GOLD Analysis:

XAUUSD is moving in Ascending channel and market has rebounded from the higher low area of the channel

Gold has recently broken through the horizontal barrier in the $2,008-2,010 range, achieving $2,018 on Monday, marking its highest level since mid-May. At present, the precious metal seems to be undergoing a bullish consolidation phase, hovering just below this key level as it enters the European session on Tuesday.

This surge in gold prices is attributed to various factors, including speculations about a potential pause in the Federal Reserve’s monetary tightening cycle. This speculation gained momentum after the release of softer US consumer inflation figures two weeks ago. Furthermore, market expectations now include the possibility of a series of rate cuts in 2024. These factors have caused the US Dollar to slide to a nearly three-week low, supporting the ongoing upward trend in gold prices from the sub-$1,950 levels observed on November 13.

Despite concerns about a global economic downturn, which typically favors traditional safe-haven assets like gold, there is a cautious tone among bullish traders. This caution is partly influenced by positive sentiment in Asian equity markets. Bullish traders are eagerly awaiting the release of the Personal Consumption Expenditure Price Index from the United States (US) for substantial impetus. Additionally, the release of the Conference Board’s Consumer Confidence Index and speeches by influential Federal Open Market Committee (FOMC) members later on Tuesday could present short-term trading opportunities.

Despite these potential catalysts, the near-term fundamental backdrop appears to strongly favor bullish traders. The growing consensus that the Federal Reserve has concluded its rate hikes provides support for the non-yielding gold price to hold above the psychological $2,000 mark.

The release of softer US consumer inflation figures two weeks ago increased expectations that the Fed would maintain current interest rates and potentially ease policy in 2024. Monday’s data indicated a larger-than-expected decline in sales of new single-family homes in the US for October, driven by higher mortgage rates affecting affordability. The benchmark 10-year US Treasury bond yield is near a two-month low, pulling the US Dollar to a nearly three-month low and benefiting XAUUSD.

The looming risk of a recession adds further support to the safe-haven precious metal, although gains are capped by a positive tone in equity markets. Traders are now eagerly anticipating the Conference Board’s US Consumer Confidence Index and Fed officials’ speeches for market impetus during the North American session. Additionally, focus remains on Thursday’s release of the Fed’s preferred inflation gauge, the core PCE Price Index.

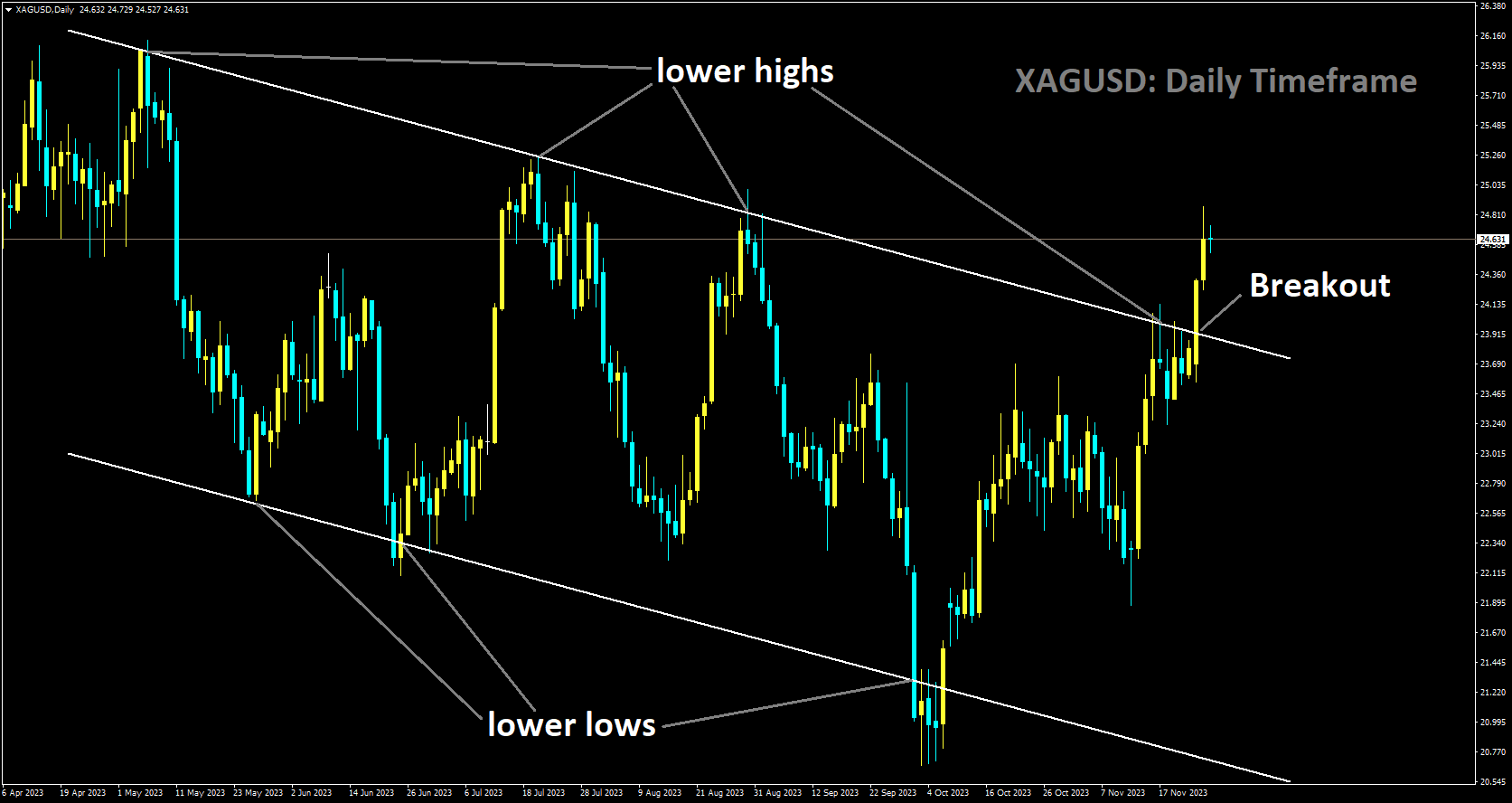

SILVER Analysis:

XAGUSD has broken Descending channel in upside

The US Dollar Index is currently at 103.25, experiencing losses of nearly 0.15%. Ongoing vulnerability in the Greenback is attributed to dovish speculations concerning the future actions of the Federal Reserve, with market attention focused on Thursday’s release of Personal Consumption Expenditures figures – the Fed’s preferred gauge for inflation.

Despite the release of October’s data on New Home Sales and Building Permits during the session, they did not significantly impact the dynamics of the USD. The US Dollar’s weakness stems from concerns about a cooling labor market and subdued inflation in the US economy, leading to expectations of a dovish stance by the Federal Reserve.

Investors are eagerly awaiting the release of October’s PCE figures, an additional jobs report, and the November Consumer Price Index (CPI) before the December meeting, where clearer guidance from the Fed is anticipated. These forthcoming releases are expected to shape the future movements of the US Dollar.

The US Dollar is currently navigating within a neutral range, influenced by the impending PCE inflation figures and the prevailing dovish sentiment towards the Federal Reserve. In terms of recent data, New Home Sales for October fell below expectations, recording 679K compared to the anticipated 725K, as reported by the US Census Bureau. However, October brought positive news with the Building Permits figure, surpassing both previous and predicted numbers at 1.498 million.

Notably, US bond yields have reversed course at the beginning of the week, with 2-year, 5-year, and 10-year yields at 4.92%, 4.44%, and 4.42%, respectively, currently hindering the USD’s upward momentum. According to the CME FedWatch Tool, markets are currently pricing in no rate hike at the December meeting, and rate swap futures indicate expectations for rate cuts in mid-2024.

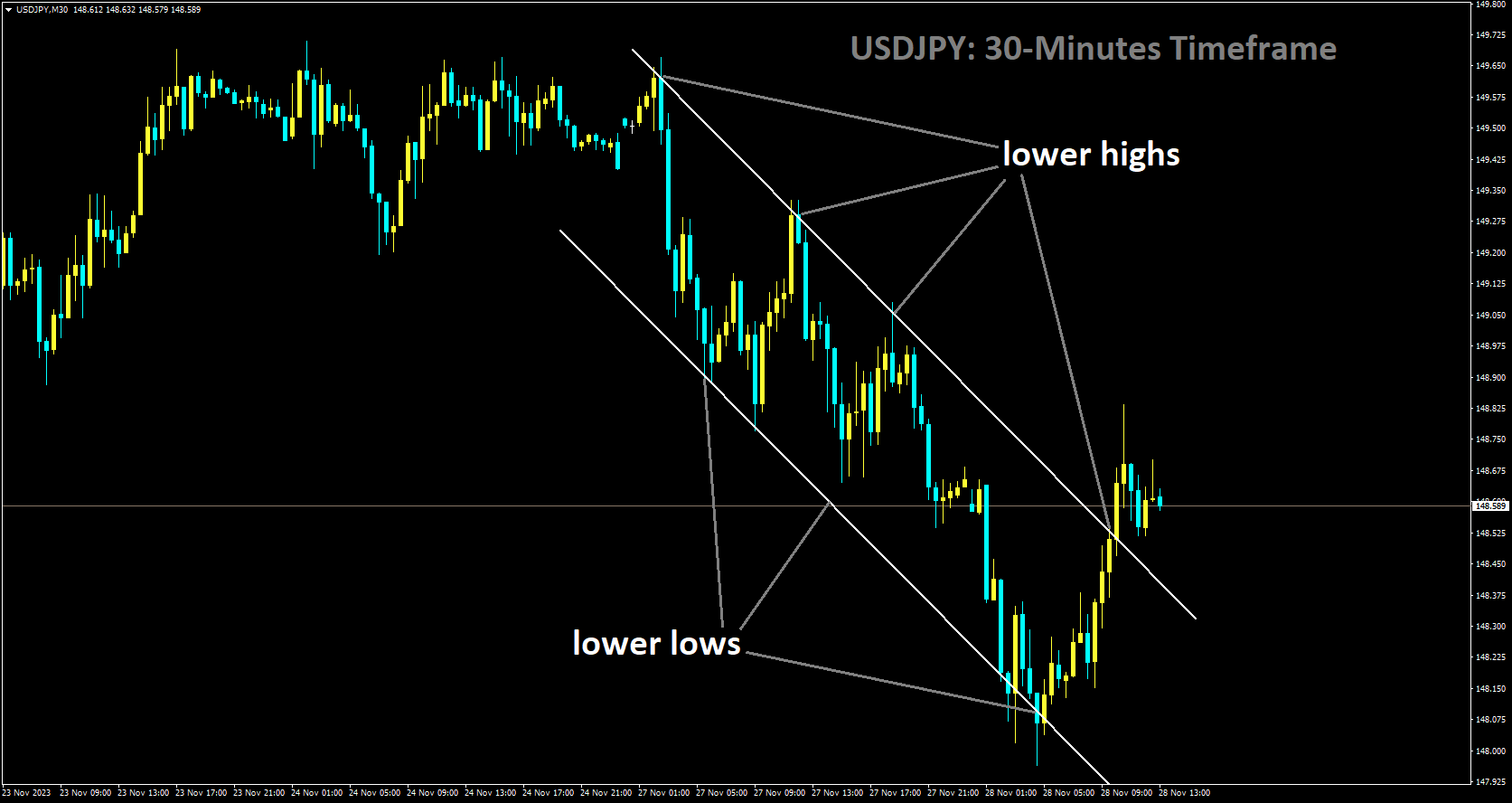

USDJPY Analysis:

USDJPY is moving in Descending channel and market has reached lower high area of the channel

The Japanese Yen concluded the trading week on a subdued note, influenced by a post-US Thanksgiving Day lull. However, Friday provided crucial information for the Bank of Japan’s (BOJ) analysis. Once again, headline inflation exceeded 2%, surpassing estimates and maintaining a level above 3%. It’s important to recall that the BOJ consistently emphasizes its desire for sustained inflation above 2%, heightening the likelihood of a potential policy shift.

A hawkish move would support the yen and potentially mark the end of the negative interest rates policy.The ongoing conflict in Israel requires close monitoring, as the JPY may garner additional support in the event of an escalation due to safe-haven demand. Looking ahead to the upcoming, the focus will shift more towards US economic data, with the core PCE deflator taking precedence as the Federal Reserve’s preferred measure of inflation.

From a Japanese perspective, BoJ officials will be dispersed throughout the week, along with the release of retail sales and unemployment data.

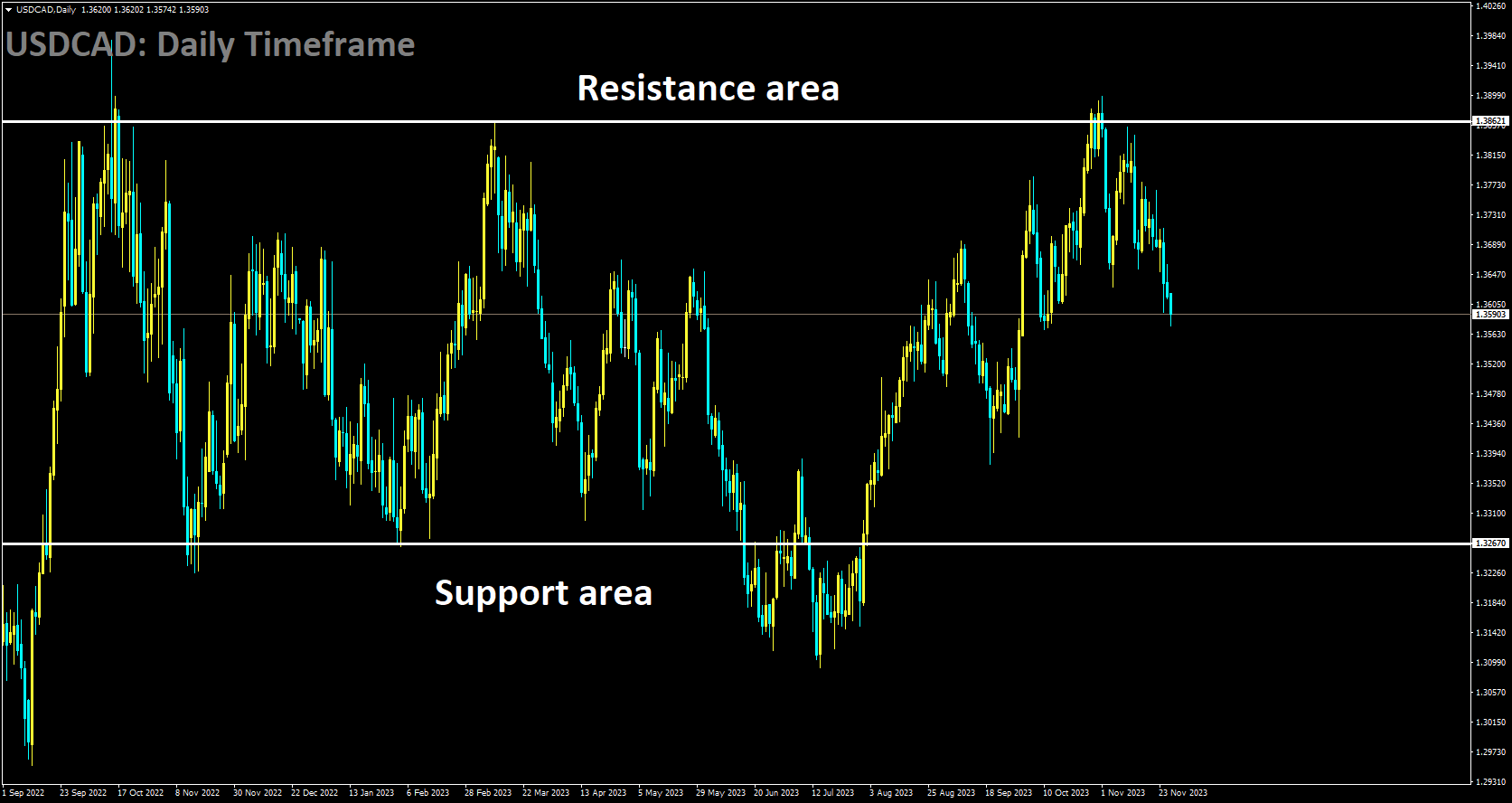

USDCAD Analysis:

USDCAD is moving in box pattern and market has fallen from the resistance area of the pattern

The Canadian Dollar receives some support from the rebound in crude oil prices and positive market sentiment. Western Texas Intermediate has broken a four-day losing streak, currently hovering around $75.30 per barrel. Attention is now directed towards the imminent OPEC+ meeting, with widespread expectations for a decision to deepen and extend cuts to oil production.

The US Dollar Index, hitting its lowest point since late August at 103.07 on Tuesday, continues its downward trend, propelled by a decline in US Treasury yields. Notably, the 2 and 10-year bond yields have eased to 4.87% and 4.40%, respectively.

The US Dollar faces downward pressure as traders factor in almost 85 basis points of cuts in 2024 by the Federal Reserve (Fed). The risk-on sentiment is further reinforced by a recent report from the US Census Bureau, revealing a significant 5.6% drop in New Home Sales for October at 679K, below the market consensus of 725K.

Looking ahead, investors are likely to focus on Canada’s Gross Domestic Product on Thursday, followed by the Net Change in Employment on Friday. Additionally, Tuesday brings attention to US data, including the Housing Price Index and CB Consumer Confidence. Speeches from Federal Reserve officials during the week will offer valuable insights into the central bank’s perspective on the economic landscape.

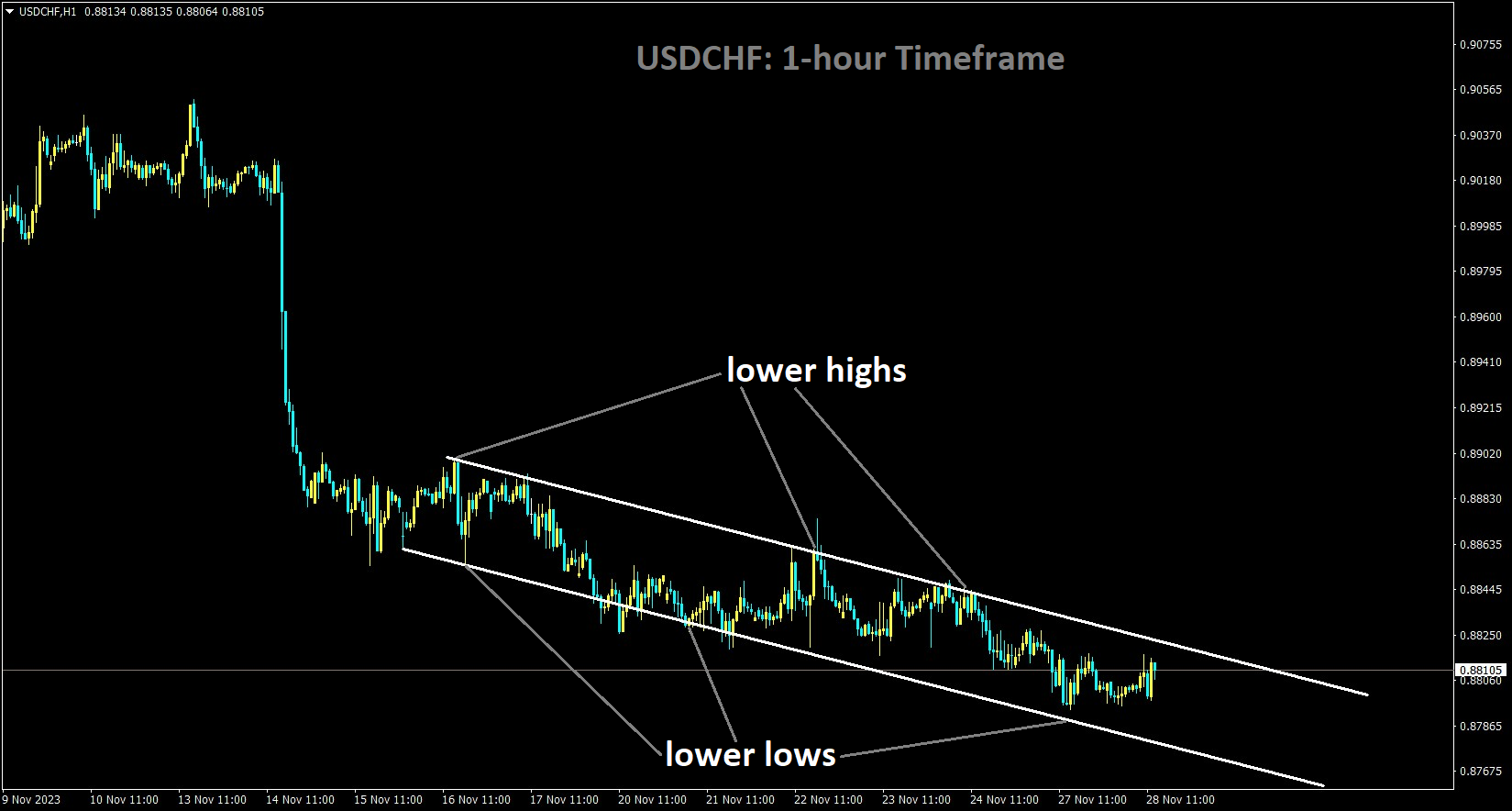

USDCHF Analysis:

USDCHF is moving in the Descending channel and the market has reached the lower high area of the channel

The USDCHF pair grapples with ongoing losses, primarily attributed to the weakened US Dollar amid expectations that the US Federal Reserve is poised to conclude its monetary rate hike cycle. Furthermore, investors are factoring in a potential 85 basis points of interest rate cuts by the Fed in the coming year.

The US Dollar Index, currently hovering around 103.20, maintains a negative bias as reinforced by a risk-on sentiment fueled by the latest report from the US Census Bureau. The report reveals a significant 5.6% decline in New Home Sales for October, registering at 679,000, notably below the market expectation of 725,000. The prevailing downtrend persists, propelled by a dip in US Treasury yields.

Looking ahead, the United States is set to release the Housing Price Index and CB Consumer Confidence, accompanied by insights from Federal Reserve officials, offering a comprehensive view of the economic landscape. The upcoming Swiss ZEW Survey Expectations on Wednesday carries particular significance as it initiates a week of notable data releases.

The last reported reading in October was -37.8, indicating pervasive pessimism among businesses regarding the Swiss economy. Additionally, Swiss Real Retail Sales for October, scheduled for release on Thursday, is anticipated to show improvement, expecting a 0.2% uptick from the previous 0.6% decline. Friday will see attention on the Gross Domestic Product for the third quarter.

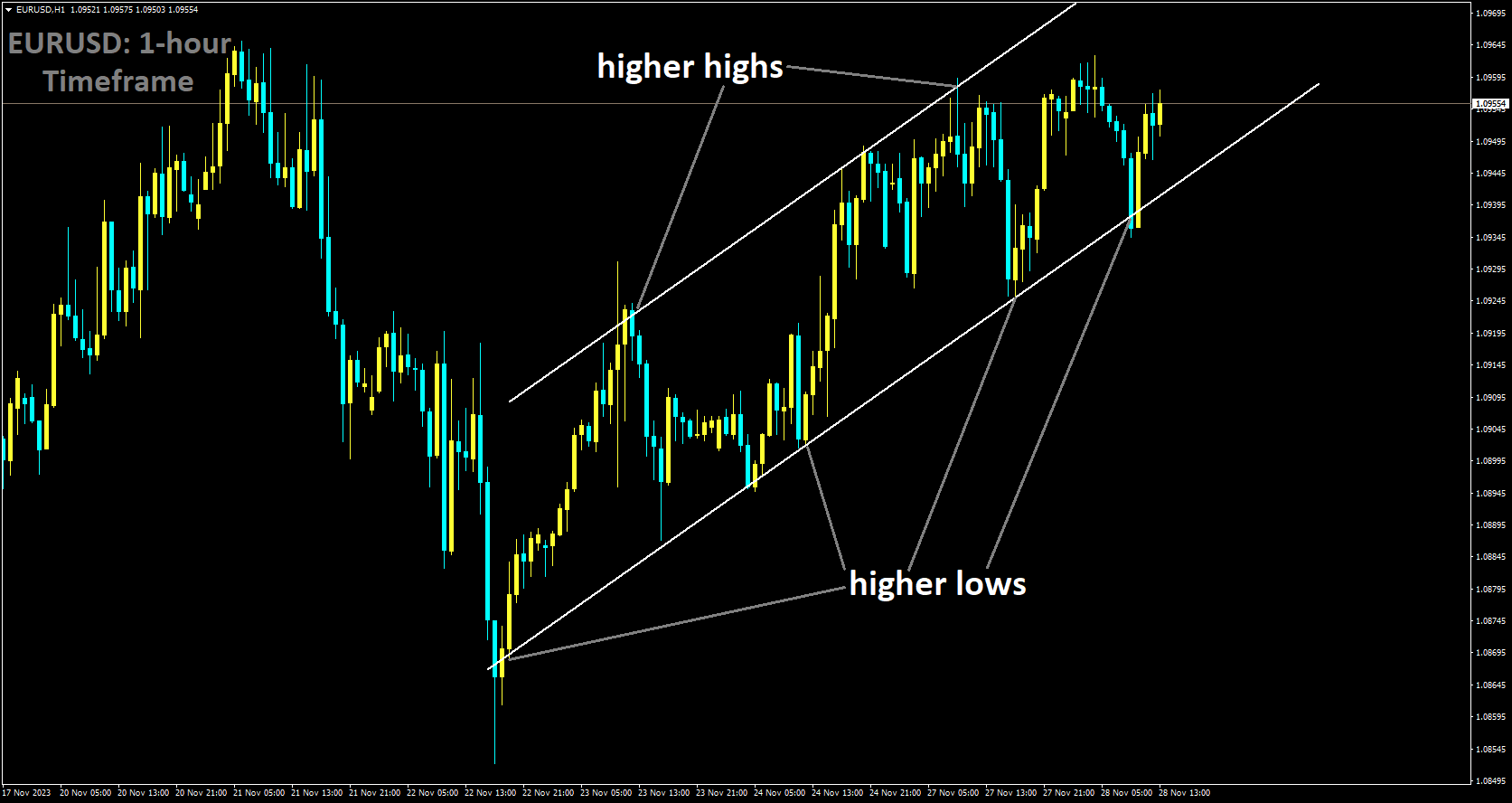

EURUSD Analysis:

EURUSD is moving in Ascending channel and market has rebounded from the higher low area of the channel

According to Société Générale, the prevalent market expectation of rate cuts commencing in the first half of 2024 may be exaggerated. This view stems from the anticipation that core inflation measures in the broader European economy will manifest with slightly higher inflation, thereby preventing rate cuts from the European Central Bank.

The downward momentum in inflation is expected to persist in November, potentially strengthening the narrative that the ECB will initiate rate cuts in the first half of 2024. Nevertheless, this narrative may undergo a reversal in early 2024. As governments phase out their energy support measures, core inflation is expected to exhibit resilience, resulting in both core and headline figures only declining to 2.5% by the end of 2024.

Unexpectedly robust performance in Brent crude has led to stronger energy dynamics in the short term compared to earlier forecasts. The gradual unwinding of government support measures aimed at mitigating the energy crisis, set to begin in December 2023 and conclude in May 2024, is projected to maintain headline inflation at its current levels. Although market expectations anticipate a return to 2% headline inflation in late summer 2024, Société Générale suggests that this outlook might be challenged and proven incorrect.

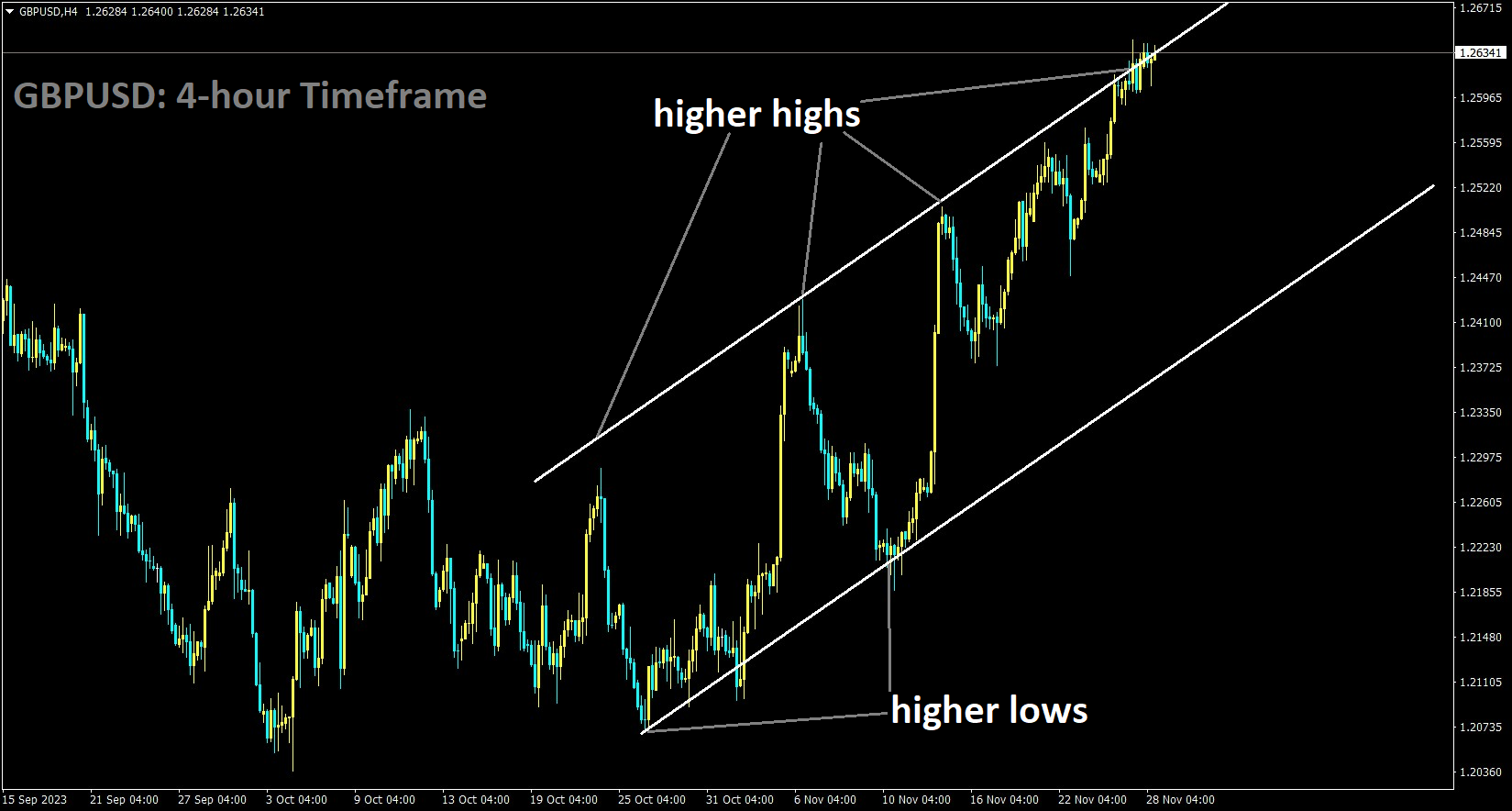

GBPUSD Analysis:

GBPUSD is moving in an Ascending channel and the market has reached the higher high area of the channel

Bank of England governor Andrew Bailey issued a cautionary statement, expressing the difficulty and time required to bring inflation back to the target of 2%. Bailey highlighted that the present restrictive policy is negatively impacting economic growth. During an interview with ChronicleLive, he emphasized the consequences if the central bank fails to bring inflation under control, suggesting that the situation could worsen.

Bank of England

Looking ahead, Bailey projected that by the end of the first quarter next year, inflation might be slightly below 4%, with the challenge of achieving the remaining 2% primarily reliant on policy and monetary measures. He noted that the current policy is operating in a restrictive manner, constraining the overall economy. Considering market rate expectations, there were indications of a potential 90 to 100 basis points of rate cuts in 2024, although current probabilities suggest a more conservative estimate of around 61 basis points.

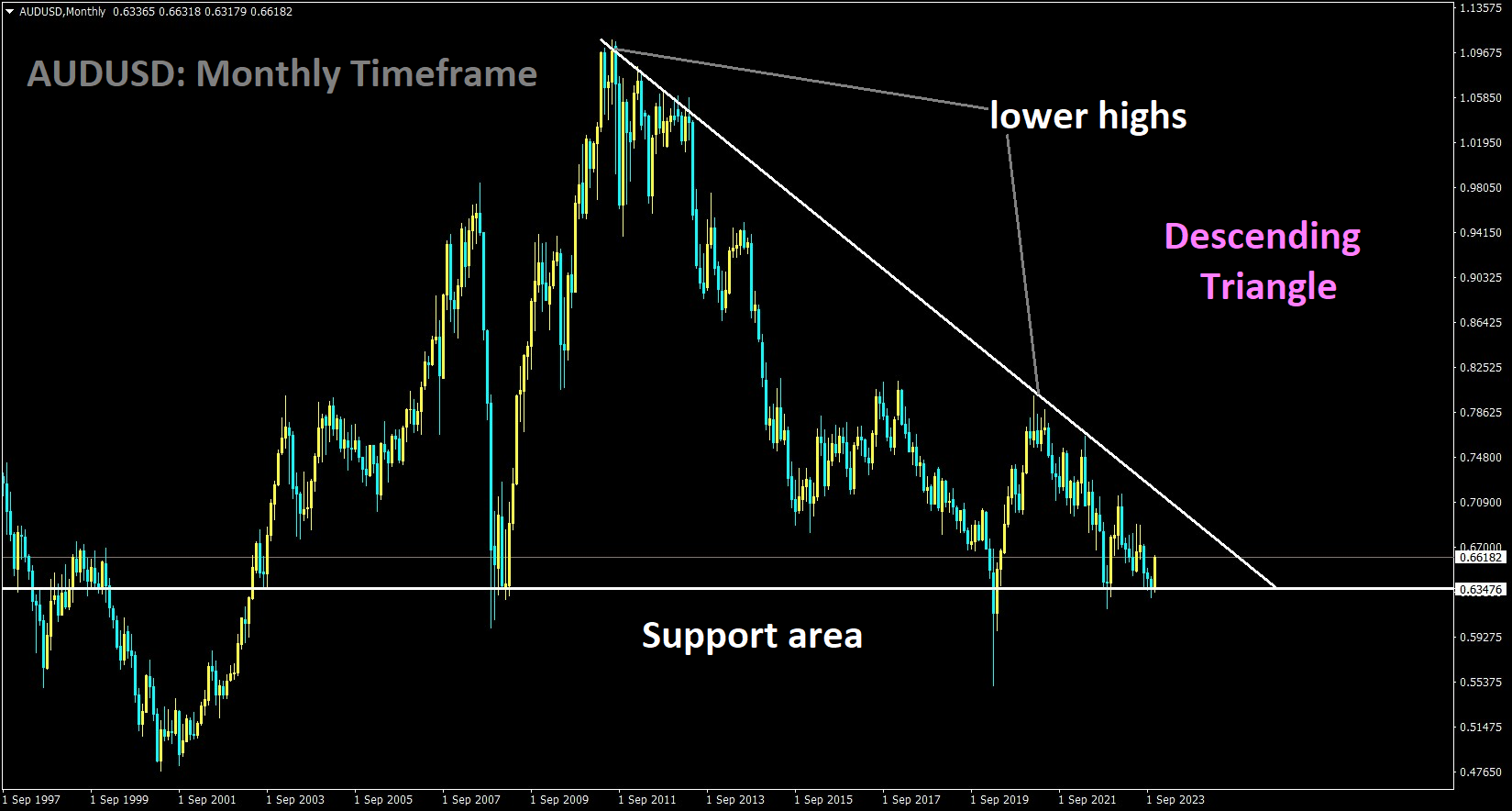

AUDUSD Analysis:

AUDUSD is moving in the Descending triangle pattern and the market has rebounded from the support area of the pattern

Reserve Bank of Australia Governor Michele Bullock engaged in a panel discussion titled “Inflation, Financial Stability, and Employment” at the Hong Kong Monetary Authority and Bank for International Settlements High-Level Conference in Hong Kong on Tuesday. During the discussion, she emphasized the delicate balance the central bank must strike when using interest rates to address inflation without negatively impacting unemployment.

Australia’s inflation trajectory mirrors global patterns, and the current monetary policy is characterized as restrictive. Rate increases are having a cooling effect on demand. However, the sustained demand is partly fueled by immigration, contributing to secondary effects of rising costs. Bullock highlighted the persistence of inflation in the services sector, emphasizing its resistance to easy adjustments.

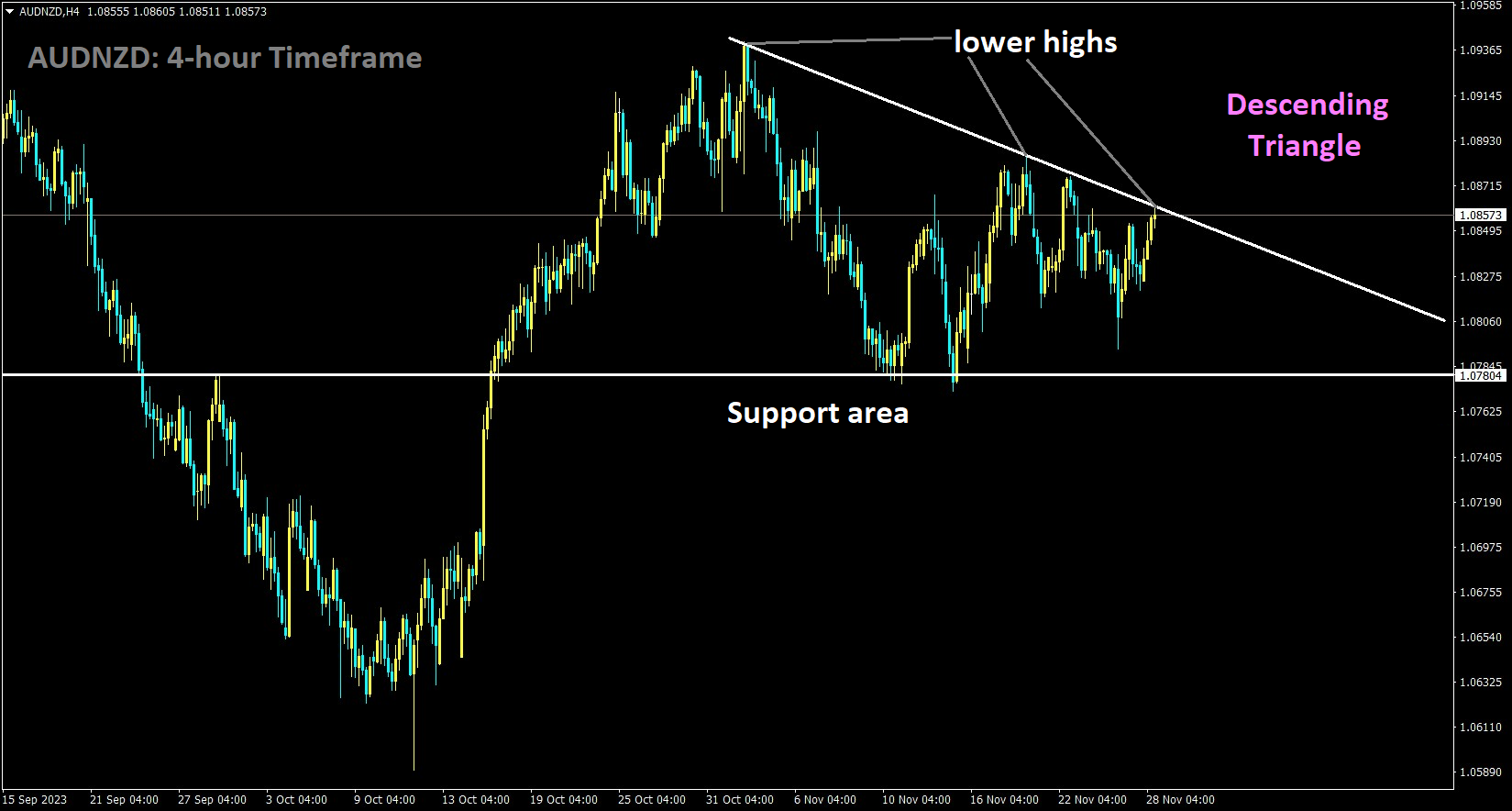

AUDNZD Analysis:

AUDNZD is moving in the Descending triangle pattern and the market has reached the lower high area of the pattern

China’s Premier Li Keqiang expressed Beijing’s opposition to any form of decoupling and the severing of supply chains. He conveyed China’s willingness to strengthen supply chain linkages with all countries and affirmed the country’s commitment to establishing an international business environment based on rule of law principles.

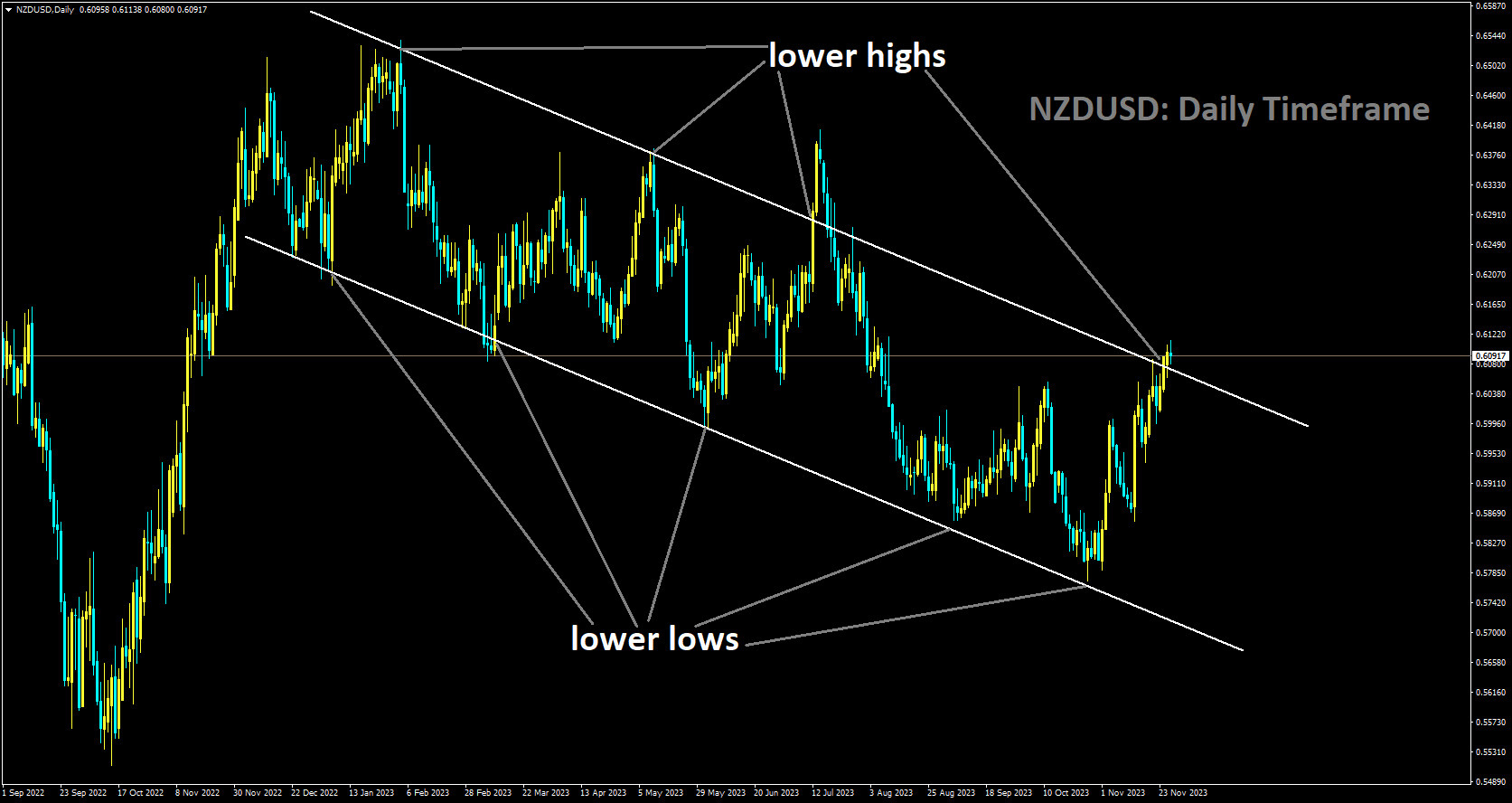

NZDUSD Analysis:

NZDUSD is moving in Descending channel and market has reached lower high area of the channel

The NZDUSD uptick is supported by the overall weakness of the US Dollar. The focal point of the week is the upcoming monetary policy meeting of the Reserve Bank of New Zealand on Wednesday. The New Zealand central bank is anticipated to maintain its overnight cash rate at 5.50% for the fourth consecutive meeting, with speculation about a potential future rate cut, although the specific timing remains uncertain.

Additionally, the recently announced Chinese stimulus plan aimed at boosting the property sector contributes to providing some support for the New Zealand Dollar, known as a China-proxy currency. On the US Dollar front, Monday’s housing data indicated that higher mortgage rates had a negative impact on demand in October. The Census Bureau and the Department of Housing and Urban Development reported a 5.6% month-on-month decline in New Home Sales to 679K in October, falling short of the expected 725K.

Concurrently, the Dallas Fed Manufacturing Index for November was reported at -19.9, compared to the previous -19.2. The softer US data exerts downward pressure on the Greenback, acting as a favorable factor for the NZDUSD pair. Tuesday brings a focus on additional US data, including the Housing Price Index, S&P/Case-Shiller Home Price Indices, CB Consumer Confidence, and the Richmond Fed Manufacturing Index. Attention will then shift to the RBNZ’s interest rate decision on Wednesday. These events hold the potential to introduce volatility to the market and establish a clearer direction for the NZDUSD pair.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% FLAT OFFER for Signals 😍 GOING TO END – Get now: forexfib.com/discount/