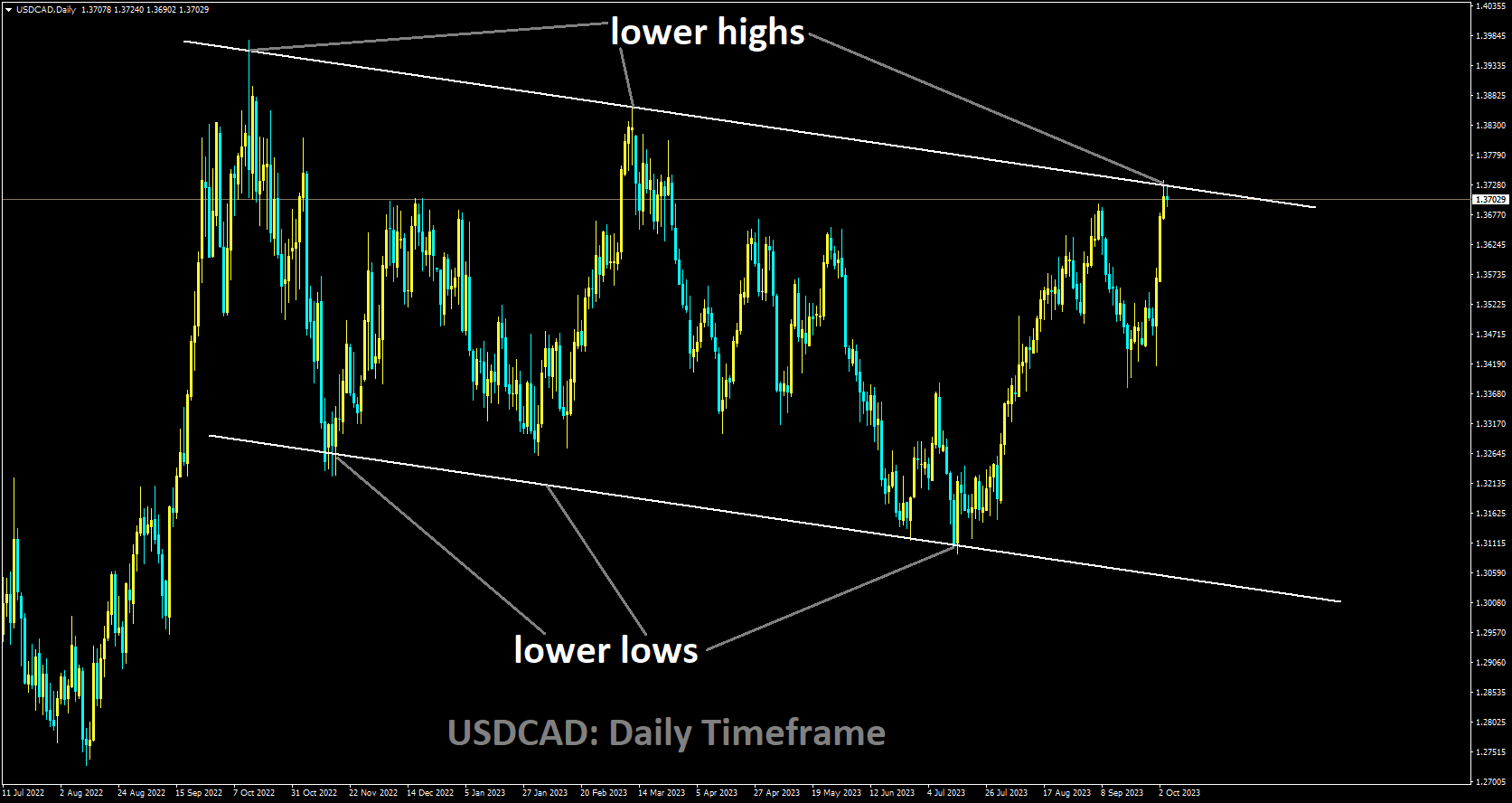

USDCAD Analysis

USDCAD is moving in Descending channel and market has reached lower high area of the channel

As of this writing, the US Dollar Index (DXY) is trading at 107.10, which is in line with the 11-month high recorded on Tuesday. Strong US job data and rising US Treasury yields are the main drivers of the USD’s strength. Expectations were not met by US JOLTS Job Openings, which led to an increase in US Treasury yields. On Wednesday, the yield on the US 10-year bond hit 4.85%, the highest level since 2007. According to the JOLTS report, job openings increased to 9.61 million in August from 8.92 million in July, above market estimates. Positive sentiment towards the Greenback is also being strengthened by the Fed’s hawkish stance, which calls for maintaining higher interest rates for an extended period of time.

If the current economic conditions continue, Cleveland Federal Reserve President Loretta Mester hinted that she might support raising interest rates at the next meeting. However, Raphael Bostic, the president of the Atlanta Fed, offered a cautious assessment of the Fed’s policy outlook, noting that there is no rush to raise or lower rates. The US employment data, which includes the release of the Nonfarm Payrolls on Friday and the ADP report on Wednesday, is highly anticipated by market participants. The S&P Global Manufacturing PMI for Canada was made public on Monday. The report indicated that the previous reading of 48.0 decreased to 47.5 in September. Additionally, since the nation is the top oil exporter to the US, declining crude oil prices also pulled the commodity-linked CAD lower. As of the time of publication, West Texas Intermediate Crude Oil was trading for about $88.00 per barrel less. Investors will probably pay close attention to Canada’s Ivey Purchasing Managers Index to get additional indications about the state of the economy there.

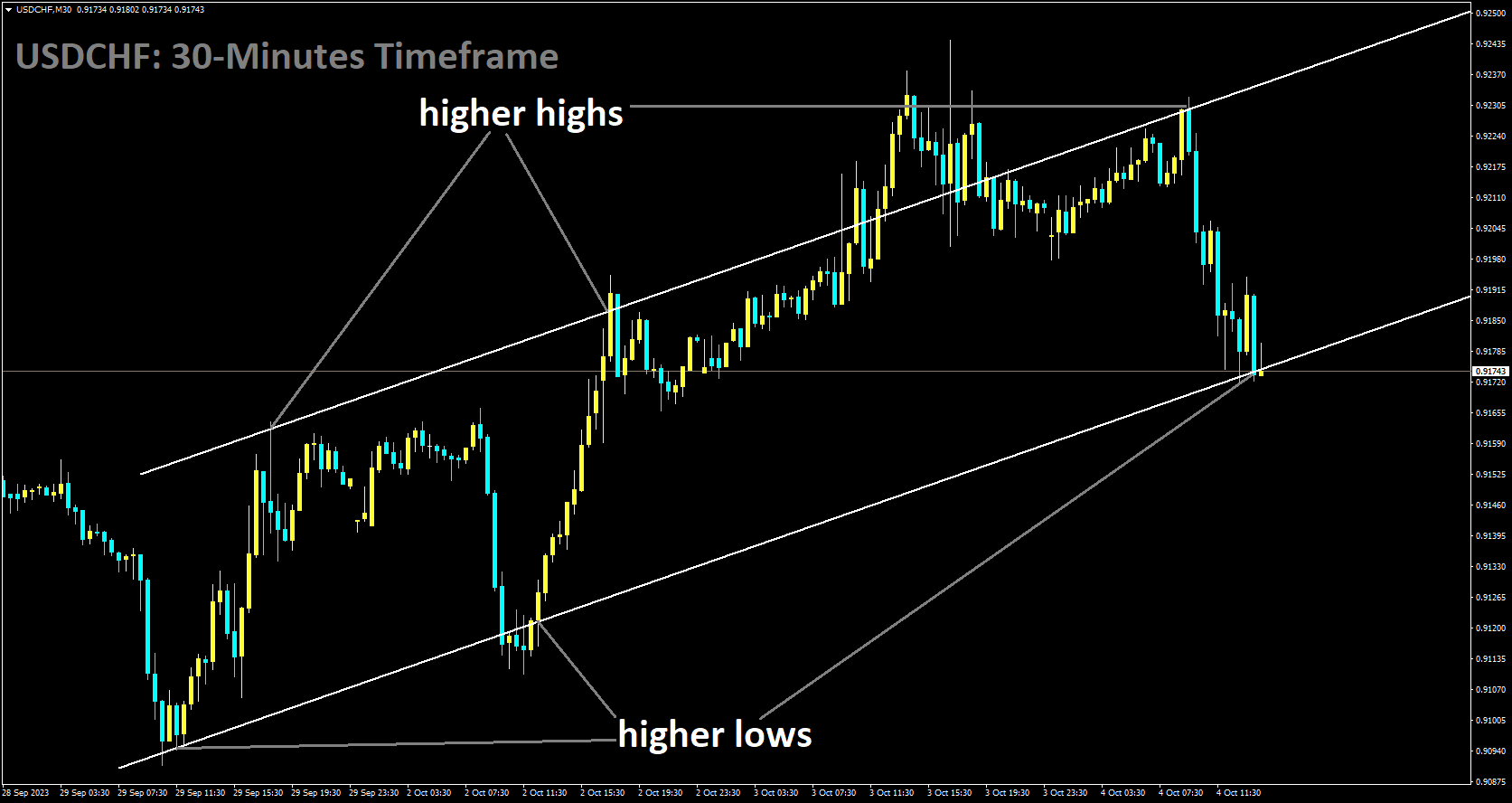

USDCHF Analysis

USDCHF is moving in Ascending channel and market has reached higher low area of the channel

Strong US job data and rising US Treasury yields are the main drivers of the USD’s strength. Expectations were not met by US JOLTS Job Openings, which led to an increase in US Treasury yields. On Wednesday, the yield on the US 10-year bond hit 4.85%, the highest level since 2007. According to the JOLTS report, job openings increased to 9.61 million in August from 8.92 million in July, above market estimates. Positive sentiment towards the Greenback is also being strengthened by the Fed’s hawkish stance, which calls for maintaining higher interest rates for an extended period of time. If the current economic conditions continue, Cleveland Federal Reserve President Loretta Mester hinted that she might support raising interest rates at the next meeting. However, Raphael Bostic, the president of the Atlanta Fed, offered a cautious assessment of the Fed’s policy outlook, noting that there is no rush to raise or lower rates.

Swiss National Bank decided to keep interest rates at 1.75%

The US employment data, which includes the release of the Nonfarm Payrolls on Friday and the ADP report on Wednesday, is highly anticipated by market participants. In contrast to expectations of 2.00%, the Swiss National Bank (SNB) decided to keep interest rates at 1.75%. The significant tightening seen in recent quarters, which the central bank cited as a counterbalance to the persistent inflationary pressures, was used to justify this decision. The inflation rate for both headline and core measures remains comfortably within the SNB’s target range of 0-2%, according to the most recent data on the country’s CPI. Remaining at cycle lows, the unemployment rate holds steady at its previous reading. While the Services PMI continues to expand, the Manufacturing PMI has seen a significant rebound but is still in contraction. The expectation in the market is that the SNB will keep rates unchanged at the next meeting.

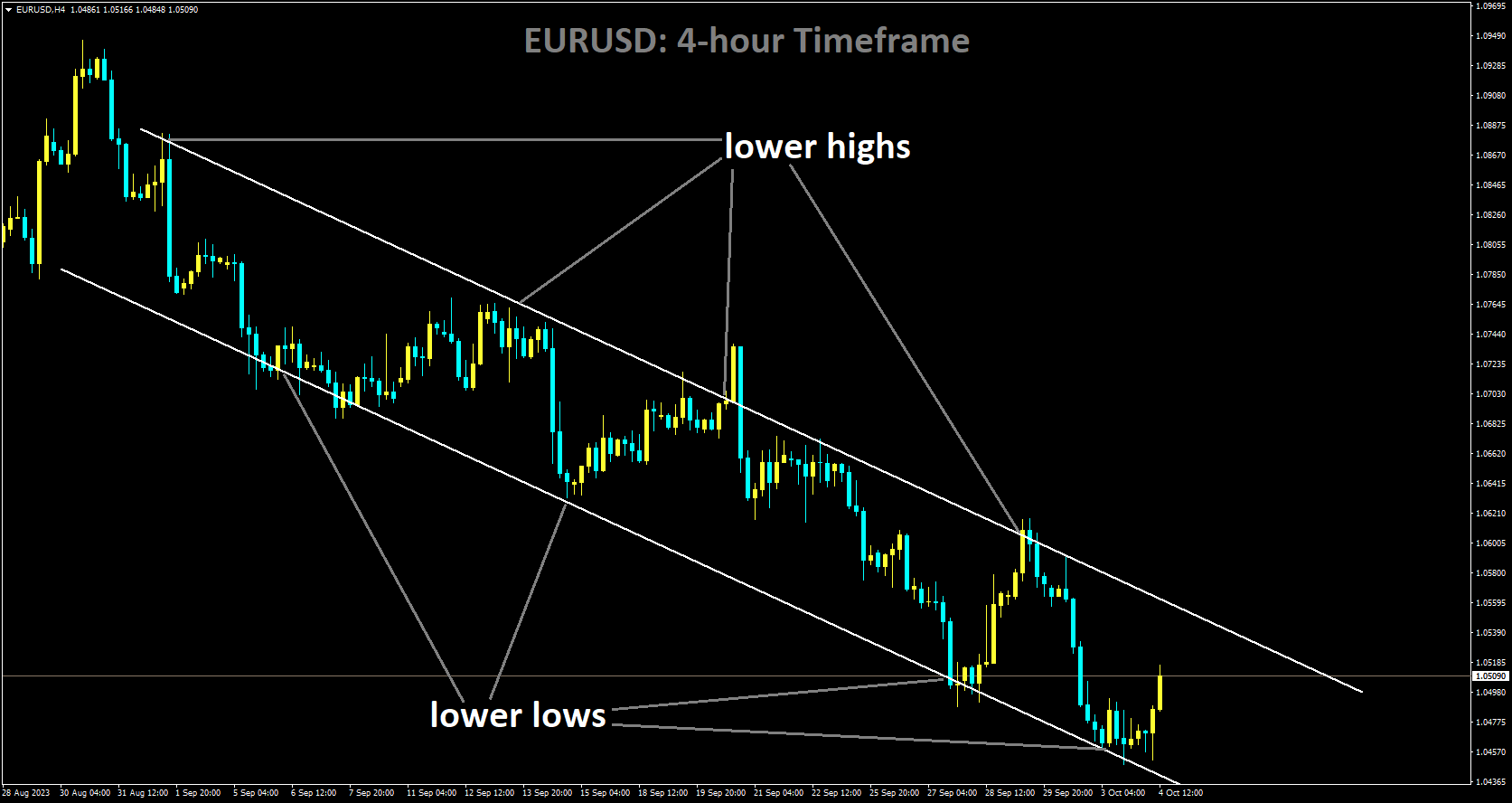

EURUSD Analysis

EURUSD is moving in Descending channel and market has rebounded from the lower low area of the channel.

EURUSD is still trading below 1.05 at this point. ING economists assess the prospects for the pair. ECB President Christine Lagarde is scheduled to speak at a conference today regarding monetary policy. Since the market is pricing in almost no additional tightening from the ECB, any hawkish comments she makes could offer some relief to the struggling EURUSD. Given the challenging external environment, any gains above 1.05 appear difficult to maintain, and over the next few weeks, we can expect to see EURUSD trading near the soft side of a 1.04–1.06 range.

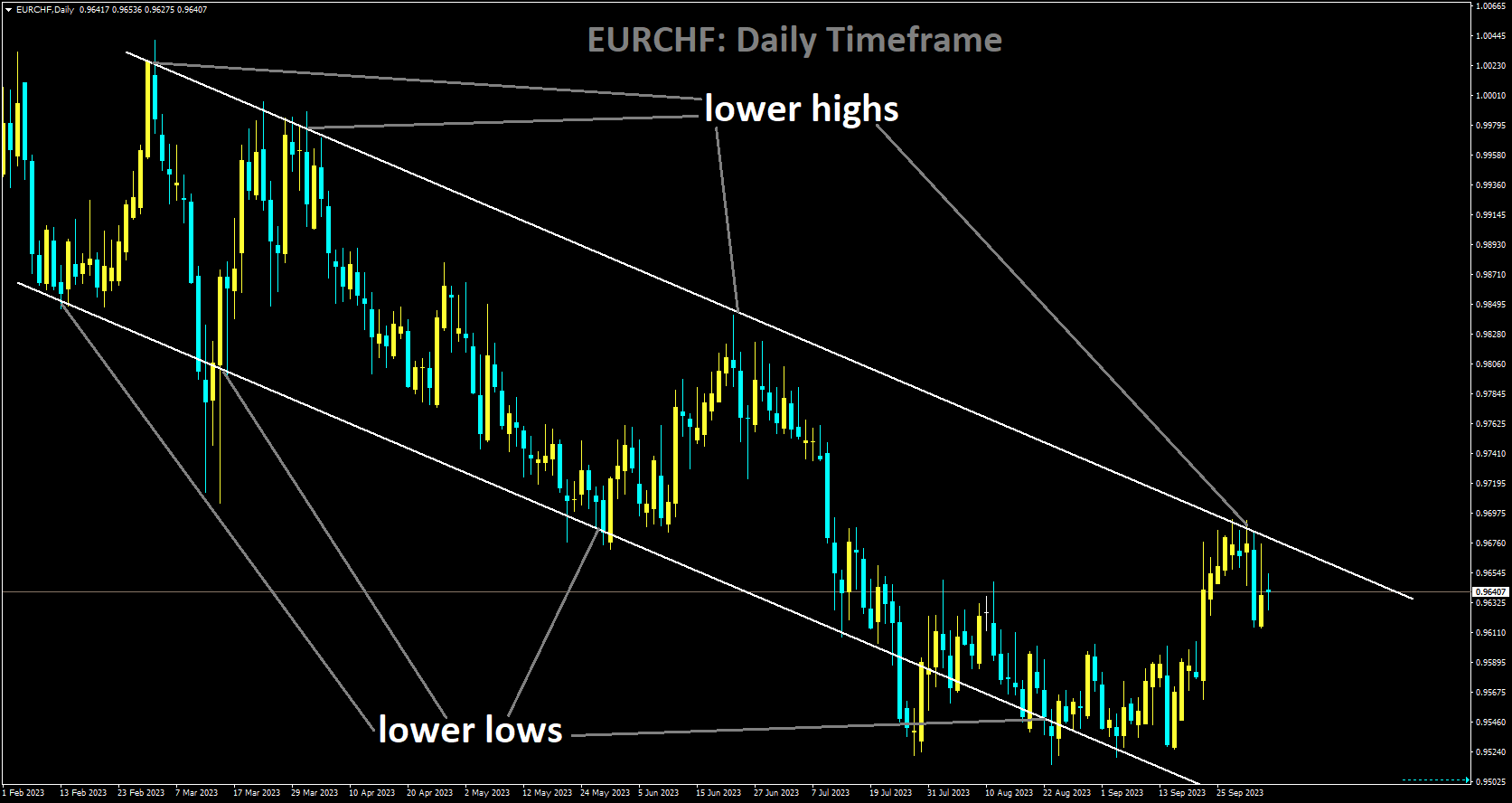

EURCHF Analysis

EURCHF is moving in Descending channel and market has reached lower high area of the channel

Even though inflation is above the European Central Bank’s target and there are growing concerns about a potential recession or even stagflation in the region, the bank may decide to halt changing its policies. Final Services PMIs are scheduled for release on the domestic calendar, coinciding with ECB President Christine Lagarde’s speech. In relation to the USD on Wednesday, the EUR appears somewhat bid. The markets anticipate a halt to the ECB’s tightening programme.

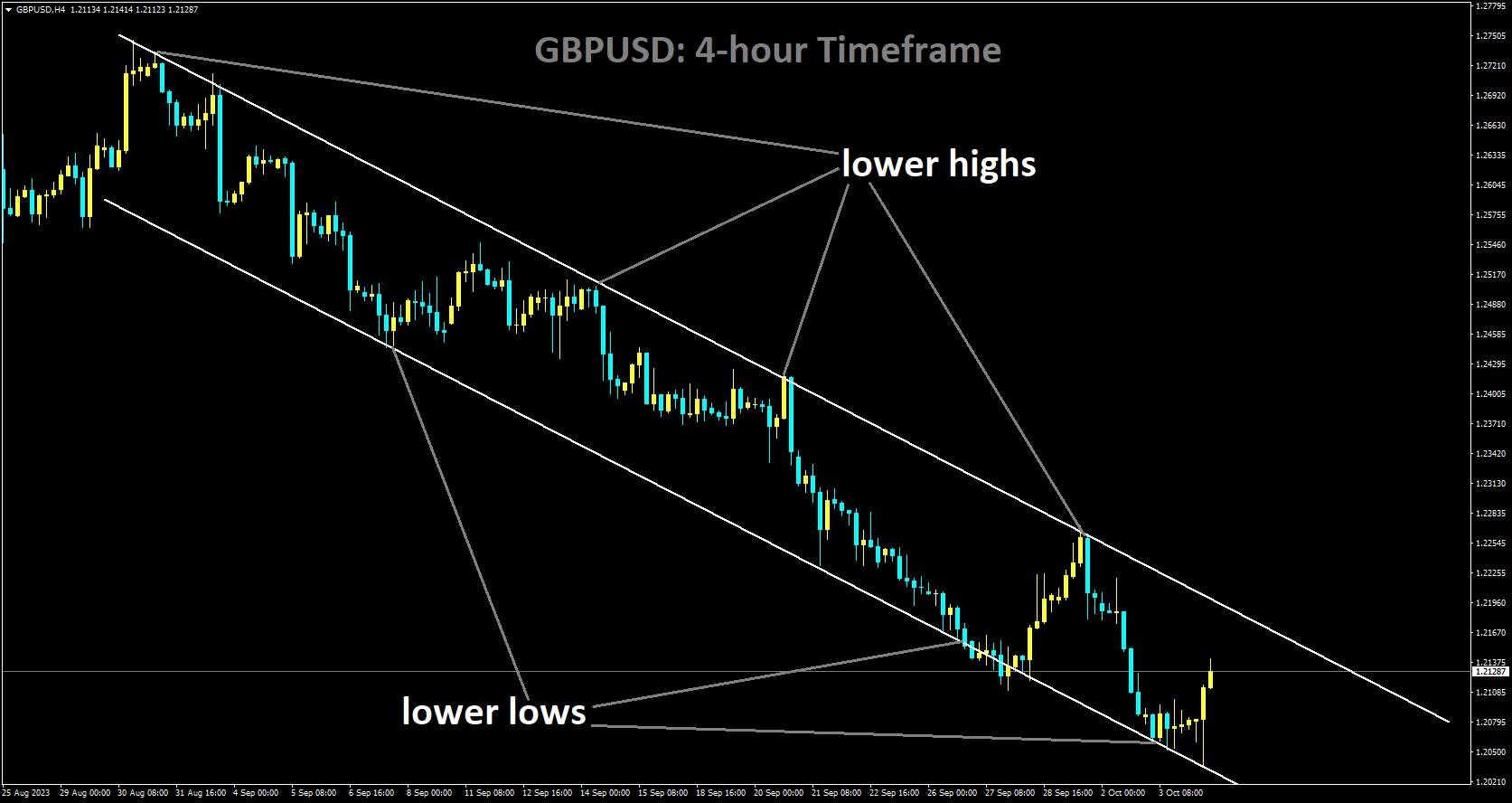

GBPUSD Analysis

GBPUSD is moving in Descending channel and market has rebounded from the lower low area of the channel

The pound sterling (GBP) has been selling off steadily over the last three months, but it is still having trouble finding a stable base. A vicious sell-off is expected for the GBP/USD pair as the UK economy struggles due to low growth prospects and persistent inflation. The Bank of England (BoE) is disinclined to raise interest rates further because the risks of a deeper recession are increasing, even though UK inflation is still more than three times the target rate of 2%. The UK’s Services PMI is expected to stay below the 50.0 threshold for the second consecutive month, following a contractionary period in the Manufacturing PMI that lasted more than a year. Because of the weak demand, British manufacturers have reduced their workforce and new orders. Increased oil prices and supply chain hiccups might put the UK economy even more at risk. The pound sterling is unable to hold onto the critical 1.2050 support level in front of the September Services PMI data. Based on the projections, the Services PMI remains stable at 47.2. The contraction in service activities would occur for the second consecutive month. A figure that is less than 50.0 signifies a contraction. Rising interest rates are a constant threat to UK economic activity. A decline in both domestic and foreign demand has left businesses feeling extremely pessimistic about the state of the economy.

The UK Manufacturing PMI continued to decline this week for the fourteenth consecutive month as businesses reduced employment, new orders, and output in response to the weakening demand. Even though the UK economy is having difficulty stabilizing due to economic uncertainty, policymakers at the Bank of England are still concerned about rising inflation despite raising interest rates to 5.25%. Most policymakers at the Bank of England are in favor of keeping the interest rate unchanged when it comes to September, but Katherine Mann believes that monetary policy is not tight enough to keep inflation below 2%.

BoE Mann went on to say that stronger price growth and a “world where inflation shocks are likely to be more frequent” are what policymakers must deal with, which means permanent rate increases. Food price inflation dropped for the fifth consecutive month to a single-digit annualized rate of 9.9% from 11.5%, according to the British Retail Consortium (BRC), despite all the negative headlines about the UK’s economic prospects and sticky inflation.

Though she cautioned that growing oil prices, a global sugar shortage, and supply disruptions brought on by the conflict in Ukraine could stifle the trend, BRC Chief Executive Helen Dickinson stated that the organization expects shop price inflation to continue declining throughout the remainder of the year. Regarding international trade, Business & Trade Minister Kemi Badenoch told the Conservative Party conference that President Joe Biden’s administration had “zero” chance of negotiating a free trade agreement with the United States. This was reported by Reuters. As investors wait for ADP to release the US Employment Change data, the market is still in a calm state. The consensus predicts that private payroll growth in September will be 153K, which is less than the 177K increase reported in August. The US labor market data for September will influence the monetary policy that the Federal Reserve (Fed) will adopt in November. Following hawkish comments from Fed Governor Michelle Bowman and President Loretta Mester of the Cleveland Fed Bank, the odds of another interest rate hike from the Fed are surging, and the US Dollar Index (DXY) continues to rise near 107.20. The US JOLTS Job Openings data for August was positive. Companies announced 9.61 million open positions, compared to forecasts of 8.8 million.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% FLAT OFFER for Signals 😍 GOING TO END – Get now: forexfib.com/discount/