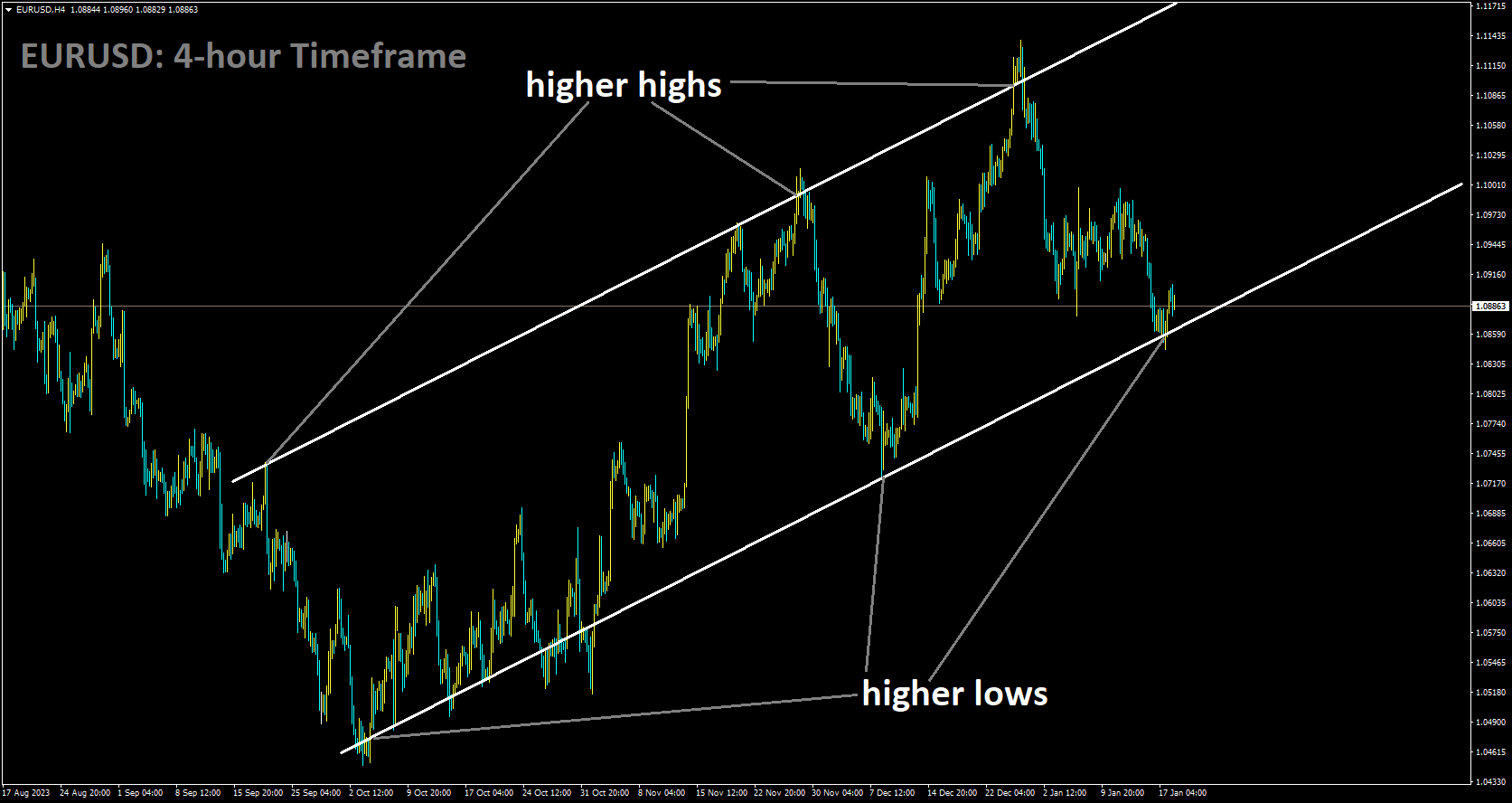

EURUSD Analysis

EURUSD is moving in Ascending channel and market has reached higher low area of the channel

BostJan Vastle, a member of the CB Governing Council, mentioned that the ECB will avoid rate cuts until inflation returns to the 2% target level, given the current elevated inflation in the Euro area. Bostjan Vasle, a member of the European Central Bank Governing Council, noted that it is premature to anticipate rate cuts in the second quarter. He emphasized the need for Euro area inflation to return to the 2% target before any changes to the central bank’s monetary policy.

On the other hand, the Japanese Yen’s strength is tempered by expectations that the Bank of Japan will continue its ultra-dovish stance. Eiji Maeda, a former executive at the Japanese central bank, mentioned the possibility of ending negative interest rates in April but suggested a cautious approach compared to the ECB’s more aggressive stance. Additionally, escalating tension in the Middle East could limit the downside for the Japanese Yen, following Houthi rebels’ attack on a US-owned cargo ship using a kamikaze drone in the Red Sea.

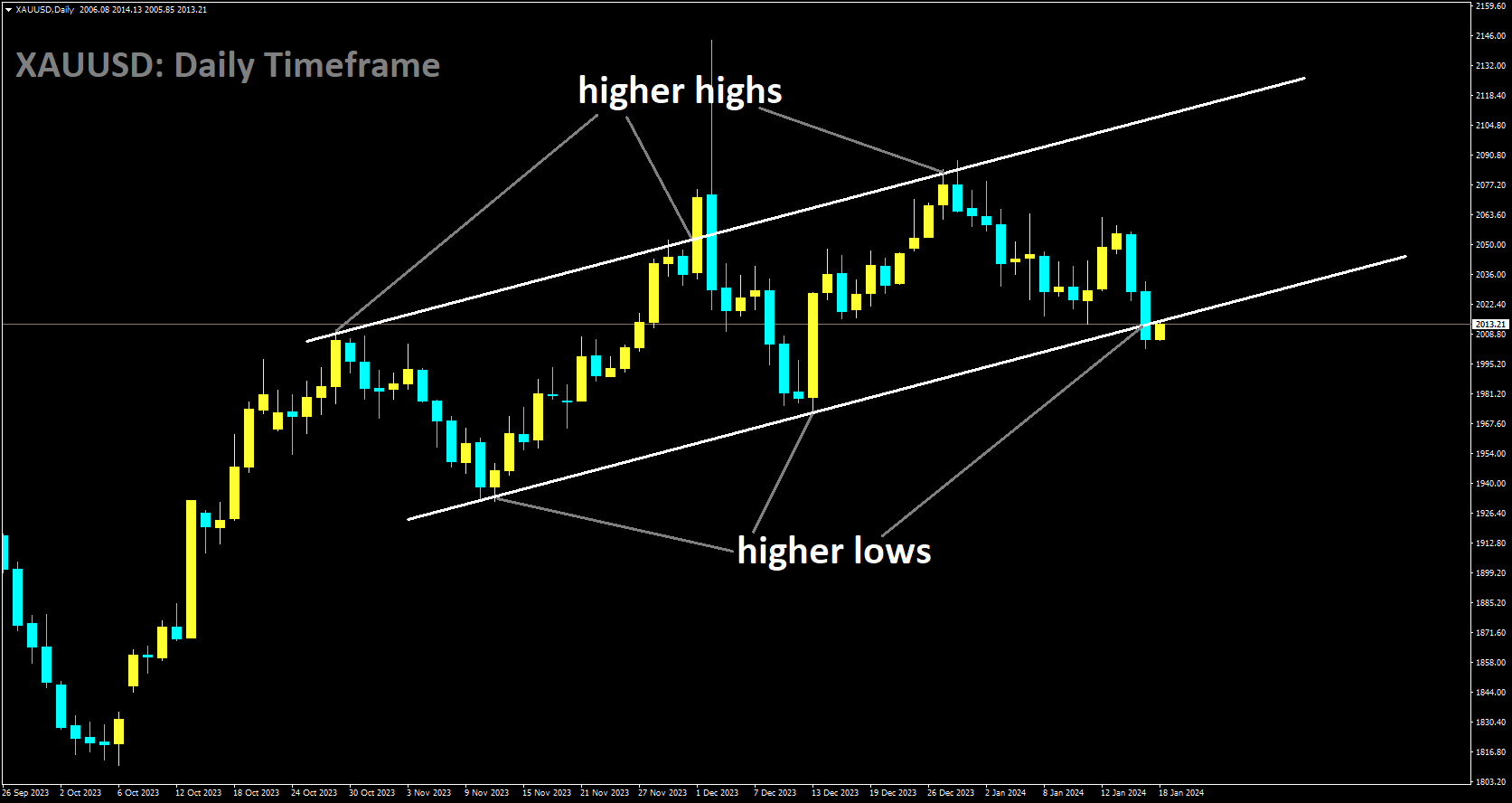

Gold Analysis

XAUUSD is moving in Ascending channel and market has reached higher low area of the channel

Geopolitical tensions in the Red Sea region have led to a dip in gold prices, while the US Dollar has gained strength due to hints from Federal Reserve central bank speakers that interest rates will remain stable until inflation reaches the 2% target.

The decline in gold prices can be attributed to robust economic data in the United States, which has tempered expectations of an immediate interest rate cut. Currently, gold is priced at $2,007, showing a slight 0.07% increase for the day. Meanwhile, the US Dollar Index has surged to a new high for 2024, nearing 103.70. US Treasury yields have also risen across the yield curve, with the 10-year yield at 4.10%. Uncertainty prevails regarding the timeline for potential interest rate discussions at the Federal Reserve (Fed). According to the CME Fedwatch tool, traders now see a 57% chance of a 25 basis point (bps) interest rate cut in March, down from 70% earlier in the week. Furthermore, better-than-expected US Retail Sales data has pushed back rate cut expectations. December’s Retail Sales showed a 0.6% month-on-month increase, surpassing the previous 0.3% figure. The Retail Sales Control Group also saw growth, with a 0.8% increase in December compared to the previous reading of 0.5%. Additionally, concerns about deteriorating Chinese economic data are impacting gold prices, as China is a significant consumer of gold.

China’s Gross Domestic Product expanded by 5.2% last year, slightly falling short of the expected 5.3%. Industrial production rose by 6.8% year-on-year in December, while Retail Sales slowed to a 7.4% year-on-year increase in December from 10.1% the previous month. Traders will closely monitor several US economic indicators scheduled for release on Thursday, including Housing Starts, Building Permits, weekly Initial Claims, and the Philly Fed Manufacturing Index. These data points may provide clearer direction for gold prices.

Additionally, Gita Gopinath, the Deputy Managing Director of the International Monetary Fund, has emphasized that relatively elevated services inflation in both the United States and the Euro area is causing a more gradual decline in the overall inflation rate, as opposed to a sharp decrease. Tight labor market conditions are also contributing to inflation maintaining a faster pace. Consequently, central banks are anticipated to primarily consider rate cuts in the latter half of 2024, rather than during the first half. In a recent interview with the Financial Times, Gopinath shared her perspective on inflation and anticipated interest rate cuts by central banks. She stressed the importance of caution when considering interest rate reductions for the current year. Gopinath pointed out that the inflation rate is expected to decrease less rapidly than in the previous year, primarily due to the presence of tight labor markets and elevated services inflation not only in the United States and the Euro area but also in other regions. Based on available data, Gopinath suggested that rate cuts are more likely to occur in the second half of the year rather than the first half.

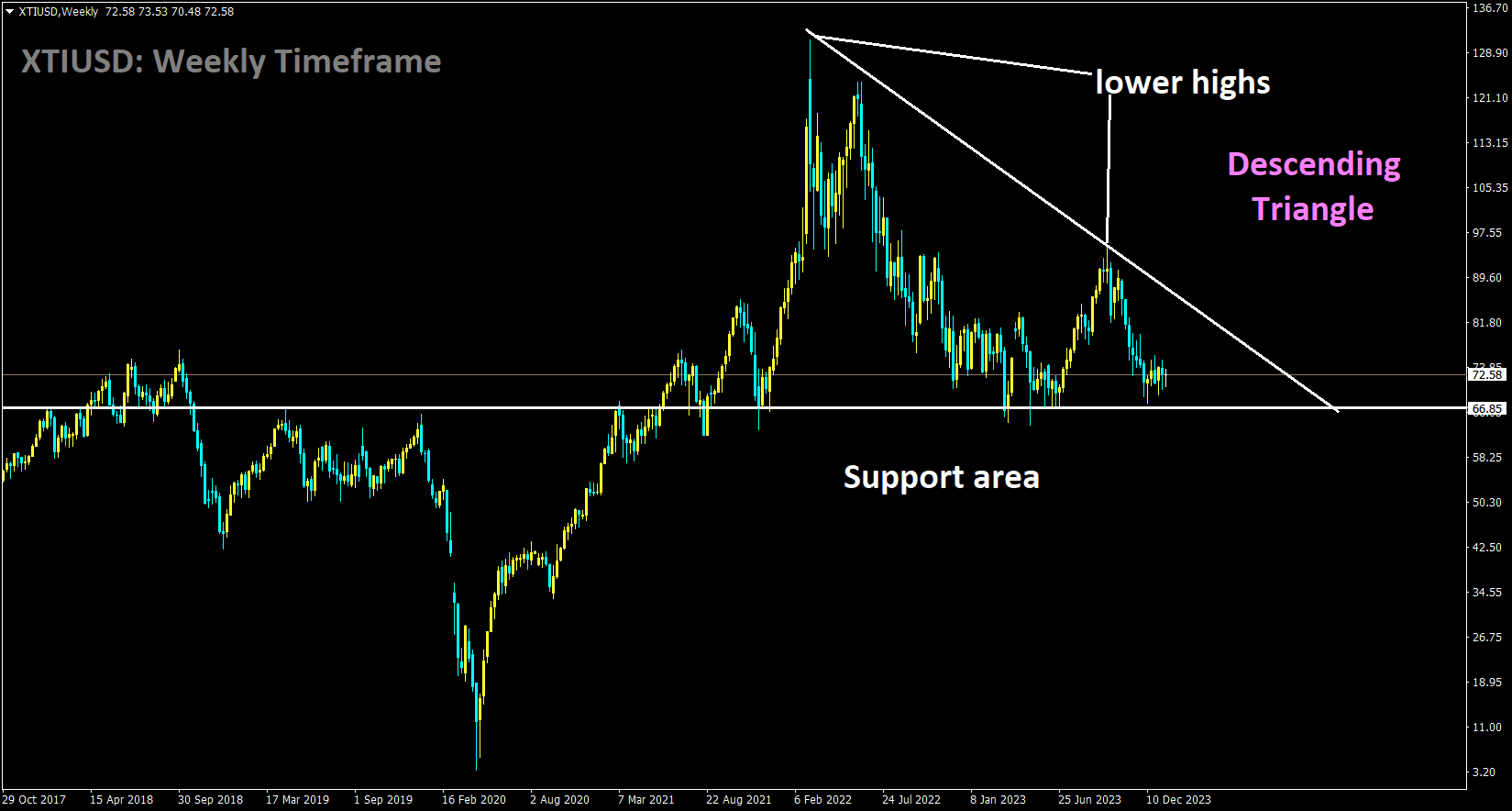

XTIUSD Analysis

Crude oil is moving in the Descending triangle pattern and the market has reached the support area of the pattern

US Federal Reserve Governor Christopher Waller has emphasized that potential rate cuts will depend solely on inflation reaching the target level, maintaining a steady approach as long as central banks keep rates stable. This announcement has strengthened the US Dollar against its currency counterparts.

US Treasury yields across the yield curve have surged to their highest levels in five weeks. The 10-year note reached 4.129%, while the 30-year bond spiked as high as 4.344%. This rise in yields is driven by investors adhering to the US Federal Reserve’s “higher for longer” stance, contributing to a stronger US Dollar, which, although it retraced some gains, managed to hold onto a marginal 0.05% increase, reaching 103.38. During the US session, US Retail Sales data for December was released, showing a 0.6% increase, surpassing both the expected 0.4% rise and the November figures. Additionally, the US Federal Reserve reported a modest improvement in Industrial Production, which grew by 0.1%. This positive shift followed a period of contraction and stagnation in October and November of the previous year. Furthermore, earlier data released during the European session revealed that UK inflation exceeded expectations, leading to an upsurge in global bond yields. Initially, investors anticipated the possibility of 175 basis points of rate cuts by the Fed in 2024. However, as the session progressed, they adjusted their expectations and now anticipate 145 basis points of monetary easing, indicating a reduction of one rate cut. Federal Reserve Governor Christopher Waller’s remarks on Tuesday have also influenced market sentiment, emphasizing that the Fed is in no rush to implement monetary policy easing, as inflation is “within striking distance” of their target. While he expressed openness to the idea of lowering interest rates, Waller cautioned against rushing such policy changes and stressed the importance of waiting until the risks of inflation resurgence have significantly diminished.

The US 10-year Treasury note saw a four-basis-point increase, reaching 4.106%, while the 30-year bond climbed five basis points to 4.344%, before settling at 4.323%. Meanwhile, the divergence in the US 10s-2s yield curve paused, as the 2-year Treasury note rose by 13 basis points due to expectations that the Fed would remain hesitant to ease policy as initially anticipated by the markets. Looking ahead, the US economic calendar will feature US Initial Jobless Claims, along with additional speeches by Fed officials on Thursday. Friday will bring the University of Michigan Consumer Sentiment report.

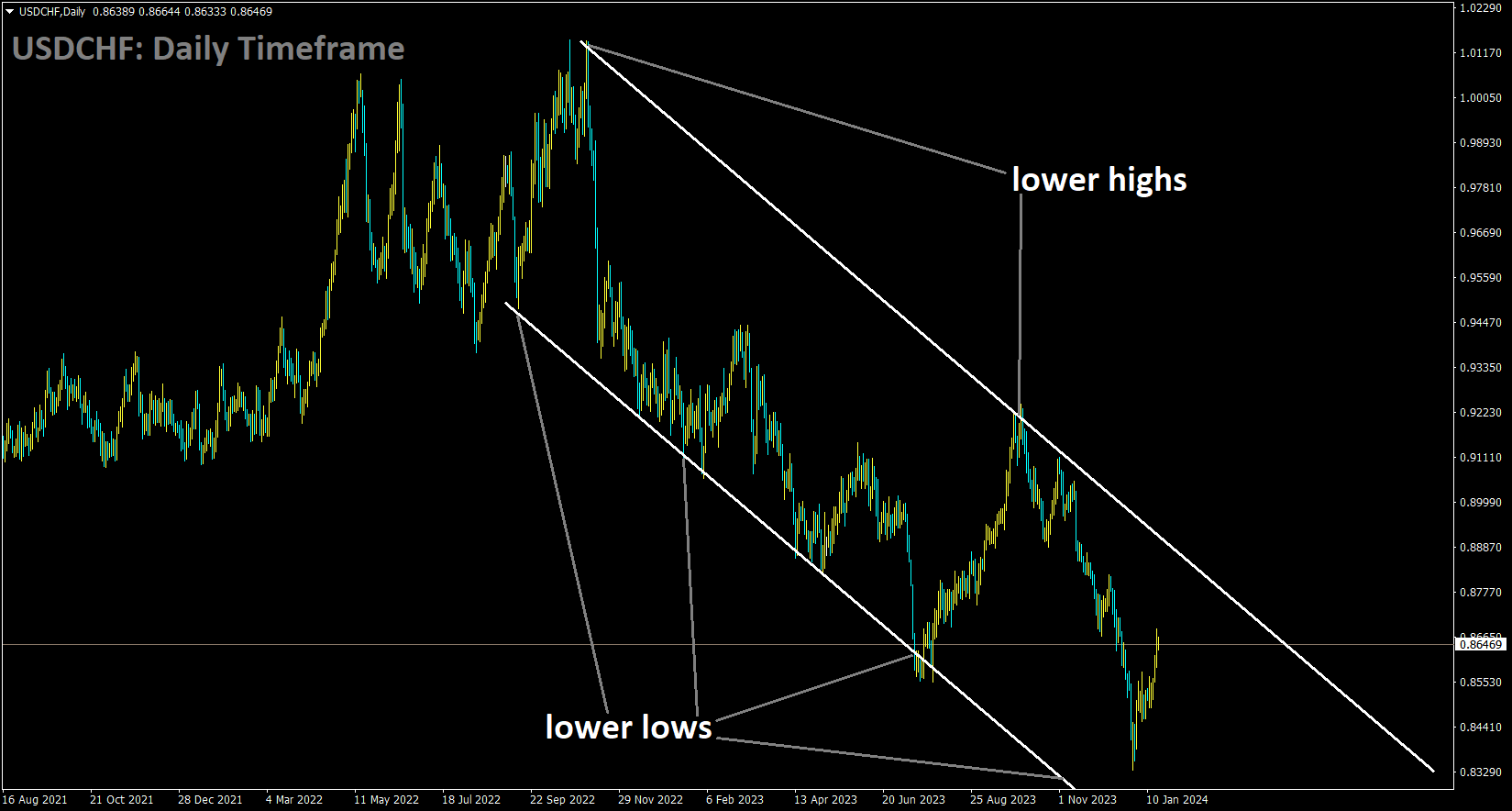

USDCHF Analysis

USDCHF is moving in the Descending channel and the market has rebounded from the lower low area of the channel

The US Dollar initially gained strength against the Swiss Franc on expectations of rate cuts from the Federal Reserve, but this gain was reversed following the release of US inflation data last week, which exceeded expectations. Investors are now eagerly awaiting a speech from Thomas Jordan, the Chairman of the Swiss National Bank.

The US Dollar is receiving support from investor sentiment as expectations for the Federal Reserve’s initial rate cut in March have diminished. Robust US Retail Sales data released on Wednesday further contributed to this shift in expectations, with the probability of a rate cut notably decreasing to 57%, down from its previous level of over 70%. December’s US Retail Sales data showed a month-over-month growth of 0.6%, surpassing market expectations of 0.4% and exceeding the previous figure of 0.3%. Additionally, the Retail Sales Control Group improved, rising to 0.8% compared to the previous reading of 0.5%. Market participants will likely closely monitor US housing data scheduled for release on Thursday.

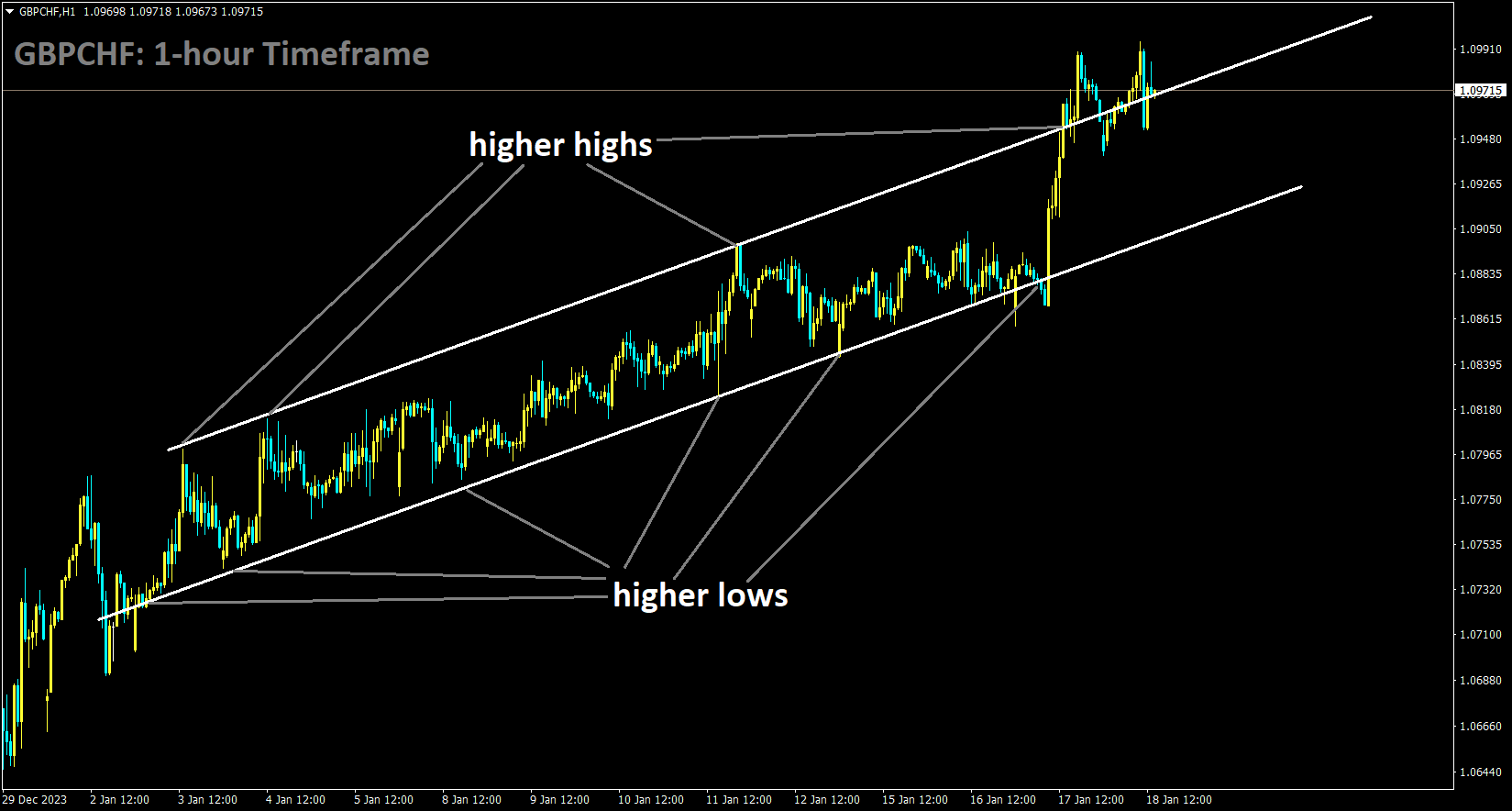

GBPCHF Analysis

GBPCHF is moving in an Ascending channel and the market has reached the higher high area of the channel

The Swiss Franc is facing downward pressure in anticipation of Swiss National Bank Chairman Thomas Jordan’s speech at the World Economic Forum in Davos on Thursday. In their most recent policy update in December, the Swiss National Bank reaffirmed their commitment to adjusting monetary policy as necessary to maintain inflation within a range consistent with price stability over the medium term. The SNB’s recent policy stance has been relatively neutral, devoid of any significant surprises.

Recent economic indicators, such as a slight uptick in Swiss consumer prices in December and improved consumer demand in November, could influence the SNB’s decision-making in the upcoming meeting. These moderate figures might discourage the SNB from making alterations to its monetary policy. Furthermore, the SNB has signaled its readiness to intervene in the foreign exchange market, if required, to support the Swiss Franc.

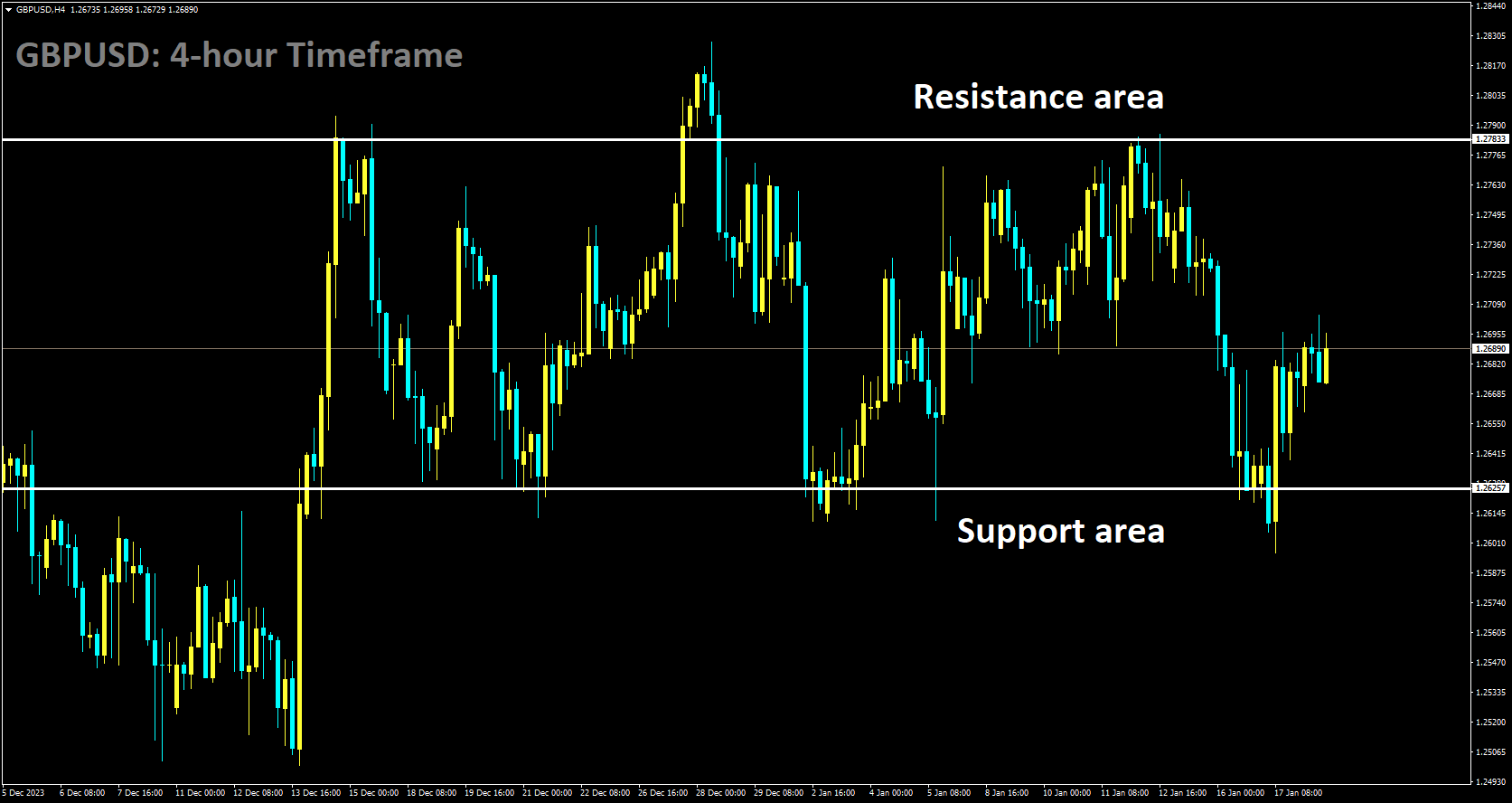

GBPUSD Analysis

GBPUSD is moving in box pattern and market has rebounded from the support area of the pattern

The latest UK Consumer Price Index (CPI) figures for December revealed a rise to 4.0%, up from the 3.9% reported in November. In light of this elevated inflation level, the Bank of England is expected to uphold its hawkish stance on interest rates during the first half of 2024.

The UK Office for National Statistics released data on Wednesday indicating that the Consumer Price Index increased for the first time in 10 months, rising from 3.9% in the previous month to 4.0% in December. Additionally, the core CPI, which excludes volatile prices of food, energy, alcohol, and tobacco, remained steady at 5.1% in December, defying expectations of a decline to 4.9%. These developments had an immediate impact on the markets, with the probability of the Bank of England initiating rate cuts by mid-May decreasing from just over 80% late on Tuesday to approximately 60%. This change in sentiment is providing support for the British Pound. Conversely, the US Dollar is experiencing a slight decline, potentially driven by profit-taking following its recent rally to its highest level since December 13. This trend is contributing to the strength of the GBP/USD pair. Additionally, the release of upbeat US Retail Sales figures on Wednesday has led investors to reconsider their expectations for a March interest rate cut by the Federal Reserve, which is keeping US Treasury bond yields elevated and preventing a significant depreciation of the USD. As a result, traders are refraining from making aggressive bullish bets on the currency pair. Furthermore, ongoing speculations regarding the Fed’s intention to maintain higher interest rates for a more extended period, along with concerns about geopolitical risks and China’s economic challenges, are dampening overall market sentiment.

This sentiment is evident in the generally weaker performance of equity markets, which could further bolster the US Dollar’s reputation as a safe-haven currency compared to the British Pound. Therefore, it is advisable to await confirmation of strong sustained buying before concluding that the GBP/USD pair has established a short-term bottom and considering further appreciation, especially in the absence of significant market-moving economic releases from the UK. Later in the early North American session, traders will monitor the US economic calendar, which includes regular updates such as Weekly Initial Jobless Claims, the Philly Fed Manufacturing Index, Building Permits, and Housing Starts. Additionally, a scheduled speech by Atlanta Fed President Raphael Bostic and fluctuations in US bond yields will influence USD price dynamics, potentially impacting the GBPUSD pair.

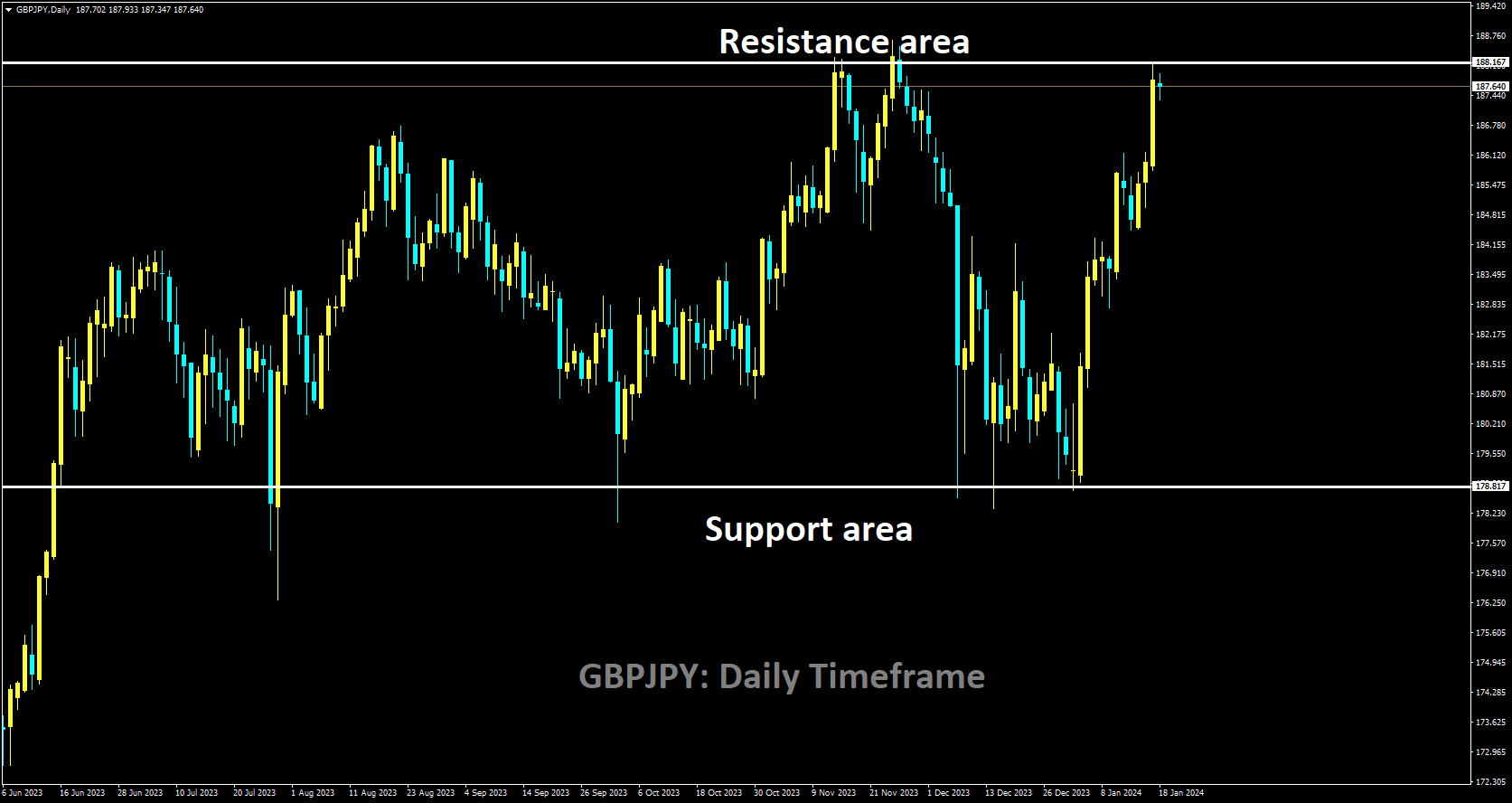

GBPJPY Analysis

GBPJPY is moving in box pattern and market has reached resistance area of the pattern

The Japanese Yen faced a decline after the Bank of Japan’s announcement to maintain an accommodative monetary policy until inflation reaches 2%. This week, Japan will release Machinery Orders data, expected to show a November decrease of -0.80% compared to October’s -0.70%.

Conversely, the British Pound strengthened against the Japanese Yen due to the UK Consumer Price Index report exceeding expectations. December’s UK CPI showed a 0.4% month-on-month (MoM) increase, double the market forecast of 0.2% and a reversal of the previous -0.2% decline. This unexpected resilience in inflation reduces the likelihood of the Bank of England implementing rate cuts, resulting in a strengthening of the GBP.

Additionally, the UK Retail Price Index for December rose by 0.5%, surpassing the forecast of 0.4% and reversing the previous month’s -0.1% reading, further disappointing rate-hungry investors. Meanwhile, the Bank of Japan remains committed to its accommodative monetary policy due to concerns about future inflation falling below the 2% target. Looking ahead, Japanese Machinery Orders data for November is expected on Thursday, with a MoM decline of 0.8% and a YoY recovery to 0.2%. GBP traders will react to UK Retail Sales figures for December on Friday, with forecasts suggesting a MoM decline of -0.5% and a YoY increase of 1.1%.

Additionally, the UK Retail Price Index for December rose by 0.5%, surpassing the forecast of 0.4% and reversing the previous month’s -0.1% reading, further disappointing rate-hungry investors. Meanwhile, the Bank of Japan remains committed to its accommodative monetary policy due to concerns about future inflation falling below the 2% target. Looking ahead, Japanese Machinery Orders data for November is expected on Thursday, with a MoM decline of 0.8% and a YoY recovery to 0.2%. GBP traders will react to UK Retail Sales figures for December on Friday, with forecasts suggesting a MoM decline of -0.5% and a YoY increase of 1.1%.

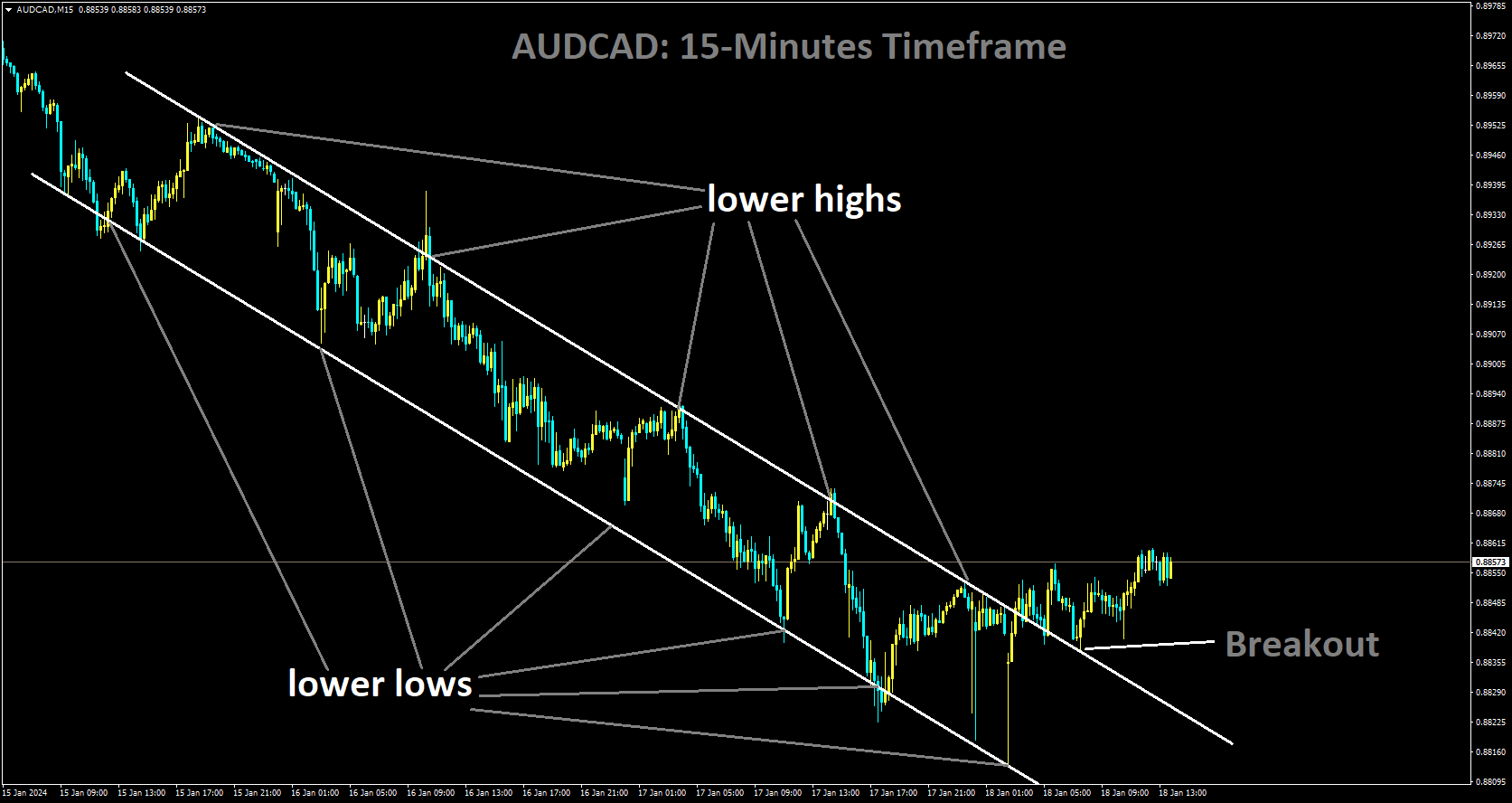

AUDCAD Analysis

AUDCAD has broken Descending channel in upside

The Canadian Dollar saw a modest uptick in value after the OPEC committee projected increased oil demand for 2024 and 2025, despite the Canadian Raw Material Index contracting for the second consecutive month, reaching its lowest point since June of the previous year.

In December, Canada’s Raw Material Price Index continued to contract for the second consecutive month, showing a consistent deflationary trend in materials prices. The index contracted by 4.9%, matching the previous month’s figure. Additionally, the Industrial Product Price experienced a larger-than-expected decline of 1.5%, surpassing the anticipated decrease of 0.7% and the previous month’s fall of 0.3%. In contrast, the US Dollar Index saw its winning streak end due to disappointing US Treasury yields. The DXY is trading lower near 103.30, with the 2-year and 10-year yields on US bond coupons at 4.33% and 4.08%, respectively, at the time of this press release.

In the United States, Retail Sales for December exhibited growth of 0.6%, surpassing market expectations of 0.4%. Retail Sales Control Group also improved, reaching 0.8%. Retail Sales excluding Autos increased by 0.4%. US housing data set to be released on Thursday will be closely monitored. In Canada, Retail Sales data will be released on Friday.

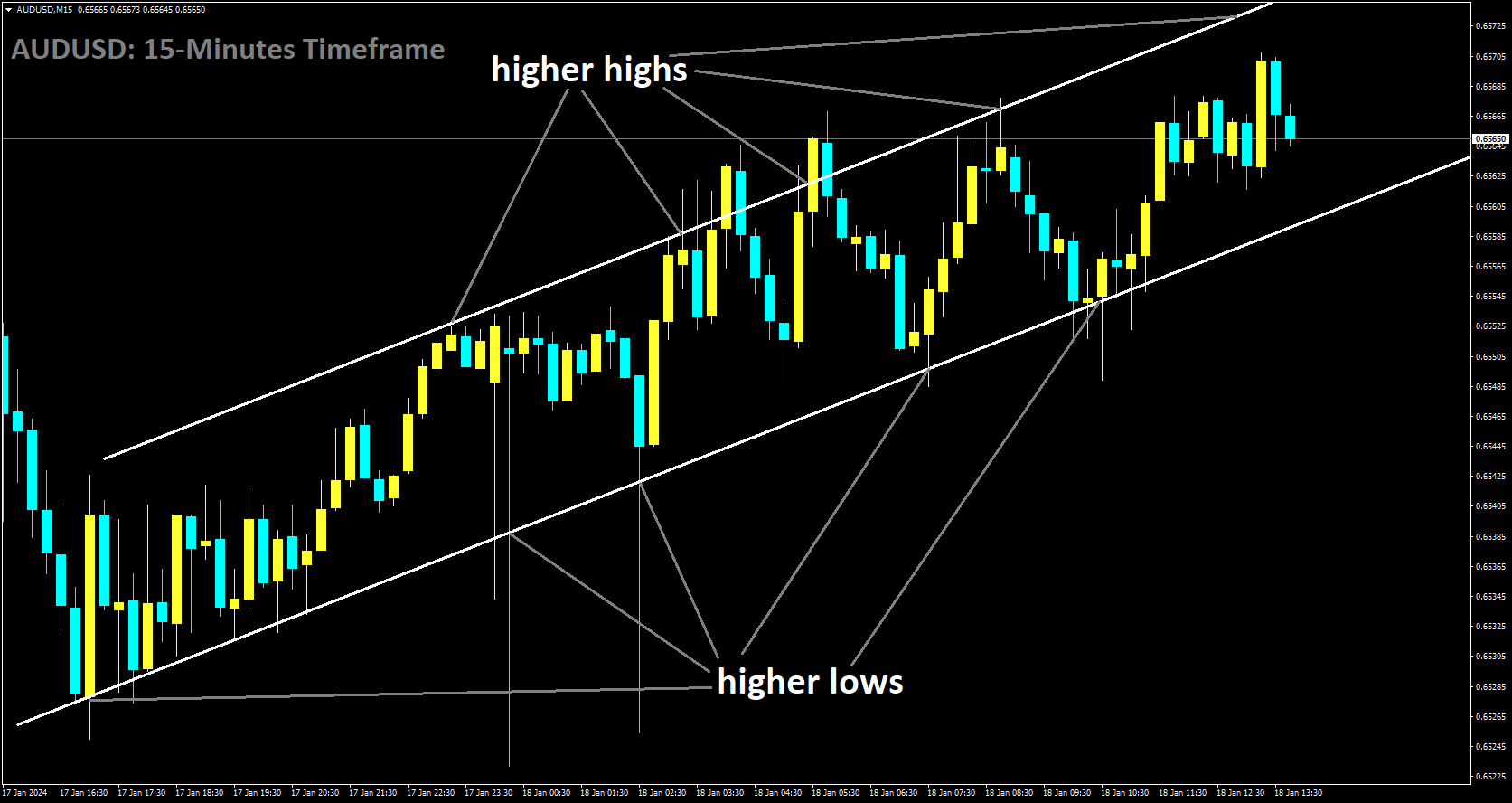

AUDUSD Analysis

AUDUSD is moving in Ascending channel and market has fallen from the higher high area of the channel

In December, the Australian unemployment rate held steady at 3.9%, with a significant negative shift in employment change, showing a decline of 65.1K jobs, contrary to the forecast of a gain of 17.6K jobs and the 61.5K jobs added in the previous month. Official data from the Australian Bureau of Statistics confirmed that Australia’s unemployment rate remained at 3.9% in December, in line with both expectations and the previous month’s figure.

However, there was a notable negative shift in employment change, showing a decrease of 65.1K jobs. This contrasted sharply with the anticipated increase of 17.6K jobs and the 61.5K jobs added in the previous month.

However, there was a notable negative shift in employment change, showing a decrease of 65.1K jobs. This contrasted sharply with the anticipated increase of 17.6K jobs and the 61.5K jobs added in the previous month.

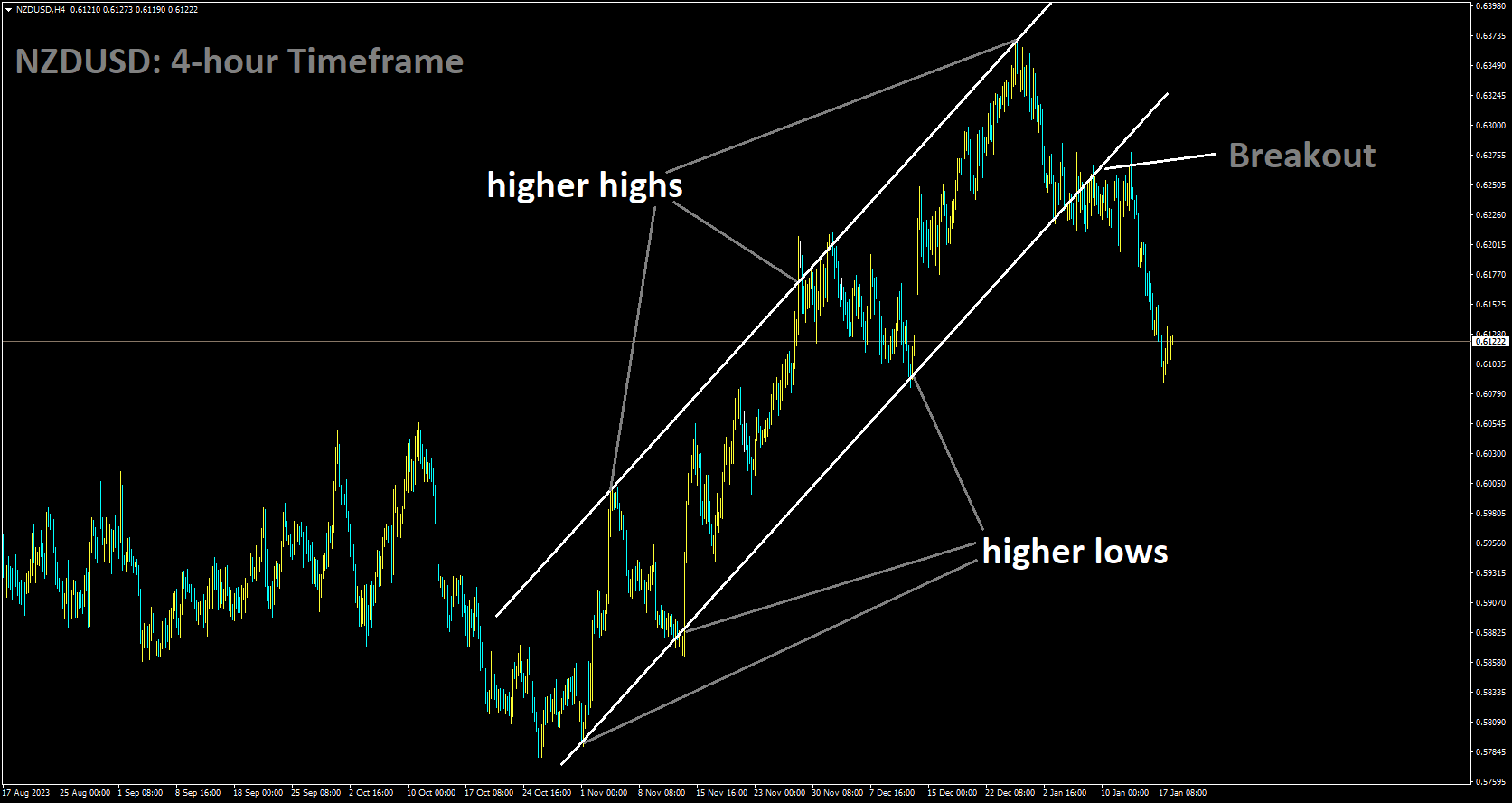

NZDUSD Analysis

NZDUSD has broken Ascending channel in downside

In December, the New Zealand Dollar Food Price Index showed a slight decrease of -0.10%, an improvement compared to the -0.20% decline in November. Food prices have risen compared to the previous year.

New Zealand’s Food Price Index recorded its lowest annual increase in food prices since December 2021. While food prices generally rose for the year ending in December, the month itself marked the fourth consecutive month of month-on-month declines in food inflation. In December, monthly food prices declined by 0.1%, indicating a slower pace of decrease compared to November’s 0.2% downturn.

Despite these declines, food prices remain higher compared to the same period last year. Groceries and non-alcoholic beverages increased by 5.4% and 5.5%, respectively, over the year, while restaurants and ready-to-eat foods showed the most significant gains, with a 7.1% increase. Overall, fruits and vegetables had a modest 1.5% year-on-year price increase, helping to prevent a more significant overall increase in food prices.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% FLAT OFFER for Signals 😍 GOING TO END – Get now: forexfib.com/discount/