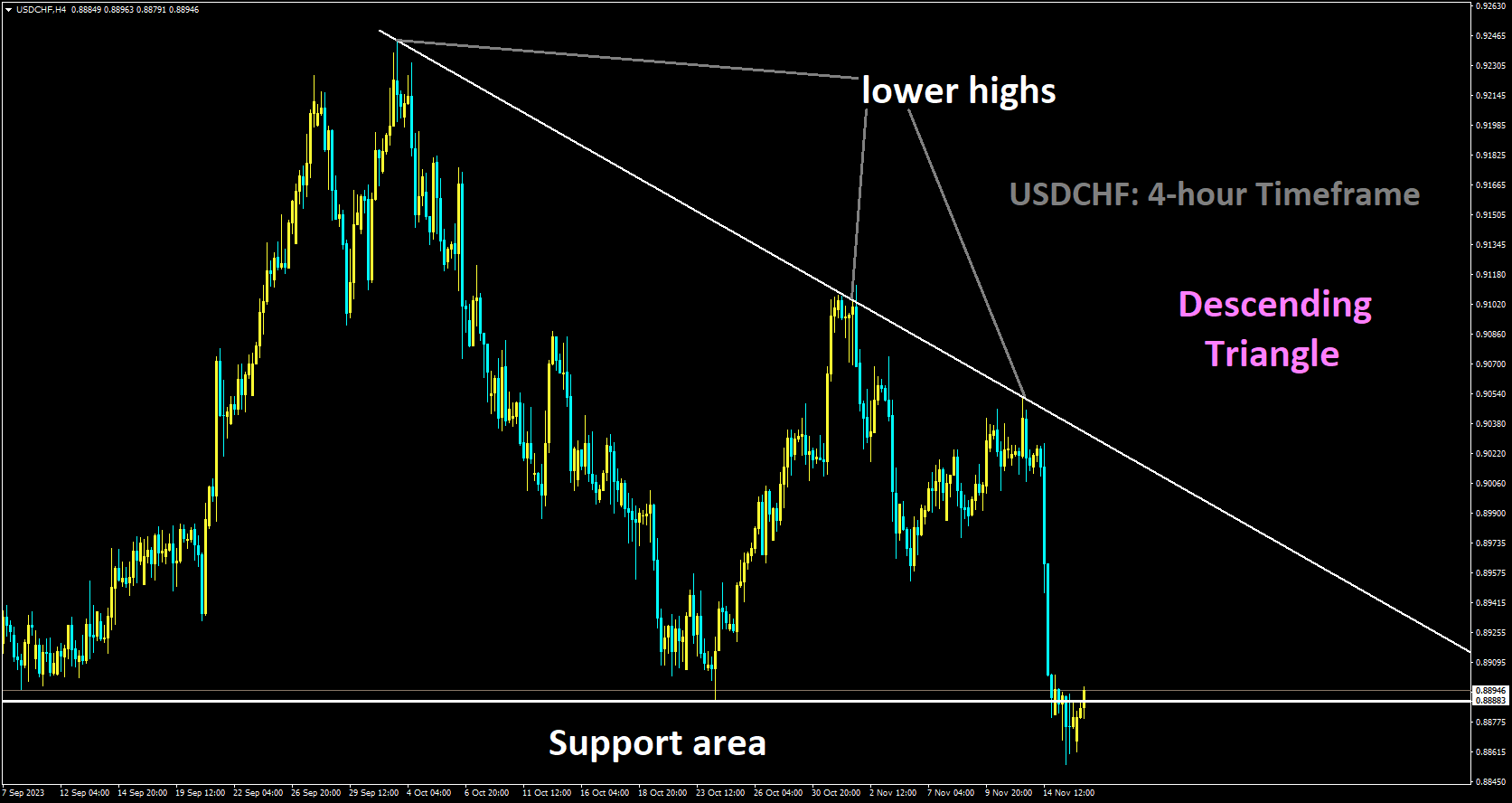

USDCHF Analysis:

USDCHF is moving in Descending Triangle and market has reached support area of the pattern

The US Dollar Index exhibited improvement following the release of economic data from the United States on Wednesday. October’s US Retail Sales showed a modest easing at 0.1%, contrary to expectations of a more pronounced decline of 0.3%. However, the unexpected decrease in the US Producer Price Index by 0.5%, compared to the anticipated 0.1% increase, and the decline in the annual PPI from 2.2% to 1.3%, raised concerns about potential challenges to progress on inflation. This uncertainty justified the Federal Reserve’s cautious stance, even in the face of recent data showing a decline in inflation, introducing an element of unpredictability. The impending Fed policy decision for the December meeting has, in turn, garnered support for the USDCHF pair. Additionally, the USDCHF pair has experienced a rebound, driven by an increase in US Treasury yields, with the 2-year rate at 4.90% and 10-year rates at 4.50%, as of the current writing.

Swiss National Bank Chairman Thomas Jordan, in an interview with a local television station, did not rule out the possibility of more interest rate hikes in the future. This statement may have contributed to upward support, shoring up the Swiss Franc in recent sessions. The focus on Friday will be on Swiss Industrial Production for the third quarter, providing insights into whether the Swiss National Bank (SNB) will consider an interest rate increase in the December meeting. However, attention will also be on the weekly US Jobless Claims to be released later in the North American session, offering further insights into the condition of the US labor market.

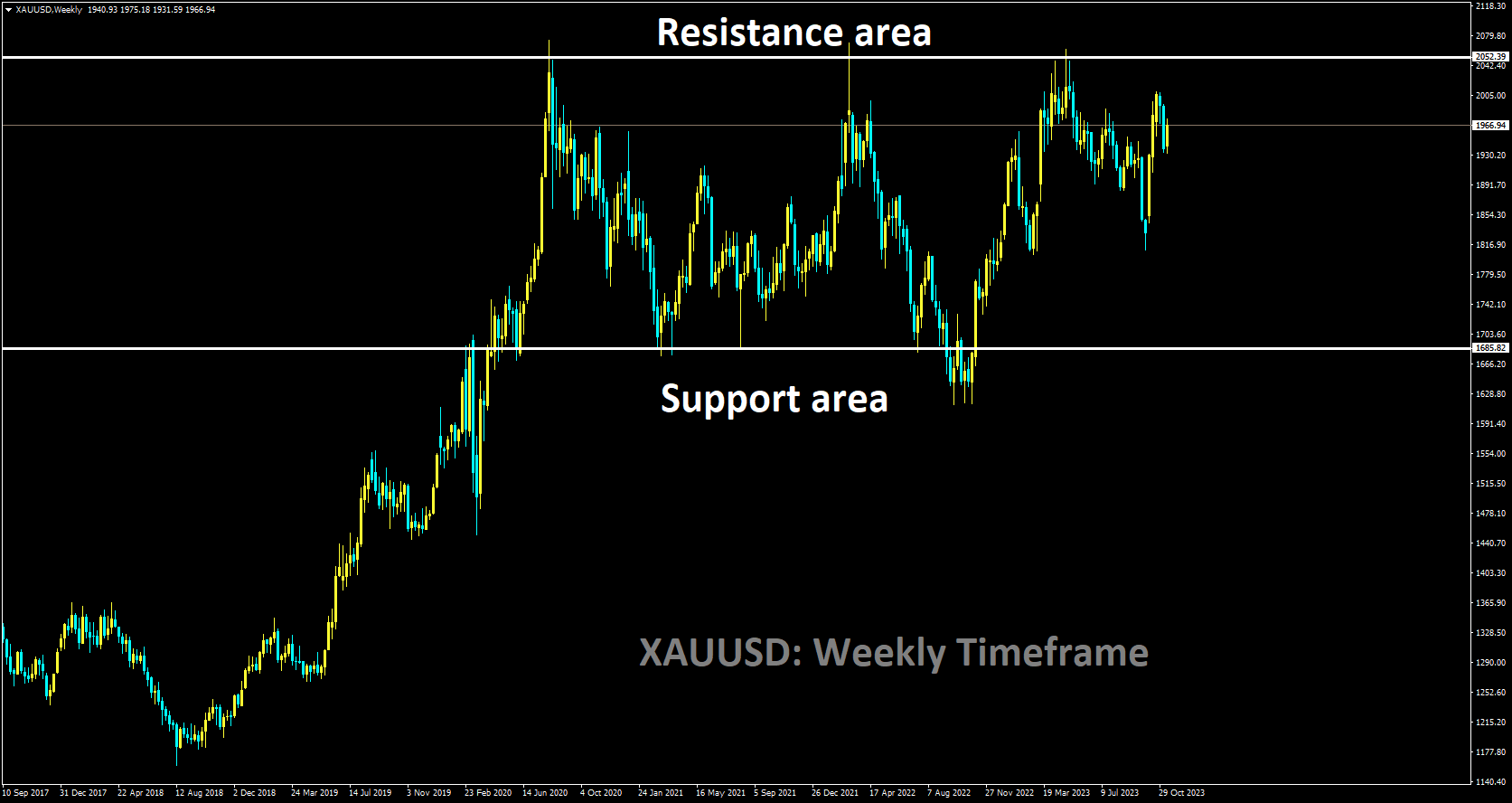

GOLD Analysis:

XAUUSD is moving in Box pattern

Gold prices continued to rise, albeit with trimmed gains as the United Kingdom joined other developed economies in potentially easing inflationary pressures. Official data disclosed a two-year low in the annual headline consumer price rise for October, at 4.6%, a substantial slowdown from the previous month’s 6.7%. Lower fuel prices were a contributing factor to this downturn. Even the core inflation measure, excluding fuel, declined from 6.1% to 5.7%. This trend aligns with recent data from the US, where a reduction in price pressures has created a positive environment for gold.

Investors are increasingly hopeful of victory against inflation, especially as many central banks have raised interest rates. The anticipation of potential interest rate cuts in the first half of the coming year is growing. Despite gold’s reputation as an inflation hedge, it has faced challenges amid rising borrowing costs.

Investors have shifted towards more lucrative returns in bond markets, impacting both non-yielding assets like gold and riskier investments like equities. The recent boost in gold prices can be attributed, in part, to the softer inflation figures and geopolitical tensions in Ukraine and the Middle East.

However, caution is warranted as markets might be overly optimistic. Inflation, while showing recent weakness, remains above central bank targets globally. Interest rates are likely to remain stable as long as inflation persists. Historical lessons from the inflationary era of the 1970s underscore the difficulty of eradicating entrenched inflation, which may not follow the linear decline anticipated by current market expectations. Nevertheless, the current momentum favors gold bulls, with geopolitical uncertainties providing additional support. Looking ahead, Friday brings heavyweight price data with the Eurozone’s final core CPI rate taking center stage. Expectations are for a slight easing to 4.2% from 4.5%. A print in line with expectations is likely to be well received by the gold market.

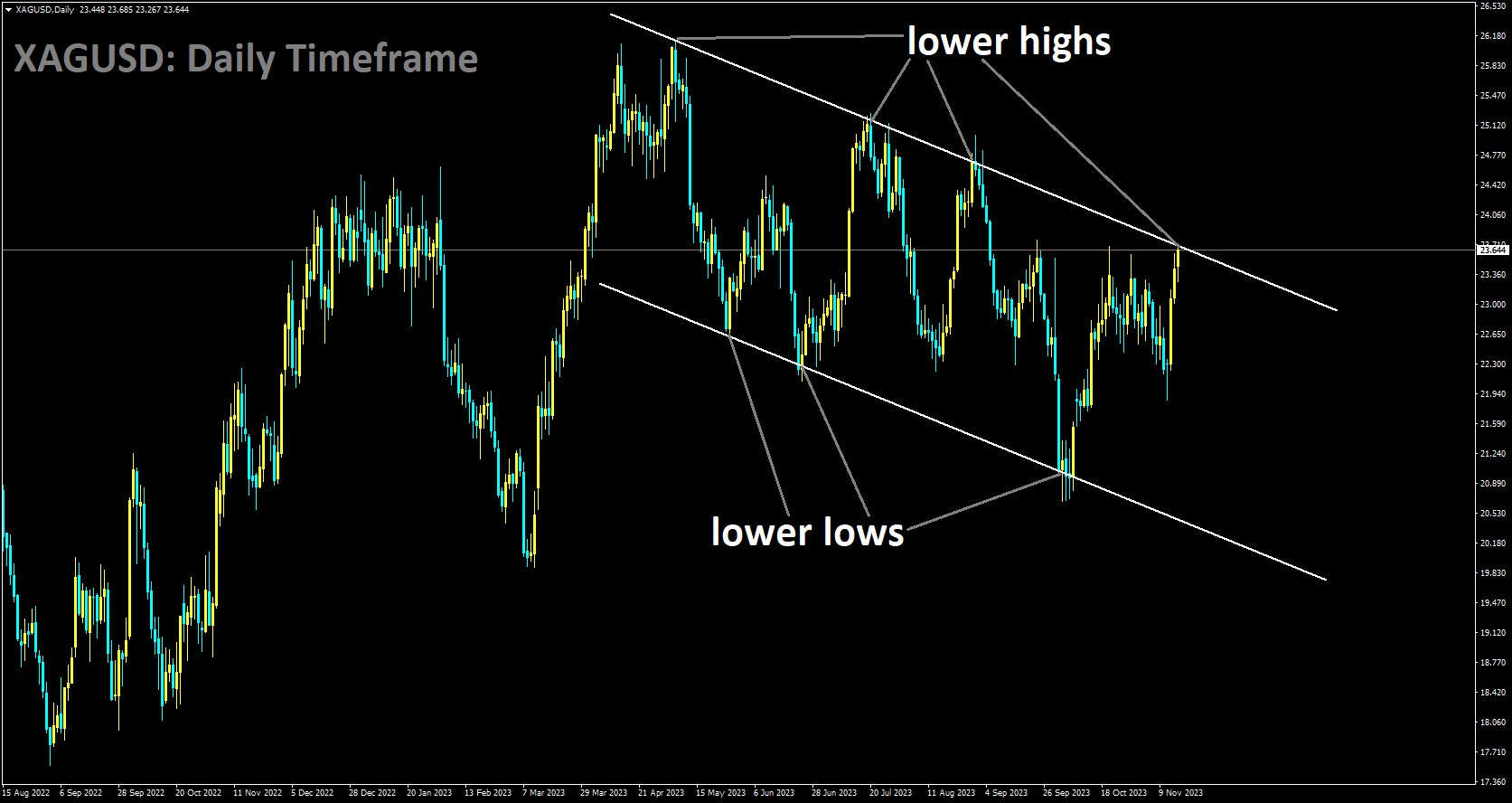

SILVER Analysis:

XAGUSD is moving in Descending channel and market has reached lower high area of the channel

US retail sales interrupted a streak of six consecutive positive performances, registering a 0.1% decline compared to September. Furthermore, September’s initially reported increase of +0.7% was revised upward to +0.9%. Retail sales have been a significant contributor to the robust performance of the US economy, playing a pivotal role in the impressive Q3 GDP outperformance driven by American consumers. However, leading indicators such as softened labor data, including NFP and average weekly earnings, along with a recent decrease in the Consumer Price Index, set a cautious tone ahead of the retail sales data release.

Interestingly, the market’s response appears to be influenced more by the actual retail sales figures rather than the consensus, with both the dollar and the 2-year treasury yield experiencing increases despite the month-on-month contraction in retail sales. As the holiday season approaches, markets are now turning their attention to the possibility of a “Santa rally,” assessing the potential market dynamics leading up to Christmas.

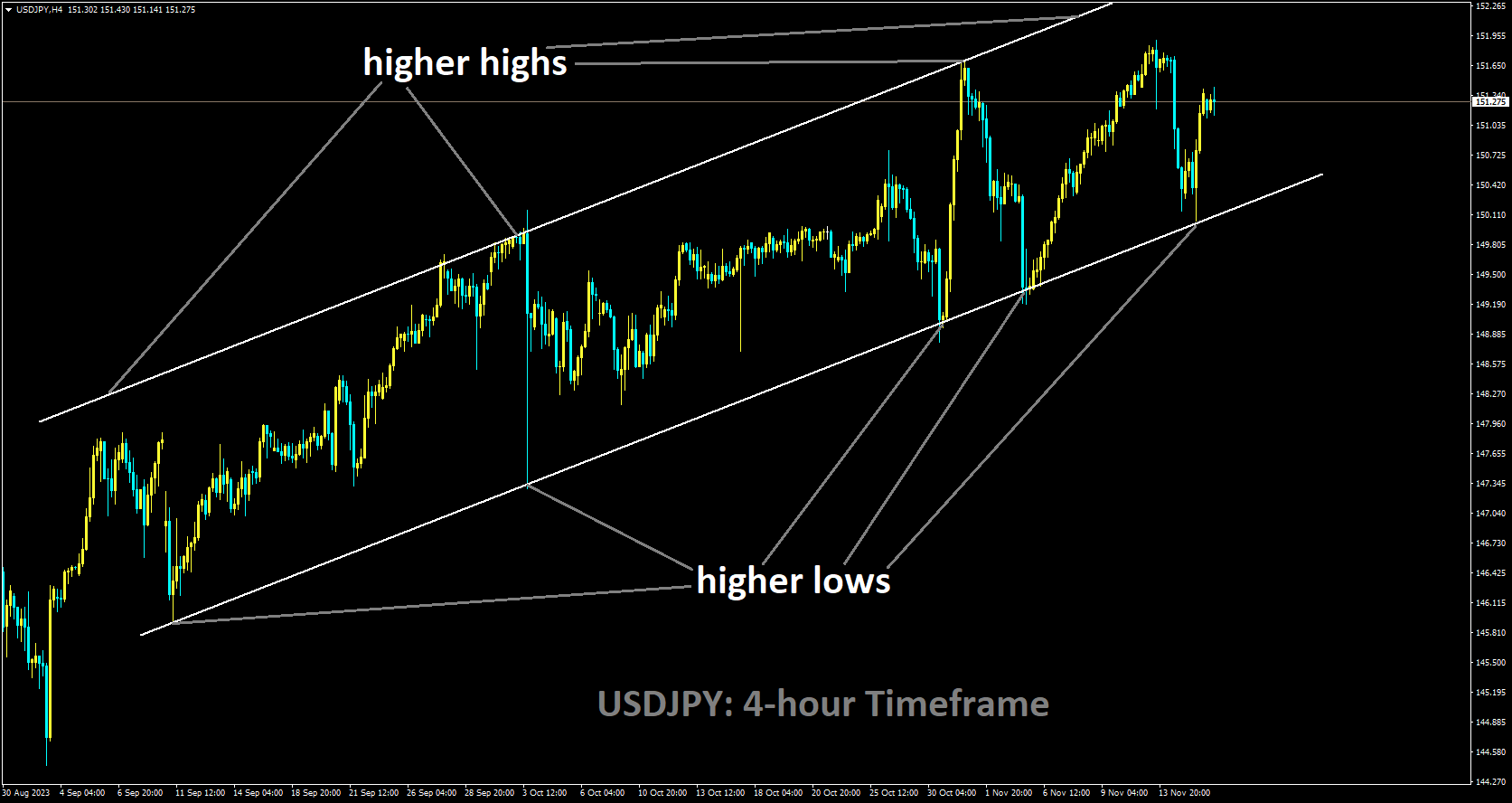

USDJPY Analysis:

USDJPY is moving in Ascending channel and market has rebounded from the higher low area of the channel

Strong Retail Sales figures in the US and disappointing Q3 Gross Domestic Product figures from Japan have fueled dovish expectations regarding the Bank of Japan. In October, the US Producer Price Index reported a 1.3% increase, falling short of the expected 1.9% rise. Additionally, a monthly decline of 0.5% was observed, contrasting with the projected 0.1% growth. On the contrary, Retail Sales experienced a marginal decrease of 0.1%, surpassing the anticipated 0.3% contraction. Year-on-year, sales rose by 2.5%, indicating a slower growth rate compared to September’s 4.1% increase.

In response, the US Dollar garnered some demand as markets expressed concerns that robust data might prompt Federal Reserve officials to consider further tightening, leading to a rise in US Treasuries after the release. However, given the reports of cooling inflation and job creation figures, the prevailing sentiment suggests that the Federal Reserve is unlikely to hike in the upcoming December meeting. On the Japanese Yen’s side, Japan’s Q3 GDP contracted by -0.5% QoQ, below expectations of -0.1% and significantly lower than the corresponding 1.2% growth recorded in Q2. This marks its weakest reading since Q1 2022. Consequently, Japanese Government Bond Yields experienced a sharp decline, reflecting the anticipation that the Bank of Japan won’t rush to hike rates due to the weakening economy. In alignment with this sentiment, the World Interest Rate Probabilities tool indicates a postponement in liftoff expectations until June.

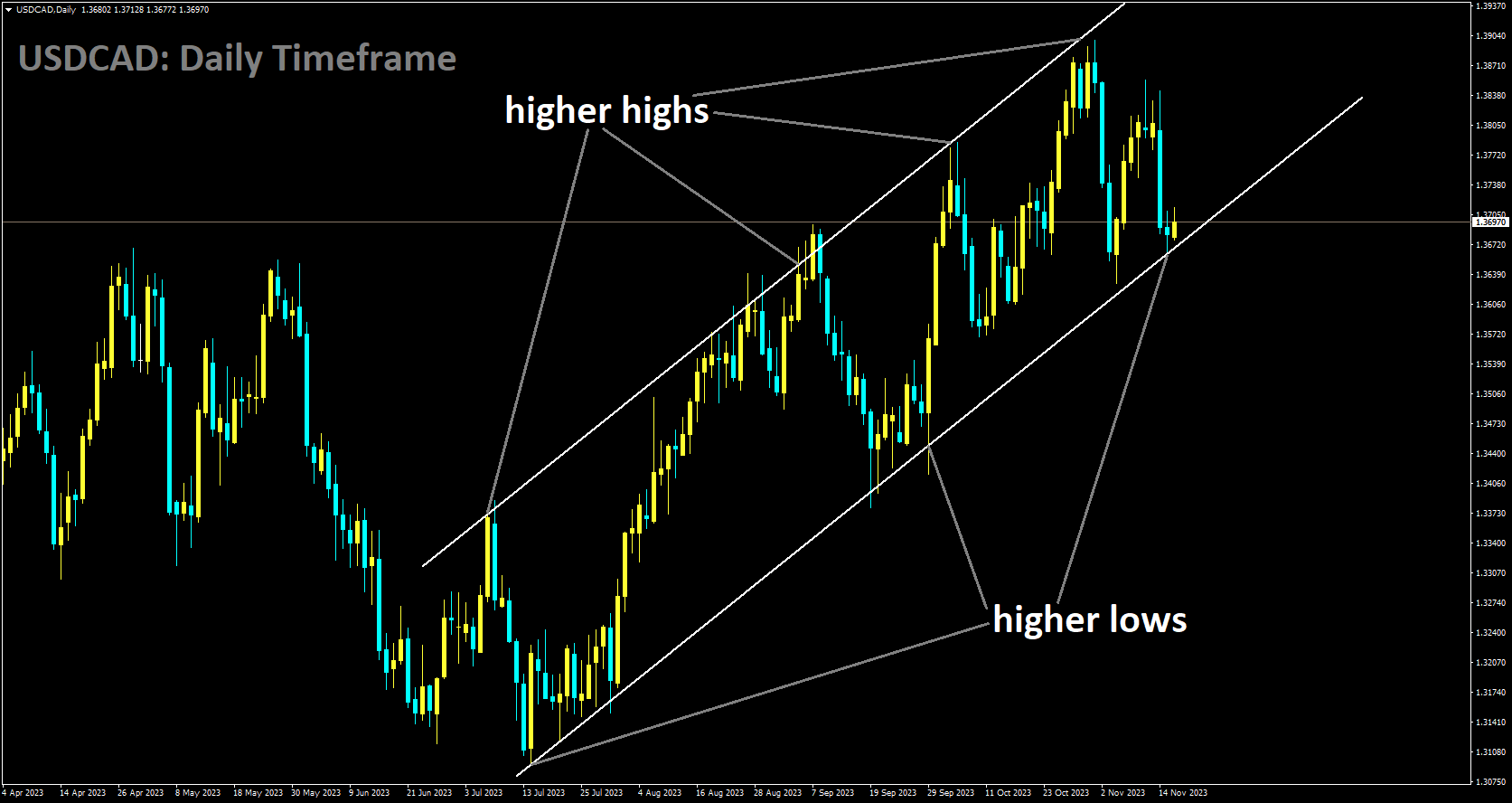

USDCAD Analysis:

USDCAD is moving in Ascending channel and market has reached higher low area of the channel

The analysis of the USDCAD pair for October reveals that the US Consumer Price Index (CPI) exhibited a performance that was less robust than initially anticipated. The headline inflation remained stagnant at 0.0% month-on-month (m/m) with a 3.2% year-on-year (y/y) increase, which was lower than the figures recorded in September at 0.4% m/m and 3.7% y/y. This stability in October was achieved through a delicate balance, as the ongoing increase in housing and food costs counteracted the decline in gasoline prices. In contrast, the core CPI inflation, which excludes volatile items, saw a modest rise of 0.2% m/m and 4.0% y/y, slightly down from 0.3% m/m and 4.1% y/y in September.

Looking forward, the forecast indicates an expected gradual cooling of headline inflation towards the end of 2023 and into 2024. The projection for December 2023 suggests headline CPI inflation to be around 3.2%, resulting in an annual average of approximately 4.1% for the full year of 2023. Furthermore, core inflation is anticipated to follow a similar easing trend, possibly reaching 3.9% y/y by the end of 2023, which is still notably above the Federal Reserve’s 2% target. The annual average for core inflation in 2023 is projected to be 4.8%, with a further decline to an average of 2.2% in 2024.

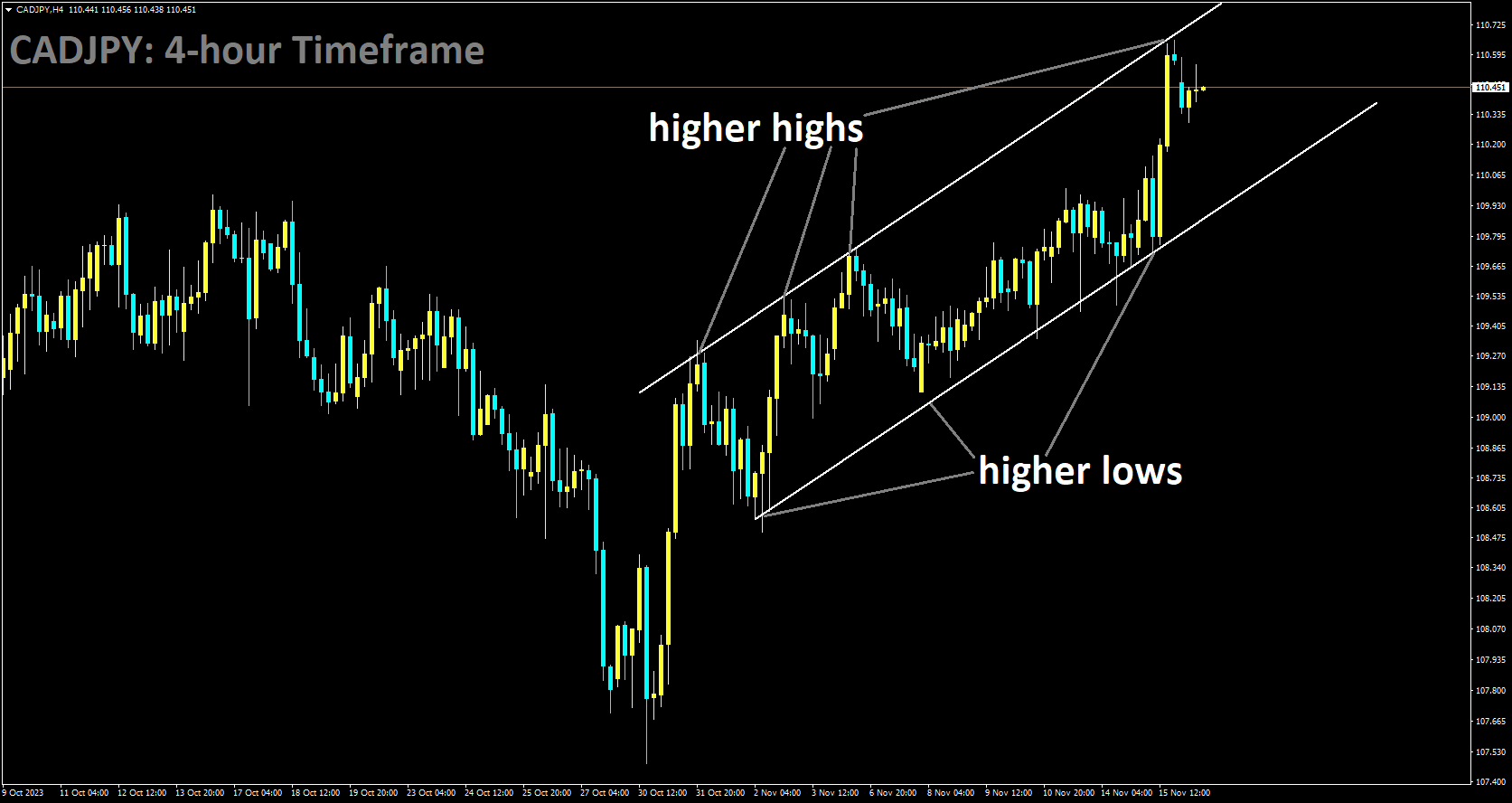

CADJPY Analysis:

CADJPY is moving in Ascending channel and market has reached higher high area of the channel

The Canadian Dollar continued its positive momentum against the US Dollar, displaying gains for the second consecutive day. This upward movement was supported by better-than-expected wholesale and business sales figures in Canada. However, the Canadian Dollar’s ascent was tempered by the decline in Crude Oil prices. Notably, Canada’s manufacturing sales exceeded forecasts in September, while wholesale sales softened but still outperformed expectations.

On the US front, Retail Sales for October fell short of expectations, contributing to the dynamics of the CADJPY pair. Market participants are closely monitoring additional data points, such as Canadian Housing Starts and changes in employment insurance benefits recipients, to gain further insights into the Canadian economic landscape and potential impacts on the currency pair.

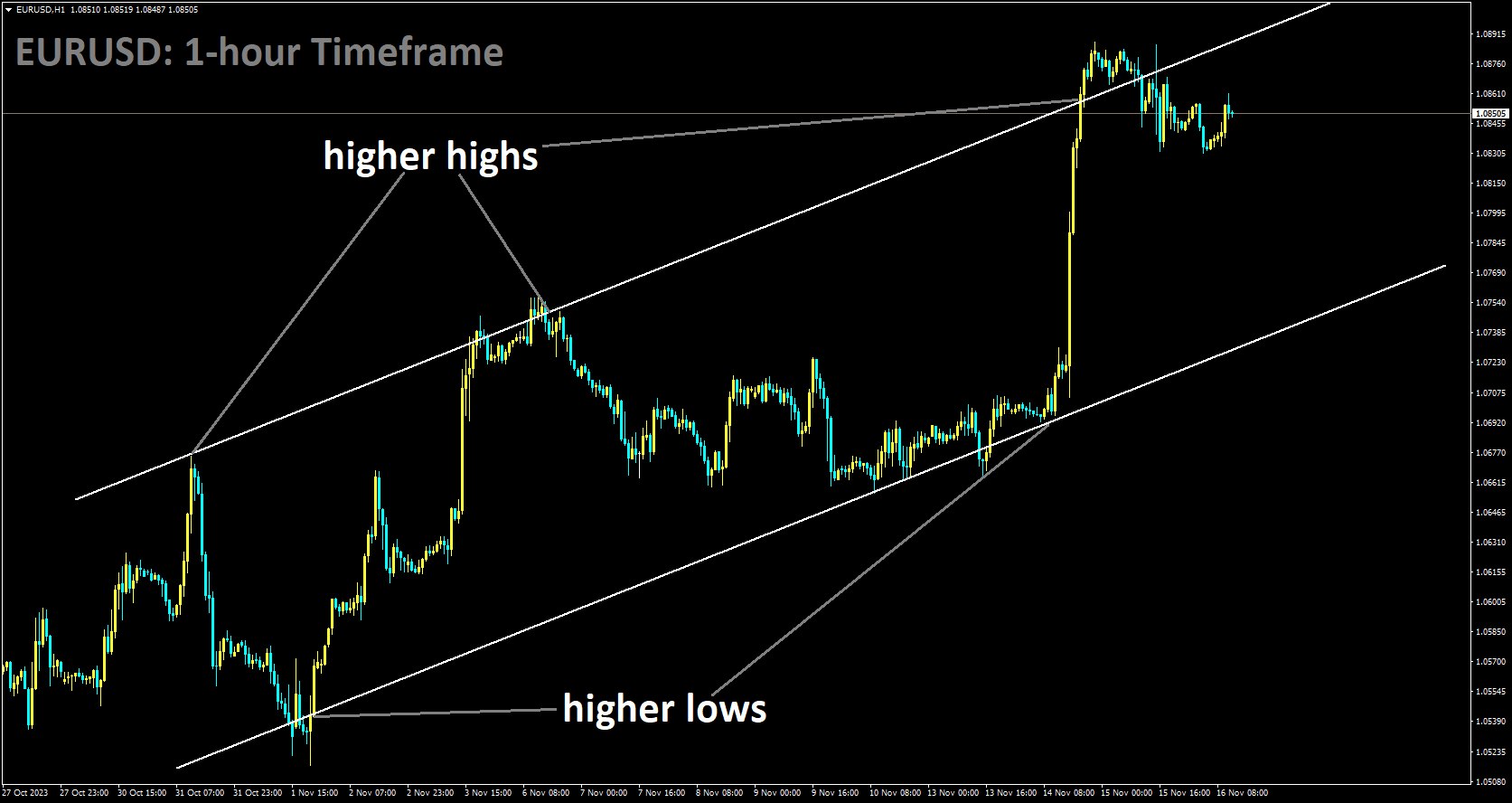

EURUSD Analysis:

EURUSD is moving in Ascending channel and market has fallen from the higher high area of the channel

The analysis of EURUSD indicates a shift in market sentiment as the US economy experiences a cooling trend. There is a growing perception that the Federal Reserve (Fed) has concluded its hiking cycle. October’s US Producer Price Index (PPI) recorded a 0.5% month-on-month decrease, contrasting with a 0.4% increase in September. Concurrently, Retail Sales declined by 0.1% during the same period, contrary to expectations of a 0.3% fall. However, Core Retail Sales showed a modest rise of 0.2%, improving from the previous reading of 0.6%.

In contrast, the Eurozone witnessed a decline in industrial production in September, with a 1.1% month-on-month decrease compared to the previous 0.6% rise. On a yearly basis, the figure plummeted by 6.9%, contrasting with the 5.1% decline in the prior reading. This exerted selling pressure on the Euro against the US Dollar. Looking ahead, market participants are closely monitoring European Central Bank (ECB) President Lagarde’s speech and the release of US weekly Initial Jobless Claims for further insights into economic conditions and potential market impacts.

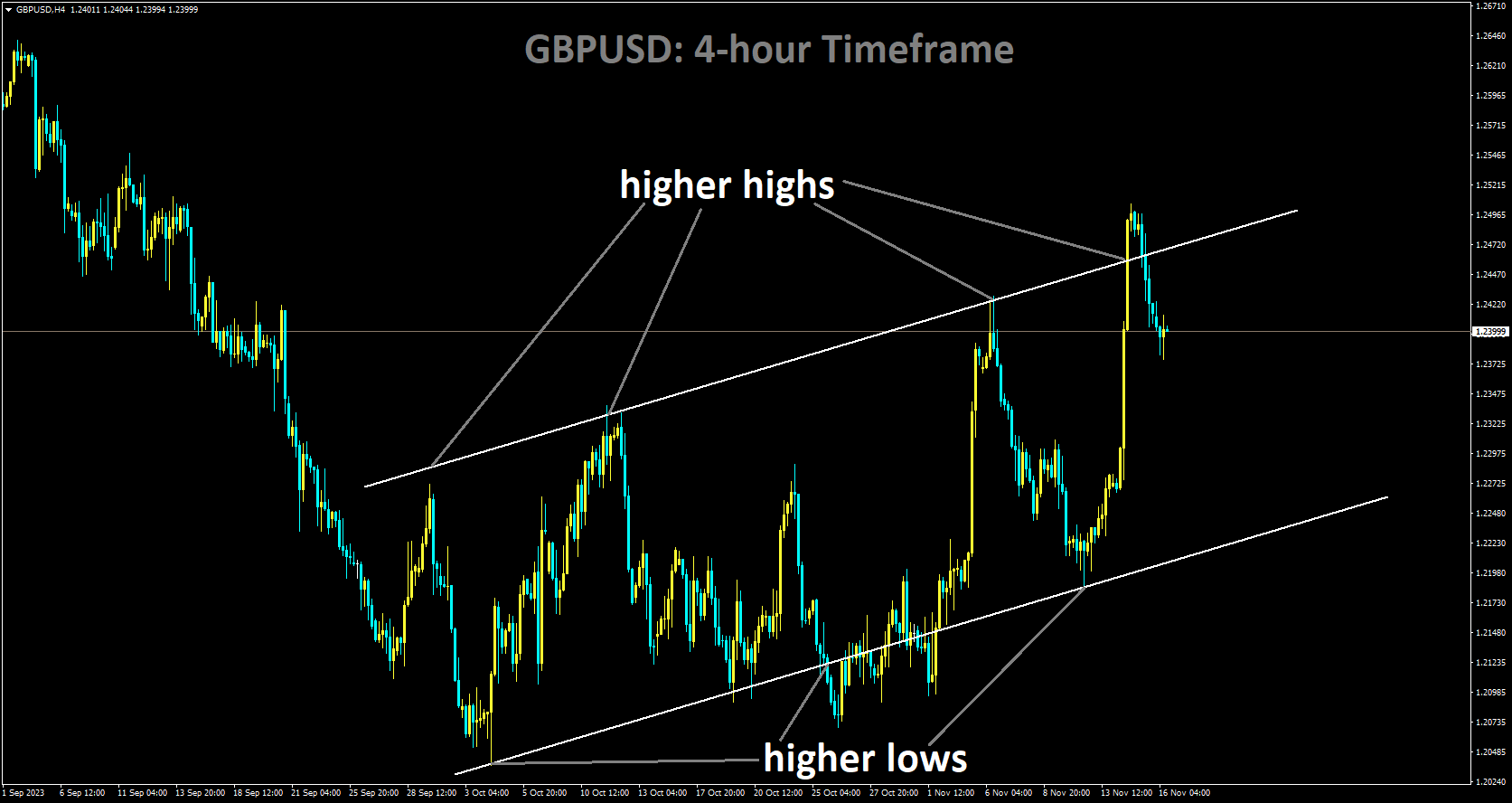

GBPUSD Analysis:

GBPUSD is moving in Ascending channel and market has fallen from the higher high area of the channel

The analysis of GBPUSD reveals that UK inflation surpassed expectations, driven by declines in both core and headline measures. Notably, a significant drop in food and energy prices played a substantial role in this development, contributing to a substantial decrease in goods inflation from 6.2% to 2.9% when comparing October 2023 to the same period last year. Services inflation, another closely monitored metric, also experienced a modest decline from 6.9% to 6.6%.

This significant 12-month decline in headline inflation aligns with Rishi Sunak’s pledge to halve inflation by the end of 2023, reinforcing the belief that the Bank of England has concluded its interest rate hikes. However, areas such as inflation, average earnings, and services inflation continue to remain elevated, as previously highlighted by the Bank of England. While average earnings have received less recent attention, the immediate market reaction following the release had a relatively subdued impact on gains propelled by lower US CPI.

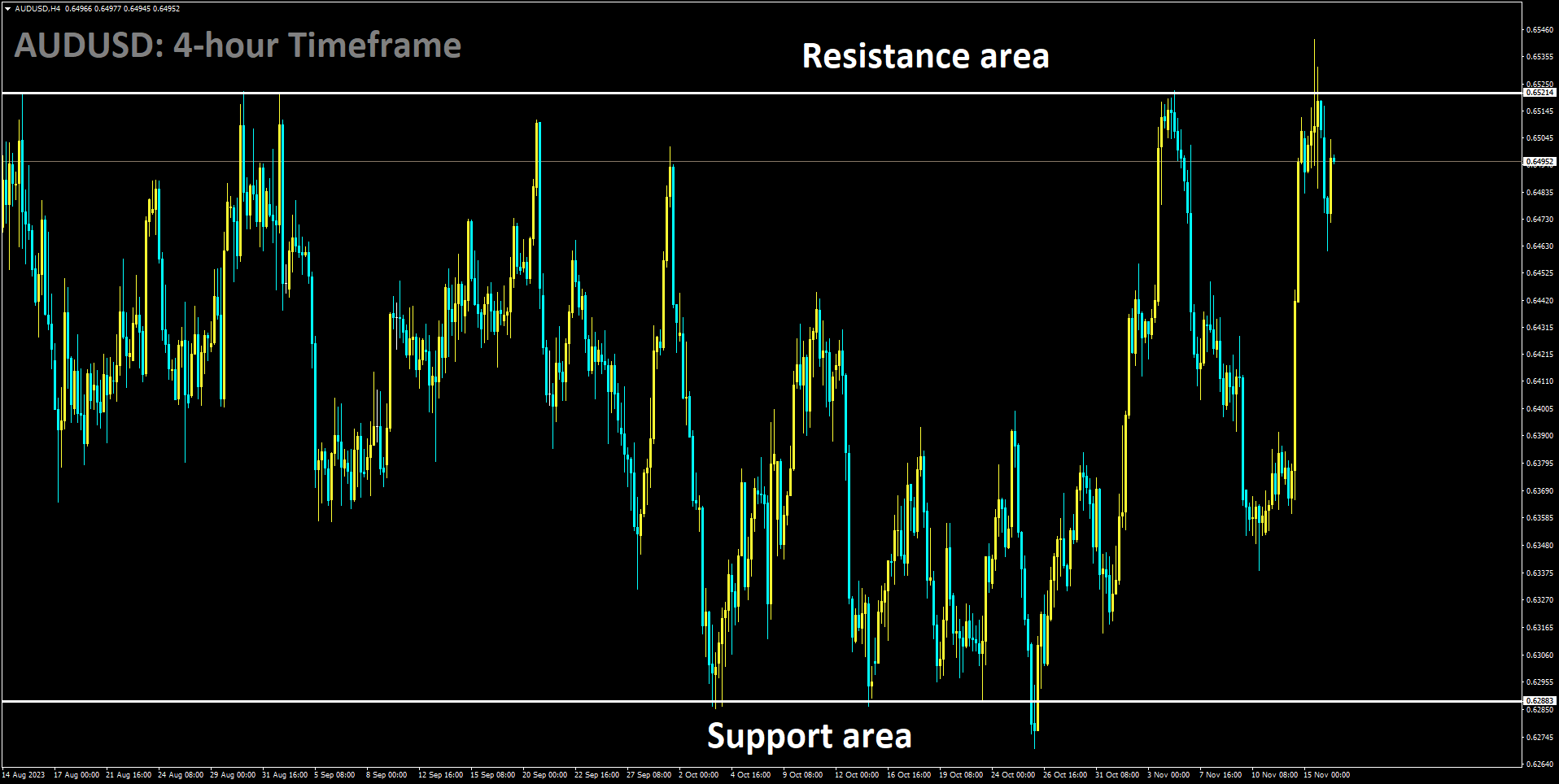

AUDUSD Analysis:

AUDUSD is moving in box pattern and market has fallen from the resistance area of the pattern

The analysis of AUDUSD suggests a negative bias following the release of Australian employment data, despite exceeding expectations. The seasonally adjusted Employment Change showed a rise of 55K in October, surpassing the anticipated 20K and the previous month’s 6.7K. However, the positive impact of this headline figure was somewhat diminished as the majority of the added jobs were part-time positions. Australia’s Unemployment Rate for October matched expectations at 3.7%, compared to the previous figure of 3.6%. Despite these positive employment figures, the AUDUSD pair experienced volatility in the prior session due to economic data released from the United States (US) on Wednesday. Australia’s Wage Price Index met expectations, growing by 1.3% compared to the previous reading of 0.8%, with a year-over-year increase of 4.0%, exceeding the anticipated 3.9%. On the sentiment front, Australia’s Westpac Consumer Confidence declined by 2.6% in November, reversing the previous growth of 2.9%.

RBA Assistant Governor (Economic) Marion Kohler remarked that the slowdown in inflation is expected to be slower than initially anticipated. This is attributed to the sustained high level of domestic demand and robust pressures from labor and other costs. Kohler emphasized the necessity for a tighter policy to address the challenges posed by elevated inflation. The National Australia Bank (NAB) economists foresee another 25 basis points hike in February following Q4 inflation data, with rate cuts unlikely until November 2024. Turning to China, Industrial Production in October showed growth at 4.6%, a slight increase from the previous 4.5%, contrary to expectations of consistency. Retail Sales year-over-year experienced an uptick to 7.6%, surpassing the anticipated 7.0%. Meanwhile, in the US, the Consumer Price Index for October reported lower readings than expected, with the annual rate slowing from 3.7% to 3.2%, below the consensus forecast of 3.3%. The monthly CPI reduced to 0.0% from 0.4%, while the US Core CPI rose by 0.2%, falling short of expectations at 0.3%, and the annual rate decreased to 4.0% from the previous 4.1%. Lastly, the US Monthly Budget Statement reported a deficit of $67B in October, compared to the expected deficit of $65B.

NZDUSD Analysis:

NZDUSD is moving in Ascending channel and market has fallen from the higher high area of the channel

The analysis of the NZDUSD pair indicates an upward boost for the New Zealand Dollar, propelled by positive economic data from China. China’s injection of 1 trillion Yuan in low-cost financing for its property sector aimed at alleviating concerns about a credit crunch is seen as a strategic move with potential ripple effects on global economies, including New Zealand. The Kiwi Dollar benefitted from the favorable impact of this positive news flow from China, especially considering New Zealand’s status as a major exporter of dairy products to the Chinese market.

However, on Thursday, data revealed a 0.38% decline in China’s House Price Index for October, signalling a deteriorating condition in China’s property sector. Concurrently, the US Dollar Index strengthened following Wednesday’s release of economic data from the United States, marking a second consecutive day of gains. At the time of writing, the spot price hovers around 104.50.

In the US, October’s Retail Sales showed a modest easing at 0.1%, below the expected decline of 0.3%, potentially posing challenges to progress on US inflation. The Federal Reserve’s cautious stance, despite recent soft inflation data, introduces an element of uncertainty into the market. Additionally, the unexpected 0.5% decline in the US Producer Price Index (PPI), compared to the anticipated 0.1% increase, and the drop in the annual PPI from 2.2% to 1.3%, may moderate market sentiment regarding further rate hikes by the Fed. Market participants are likely anticipating insights from the upcoming release of the weekly US Jobless Claims later in the North American session, especially considering the US labor market’s potential role as a catalyst for higher inflation, which could influence overall market dynamics.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% FLAT OFFER for Signals 😍 GOING TO END – Get now: forexfib.com/discount/