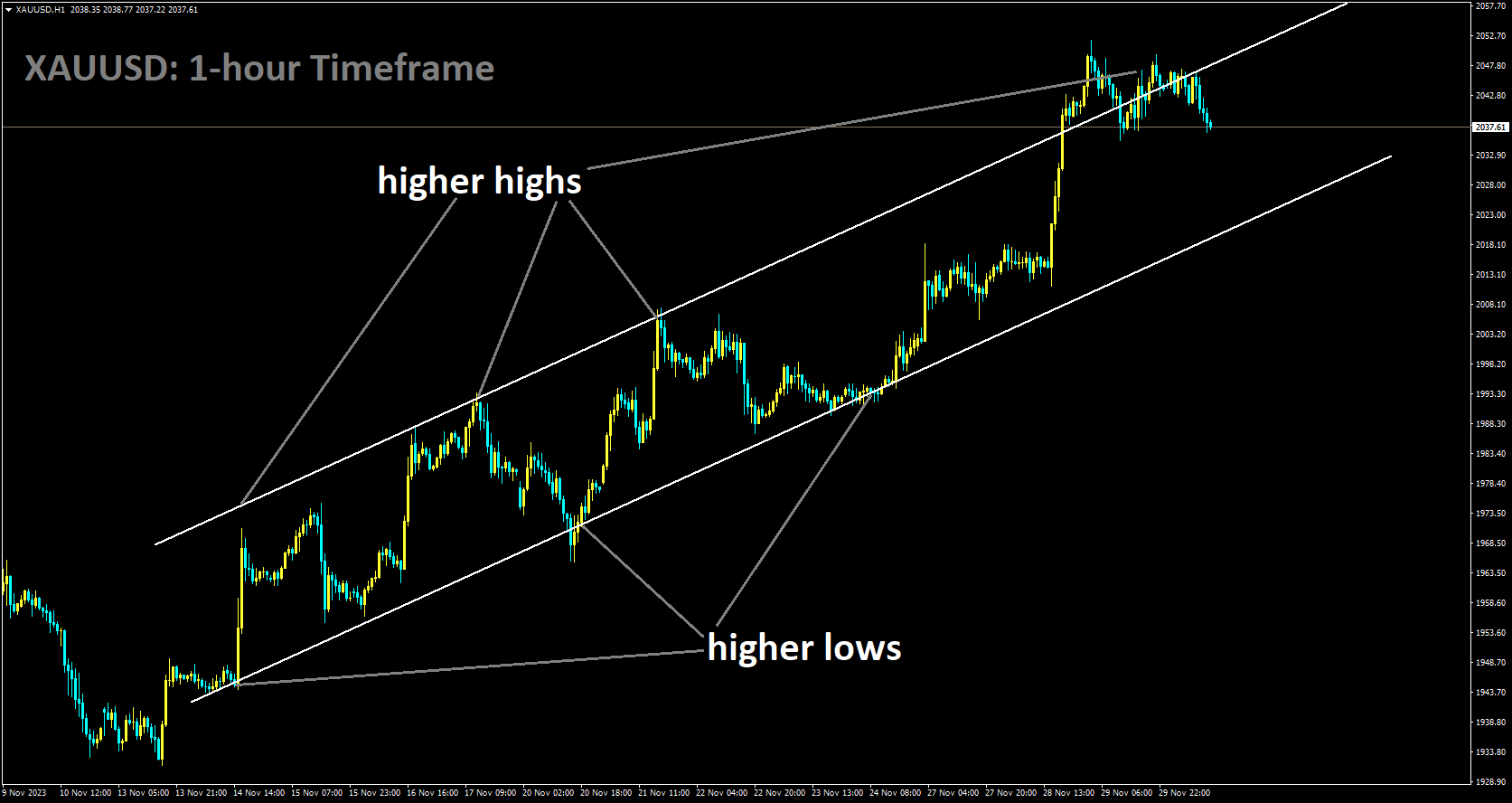

GOLD Analysis:

XAUUSD is moving in Ascending channel and market has fallen from the higher high area of the channel

Gold prices are currently exhibiting a sideways trend as optimistic investors choose to remain on the sidelines, anticipating the release of crucial Personal Consumption Expenditures data from the United States before considering any new market entries. The significance of this data lies in its potential to significantly influence longer-term inflation trends, acting as a pivotal factor for the non-yielding gold market.

As the market eagerly awaits this essential data release, there is a prevailing consensus suggesting that the Federal Reserve has completed its policy tightening cycle. This perception has contributed to a weakened US Dollar, providing substantial support for gold prices. Investors widely believe that interest rates in the US have peaked, with expectations pointing towards a series of rate cuts by the Fed in 2024.

The CME Group’s Fed Watch tool indicates a possibility of such a move as early as March 2024, with an almost 80% likelihood of a rate cut in May 2024. This sentiment is further solidified by the continuous decline in US Treasury bond yields, hindering the US Dollar’s ability to rebound from its recent low. Additionally, China’s economic challenges contribute to bolstering the safe-haven appeal of gold.

Recent statements from various Federal Reserve officials, including Fed Governor Christopher Waller and Cleveland Fed President Loretta Mester, suggesting potential future rate cuts, provide additional momentum for gold prices. Waller has hinted at the possibility of a rate cut in the coming months, while Mester expresses satisfaction with progress toward the 2% inflation target.

Market expectations now factor in a cumulative 100 basis points of rate cuts by the Fed in 2024, supported by the sustained decline in US Treasury bond yields. The sentiment in the market remains poised for potential shifts based on upcoming economic indicators and the Fed’s policy stance.

SILVER Analysis:

XAGUSD is moving in Ascending channel and market has fallen from the higher high area of the channel

In the third quarter of 2023, the US economy demonstrated robust growth, expanding at an annualized rate of 5.2%. This figure, revised upward from the initial estimate of 4.9%, surpassed the anticipated 5%. The revised GDP estimate, released with more comprehensive source data, revealed notable changes in various sectors of the economy.

Non-residential fixed investment and state and local government spending saw upward revisions, contributing to the overall growth. However, this was partially offset by a downward revision in consumer spending. Notably, residential investment experienced a significant upturn, marking the first increase in nearly two years, surpassing initial expectations at 6.2% compared to the advance estimate of 3.9%.

Private inventories played a pivotal role, adding 1.4 percentage points to growth. Government spending also increased at a faster pace, rising by 5.5% compared to the earlier estimate of 4.6%. Conversely, consumer spending slightly lagged behind expectations, increasing by 3.6%, but still marked the most substantial gain since Q4 2021.

Disposable personal income showed a notable increase of $144.0 billion or 2.9% in the third quarter, reflecting an upward revision of $48.2 billion from the previous estimate. Real disposable personal income experienced a 0.1% increase, revised upward by 1.1 percentage points.

Surprisingly, the release had a limited impact on the US Dollar, which actually lost ground post-announcement. The outlook for 2024 suggests growing optimism for more assertive rate cuts, with influential figures like Bill Ackman speculating that the Fed might initiate rate cuts earlier than market expectations.

Federal Reserve policymakers have notably adopted a dovish tone in recent comments, with some, like policymaker Bowman, maintaining a slightly hawkish stance. However, the pace of economic growth in Q4 is expected to slow, with Fed policymakers eyeing a range of 1-2%. Concerns linger about the service sector, which has faced heightened demand, keeping prices elevated.

The end of 2023 and the start of 2024 will be pivotal in determining how the US economy navigates these challenges and whether the battle against inflation is firmly in the Federal Reserve’s rearview mirror. The nuanced economic landscape and potential policy shifts make the silver market particularly sensitive to upcoming economic indicators and Federal Reserve decisions.

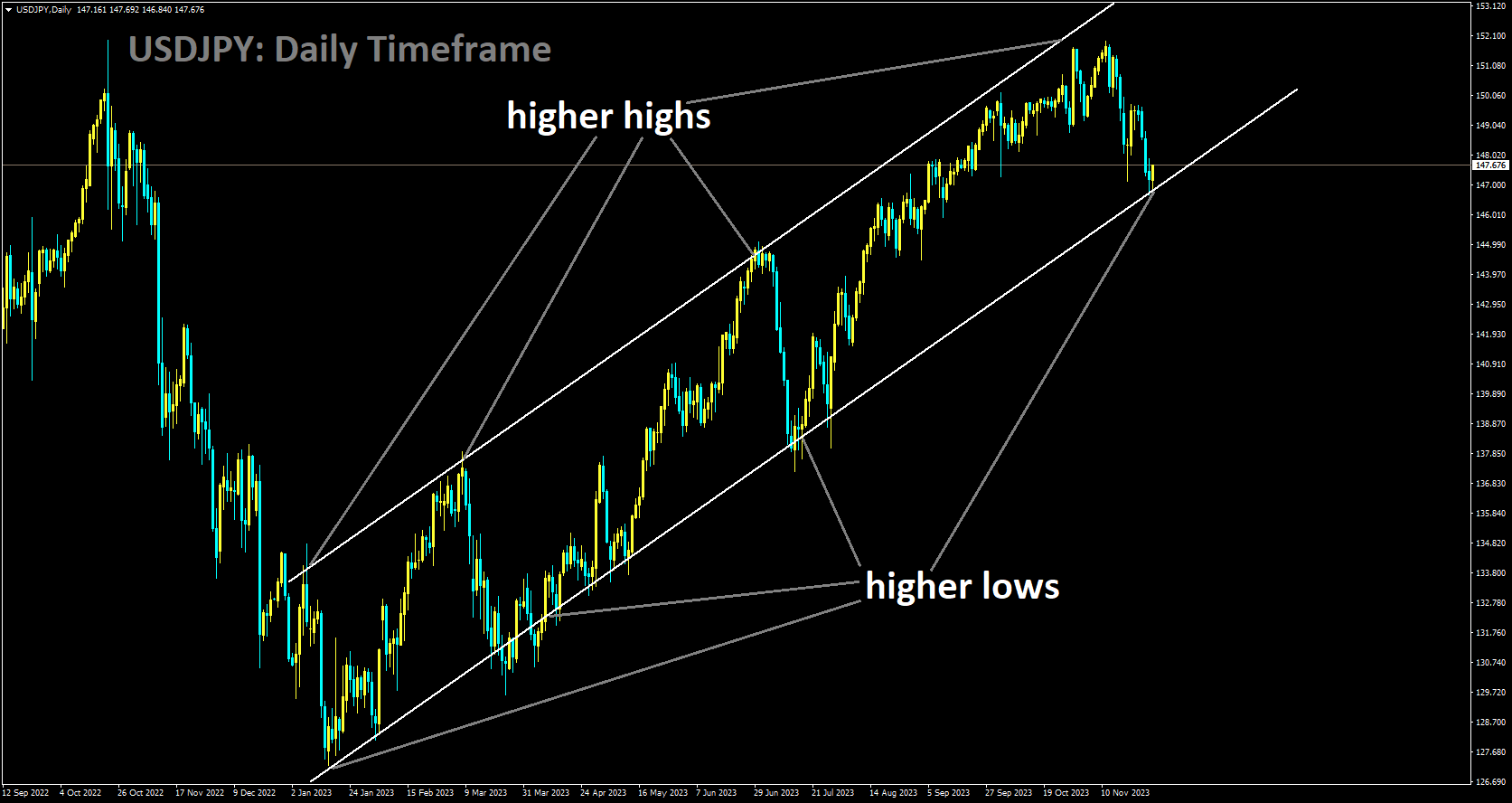

USDJPY Analysis:

USDJPY is moving in Ascending channel and market has reached higher low area of the channel

Toyoaki Nakamura, a Bank of Japan Board member, provided insights in recent remarks on the potential departure from the central bank’s ultra-loose monetary policy. Nakamura emphasized the difficulty in specifying the timing of such a policy shift and highlighted the need to observe sustainable increases in wages and inflation before considering such a move.

The current juncture, according to Nakamura, is not suitable for contemplating a policy shift, and he emphasized the necessity to observe sustainable increases in wages and inflation before considering any move away from the current ultra-loose monetary policy.

Nakamura expressed the intention to assess firms’ profitability to determine the appropriate timing for a policy shift, mentioning the scrutiny of data, including the upcoming Ministry of Finance quarterly business sentiment survey, to gauge whether conditions are aligning for any potential policy adjustments.

The USDJPY analysis indicates the cautious approach of the Bank of Japan regarding any shift in its monetary policy. The central bank is closely monitoring economic indicators and profitability trends in businesses, underlining the importance of sustainable improvements before considering changes.

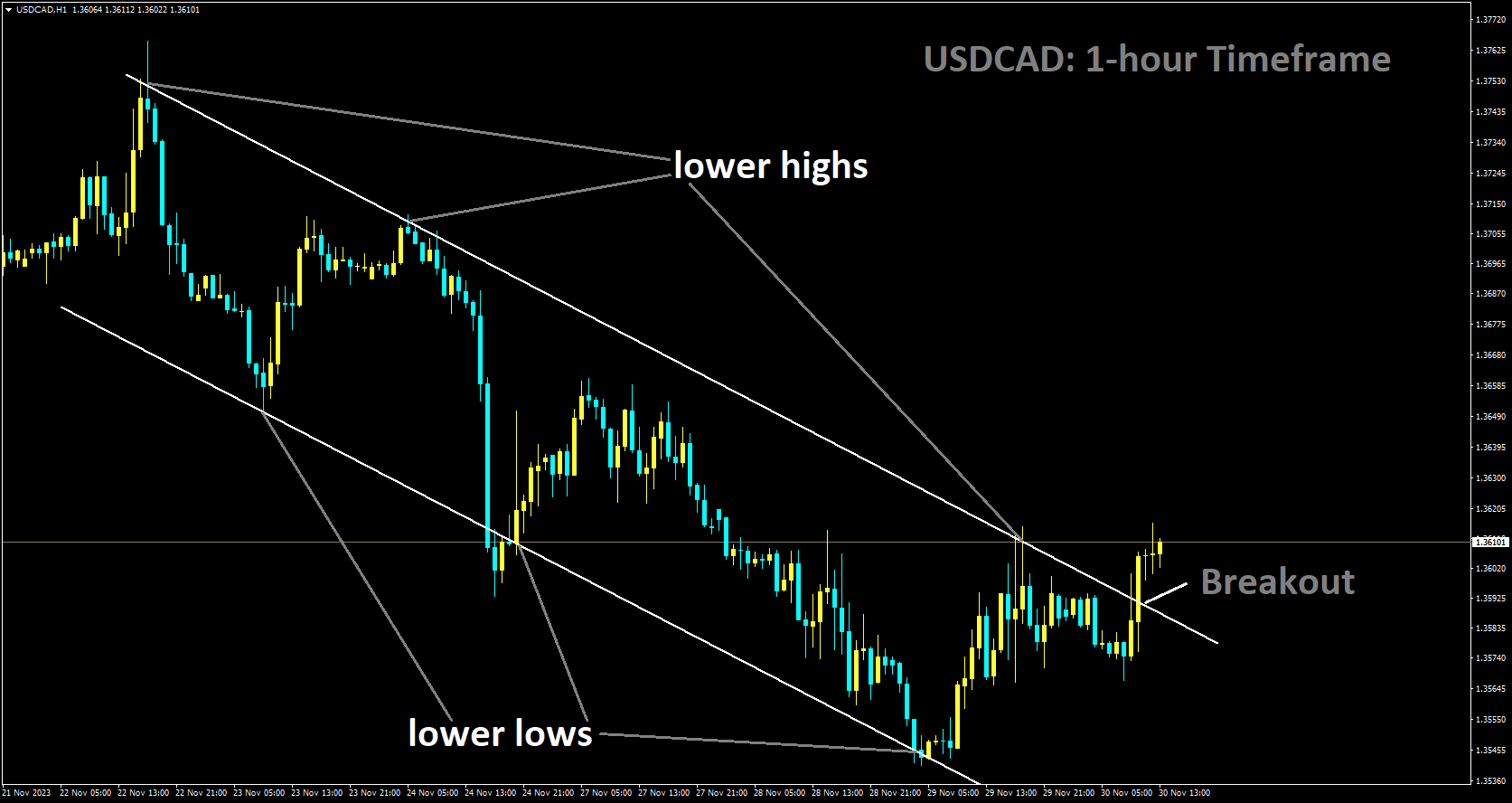

USDCAD Analysis:

USDCAD has broken Descending channel in upside

The Canadian Dollar is finding support from a weaker US Dollar and improved crude oil prices. The US Dollar Index appears poised to resume its downward trend after Wednesday’s gains, currently trading lower around 102.80.

The USDCAD pair received a boost from stronger-than-expected US Gross Domestic Product Annualized data released by the US Bureau of Economic Analysis. Third-quarter US GDP annualized increased by 5.2%, surpassing the previous reading of 4.9% and exceeding the market consensus of 5.0%.

Western Texas Intermediate (WTI) prices are on a three-day winning streak, trading near $77.90 per barrel at the moment. The momentum in crude oil prices is attributed to the upcoming meeting of the Organization of the Petroleum Exporting Countries (OPEC) and its allies. Anticipation surrounds the likelihood of Saudi Arabia and Russia proposing an extension of oil supply cuts into 2024.

Concerns about oil demand have surfaced again following China’s economic data. The NBS Manufacturing PMI for November declined to 49.4 from the previous reading of 49.5, while the Non-Manufacturing PMI contracted to 50.02, falling below the expected 51.1.

Canada’s Gross Domestic Product Annualized for the third quarter is set to be released on Thursday, with expectations of a 0.2% increase. Meanwhile, the United States will release crucial economic data, including Initial Jobless Claims for the week ending on November 24 and the Personal Consumption Expenditure Price Index data.

The USDCAD analysis underscores the interplay of factors influencing the currency pair, including the dynamics of the US Dollar, crude oil prices, and economic indicators from both Canada and the United States. The upcoming economic releases will play a significant role in shaping the trajectory of the USDCAD pair.

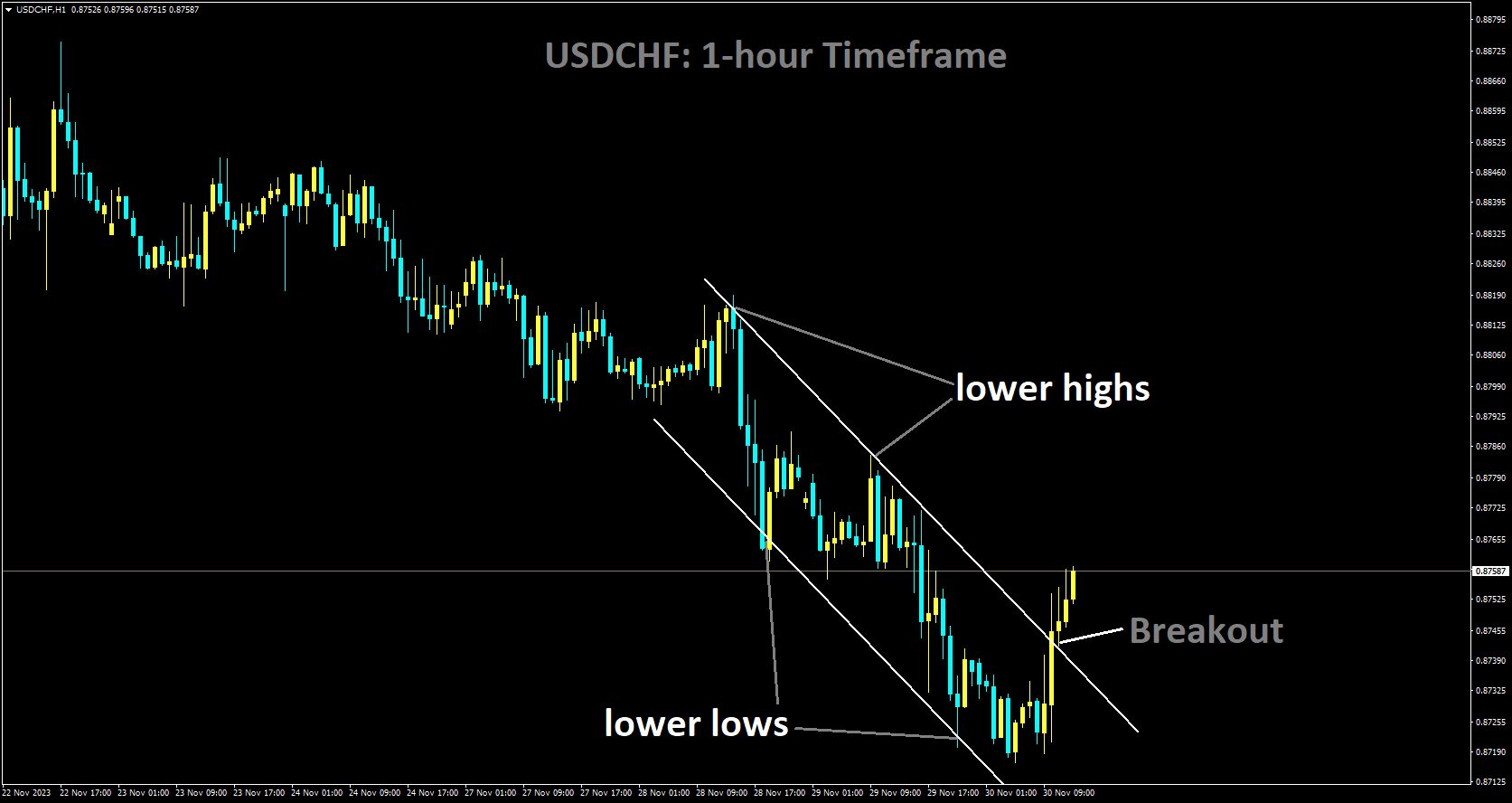

USDCHF Analysis:

USDCHF has broken Descending channel in upside

The recent decrease in US bond yields over the past three sessions is attributed to the prevailing positive sentiment suggesting that the Federal Reserve (Fed) may conclude its interest rate hikes. However, as of the current press time on Thursday, the 10 and 2-year US Treasury yields have inched slightly higher to 4.27% and 4.65%, respectively.

Furthermore, the US Dollar received support from stronger Gross Domestic Product Annualized data, which exhibited a 5.2% increase in the third quarter, surpassing the expected rise of 5.0%. The focus will now shift to Initial Jobless Claims for the week ending on November 24 and Personal Consumption Expenditure Price Index data.

Cleveland Federal Reserve President Loretta Mester emphasized that any decision to implement additional hikes would hinge on data-driven considerations. She highlighted that the current monetary policy is well-placed to assess forthcoming data on the economy and financial conditions.

On the Swiss front, the Swiss Franc remains supported and strengthened by the hawkish comments from Swiss National Bank Chairman Thomas Jordan, who has not ruled out the possibility of future interest rate hikes. The ZEW Survey Expectations report indicated a decline to 29.6 figures in November compared to the previous contraction of 37.8.

Additionally, attention will be on Swiss Real Retail Sales for October on Thursday and the Gross Domestic Product for the third quarter on Friday. The USDCHF analysis illustrates the intricate relationship between US bond yields, the US Dollar’s performance, and the impact on the Swiss Franc. The comments from the Swiss National Bank and upcoming economic reports in Switzerland will be pivotal in determining the currency pair’s movement.

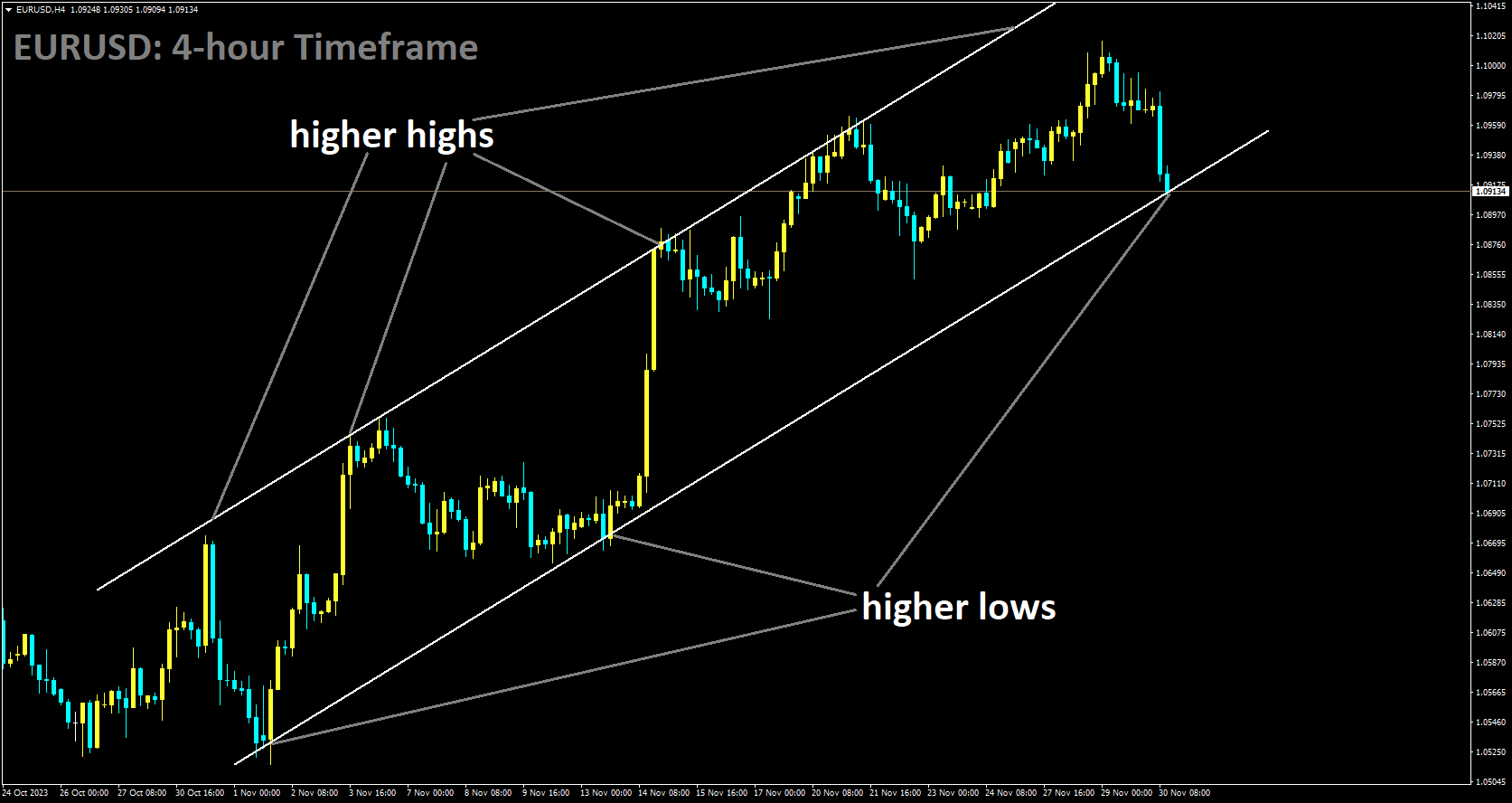

EURUSD Analysis:

EURUSD is moving in Ascending channel and market has reached higher low area of the channel

In Germany, inflation eased to 3.2% compared to November 2022, marking a further decline from the 3.8% year-on-year figure recorded in October. Notably, there was a month-on-month decrease of 0.4%, surpassing the estimated -0.2%. Tomorrow, the EU is set to release inflation data, and consensus estimates suggest a continued drop in both headline and core measures of inflation.

The declining trend in inflation has led to market expectations of rate cuts in 2024, aligning with the anticipated pace of cuts from the Federal Reserve, amounting to just over 100 basis points.

However, there is a concern that inflation might decrease further in the EU, given that the European economy has not exhibited the same resilience as the US. This divergence in economic performance could intensify existing economic challenges, posing a potential threat to the Euro.

The impact of the inflation report was overshadowed when the US GDP growth for the third quarter received an upward revision, leading to a downward move on the 5-minute time frame within the same trading day. The EURUSD analysis reflects the complex dynamics between inflation trends in Germany and the broader EU, market expectations, and the impact of US economic indicators on the Euro.

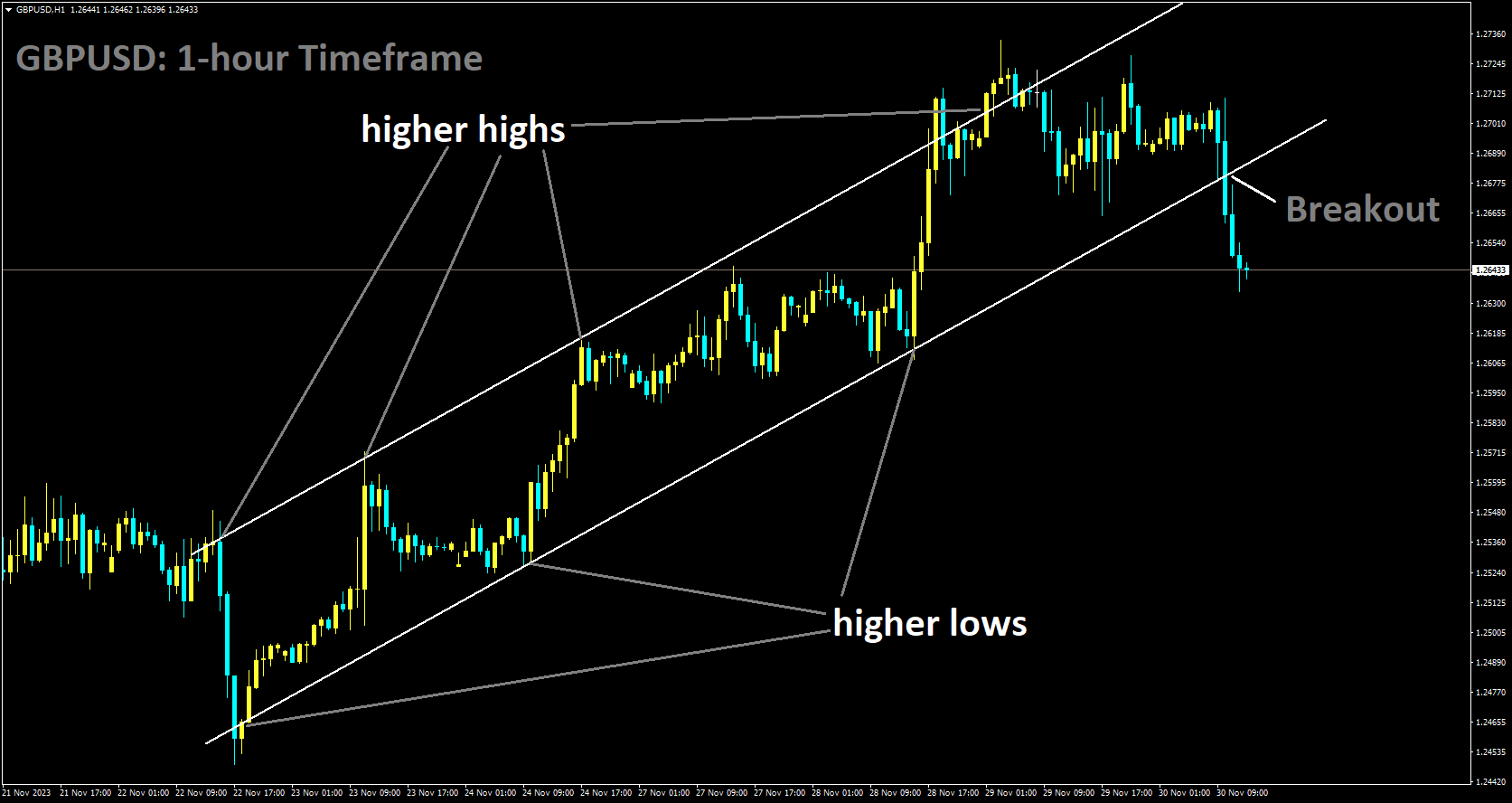

GBPUSD Analysis:

GBPUSD has broken Ascending channel in downside

Bank of England Governor Andrew Bailey has underscored the central bank’s dedication to taking necessary measures to bring inflation down to its 2.0% target. Despite the efforts made, Bailey noted a lack of sufficient progress, casting uncertainty on achieving the inflation goal. This hawkish stance may have contributed to the upward support for the Pound Sterling.

Meanwhile, the recent decrease in US bond yields over the past three sessions is attributed to the prevailing positive sentiment that the Federal Reserve might conclude its interest rate hikes. However, as of the current press time on Thursday, the 10 and 2-year US Treasury yields have slightly increased to 4.27% and 4.65%, respectively.

The US Dollar Index hovers around 102.80 at the moment, exhibiting indecision likely influenced by mixed remarks from Federal Reserve members. Cleveland Federal Reserve President Loretta Mester has highlighted that any decision to implement additional interest rate hikes would rely on data-driven considerations. Governor Michelle Bowman’s expressed desire to maintain the possibility of more rate hikes raises concerns about the persistence of inflationary pressure. In contrast, Fed Governor Christopher Waller has suggested a more accommodative approach by not insisting on maintaining high-interest rates.

The GBPUSD analysis illuminates the multifaceted factors influencing the currency pair, including the dynamics of US bond yields, the US Dollar’s performance, and the nuanced comments from Bank of England officials. The uncertainties surrounding inflation and interest rate expectations contribute to the complexity of the GBPUSD landscape.

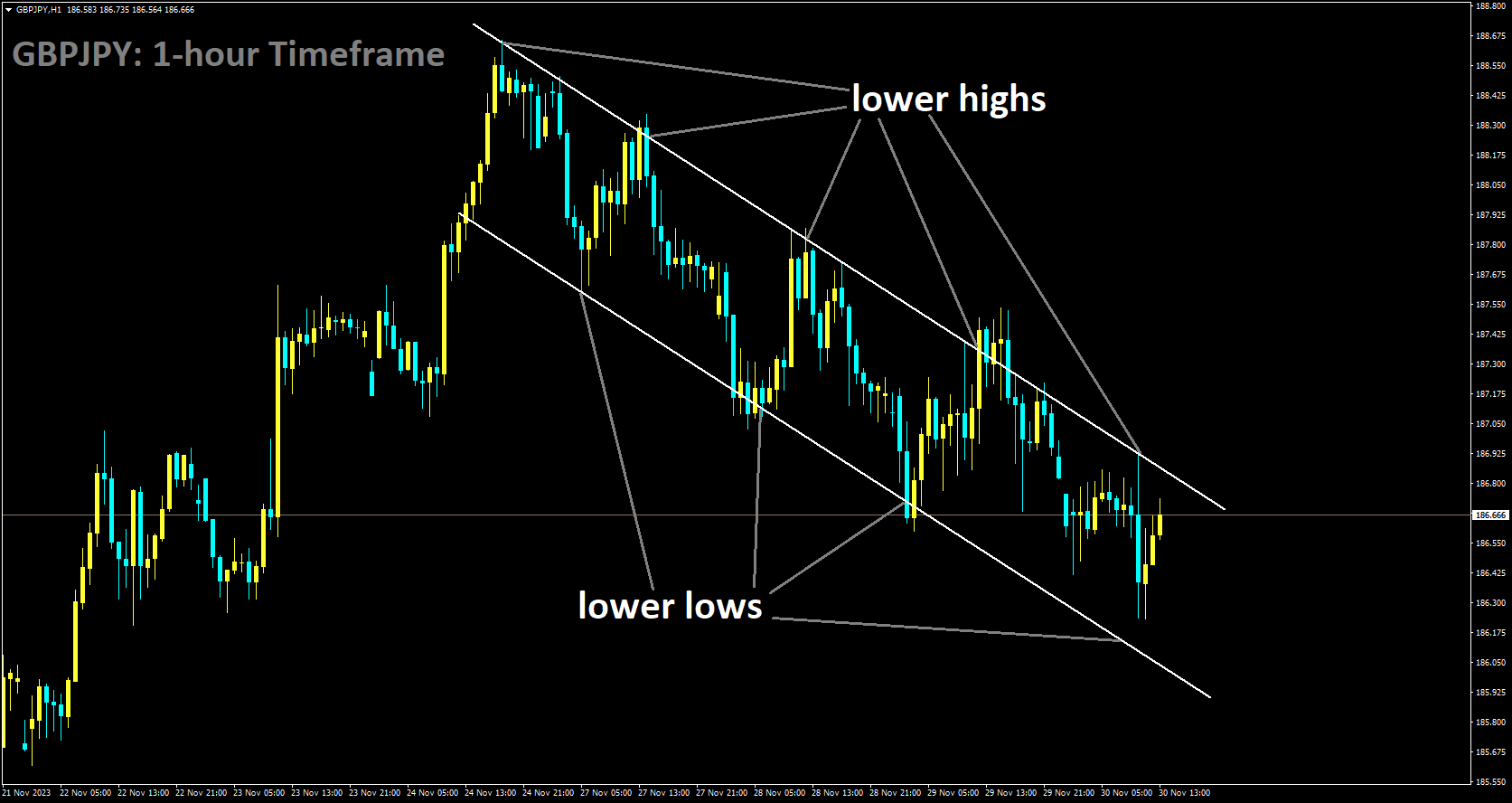

GBPJPY Analysis:

GBPJPY is moving in Descending channel and market has reached lower high area of the channel

Japanese month-on-month industrial production rose by 1%, surpassing the previous month’s 0.5% increase and exceeding the market forecast of 0.8%. The annualized industrial production for October rebounded from the previous period’s 4.4% decline, registering a positive figure of 0.9%.

The GBPJPY analysis indicates the positive signs in Japanese industrial production, contributing to the dynamics of the currency pair. The strength of the Japanese industrial sector, coupled with broader market sentiments, influences the GBPJPY movement.

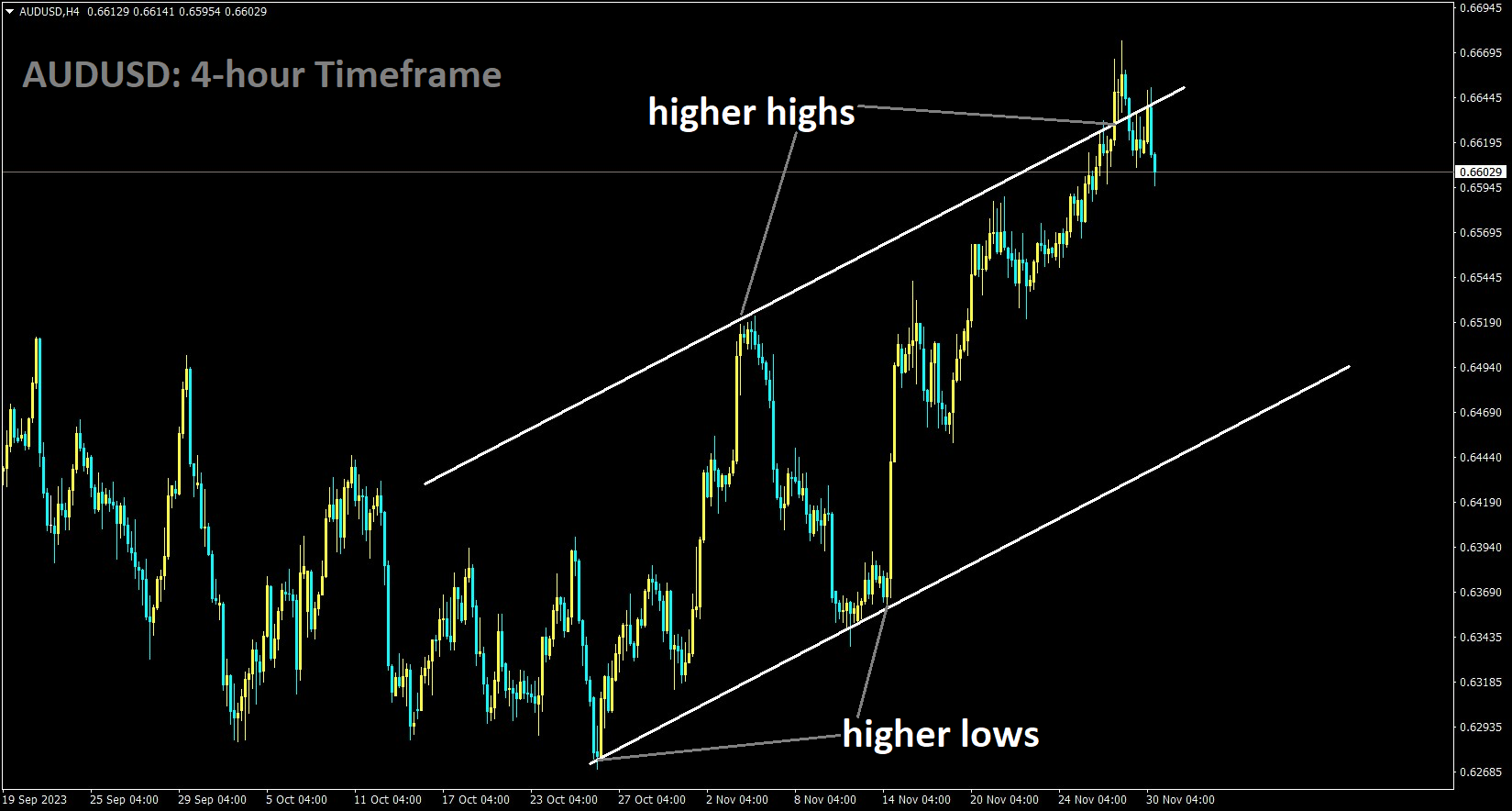

AUDUSD Analysis:

AUDUSD is moving in Ascending channel and market has reached the higher high area of the channel

The Aussie pair is facing downward pressure, largely attributed to the resurgent US Dollar. Australia’s Private Capital Expenditure contracted by 0.6% in Q3, a notable decrease from the previous growth of 2.8%, falling short of the anticipated 1.0% rise. The data, released by the Australian Bureau of Statistics, indicates a decline in both current and future capital expenditure intentions within the country’s private sector.

This contraction is expected to alleviate inflationary pressures, reducing the likelihood of an interest rate hike by the Reserve Bank of Australia. China’s NBS Manufacturing PMI for November declined to 49.4 from the previous reading of 49.5, missing the market expectation of an increase to 49.7.

Furthermore, the Non-Manufacturing PMI contracted to 50.02, below the expected 51.1 and the previous reading of 50.6. The disappointing PMI data has sparked discussions about the need for additional stimulus, benefitting the Australian Dollar.

Although the US Dollar Index halted its four-day losing streak supported by stronger-than-expected US Gross Domestic Product Annualized data, it struggles to maintain its position. The data, released by the US Bureau of Economic Analysis, indicated a third-quarter increase in the value of final goods and services produced in the United States.

Notable economic data releases later in the North American session include the weekly Jobless Claims for the week ending on November 24, with an expected increase to 220K from the previous 209K. Additionally, the Core Personal Consumption Expenditure Price Index for October is anticipated to show a slowdown in consumer inflation, with the expected annual rate decreasing from 3.7% to 3.5%.

Australia’s Monthly Consumer Price Index for October reveals a reading of 4.9%, a decrease from the previous 5.6% in September and slightly below the expected 5.2%. Meanwhile, Australia’s seasonally adjusted Retail Sales data for October declined by 0.2% against market expectations of a 0.1% rise and the prior 0.9%.

Reserve Bank of Australia (RBA) Governor Michele Bullock cautioned that the current monetary policy, characterized by rate hikes, may dampen demand, especially considering persistent services inflation. Governor Bullock stressed the need for caution in using high-interest rates to combat inflation without inadvertently increasing the unemployment rate.

The AUDUSD analysis delves into the factors contributing to the downward pressure on the Aussie pair, including economic indicators from Australia and China, as well as the dynamics of the US Dollar. The nuanced interplay of these factors shapes the AUDUSD landscape.

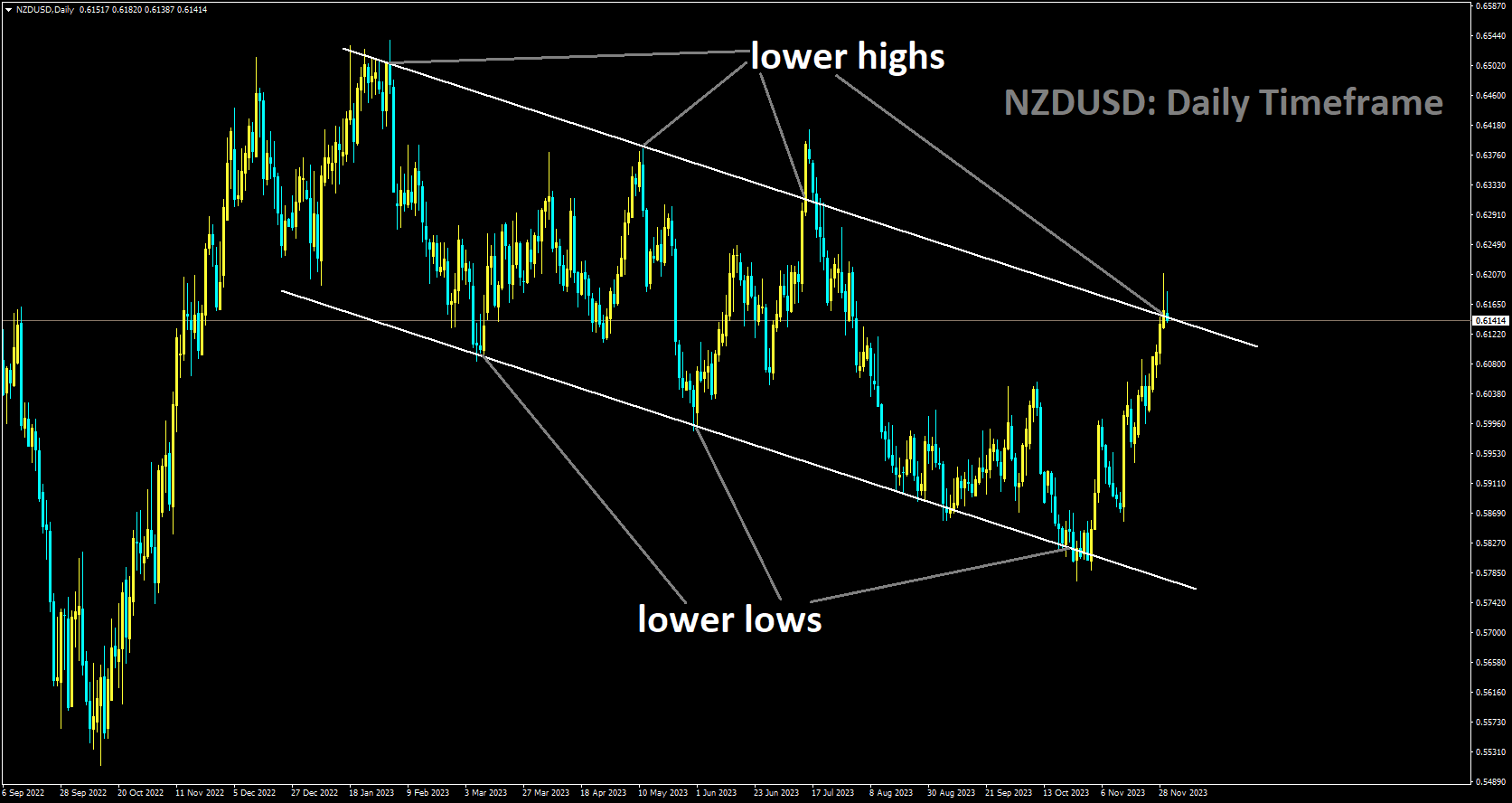

NZDUSD Analysis:

NZDUSD is moving in Descending channel and market has reached lower high area of the channel

The New Zealand dollar exhibited a substantial upswing, primarily influenced by a depreciation in the US dollar and the outcome of the Reserve Bank of New Zealand’s (RBNZ) interest rate deliberations. While the central bank elected to keep interest rates unchanged, Governor Orr’s communication carried a distinctly hawkish and resolute tone.

Governor Orr underscored this stance through several key statements, notably expressing apprehension about inflation persisting beyond the prescribed band. Moreover, he drew attention to the gradual increase in the 10-year inflation expectation, expressing concern about the upward trajectory of longer-term inflation expectations.

In emphasizing the global context, Governor Orr acknowledged the importance of global interest rates for New Zealand. He stressed the necessity of maintaining the existing interest rates for an extended period. Additionally, the central bank signaled flexibility by asserting its capability to respond to unforeseen shocks outside the regular policy meeting schedules.

Although the prevailing expectations in money markets do not anticipate further rate hikes in 2024, the RBNZ highlighted its commitment to data dependency. In the event that inflation data continues its upward trajectory, the Reserve Bank of New Zealand may decisively opt for tightening monetary policy once again. This nuanced approach suggests a proactive stance on the part of the central bank, ready to adapt to evolving economic conditions and data trends.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% FLAT OFFER for Signals 😍 GOING TO END – Get now: forexfib.com/discount/