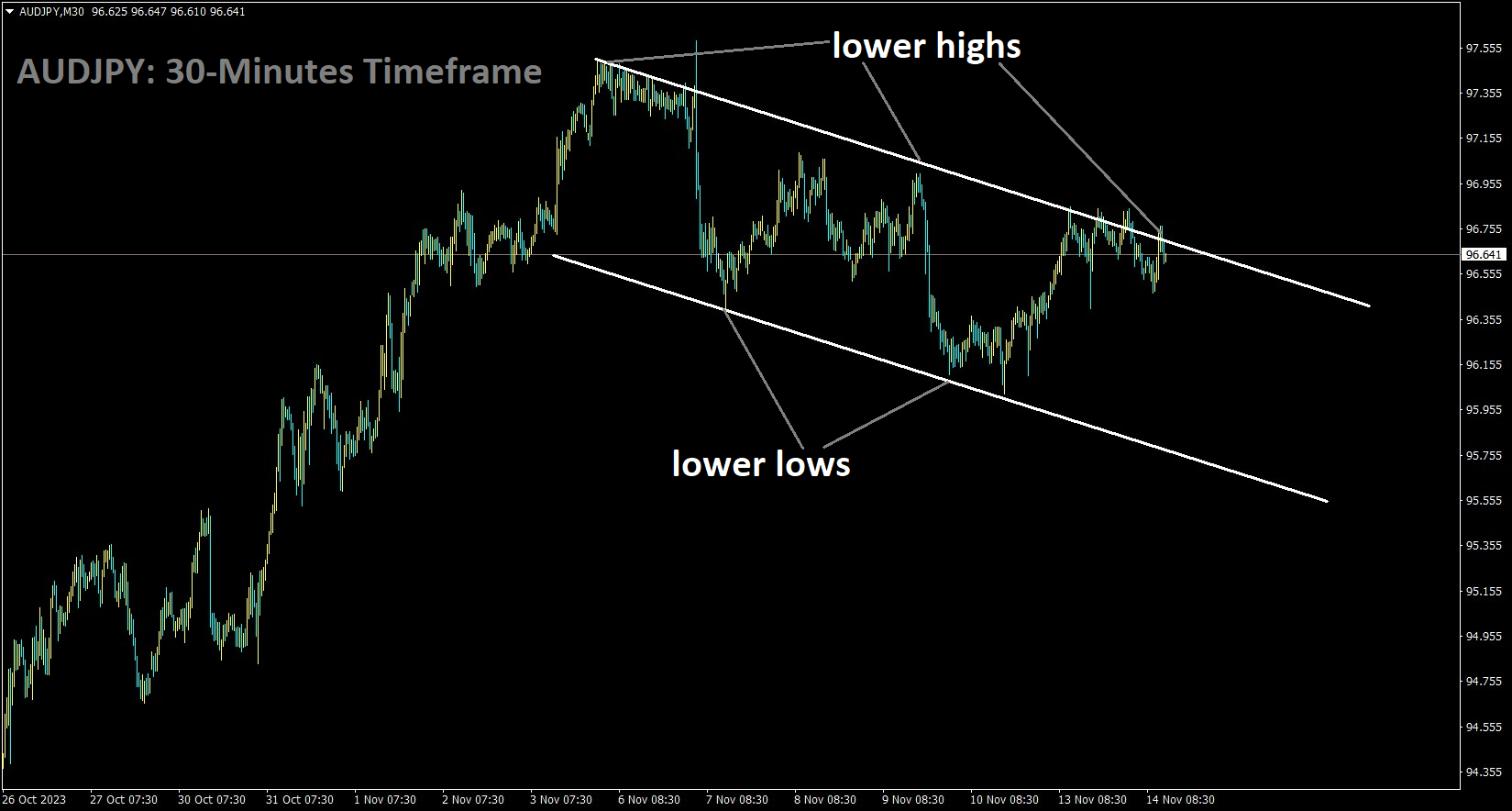

AUDJPY Analysis:

AUDJPY is moving in the Descending channel and the market has reached the lower high area of the channel

Japanese Finance Minister Shunichi Suzuki stated that foreign exchange levels are guided by fundamentals, and increased volatility is undesirable. He emphasized the careful monitoring of FX movements, acknowledging both positive and negative aspects related to the yen.

Japanese Finance Minister Sunichi Suzuki emphasized the significance of currencies moving in a stable manner that aligns with underlying fundamentals. He stressed that excessive fluctuations in foreign exchange rates are undesirable. Suzuki committed to taking all necessary measures to address currency movements and acknowledged the potential advantages and disadvantages associated with a weaker yen. However, he refrained from making specific comments on currency levels.

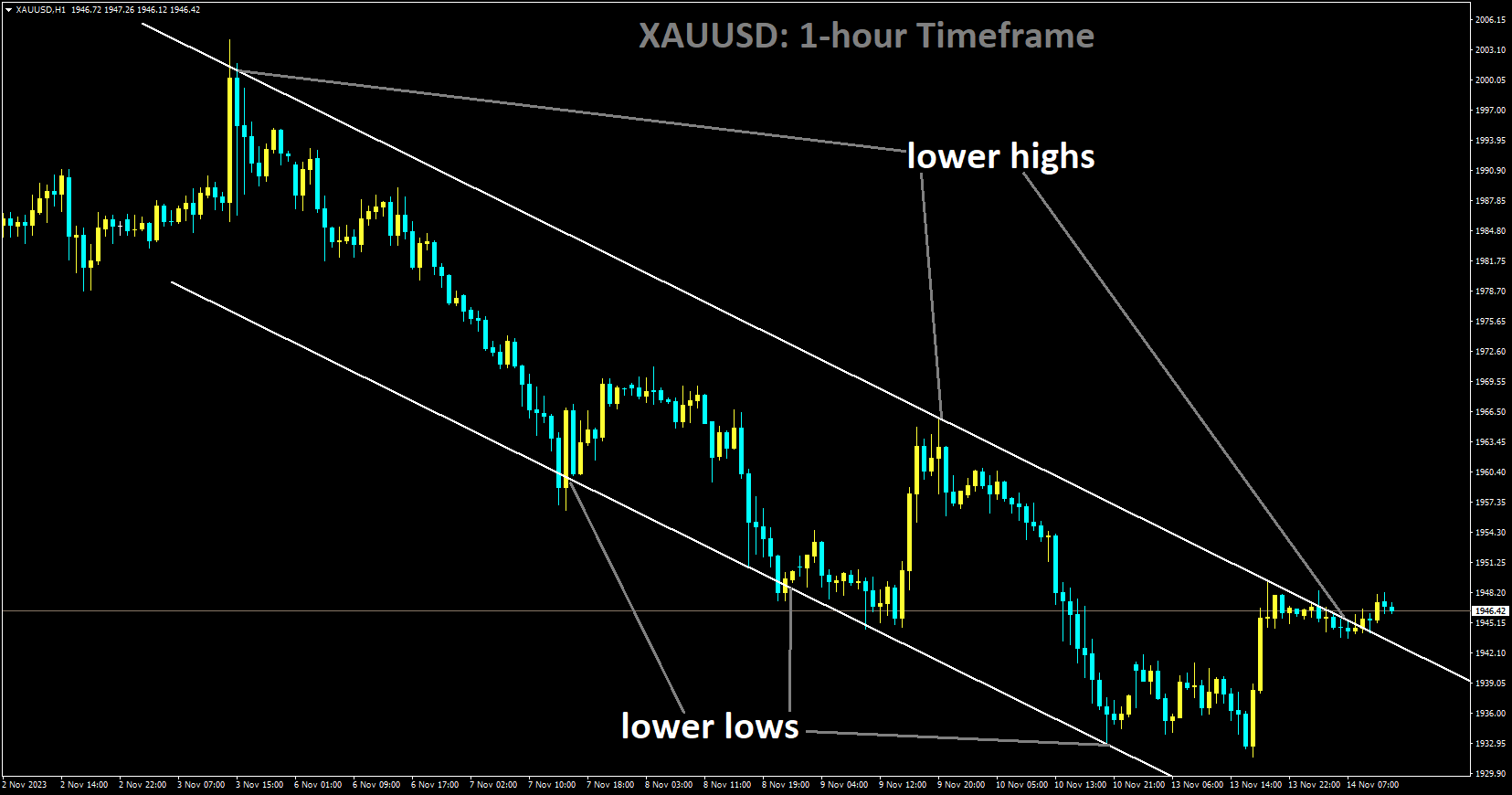

GOLD Analysis:

XAUUSD is moving in Descending channel and market has reached lower high area of the channel

The recent decline in gold prices can be attributed to the slower pace of developments in the conflict between Hamas and Israel compared to the previous week. Concurrently, the US Dollar has gained strength, driven by optimistic comments from Federal Reserve members regarding potential rate hikes. As the economic calendar in the United States remains relatively limited, the focus of most traders is now on the eagerly anticipated release of the Consumer Price Index (CPI).

According to a New York Fed poll, there is a noticeable cooling of inflation expectations for the upcoming year. Projections suggest a decline in October prices from 3.7% to 3.3% year-on-year. Additionally, forecasts indicate that the Core CPI is expected to remain unchanged at 4.1%, consistent with previous data. Despite the ongoing conflict in the Gaza Strip between Israel and Hamas, geopolitical risks seem to be subdued in market reactions. However, it’s worth noting that an escalation of the conflict could potentially favor gold.

Traders in the gold market are closely monitoring remarks from various Federal Reserve speakers throughout the week. While Governor Lisa Cook offered no significant insights into monetary policy on Monday, Tuesday’s agenda features key figures such as Fed Vice-Chairman Philip Jefferson, John Williams from the New York Fed, and Lisa Cook again. Furthermore, on Wednesday, the meeting between US President Joe Biden and his Chinese counterpart, President Xi Jinping, at the Asia-Pacific Economic Cooperation summit in San Francisco is expected to address matters of military cooperation. Any developments in these events could impact gold prices.

Traders in the gold market are closely monitoring remarks from various Federal Reserve speakers throughout the week. While Governor Lisa Cook offered no significant insights into monetary policy on Monday, Tuesday’s agenda features key figures such as Fed Vice-Chairman Philip Jefferson, John Williams from the New York Fed, and Lisa Cook again. Furthermore, on Wednesday, the meeting between US President Joe Biden and his Chinese counterpart, President Xi Jinping, at the Asia-Pacific Economic Cooperation summit in San Francisco is expected to address matters of military cooperation. Any developments in these events could impact gold prices.

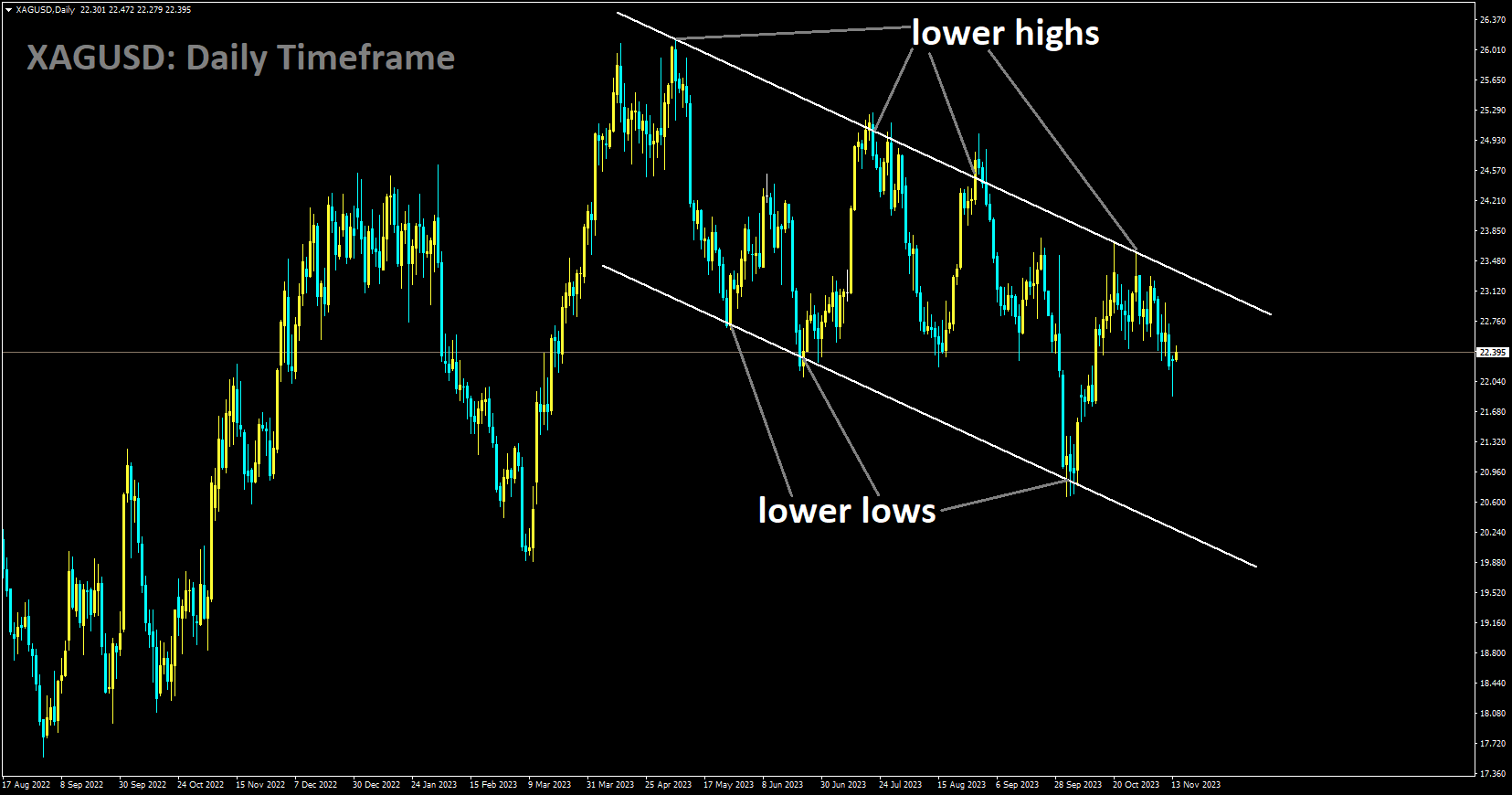

SILVER Analysis:

XAGUSD is moving in Descending channel and market has fallen from the lower high area of the channel

The spotlight in silver trading is on the release of the US Consumer Price Index (CPI) data, which is anticipated today. Expectations point to a decrease from the previous month’s 3.7% to 3.3%. Federal Reserve Chair Powell has already indicated the ongoing nature of the rate hike cycle, emphasizing that inflation is still below the target.

The U.S. Bureau of Labor Statistics is set to unveil the latest consumer price index (CPI) numbers, and given the Federal Reserve’s heightened sensitivity to incoming data, the financial markets are assigning added significance to this report. The potential for increased volatility in the upcoming trading sessions is notable, affecting not only silver prices but also the EURUSD currency pair and the Nasdaq 100.

Projections indicate that the headline CPI, adjusted for seasonal factors, is expected to show a modest 0.1% increase in October, potentially reducing the annual rate from 3.7% to 3.3%. Simultaneously, the core CPI, which excludes food and energy, is anticipated to rise by 0.3% on a monthly basis, maintaining a 4.1% reading for the 12-month period. The Federal Reserve’s cautious outlook and data-centric approach add complexity to the potential market reactions, making silver traders keenly watch the CPI release and its impact on precious metals.

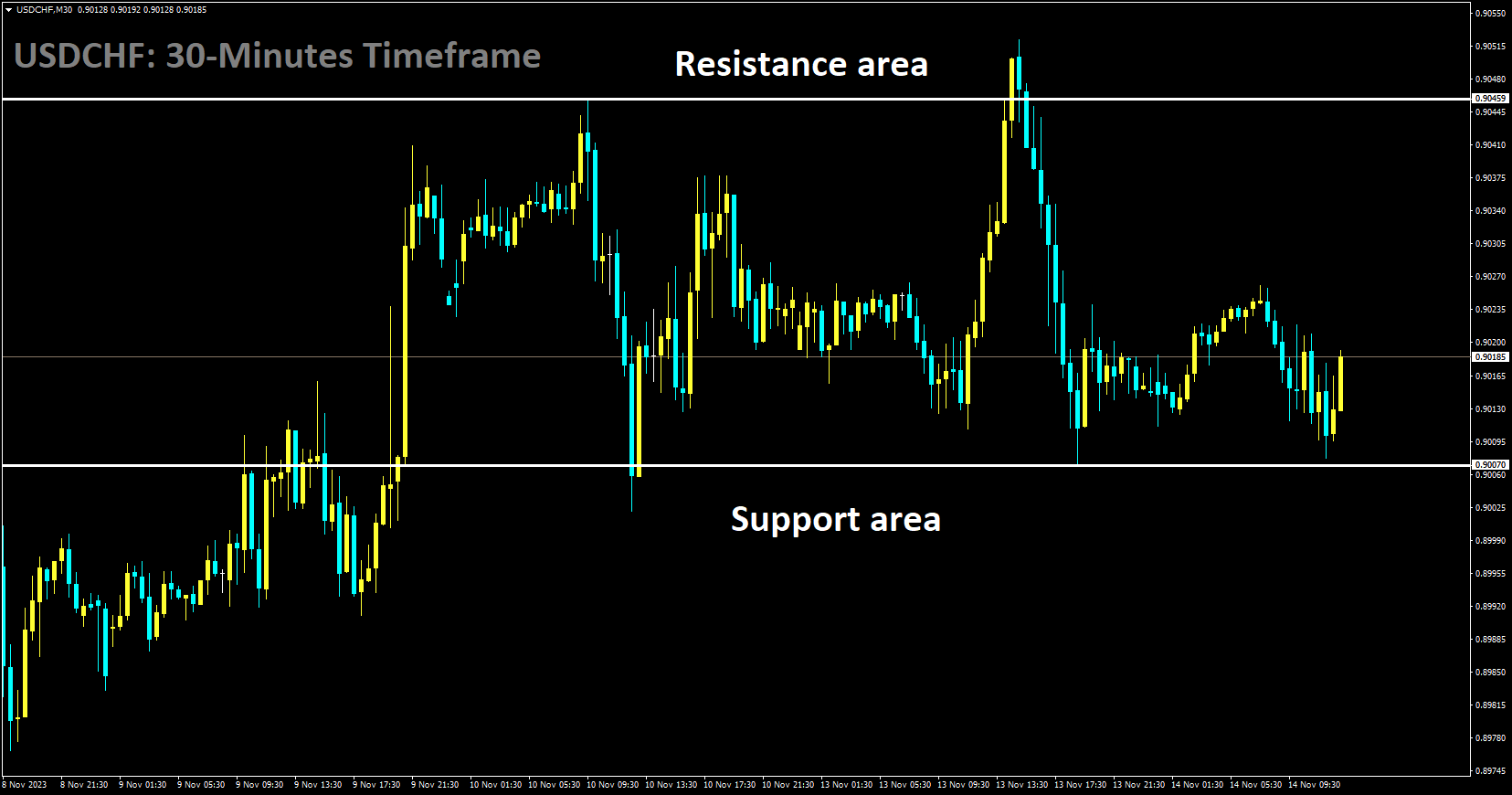

USDCHF Analysis:

USDCHF is moving box pattern and market has rebounded from the support area of the pattern

In today’s speech on uncertainty and volatility in Zurich, Swiss National Bank Chairman Thomas Jordan is expected to emphasize the intention to keep rates lower, aligning with the SNB’s expectations of lower inflation. The Swiss Franc has displayed a generally sideways trend as investors adopt a cautious stance, awaiting the release of the United States Consumer Price Index (CPI) data for October.

In the early European session, S&P500 futures traded without much enthusiasm, reflecting caution among market participants ahead of the crucial US inflation figures. Although the US Dollar Index rebounded from 105.60, its overall movement remained subdued. The market’s focus is squarely on the upcoming consumer inflation data, which is anticipated to offer fresh insights into potential monetary policy actions by the Federal Reserve.

According to consensus estimates, the monthly headline CPI is projected to show a nominal increase of 0.1%, a decline from the 0.4% growth recorded in September. The annual CPI is anticipated to rise by 3.3%, a decrease from the 3.7% increase in September. The monthly and annual core CPI, which excludes the volatile components of oil and food prices, is expected to expand at a steady pace of 0.3% and 4.1%, respectively. A persistent core inflation report could influence Federal Reserve policymakers toward a more tightening-oriented narrative.

In the previous week, Fed Chair Jerome Powell expressed the view that the current monetary policy is insufficient to bring down inflation to the 2% target. Turning attention to the Swiss Franc, investors are awaiting a speech from Swiss National Bank (SNB) Chairman Thomas J. Jordan. It is anticipated that Jordan will provide guidance on potential monetary policy actions, with an emphasis on maintaining higher interest rates to keep inflation below 2%.

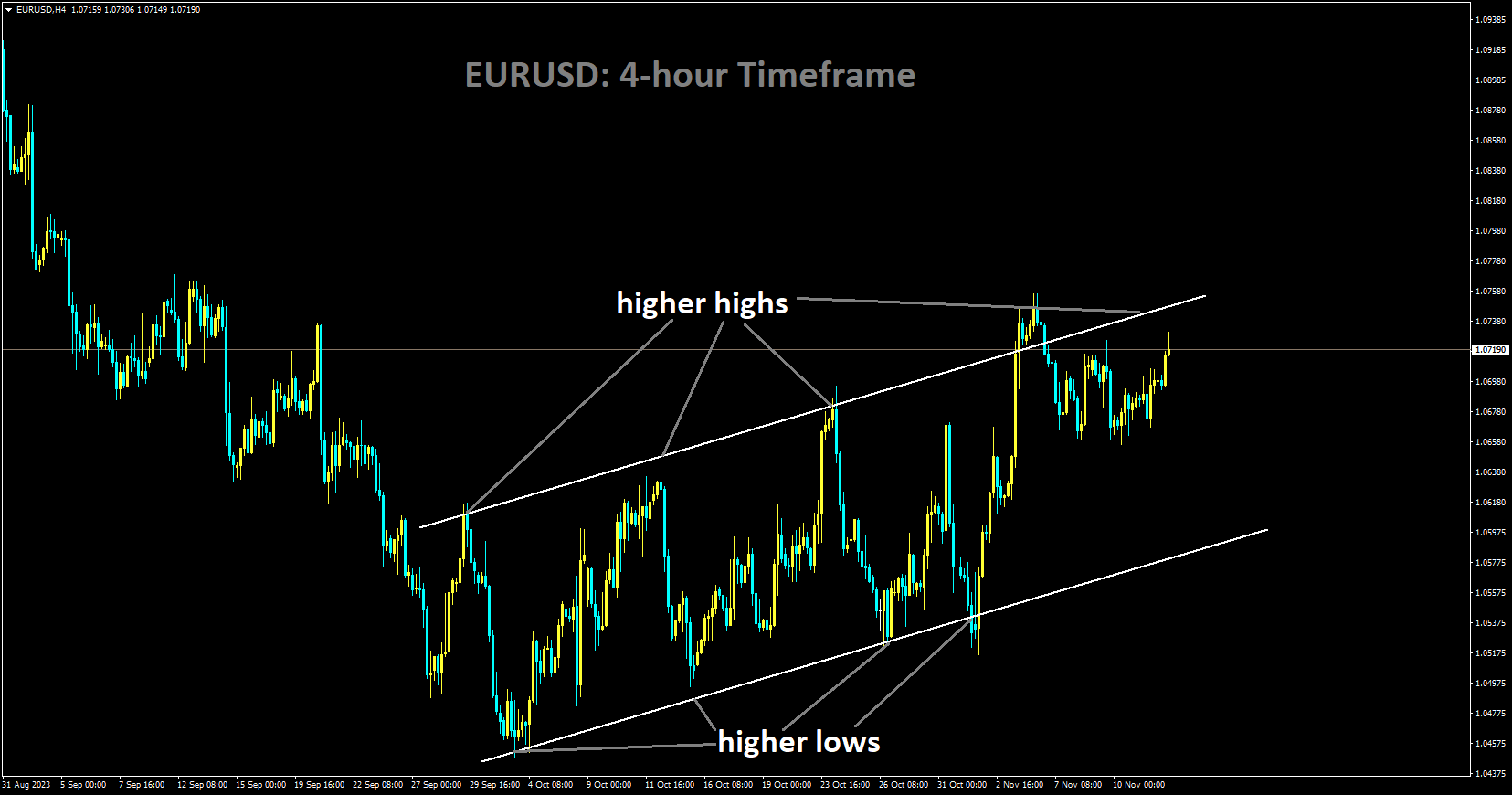

EURUSD Analysis:

EURUSD is moving in Ascending channel and market has reached higher high area of the channel

Martins Kazaks, a member of the European Central Bank Governing Council, expressed the view that it is premature to conclude that the terminal rate has been reached. He highlighted the potential risk of spillover into inflation and noted the absence of a clear peak in wage growth. Kazaks emphasized that there is no automatic certainty regarding the next rate move.

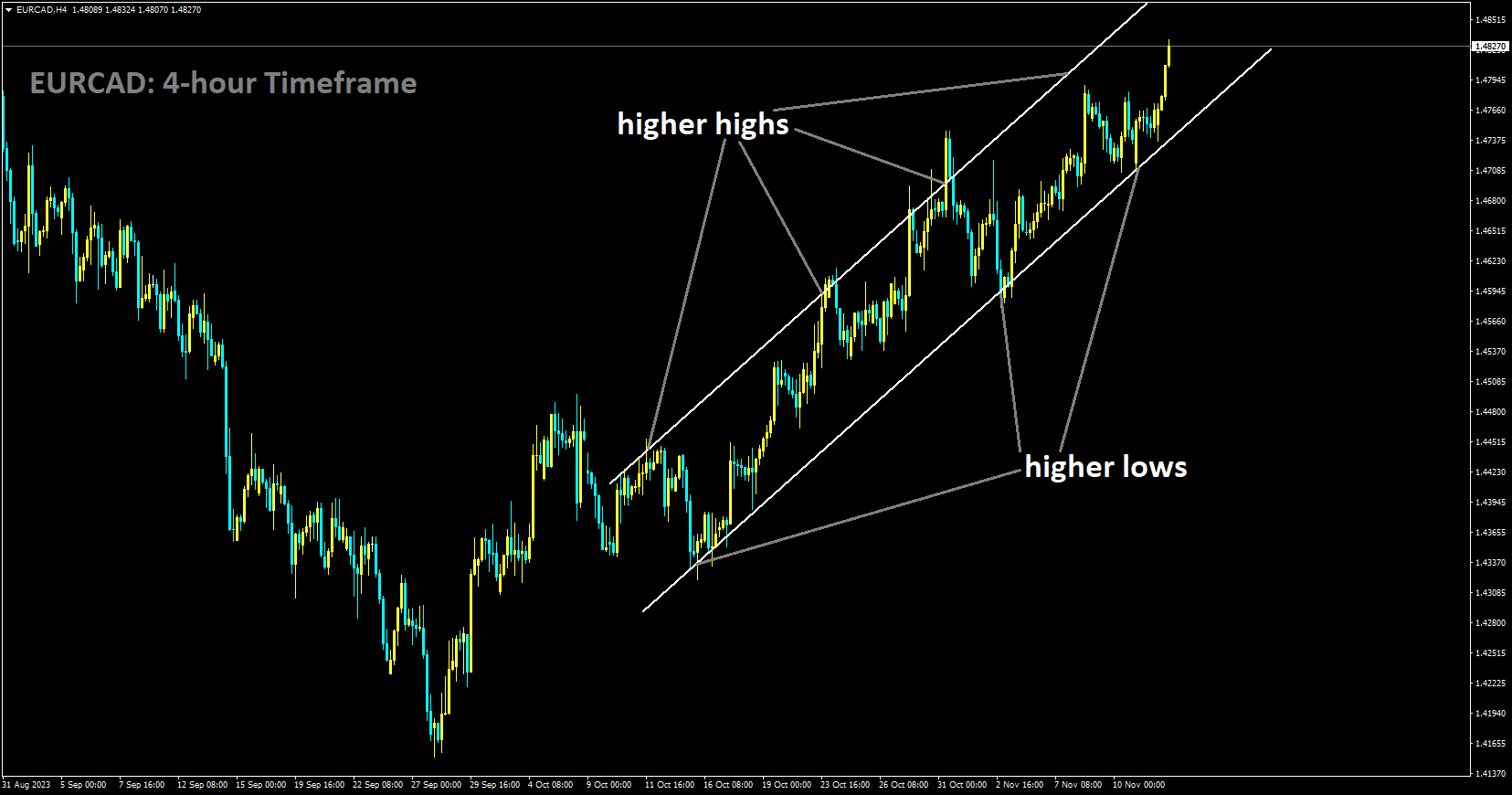

EURCAD Analysis:

EURCAD is moving in Ascending channel and market has rebounded from the higher low area of the channel

Deputy Governor Toni Gravelle of the Bank of Canada discussed financial stability and regulation within the Canadian economy during the Zurich meeting. The Canadian Dollar continues to exhibit weakness in the market, attributed to lower-than-expected demand for oil.

The Canadian Dollar is experiencing limited momentum in quiet holiday markets, as most Canadian provinces and territories observe Remembrance Day. With little notable economic data on the agenda for the CAD this week, the Loonie’s trajectory will be influenced by overall market sentiment as the trading week unfolds. The scarcity of substantial economic data for CAD traders underscores the likelihood of the Loonie being guided by market flows, particularly with a robust US data schedule scheduled for the week.

On early Tuesday, Bank of Canada Deputy Governor Toni Gravelle is set to deliver remarks as part of a panel discussion titled Challenges for Financial Stability and Financial Regulation amid Heightened Uncertainty. Gravelle is participating in the Third High-Level Conference on Global Risk, Uncertainty, and Volatility in Zurich, Switzerland. While the BoC Deputy Governor’s comments are not anticipated to significantly impact the markets, investors are advised to remain vigilant.

On early Tuesday, Bank of Canada Deputy Governor Toni Gravelle is set to deliver remarks as part of a panel discussion titled Challenges for Financial Stability and Financial Regulation amid Heightened Uncertainty. Gravelle is participating in the Third High-Level Conference on Global Risk, Uncertainty, and Volatility in Zurich, Switzerland. While the BoC Deputy Governor’s comments are not anticipated to significantly impact the markets, investors are advised to remain vigilant.

EURAUD Analysis:

EURAUD is moving in Ascending channel and market has rebounded from the higher low area of the channel

Assistant Governor Marion Kohler of the Reserve Bank of Australia (RBA) mentioned that inflation in the Australian economy is elevated, primarily influenced by robust consumer demand and strong labor and wage conditions. The RBA is anticipated to implement a rate hike in the first half of 2024.

The Reserve Bank of Australia Assistant Governor (Economic) Marion Kohler remarked that the decline in inflation is expected to be slower than initially anticipated, citing sustained domestic demand and robust labor and cost pressures. Kohler emphasized the need for a tighter policy to counter elevated inflation.

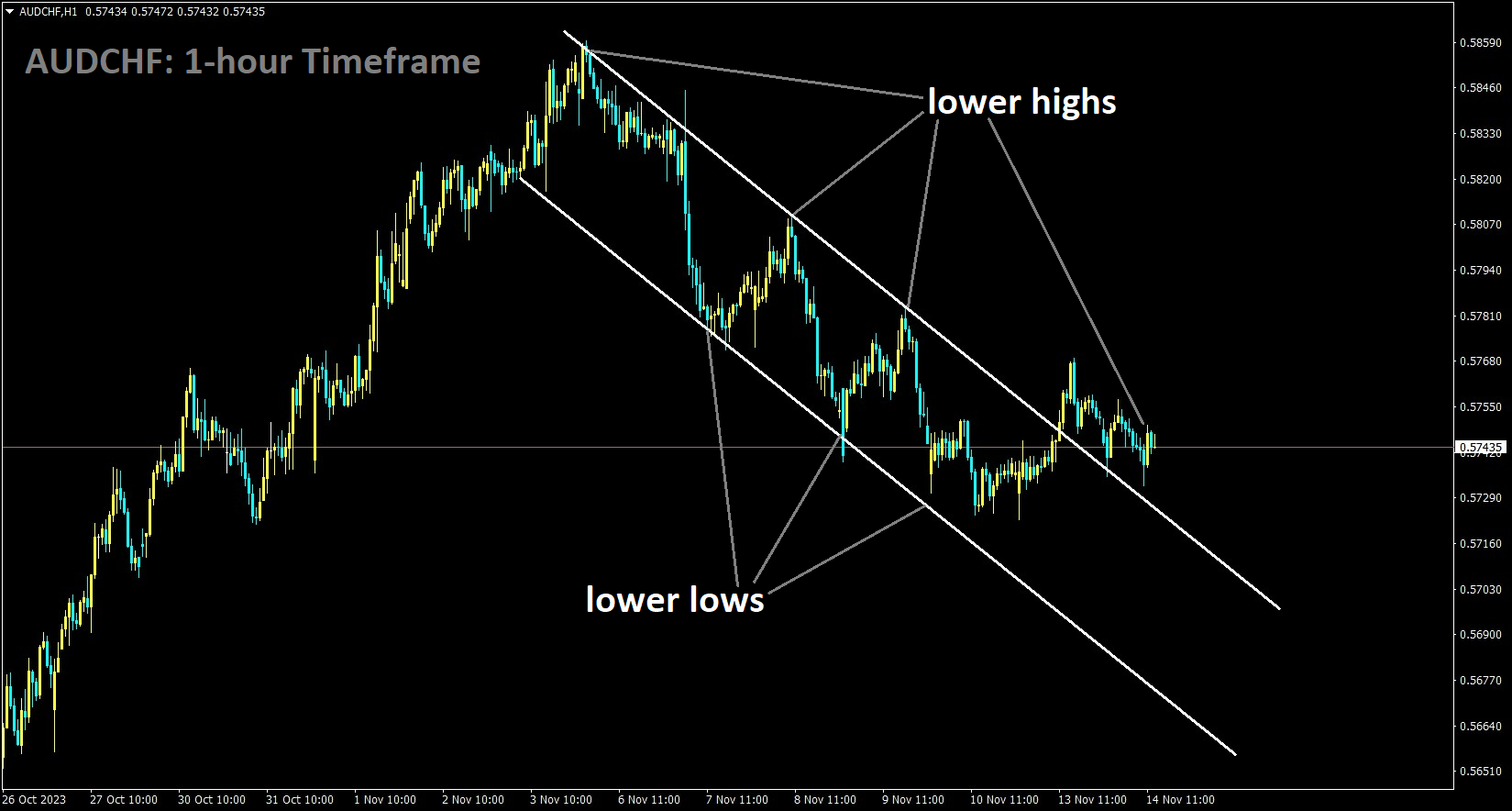

AUDCHF Analysis:

AUDCHF is moving in the Descending channel and the market has reached the lower high area of the channel

Market expectations lean towards additional rate hikes by the RBA in the first half of the coming year. Looking ahead, market participants will monitor Australia’s Westpac Consumer Confidence and the National Australia Bank’s Business surveys. Additionally, the US CPI data is scheduled for release on Tuesday. Later in the week, attention will turn to Australia’s Q3 Wage Price Index on Wednesday and the employment report on Thursday.

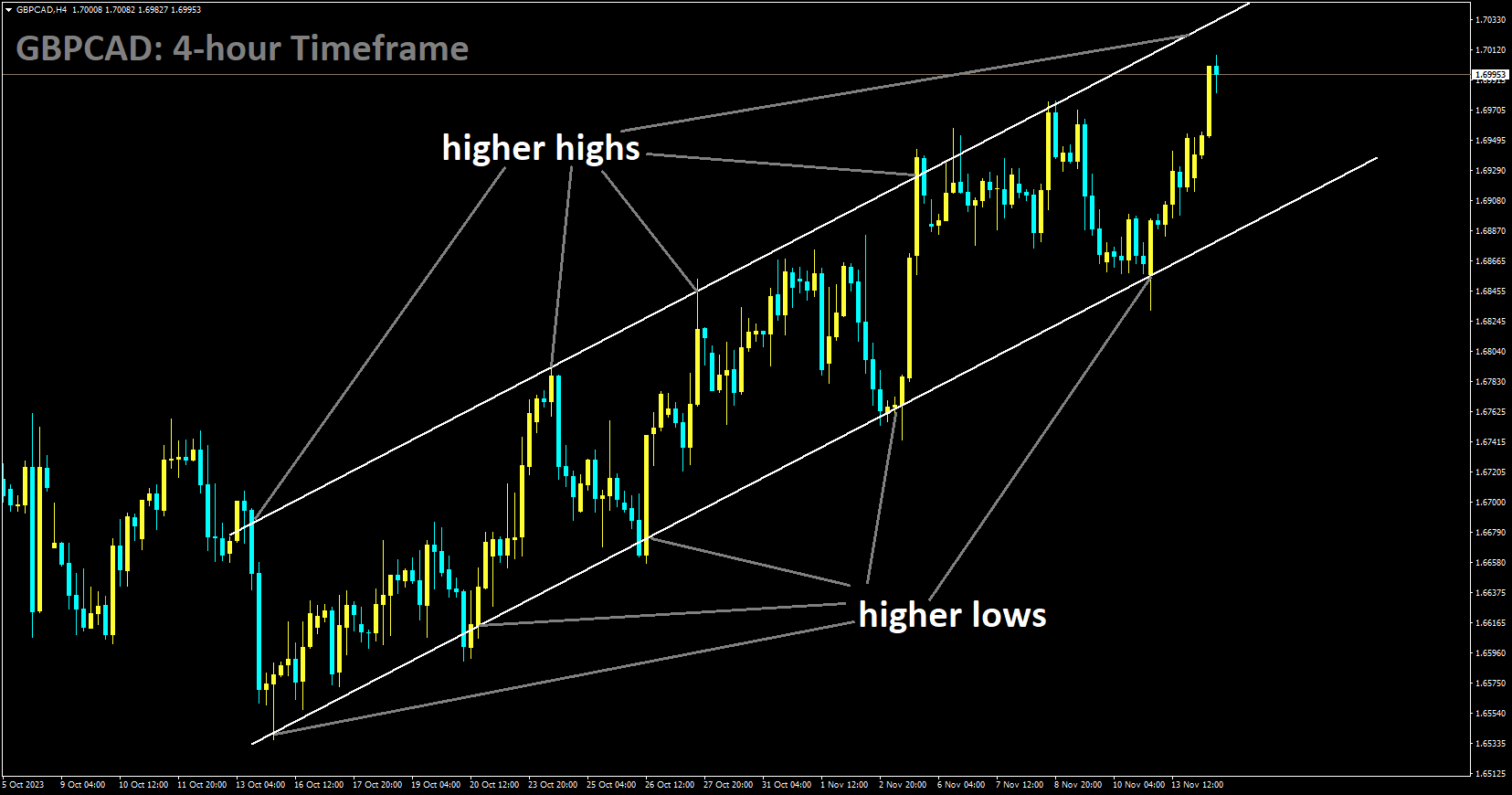

GBPCAD Analysis:

GBPCAD is moving in Ascending channel and market has reached higher high area of the channel

In the quarter ending in September, the unemployment rate stood at 4.2%, aligning with the anticipated data. Jobless claims for September totaled -17.8K, a decrease from -20.4K in August. Additionally, the employment change for September reported a figure of -207K, contrasting with the -82K recorded in August.

The Office for National Statistics revealed that the United Kingdom’s ILO Unemployment Rate remained stable at 4.2% in the quarter ending in September, aligning with the market forecast for the same period. Additional data disclosed that the count of individuals claiming unemployment benefits increased by 17.8K in September, a slight decrease from the previous rise of 20.4K.

The British Employment Change for September reported a figure of -207K, contrasting with the -82K recorded in August.

In terms of earnings, the Average Earnings excluding Bonus in the UK exhibited a 7.7% year-on-year increase in September, slightly lower than the 7.8% growth observed in August but in line with market expectations. Furthermore, another gauge of wage inflation, Average Earnings including Bonus, showed a 7.9% acceleration during the reported period, compared to an 8.2% increase in August and exceeding the anticipated 7.4%.

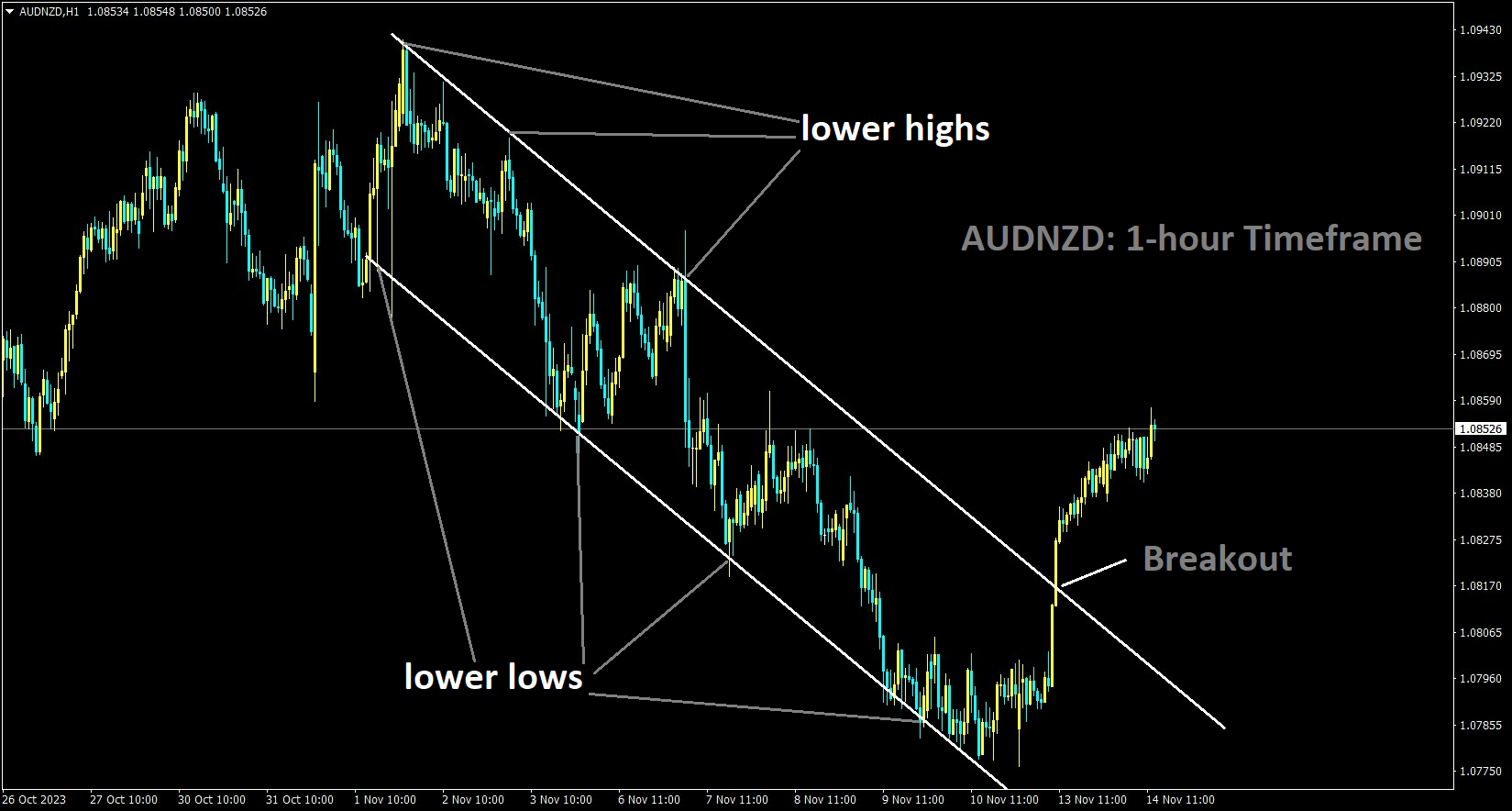

AUDNZD Analysis:

AUDNZD has broken the Descending channel in upside

The New Zealand Dollar Food Price Index fell below expectations, registering at -0.90%. This index holds a 19% weight in the Consumer Price Index. Analysts from Goldman Sachs indicated that the Reserve Bank of New Zealand has initiated rate cuts in Q4 of 2024, signaling the conclusion of the rate hike cycle in the New Zealand economy. It is anticipated that inflation will subside in Q4 2024.

The New Zealand Dollar is under downward pressure, potentially stemming from the Kiwi Food Price Index reporting a 0.9% decline in October. Given that food prices make up almost 19% of the NZ Consumer Price Index, the Food Price Index holds significance as an indicator of inflation in the country.

It monitors the prices of a basket of food items representing the typical spending patterns of New Zealand households. Goldman Sachs is predicting a decrease in New Zealand CPI rates to below 3.0% by Q4 2024. This projection includes an expectation that the Reserve Bank of New Zealand has completed its rate hike cycles, and Goldman Sachs foresees the RBNZ initiating rate cuts starting in Q4 of 2024.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% FLAT OFFER for Signals 😍 GOING TO END – Get now: forexfib.com/discount/