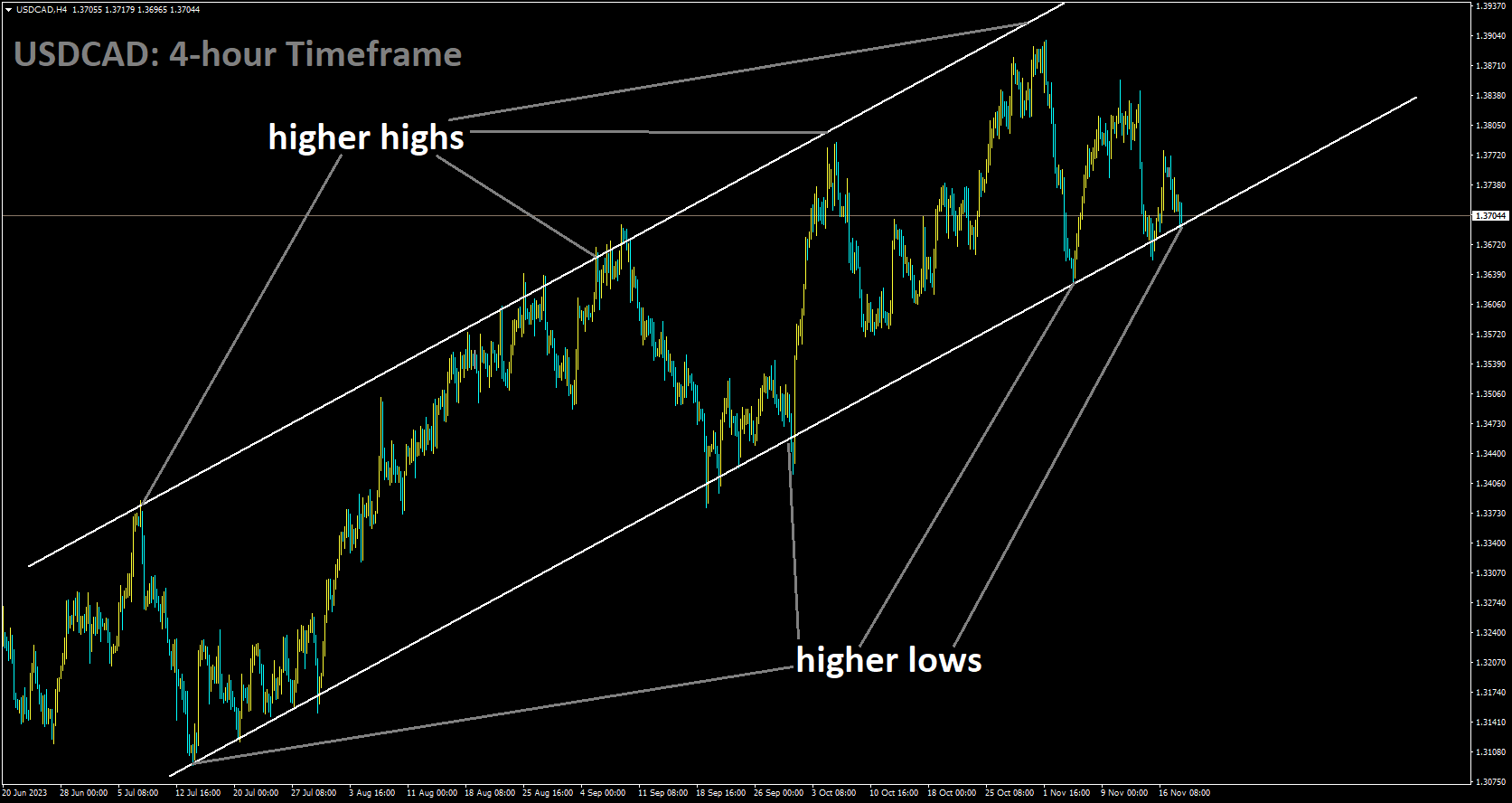

USDCAD Analysis:

USDCAD is moving in Ascending channel and market has reached higher low area of the channel

The Bank of Canada has maintained interest rates due to the decline in oil prices. With cooling inflation and other economic indicators trending downwards, the Canadian Dollar has weakened against its counterparts.

Saudi Arabia expresses its intention to reduce daily oil production by 1 million barrels per day, as reported by the Financial Times. However, there are doubts about the practicality of this plan. The ongoing war conflict is cited as a factor contributing to stabilizing oil prices, in accordance with statements from Saudi Arabia.

Last week, Federal Reserve officials reiterated their stance on the monetary policy outlook. Boston Federal Reserve President Susan Collins emphasized the Fed’s commitment to reducing inflation without causing significant harm to the labor market, advocating a patient approach to future interest rate moves. Concurrently, Fed President Austan Goolsbee expressed confidence that inflation would align with the Fed’s target as long as pressures on house prices decrease. Market sentiment suggests a belief that the Fed has concluded its hiking cycle, with expectations of monetary policy easing commencing in May 2024.

Earlier this month, the Bank of Canada signaled the likely end of the era of historically low-interest rates, cautioning households and businesses to anticipate higher borrowing costs. Additionally, a potential rebound in oil prices could positively impact the commodity-linked Canadian Dollar, given the country’s position as a leading oil exporter to the United States.

Traders will closely monitor key events this week, including the release of the Federal Open Market Committee Meeting Minutes and the Canadian Consumer Price Index for October on Tuesday. Wednesday will see the unveiling of US Durable Goods Orders for October and the Michigan Consumer Sentiment Index for November, while Friday will bring the release of S&P Global PMI data. These data points will influence trading opportunities around the USDCAD pair.

Saudi Arabia, the world’s leading oil exporter, is considering an extension of oil production cuts into the next year. The plan is to continue reducing output by 1 million barrels per day, at least until the spring, in response to declining prices and heightened tensions in Israel-conflict. This information comes from sources cited by the Financial Times after oil prices reached a four-month low of $72.35 per barrel last week.

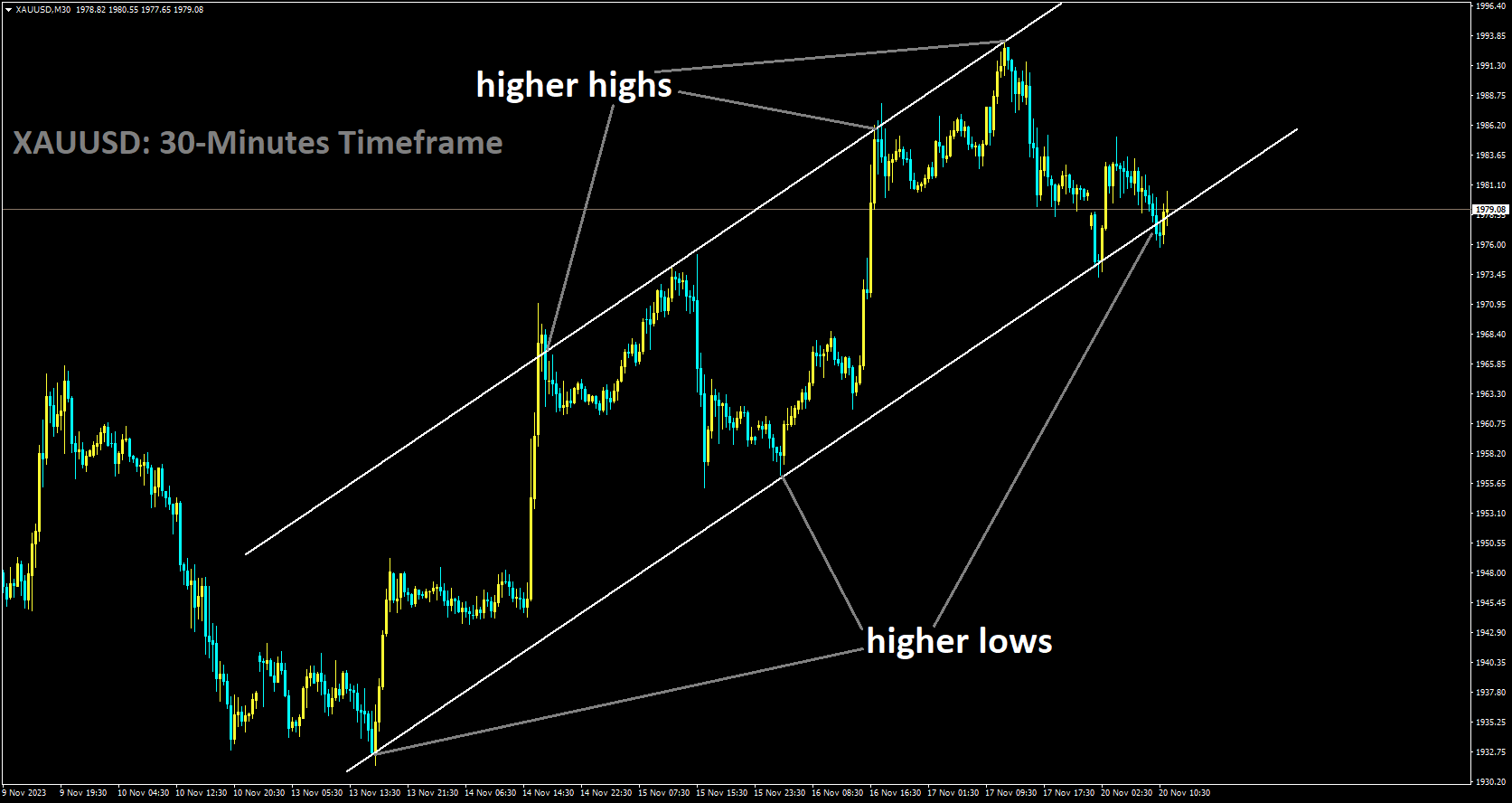

GOLD Analysis:

XAUUSD is moving in Ascending channel and market has reached higher low area of the channel

As the financial markets eagerly anticipate the December meeting, the Federal Reserve has signaled a clear inclination to maintain interest rates at their current level. This forward guidance has triggered a notable surge in gold prices. Investors are closely monitoring the central bank’s stance, with the prevailing expectation that the Fed will adopt a dovish position during the December meeting. The optimism surrounding potential stimulus measures from China has, however, tempered gains in the early European session. Despite this, the market remains cautious, with investors increasingly convinced that the US central bank will maintain its existing policy.

A key factor influencing gold prices is the growing expectation among investors that the Federal Reserve may initiate interest rate cuts as early as March 2024. This expectation has contributed to a decline in the value of the US Dollar, reaching its lowest level since August 31. Additionally, the deteriorating global economic outlook and heightened geopolitical risks have provided some support to the safe-haven appeal of gold. However, traders are adopting a cautious approach, refraining from aggressive directional bets as they await the release of the Federal Open Market Committee (FOMC) meeting minutes scheduled for Tuesday.

The upcoming FOMC minutes are highly anticipated as they are expected to provide valuable insights into the path of interest rates and policymakers’ perspectives on whether the US Central Bank should consider raising rates again in the near future. This analysis is considered pivotal in influencing USD price dynamics and offering fresh momentum to the non-yielding gold price. Last week’s US Consumer Price Index (CPI) report, indicating a faster-than-anticipated cooling of consumer inflation, and Thursday’s US Jobless Claims, suggesting a moderation in the labor market, have contributed to the persistent buoyancy in gold prices.

Investors are closely monitoring the Fed’s future policy expectations, with nearly 100 basis points of rate cuts being priced in by the end of 2024. This shift in expectations has led to a decline in the benchmark 10-year US Treasury yield to a two-month low. The decline in the US Dollar to its lowest level since September is another factor supporting gold prices ahead of the FOMC minutes release on Tuesday. Additionally, the escalation of violence between Israel and Palestine has raised concerns about its potential impact on the global economy, potentially leading to a recession in a worst-case scenario.

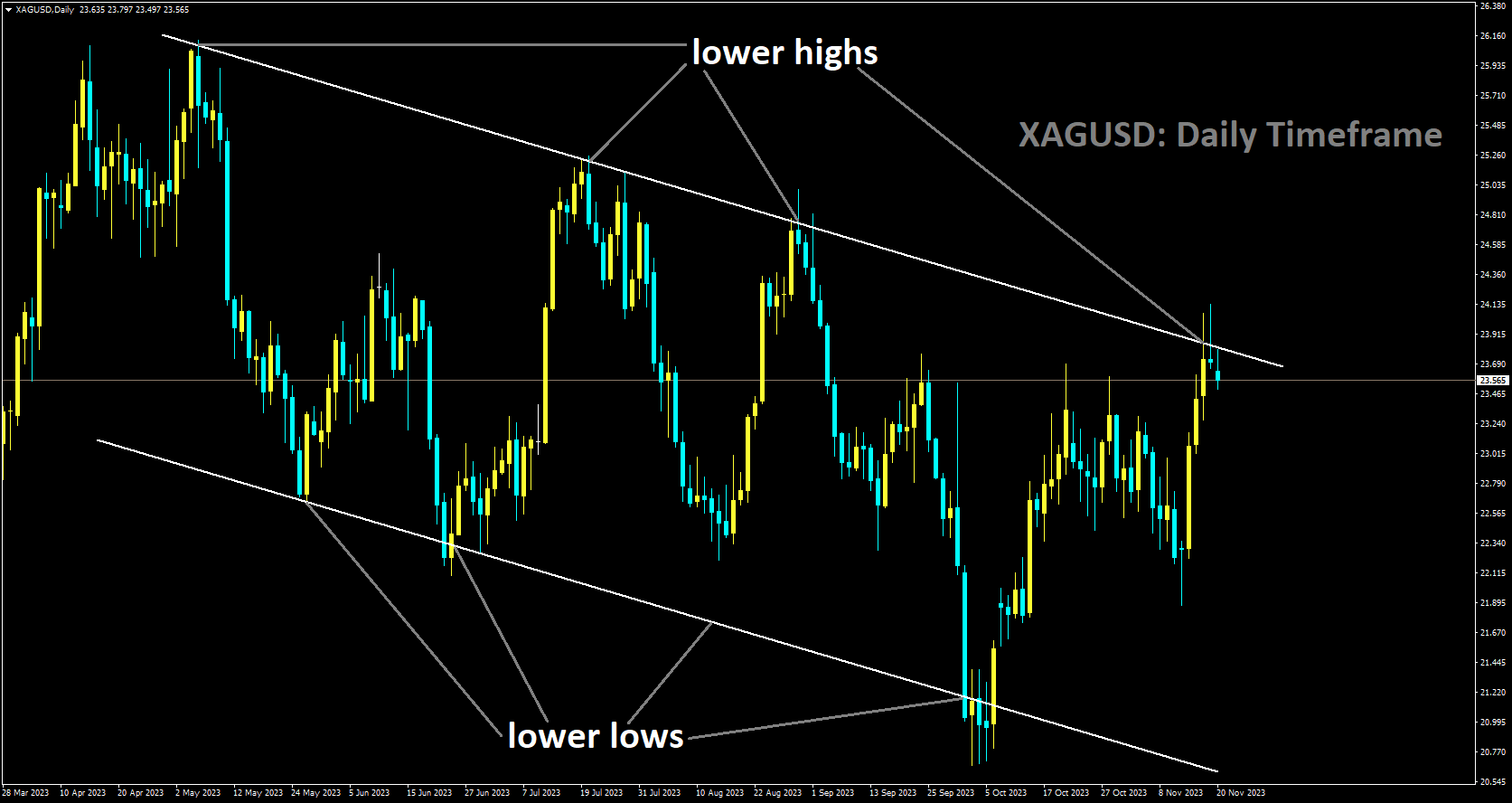

SILVER Analysis:

XAGUSD is moving in Descending channel and market has reached lower high area of the channel

In the context of the United States, domestic economic data falling below expectations has resulted in the US Dollar Index experiencing a decline, reaching 103.90 and concluding a week marked by a 1.60% loss. The Greenback’s downturn is primarily attributed to soft inflation figures and weak economic activity data in the country. Signs of inflationary pressures and a cooling labor market in the US have led to a market sentiment favoring the notion that the Federal Reserve has concluded its hiking cycle. This sentiment has contributed to the weakening of the US Dollar throughout the week.

Looking ahead, the focus is on the release of Durable Goods figures for October and S&P PMIs for November in the next week. These data points are expected to provide further insights into the economic conditions in the United States and influence market sentiment. The US Dollar Index’s continued descent towards 103.90 during the week has significant implications for various currency pairs and trading opportunities.

The economic indicators from the US, including the Core Consumer Price Index (CPI) falling below expectations and the Core Producer Price Index (PPI) for October failing to meet expectations, have played a role in shaping market expectations. While Retail Sales for October outperformed expectations, showing a 0.1% MoM decline against the anticipated 0.3% decline, the overall economic outlook remains a crucial factor for traders and investors.

In the week ending November 11, US Initial Jobless Claims increased to 231,000, surpassing the predicted 220,000. Industrial Production in the United States fell short of expectations, experiencing a 0.6% MoM decline, higher than the anticipated -0.3%. It also recorded a YoY decrease of 0.7%. However, Housing Starts and Building Permits for October surpassed expectations.

The statements from Susan Collins from the Fed, not ruling out further tightening, and the slight increase in US Treasury yields add complexity to the market dynamics. The probability of a 25-basis-point hike in December, according to the CME FedWatch Tool, is currently zero. Market expectations are leaning towards rate cuts, potentially appearing sooner than anticipated, with bets on May 2024 or even March.

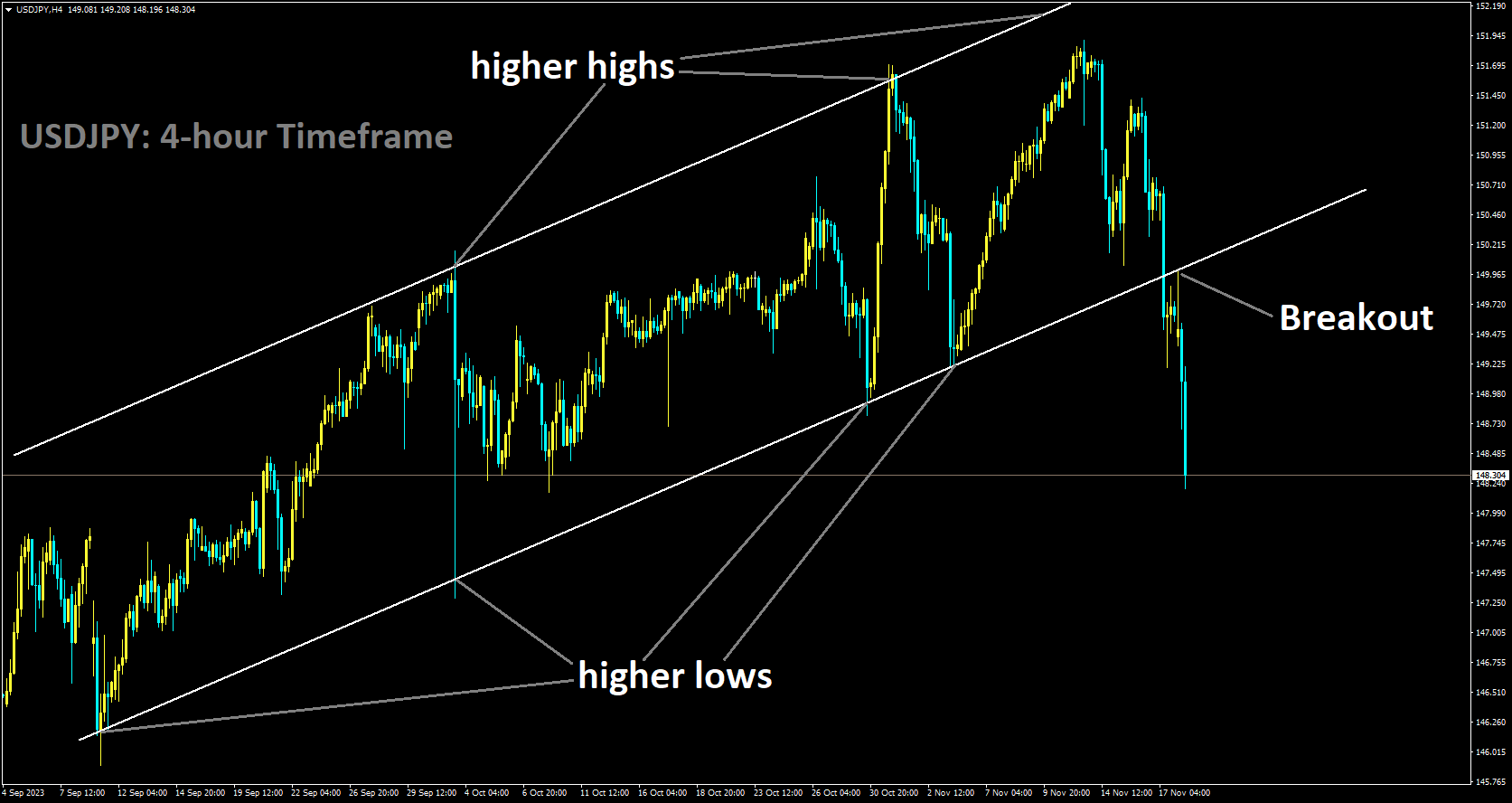

USDJPY Analysis:

USDJPY has broken Ascending channel in downside

Governor Ueda of the Bank of Japan has indicated that the era of accommodating monetary policies will conclude once sustainable wages and inflation targets are met within the Japanese economy. Finance Minister Akazawa emphasizes that intervention in FX pairs is not intended for speculation but aims to counteract volatility and stabilize prices.

Recent statements from Bank of Japan (BOJ) Governor Ueda and Japan’s Finance Minister Akazawa suggest that the Japanese Yen could face further downside. Both officials mention a potential reconsideration of Yield Curve Control (YCC) and negative interest rates, contingent on achieving stable and sustainable inflation hitting the target. However, they emphasize the need for caution in communicating potential policy changes to avoid unintended consequences in the markets. The timing of any shift from the ultra-easy policy remains uncertain, and there is no specific foreign exchange level in mind for intervention, with a focus on curbing excess volatility rather than intervening solely based on yen weakening.

These statements underscore Japan’s careful approach amid various global uncertainties, including the Federal Reserve’s stance, geopolitical tensions, and China’s economic growth. Adapting monetary policy will require the Bank of Japan to navigate multiple unpredictable factors.

Looking ahead, if US durable goods orders take a negative turn in the coming days, the US dollar may experience pressure. From the USDJPY perspective, Japanese inflation becomes crucial in influencing BOJ policy decisions. The central bank has consistently emphasized the necessity of sustained inflation above the 2% target before contemplating policy adjustments. With forecasts indicating a potential rise in inflation, this could prompt the BOJ to consider easing policy measures in the future.

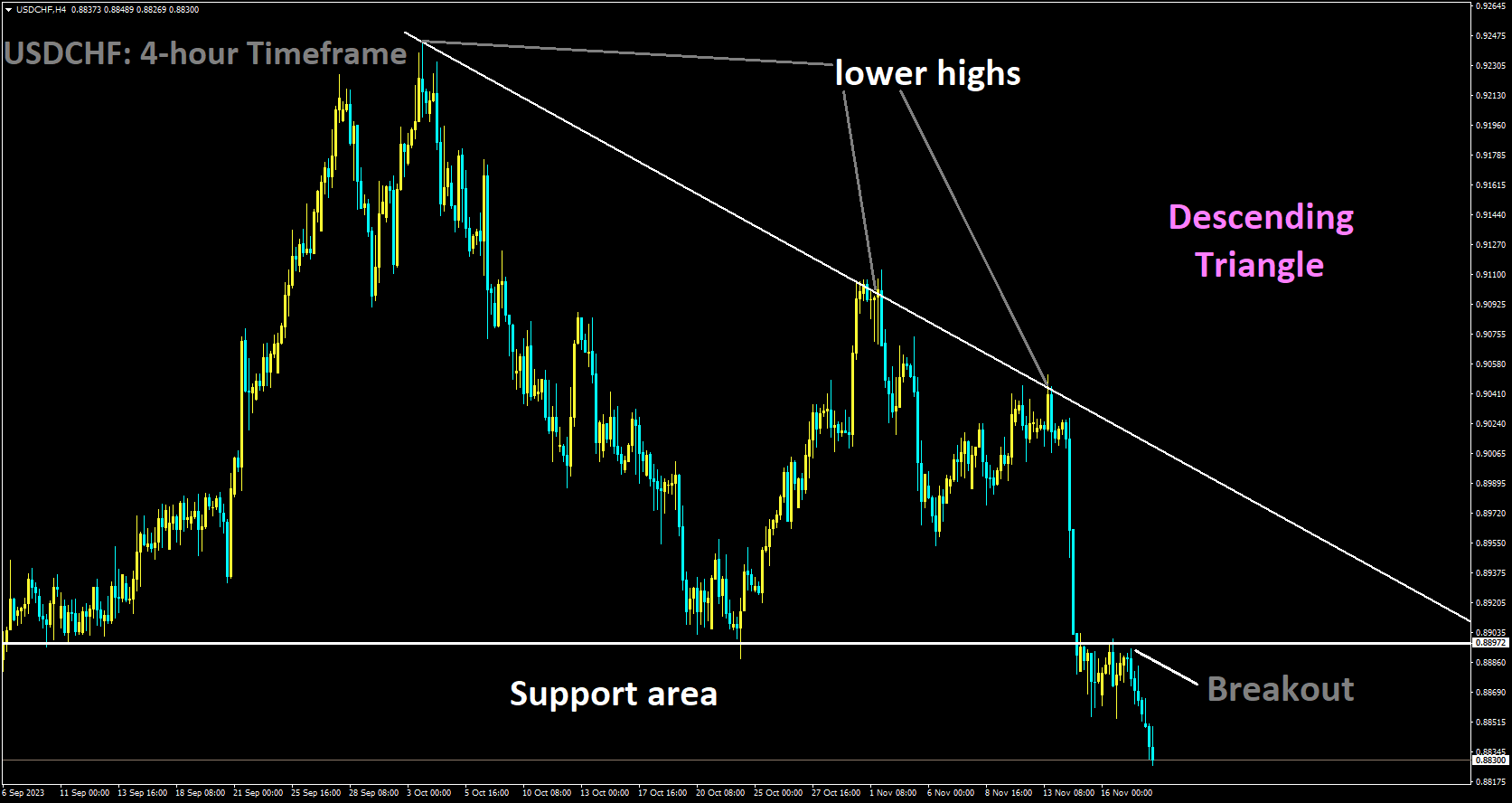

USDCHF Analysis:

USDCHF has broken Descending Triangle in downside

Swiss industrial production for Q3 exceeded expectations, registering at 2.05%, surpassing the forecast of -0.70% and the previous quarter’s figure of 0.80%. This positive outcome suggests potential strength for the Swiss Franc against its counterparts.

The USDCHF pair is under downward pressure as market signals suggest a cooling labor market in the United States. This perception implies that the Federal Reserve may have concluded its hiking cycle, resulting in a decline in the US Dollar’s strength over the past week. Despite this, Bank of America holds the view that Fed Funds rates will remain elevated for an extended period, identifying potential upside risks. The revised forecasts project higher rates across the yield curve, with a 10-year US Treasury yield expected to reach 4.25% by the end of 2024.

While BoA’s forecasts align slightly below market forwards, they surpass consensus estimates, particularly towards the end of 2024. The 2-year yield forecasts suggest a potential for a higher cutting trough compared to the baseline in US economics. The US Dollar Index continues its decline, currently trading around 103.70, reflecting pressure on US bond yields. The 2-year Treasury yield is lower, bidding at 4.88% at the time of writing.

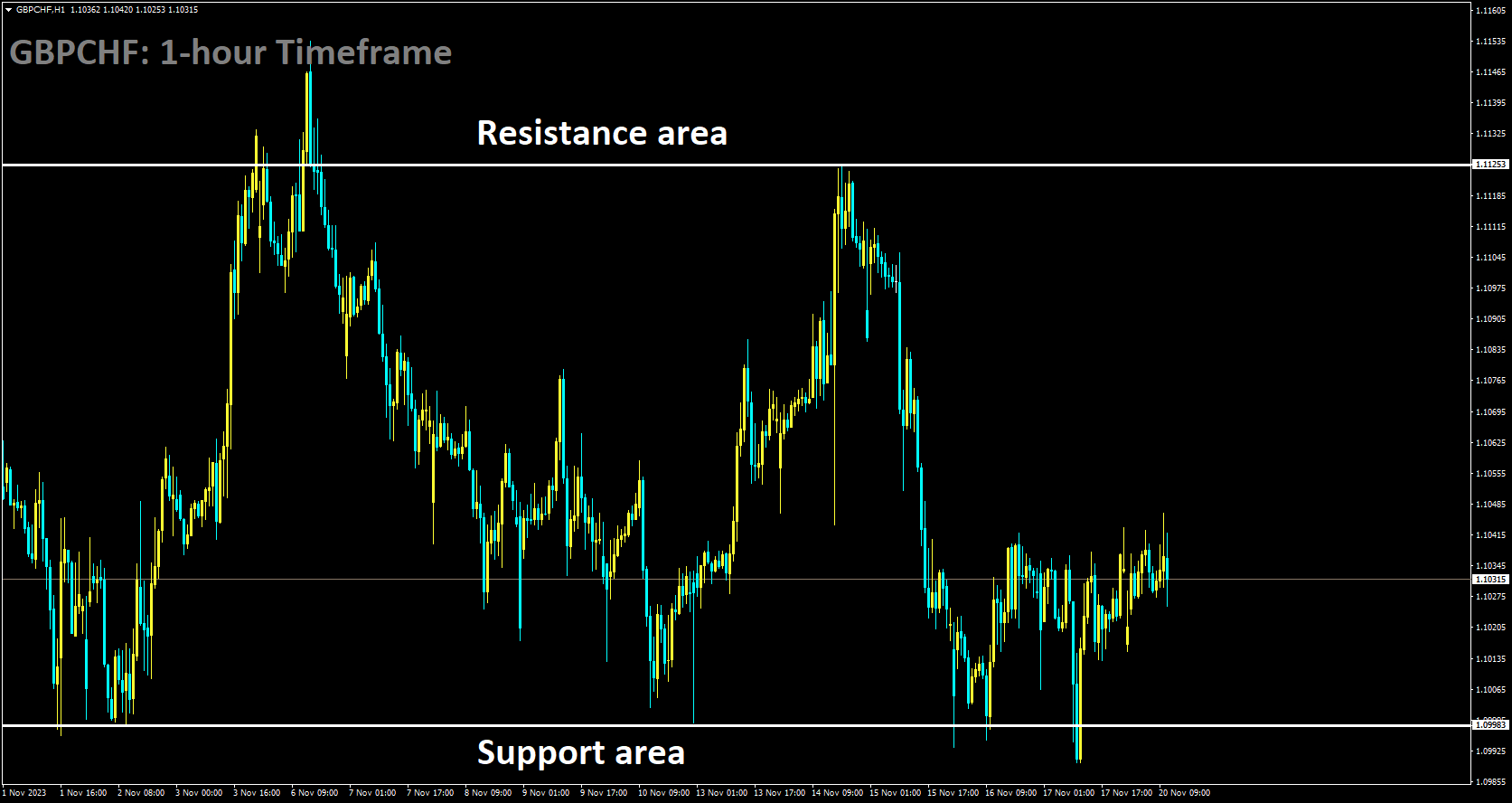

GBPCHF Analysis:

GBPCHF is moving in box pattern and market has rebounded from the support area of the pattern

Swiss Industrial Production for the third quarter exceeded expectations at 2.0%, surpassing the previous quarter’s -0.7%. The revised figure for the previous quarter was marginally higher, changing from -0.8%. This data indicates an improvement in Switzerland’s industrial output, positively influencing the Swiss Franc. Furthermore, Swiss National Bank Chairman Thomas Jordan’s hawkish comments, not ruling out the possibility of more interest rate hikes in the future, continue to bolster the strength of the Swiss Franc. The focus this Tuesday will be on the FOMC minutes, providing insights into the Fed committee’s decision to maintain rates, along with Swiss Import and Export data. These releases are anticipated to offer additional clarity on the economic outlook for both nations.

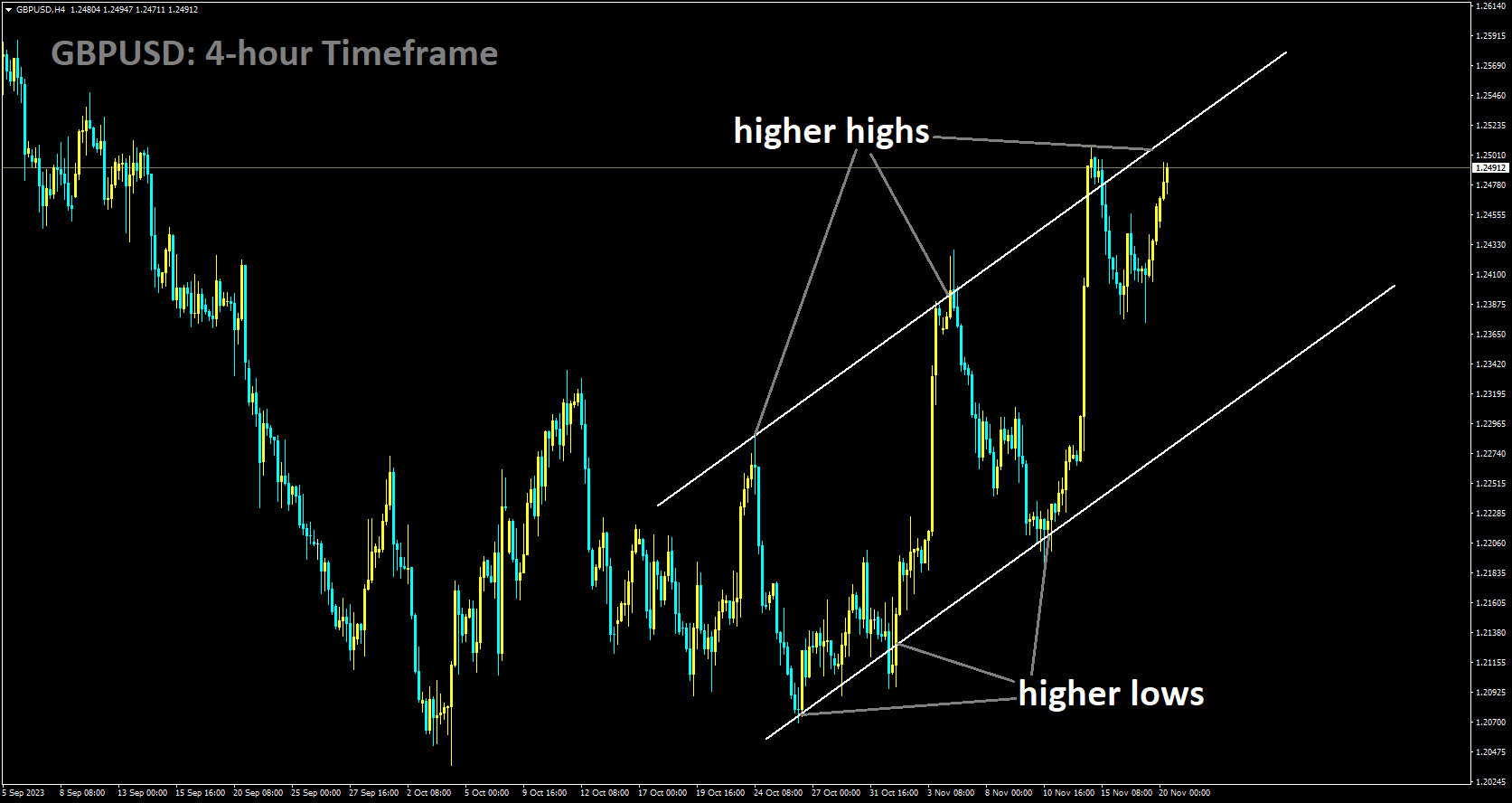

GBPUSD Analysis:

GBPUSD is moving in Ascending channel and market has reached higher high area of the channel

The stability of GBP domestic data is at risk, as there is a high expectation for UK Prime Minister Rishi Sunak to fulfill his commitment to achieving a 5% inflation target in the near future.

The British Pound appears poised to begin the upcoming trading week notably stronger against the United States Dollar than it was at the start of the previous one. However, this ascent seems precarious, and betting on further gains may be imprudent. Like many other currencies, GBPUSD has capitalized on the growing market conviction that US interest rates will not rise this year and may potentially decrease in the first half of 2024. This sentiment gained significant support from the latest US inflation figures released last week, showing a decline in headline consumer price inflation to 3.2% in October from the previous month’s 3.7%, reinforcing the trend of weakening inflation since the end of the previous year.

While Sterling benefits from the narrative of ‘Dollar weakness,’ domestic economic news in the UK is less reassuring. Despite the Bank of England’s series of rate hikes over the past year to address higher inflation, signs of their effectiveness coincide with a noticeable impact on economic activity. Higher borrowing costs are constraining economic growth, even as the cost of living crisis may be abating. Official UK retail sales figures from last week highlighted this, depicting sales volumes at their lowest since February 2021, during the peak of the Covid-19 pandemic. Weather conditions and pre-Christmas spending constraints likely contributed to these figures, but the underlying economic outlook is concerning. Political instability adds another layer of uncertainty as Prime Minister Rishi Sunak faces challenges in asserting control over his party. Against this backdrop, the Pound may not be an attractive investment. This reality could reemerge this week, particularly as major scheduled risk events are sparse, and central bank meetings are on the horizon in mid-December. While the Pound may not experience a significant decline this week, the outlook for further gains in the near term appears challenging. Consequently, the sentiment leans towards a bearish outlook for the Pound this week.

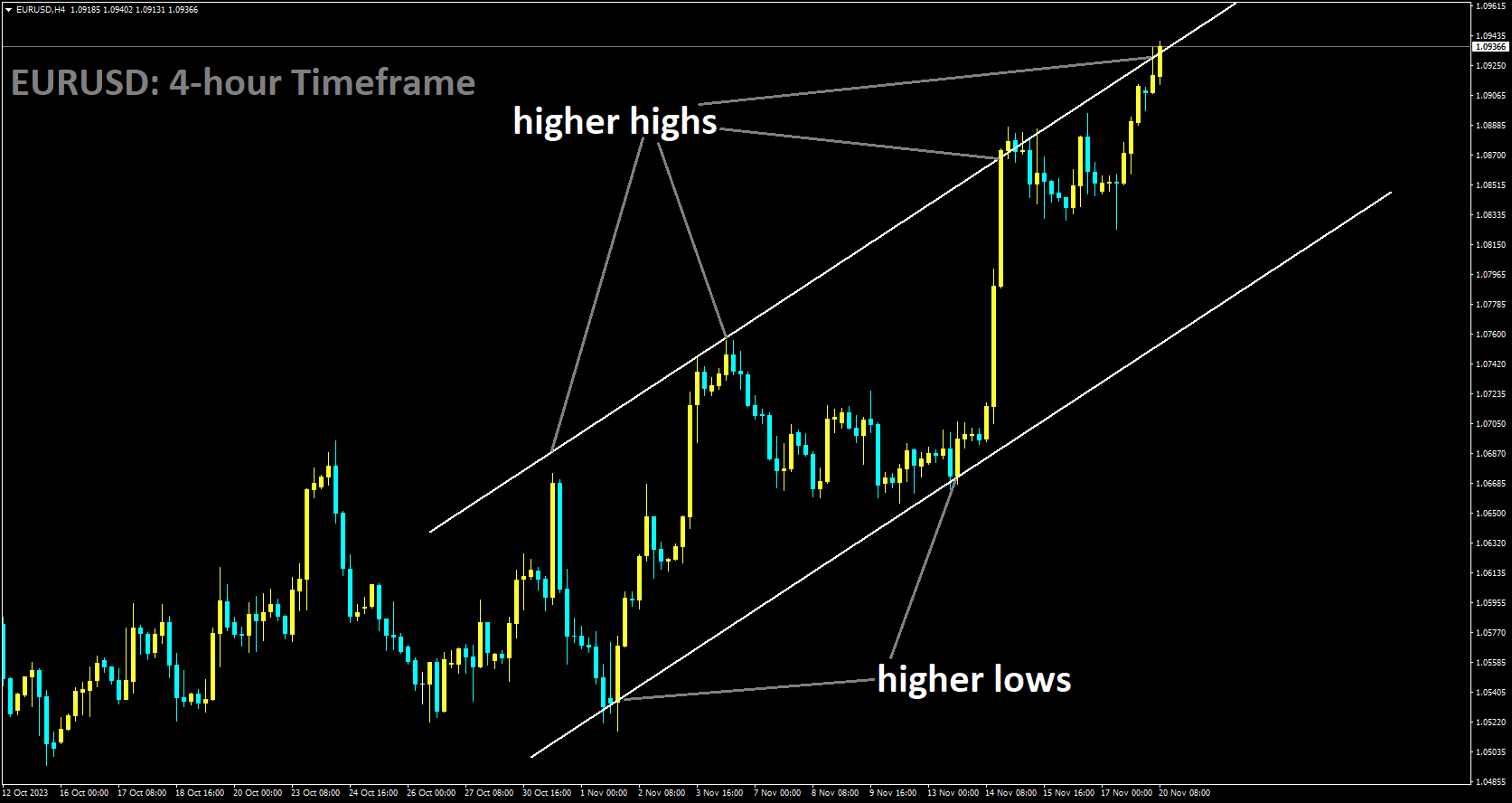

EURUSD Analysis:

EURUSD is moving in Ascending channel and market has reached higher high area of the channel

ECB policymakers have indicated that inflation is still not meeting our target; however, there is a possibility of a rate hike in the upcoming meeting.

The US Dollar initiates the new week with a rebound, recovering from Friday’s dip to a level not seen in over two and a half months. This recovery poses a challenge for the EURUSD pair. However, a substantial resurgence in the USD remains elusive, given the prevailing sentiment that the Federal Reserve has concluded its interest rate hikes. This belief is reinforced by US data indicating a more rapid cooling of inflation than expected. Furthermore, the markets are now factoring in the potential for rate cuts in the first half of 2024, contributing to a recent sharp decline in US Treasury bond yields. The benchmark 10-year US government bond yield reached a two-month low of 4.379% on Friday. Despite this, the Greenback’s appreciation is likely to be limited, given the stable performance in equity markets.

Conversely, the Euro may find continued support from hawkish statements made by European Central Bank officials on Friday, countering expectations for early rate cuts. Bundesbank President Joachim Nagel cautioned against initiating interest rate cuts too soon, and ECB policymaker Robert Holzmann argued that a rate cut in the second quarter was premature. This fundamental backdrop supports a positive short-term outlook for the EUR/USD pair, favoring bullish traders. Additionally, from a technical standpoint, the sustained breakout above the confluence barrier of the 100- and 200-day SMAs last week indicates that the path of least resistance for spot prices is upward. This is especially true in the absence of significant macroeconomic data from both the Eurozone and the US on Monday.

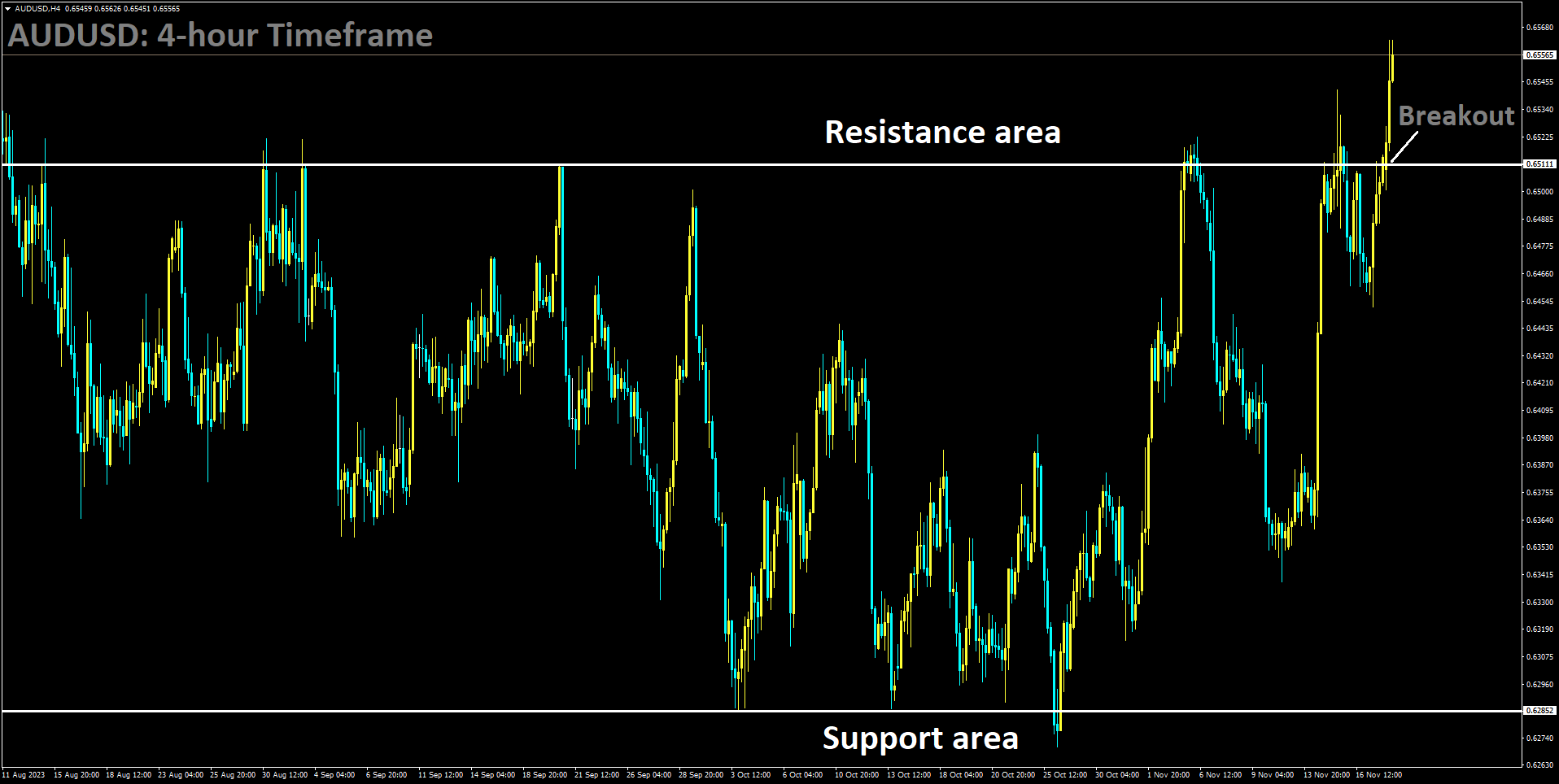

AUDUSD Analysis:

AUDUSD has broken in box pattern in upside

Today, the People’s Bank of China maintained its interest rate at 3.45%, a move that bodes well for the Australian Dollar. In response to this decision, the Australian Dollar found support, aligning with expectations as the loan prime rate remained at 3.45%. Despite this, the AUDUSD pair faced resistance as the US Dollar aimed to recover from a recent two-month low. The market continues to anticipate a potential interest rate hike by the Reserve Bank of Australia (RBA) in the first half of 2024. RBA Assistant Governor Marion Kohler noted that while inflation is expected to decrease, reaching the RBA’s 2%-3% target is not projected until the end of 2025. Attention is likely to shift to the RBA Meeting Minutes and a speech by RBA Governor Bullock on Tuesday.

The Australian Dollar received support from weak US inflation figures and sluggish economic activity in the United States, contributing to a decline in the US Dollar. Signs of inflationary pressures and a cooling labor market fueled speculation that the Federal Reserve (Fed) may have concluded its hiking cycle, resulting in weakness for the Greenback in the previous week. The US Dollar Index continued its decline for the second consecutive session, influenced by pressure on US Treasury yields. Despite positive US housing data on Friday, the US Dollar faced downward pressure.

Boston Federal Reserve President Susan Collins expressed optimism about the Fed’s ability to address inflation without significant damage to the labor market through a “patient” approach to interest rate moves. The Federal Open Market Committee minutes on Tuesday are expected to shed light on the Fed’s stance on inflationary pressure and its monetary policy approach.

In Australia, the seasonally adjusted Employment Change for October exceeded market expectations at 55K, compared to the anticipated 20K and the previous month’s 6.7K. The Aussie Unemployment Rate for October met expectations at 3.7%. Australia’s Wage Price Index grew as expected by 1.3%, surpassing the previous reading of 0.8%, with a year-over-year increase of 4.0%, surpassing the anticipated 3.9%.

Meanwhile, in the US, Continuing Jobless Claims for the week ending on November 3 reached the highest level since 2022 at 1.865M, while Initial Jobless Claims for the week ending on November 10 rose to 231K, above the expected 220K and marking the highest level in nearly three months. October’s US Consumer Price Index showed lower readings than expected, with the annual rate slowing to 3.2%, below the consensus forecast of 3.3%. The monthly CPI reduced to 0.0% from 0.4%, and the US Core CPI rose by 0.2%, below expectations, with the annual rate decreasing to 4.0% from 4.1%.

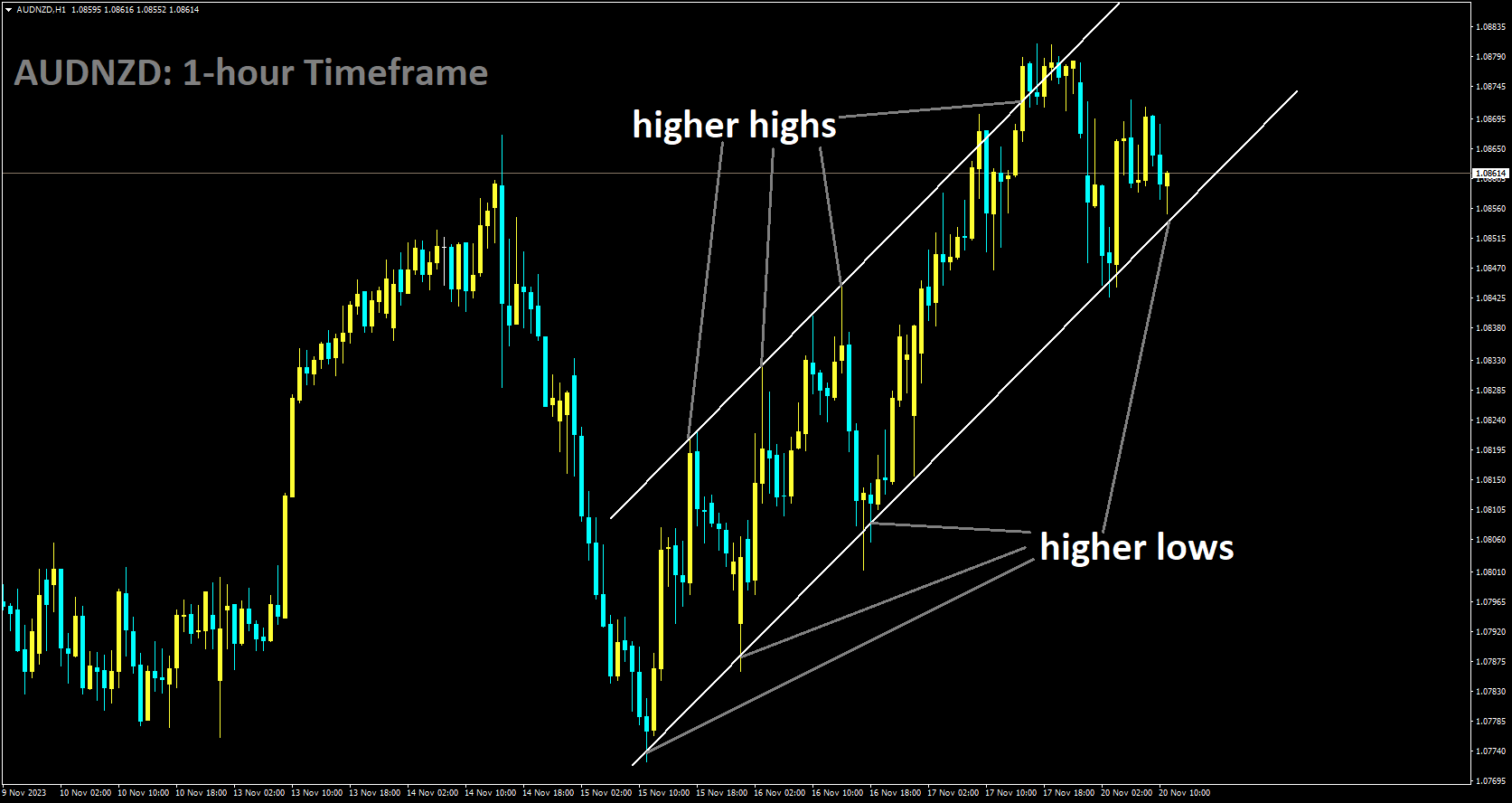

AUDNZD Analysis:

AUDNZD is moving in Ascending channel and market has reached higher low area of the channel

Due to a drop in oil prices, China chose to maintain its rates unchanged, creating a more favorable export environment for the New Zealand economy. Consequently, the NZD Dollar strengthened against its counterparts.

At the week’s close, the New Zealand Dollar exhibited mixed performance, gaining against the US Dollar, Euro, and Pound but facing a decline against the strengthening Japanese Yen. Analysts at Danske Bank attribute the Yen’s strength to its historical performance during periods of global growth and inflation decline.

Across most pairs, the New Zealand Dollar is on the rise, except against the Yen. This trend follows recent inflation data from the US, Eurozone, and UK, indicating slower-than-expected price increases. The subdued inflation numbers lessen the likelihood of central banks in these regions raising interest rates, impacting the demand for USD, EUR, and GBP. Typically, higher interest rates attract foreign capital, influencing currency demand.

The drop in oil prices, moving from the $90s per barrel to the $70s, is anticipated to contribute to a global reduction in inflation. The Kiwi might have experienced a boost in sentiment from China after a significant meeting between US President Joe Biden and Chinese President Xi Jinping in San Francisco. The decision to reopen communication channels between the two leaders, as reported by Reuters, potentially influenced the positive outlook for the New Zealand Dollar.

The drop in oil prices, moving from the $90s per barrel to the $70s, is anticipated to contribute to a global reduction in inflation. The Kiwi might have experienced a boost in sentiment from China after a significant meeting between US President Joe Biden and Chinese President Xi Jinping in San Francisco. The decision to reopen communication channels between the two leaders, as reported by Reuters, potentially influenced the positive outlook for the New Zealand Dollar.

In contrast, the Yen outperforms the NZD based on various factors. The decline in oil prices supports the Japanese Trade Balance, as oil is a significant import. The Yen tends to thrive in environments characterized by declining growth and inflation. Investors speculate that peak interest rates have been reached in the US, suggesting a narrowing yield differential between the two countries. This could reduce the use of the JPY as a funding currency in the carry trade to purchase US Dollars.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% FLAT OFFER for Signals 😍 GOING TO END – Get now: forexfib.com/discount/