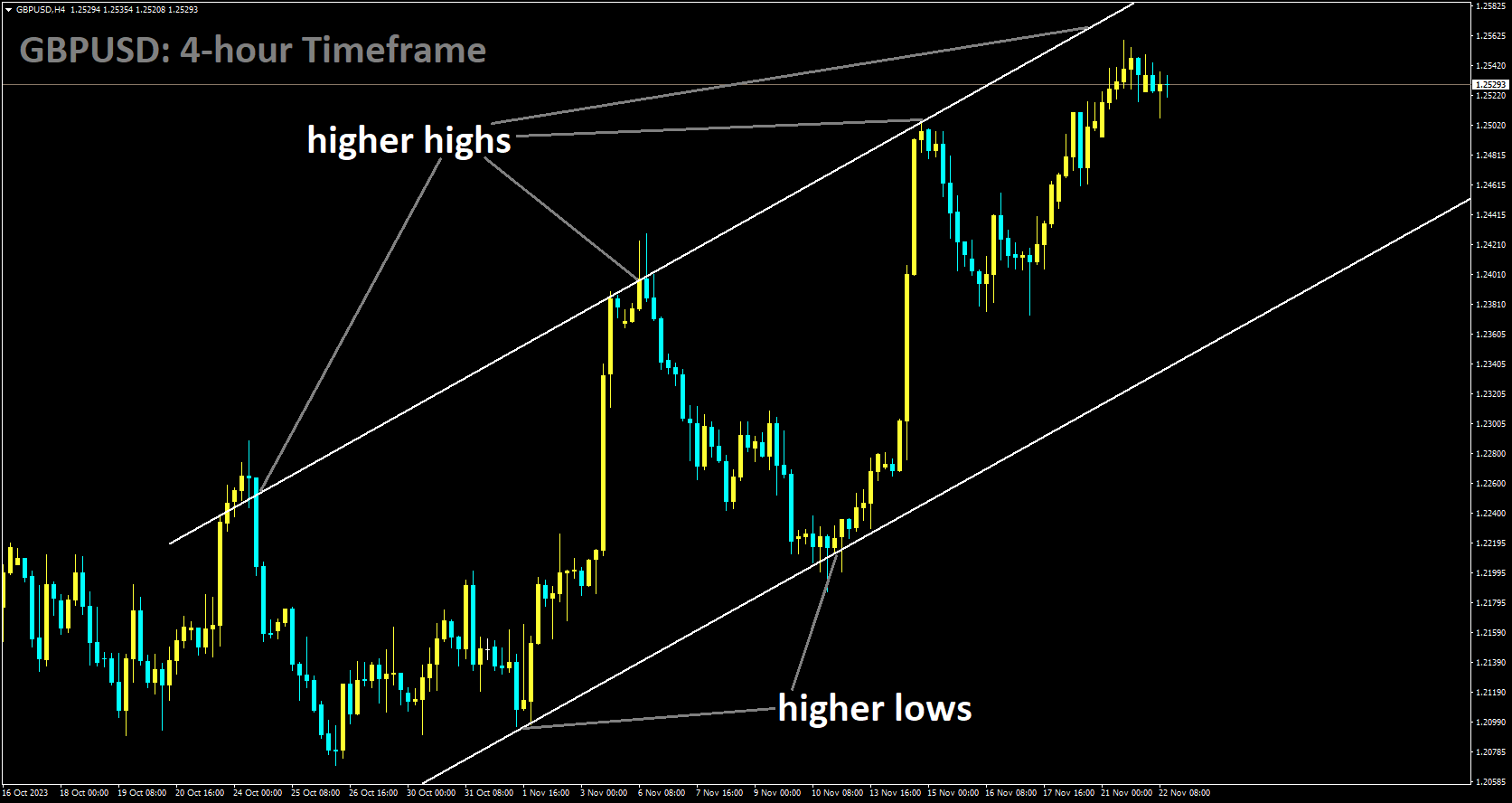

GBPUSD Analysis:

GBPUSD is moving in Ascending channel and market has reached higher high area of the channel

The strength of the British pound is being sustained by a weakened US dollar and the assertive stance of Bank of England Governor Andrew Bailey. Bailey has made crucial remarks regarding inflation and the future of monetary policy, expressing concerns about inflation risks and hinting at the possibility of more aggressive action. While the recently released October inflation data brought positive news, Bailey remains cautious, emphasizing the need to monitor signs of persistent inflation. Geopolitical events in the Middle East contribute to potential upward risks in energy prices. Despite the positive inflation figures, it is premature to consider rate cuts.

Earlier today, UK public sector borrowing data exceeded estimates significantly, although the figure remains deeply negative and is the lowest since June 2023. The debt-to-GDP ratio remains above 100% due to government stimulus measures during the COVID-19 pandemic. The sustained high levels of inflation and interest rates have worsened the deficit, especially as a significant portion of the UK’s debt is inflation-linked. Elevated debt levels pose challenges for absorbing additional economic shocks and expose the nation to credit downgrades.

Later today, attention will shift to the FOMC minutes from the November rate announcement. The Fed has resisted expectations for rate cuts, maintaining a ‘higher for longer’ narrative, but also acknowledging the impact of elevated rates on the US economy. While the minutes are anticipated to echo similar sentiments, recent data indicating a slowing economy and a weakening job market suggests that any dovish messaging could be seized upon by USD bears.

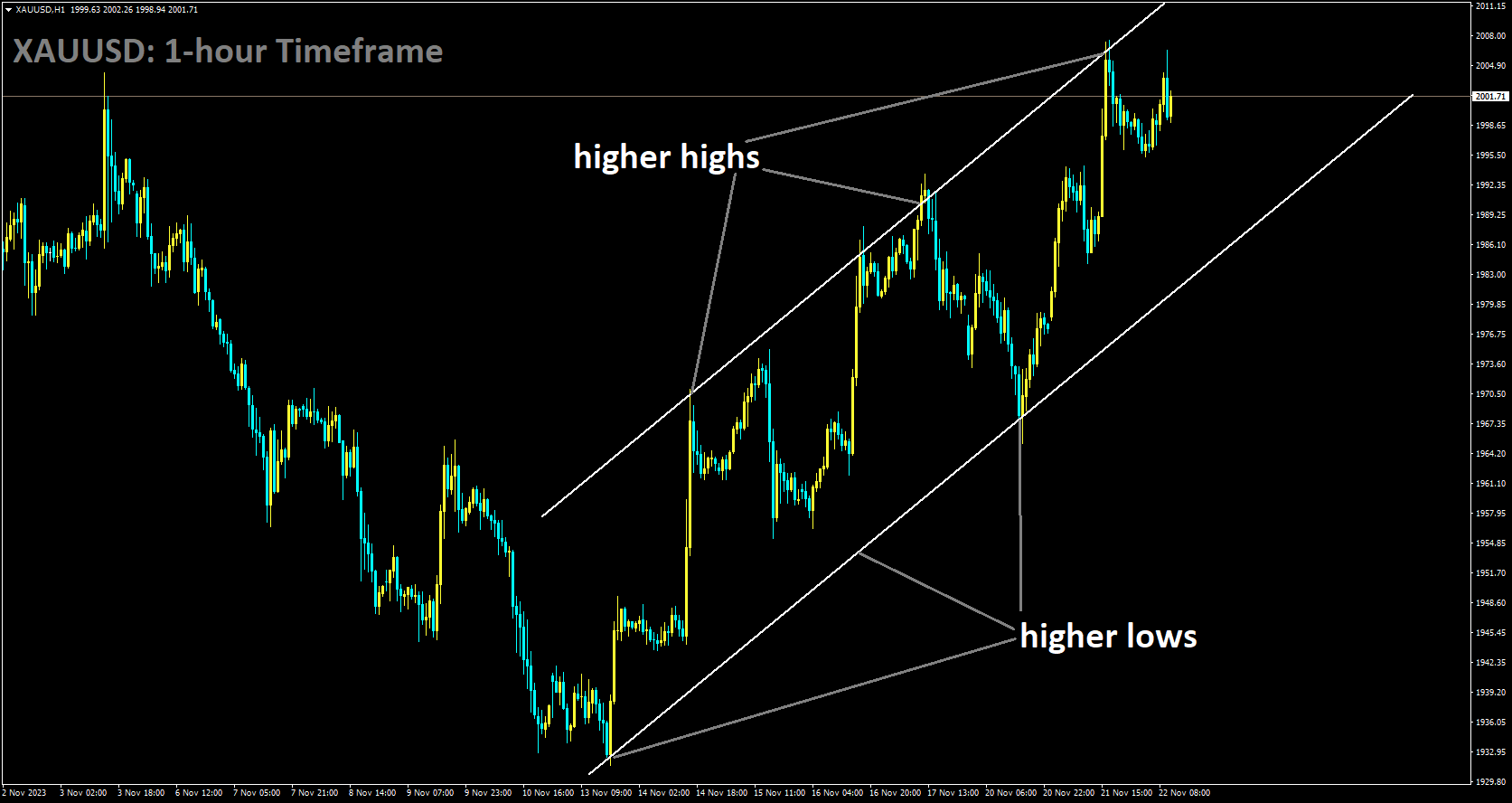

GOLD Analysis:

XAUUSD is moving in Ascending channel and market has reached higher high area of the channel

The imminent release of minutes from the November 1st FOMC meeting holds significant implications for understanding the Federal Reserve’s perspective on the economic landscape. While prevailing market sentiment leans towards the belief that interest rates have reached their zenith and are poised for cuts in the coming year, Federal Reserve Chair Powell strikes a more cautious note regarding inflation.

Despite the prevailing consensus, Powell emphasizes the central bank’s preparedness to escalate interest rates further if circumstances dictate such action. This stands in stark contrast to market expectations, which are pricing in a 100 basis point reduction in US interest rates by the end of the next year, with an initial 25 basis point cut anticipated at the May 2024 meeting.

As these divergent viewpoints create a dynamic backdrop, the US dollar has experienced a decline, shedding four points since the onset of November and breaching several layers of support. The critical juncture for the US Dollar Index lies in its ability to reclaim the 200-day simple moving average; failure to do so may pave the way for further losses.Looking ahead, the financial markets are expected to undergo a period of relative calm post-Wednesday as the US observes Thanksgiving Day on Thursday, followed by the annual Black Friday event. This reduction in market liquidity is likely to contribute to a dampening of volatility heading into the weekend.

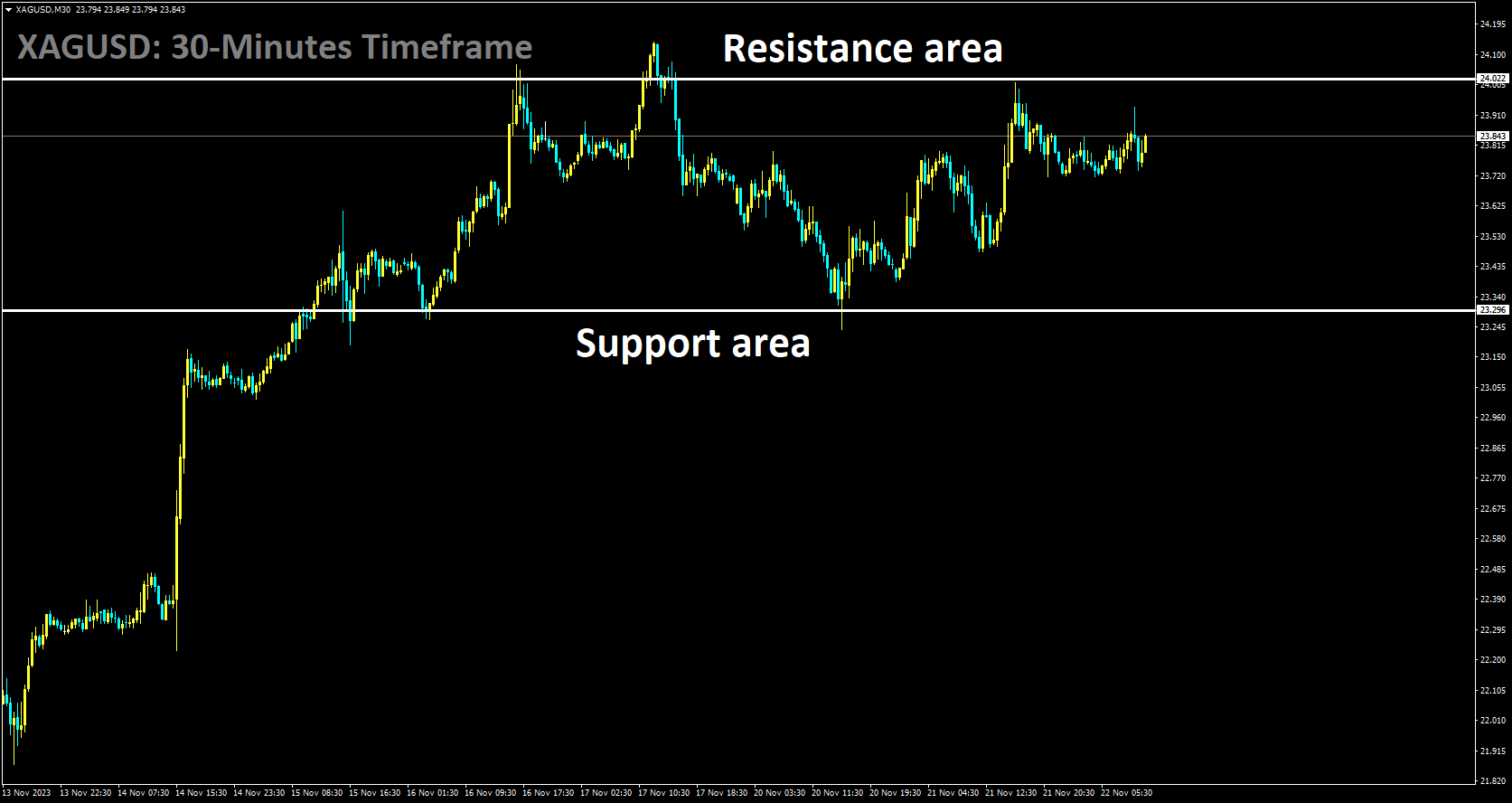

SILVER Analysis:

XAGUSD is moving in box pattern

The recently disclosed minutes from the November FOMC meeting failed to trigger significant market surprises, aligning with the subdued market response observed post-release. This aligns with the broader trend in data and market participants’ reactions, especially in light of recent US inflation figures, which prompted a widespread sell-off in the US dollar.

While the post-meeting outlook for Federal Reserve members may have evolved, some key takeaways from the minutes include the unchanged September staff projections. The central theme remains the Federal Reserve’s commitment to data-driven decision-making, with an emphasis on the potential appropriateness of further policy tightening if progress toward the inflation goal proves insufficient.

Despite the recent boost from the Consumer Price Index (CPI) print, Fed policymakers acknowledge that there is still work to be done, particularly in reducing core services inflation, excluding housing. Rate expectations, as indicated by the FedWatch tool, saw minimal change after the release of the minutes. The first rate cut is anticipated in May 2024, with full pricing in for June 2024.

The upcoming high-impact US data for the week, including Durable Goods Orders and the Final Michigan Sentiment print, is expected tomorrow. However, the market does not anticipate these releases to be particularly exciting, with minimal or short-term impact on the US dollar.

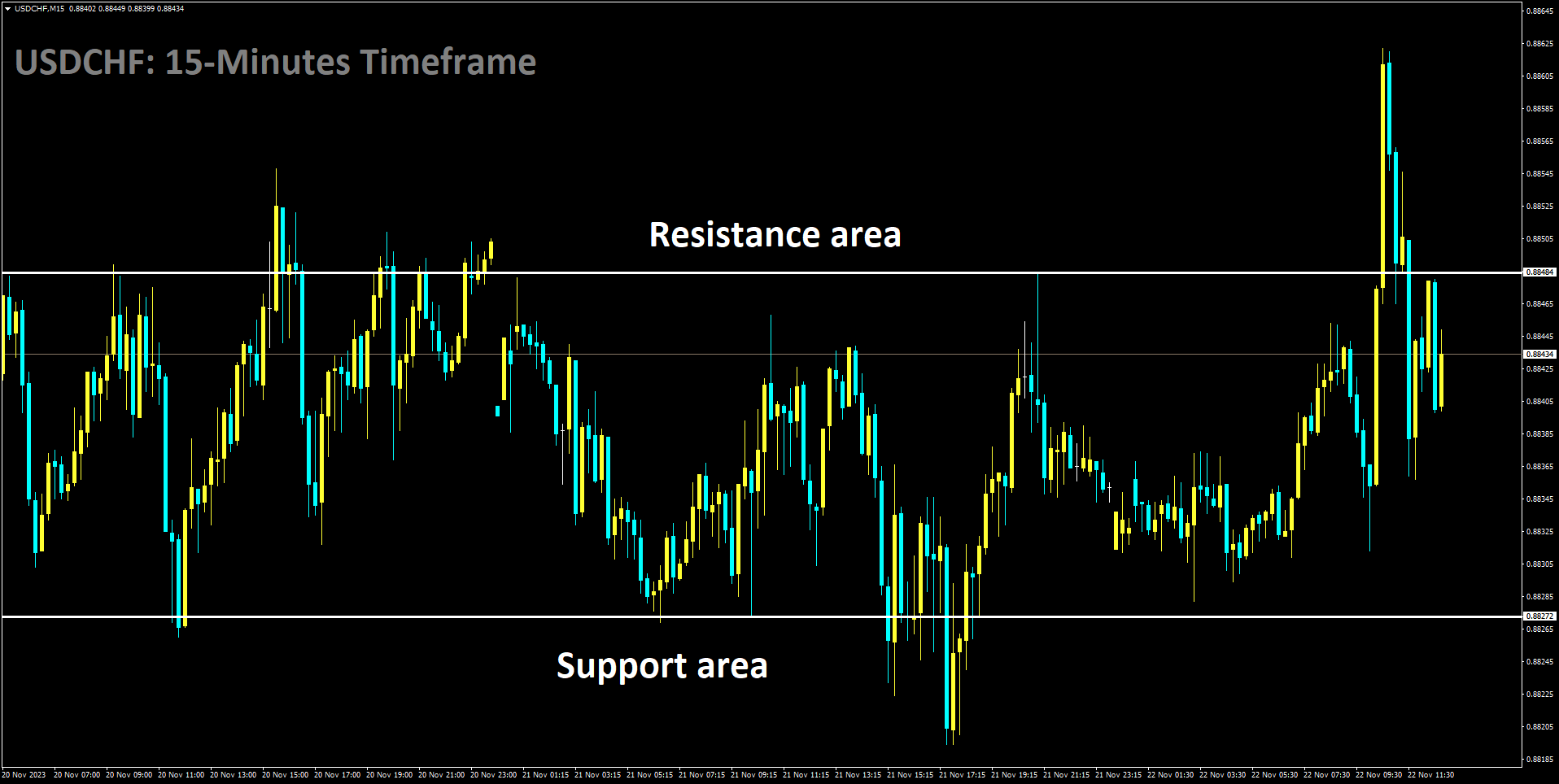

USDCHF Analysis:

USDCHF is moving in box pattern and market has fallen from the resistance area of the pattern

The recently unveiled minutes from the Federal Open Market Committee meeting on Tuesday underscore unanimous agreement among participants. The core tenets include the continuation of policy decisions based on a comprehensive assessment of incoming information and the consensus on the necessity for monetary policy to remain restrictive until inflation consistently aligns with the Committee’s target.

Market sentiment currently leans towards the belief that the Federal Reserve has concluded its hiking cycle, with anticipated rate cuts expected in the middle of 2024. This perception contributes to selling pressure on the US dollar and acts as a hindrance for the USDCHF pair.

Shifting focus to the Swiss Franc, the Swiss Trade Balance for October revealed a decrease from the preceding month, registering at 4,600M, down from 6,282M. This decline is attributed to reduced imports to 18,491M, compared to September, and a decrease in exports to 23,091M from the 24,788M recorded earlier.

Swiss National Bank Chairman Thomas Jordan’s remarks, hinting at the potential for future rate hikes, have provided support for the Swiss Franc against the US dollar. In the context of today’s market activity, attention will be directed towards US weekly Jobless Claims, Durable Goods Orders, and the University of Michigan Consumer Sentiment survey. Additionally, the upcoming US S&P Global PMI data on Friday is anticipated to offer a clearer direction for the USDCHF pair.

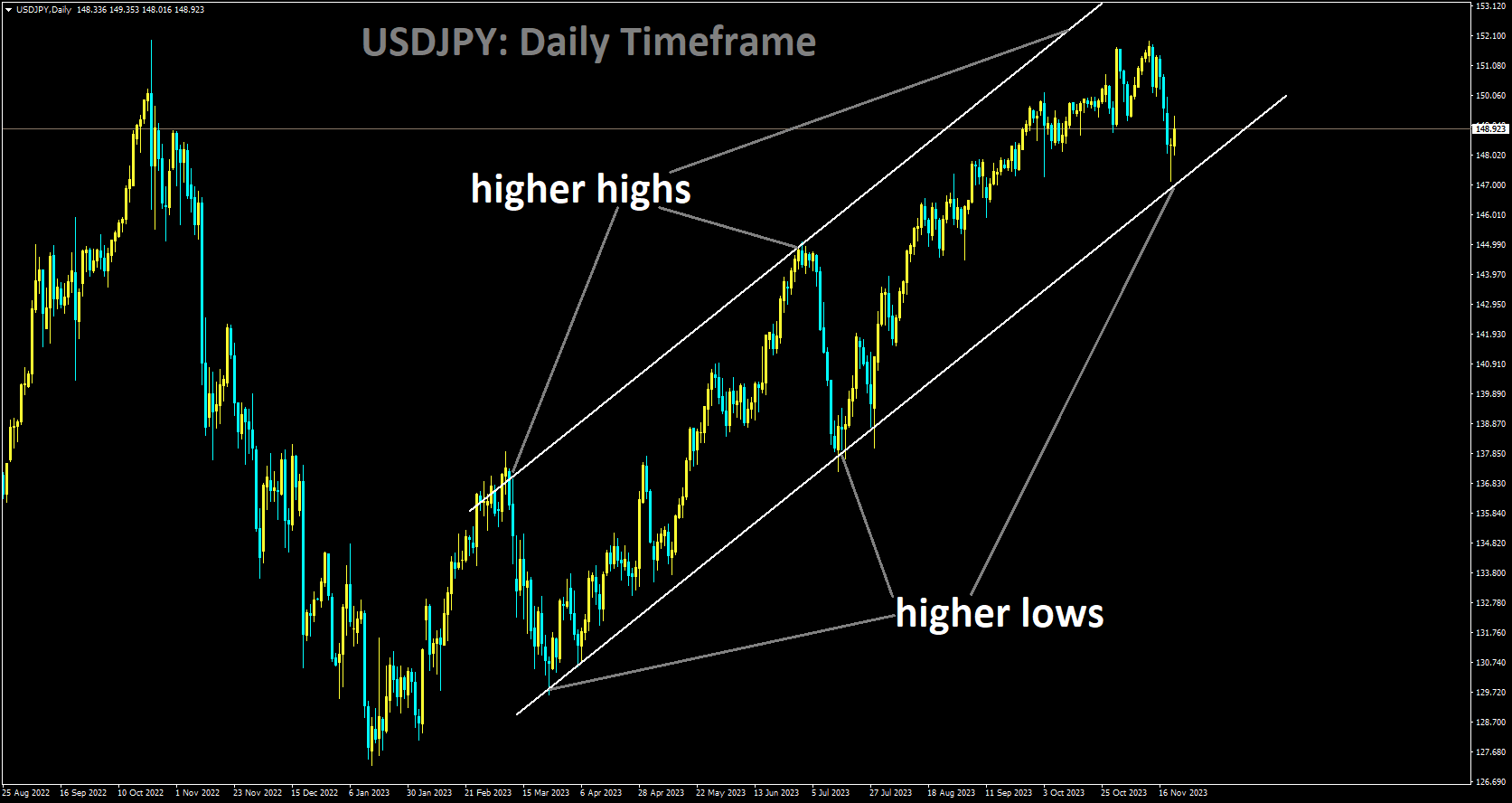

USDJPY Analysis:

USDJPY is moving in Ascending channel and market has reached higher low area of the channel

The Japanese yen faces challenges in maintaining a sustained period of strength, even after the Bank of Japan’s removal of previous obstacles to increasing bond yields—a move typically associated with currency appreciation. The initial lack of momentum is compounded by the fact that BoJ Governor Ueda did not specify a timeline for when the central bank might shift away from its ultra-loose policy.

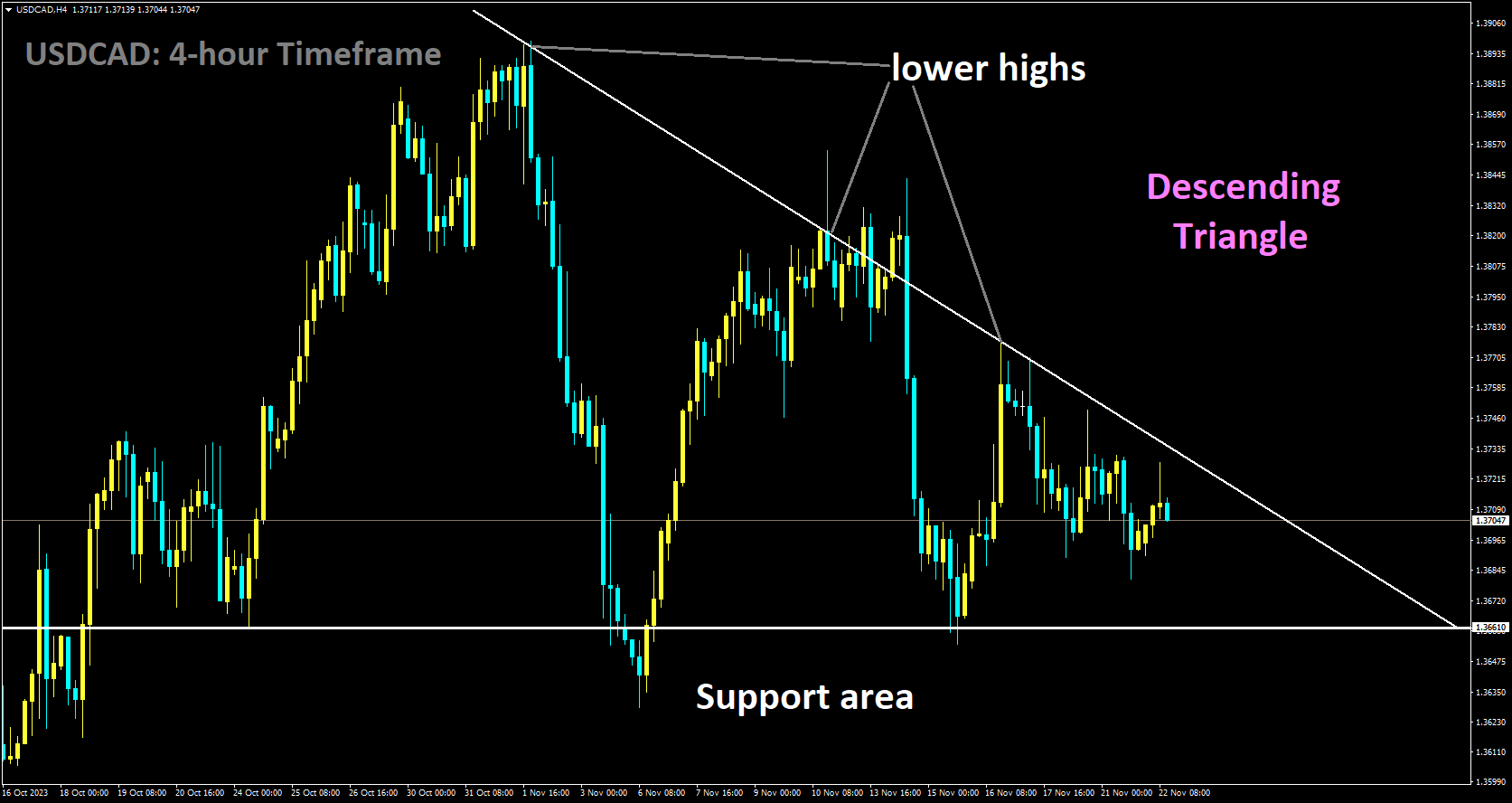

USDCAD Analysis:

USDCAD is moving in Descending Triangle and market has fallen from the lower high area of the pattern

The Bank of Canada received positive news as Canadian inflation, mirroring its US counterpart, declined more than anticipated. This development holds significance for the Bank of Canada, considering the gradual increase in inflation since the June low of 2.8%, peaking at 4% in August. The October 2023 annual inflation rate in Canada dropped to 3.1% from the previous month’s 3.8%, slightly below the market’s expected 3.2%. This outcome was softer than the Bank of Canada’s projection, which foresaw inflation remaining close to 3.5% until the middle of the next year. The market perceives this as an indication that another rate hike from the central bank is unlikely in the near term.

The current interest rate environment is already impacting Canadian consumers, and an additional hike could exacerbate the challenges they face. The decline in gas prices played a significant role in the overall decline in inflation, and a reduction in food price inflation is viewed as a positive development. However, from a consumer standpoint, the current 5.6% food price inflation remains uncomfortably high, and rising bond yields are keeping mortgage costs elevated. This less-than-optimistic outlook for the Canadian economy may continue to exert pressure on the Canadian dollar in the foreseeable future. Despite the US Federal Reserve Minutes having little impact on markets earlier, recent data suggests that the Fed is making significant efforts to bring inflation back to its target.

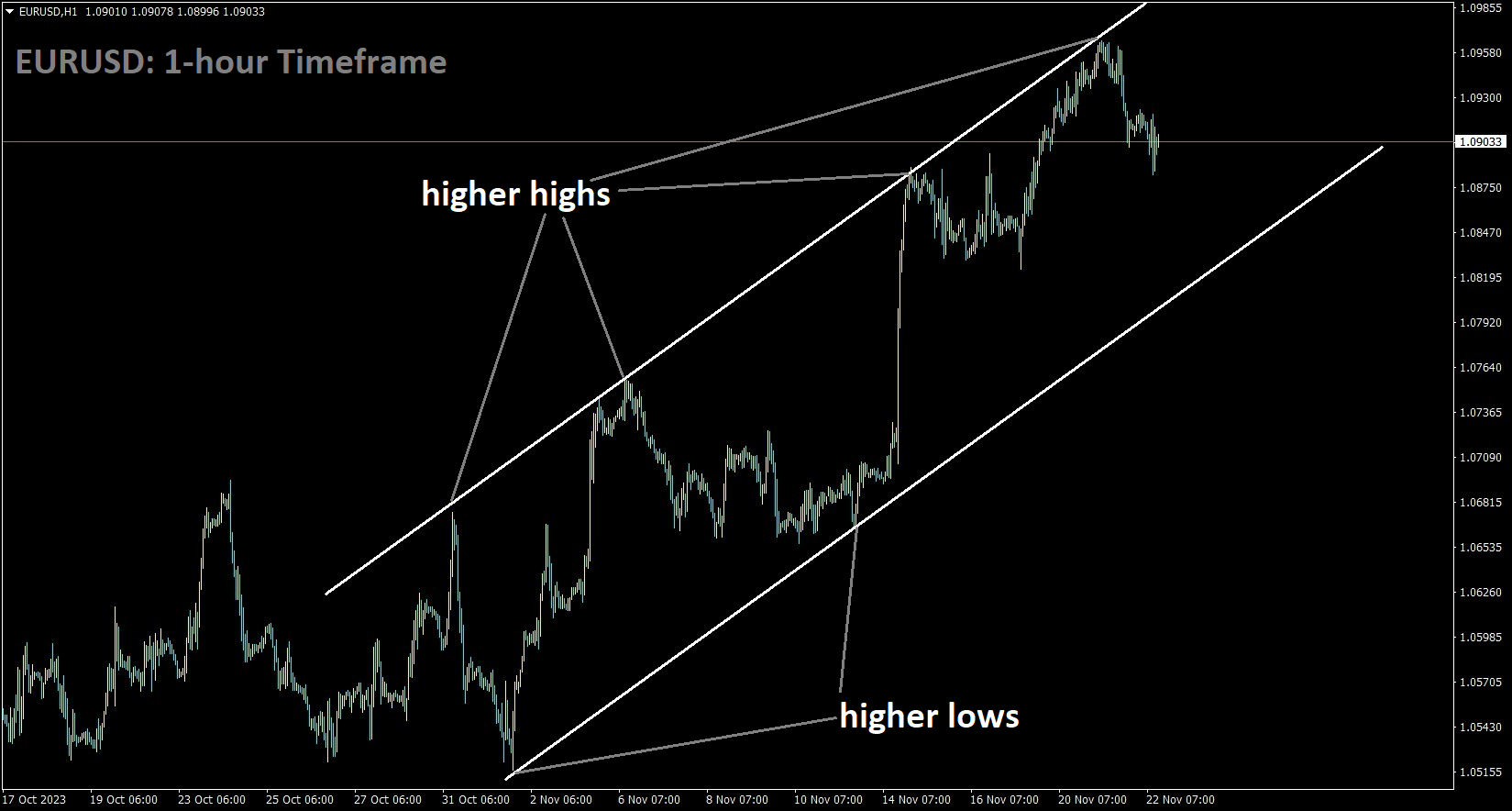

EURUSD Analysis:

EURUSD is moving in an Ascending channel and market has fallen from the higher high area of the channel

The EURUSD pair received a measure of support following hawkish remarks made overnight by Christine Lagarde, the President of the European Central Bank. Speaking at an event in Berlin, Lagarde mentioned that it is premature to declare victory over inflation, cautioning against bets based on short-term data flow.

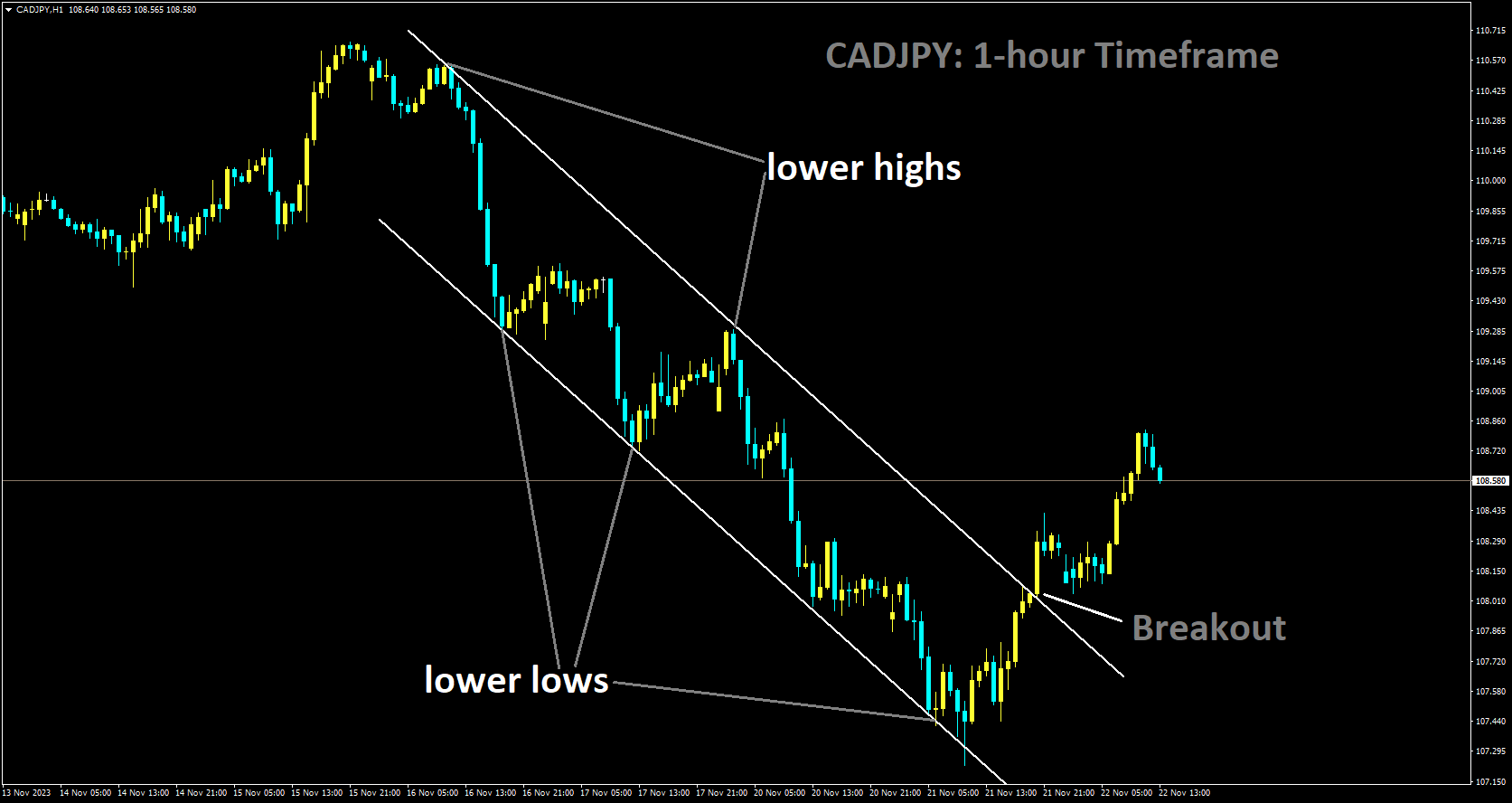

CADJPY Analysis:

CADJPY has broken Descending channel in upside

In an address to members of Parliament on Wednesday, Japan’s Prime Minister Fumio Kishida stated that the monetary policy of the Bank of Japan is not designed to influence foreign exchange rates in a specific direction. Kishida further noted that his government anticipates the BOJ to implement appropriate monetary policies and to communicate its perspectives with the government.

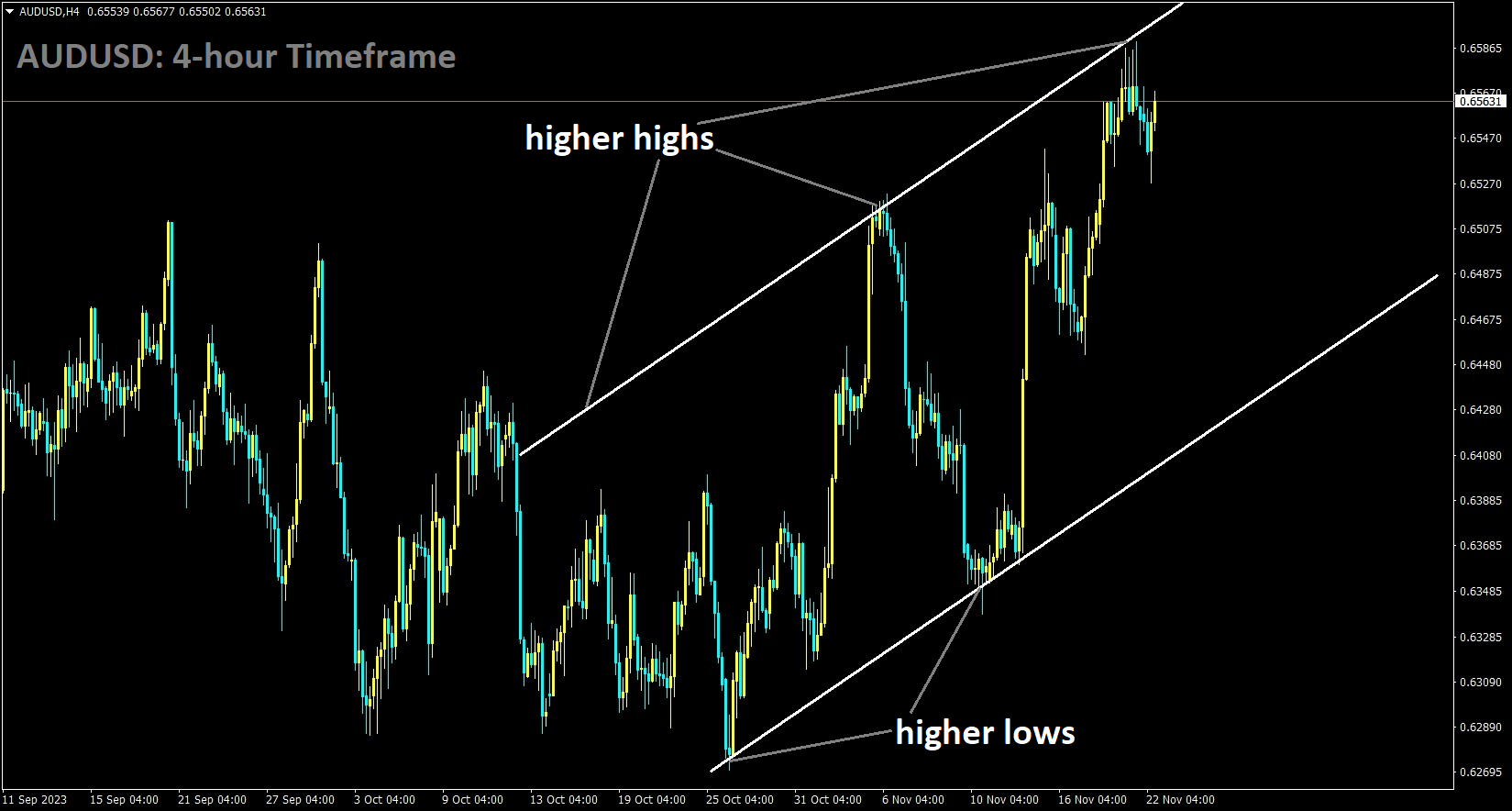

AUDUSD Analysis:

AUDUSD is moving in an Ascending channel and the market has reached the higher high area of the channel

The minutes from the November 7th RBA meeting unveiled a close consideration of a 25 basis points rate hike, aimed at anchoring inflation expectations. Notably, the committee’s recent forecasts incorporated the assumption of additional rate increases. The decision was somewhat facilitated by the comparatively low Australian Cash Rate in comparison to other major central banks.

Although Australian interest rates are somewhat restrictive, the housing market displayed resilience, indicating that demand could still pose potential challenges in the sector, potentially influencing future price increases. In a panel discussion earlier today, RBA Governor Michele Bullock emphasized the evolving nature of the inflation profile, initially rooted in supply-side issues but more recently demonstrating an increasingly significant role played by demand.

NZDUSD Analysis:

NZDUSD is moving in Ascending channel and market has fallen from the higher high area of the channel

The New Zealand Dollar experienced an early rally on Tuesday, but this momentum waned as the US Dollar strengthened following the release of the Federal Open Market Committee Minutes from its early November meeting. The FOMC Minutes indicated the central bank’s readiness for further tightening if deemed necessary. Optimism about the Chinese economy, fueled by pledges of support from Chinese central bank officials on Monday, has contributed to the positive outlook for New Zealand, a significant trading partner. As optimism grows regarding China, New Zealand’s largest trading neighbor, the New Zealand Dollar sees upward movement. This reflects the anticipation of robust demand for Kiwi goods, leading to increased demand for the currency and bolstering its strength.

On Monday, the People’s Bank of China reiterated its commitment to providing additional policy support for the struggling real estate sector. The decision to maintain the benchmark Loan Prime Rate at record lows of 3.45% further supports the availability of easy credit. Meanwhile, the US Dollar continues to be burdened by the expectation that the Federal Reserve has completed its current interest rate cycle and is at a crucial turning point. The anticipation of nearly 100 basis points of Fed rate cuts by December 2024 has led to a significant decline in US Treasury bond yields, closely linked to the USD. The yield on the 10-year US government bond hit a two-month low on Friday, further undermining the US Dollar. The next significant release for NZDUSD will be the minutes from the November Federal Reserve meeting, offering insights into the views of the Fed’s interest-rate setters and whether they align with the market’s perspective on reaching the peak rate.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% FLAT OFFER for Signals 😍 GOING TO END – Get now: forexfib.com/discount/