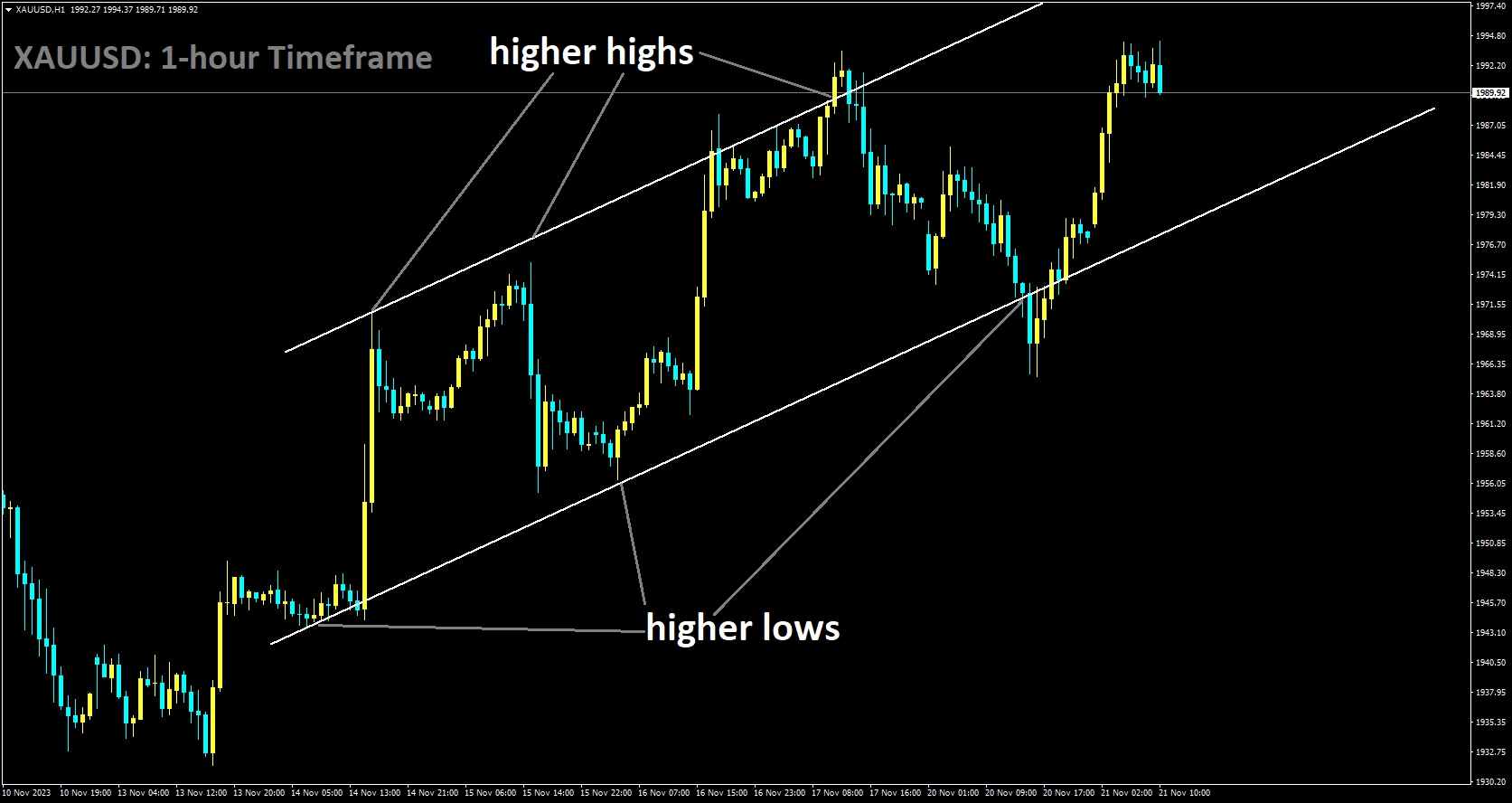

Gold Analysis:

XAUUSD is moving in Ascending channel and market has rebounded from the higher low area of the channel

On Tuesday, gold surged, reaching a two-week high above $1,994 during the European session. The US Dollar continued its significant decline, hitting a nearly three-month low, prompted by speculation that the Federal Reserve might initiate rate cuts as early as March 2024. This dovish outlook, reinforced by declining US Treasury bond yields, became a crucial factor driving investors towards the non-yielding gold. Despite positive sentiment in equity markets due to China’s commitment to additional stimulus measures, the traditional safe-haven status of gold was not compromised, indicating a strong intraday bullish movement. The prevailing trend suggests that XAUUSD is inclined towards further gains. However, traders may exercise caution ahead of the Federal Open Market Committee (FOMC) meeting minutes, given the uncertainty surrounding the timing of the Fed’s monetary policy easing.

The ongoing sell-off of the US Dollar, fueled by expectations of a dovish Federal Reserve, supported a robust upward movement in gold prices on Tuesday. Investors now appear convinced that the Fed has concluded its interest rate-hiking cycle and are eager for signals regarding when the central bank might initiate monetary policy easing.

The 2-year US government bond yield, a gauge of interest rate expectations, remains below the current 5.25-to-5.50% Fed funds target, signaling a growing momentum favoring rate cuts. The CME’s Fedwatch tool indicates approximately a 30% probability that the Fed will begin cutting rates as early as March 2024, with expectations of nearly 100 basis points of cumulative easing by year-end. The benchmark US 10-year Treasury yield reaches a fresh two-month low, putting pressure on the USD, countering the positive market sentiment, and benefiting gold as a non-yielding asset.

Investor optimism increased after Chinese officials pledged more policy support for the troubled real estate sector, aiming to stimulate stronger economic growth. China’s new finance minister, Lan Fo’an, announced plans to boost budget spending to support the post-pandemic recovery in the world’s second-largest economy. While Fed officials have not ruled out the possibility of further interest rate hikes, Richmond Fed President Thomas Barkin indicated on Monday that inflation might persist, necessitating the central bank to maintain higher rates for a longer duration than current investor expectations. This potential headwind for gold underscores the importance of the upcoming FOMC minutes for fresh insights into the Fed’s future policy actions and meaningful market direction.

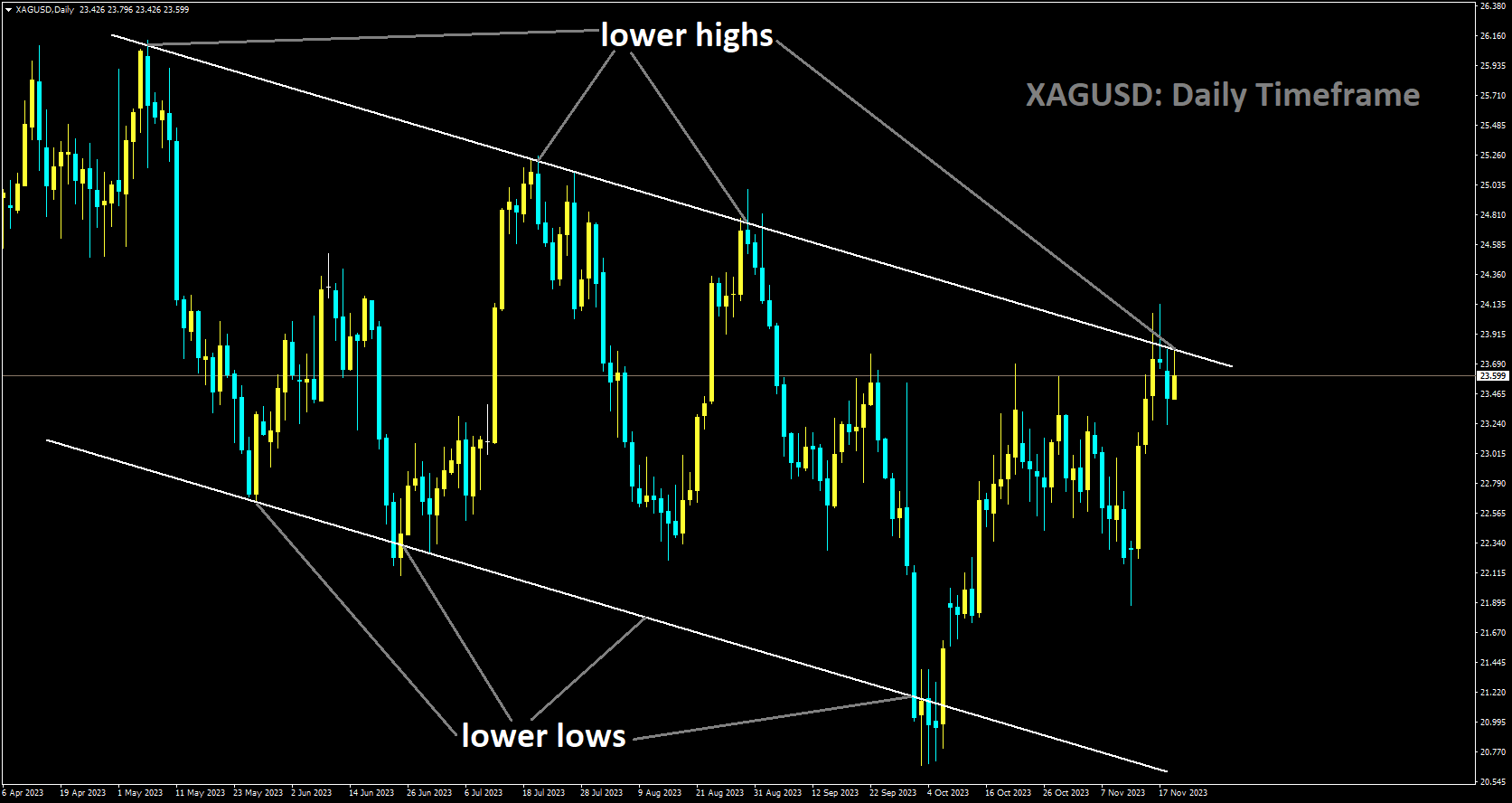

Silver Analysis:

XAGUSD is moving in Descending channel and market has reached lower high area of the channel

HSBC economists anticipate that the USD will not undergo significant changes due to anticipated Fed rate cuts in 2024. Their outlook for modest USD strength in 2024 is not contingent on an expected crisis, either within the US economy or globally. Therefore, the potential impact of Fed easing on the USD is viewed as uncertain, rather than generating a ‘safe-haven’ USD bullish sentiment.

If rate cuts align with a deceleration in US inflation, it is likely that US real interest rates will persist in positive territory, providing support for the USD. Shallow cuts could eventually result in the US economy regaining momentum, contributing to the ongoing support for the USD.

USDJPY Analysis:

USDJPY is moving in Ascending channel and market has fallen higher high area of the channel

The US Dollar plunges to a nearly three-month low amid expectations of a dovish stance from the Federal Reserve, exerting downward pressure on the USDJPY pair. Investors are increasingly convinced that the US central bank has concluded its policy-tightening efforts, with pricing reflecting the possibility of a 25 basis points rate cut as early as March 2024. This development contributes to a decline in the yield on the benchmark 10-year US government bond to a two-month low, further undermining the Greenback. The Japanese Yen benefits from the diminishing US-Japan rate differential and speculations that the Bank of Japan is likely to end its negative interest rate policy by early next year. While this adds to the negative sentiment around the USDJPY pair, the risk-on mood in the market could mitigate the safe-haven appeal of the JPY, providing some support. Traders may adopt a cautious approach, awaiting the release of the FOMC minutes later in the US session.

Investors grapple with uncertainty regarding the timing of the Fed’s rate cuts. Fed officials have not ruled out the possibility of needing more rate hikes if economic data necessitates a change. Richmond Fed President Thomas Barkin suggested on Monday that inflation could persist, potentially requiring the central bank to maintain higher interest rates for a longer duration than currently anticipated by investors. This stance could help limit the downside for the USDJPY pair. Consequently, the upcoming minutes will be closely scrutinized for fresh insights into the trajectory of interest rates and policymakers’ views on whether the US central bank should consider raising rates again this year. This, in turn, is expected to provide meaningful momentum to the USD and the USD/JPY pair. Despite this, the prevailing fundamental backdrop favors bearish sentiment, suggesting that the USDJPY pair is inclined toward further declines.

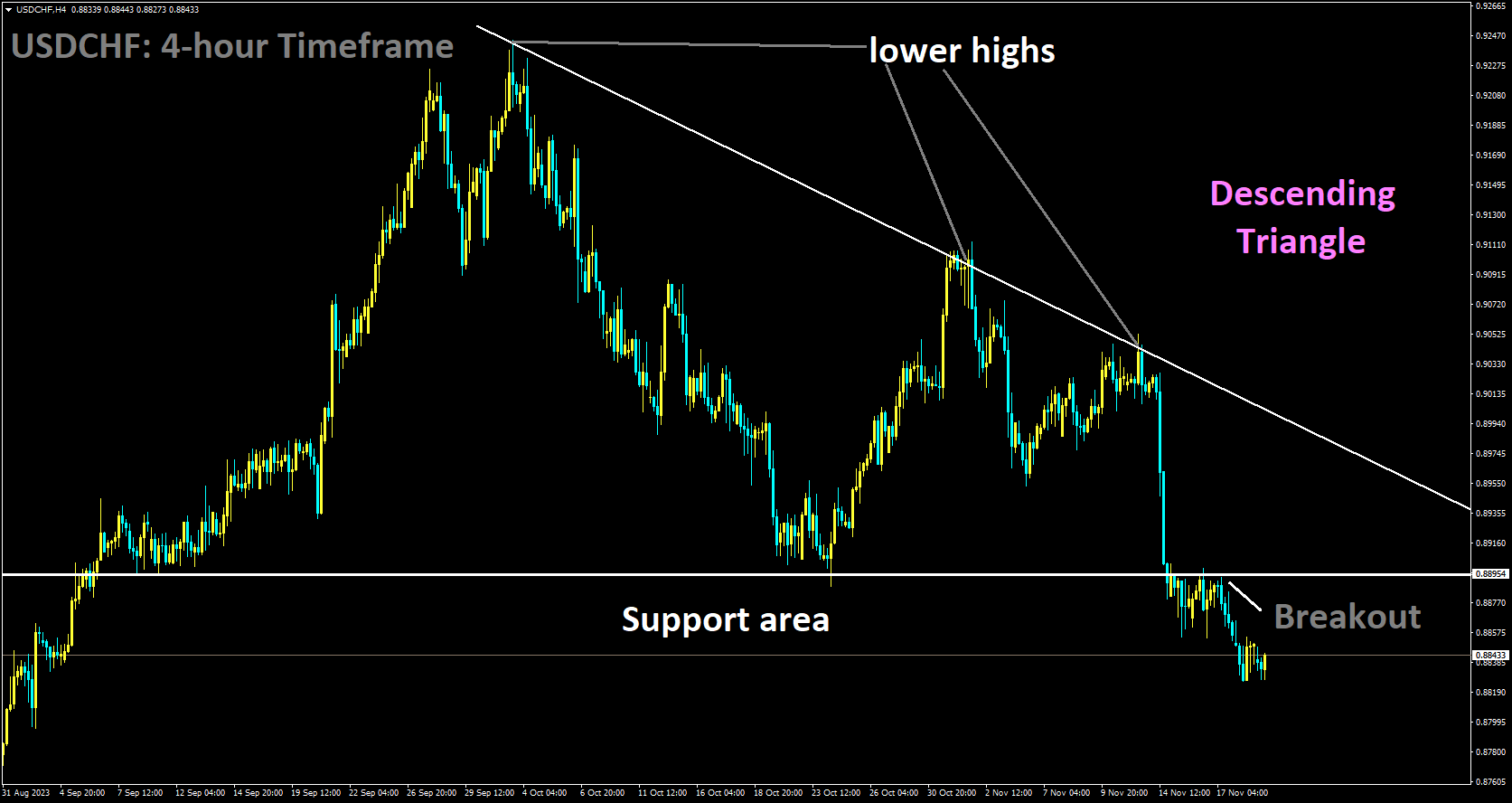

USDCHF Analysis:

USDCHF has broken Descending Triangle in downside

For the third consecutive day, the USDCHF pair encounters challenges, likely influenced by an enhanced risk appetite and signs of a cooling labor market, as investors anticipate a dovish stance from the Federal Reserve. The softer Consumer Price Index (CPI) in the United States for October has prompted a reevaluation of the likelihood of a rate hike by the Fed at the December meeting, leading investors to consider the prospect of potential rate cuts in 2024. According to the latest report from the US Bureau of Labor Statistics, the US CPI decelerated to 3.2% (YoY), falling below the consensus of 3.3% and down from the previous reading of 3.7%. The Core CPI eased to 4.0% (YoY), slightly below the expected unchanged figure and the previous reading of 4.1%.

The hawkish comments from Swiss National Bank (SNB) Chairman Thomas Jordan, where he does not dismiss the possibility of more interest rate hikes in the future, continue to provide support and bolster the strength of the Swiss Franc (CHF). Additionally, Swiss Industrial Production (YoY) for the third quarter surpassed expectations, registering at 2.0%, a notable improvement from the revised -0.7% (initially -0.8%) reported in the previous quarter by Swiss Statistics. This positive trend, seen as inflationary, may have contributed to weakening the USDCHF pair. On Tuesday, the release of Swiss Import and Export data will add to market developments. Traders will then shift their attention to crucial US economic indicators, including Existing Home Sales and the Chicago Fed National Activity Index. Furthermore, insights into the Federal Reserve committee’s decision-making process regarding interest rates may be gleaned from the upcoming release of the FOMC meeting minutes.

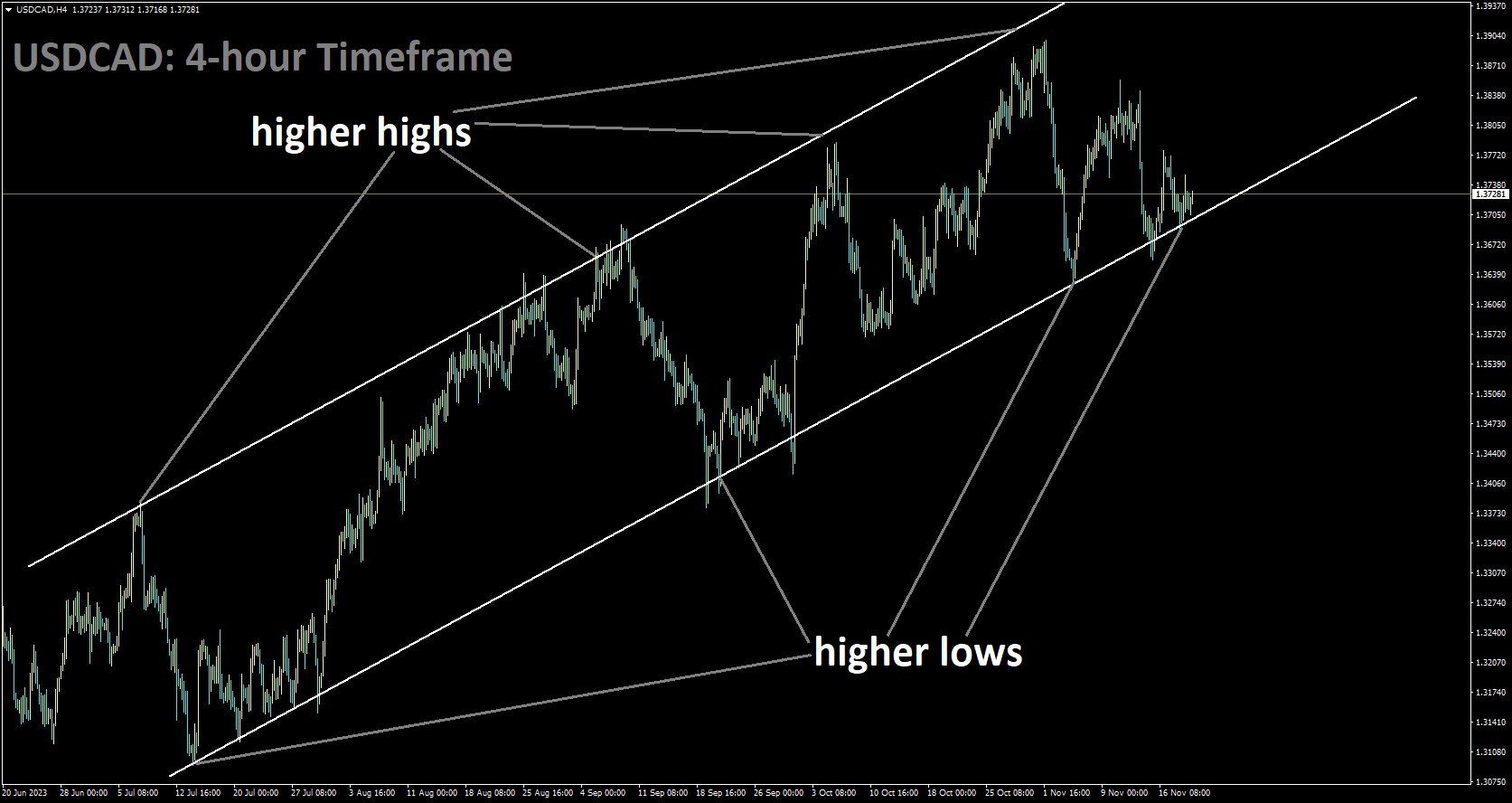

USDCAD Analysis:

USDCAD is moving in Ascending channel and market has reached higher low area of the channel

The Canadian Dollar is finding upward support against the US Dollar, courtesy of higher Crude Oil prices. Western Texas Intermediate is trading near $77.50 per barrel as of the current press time. Market speculation suggests that the Organization of the Petroleum Exporting Countries (OPEC) may opt for further production cuts during its upcoming meeting on November 26. Adding to the market dynamics, Canada’s Consumer Price Index data is scheduled for release on Tuesday. The year-on-year inflation rate in October is expected to decrease to 3.2% from the previous reading of 3.8%. A decline in inflation might provide the Bank of Canada with flexibility to maintain its target for the overnight rate at 5.0% during the December meeting, particularly as the central bank has indicated that economic indicators will influence rate decisions.

The US Dollar is facing challenges amid an enhanced risk appetite, fueled by expectations of a dovish stance from the Federal Reserve. The release of softer inflation figures last week, with the Consumer Price Index slowing to 3.2% (YoY) and the core CPI dropping to 4.0% (YoY), has prompted investors to reconsider the probability of a rate hike at the December meeting and consider potential rate cuts in 2024. Traders are closely monitoring key US economic indicators, including Existing Home Sales and the Chicago Fed National Activity Index on Tuesday. Additionally, market participants eagerly await insights from the Federal Reserve’s minutes from its recent meeting.

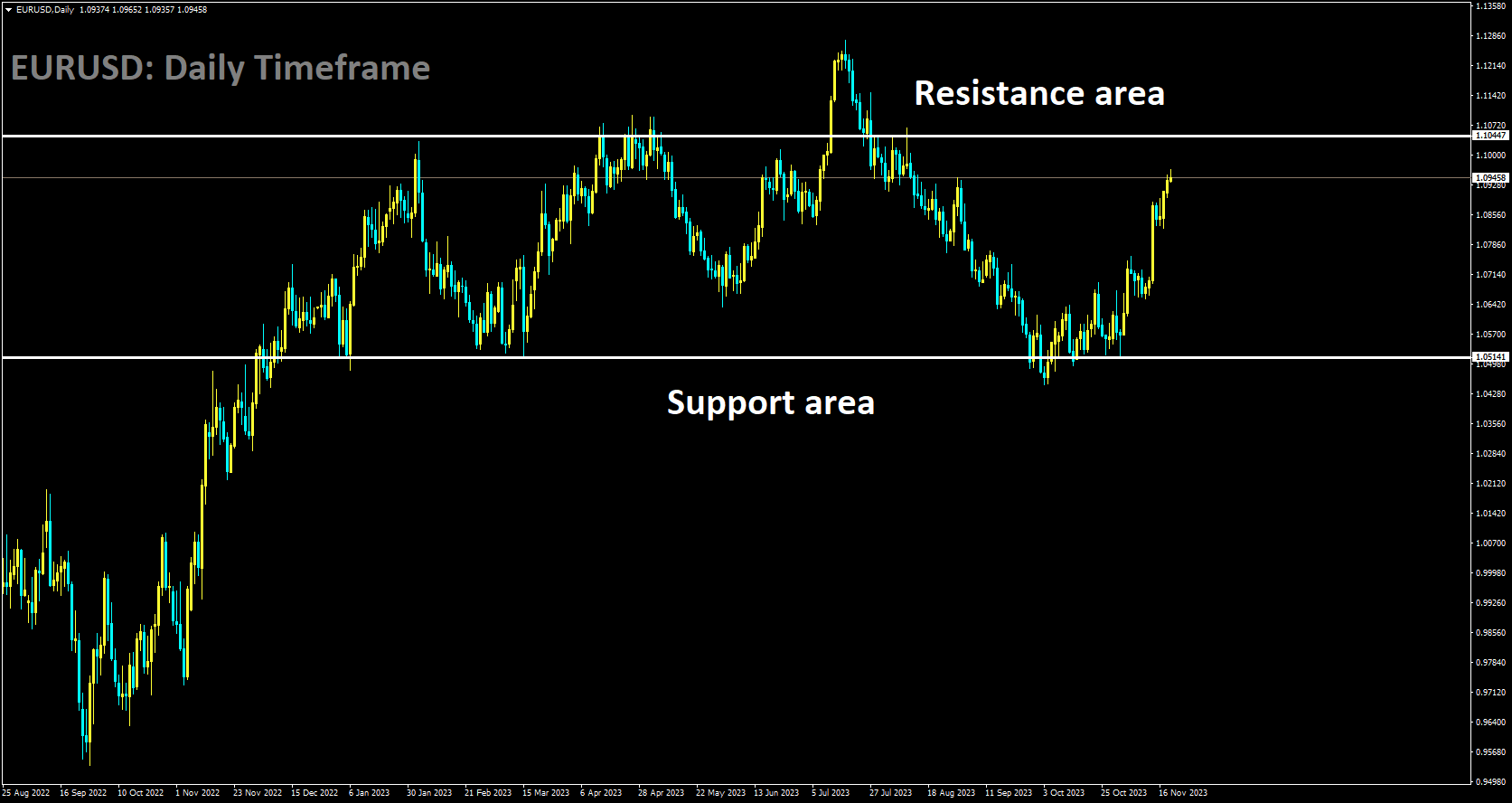

EURUSD Analysis:

EURUSD is moving in box pattern and market has rebounded from the support area of the pattern

Francois Villeroy de Galhau, a member of the European Central Bank Governing Council and the President of the Bank of France, asserted on Tuesday that interest rates have reached a plateau and are expected to remain at this level for the next few quarters. He dismissed any discussion of a rate cut as premature, emphasizing that our reliance on forward guidance has been excessive and that a more modest approach should be taken with future guidance. Villeroy de Galhau anticipates increased bond volatility, stating that renewed increases in volatility would be an additional reason not to raise rates. He also emphasized the need to discontinue Pandemic Emergency Purchase Program reinvestments in due time, possibly earlier than the originally planned end date of 2024.

Regarding the inflation target, Villeroy de Galhau expressed a lack of fixation on achieving a 2% target to the nearest decimal place. He downplayed the impact of recent developments in Israel and the oil market, suggesting that these factors should not significantly alter the downward trend in inflation.

Villeroy de Galhau expressed confidence in the ability to avoid a recession, stating that a soft landing path is more likely. He noted a shift in the central question from “When will we stop hiking?” to “When will we start cutting?” He anticipates that rates will plateau for at least the next several meetings and the next few quarters.

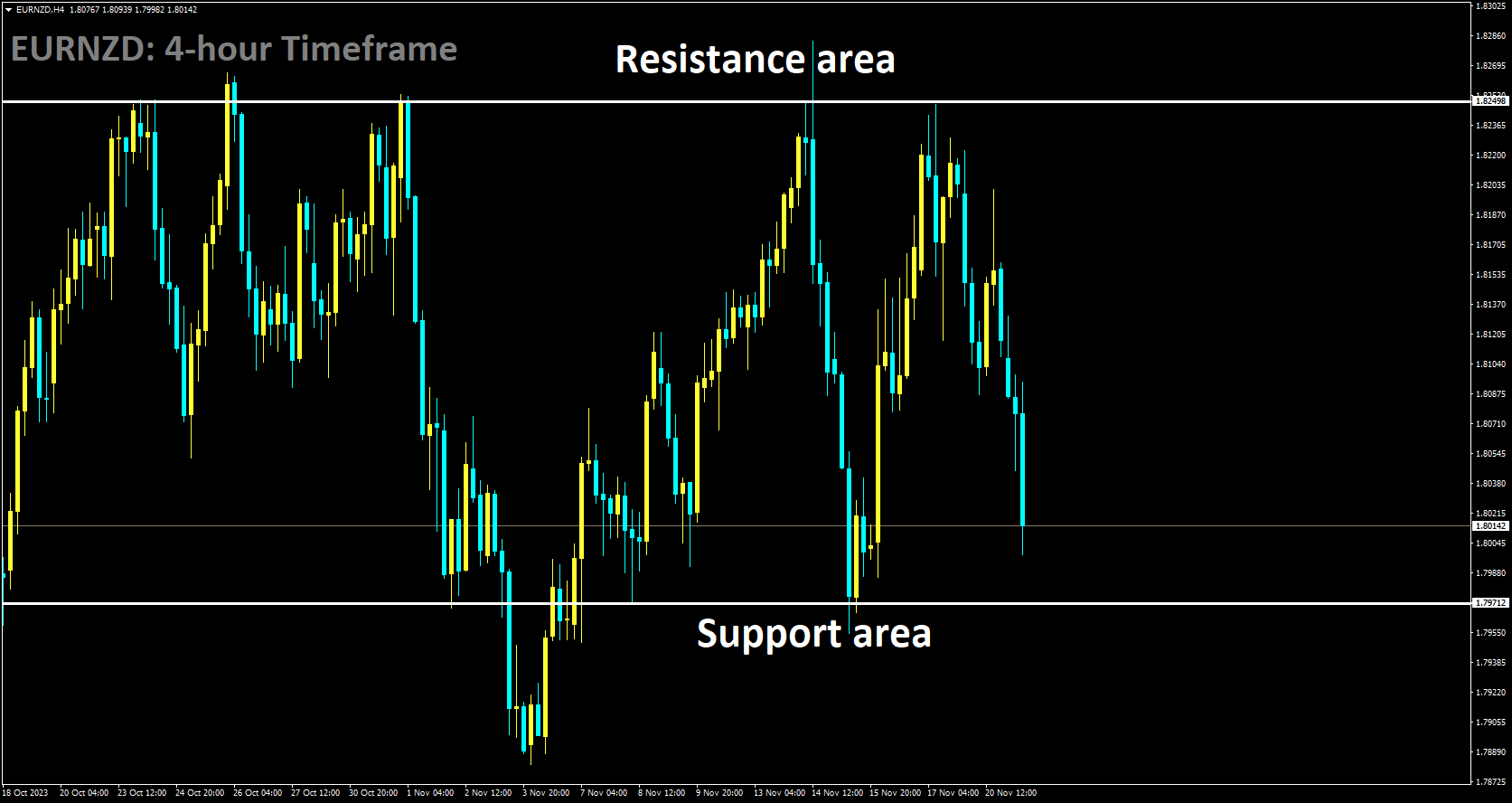

EURNZD Analysis:

EURNZD is moving in box pattern and market has fallen from the resistance area of the pattern

According to the latest data from Statistics New Zealand released on Tuesday, New Zealand’s Trade Balance for October was reported at -$14.81 billion year-on-year, an improvement from the previous figure of -$15.41 billion. Detailed breakdown reveals that exports increased to $5.40 billion during the same month, up from $4.77 billion in the previous period, while imports declined to $7.11 billion, compared to the earlier reading of $7.20 billion.

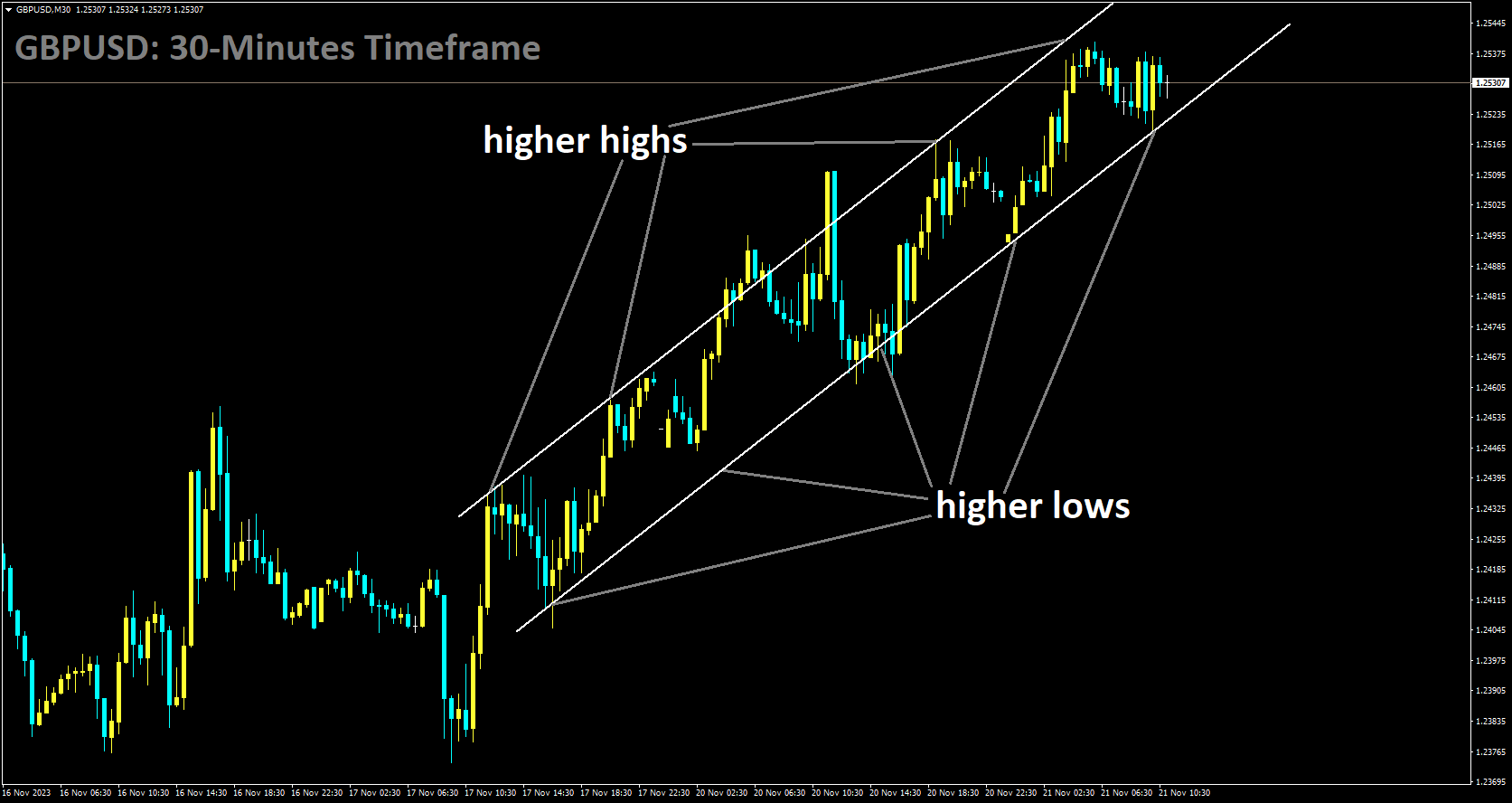

GBPUSD Analysis:

GBPUSD is moving in Ascending channel and market has reached higher low area of the channel

During the Henry Plumb Memorial Lecture, Bank of England Governor Andrew Bailey acknowledged that while inflation has significantly exceeded the central bank’s primary targets, there are indications that the surge in prices, particularly in the food sector, is starting to subside. Governor Bailey highlighted that overall inflation surpassed the Bank of England’s 2% target, peaking at 11.1% in October 2022. Although recent data shows a reduction to 4.6%, there remains a considerable gap to bridge before returning to the 2% target, and Governor Bailey cautions against prematurely declaring victory over inflation.

The inflation rate for food and beverages reached 19.1% in March 2023, contributing a substantial 2 percentage points to the overall inflation figure. Governor Bailey emphasized that as of October, food inflation still exceeds 10%, and the Bank of England anticipates a slowdown in food price growth to 3% by the conclusion of the short-term forecast cycle in March 2024.

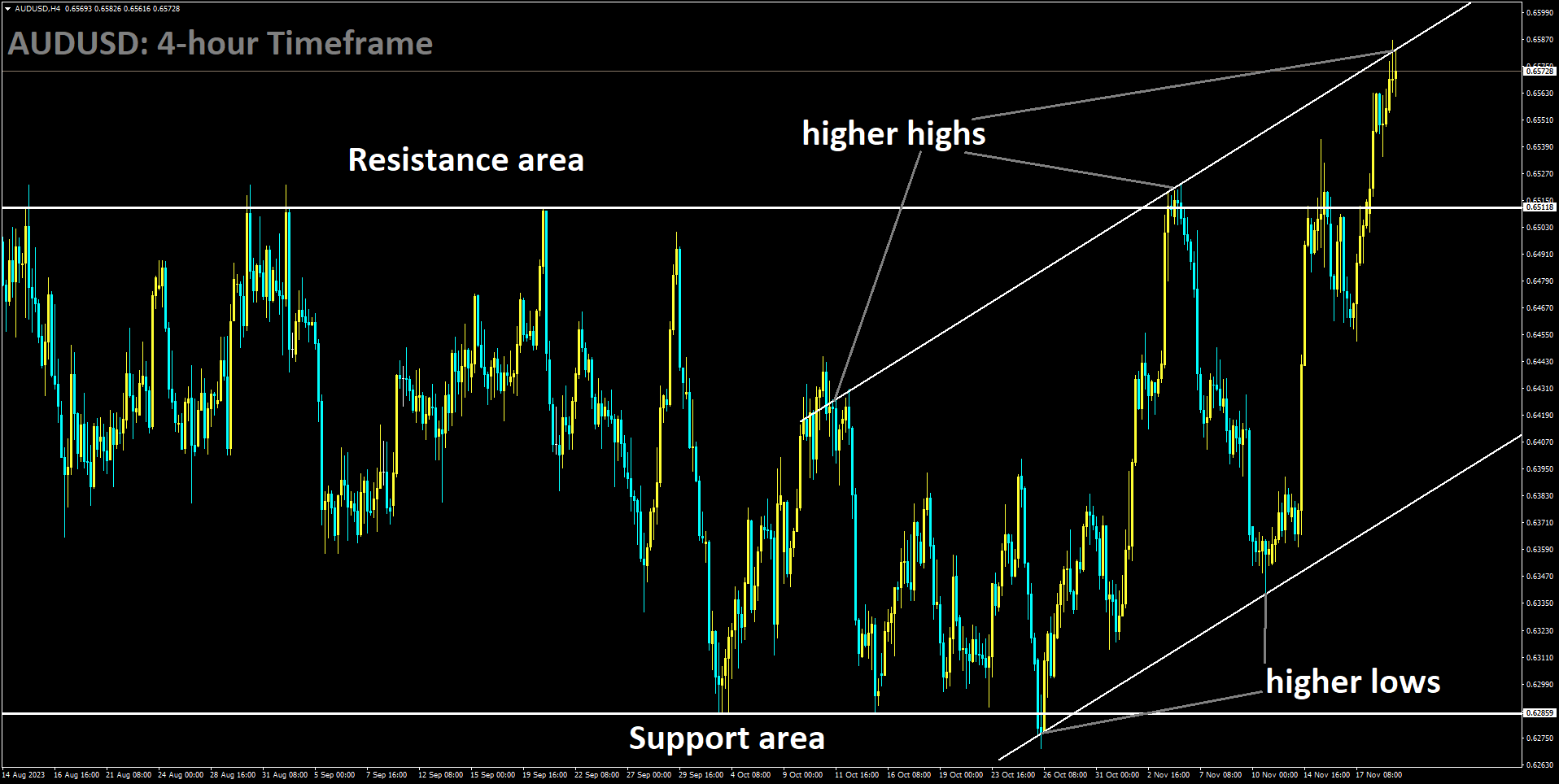

AUDUSD Analysis:

AUDUSD is moving in Ascending channel and market has reached higher high area of the channel

The Australian Dollar has continued its upward trend for the third consecutive session on Tuesday, propelled by the hawkish remarks from Reserve Bank of Australia Governor Michele Bullock. This surge is further supported by the hawkish undertone in the RBA’s November meeting minutes, escalating commodity prices, and a positive outlook from investors regarding potential additional stimulus measures in China. Governor Bullock highlights the robustness of Australia’s labor market, expressing confidence in the sustainability of employment progress.

Additionally, she emphasizes that the inflation challenge is influenced not only by supply issues but also by underlying demand, posing a significant concern for the next one or two years. The RBA’s November meeting minutes reveal the board’s acknowledgment of a credible case against an immediate rate hike but a stronger consideration for tightening due to heightened inflation risks. The decision on further tightening is contingent on data and risk assessment, with an emphasis on preventing even a modest rise in inflation expectations. Staff forecasts assume one or two more rate increases, and the rise in house prices suggests that policy might not be overly restrictive.

According to Bloomberg sources, Chinese authorities are anticipated to support the real estate sector by compiling a list of 50 eligible developers, both private and state-owned. This list is expected to guide financial institutions in providing support through avenues such as bank loans, debt, and equity financing. The US Dollar Index continues its decline, approaching three-month lows, driven by improved risk appetite and lower US Treasury yields. Despite the growth in the US economy, the Greenback faces short-term vulnerability. Focus is on US data, including Existing Home Sales, the Chicago Fed National Activity Index, and the release of the Federal Reserve’s meeting minutes. Australia’s October seasonally adjusted Employment Change exceeded market expectations at 55K, compared to the anticipated 20K and the previous month’s 6.7K.

The Aussie Unemployment Rate for October met expectations at 3.7%, in line with the previous figure of 3.6%. Australia’s Wage Price Index grew as expected at 1.3%, surpassing the previous reading of 0.8%. The year-over-year data showed a 4.0% increase, exceeding the anticipated 3.9%. RBA Assistant Governor Marion Kohler anticipates a decrease in inflation but does not expect it to reach the RBA’s 2-3% target until the end of 2025. The People’s Bank of China (PBoC) maintains its loan prime rate at 3.45%, as predicted. Boston Federal Reserve President Susan Collins expresses optimism about the Fed’s ability to lower inflation without significant damage to the labor market by adopting a patient approach to further interest rate moves. October’s US Consumer Price Index indicates lower readings than expected, with the annual rate slowing from 3.7% to 3.2%, falling below the consensus forecast of 3.3%. The monthly CPI reduces to 0.0% from 0.4%, and the US Core CPI rises by 0.2%, below the expected 0.3%, with the annual rate decreasing to 4.0% from the prior 4.1%.

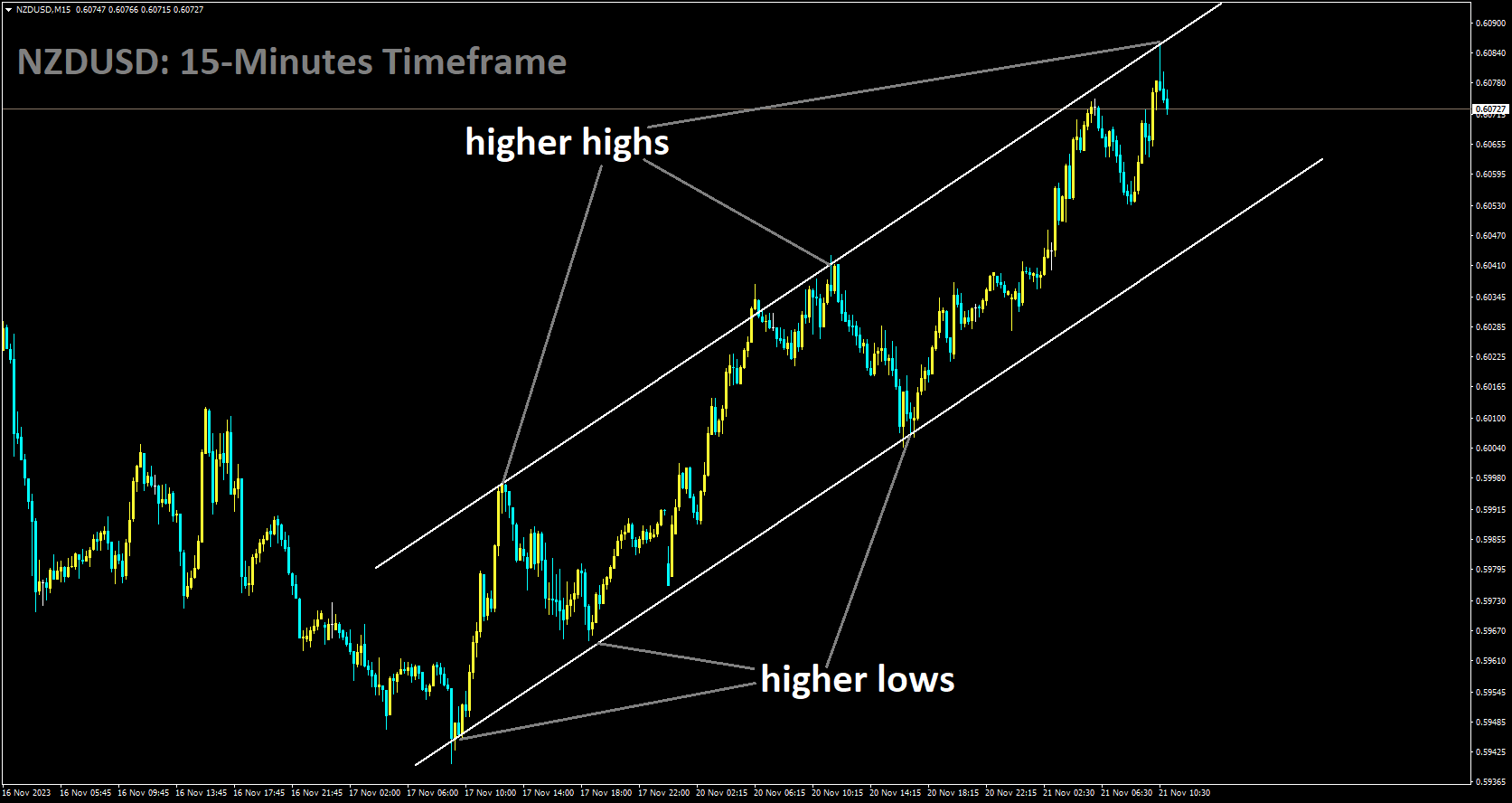

NZDUSD Analysis

NZDUSD is moving in Ascending channel and market has fallen from the higher high area of the channel

Persistent selling pressure on the US Dollar is driven by the increasing consensus that the Federal Reserve has completed its policy-tightening measures. Moreover, market sentiment now incorporates the likelihood of the Fed implementing rate cuts, possibly as early as March 2024. Consequently, US Treasury bond yields experience a further decline, pushing the USD to a nearly three-month low. This downturn significantly contributes to the upward momentum of the NZDUSD pair. Beyond these dynamics, optimism surrounding additional stimulus measures from China diminishes the safe-haven appeal of the US dollar, favoring antipodean currencies, including the New Zealand Dollar . Chinese authorities have pledged additional policy support for the struggling real estate sector, and the People’s Bank of China has maintained its benchmark Loan Prime Rate at record lows while injecting approximately 80 billion Yuan of liquidity into the economy on Monday.

Despite these favorable factors, the NZDUSD pair encounters challenges in capitalizing on the positive momentum. Traders exhibit hesitancy in taking aggressive positions, opting to remain on the sidelines, particularly in anticipation of the imminent release of the FOMC meeting minutes during the US session. The uncertainty centers around the timing of potential rate cuts by the Fed. Investors eagerly seek fresh insights into policymakers’ perspectives on whether the US central bank should contemplate raising interest rates again. This outlook holds a pivotal role in shaping short-term USD price dynamics and could provide substantial momentum to the NZDUSD pair. As the market awaits this event risk, attention will also be directed to the US economic docket, which includes the release of Existing Home Sales data, presenting short-term trading opportunities.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% FLAT OFFER for Signals 😍 GOING TO END – Get now: forexfib.com/discount/