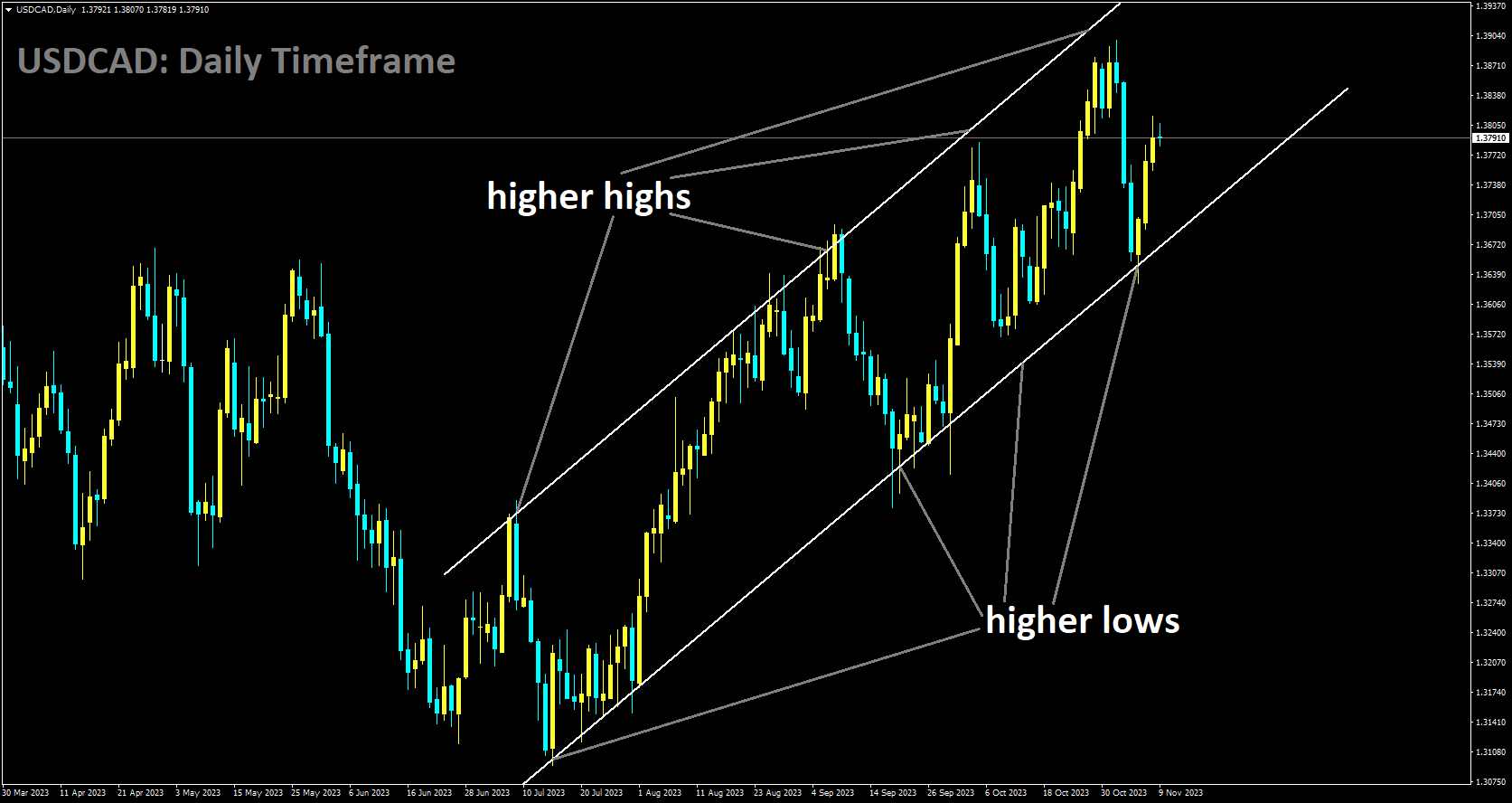

USDCAD Analysis:

USDCAD is moving in Ascending channel and market has rebounded from the higher low area of the channel

Governor Tiff Mackhelm of the Bank of Canada declared that rate increases are not feasible in the event of a decline in inflation. After the governor’s speech, Canadian Dollar stumbled.

US Dollar bulls are on the defensive as it becomes increasingly apparent that the Federal Reserve is nearing the end of its policy-tightening campaign, as evidenced by the declining yields on US Treasury bonds. As a result, the USDCAD pair appears to be under pressure. The question of whether interest rate hikes were necessary to bring inflation back to the 2% target or if they had peaked has been called into question by several Fed officials’ recent statements. Furthermore, the cautious attitude of the market should help limit the decline in the safe-haven Greenback. Apart from this, low prices for crude oil could continue to weaken the Canadian dollar, which is linked to commodities, and support the USD/CAD pair. Investors now seem to be less concerned about Middle East supply disruptions as a result of the Israel-Hamas conflict. This, combined with a lowering of concerns about global supply constraints and a worsening outlook for the global economy—both of which are predicted to hurt fuel demand pulled the black liquid closer to its four-month low on Wednesday.

In the meantime, Bank of Canada Governor Tiff Macklem had hinted that the central bank might not need to raise its benchmark overnight rate if inflation drops as predicted. Therefore, it is possible that some dip buying will take place in the vicinity of the USDCAD pair. Therefore, until there has been a sizable amount of follow-through selling, it will be prudent to wait to declare that the move-up that has been visible since the beginning of this week has peaked. Market participants are now interested in the US economic docket, which includes the regular Weekly Initial Jobless Claims release later in the early North American session. However, the focus will remain on Fed Chair Jerome Powell’s speech, which will increase demand for the USD and provide some momentum to the USD/CAD pair as well as the yields on US bonds. Furthermore, the fluctuations in oil prices could present chances for short-term trading.

In the meantime, Bank of Canada Governor Tiff Macklem had hinted that the central bank might not need to raise its benchmark overnight rate if inflation drops as predicted. Therefore, it is possible that some dip buying will take place in the vicinity of the USDCAD pair. Therefore, until there has been a sizable amount of follow-through selling, it will be prudent to wait to declare that the move-up that has been visible since the beginning of this week has peaked. Market participants are now interested in the US economic docket, which includes the regular Weekly Initial Jobless Claims release later in the early North American session. However, the focus will remain on Fed Chair Jerome Powell’s speech, which will increase demand for the USD and provide some momentum to the USD/CAD pair as well as the yields on US bonds. Furthermore, the fluctuations in oil prices could present chances for short-term trading.

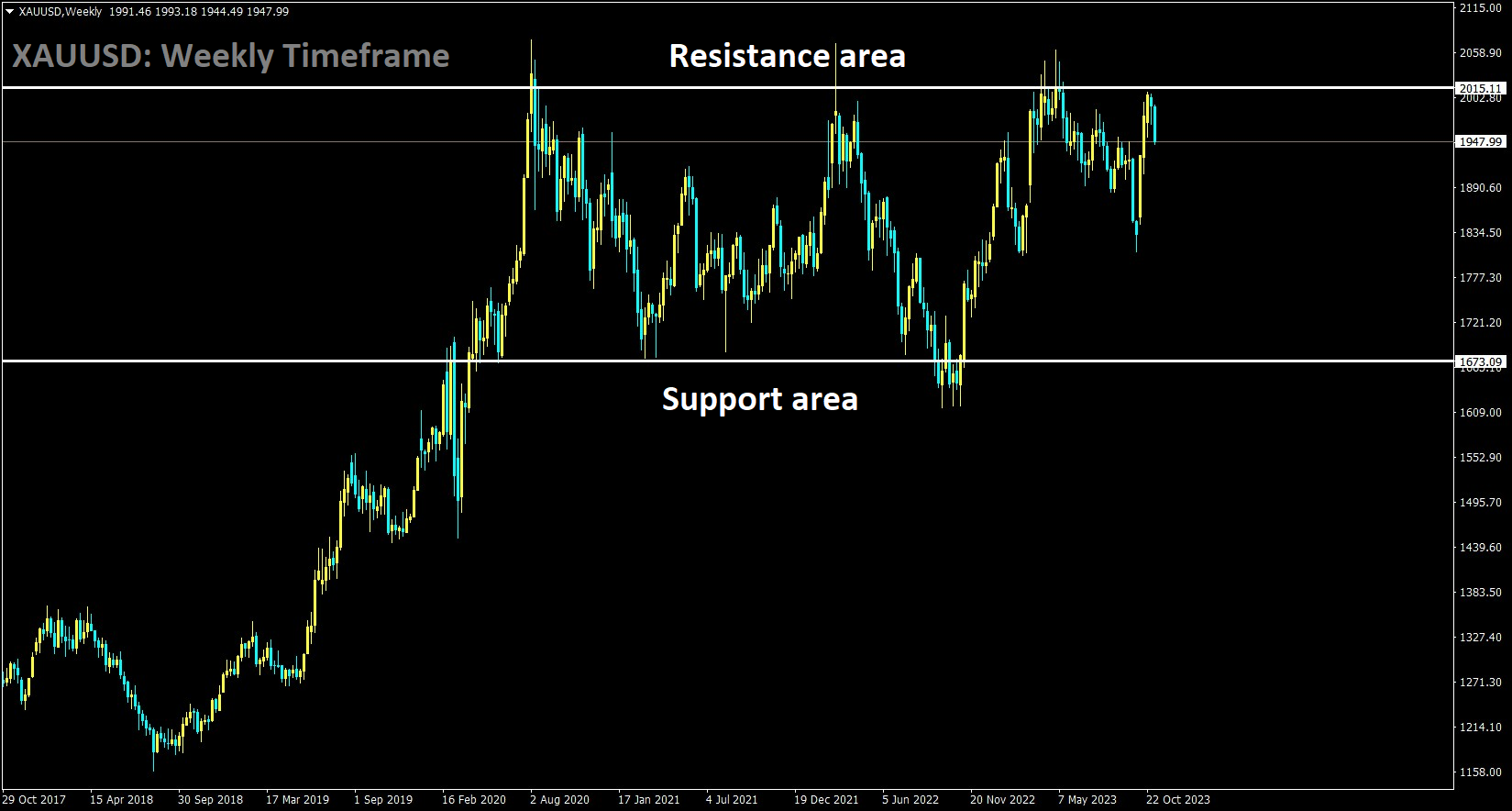

GOLD Analysis:

XAUUSD is moving in the Box pattern and the market has fallen from the resistance area of the pattern

Israel’s wartime fear has diminished along with gold prices. The US dollar has been weakening since the Fed took its dovish position. The gold price for this week will be decided by the two days of the FED’s Powell speech. The price of gold is still unable to stage a meaningful comeback as we head into the European session, and it is currently trading close to where it was when it was touched on October 19. The Federal Reserve (Fed) released a series of mixed signals this week about the direction of potential rate hikes, which has caused flows out of the non-yielding yellow metal since the start of the week. Furthermore, it appears that investors are less worried about the Israel-Hamas conflict getting worse. This is believed to be one more factor that reduces demand for the safe-haven precious metal.

Nonetheless, the US central bank’s policy-tightening campaign is widely believed to be coming to an end, which has kept the gold price from falling much further. The expectations keep the US dollar weak, which drives down the yields on US Treasury bonds. Furthermore, the perception is that the market’s overall caution and China’s economic issues are mitigating the downside and offering some support for precious metal prices. Traders are currently awaiting some momentum from the release of the US Weekly Initial Jobless Claims data ahead of Fed Chair Jerome Powell’s speech.

The benchmark 10-year US government bond’s yield held near to its lowest level in more than a month, and the US dollar’s depreciation helped limit losses for the non-yielding yellow metal. Federal Reserve officials continue to say that further policy tightening is possible, but the CME FedWatch Tool predicts an 18% chance of rate cuts as early as March. Fed Governor Lisa Cook feels that the current policy is sufficiently restrictive for price stability, while Fed President Neil Kashkari questions its suitability given the strength of the US economy. More rate hikes this year, according to Fed Governor Michelle Bowman, are anticipated, but Chicago Fed President Austan Goolsbee stressed the significance of focusing on how high rates should remain. Fed Chair Jerome Powell, meanwhile, avoided talking about monetary policy or the status of the economy on Wednesday because he was due to speak at another conference this Thursday. The most recent Chinese inflation data, which were released earlier on Thursday, showed persistent disinflationary pressures, as the outlook for the domestic economy continues to deteriorate.

The National Bureau of Statistics reports that after a 0.2% increase in September, the annual rate and headline CPI in China fell by 0.1% and 0.2%, respectively, in October. China’s Producer Price Index (PPI) fell in October for the thirteenth consecutive month. The 2.6% decline was marginally greater than the 2.5% decline in the previous month, but it was still less than the 2.8% decline forecast.

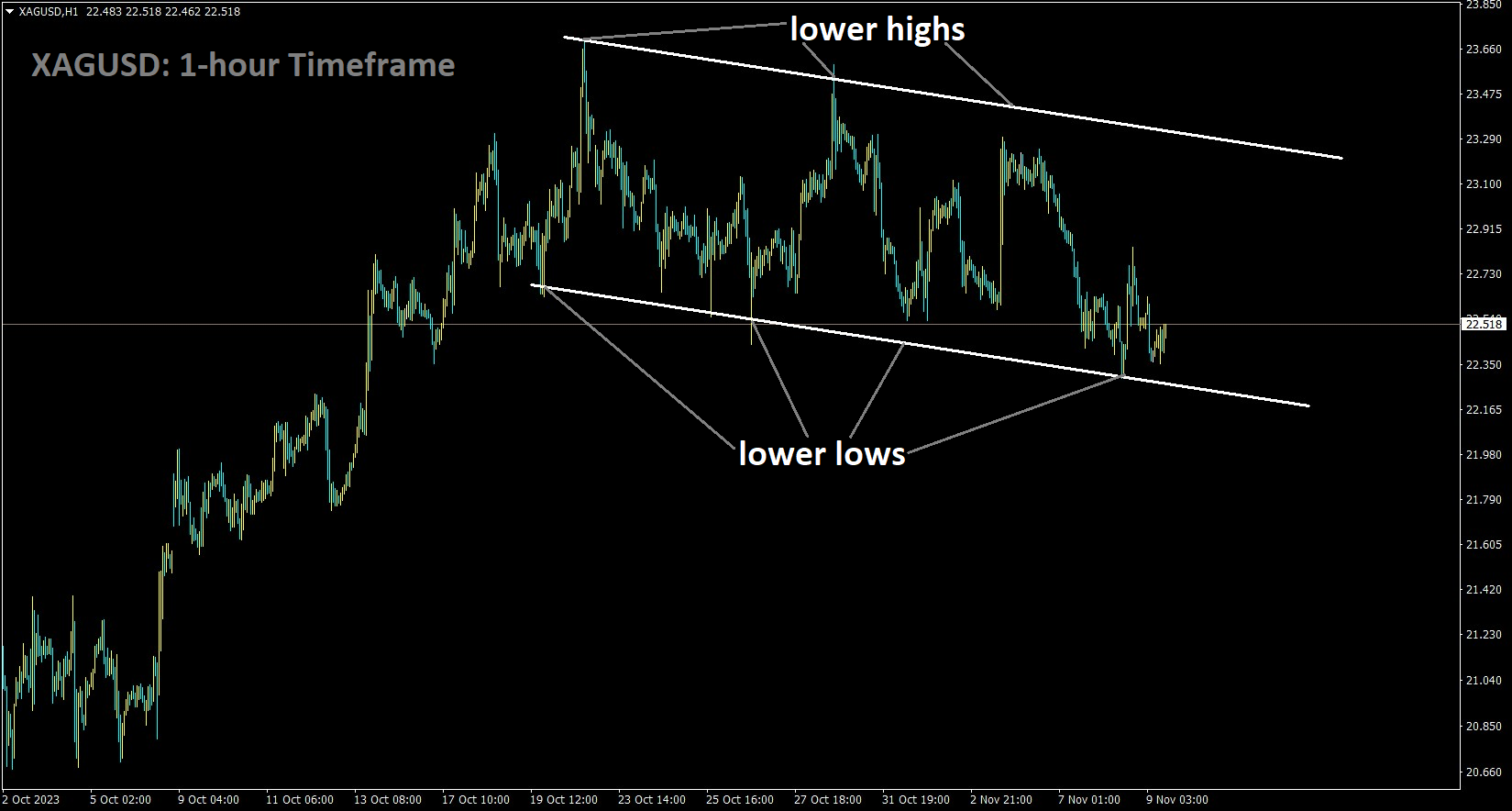

SILVER Analysis:

XAGUSD is moving in the Descending channel and the market has reached the lower low area of the channel

Governor of the US Federal Reserve Patrick Harker said that rate hikes will be contingent on the data and that inflation will continue to drop, with a projected 3% drop in 2024 and a subsequent decline in 2025. The unemployment rate will peak at 4.5% in 2024 and then begin to decline in 2025.

The President of the Philadelphia Fed, Patrick Harker, said that the data could influence the direction of the US Federal Reserve’s upcoming interest rate decision. backed a stable interest rate stance at the most recent FOMC meeting. It is time to evaluate the results of earlier rate hikes. Rates will not be lowered by the Fed anytime soon; they will stay higher for longer.

There is a growing balance in the labor market. The unemployment rate will rise to 4.5% in 2024 and then begin to decline. Confident customers will help ensure a soft landing. Currently, it is unclear if customers have made any purchases. There is not a recession, but growth will most likely slow. progressively falling, to reach 3% in 2024 and then 2% beyond that.

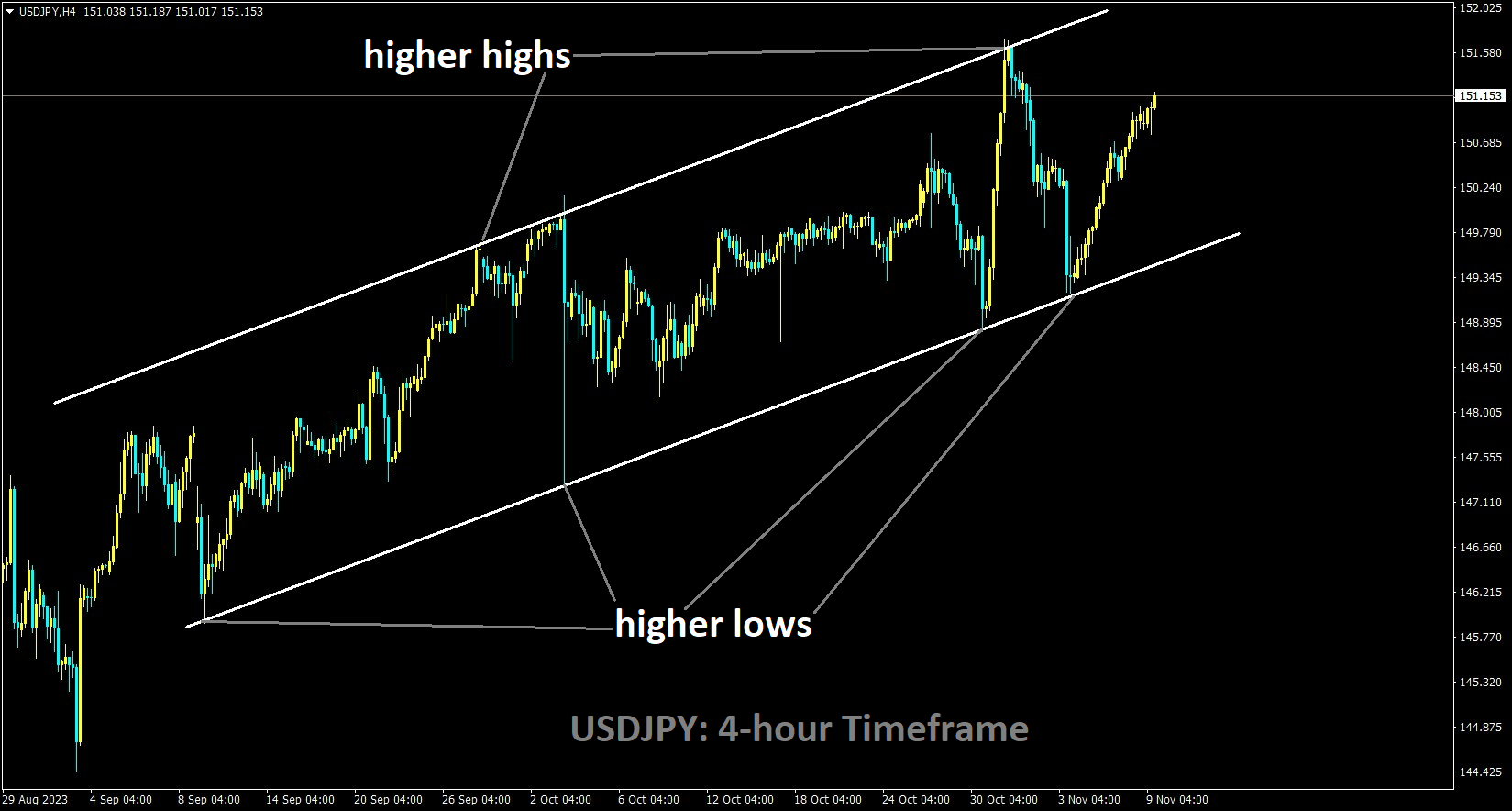

USDJPY Analysis:

USDJPY is moving in an Ascending channel and the market has rebounded from the higher low area of the channel

The governor of the Bank of Japan, Ueda, stated that since businesses raised labor costs and material prices, inflation will soon reach the 2% target in a sustainable manner. As a result, the extremely loose monetary policy continues.

On Thursday, Bank of Japan Governor Kazuo Ueda said that once inflation sustainably hits 2%, wages ought to increase at least as quickly. Businesses are acting more actively than in the past to increase wages and prices. It will be crucial to evaluate whether wage increases will ripple throughout society and lead to price increases by businesses in anticipation of future wage increases in order to ascertain whether the inflation target will be maintained.

We will keep using the negative rate, ycc framework until a sustained 2% inflation target is within reach. Changes in the economy and prices at the time of exit will dictate the order in which we end these policies.

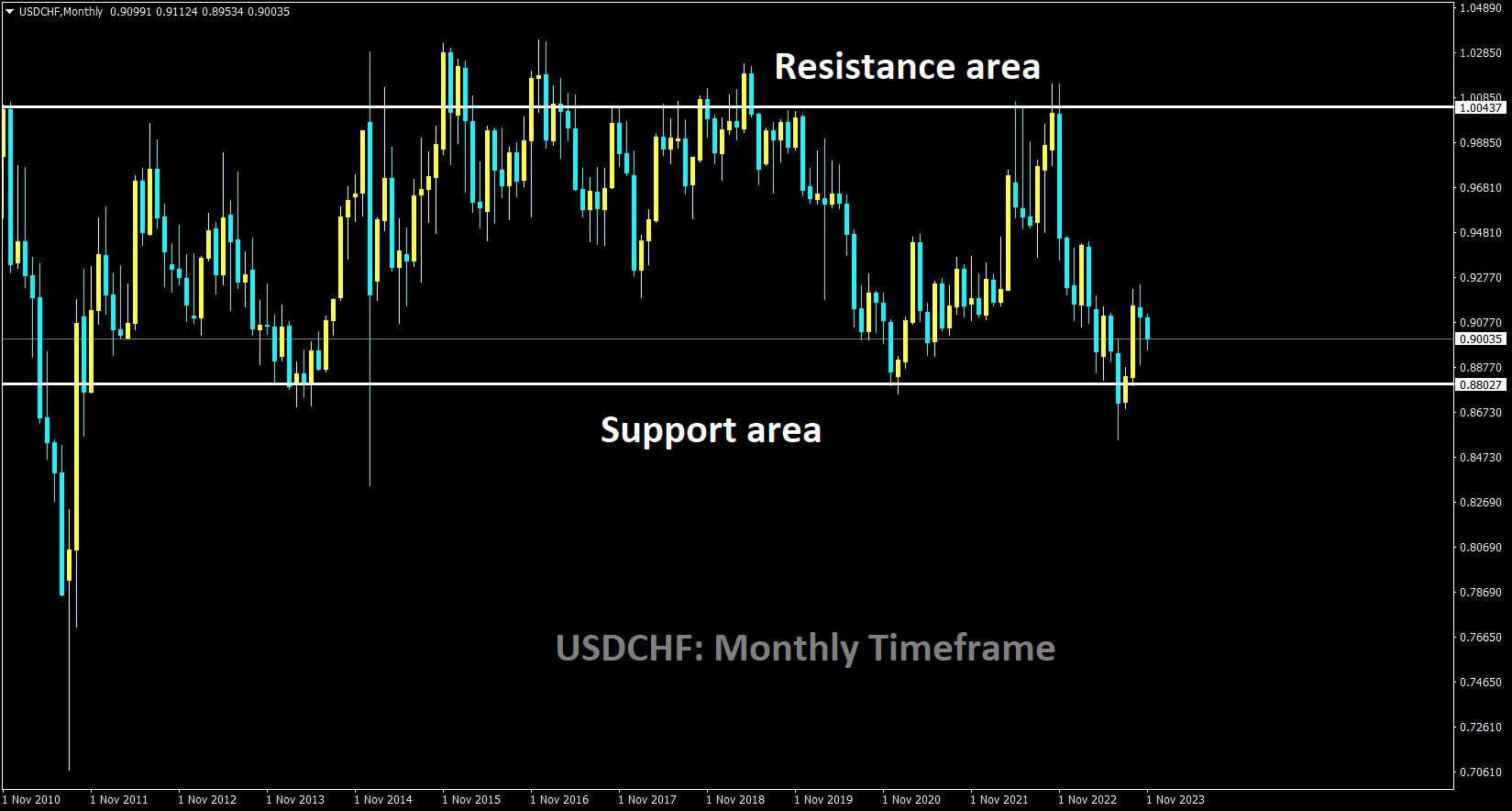

USDCHF Analysis:

USDCHF is moving in the Box pattern and the market has rebounded from the support area of the pattern

Yesterday, Switzerland was removed from the list of currencies that US authorities had been manipulating. SNB is required to report to US authorities on the current status of the money supply and economy.

The Swiss National Bank retorted on Wednesday that they were not manipulating their currencies. The SNB stated it took note of the decision, which was detailed in the Treasury’s semi-annual report on the currency policies of the US’s principal trading partners. In a statement released on Wednesday, the SNB stated that it is still in contact with US authorities while working with Swiss authorities to explain Switzerland’s monetary policy and economic conditions. We are delighted to carry on these discussions. Switzerland found itself at odds with the US after the SNB made significant purchases of foreign currencies with the goal of weakening the safe haven franc as its value rose. In an effort to control import inflation, the SNB has since changed its mind and permitted the franc to weaken.

Switzerland had exceeded all three potential manipulation thresholds, but in its November 2022 report, the Treasury declined to label it as a manipulator. But in June, the Treasury discontinued its improved analysis of Switzerland and reduced its ranking. Switzerland and South Korea were taken off the watch list on Wednesday after meeting a single condition for two straight times. To qualify, a country had to meet two of the following three criteria: it had to have a trade surplus of more than $15 billion with the United States of America, a high global current account surplus of more than 3% of GDP, and continuous net foreign currency purchases of more than 2% of GDP over a 12-month period. The designation had sparked heated negotiations between U.S. and Swiss officials, who clarified that the country’s policies were not meant to gain a trade advantage but rather to mitigate the adverse effects of the strong Swiss franc on the export-oriented economy of Switzerland.

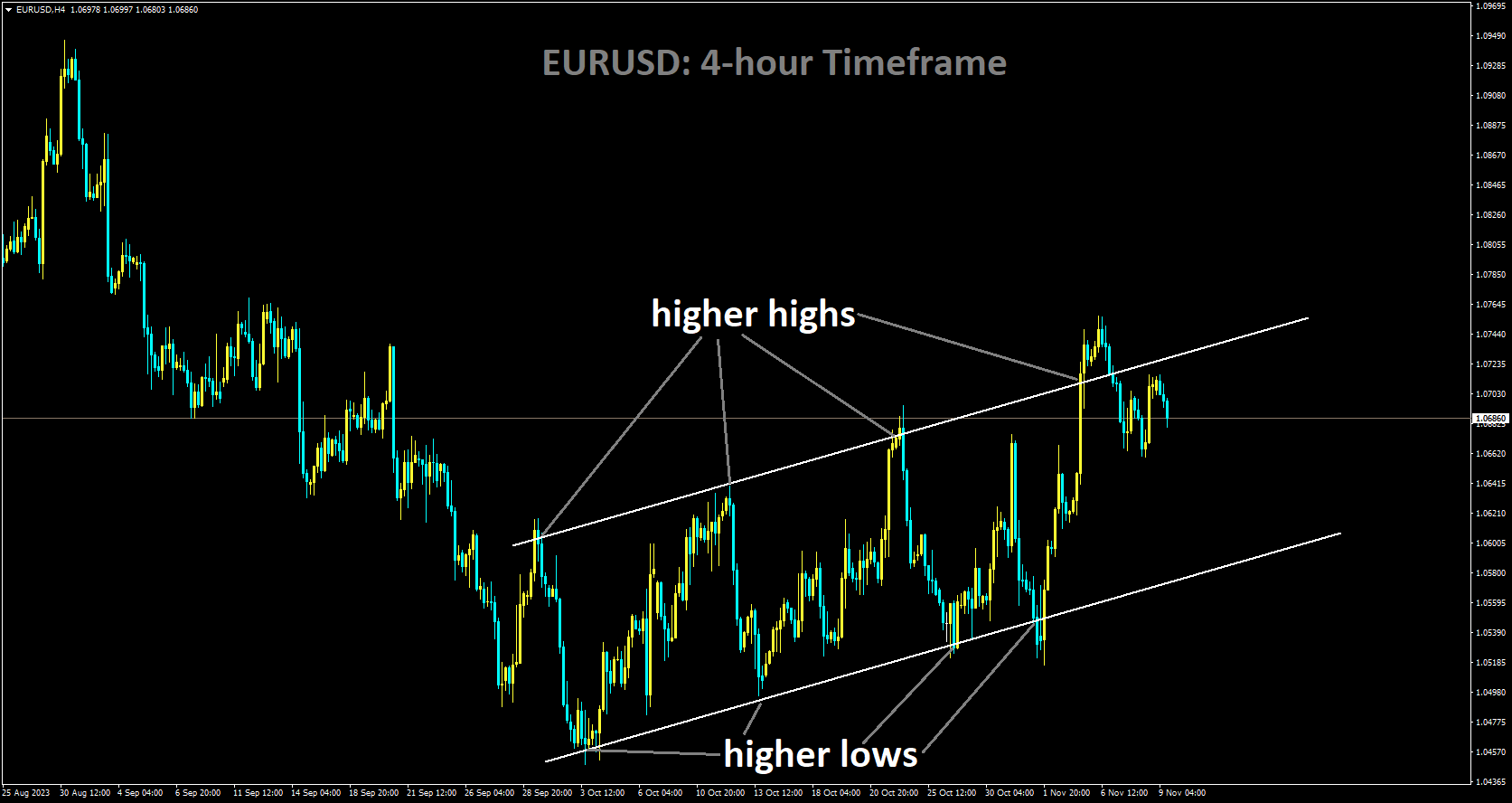

EURUSD Analysis:

EURUSD is moving in Ascending channel and market has fallen from the higher high area of the channel

Last month, the euro dropped against the US dollar as German inflation marginally declined. By year-end or year-end 2024, the ECB is expected to move +/- 30bps in either direction.

The euro has lost some of its recent gains in the wake of the NFP, as some speakers from the US central bank outsold their counterparts from the European central bank. The resilience of the US economy and the potential need for additional interest rate increases were highlighted by Fed officials Logan and Bowman in particular. In conclusion, given the most recent NFP miss and a notable decline in German inflation using both MoM and YoY measures, Fed officials will likely adopt a wait and see approach. This number is a stand-in for the overall inflationary environment and represents the biggest economy in the euro area. Later today, ECB speakers are scheduled to speak; this could give their remarks a dovish tone and damage the euro. The euro area is expected to see lower retail sales, which could make things worse.

The Federal Reserve, with Fed Chair Jerome Powell at the center of attention, will come back into the spotlight later today. We will examine the speech to find any clues or potential changes to the earlier tale. Other Fed speakers will speak after Mr. Powell, but the markets’ reactions will likely be focused on the Fed Chair. The unpredictable nature of expectations in the financial markets is demonstrated by the ‘dovish’ re-pricing of implied Fed funds futures to pre-NFP levels. The US dollar may be supported ceteris paribus if the ECB lowers rates by an extra +/-30bps by year’s end in 2024. The ongoing conflict in the Middle East could make the USD a safer haven than the EUR.

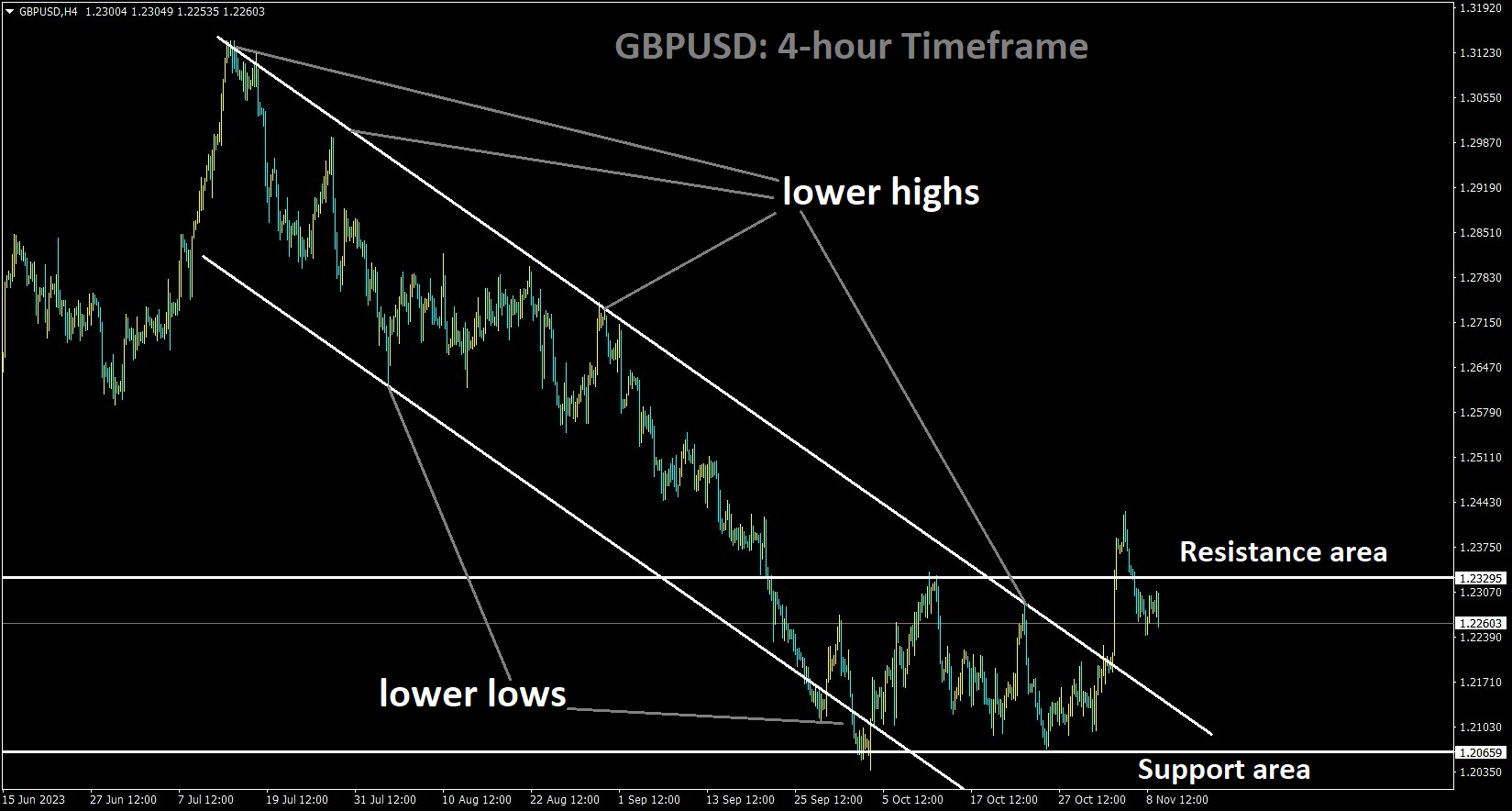

GBPUSD Analysis:

GBPUSD is moving in the Descending channel and the Box pattern, Market has fallen from the resistance area of the pattern

The Bank of England’s Governor Bailey declared that rate reductions are not currently planned and that the 2% inflation target will be met in two years. Future rate decisions will only be made on the basis of data, and longer-term rates will be higher.

The British pound suffered today when Bank of England Governor Andrew Bailey reiterated Chief Economist Huw Pill’s forecast that inflation would fall precipitously, as it had earlier in the day in the Euro area. Still, the governor maintained his “higher for longer” position, projecting 2% inflation after two years. Money markets have been generally dovishly repriced with no further rate hikes and an increase in cumulative interest rate cuts to 65bps by December 2024 from 50bps just a week ago. Governor Bailey of the Bank of England It is far too early to talk about rate cuts. The key lesson is that we believe restrictive policy will be required for a significant period of time, even in spite of possible upside risks. We think that economic growth is very muted and that policies are now restrictive.

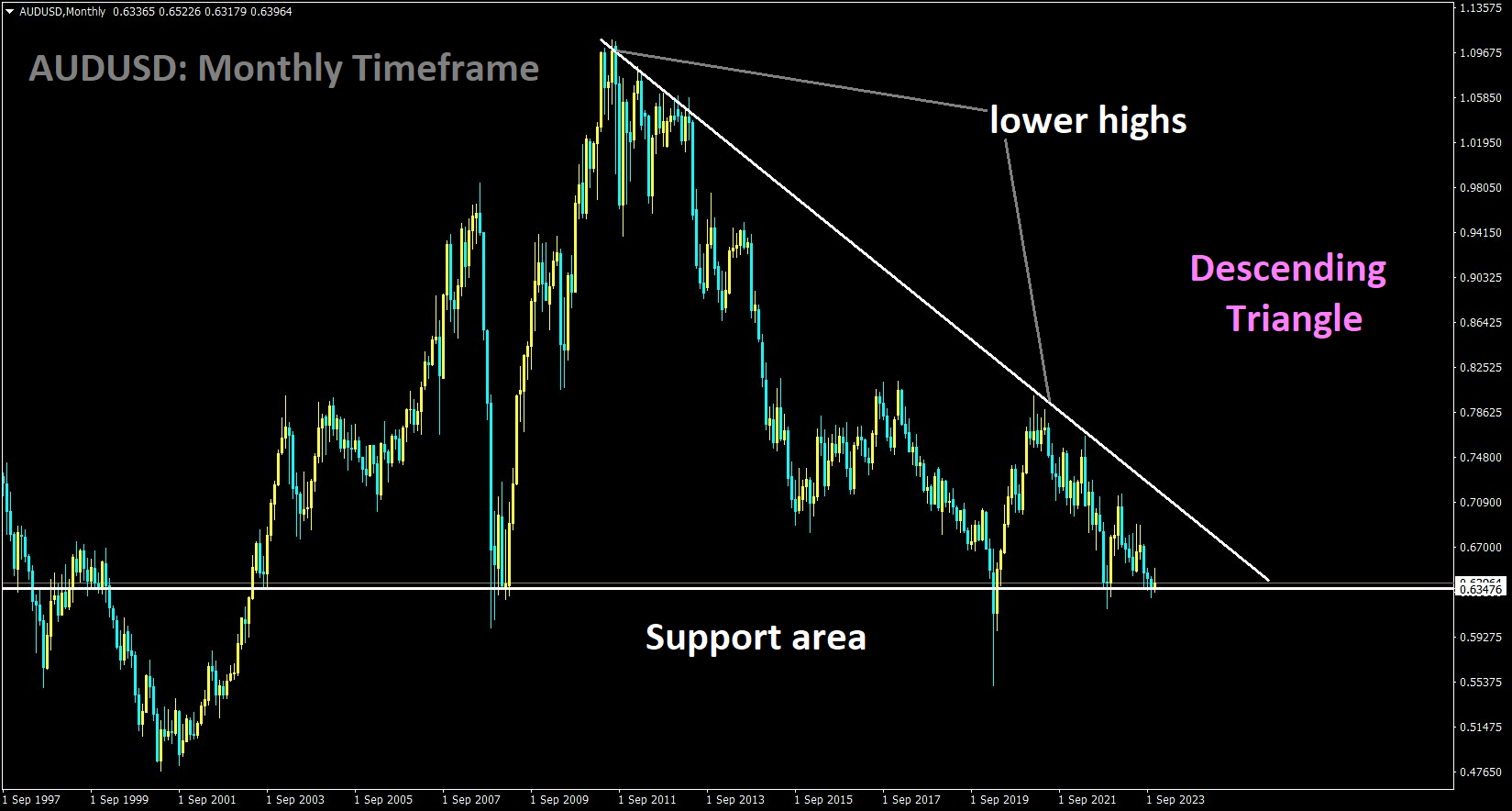

AUDUSD Analysis:

AUDUSD is moving in the Descending triangle pattern and the market has reached the support area of the pattern

A UOB analyst predicts that rate reductions will happen in Q2, or the second half of 2024, following Q1’s higher rate maintenance by the RBA. We expect a rate cut of 85 basis points the following year, which could come as low as 3.5% in the fourth quarter of 2024.

Senior economist at UOB Group Alvin Liew discusses his feelings regarding the RBA’s most recent interest rate decision. As we had predicted, the Reserve Bank of Australia (RBA) decided to raise the cash rate target by 25 basis points, to 4.35%. The decision was widely projected by us and the markets. According to the Bloomberg survey, 29 out of the 32 economists polled expected an increase of 25 basis points, while three economists predicted no change. The interest rates on Exchange Settlement balances were also raised, going from 4.25 percent to 4.25 basis points. This is the first rate increase under RBA Governor Michele Bullock, who took over the role last month after the bank held rates steady for four meetings running.

Although Australia’s inflation has passed its peak, the RBA justified the hike in its accompanying statement, arguing that it is still too high and has been more persistent than expected a few months ago. In light of the expected hike on Tuesday and the more dovish-sounding policy guidance in November, we continue to hold our unchanged position on RBA policy. We expect the RBA to keep the peak policy rate at 4.35% through December and the first quarter of 2024. The second quarter of 2024 is then projected to see the first rate decrease. In Q4 of 2024, we expect to lower the RBA cash rate by an aggregate of 85 basis points, bringing it down to 3.5%.

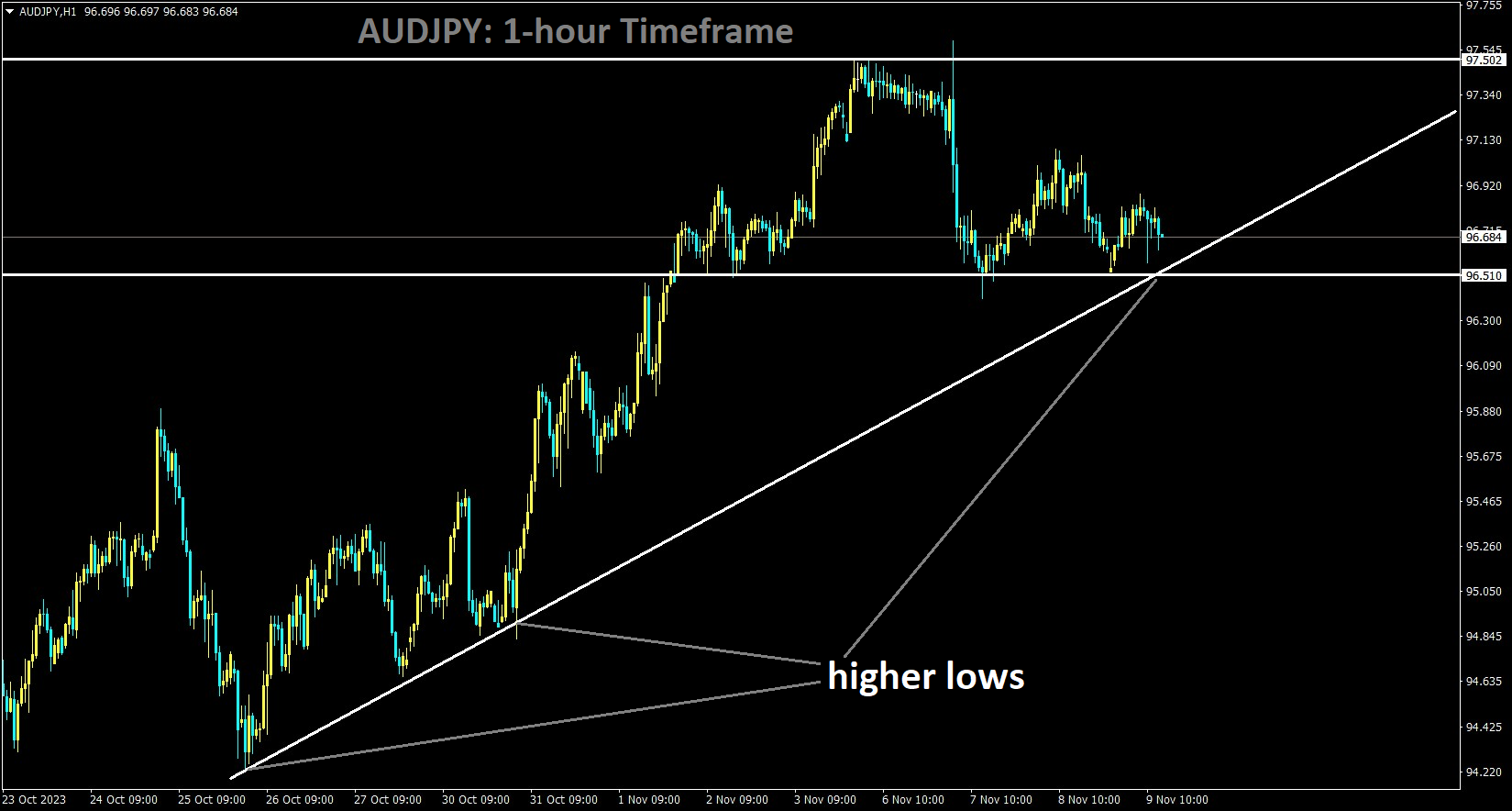

AUDJPY Analysis:

AUDJPY is moving in an Ascending trend line and the market has reached the higher low area of the trend line

China’s CPI figures fell in October from -0.20% in September to 0.0% in September. PPI data now stands at 2.6%, down from 2.7% in September.

October saw a 0.2% year-over-year decline in China’s Consumer Price Index (CPI), which had been flat at 0% in September. The market had anticipated a 0.1% drop.

In October, Chinese CPI inflation dropped to 0.1% from 0% in September and an estimated 0.1% decline. China’s Producer Price Index (PPI) fell 2.6% YoY in October as opposed to 2.5% in September. The 2.7% decline in the reported period was greater than anticipated in the data.

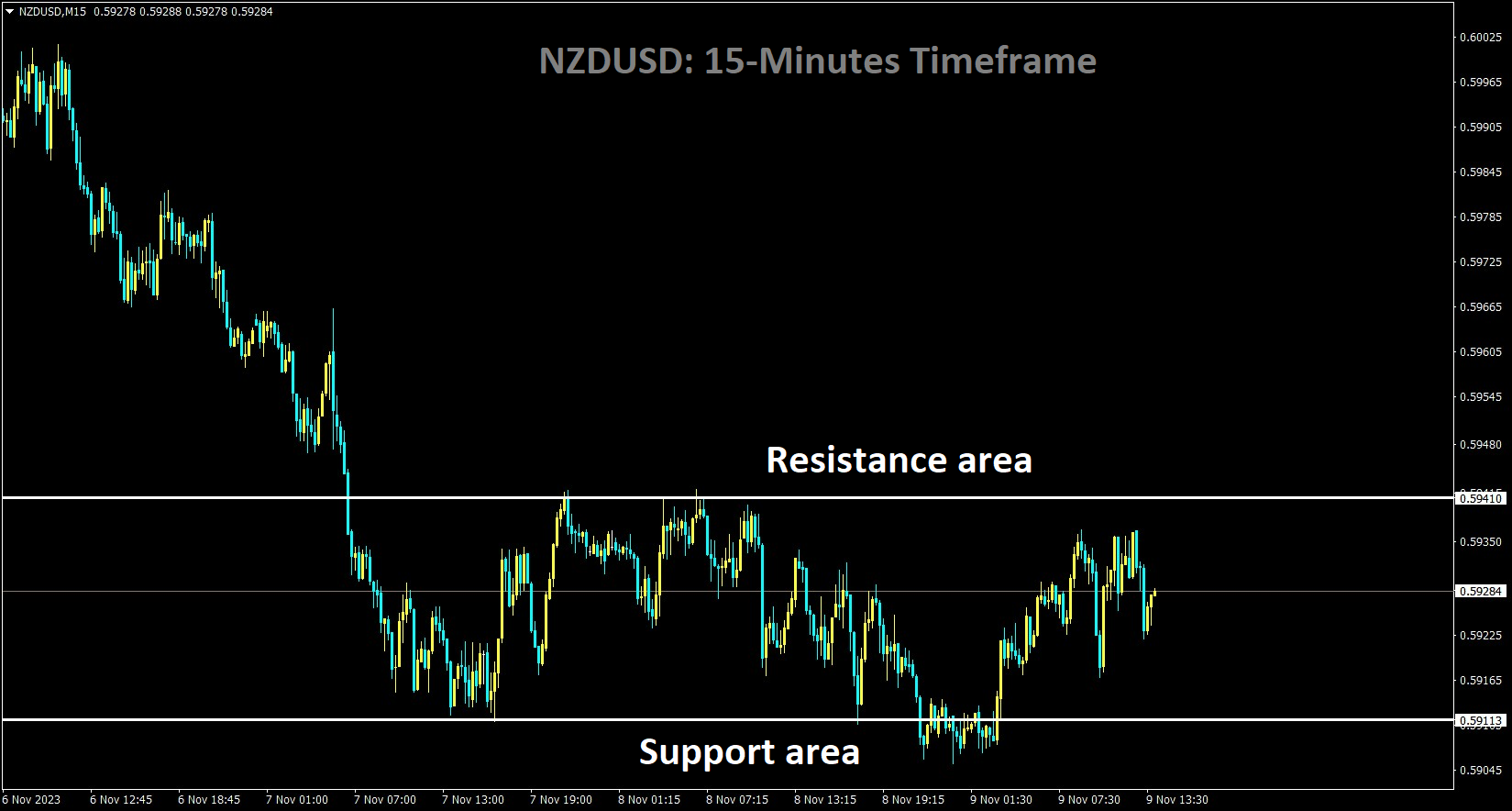

NZDUSD Analysis:

NZDUSD is moving in the Box pattern and the market has fallen from the resistance area of the pattern

The market saw a depreciation of the NZD dollar after the RBNZ survey predicted that inflation would fall this year, from 4.17% to 3.60%. The forecast for the following two years has increased to 2.76% from 2.83%.

The value of the New Zealand dollar dropped by more than one-third of a percentage point against the US dollar on Wednesday. The market’s negative sentiment stems from a somewhat gloomy forecast for the global economy. New Zealand is a major exporter of commodities, so a slowdown in global growth would not be good for the country’s currency. Overnight, the Reserve Bank of New Zealand issued an inflation report that was not encouraging for the New Zealand currency. It exposed a widespread perception that prices will drop soon, maybe as a result of the economy slowing down and consumers becoming less interested in purchasing goods and services. A number of Fed officials, including Fed governor Michelle Bowman, have expressed hawkish views, which have encouraged the New Zealand dollar to continue losing ground against the US dollar.

The New Zealand Dollar trades at a lower value in relation to the US Dollar when there is a general tone of risk-off. The release of the RBNZ’s Q3 inflation expectations report resulted in further losses for the Kiwi relative to the US dollar. Compared to the previous report, respondents anticipated a decrease in inflation in the upcoming year. One year later, they reported 3.60% inflation, which is lower than the 4.17% reported in the Q2 report. As per Stats NZ, real inflation in New Zealand dropped from 6.0% in the previous quarter to 5.6% in the third. Given the decreased expectations for inflation, the Reserve Bank of New Zealand (RBNZ), whose main cash rate is currently 5.50%, is unlikely to raise interest rates. Higher interest rates typically boost the value of a currency because they draw in more capital from foreign investors looking for bigger returns. This explains why the report might have had a negative impact on the NZDUSD.

Inflation expectations for the next two years dropped from 2.83% to 2.76%, according to the RBNZ report. It is currently widely believed that an interest rate increase by the US Federal Reserve (Fed) is unlikely to occur anytime soon. Fed Governor Michelle Bowman said on Tuesday that the Fed may need to hike interest rates even further in order to control inflation. She did, however, also note that the notable increase in Treasury yields since September has resulted in tighter financial conditions. Federal Reserve Chair Jerome Powell’s speech on Wednesday failed to excite investors because he avoided discussing monetary policy. The anticipated comments from several other Fed governors could still have an effect on the pair in the near future.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% FLAT OFFER for Signals 😍 GOING TO END – Get now: forexfib.com/discount/