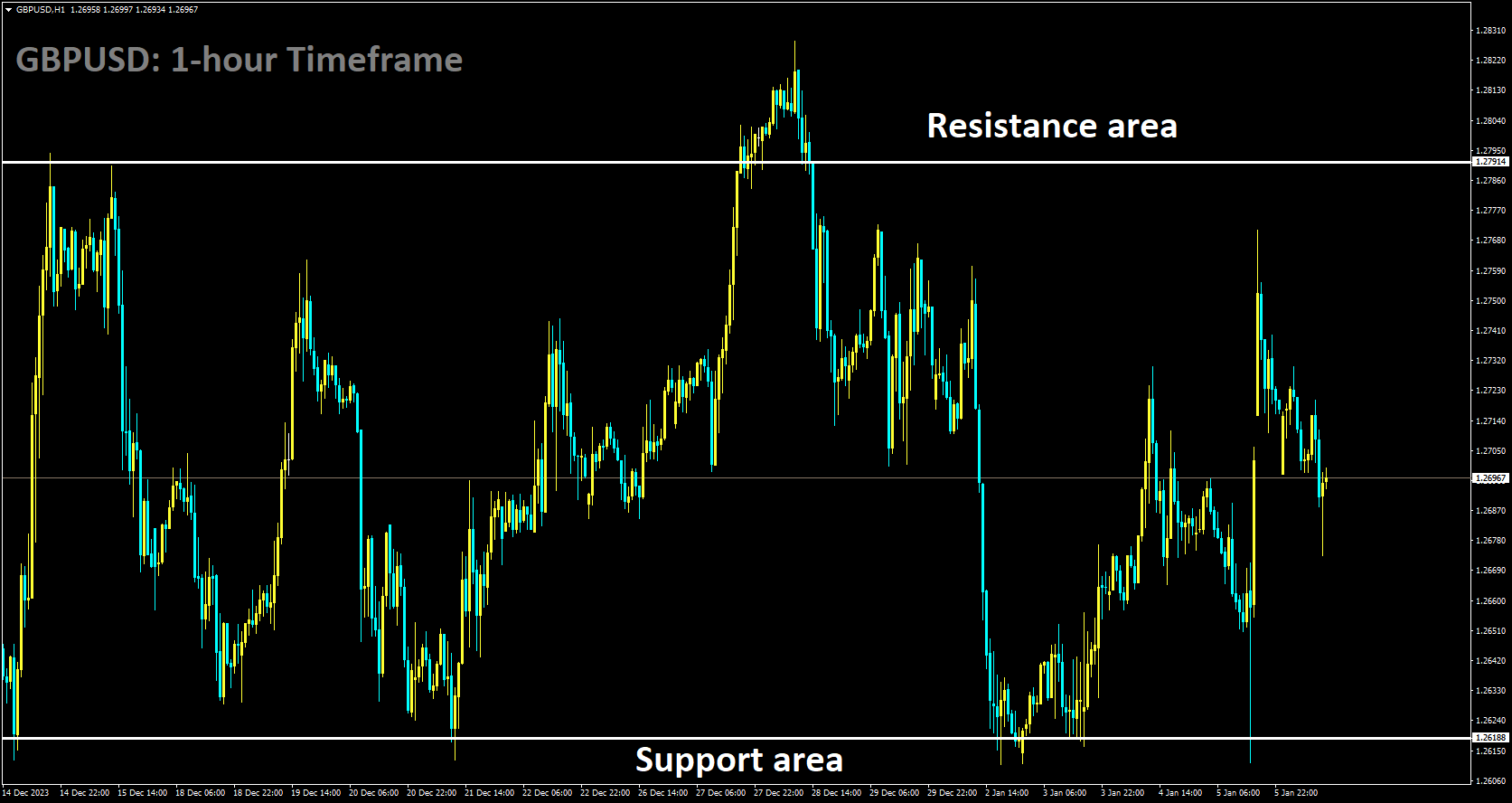

GBPUSD Analysis:

GBPUSD is moving in box pattern and market has fallen from the resistance area of the pattern

The Pound Sterling has shown significant strength against the US Dollar, as market risk appetite improved, despite the release of positive US economic data. The GBP/USD pair has continued to strengthen, even though all components of the US Nonfarm Payrolls data for December exceeded expectations. It appears that the robust labor demand in the US had already been factored in by market participants. However, there are challenges ahead for Bank of England policymakers, as they grapple with the difficult task of navigating between deepening recession risks in the UK economy and persistently high underlying inflation. The likelihood of a technical recession in the UK is elevated, given the contraction observed in the third quarter and the expected stagnation in the final quarter. Additionally, recent PMI data indicates ongoing challenges in the manufacturing sector due to elevated interest rates. The outlook for the GBPUSD pair has dimmed, as US employment indicators could reshape guidance on interest rates by the Federal Reserve.

Analysis Despite the stronger-than-expected official Employment data for December in the United States, the Pound Sterling has staged a robust recovery. US employers added 216,000 workers, surpassing the 199,000 jobs created in November, albeit with more modest job gains in December. The Unemployment Rate remained steady at 3.7%, contrary to expectations of a slight increase to 3.8%. Average Hourly Earnings maintained a steady pace of 0.4%, with annual wage growth at 4.1%, up from the previous 4.0%. Investors had anticipated a softening in labor cost data to 3.9%. Bets favoring a rate cut by the Federal Reserve in March have significantly receded. The US Dollar Index declined sharply after reaching a fresh three-week high at 103.00. In contrast, the Pound Sterling continues to face pressure as investors anticipate a mild recession in the United Kingdom, with the economy contracting by 0.1% in the third quarter of 2023.

Bank of England policymakers are in a delicate balancing act, weighing the potential benefits of an early rate cut to avert a recession against the risk of fuelling inflationary pressures. While the UK’s manufacturing sector remains in contraction due to challenging conditions both domestically and abroad, the Services PMI, which measures activity in the services sector, expanded at the fastest pace since June. S&P Global reported a December Services PMI reading of 53.4, exceeding expectations of 52.7 and the previous reading of 50.9. The significant increase in client demand, driven by hopes of lower borrowing costs and economic recovery in 2024, accelerated growth in service activities according to S&P Global.

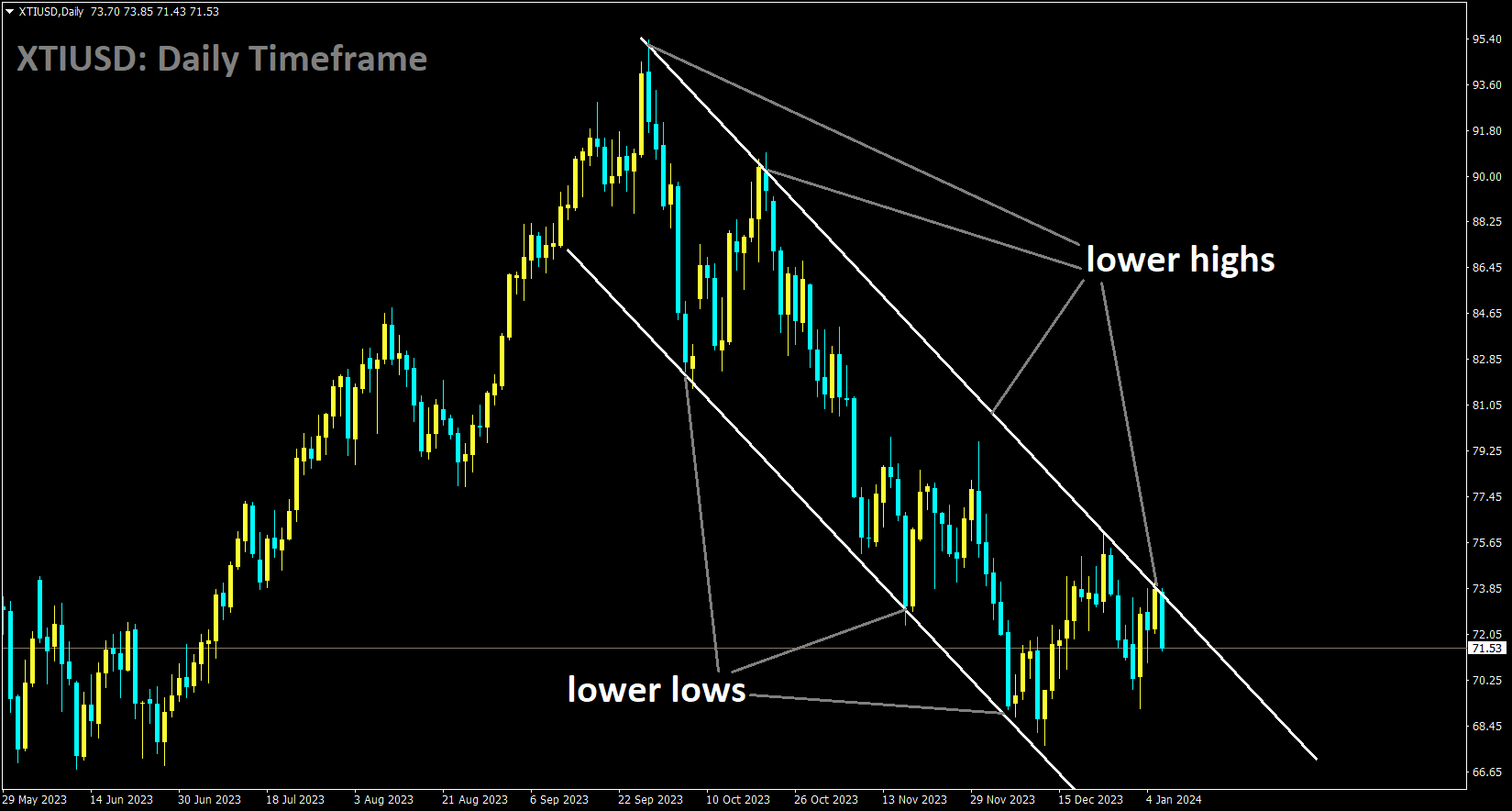

Crude Oil Analysis:

XTIUSD is moving in the Descending channel and the market has fallen from the lower high area of the channel

During the Asian session on Monday, the West Texas Intermediate price retraced its recent gains and was trading lower, hovering around the $73.00 per barrel mark. Several factors are contributing to this decline in crude oil prices, with one key factor being the price cuts initiated by the leading oil exporter, Saudi Arabia. Additionally, an increase in oil production by the Organization of the Petroleum Exporting Countries and its allies has added downward pressure on oil prices. According to a Reuters survey, their combined output rose by 70,000 barrels per day (bpd) in December, reaching a total of 27.88 million bpd. Notably, Iraq and Angola accounted for the most significant increases, contributing 60,000 bpd to this rise. Furthermore, Nigeria reported an uptick in its crude oil shipments during the same period. These increases in oil production counteract the ongoing production cuts by Saudi Arabia and other members of the OPEC+ alliance. The survey findings also indicate that Saudi Arabia has slightly reduced its production, bringing it below 9 million bpd, while continuing a voluntary 1 million bpd output cut. These actions are part of Saudi Arabia’s efforts to influence global oil prices.

Adding to these dynamics, Saudi Arabia made an announcement on Sunday about reducing the February Official Selling Price of its flagship Arab Light crude to Asia, marking the lowest level in 27 months. Furthermore, last week, the Iran-backed Houthis escalated concerns regarding oil supply by launching two anti-ship ballistic missiles at a container ship in the southern Red Sea while it was en route to Israel. This provocative action has heightened geopolitical tensions in the region, particularly concerning maritime routes. US Secretary of State Antony Blinken issued a warning regarding the Gaza conflict, expressing concern that without concerted peace efforts, the conflict could potentially spread across the broader region.

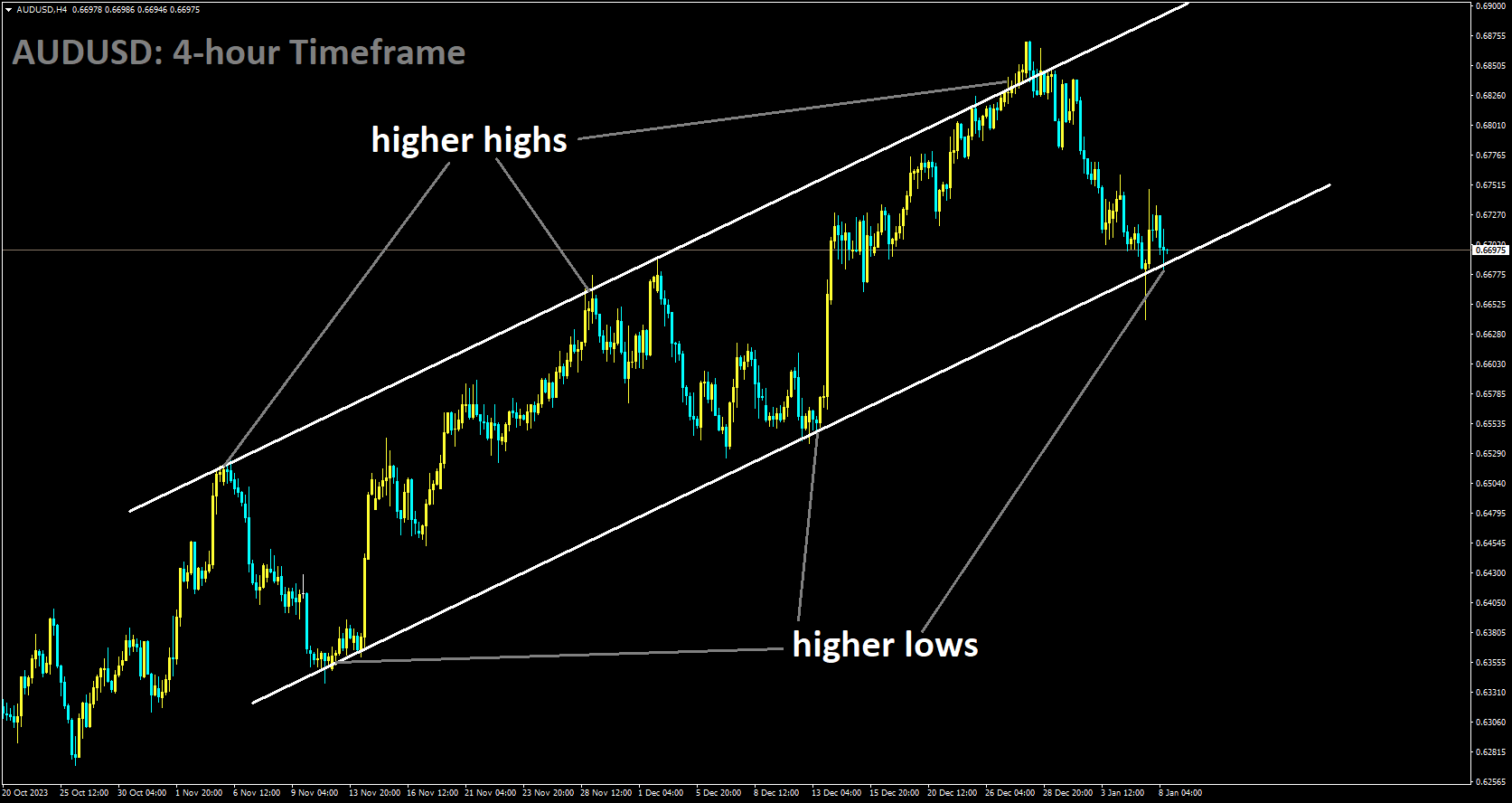

AUDUSD Analysis:

AUDUSD is moving in Ascending channel and market has reached higher low area of the channel

The AUDUSD pair experienced notable fluctuations, driven mainly by mixed economic data out of the United States. Despite a strong US employment report, concerns persisted regarding weaker business activity in the services sector, prompting investors to approach the economic outlook cautiously. Australia is set to release November’s Retail Sales data on Tuesday, with expectations of a 1.2% increase compared to October’s 0.2% decline. This release could influence Reserve Bank of Australia (RBA) policymakers to maintain elevated interest rates for an extended period. However, recent data from the Judo Bank Purchasing Managers Index revealed a contraction in business activities in both the services and manufacturing sectors, exposing the Australian Dollar’s vulnerability. Additionally, the bankruptcy liquidation of Chinese wealth manager Zhongzhi Enterprise Group, facing a substantial $64 billion in liabilities, raised concerns about potential contagion from the broader property debt crisis into the financial sector. Given the close economic ties between China and Australia, this event is likely to negatively impact the Aussie Dollar.

The US Dollar Index has been trading sideways with a slight downward bias, potentially influenced by the decline in short-term yields on the 2-year US Treasury bond. On Friday, the US Dollar exhibited fluctuations, driven by mixed US data. The US Bureau of Labor Statistics reported positive developments in the job market, with Nonfarm Payrolls increasing to 216K in December, surpassing the November figure of 173K and beating the market expectation of 170K. Moreover, Average Hourly Earnings improved to 4.1% from the previous 4.0%, while the monthly index remained steady at 0.4%, surpassing the expected 0.3% decline. However, the Institute for Supply Management indicated a slowdown in the services sector in December, with the Services Purchasing Managers Index coming in at 50.6, below the expected 52.6 and the previous 52.7. The Services Employment Index also declined to 43.3 from the previous 50.7. Thomas Barkin, President of the Federal Reserve Bank of Richmond, noted a steady softening pattern in the US labor market, suggesting that a reacceleration of the labor market is unlikely at this point.

Federal Reserve Bank of Dallas President Lorie K. Logan provided insights on Saturday, suggesting that a rate hike should not be ruled out, considering the recent easing in financial conditions. She emphasized the importance of avoiding premature easing, which could stimulate demand, as maintaining sufficiently tight financial conditions is crucial to managing the risk of inflation picking back up and potentially reversing progress. In Australia, the Judo Bank Services PMI reported a reading of 47.1, falling short of market expectations for it to remain stable at 47.6. The Composite PMI decreased to 46.9 from the previous figure of 47.4. Australia’s Judo Bank Manufacturing PMI also indicated a modest contraction in manufacturing activity, declining to 47.6 in December from the previous reading of 47.8. On the other hand, China’s Caixin Services PMI rose to 52.9 in December, surpassing the expected 51.6 and the previous 51.5.

In the United States, the ADP Employment Change data showed the addition of 164K new positions, surpassing the previous figure of 101K and the market expectation of 115K. Additionally, US Initial Jobless Claims for the week ending on December 29 displayed positive signs for the labor market, decreasing to 202K from the previous 220K, beating the anticipated 216K. However, the US S&P Global Composite PMI for December reported a minor dip in business activities, registering a reading of 50.9 compared to the market consensus of a steady 51.0.

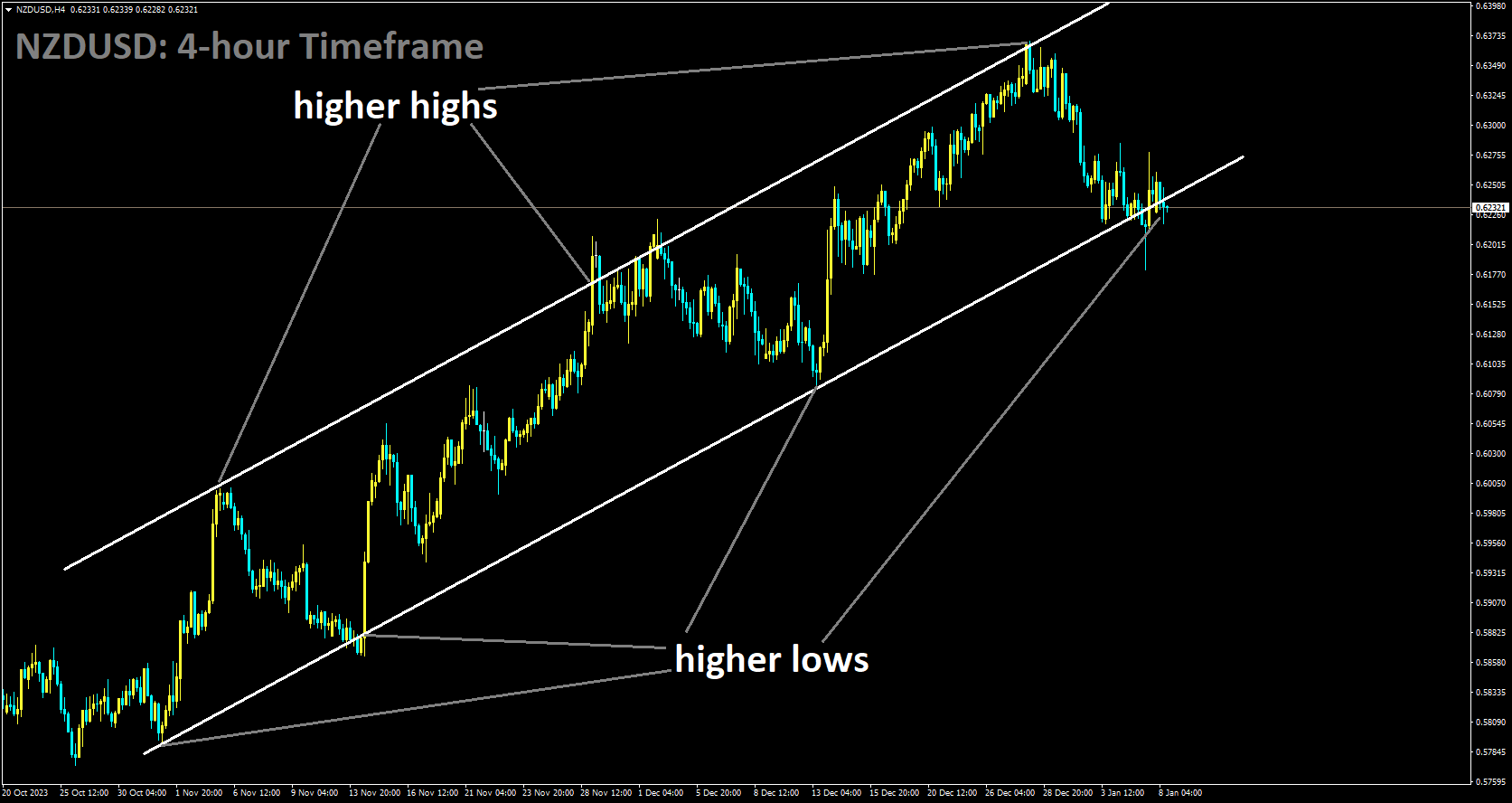

NZDUSD Analysis:

NZDUSD is moving in Ascending channel and market has reached higher low area of the channel

The release of US inflation data through the Consumer Price Index on Thursday may provide further insights into price pressures. The robust US labor data from Friday has reduced the likelihood of potential rate cuts by the Federal Reserve. Traders are now positioning themselves for the possibility of five or six rate hikes by the Fed throughout the year, a change from the fully priced-in status observed at the end of the previous year. According to the US labor data released on Friday, US Nonfarm Payrolls increased by 216,000 jobs in December, up from 173,000 in November, surpassing the market consensus of 170,000. Additionally, the Unemployment Rate remained steady at 3.7%, and Average Hourly Earnings showed strength, rising by 0.4% month-on-month, surpassing the expected 0.3%. The annual figure for December stood at 4.1% year-on-year, compared to 4.0% in the previous reading, exceeding the consensus estimate of 3.9%.

Shifting our focus to the New Zealand Dollar (NZD), the recent stronger-than-expected economic data from China has boosted the NZD, often considered a proxy for China’s economic performance. This development has provided tailwinds for the NZDUSD currency pair. Traders will closely monitor upcoming Chinese data scheduled for release later this week, including the December Chinese Producer Price Index and Consumer Price Index. Positive data could further support the NZD against the US Dollar. In the lead-up to the US CPI reports on Thursday, market participants will also pay attention to New Zealand Building Permits data on Tuesday. Finally, on Friday, attention will shift to the Chinese CPI and PPI figures, offering traders valuable insights and potential trading opportunities involving the NZDUSD pair.

Shifting our focus to the New Zealand Dollar (NZD), the recent stronger-than-expected economic data from China has boosted the NZD, often considered a proxy for China’s economic performance. This development has provided tailwinds for the NZDUSD currency pair. Traders will closely monitor upcoming Chinese data scheduled for release later this week, including the December Chinese Producer Price Index and Consumer Price Index. Positive data could further support the NZD against the US Dollar. In the lead-up to the US CPI reports on Thursday, market participants will also pay attention to New Zealand Building Permits data on Tuesday. Finally, on Friday, attention will shift to the Chinese CPI and PPI figures, offering traders valuable insights and potential trading opportunities involving the NZDUSD pair.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% FLAT OFFER for Signals 😍 GOING TO END – Get now: forexfib.com/discount/