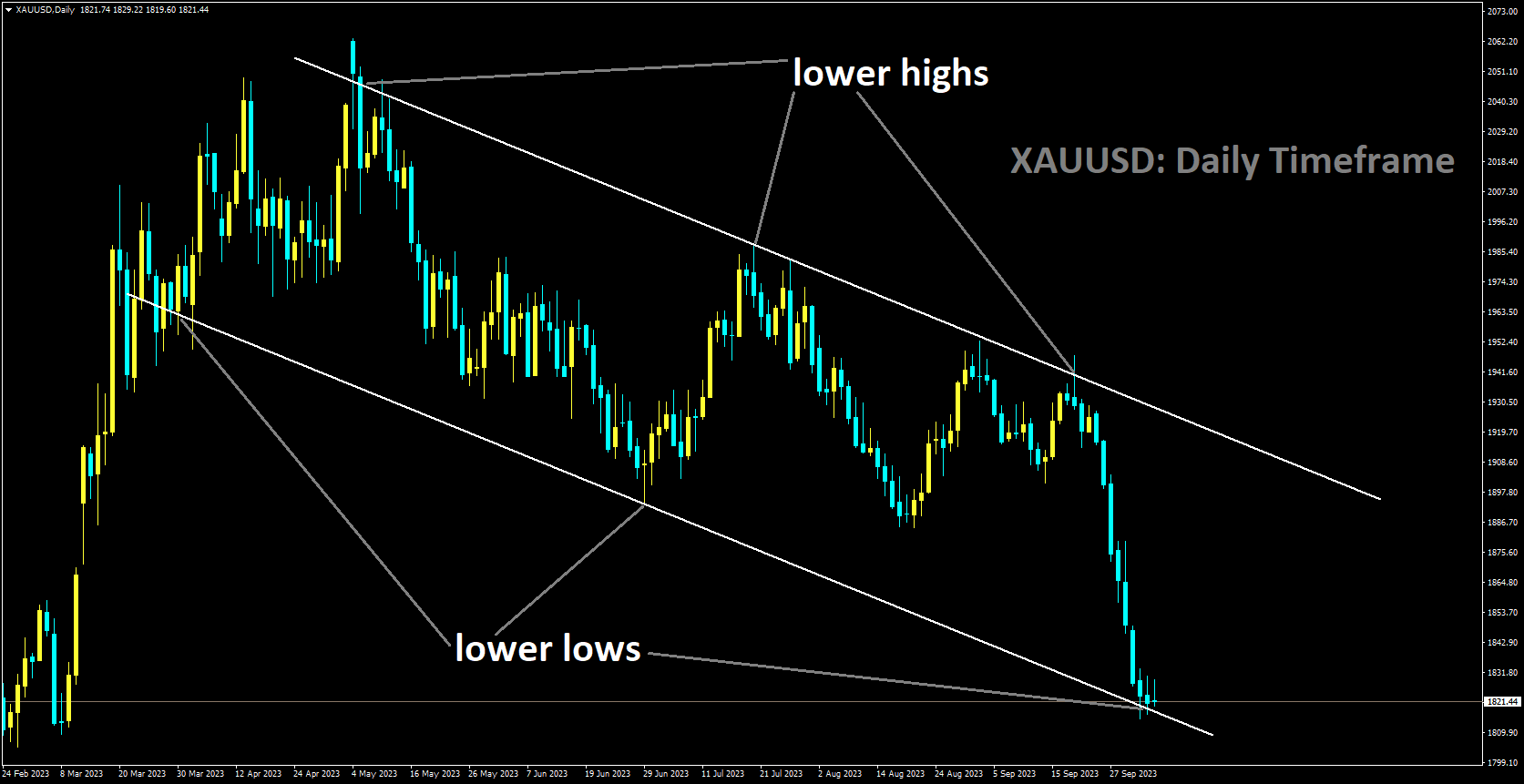

GOLD Analysis

XAUUSD is moving in Descending channel and market has reached lower low area of the channel

The gold price gains some traction on Thursday and maintains its intraday gains through the early European session. For the time being, the precious metal appears to have broken an eight-day losing streak to a seven-month low set on Tuesday. US Treasury bond yields and the US Dollar USD have fallen from recent highs as investors seek more clarity on the Federal Reserve’s Fed next policy move, which supports the metal. According to a report released on Wednesday by Automatic Data Processing ADP, the labour market in the United States US is cooling. In addition, a survey conducted by the Institute for Supply Management ISM revealed a cooling in the US services sector, providing the Fed with an incentive to stop raising interest rates. This causes a correction in US bond yields and prompts traders to reduce their USD bullish bets.

Any meaningful recovery in the gold price, on the other hand, appears elusive, necessitating some caution for aggressive bullish traders. The US macro data remains consistent with expectations for solid third-quarter economic growth, allowing the Fed to keep rates higher for longer. Furthermore, recent comments by several Fed officials bolstered the case for additional policy tightening to return inflation to the 2% target. This opens the door for at least one more Fed rate hike in 2023, which will likely act as a tailwind for US bond yields and limit the USD’s corrective decline. As a result, it is prudent to wait for strong follow-through buying before confirming that the XAUUSD has formed a near-term bottom and positioning for a further upward move. Traders may also prefer to sit out the release of the closely watched US monthly employment figures on Friday. The widely publicised NFP report will play an important role in shaping expectations about the Fed’s future rate-hike path, which will drive USD demand in the short term and provide a new directional impetus to the Gold price. Moving on to the key data risk, the US Weekly Initial Jobless Claims data will be scrutinised for short-term opportunities later this Thursday during the early North American session.

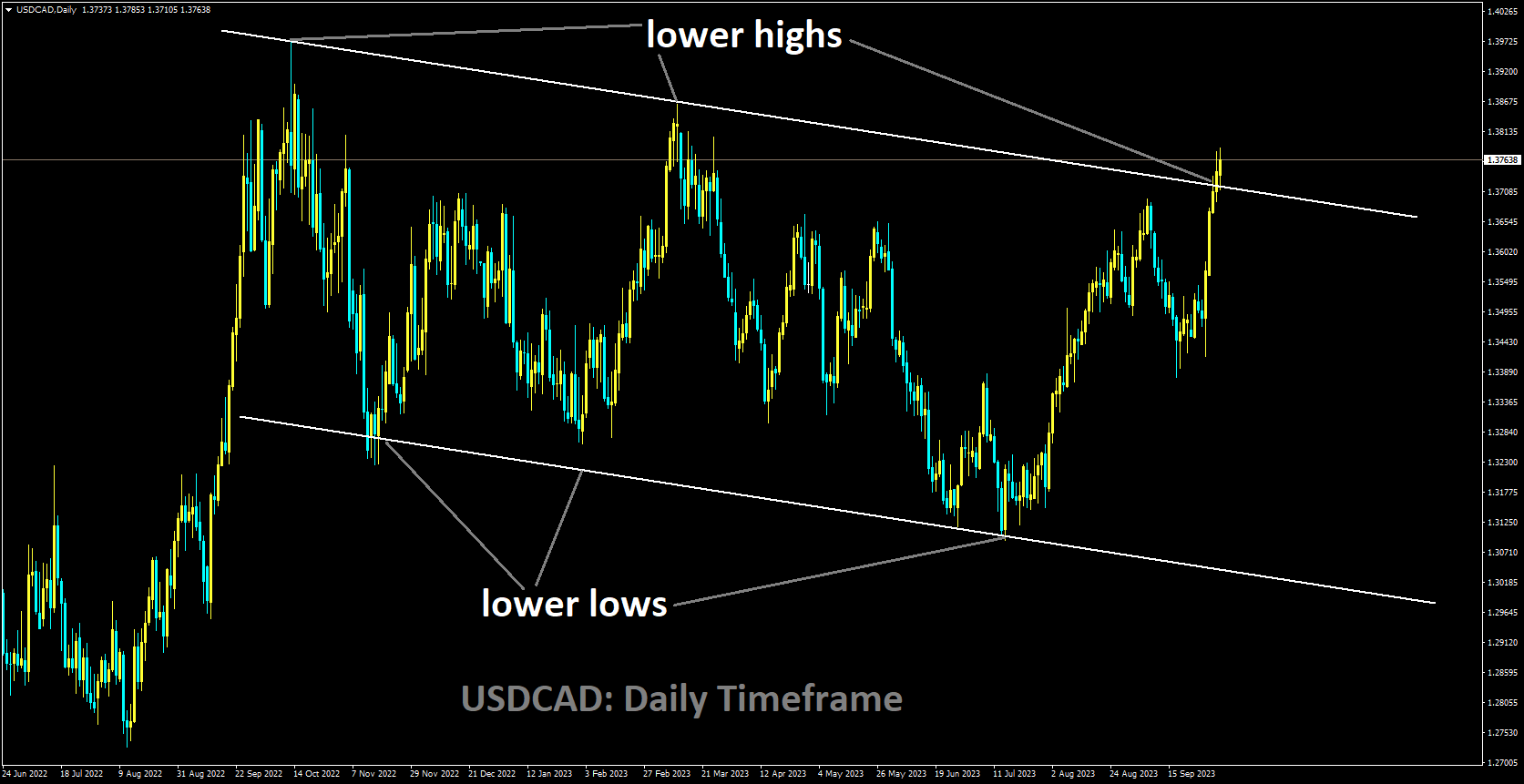

USDCAD Analysis

USDCAD is moving in Descending channel and market has reached lower high area of the channel

During the early Asian session on Thursday, the USDCAD pair extends its gains around the mid-1.3700s. A drop in oil prices puts some pressure on the Canadian Dollar and helps the USDCAD pair. Markets are becoming cautious ahead of the US Nonfarm Payrolls report on Friday, with the US economy expected to add 170,000 jobs in September. Nonetheless, a drop in oil prices dragged down the commodity-linked Loonie, as Canada is the leading oil exporter to the US. A data release earlier this week revealed that the Canadian S&P Global Manufacturing PMI for September was 47.5, up from 48.0 in the previous reading. According to the Automatic Data Processing report on Thursday, US private payrolls increased by 89,000 in September, up from 180,000 in the previous reading. This figure fell short of the estimate of 153,000 and was the lowest since January 2021.

Meanwhile, the US ISM Services PMI fell to 53.6 in September from 54.5 the previous month, in line with market expectations. The Greenback falls across the board in response to the data. The bearish momentum in oil prices, however, is offset by disappointing US job data. Market participants will be looking forward to the release of US weekly jobless claims, Canadian trade data, and the Canadian Ivey Purchasing Managers Index (PMI) for September. The US Nonfarm Payrolls will be closely watched on Friday, followed by Canadian job reports. Traders will use these figures to identify trading opportunities in the USDCAD pair.

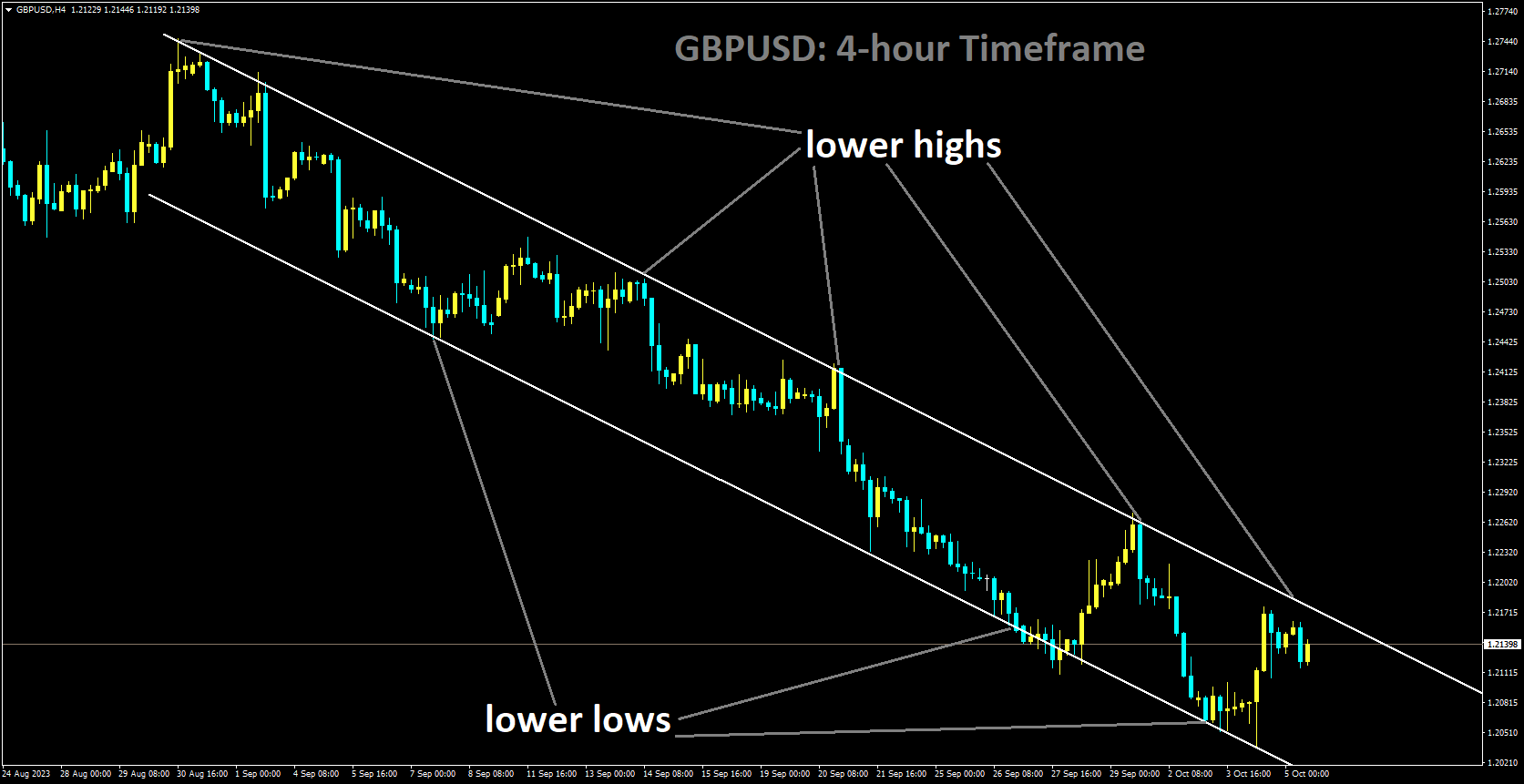

GBPUSD Analysis

GBPUSD is moving in Descending channel and market has reached lower high area of the channel

The Pound Sterling GBP recovers as demand for risky assets rises, but it struggles to extend the rally. The GBPUSD pair’s upside appears limited as the UK economy approaches a slowdown due to vulnerable economic activities, potential inflation shocks, and deteriorating demand. Despite an increase in the UK Services PMI, the economic data remains below the 50.0 mark, indicating a contraction. The UK economy is failing to absorb the effects of the Bank of England’s BoE higher interest rates, rising oil prices, and supply chain disruptions caused by the Russia-Ukraine war. The Pound Sterling is aiming to extend its gains towards the round-level resistance of 1.2200 as the US Dollar falls back after the release of weaker-than-expected US ADP Employment Change data. The decline in the appeal of the US Dollar has improved market sentiment and redirected investment into riskier assets. On Wednesday, the GBPUSD pair attempted to recover after the UK Services PMI for September came in better than expected. According to S&P Global, the Services PMI fell below the 50.0 mark for the second time in a row, but it outperformed expectations significantly.

The Services PMI came in at 49.3, which was higher than expected and higher than the previous release of 47.2. According to S&P Global, the improvement in economic data was caused by a sustained easing of inflationary pressure.

Several companies were upbeat as the Bank of England paused its policy tightening. The data collection agency warned that the broader outlook remains sluggish, owing to higher borrowing costs and a weak order book as a result of the weak economic conditions. Due to sluggish demand, British manufacturers have reduced new orders and labour. Rising oil prices and supply chain disruptions may put the UK economy on the defensive. Meanwhile, Bank of England Governor Andrew Bailey warned about potential inflation shocks but remained confident that inflation would be kept to 5% or less by year’s end. Andrew Bailey was adamantly opposed to changing the UK’s 2% inflation target. Earlier, Katherine Mann, a BoE policymaker, warned that policymakers are facing a “world where inflation shocks are likely to be more frequent” with stronger price growth, implying that interest rates will need to be permanently higher. Investors will be looking forward to the S&P Global Construction PMI data for September, which will be released at 08:30 GMT. The economic data is expected to fall to 49.9 from 50.8 in August, according to forecasts.

Construction spending in the United Kingdom is expected to fall as a result of rising mortgage rates, which are discouraging households from investing in the housing sector. The US Dollar Index DXY finds an intermediate support near 106.50, but a volatile move is expected as investors shift their attention to the September Nonfarm Payrolls NFP report following weak ADP job data. ADP reported that new private payroll additions in September were half as many as in August, at 89k. Investors had already predicted 153k fewer jobs. Soft labour market data are expected to dampen expectations of another Federal Reserve Fed interest rate hike in 2023, which were supported by Cleveland Fed Bank President Loretta Mester and Fed Governor Michelle Bowman. The US ISM Services PMI was 53.6, matching expectations, but remained below the August reading of 54.5. New Orders fell significantly to 51.8 from 57.5 in the previous release.

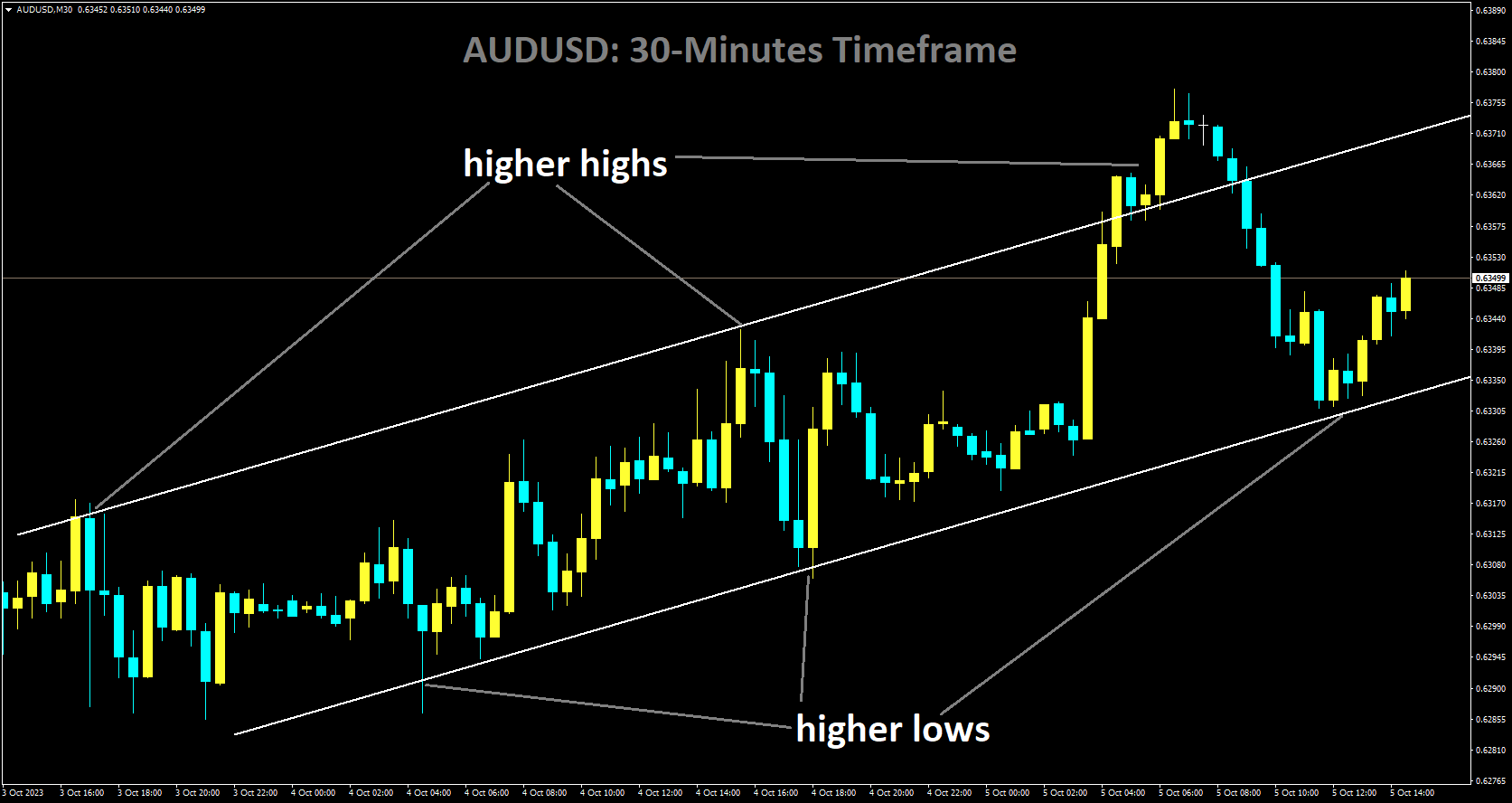

AUDUSD Analysis

AUDUSD is moving in Ascending channel and market has rebounded from the higher low area of the channel

The Australian Dollar is gaining ground, building on its gains from the previous session. Following the decline in US Treasury yields, the Aussie pair received upward support from the US Dollar. The Australian Bureau of Statistics reported that Trade Balance data for August improved, reflecting solid growth in Australian exports, which could support the Australian Dollar . However, the AUDUSD pair may face difficulties due to market skepticism about the US Federal Reserve’s interest rate trajectory. Furthermore, the Reserve Bank of Australia’s dovish stance in policy decisions adds to the downward pressure on the Australian Dollar. The US Dollar Index is correcting from an 11-month high following disappointing US employment data on Wednesday, as well as a pullback in US Treasury yields. The initial bond sell-off, however, pushed US yields to levels not seen in years, followed by a rebound. Investors will keep a close eye on the bond market, recognising its importance in driving financial markets.

Australia’s MoM trade balance improved in August, reaching 9,640 million, exceeding market expectations of 8,725 million. The reading for July was 8,039 million. In its most recent policy meeting on Tuesday, the RBA chose to maintain the status quo, leaving the current interest rate unchanged at 4.10%. The Reserve Bank of Australia may raise interest rates, with expectations pointing to a peak of 4.35% by the end of the year. This forecast corresponds to the persistent rise in inflation above the target. Michele Bullock, the newly appointed governor of the RBA, emphasised the need for additional tightening of monetary policy in her inaugural monetary policy statement following the interest rate decision. Bullock noted that recent data point to inflation returning to the target range. While inflation in Australia has peaked, it remains high and is expected to remain so for some time. In September, the US ISM Services PMI fell from 54.5 to 53.6, as expected. The September ADP Employment Change increased by 89,000, falling short of the market consensus of 153,000 and representing the lowest level since January 2021. The 10-year US Treasury yield has fallen from 4.88% on Wednesday, which was the highest since 2007. Traders are looking forward to Friday’s Jobless Claims and Nonfarm Payrolls. Positive data could lead to more USD gains and increased volatility in the bond market.

NZDUSD Analysis

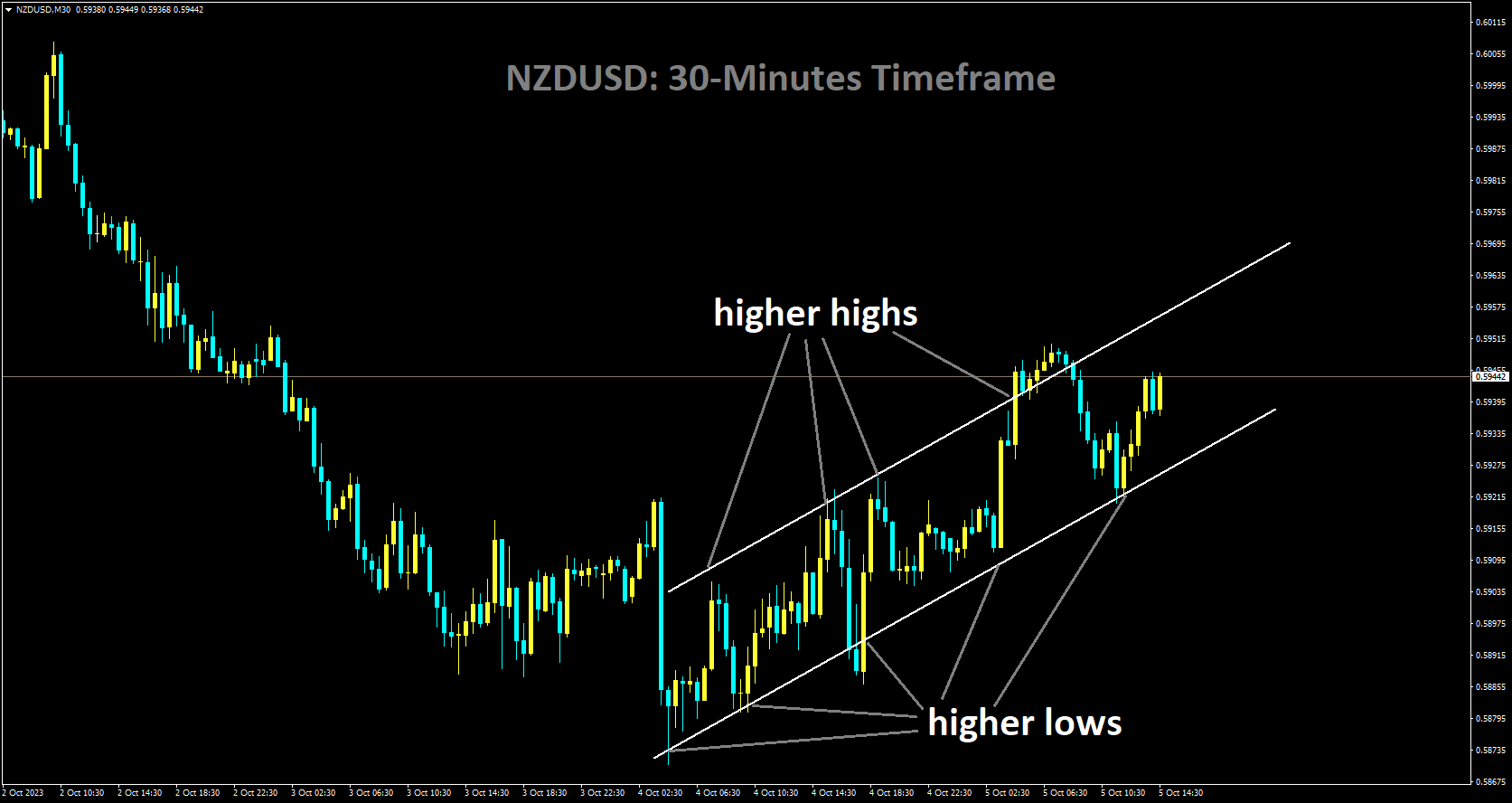

NZDUSD is moving in Ascending channel and market has rebounded from the higher low area of the channel

During the early European session on Thursday, the NZDUSD pair attracts some buyers near 0.5935. The weak US labour data put some downward pressure on the US Dollar and helped to support the pair. Meanwhile, the US Dollar Index falls to 106.65, having retraced from an 11-month high of 107.34. According to Automatic Data Processing , private payrolls in the United States increased by 89,000 in September, up from 180,000 in the previous reading. This figure fell short of the estimate of 153,000 and was the lowest since January 2021. Furthermore, the US ISM Services PMI fell to 53.6 in September from 54.5 in August, matching market expectations. Market participants will, however, take cues from additional labour market data, such as the US Nonfarm Payrolls on Friday. In September, the US economy is expected to add 170,000 jobs. The weaker-than-expected Nonfarm Payrolls data may cause the US dollar to fall and act as a tailwind for the NZDUSD pair.

On Tuesday, Cleveland Federal Reserve President Loretta Mester stated that if the current economic situation holds, she is likely to favour an interest rate hike at the next meeting, while also mentioning that the Fed is likely at or near its peak for interest rate target. Meanwhile, Atlanta Fed President Raphael Bostic has stated that he will be patient and that there is no need for us to do anything else.

In New Zealand, the Reserve Bank of New Zealand held the Official Cash Rate at 5.5% at its October meeting on Wednesday, as widely expected. According to the RBNZ statement, the committee agreed that interest rates may need to remain at a restrictive level for a longer period of time.

Concerning the data, the National Bank of New Zealand reported on Thursday that New Zealand’s ANZ Commodity Price for September fell 1.3%, compared to a 2.9% drop the previous month. The nation’s NZIER Business Confidence for the third quarter q3 fell to -52% QoQ on Tuesday, down from -63% in the previous reading. Looking ahead, market participants will be watching the US weekly jobless claims, which are due on Thursday. On Friday, the focus will shift to the highly anticipated US Nonfarm Payrolls. This event has the potential to cause market volatility. Traders will use the graph to identify trading opportunities in the NZDUSD pair.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% FLAT OFFER for Signals 😍 GOING TO END – Get now: forexfib.com/discount/