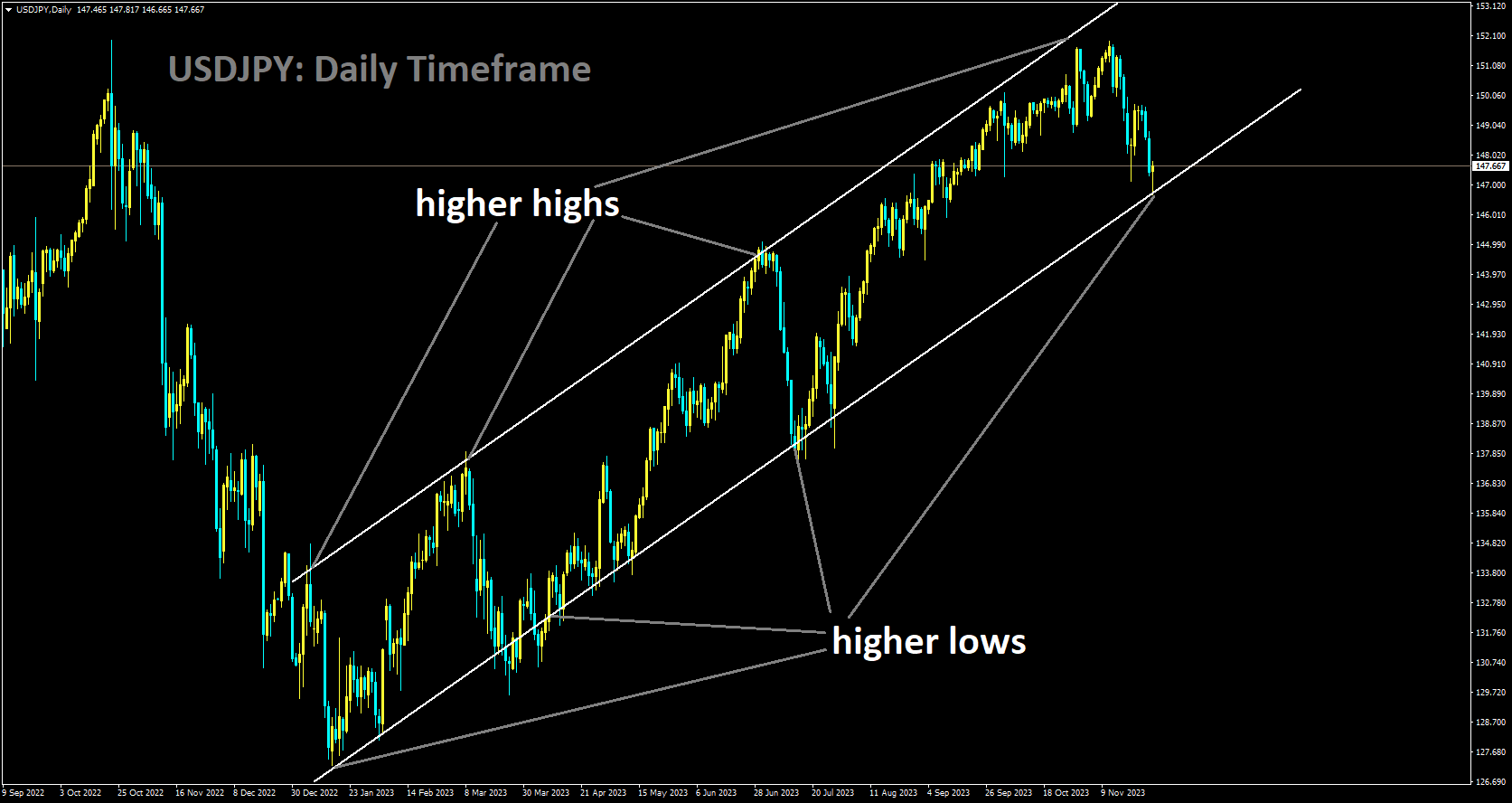

USDJPY Analysis

USDJPY is moving in Ascending channel and market has reached higher low area of the channel

During early European trading on Wednesday, Bank of Japan board member Seiji Adachi emphasized the challenge of discontinuing negative interest rates until a positive wage-inflation cycle initiates. He highlighted that such a cycle has not materialized thus far. However, he suggested that if the likelihood of its occurrence rises, discussions about an exit strategy can commence. Adachi emphasized that waiting for the cycle to turn positive is not a prerequisite for deliberating the exit from negative rates.

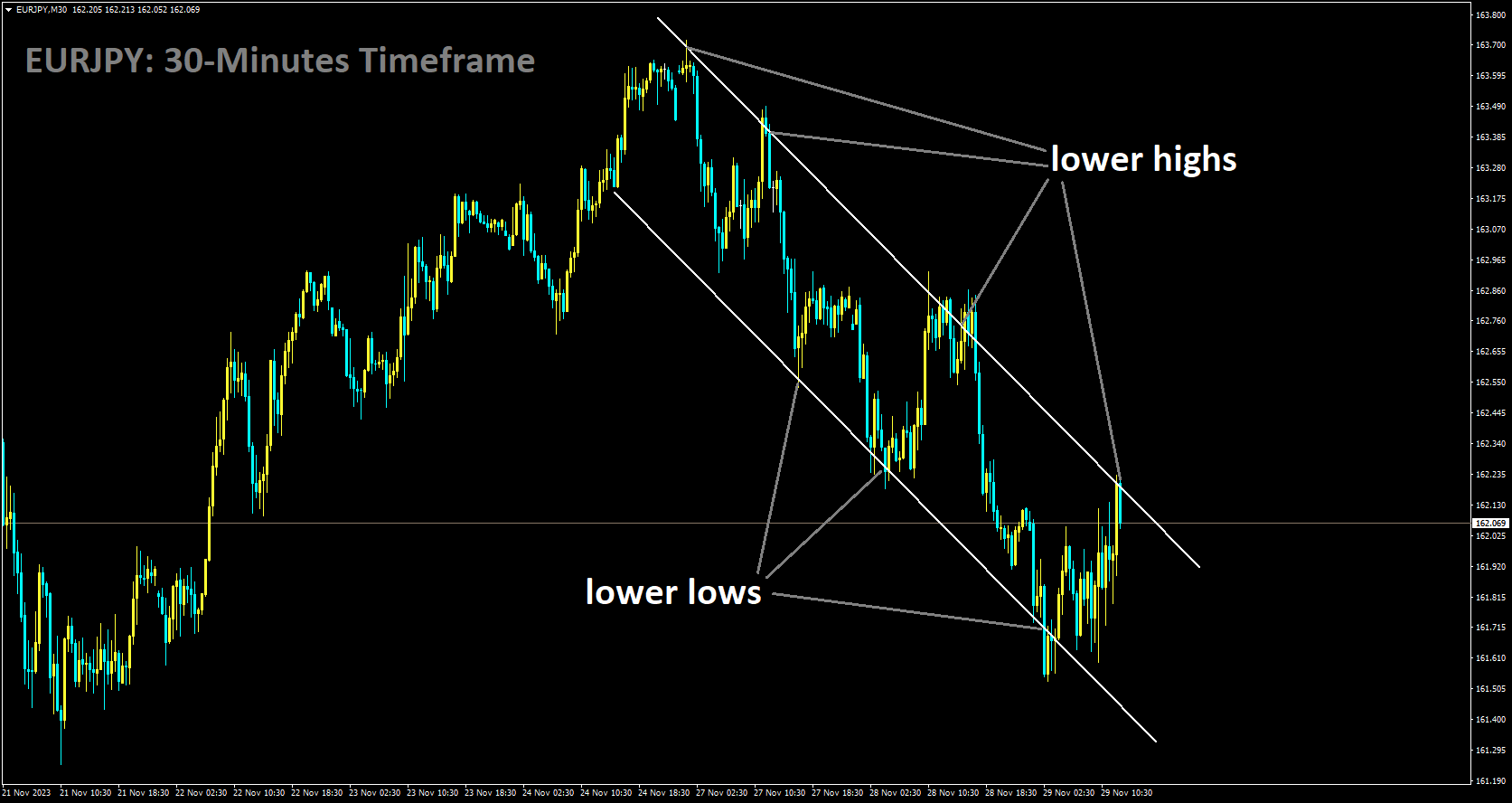

EURJPY Analysis

EURJPY is moving in Descending channel and market has reached lower high area of the channel

ECB President Lagarde addressed the European Financial Reporting Advisory Group Conference in Brussels via a pre-recorded video, touching on the topic of quantitative tightening (QT). Lagarde mentioned that it would be a subject for discussion and consideration within the governing council in the near future. Despite Lagarde’s remarks, financial markets paid more attention to comments from Federal Reserve (Fed) officials leaning towards the dovish end of the spectrum. Market participants appear skeptical that concluding the pandemic emergency purchase program will be a straightforward or rapid undertaking.

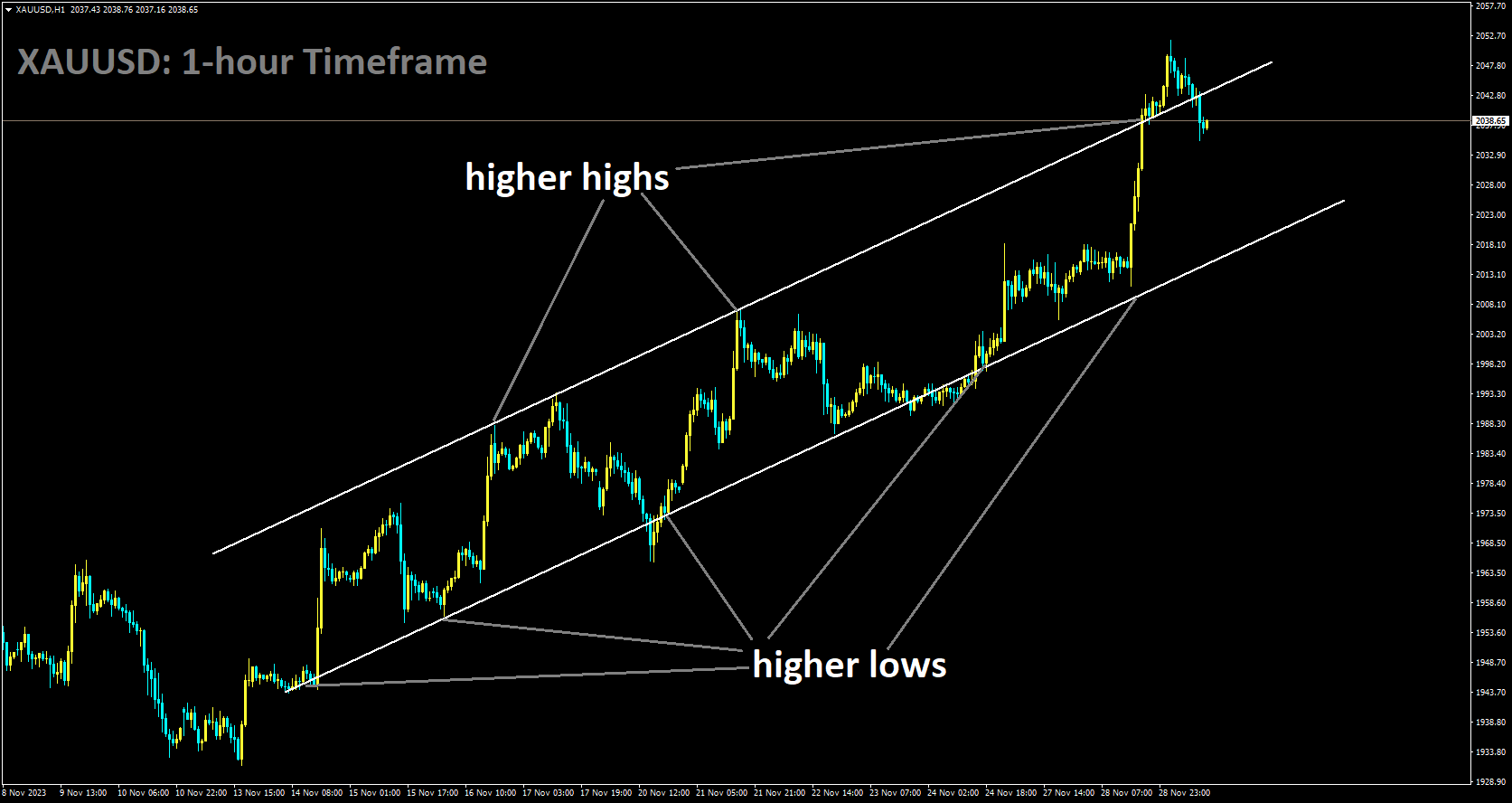

GOLD Analysis

XAUUSD is moving in Ascending channel and market has reached higher high area of the channel

The price of gold peaked at nearly $2,052, reaching its highest point in almost seven months. However, it retraced some gains as the European session approached. The US Dollar saw a modest rebound from its lowest level since August 11, coupled with an overall positive risk sentiment, which limited gains for gold. Despite this, gold maintained positive momentum for the fifth consecutive day, marking the sixth day in the last seven. There are expectations of further appreciation amid the anticipation that the Federal Reserve (Fed) will refrain from raising interest rates. Fed Governor Christopher Waller’s comments on Tuesday, signaling a less hawkish stance, reinforced expectations that the US central bank might start easing its monetary policy as early as March 2024. Additionally, a lackluster US bond auction on Tuesday pushed the yield on the benchmark 10-year US government bond further, expected to restrain a significant USD recovery and act as a tailwind for gold. Traders may exercise caution ahead of key macro data from the US.

The preliminary or second estimate of the US GDP report is scheduled for release in the early North American session. Expectations point to the world’s largest economy expanding at a 5% annualized pace in the third quarter, up from the previously reported 4.9% growth. Fedspeak is anticipated to influence USD demand, presenting short-term trading opportunities around the gold price. However, the primary focus remains on crucial US inflation data expected on Thursday, which could impact the Fed’s near-term policy outlook and provide new momentum for gold. Despite the US Dollar rebounding from a three-and-a-half-month low, the expectation of Fed rate cuts in 2024 continues to support gold. Governor Waller’s remarks about potential rate cuts contrast with the views of Governor Michelle Bowman, who reiterated the likelihood of further rate hikes due to persistent inflation. While the market anticipates the Fed to maintain its key lending rate in December, officials emphasize vigilance on inflation. The extension of the Israel-Hamas ceasefire deal by two days, beyond its initial expiration on Tuesday morning, could diminish gold’s safe-haven appeal. Traders are now turning their attention to the preliminary US GDP report and, subsequently, the US Core PCE Price Index on Thursday, the Fed’s preferred measure of longer-term inflation trends.

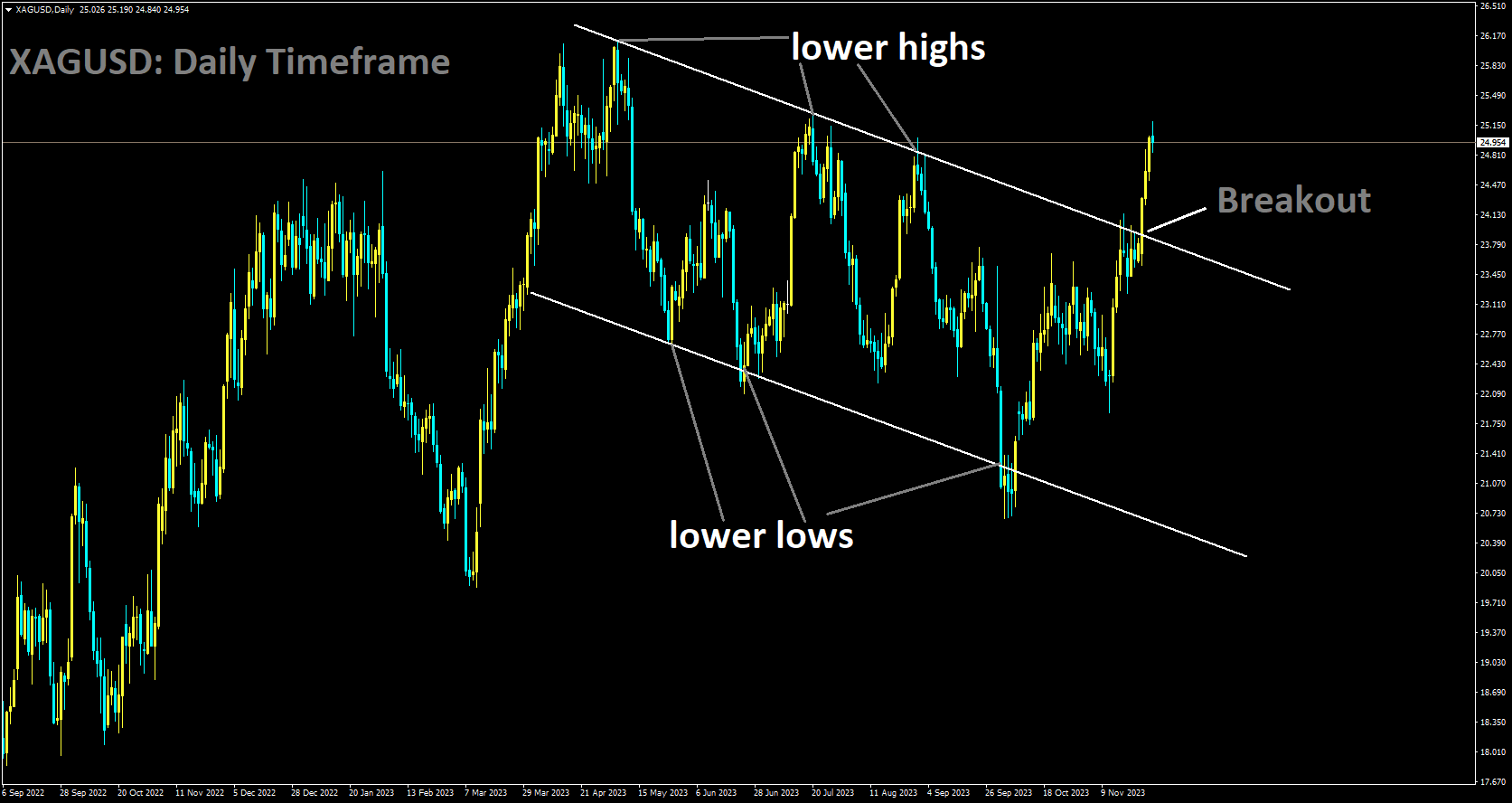

SILVER Analysis

XAGUSD has broken Descending channel in upside

In November, US consumer sentiment rebounded, as indicated by the Conference Board’s Consumer Confidence Index, which climbed to 102.0 from the revised October figure of 99.1 (initially reported as 102.6). Additional insights from the report showed a slight dip in the Present Situation Index to 138.2 from 138.6, while the Consumer Expectations Index saw an increase to 77.8 from 72.7. Notably, the one-year consumer inflation rate expectation eased to 5.7% from the previous 5.9%.

USDCAD Analysis

USDCAD has broken in Ascending channel in downside

Oil prices have rebounded, surpassing $75 and moving away from the monthly lows near $72. This increase is occurring as OPEC prepares for a preliminary meeting to reach an agreement on overall production cuts before the official OPEC+ meeting. This upward trend contrasts with the bearish sentiment confirmed by recent data from the Commodity Futures Trading Commission, revealing that Money Managers reduced their net-long positions in WTI last week. While markets are becoming less optimistic about oil, uncertainty lingers over the potential depth and duration of OPEC+ production cuts.

The US Dollar is recovering from its monthly lows as US traders return to their regular schedules, attempting to offset Monday’s losses. The Greenback is modestly higher in a mixed Tuesday market. With five Federal Reserve speakers scheduled, traders are eagerly awaiting guidance on the Fed’s next steps in December.

OPEC is scheduled to hold a virtual meeting on Thursday before the OPEC+ meeting later that day to discuss specific production cuts. However, African countries within OPEC+ are still in disagreement over oil output quotas ahead of Thursday. The latest data from the Commodity Futures Trading Commission indicates that Money Managers have reduced parts of their net-long positions in WTI, with Brent futures displaying their most significant discount since August. Russia’s seaborne crude exports are rebounding, reaching 3.24 million barrels per day, up 370,000 from November 19th.

Tensions are building among traders due to the lack of individual comments from OPEC+ members ahead of Thursday, making prepositioning uncertain. In a statement, OPEC defended the Oil-and-Gas industry ahead of the COP28 climate convention, pushing back against the International Energy Agency and highlighting the ongoing debate on the best approach to tackle global warming. Saudi Arabia continues to urge all OPEC members to reduce their production quotas as part of a collective effort to stabilize the supply side.

As is customary, the American Petroleum Institute is set to release its latest stockpile figures on Tuesday evening around 21:30 GMT. Previous data showed a build of 9.047 million barrels, and projections now suggest a 2 million barrel drawdown, potentially marking the end of the supply buildup throughout November.

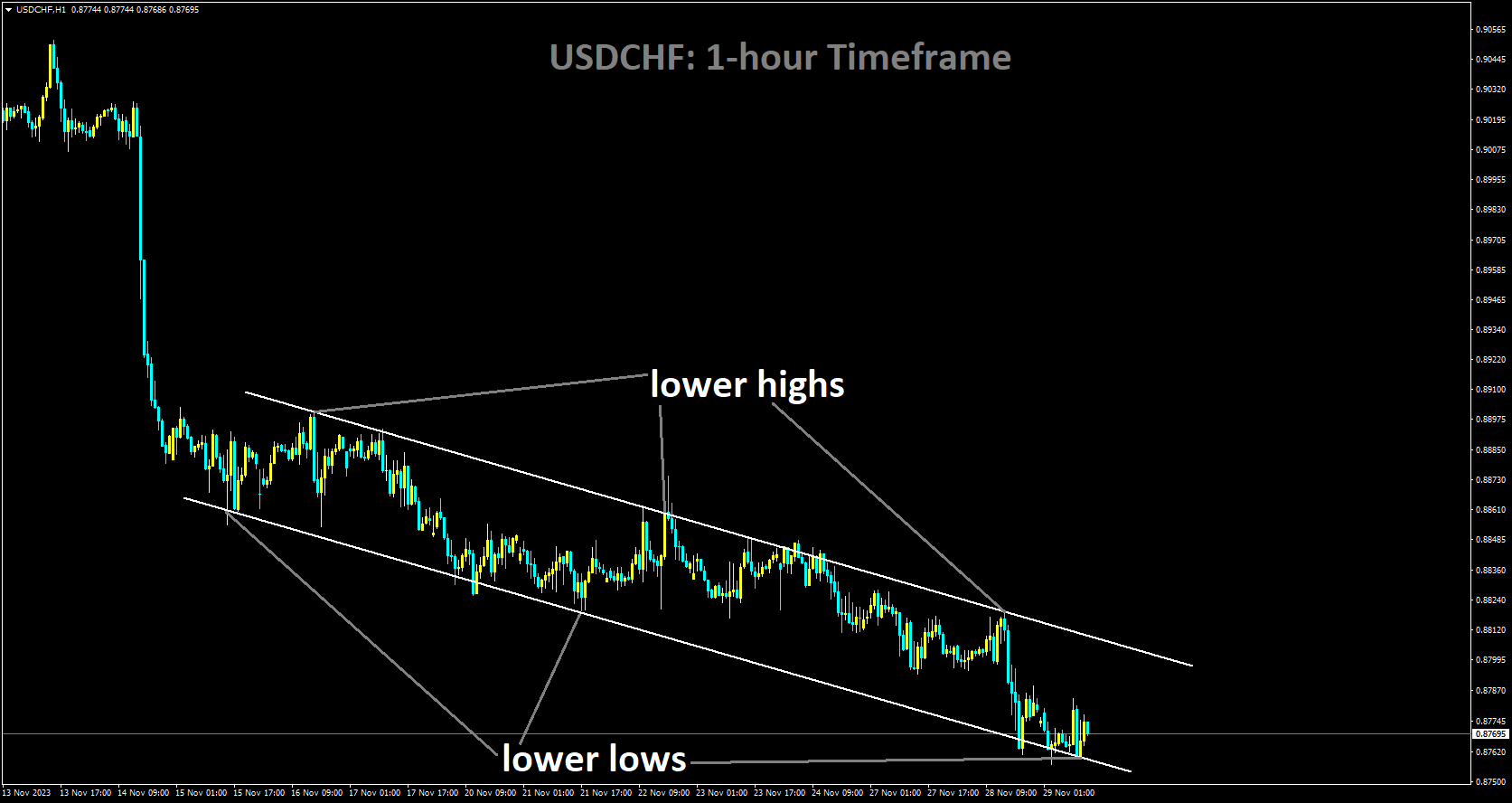

USDCHF Analysis

USDCHF is moving in Descending channel and market has reached lower low area of the channel

The USDCHF pair is grappling with ongoing losses attributed to the weakening US Dollar, fueled by the growing likelihood of the US Federal Reserve concluding its monetary rate hike cycle. Furthermore, investors are factoring in the anticipation of nearly 85 basis points in interest rate cuts by the Fed in the coming year. The US Dollar Index is hovering around 103, exhibiting a negative bias as a risk-on sentiment prevails. This sentiment is reinforced by the latest report from the US Census Bureau, revealing a significant 5.6% decline in New Home Sales for October, totaling 679,000, falling short of the market expectation of 725,000. The current trend continues to tilt towards the downside, influenced by a decrease in US Treasury yields. In the upcoming sessions, the United States is set to release the Housing Price Index and CB Consumer Confidence, alongside insights from Federal Reserve officials, providing a comprehensive overview of the economic landscape.

The Swiss ZEW Survey Expectations scheduled for Wednesday holds particular significance as it initiates a week of notable data releases. The last reported reading in October stood at -37.8, indicating prevailing pessimism among businesses concerning the Swiss economy. Additionally, the release of Swiss Real Retail Sales for October on Thursday is anticipated to show an improvement of 0.2% from the previous 0.6% decline. Finally, on Friday, attention will be on the Gross Domestic Product for the third quarter.

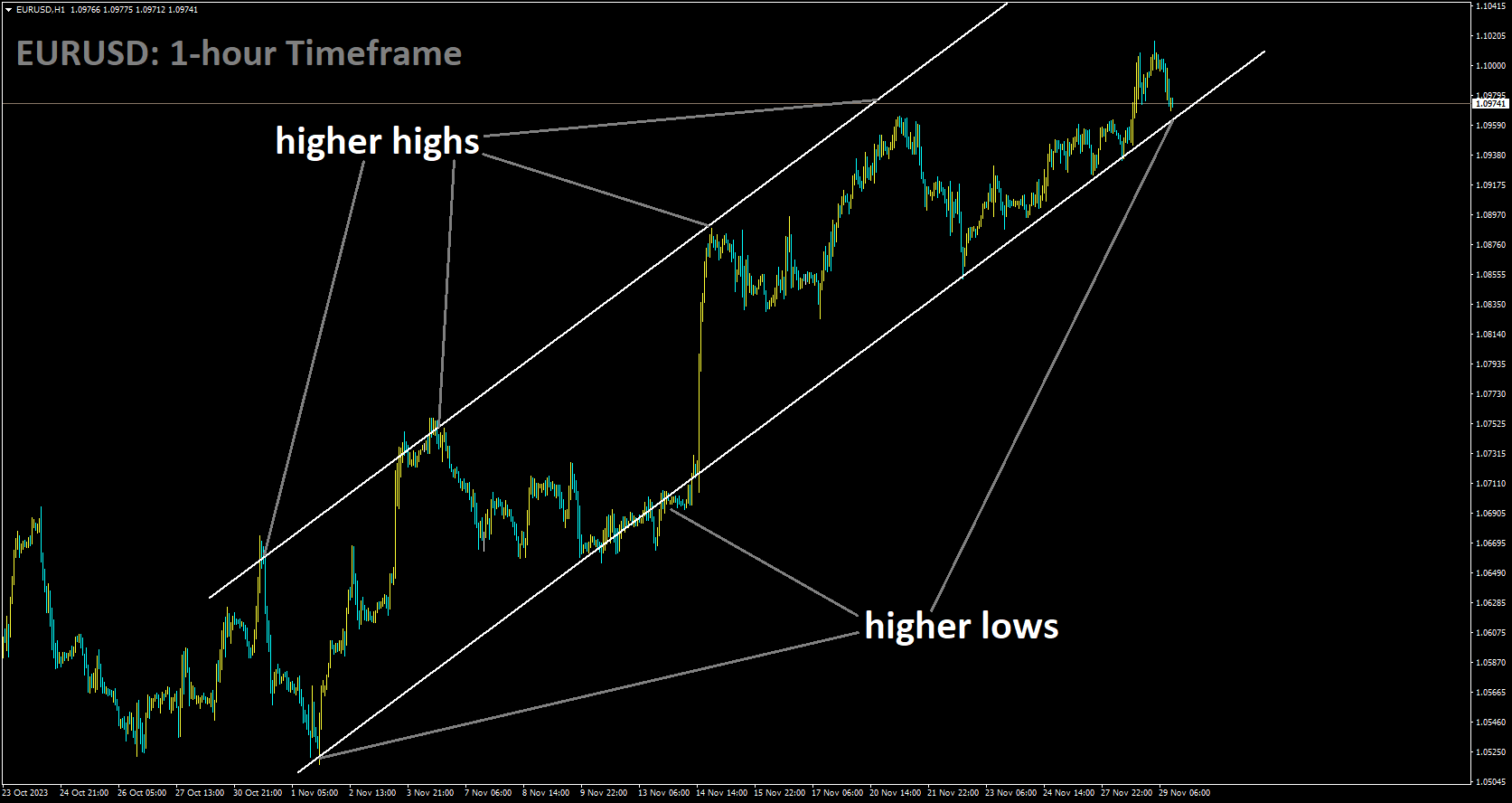

EURUSD Analysis

EURUSD is moving in Ascending channel and market has reached higher low area of the channel

The EURUSD pair is reaping the benefits of a softer US Dollar, influenced by a less hawkish stance from the US Federal Reserve. Investors are poised to closely monitor economic data related to the European Central Bank on Wednesday. Both Spain and Germany are expected to unveil preliminary Consumer Price Index data for November, with projections pointing toward a deceleration in the annual inflation rate in both countries. Additionally, the European Commission is scheduled to release its Economic Sentiment Indicator, offering insights into the overall trend of the Euro Zone economy. Despite better-than-expected economic data from the United States, the US Dollar Index continues to falter around 102.60.

The US Housing Price Index for September, holding steady at 0.6% and surpassing the expected figure of 0.4%, indicates a resilient and positive trajectory in housing prices, signaling growth in the housing market. In November, the US CB Consumer Confidence Index increased to 102.0, up from the revised October reading of 99.1 .

Moreover, the Greenback’s weakening is attributed to the decline in US Treasury yields, serving as an additional negative factor. Additionally, the accommodating statements from Fed Governor Christopher Waller may have contributed to the Dollar’s depreciation. Waller suggested that the Federal Reserve might not insist on maintaining high-interest rates in the face of consistently declining inflation. Investor attention will shift to the preliminary Gross Domestic Product Annualized for the third quarter in the US. Later in the day, the Federal Reserve is set to release the Beige Book, providing a comprehensive overview of overall economic growth in the United States.

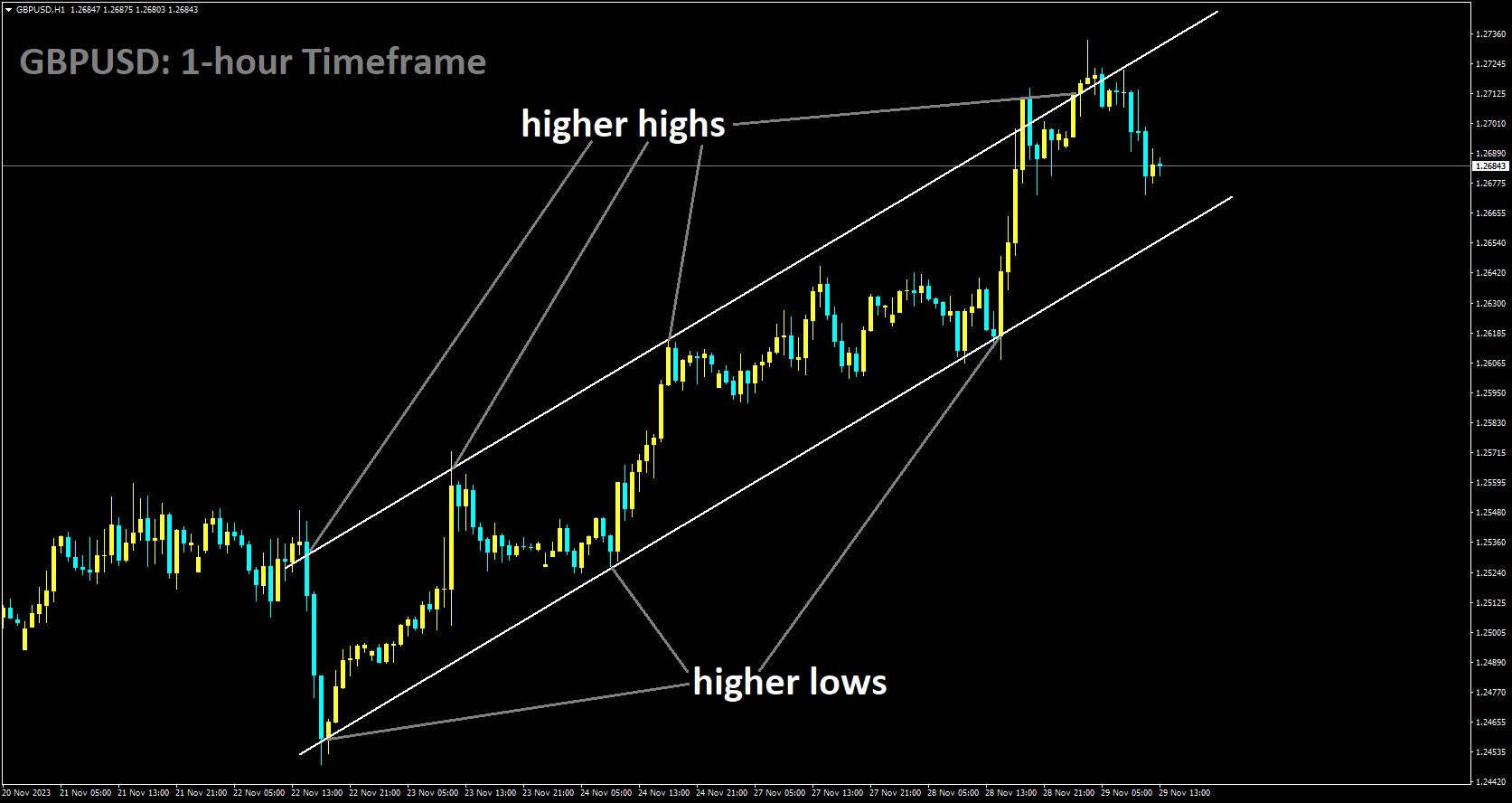

GBPUSD Analysis

GBPUSD is moving in Ascending channel and market has fallen from the higher high area of the channel

GBPUSD is on a winning streak, with the Pound Sterling displaying strength against the US Dollar for the fourth consecutive day. This resilience underscores the robust performance of the UK economy, even in the face of the tightening measures implemented by the Bank of England.

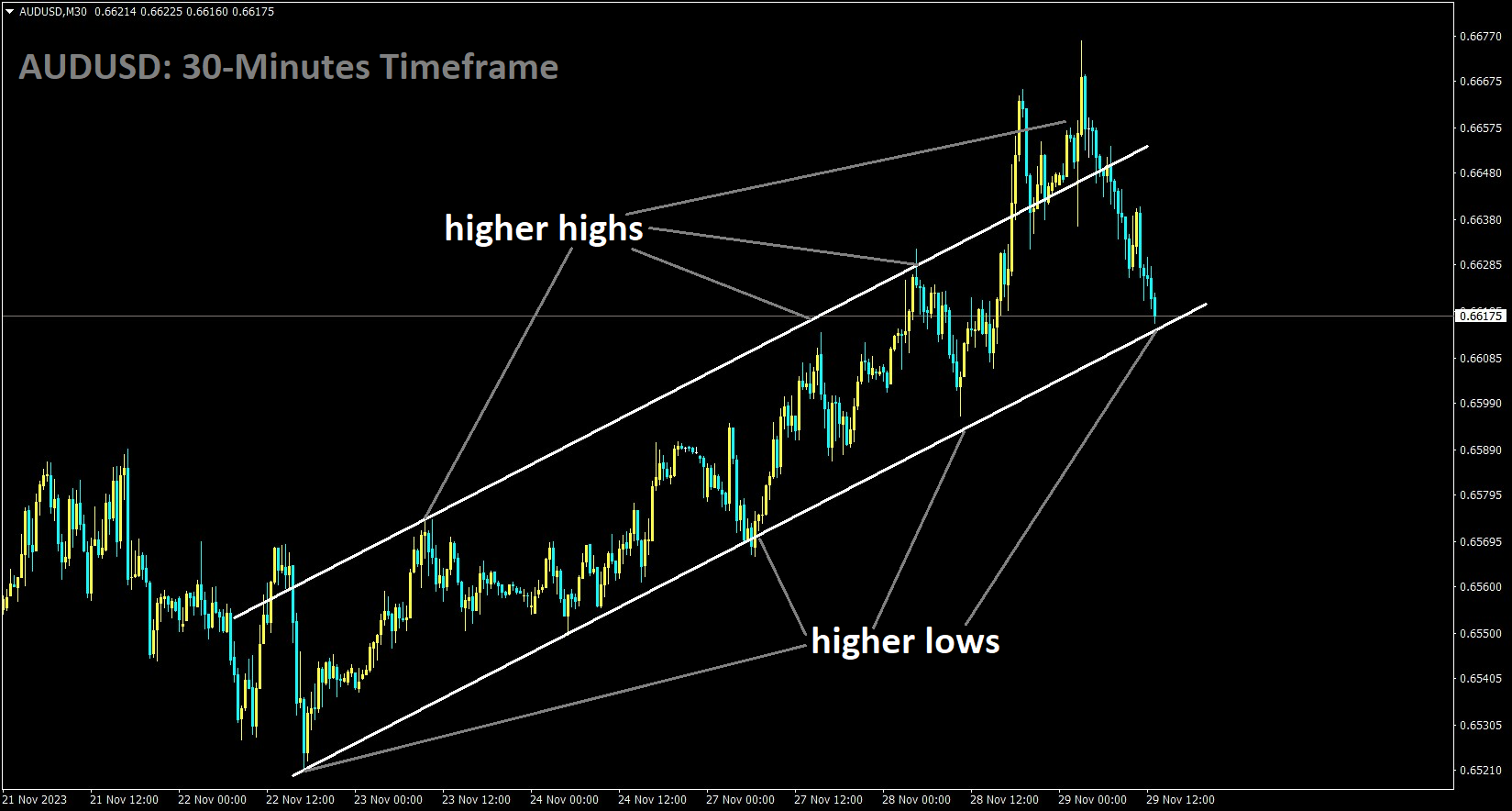

AUDUSD Analysis

AUDUSD is moving in an Ascending channel and the market has reached the higher low area of the channel

The Australian Dollar halted a four-day winning streak. Nonetheless, the AUDUSD pair had initially surged due to increased risk appetite in the market and a rise in commodity prices. The softer US Dollar (USD), influenced by a less hawkish stance from the US Federal Reserve, provided additional support to the AUDUSD pair. Australia’s Monthly Consumer Price Index for October came in at 4.9%, a slight decrease from the previous reading of 5.6% in September and slightly below the expected 5.2%. Although this less optimistic data initially applied some downward pressure, the Australian Dollar appeared to recover from this setback.

The US Dollar Index dipped to its lowest level since August 11, despite better-than-expected Housing Price Index and Consumer Confidence data from the United States (US). The decline in US Treasury yields served as an additional negative factor for the Greenback. Fed Governor Christopher Waller’s comments, suggesting that there is no need to insist on maintaining high-interest rates if inflation consistently decreases, added to the downward pressure on the Greenback. Investors are anticipated to shift their attention to the preliminary Gross Domestic Product Annualized data for the third quarter in the US, providing insights into the pace and trajectory of economic growth during that period. Later in the day, the Federal Reserve will release the Beige Book, offering a comprehensive picture of overall economic growth in the United States.

Australia’s seasonally adjusted Retail Sales data for October showed a monthly decline of 0.2%, contrasting with market expectations of a 0.1% rise and the previous month’s 0.9% increase. Reserve Bank of Australia (RBA) Governor Michele Bullock noted that the current monetary policy is on the restrictive side, with rate hikes dampening demand, especially in the context of persistent services inflation. Governor Bullock emphasized the need for caution in deploying high interest rates to combat inflation without inadvertently increasing the unemployment rate. The People’s Bank of China (PBoC) issued a notice to enhance financial support for private firms, covering areas such as listing and financing, mergers and acquisitions, and restructuring. The Federal Open Market Committee meeting minutes revealed a unanimous decision to keep policy restrictive until there is clear and sustainable evidence of inflation moving down toward the Committee’s target. The US Housing Price Index remained consistent at 0.6% in September, in line with the expected figure of 0.4%. The CB Consumer Confidence Index saw an increase in November, reaching 102.0, following a downward revision of October figures from 102.6 to 99.1.

Australia’s seasonally adjusted Retail Sales data for October showed a monthly decline of 0.2%, contrasting with market expectations of a 0.1% rise and the previous month’s 0.9% increase. Reserve Bank of Australia (RBA) Governor Michele Bullock noted that the current monetary policy is on the restrictive side, with rate hikes dampening demand, especially in the context of persistent services inflation. Governor Bullock emphasized the need for caution in deploying high interest rates to combat inflation without inadvertently increasing the unemployment rate. The People’s Bank of China (PBoC) issued a notice to enhance financial support for private firms, covering areas such as listing and financing, mergers and acquisitions, and restructuring. The Federal Open Market Committee meeting minutes revealed a unanimous decision to keep policy restrictive until there is clear and sustainable evidence of inflation moving down toward the Committee’s target. The US Housing Price Index remained consistent at 0.6% in September, in line with the expected figure of 0.4%. The CB Consumer Confidence Index saw an increase in November, reaching 102.0, following a downward revision of October figures from 102.6 to 99.1.

NZDUSD Analysis

NZDUSD is moving in an Ascending channel and the market has fallen from the higher high area of the channel

During its November monetary policy meeting, the Reserve Bank of New Zealand board members opted to maintain the interest rate at 5.50%, aligning with market expectations. Following the release of the RBNZ interest rate statement, the NZDUSD pair saw an almost 1.0% increase. The statement acknowledged the potential for an increase in the Official Cash Rate if inflationary pressures exceed expectations. Emphasizing that current interest rates are curbing spending in the economy, the RBNZ highlighted the decline in consumer price inflation, in line with its objectives. To achieve its goals, the RBNZ stressed the importance of keeping the OCR restrictive to temper demand growth and bring inflation within the 1 to 3 percent target range.

The minutes from the RBNZ interest rate meeting revealed key points, including the committee’s consensus on the need for prolonged restrictive interest rates. Despite the existing restrictiveness, the committee opted to await additional data before considering adjustments. Acknowledging a easing in labor market pressure while keeping employment above its sustainable level, the committee noted a milder-than-expected decline in aggregate demand growth in certain economic sectors.

The RBNZ committee also pointed out a 25-basis-point increase in the estimate of the long-run nominal neutral OCR to 2.50%. Governor Adrian Orr, in the post-meeting press conference, highlighted a constructive meeting with the new Prime Minister and reiterated the RBNZ’s commitment to maintaining steady rates in the coming year. Although projections indicate a potential upward bias in rates, Orr emphasized the uncertainty of this outlook.

Conversely, US Federal Reserve Governor Christopher Waller’s comments contributed to the negative momentum for the US Dollar. Waller’s suggestion that there’s no need to uphold high interest rates if inflation consistently decreases signaled a more accommodative stance from the Federal Reserve. Despite positive economic indicators such as the better-than-expected Housing Price Index and Consumer Confidence data, the US Dollar Index reached its lowest level since August 11. The decline in US Treasury yields added to the challenges facing the Greenback. The September US Housing Price Index remained stable at 0.6%, surpassing the expected figure of 0.4%. The CB Consumer Confidence Index increased to 102.0 in November, though this followed a downward revision of October figures from 102.6 to 99.1. The upcoming estimate of US GDP growth for the third quarter and the release of the Beige Book by the Federal Reserve will be closely monitored for insights into economic expansion.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% FLAT OFFER for Signals 😍 GOING TO END – Get now: forexfib.com/discount/