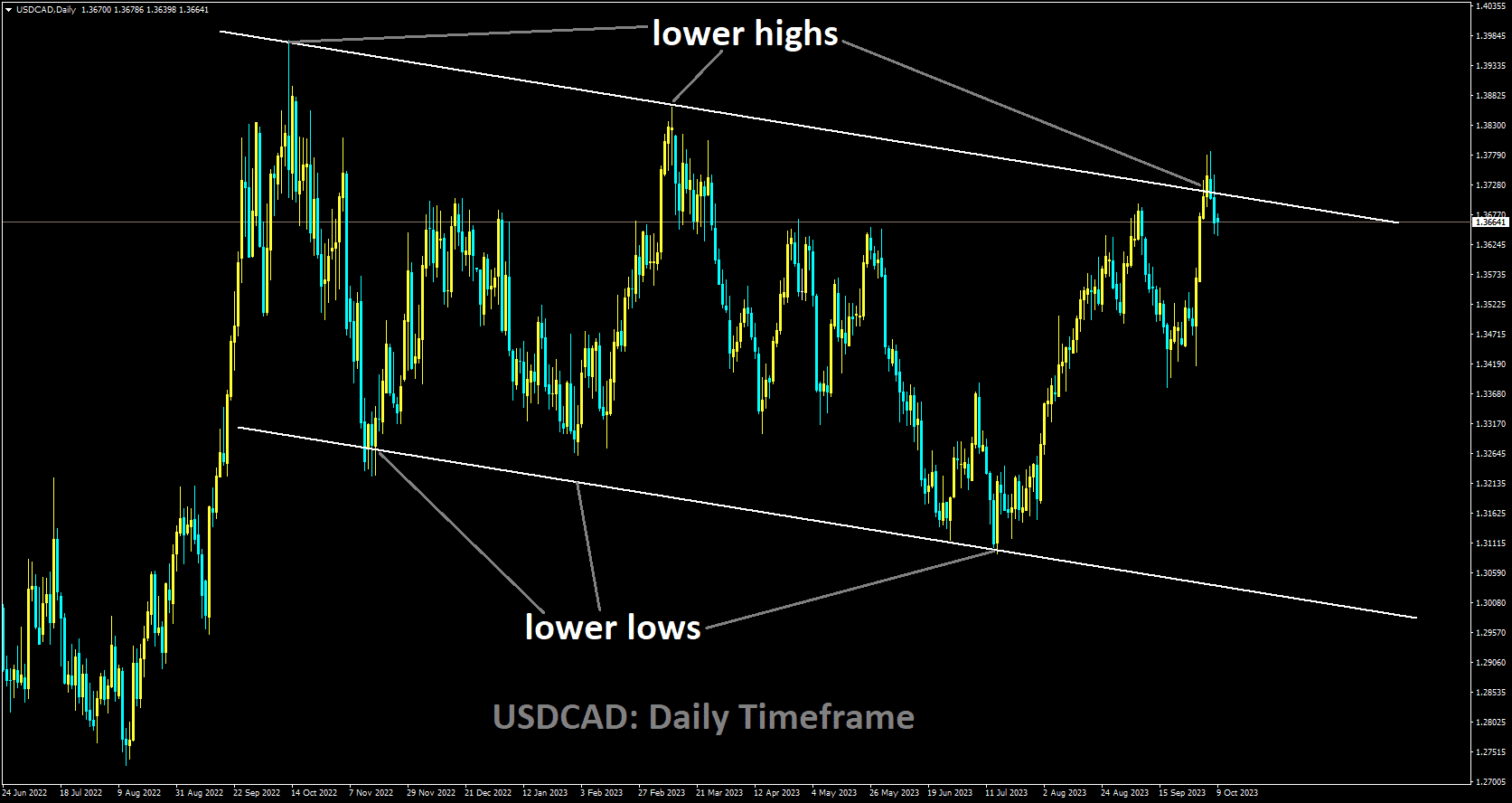

USDCAD Analysis

USDCAD is moving in Descending channel and market has reached lower high area of the channel

The USDCAD is under pressure as a result of a sharp rise in oil prices, which could be attributed to the military conflict between Palestine and Israel. Oil prices may have risen as a result of the conflict. The increased geopolitical tensions may have an impact on the Canadian Dollar CAD, particularly because Canada is the largest oil exporter to the United States US. The Western Texas Intermediate WTI oil price is up for the second day in a row, trading around $85.80 per barrel at the time of writing. Furthermore, the strong data from Canada may have bolstered the Loonie Dollar. Net Change in Employment in September was 63.8K, up from 20.0K expected and 39.9K in August. Furthermore, the unemployment rate for the month remained constant at 5.5%, versus the market consensus of 5.6%. The markets are keeping a close eye on the rekindled Middle Eastern military conflict between Palestine and Israel. The fear is that this conflict will escalate and spread to other parts of the region, introducing geopolitical uncertainties that will have an impact on global markets. The US Dollar Index DXY has recovered after three consecutive days of losses, trading around 106.20 at the time of publication. The US Dollar’s USD strength can be attributed to the strong US Nonfarm Payrolls data released on Friday.

The September jobs report revealed a significant increase of 336,000 jobs, exceeding the market expectation of 170,000. The revised August figure was 227,000. However, the US MoM remained stable at 0.2% in September, falling short of the expected 0.3%. The report showed an annual increase of 4.2%, which was lower than the expected consistent figure of 4.3%. US Treasury yields have also recovered, owing to expectations that the Federal Reserve Fed will keep interest rates high for an extended period of time. The 10-year US Treasury bond yield is currently at 4.80%, close to its peak since 2007. Investors will most likely keep an eye on the upcoming International Monetary Fund IMF meeting, which will focus on strategies for stabilising international exchange rates and promoting development. Later in the week, the US Core Producer Price Index will be closely watched, as it plays an important role in gauging inflationary trends and economic conditions in the United States.

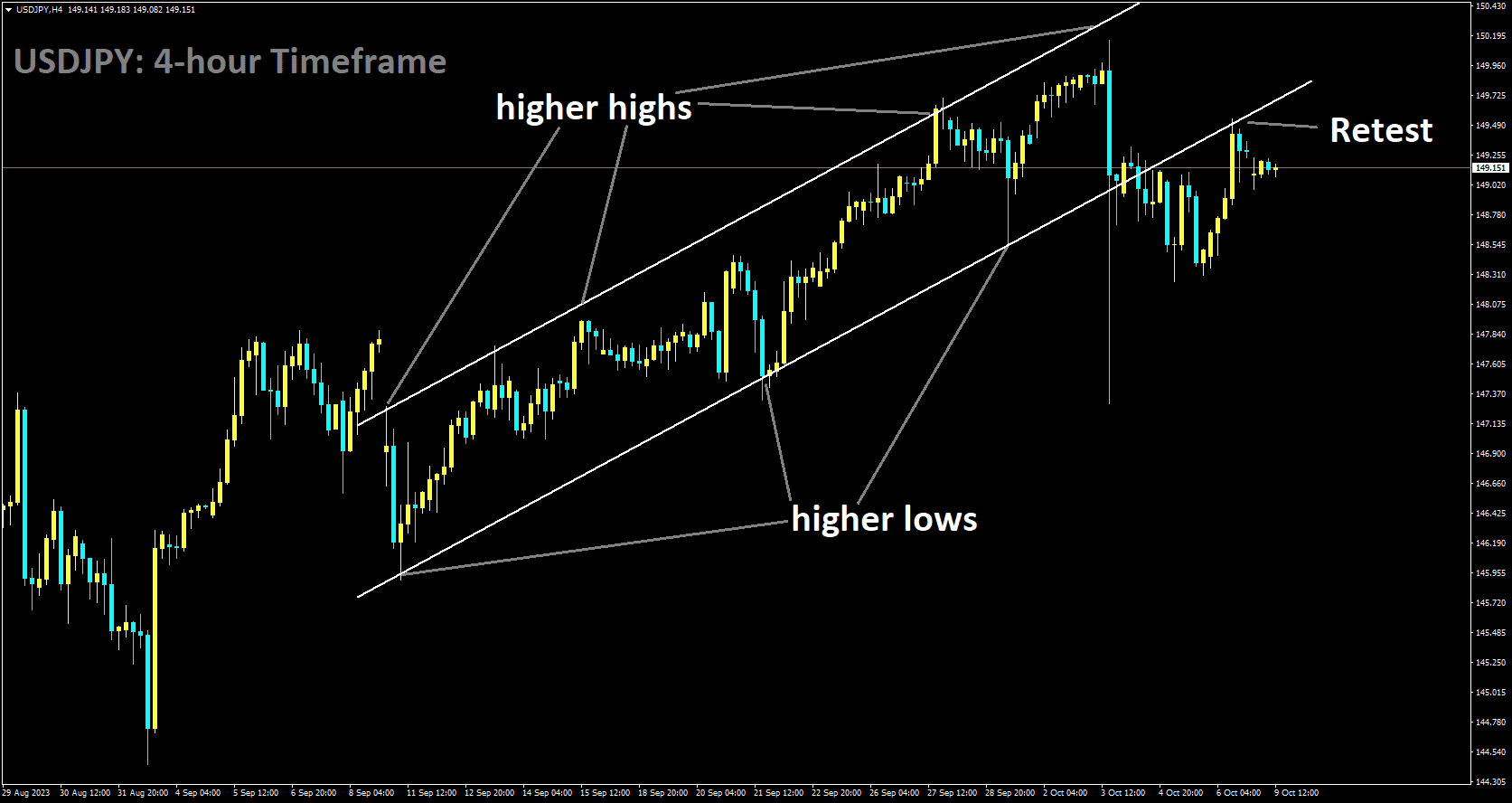

USDJPY Analysis

USDJPY has broken Ascending channel in downside and market has retest the broken area of the channel

The aftermath of escalating geopolitical tensions in the Middle East, which tends to benefit the safe-haven Japanese Yen JPY. On Saturday, the Hamas militant group in Gaza, Palestine, launched an unprecedented attack on Israeli towns. In response, Israel launched airstrikes on Gaza and declared war on the Palestinian enclave on Sunday, killing hundreds on both sides. This, in turn, weighed on global risk sentiment and drove some haven flows to the JPY. This, combined with subdued US Dollar USD price action, is seen as a bearish sign for the USDJPY pair. The economy added 336K jobs in September, exceeding even the most optimistic estimates, according to Friday’s mixed US monthly jobs data NFP. In addition, the previous month’s reading was revised higher to 227K from 187K, indicating that the labour market remains tight. This, in turn, reaffirms bets on at least one more Federal Reserve Fed rate hike by the end of the year, which supports elevated US Treasury bond yields and lends some support to the USD.

Meanwhile, the report’s additional details revealed that wage growth remained moderate during the reported month, easing inflationary concerns. This, in turn, prevents USD bulls from placing new bets, limiting the pair’s upside potential. Traders appear hesitant as well, preferring to remain on the sidelines ahead of the release of the FOMC monetary policy meeting minutes on Wednesday, followed by the latest US consumer inflation figures on Thursday. Meanwhile, speculations that Japanese authorities will intervene in the FX market to support the domestic currency contribute to the USDJPY pair’s gains being limited. Indeed, Japan’s top currency diplomat, Masato Kanda, warned last week that sustained JPY declines could necessitate intervention. Former top currency diplomat Naoyuki Shinohara, on the other hand, believes Japan will not seek to reverse the JPY’s downtrend because the falls reflect economic fundamentals. In the absence of any market-moving economic data on Monday, the aforementioned mixed fundamental backdrop warrants some caution for aggressive traders and may force the USDJPY pair to extend its consolidative price action.

Meanwhile, the report’s additional details revealed that wage growth remained moderate during the reported month, easing inflationary concerns. This, in turn, prevents USD bulls from placing new bets, limiting the pair’s upside potential. Traders appear hesitant as well, preferring to remain on the sidelines ahead of the release of the FOMC monetary policy meeting minutes on Wednesday, followed by the latest US consumer inflation figures on Thursday. Meanwhile, speculations that Japanese authorities will intervene in the FX market to support the domestic currency contribute to the USDJPY pair’s gains being limited. Indeed, Japan’s top currency diplomat, Masato Kanda, warned last week that sustained JPY declines could necessitate intervention. Former top currency diplomat Naoyuki Shinohara, on the other hand, believes Japan will not seek to reverse the JPY’s downtrend because the falls reflect economic fundamentals. In the absence of any market-moving economic data on Monday, the aforementioned mixed fundamental backdrop warrants some caution for aggressive traders and may force the USDJPY pair to extend its consolidative price action.

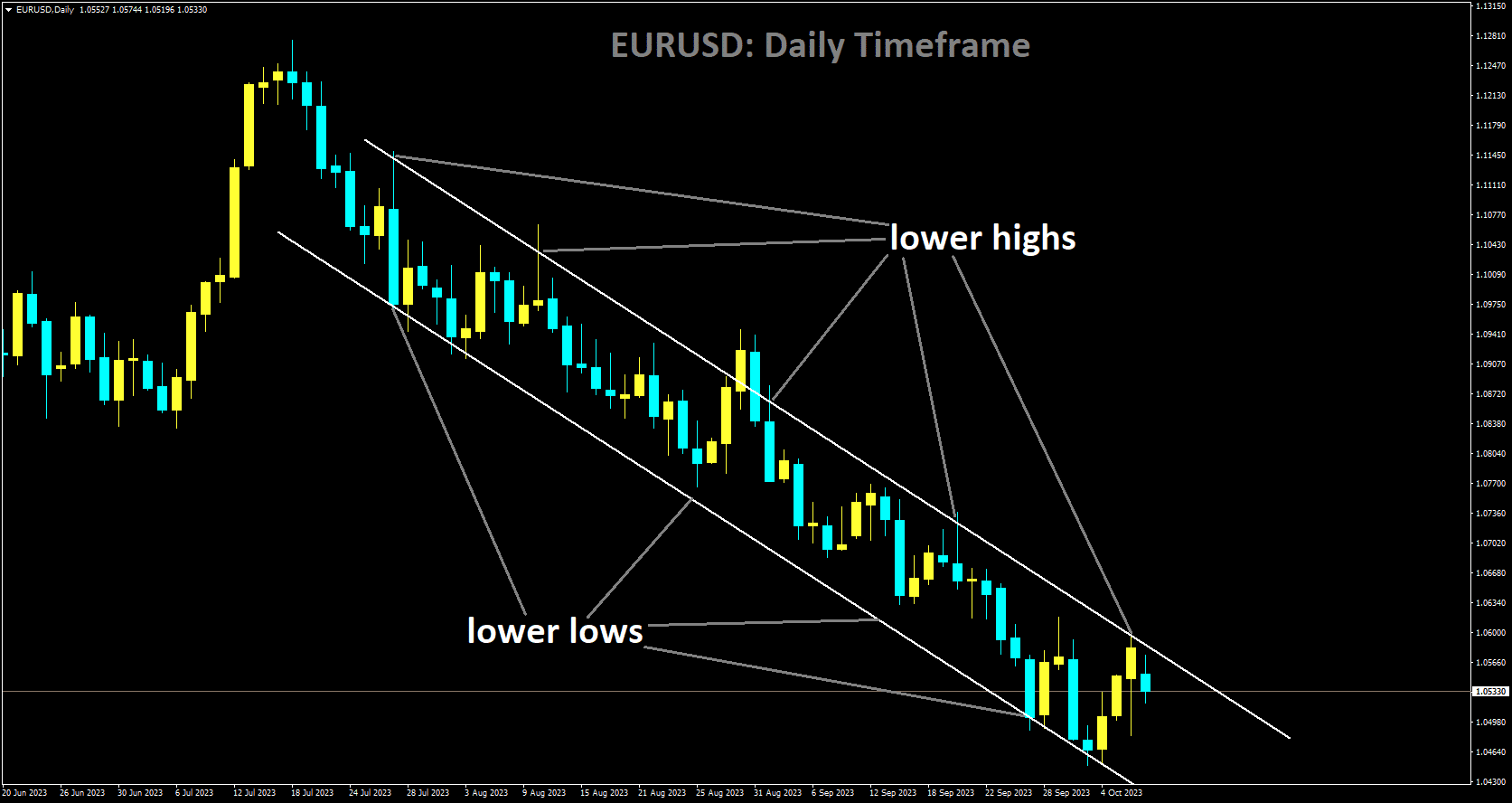

EURUSD Analysis

EURUSD is moving in Descending channel and market has reached lower high area of the channel

The EURUSD is under pressure due to risk aversion caused by the military conflict between Palestine and Israel. Christine Lagarde stated in an interview with the French newspaper La Tribune Dimanche, The key ECB interest rates have reached levels that, if maintained for a sufficiently long duration, will make a substantial contribution to the timely return of inflation to the target. Christine Lagarde, President of the European Central Bank ECB, expects inflation to fall back to 2%. Lagarde also expressed confidence in Europe’s gas reserves. Germany’s Industrial Production YoY fell by 2.0% in August, following a 1.7% drop in July. While monthly data showed a 0.2% drop, this was greater than the 0.1% drop expected. Furthermore, the release of US Nonfarm Payrolls data on Friday impacted the EURUSD pair, initially putting pressure on it but eventually ending the previous session on a positive note. The September jobs report revealed a significant increase of 336,000 jobs, which exceeded the market’s expectation of 170,000. August’s revised figure was 227,000. Nonetheless, the US Average Hourly Earnings MoM remained unchanged in September at 0.2%, falling short of the 0.3% expected. The report showed an annual decrease of 4.2%, which was lower than the expected consistent figure of 4.3%.

The markets are keeping a close eye on the ongoing military conflict in the Middle East between Hamas and Israel. Concerns remain that the conflict will escalate and spread throughout the region, introducing geopolitical uncertainties that will reverberate throughout global markets. The US Dollar Index DXY has recovered after three days of losses, aided by rising US Treasury yields. At the time of writing, the DXY is trading around 106.30. Treasury yields in the United States have recovered, influenced by expectations that the Federal Reserve Fed will maintain higher interest rates for an extended period of time. The 10-year US Treasury bond yield has risen to 4.80%, its highest level since 2007. Investors will be watching the upcoming International Monetary Fund IMF meeting closely, as discussions will centre on strategies for stabilising international exchange rates and promoting development. Furthermore, the US Core Producer Price Index may be closely watched later in the week, as it plays an important role in assessing inflationary trends and economic conditions in the United States. The escalation of violence has the potential to push investors towards traditional safe-haven assets, such as the Swiss Franc CHF. During times of increased geopolitical uncertainty, there is an increased demand for safe-haven assets, and CHF is frequently regarded as a less risky option in such circumstances.

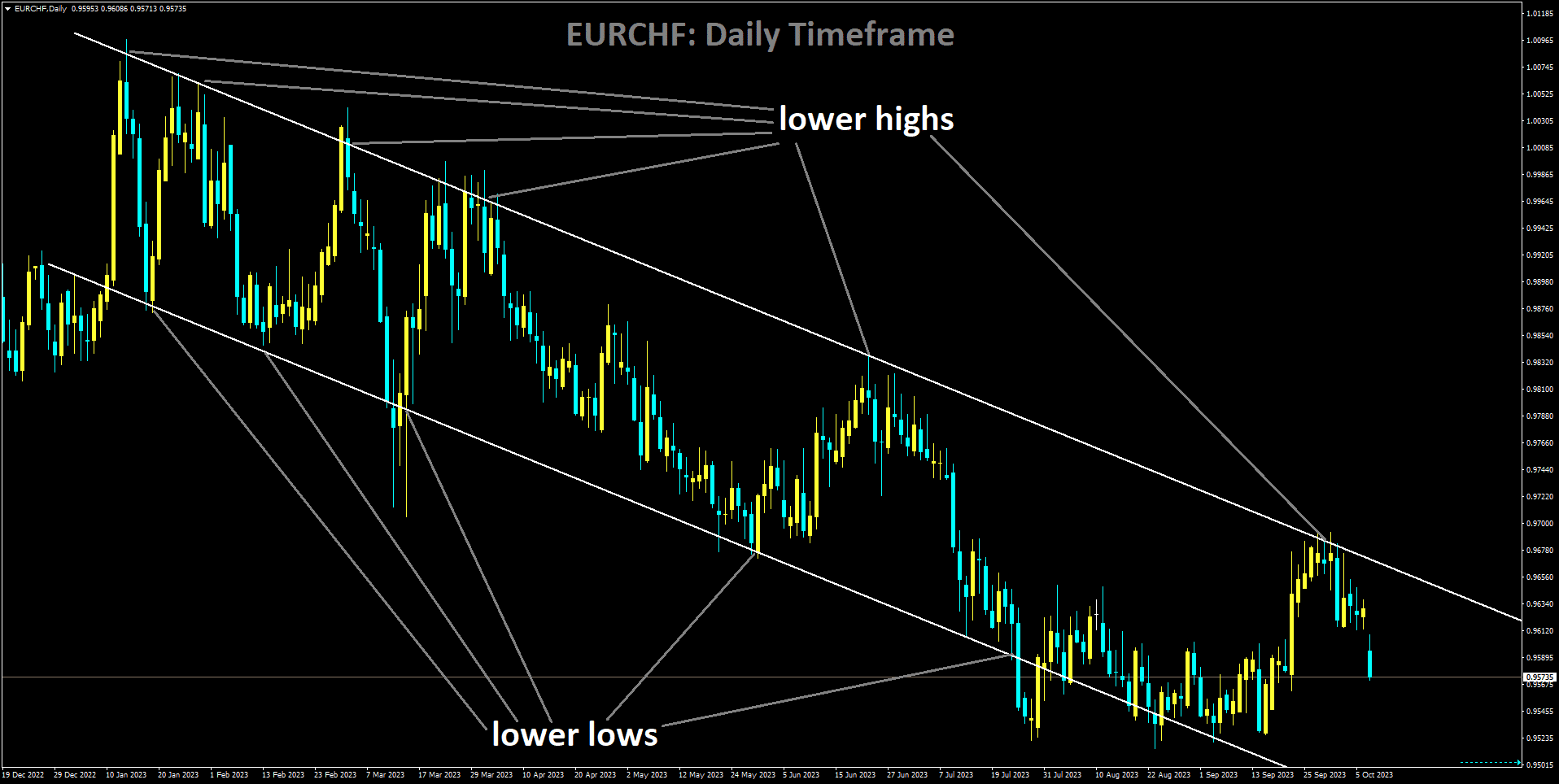

EURCHF Analysis

EURCHF is moving in Descending channel and market has fallen from the lower high area of the channel

Germany’s Industrial Production fell more than expected in August, according to official data released on Monday, indicating sluggish manufacturing sector activity. Industrial output in the Eurozone’s economic powerhouse fell 0.2% month on month, according to the federal statistics authority Destatis, compared to -0.1% expected and -0.6% seen in July. German Industrial Production fell 2.0% year on year in August, following a 1.7% drop in July.

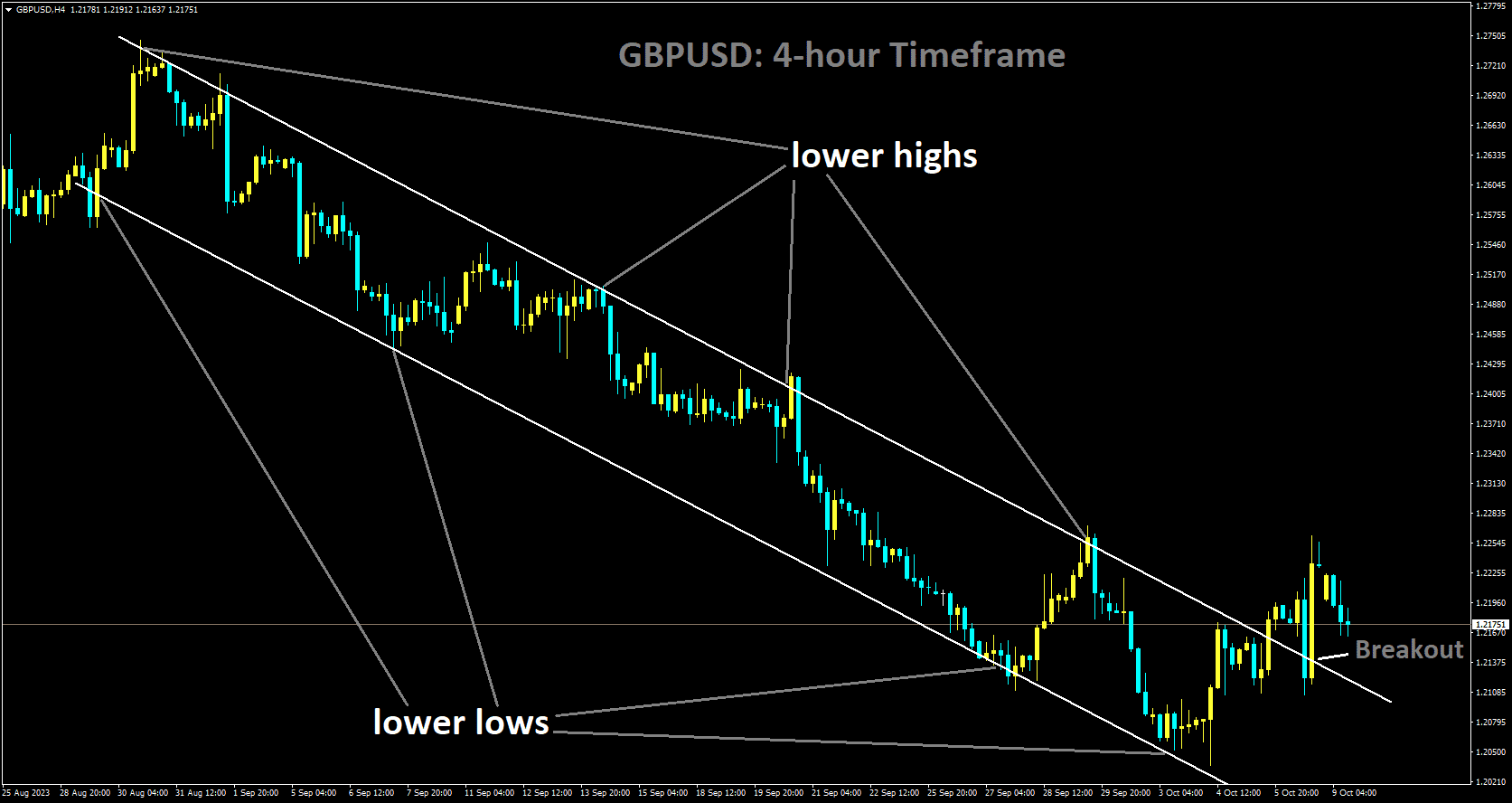

GBPUSD Analysis

GBPUSD has broken Descending channel in upside

The Pound Sterling GBP recovered from a brief pullback on Monday, as the Israel-Hamas conflict that erupted over the weekend bolstered the risk-aversion theme. The GBPUSD pair fell sharply as the Federal Reserve Fed is expected to keep one more interest rate hike on the table, while the Bank of England BoE may keep interest rates unchanged to allay fears of a UK recession. In the face of persistent inflationary pressures, the UK’s economic prospects are deteriorating as the demand outlook worsens. Firms in the United Kingdom are hesitant to raise funds at higher borrowing costs, resulting in lower labour demand and overall output. The situation is expected to worsen for a longer period of time, as the Bank of England has pledged to keep interest rates low until inflation falls below 2%. As a result of the Israel-Hamas conflict, the pound sterling has extended its correction below critical support at 1.2200.

The broader market mood is negative, as the Israel-Hamas conflict may draw in foreign players, potentially leading to a global conflict. The war began on October 7, when the Palestinian military group Hamas launched an unprecedented attack on Israel. Last week, the GBPUSD pair recovered for three trading sessions in a row after finding buying interest near 1.2050, indicating that Bank of England policymakers were optimistic about achieving price stability. Last week, Bank of England Governor Andrew Bailey predicted that inflation would fall to 5% or less by the end of the year. This suggests that UK Prime Minister Rishi Sunak will be able to keep his promise to cut inflation by half to 5.2% by the end of 2023. Ben Broadbent, a policymaker at the Bank of England, believes price stability will be achieved in two years. He went on to say that there are clear signs that higher interest rates are hurting demand and raising the unemployment rate. Higher interest rates significantly dampened the UK Manufacturing and Construction PMI in September. S&P Global reported the UK Construction PMI in September at 45.0, well below expectations of 49.9 and the previous release of 50.8. A figure less than 50.0 is considered a contraction.

Investors will be looking forward to the UK’s Financial Policy Committee FPC meeting minutes, which will be released on Tuesday at 09:30 GMT. The FPC is an official committee of the Bank of England that monitors macroeconomic and financial issues that may have an impact on the UK economy’s long-term growth prospects. The UK factor activity data for August will be closely watched this week. The Industrial and Manufacturing Production figures are expected to continue the contractionary trend, albeit at a slower pace. The US Dollar Index DXY recovered after falling to near 106.00, supported by cautious market sentiment and rising expectations of another Federal Reserve Fed interest rate increase following an upbeat Nonfarm Payrolls NFP report for September. Last Friday, 336K new jobs were added to the US labour force, far exceeding estimates of 170K and the previous release of 227K. The unemployment rate remains stable at 3.8%, slightly higher than the 3.7% expected. The monthly wage rate increased by 0.2%, which was less than the 0.3% expected. The annualised wage rate fell to 4.2%, compared to 4.3% predicted and released previously. Due to tight labour market conditions, robust consumer spending, and a revival in factory activity, the US economy has proven to be resilient. This has the potential to keep the last leg of inflation sticky and raise expectations of further policy tightening. The US Dollar is expected to remain volatile this week as investors await the release of September consumer inflation data on Thursday.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% FLAT OFFER for Signals 😍 GOING TO END – Get now: forexfib.com/discount/