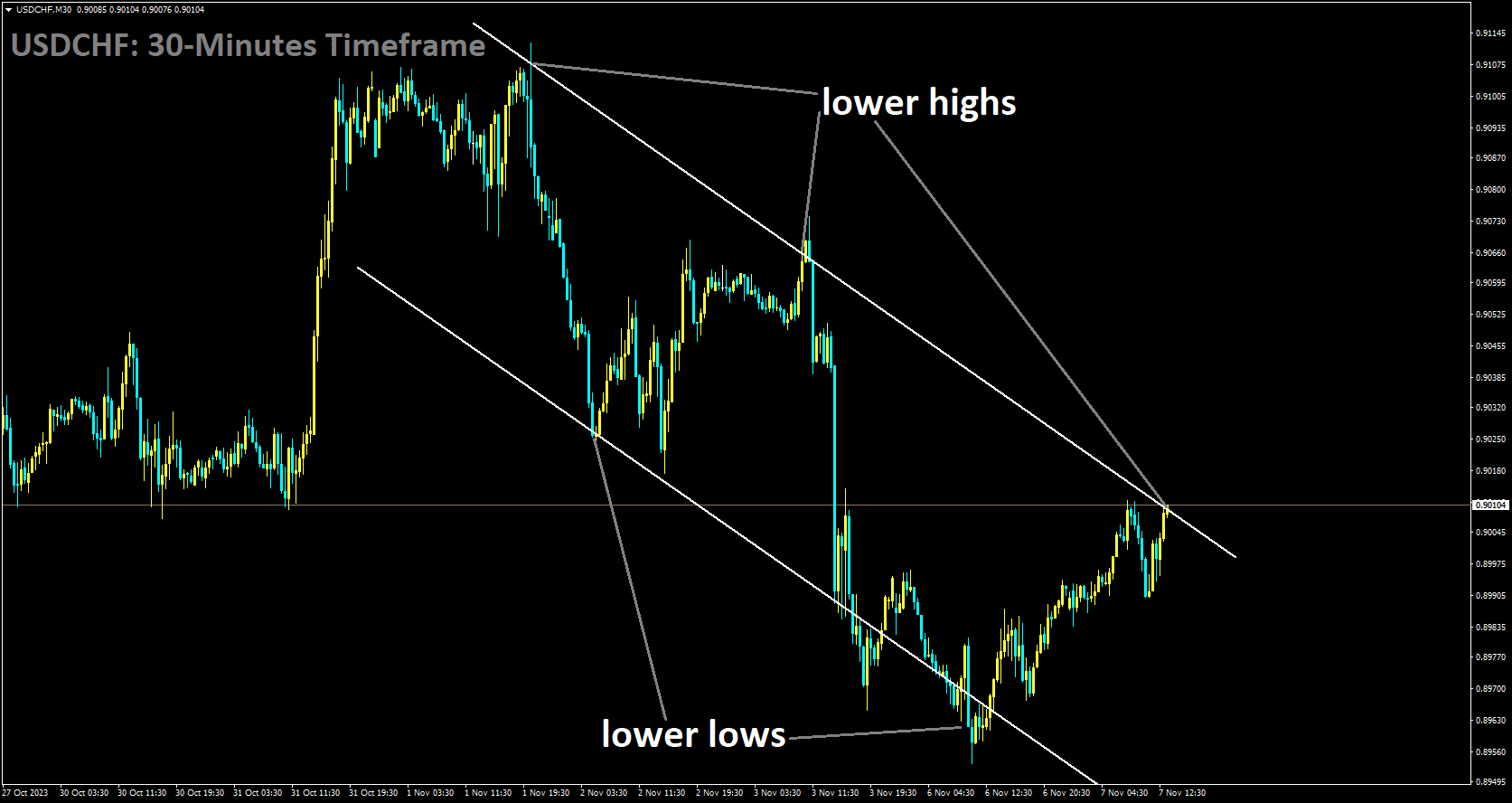

USDCHF Analysis:

USDCHF is moving in Descending channel and market has reached lower high area of the channel

The USDCHF currency pair represents the exchange rate between the US Dollar and the Swiss Franc. Several factors influence the dynamics of this currency pair.

One significant factor affecting the USDCHF pair is the movement of US Treasury bond yields. When US bond yields rise, it typically supports the US Dollar, as higher yields make US assets more attractive to investors. This can restrict the downside potential for the USDCHF pair.

The recent strengthening of the US Dollar followed dovish expectations about the Federal Reserve’s policy. Chair Jerome Powell’s comments indicated that the Fed might be nearing the endpoint of its interest rate hiking cycle. This announcement led to a sharp drop in US Treasuries, contributing to the downward trajectory of the USDCHF pair.

Weak labor market data released in the US, including a slowdown in job creation in October and an increase in the unemployment rate, also weighed on the US Dollar. These economic indicators can influence market sentiment and impact currency movements.

The yields on various US Treasuries, such as 2-year, 5-year, and 10-year bonds, have rebounded from multi-week lows, rising to certain levels. This increase in yields provided support to the US Dollar, partially reversing the earlier decline.

Looking ahead, the focus in the USDCHF pair remains on statements from various Federal Reserve officials. These statements allow investors to form expectations for future Fed decisions, which can impact the currency pair’s direction. Federal Reserve Chair Jerome Powell’s speech is particularly important in shaping market sentiment.

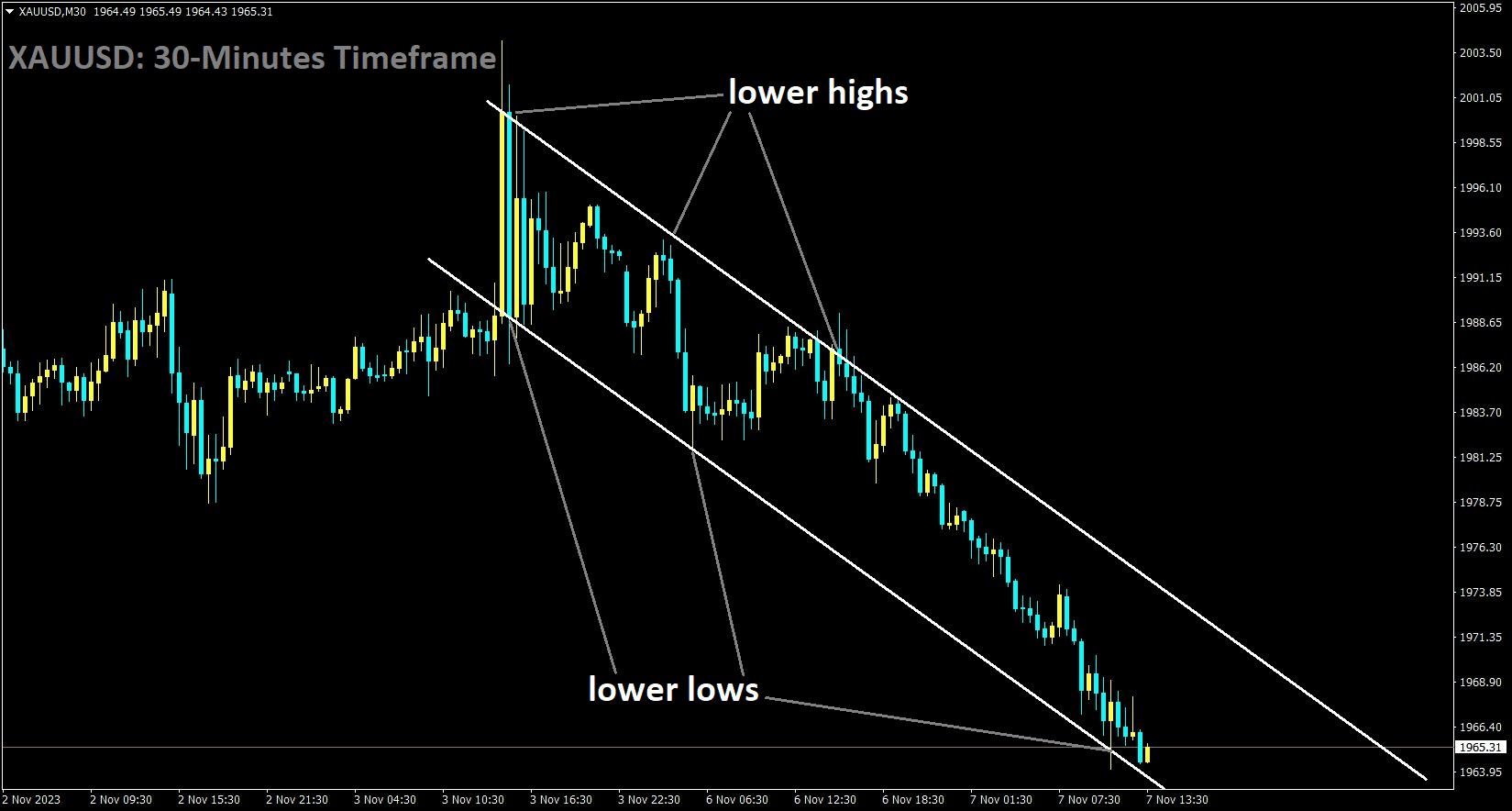

Gold Analysis:

XAUUSD is moving in the Descending channel and the market has reached the lower low area of the channel

Gold is a precious metal that has long been considered a safe-haven asset, often sought after during times of geopolitical uncertainty and economic instability. Recent developments in the Israel-Gaza conflict have had an impact on gold prices. As the conflict showed signs of de-escalation, gold prices experienced a correction, moving lower. This correction might seem surprising given weak US domestic data during the same period, which usually drives investors toward safe-haven assets like gold.

Several factors contributed to the decline in gold prices. Firstly, the US Dollar, which had been weakening, started to recover from its lowest levels since September 20. A stronger US Dollar typically puts downward pressure on the price of gold because they often move inversely to each other. Investors tend to flock to the US Dollar when they perceive it as a safer currency.

Secondly, there were no significant new developments in the Israel-Gaza conflict to sustain the heightened safe-haven demand for gold. When geopolitical tensions ease or stabilize, the appeal of assets like gold diminishes.

However, it’s crucial to note that even with the correction, gold prices remained relatively stable due to ongoing economic uncertainties and lingering concerns about the Middle East. Investors remained cautious, as evidenced by somewhat subdued equity markets, which can provide some support to the price of gold.

Additionally, a drop in US Treasury bond yields occurred as expectations grew that the Federal Reserve might be nearing the end of its policy tightening measures. Lower bond yields can make gold more attractive as an investment because it doesn’t offer yield or interest like bonds. Therefore, when bond yields decrease, gold’s relative appeal increases.

The uncertainty surrounding the Fed’s future interest rate decisions also played a role in the gold market. Investors were awaiting guidance from influential members of the Federal Open Market Committee, particularly Federal Reserve Chair Jerome Powell’s speeches. These speeches could influence short-term USD price dynamics and subsequently impact the direction of gold prices.

In the near term, the release of US Trade Balance data could provide additional trading impetus. The softer US jobs report released recently reinforced expectations that the central bank would maintain its current policy stance for the third consecutive meeting in December. Federal Reserve officials, like Governor Lisa Cook and Minneapolis Fed President Neel Kashkari, have indicated their views on the economy and inflation, affecting market sentiment. The performance of US Treasury bond yields and the ongoing geopolitical situation in the Middle East will also continue to be important factors to watch in assessing gold’s price trajectory.

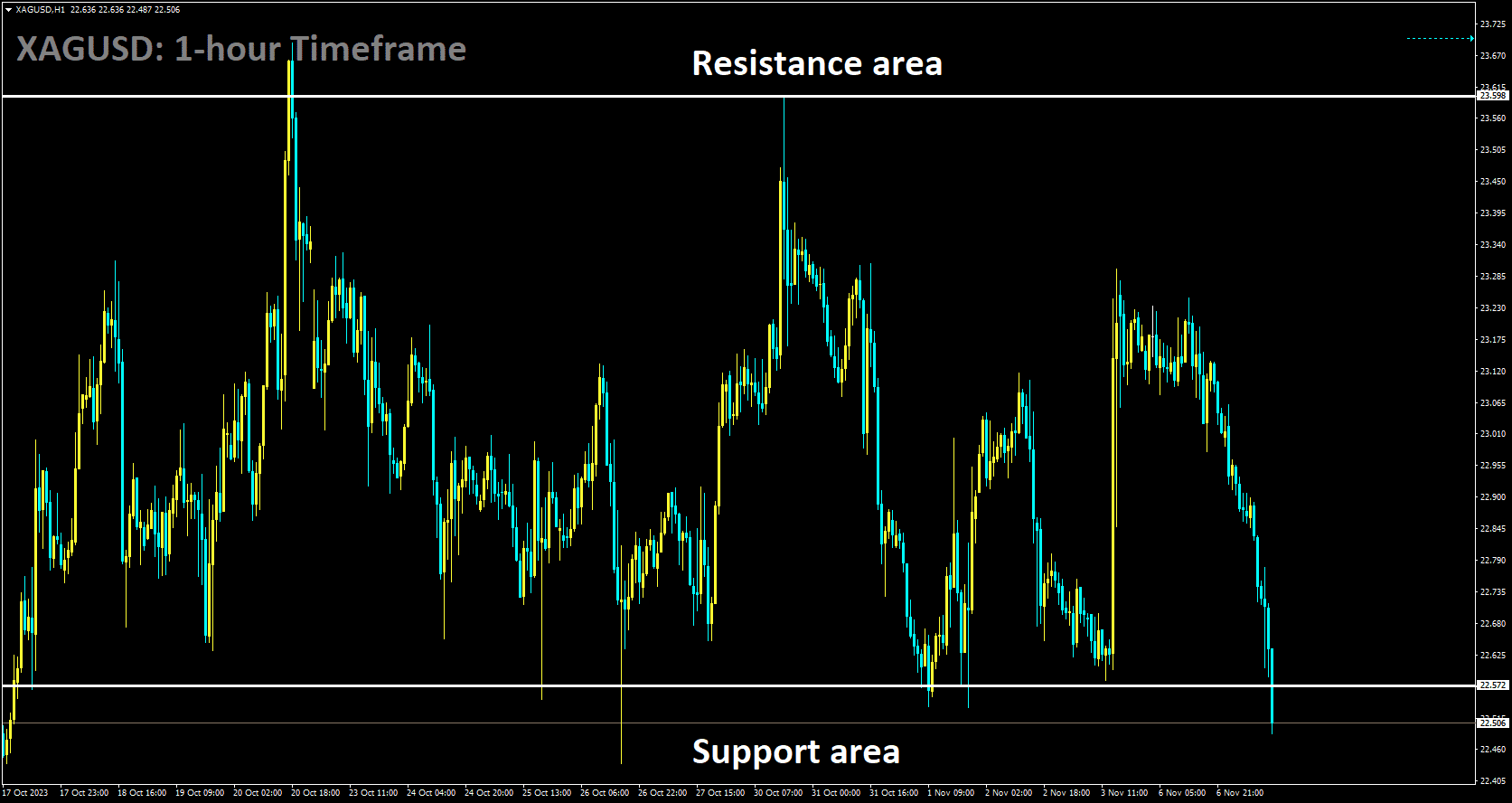

Silver Analysis:

XAGUSD is moving in box pattern and market has reached support area of the pattern

Silver, like gold, is a precious metal often considered a safe-haven asset. Minneapolis Federal Reserve President Neel Kashkari’s recent comments on monetary policy have implications for the silver market. Kashkari’s views provide insight into the Fed’s stance on inflation and its efforts to control it.

Kashkari expressed skepticism about the need for further tightening of monetary policy to combat inflation. He pointed to the resilience of the US economy, citing steady job growth, improving unemployment rates, and positive GDP numbers. Kashkari also noted that the rate hikes implemented thus far have been effective in addressing inflationary concerns.

However, Kashkari emphasized the importance of caution in policymaking. He argued that it might not be prudent to tighten monetary policy more than necessary, as this could potentially hinder economic growth. He suggested that a conservative approach to policy tightening might not effectively bring inflation down to the Federal Reserve’s 2% target within a reasonable timeframe.

Kashkari’s comments underscore the ongoing debate within the Federal Reserve about the appropriate course of action regarding interest rates and inflation control. While there have been concerns about rising inflation, especially in the wake of the COVID-19 pandemic and unprecedented monetary stimulus, Kashkari’s stance suggests that some Fed officials are advocating for a more measured approach.

The silver market can be influenced by these discussions because monetary policy decisions, particularly interest rate changes, can impact the broader economy and investor sentiment. As a result, silver investors are closely monitoring the Fed’s statements and actions for clues about future policy directions and their potential impact on inflation and the economy.

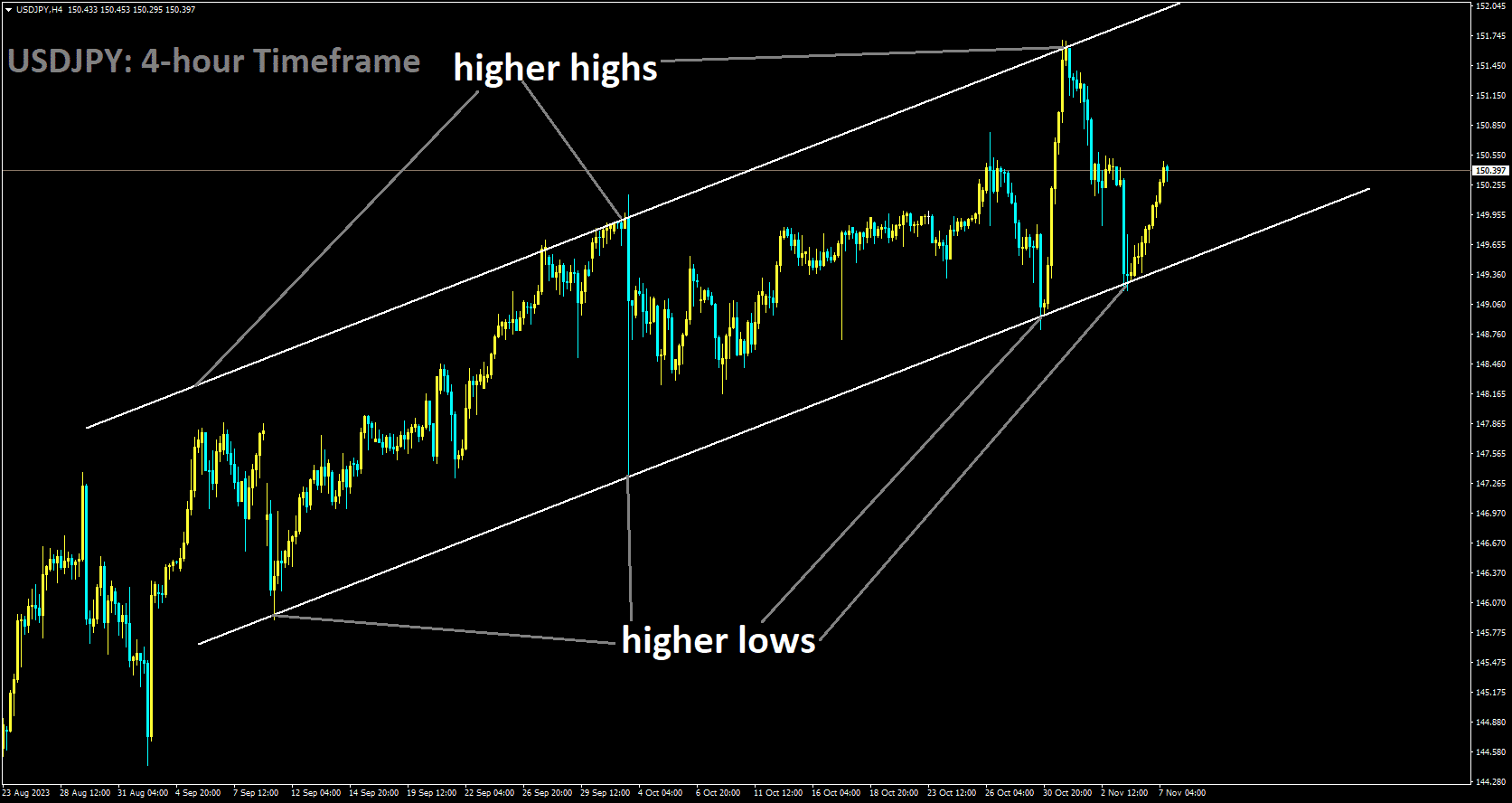

USDJPY Analysis:

USDJPY is moving in Ascending channel and market has rebounded from the higher low area of the channel

The USDJPY pair represents the exchange rate between the US Dollar and the Japanese Yen. The Bank of Japan’s (BoJ) monetary policy stance is a critical factor influencing this currency pair.

Bank of Japan Governor Kazuo Ueda’s recent confirmation of the BoJ’s hyper-accommodative monetary policy approach is noteworthy. The BoJ has maintained a policy of ultra-low interest rates and extensive asset purchases to stimulate the Japanese economy and combat deflationary pressures.

One of the BoJ’s key policy tools is its Yield Curve Control mechanism, which involves targeting a specific yield on Japanese government bonds (JGBs). Governor Ueda emphasized the BoJ’s commitment to purchasing JGBs in whatever quantity necessary to control the yield curve tightly. This approach aims to keep borrowing costs low and support economic growth.

The BoJ’s policy stance is influenced by its concerns about inflation and wage growth. Despite various efforts, inflation and wage growth in Japan have remained below the central bank’s target levels. As a result, the BoJ has indicated its willingness to maintain an easy monetary policy stance to support the Japanese economy.

The USDJPY exchange rate can be affected by changes in the BoJ’s policy outlook. A more accommodative stance by the BoJ, such as maintaining low-interest rates and continuing asset purchases, can put downward pressure on the Japanese Yen and contribute to a stronger US Dollar against the Yen. Conversely, any hints of a shift toward tighter monetary policy by the BoJ could have the opposite effect, strengthening the Yen relative to the Dollar.

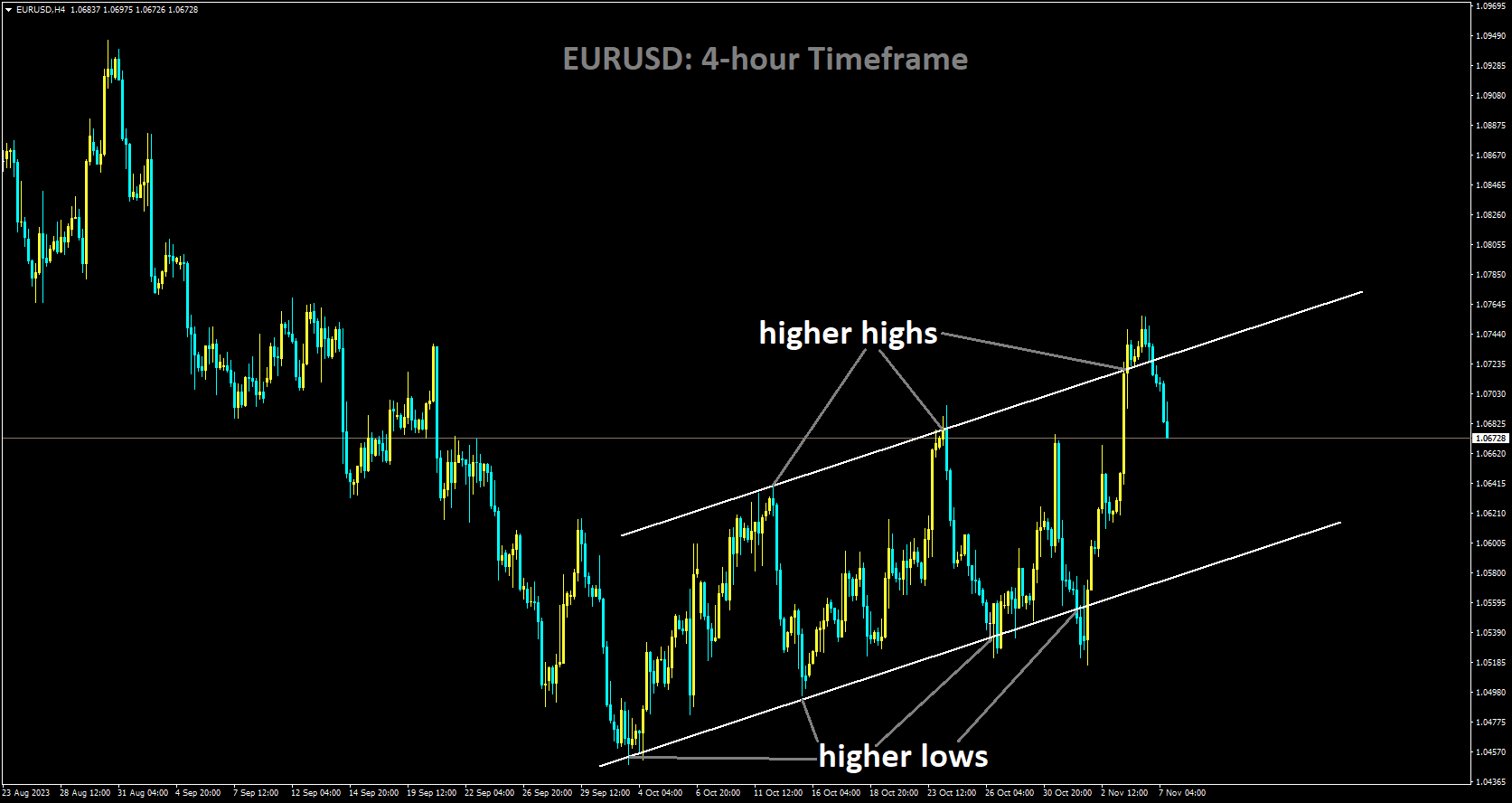

EURUSD Analysis:

EURUSD is moving in Ascending channel and market has fallen from the higher high area of the channel

The EURUSD currency pair represents the exchange rate between the Euro and the US Dollar. Recent economic developments in Germany and the European Central Bank’s (ECB) monetary policy decisions have influenced the EURUSD pair.

Germany’s industrial production figures for September showed a year-on-year decline of -3.7%, indicating a weakening manufacturing sector in the Eurozone’s largest economy. This decline raised concerns about the overall economic health of the Eurozone, as Germany plays a significant role in the region’s economic performance.

The ECB, responsible for monetary policy in the Eurozone, faces decisions regarding interest rates and other policy tools. Recent changes in inflation and GDP growth trends have implications for the ECB’s stance. Lower inflation rates and slight economic contraction in the Eurozone may influence the ECB’s decision to maintain its current policy stance.

The EURUSD exchange rate can be affected by changes in the ECB’s policy outlook. If the ECB signals a more accommodative stance by keeping interest rates unchanged or implementing additional stimulus measures, it can put downward pressure on the Euro and contribute to a stronger US Dollar against the Euro. Conversely, any hints of a shift toward tighter monetary policy by the ECB could have the opposite effect, strengthening the Euro relative to the Dollar.

EURCHF Analysis:

EURCHF is moving in the Descending channel and the market has reached the lower high area of the channel

The EURCHF currency pair represents the exchange rate between the Euro and the Swiss Franc. Recent economic developments and monetary policy decisions in the Eurozone and Switzerland have influenced the EURCHF pair.

Economists at UOB Group suggested that the ECB might maintain interest rates until the December meeting. This expectation is based on previous quarters’ CPI data and GDP growth trends in the Eurozone. Lower-than-expected inflation and economic contractions could prompt the ECB to keep interest rates at their existing levels.

Eurozone’s inflation figures, including the Consumer Price Index (CPI), showed a year-on-year increase of 2.9% in October, lower than previous readings and market expectations. Core CPI also decreased to 4.2% year-on-year. These inflation figures are important considerations for the ECB when determining its policy stance.

While inflation data may influence the ECB’s decisions, Eurozone GDP exhibited a slight contraction in the third quarter of 2023, raising concerns about economic growth. This contraction followed a previous quarter of modest gains.

Given these economic developments, including inflation and growth figures, the ECB may opt to maintain its current policy stance, especially considering already tight financing conditions and slowing economic growth.

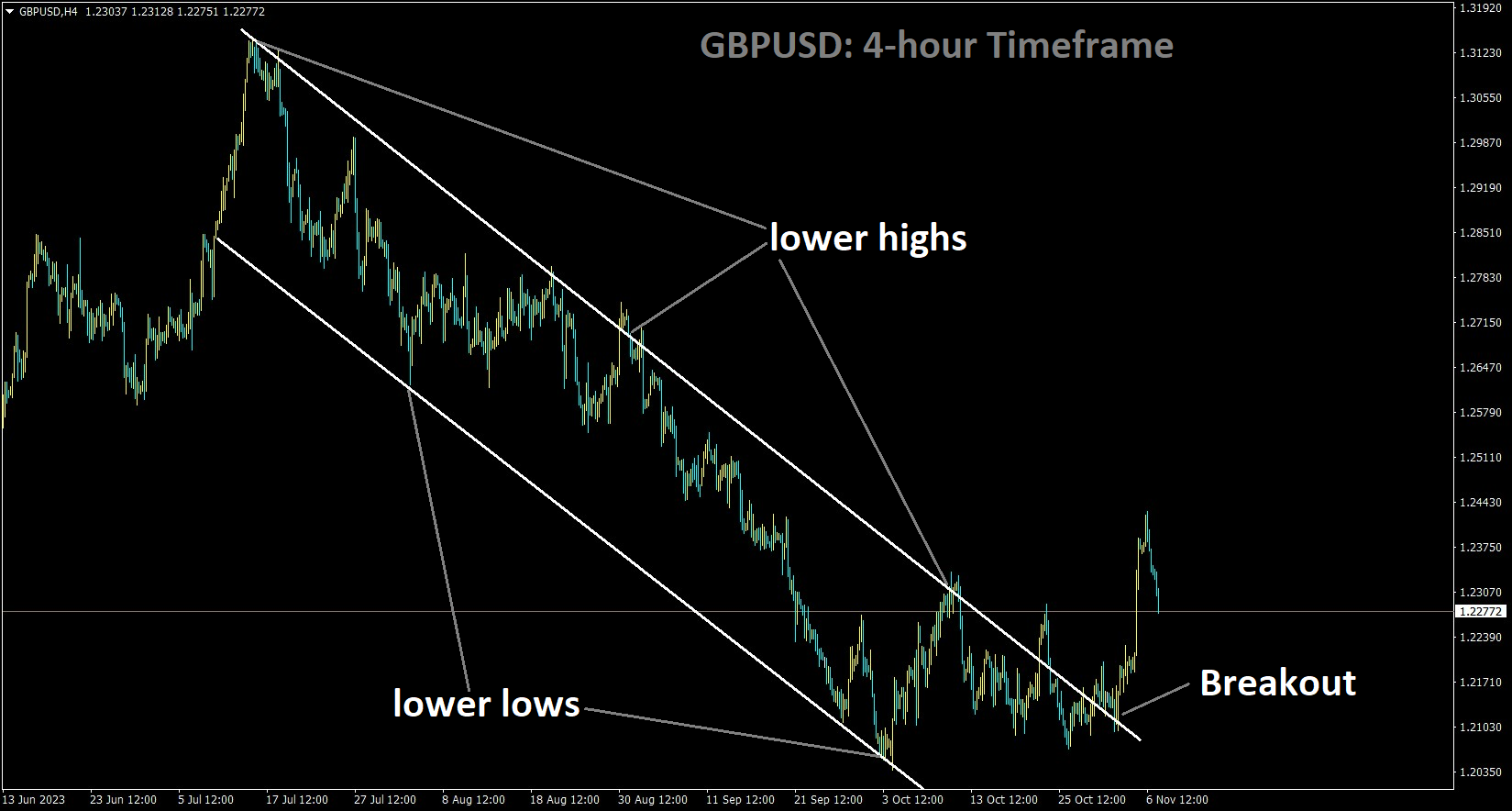

GBPUSD Analysis:

GBPUSD has broken the Descending channel in upside

The GBPUSD currency pair represents the exchange rate between the British Pound and the US Dollar. Recent developments related to the Bank of England (BoE) and the Federal Reserve have influenced the GBPUSD pair.

The Bank of England’s statement about an increased likelihood of a UK recession has had an impact on the GBPUSD exchange rate. This statement raised concerns about the economic outlook in the UK, which can lead to a weaker British Pound against the US Dollar.

On the other hand, the US Dollar has been strengthening, partly due to the belief that the Federal Reserve has concluded its interest rate hiking cycle. While the Fed’s recent announcement kept interest rates unchanged, less dovish remarks from Federal Open Market Committee (FOMC) members have led to an uptick in US Treasury bond yields. This uptick has contributed to the USD’s strength.

Global risk sentiment has also played a role in influencing the GBPUSD pair. Subdued tones in equity markets, indicating a somewhat pessimistic outlook, have bolstered the safe-haven appeal of the US Dollar.

The direction of the GBPUSD pair depends on further insights into the Fed’s future interest rate trajectory and US Treasury bond yields. Market focus remains on speeches by influential FOMC members, particularly Fed Chair Jerome Powell, as they provide guidance on the Fed’s policy direction.

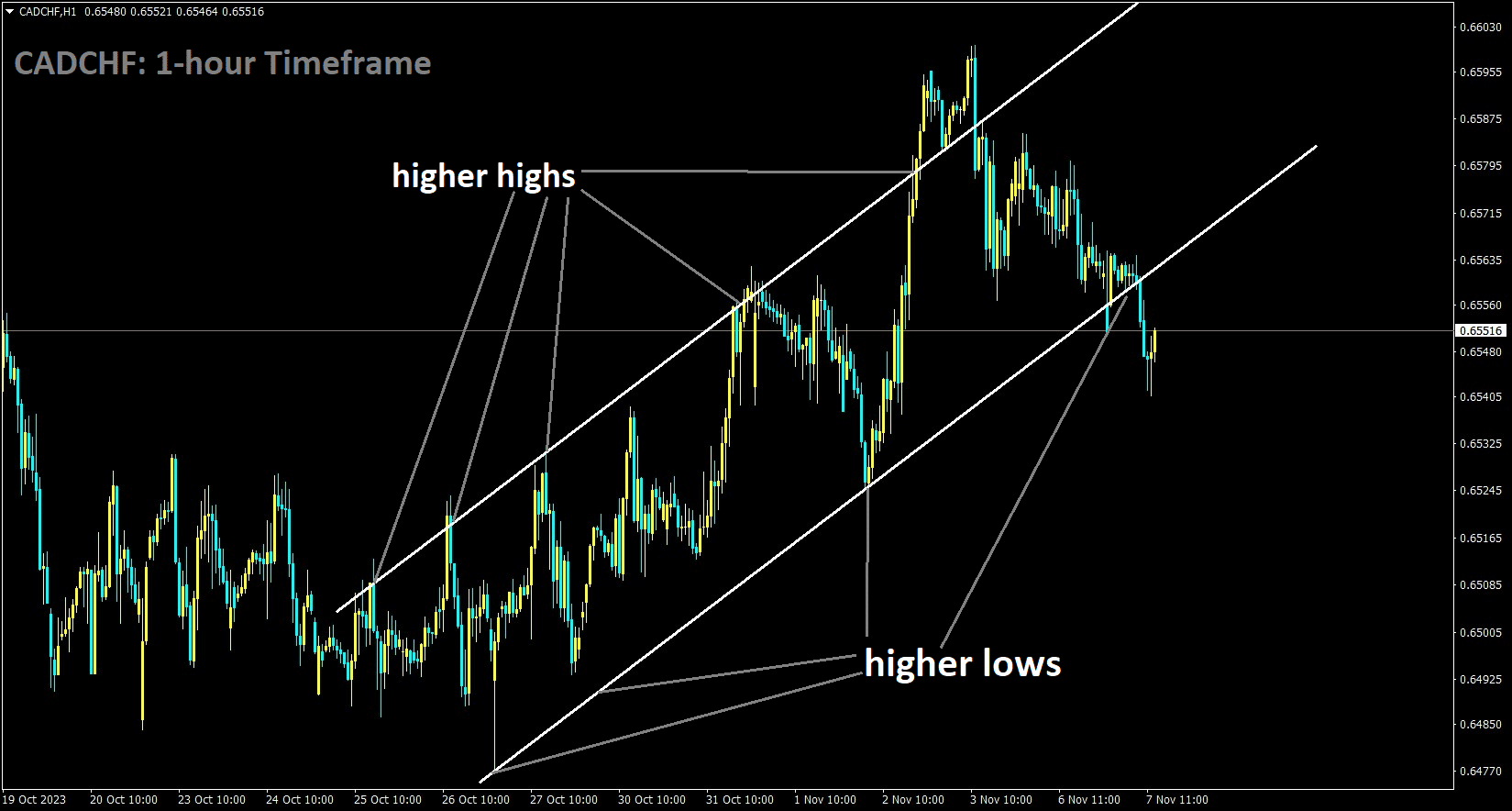

CADCHF Analysis:

CADCHF is moving in an Ascending channel and the market has reached the higher low area of the channel

The CADCHF currency pair represents the exchange rate between the Canadian Dollar and the Swiss Franc. Recent data related to Canada’s Ivey Purchasing Managers’ Index (PMI) and monetary policy decisions have influenced the CADCHF pair.

The Canadian Dollar experienced a retracement as the Ivey PMI data for October fell short of expectations. While the figures indicate growth, they disappointed market expectations. Economic data, such as the Ivey PMI, can influence the Canadian Dollar’s performance.

The economic calendar for the Canadian Dollar this week features limited data of significant importance. However, Canadian Trade Balance data, Building Permits data, and Crude Oil prices can also impact the CADCHF pair.

Crude Oil prices are noteworthy because Canada is a major oil producer, and changes in oil prices can affect the Canadian Dollar. Rising oil prices can support the CAD, while falling prices can weaken it.

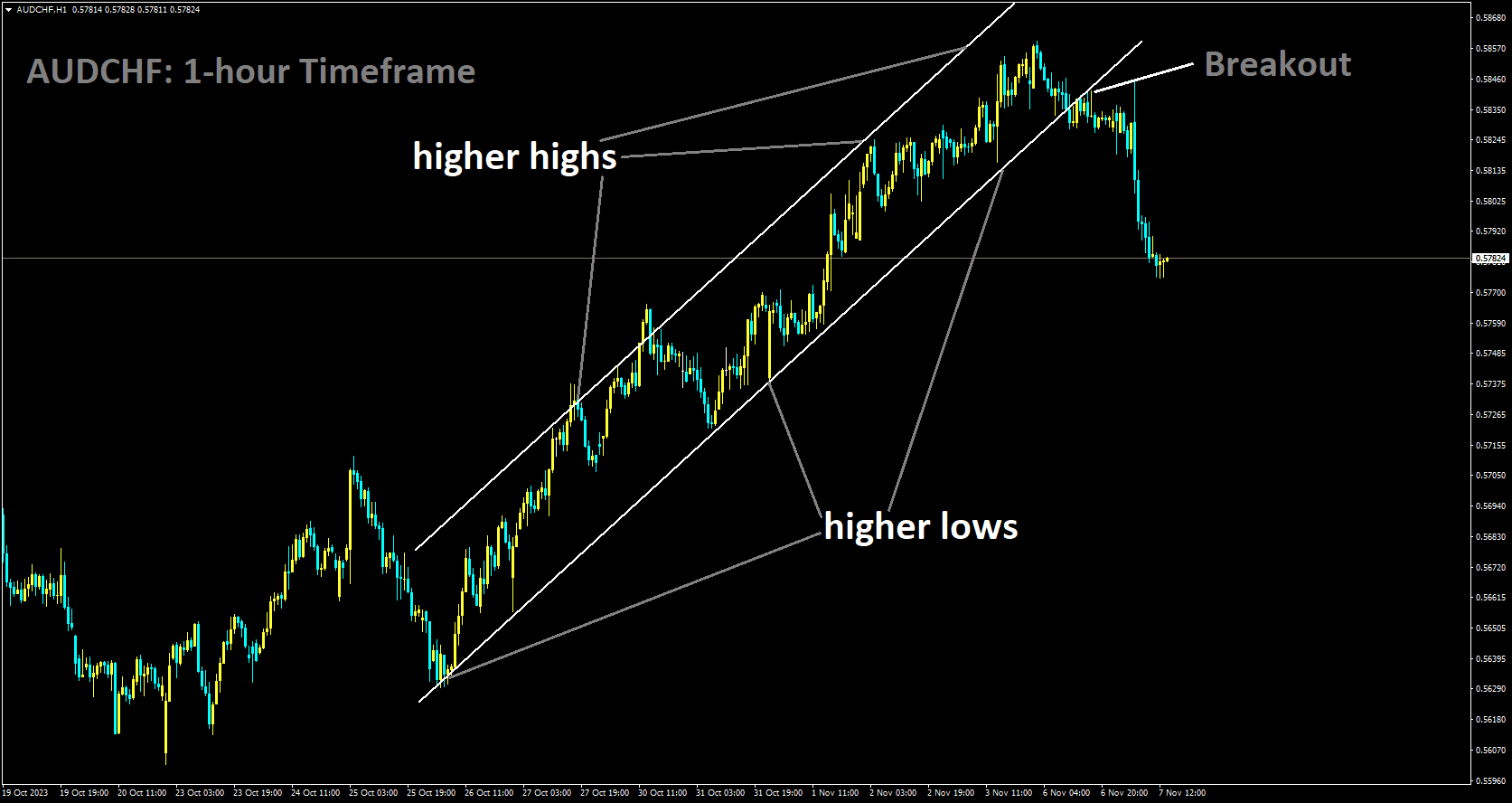

AUDCHF Analysis:

AUDCHF has broken the Ascending channel in downside

The AUDCHF currency pair represents the exchange rate between the Australian Dollar and the Swiss Franc. Recent developments related to the Reserve Bank of Australia (RBA), Consumer Price Index (CPI) data, and China’s Trade Balance have influenced the AUDCHF pair.

The RBA’s decision to raise interest rates by 25 basis points signaled a hawkish stance. This move came in response to rising CPI data for the third quarter and strong retail spending, suggesting the potential for future interest rate hikes.

China’s Trade Balance data for October showed a decrease in the surplus balance, contrary to market expectations of improvement. Exports experienced a more significant decline than anticipated, raising concerns about overseas demand.

Economic data, such as Australia’s TD Securities Inflation, Retail Sales, and Trade Balance figures, have implications for the AUDCHF pair. These data points offer insights into Australia’s economic performance and can influence the RBA’s policy decisions.

The direction of the AUDCHF pair hinges on the RBA’s commitment to its hawkish stance and economic data from both Australia and China.

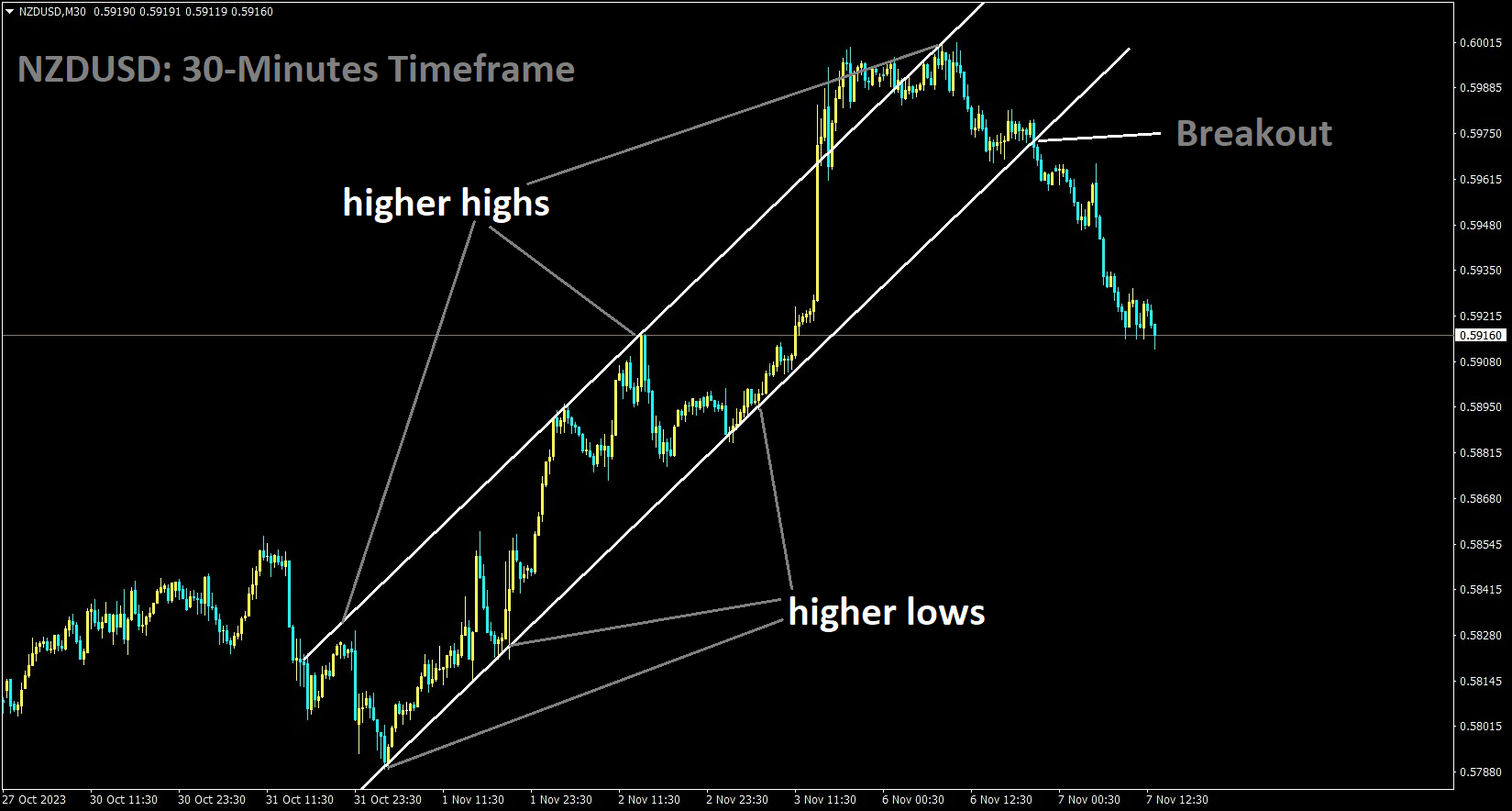

NZDUSD Analysis:

NZDUSD has broken the Ascending channel in the Downside

The NZDUSD currency pair represents the exchange rate between the New Zealand Dollar and the US Dollar. Recent developments related to the Reserve Bank of New Zealand (RBNZ), US Treasury bond yields, and economic data have influenced the NZDUSD pair.

The RBNZ’s decision to keep interest rates unchanged was influenced by the rise in the unemployment rate to 3.9% and a recent deceleration in labor growth. This decision had a positive impact on the New Zealand Dollar, strengthening it against the US Dollar.

US Treasury bond yields have risen, pulling the US Dollar closer to its previous levels. Changes in bond yields can affect the relative appeal of the US Dollar, impacting currency movements.

Economic data, such as the US Nonfarm Payrolls report, have also influenced the NZDUSD pair. The report showed a slowdown in job creation in October, raising questions about the strength of the US labor market.

Market participants are closely monitoring statements from Fed officials and their potential pushback against expectations of significant rate cuts. The direction of the NZDUSD pair is also influenced by New Zealand Business PMI data and the performance of the New Zealand labor market.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% FLAT OFFER for Signals 😍 GOING TO END – Get now: forexfib.com/discount/