Gold Analysis:

XAUUSD is moving in Ascending channel and market has reached higher low area of the channel.

The recent surge in gold prices can be attributed to two key factors: geopolitical tensions in Israel and the perception of gold as a safe-haven asset. Last Friday, the spot gold price crossed the significant milestone of US$ 2,000 as investors prepared for this week’s Federal Open Market Committee (FOMC) meeting, scheduled to conclude on Wednesday.While Treasury yields have slightly eased from recent highs, particularly the 10-year bond reaching 5.02% last week, they remain elevated. This sudden spike led to volatile price swings in gold. The rise in US Government debt yields has also bolstered the US Dollar and, to some extent, gold, due to concerns about global economic growth and riskier assets stemming from geopolitical instability in the Middle East.

In simpler terms, when both the US Dollar and Treasury yields increase, gold can face selling pressure. Similarly, gold may decline when US real yields rise because it doesn’t provide interest income.Throughout 2023, US real yields have steadily climbed and recently reached a 15-year peak, surpassing 2.60%. Real yield is calculated as the nominal yield minus the market-derived inflation rate from Treasury inflation-protected securities (TIPS) of the same maturity.

This surge in real yields results from higher nominal yields and reduced inflation expectations. Despite these developments, gold prices have yet to be significantly impacted, as shown in the chart below. Nevertheless, it’s essential to monitor these markets for any sudden shifts.The interest rate market currently anticipates no change in the Fed funds target rate at the upcoming FOMC meeting. However, remarks from Fed Chair Jerome Powell after the meeting could potentially influence gold prices.

Silver Analysis:

XAGUSD is moving in Descending channel and market has rebounded from the lower low area of the channel

In the upcoming Federal Reserve (Fed) meeting, it is expected that the Fed will maintain its current stance, primarily due to better-than-expected economic data.

The recent rally of the US dollar has paused ahead of the October 31 to November 1 Federal Open Market Committee (FOMC) meeting. This pause is attributed to dovish statements made by Fed officials earlier in the month. They emphasized that the rise in yields has eased financial conditions, reducing the immediate need for tightening monetary policy. Consequently, it’s widely anticipated that the Fed will keep interest rates unchanged in the upcoming meeting.

While Fed Chair Powell acknowledged the recent tightening of financial conditions, he has not ruled out the possibility of future rate hikes. Additionally, robust US economic data and expectations of higher interest rates for an extended period have shifted sentiment away from rate cuts in 2025.

While Fed Chair Powell acknowledged the recent tightening of financial conditions, he has not ruled out the possibility of future rate hikes. Additionally, robust US economic data and expectations of higher interest rates for an extended period have shifted sentiment away from rate cuts in 2025.

However, for this current consolidation to transform into a reversal, several conditions would need to change. This includes a potential shift in US exceptionalism, which refers to the US economy’s relative outperformance, and a more hawkish stance from the Fed. Until these conditions change, it may be premature to conclude that the US dollar has peaked.

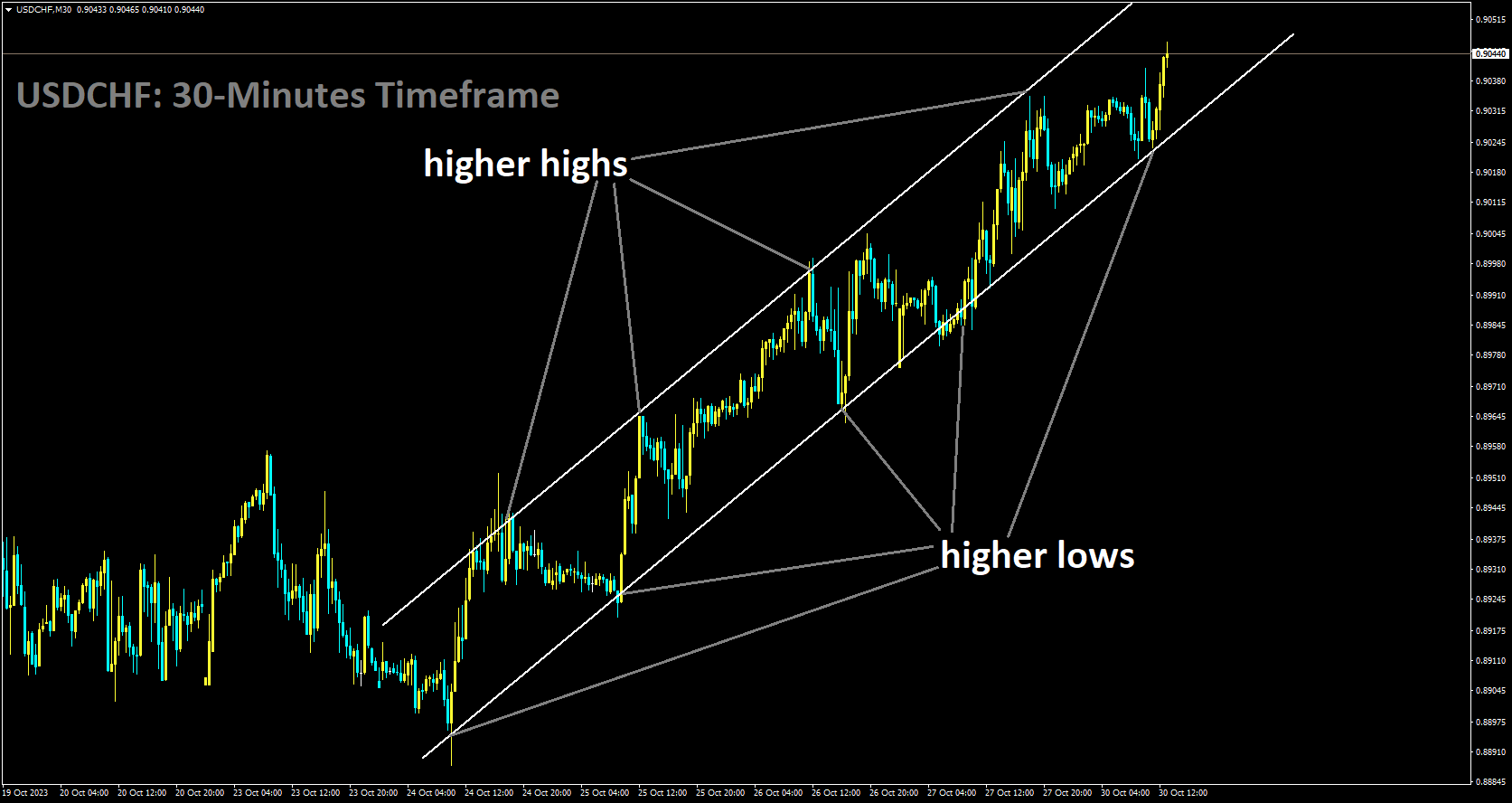

USDCHF Analysis:

USDCHF is moving in Ascending channel and market has rebounded from the higher low area of the channel

The Swiss ZEW Survey for October showed a decline to -37.8, following a drop of 27.6 in September, resulting in the weakening of the Swiss Franc against other currencies.

The US Dollar is currently facing some resistance, with market expectations pointing towards the likelihood of the US Federal Reserve (Fed) keeping interest rates at 5.5% in the upcoming Wednesday meeting. Furthermore, the US Core Personal Consumption Expenditures Price Index (YoY) saw a slight decline to 3.7% in September, down from 3.8% in August. This decline may limit potential gains in the USD/CHF currency pair. However, monthly data indicated an expected increase, with a 0.3% reading compared to the previous 0.1%, although it did not significantly boost the USD.

The ongoing escalation of conflict in the Middle East could support the safe-haven Swiss Franc (CHF) against the US Dollar (USD), as Israel intensifies its operations in Gaza and carries out multiple attacks.

While the US Dollar Index (DXY) has been subdued due to declining US Treasury yields, there are indications of a potential rebound in the 10-year US Bond yield, which currently stands at 4.87% as of the time of this report. Additionally, a recent report showed a decline in Switzerland’s business conditions and labor market, with the ZEW Survey Expectations falling to 37.8 in October, following a previous decline of 27.6.

Looking ahead, investors will closely monitor key economic events, including the US ADP Employment Change and ISM Manufacturing PMI for October during the week. On the Swiss economic calendar, Real Retail Sales (YoY) data will be of interest on Tuesday.

USDCAD Analysis:

USDCAD is moving in box pattern and market has reached resistance area of the pattern

Bank of Canada Governor Tiff Macklem stated that there are no plans for either a decrease or an increase in interest rates. He noted that inflation is currently experiencing a slowdown and projected that by 2025, the inflation rate may align with the 2% target.

The Canadian dollar is currently testing the lower end of its one-year range against the US dollar following remarks by Bank of Canada Governor Tiff Macklem last week. Macklem suggested that interest rates may have reached their peak, citing a potential lack of need for further rate hikes if inflation continues to moderate. However, he emphasized that the central bank would require clear evidence of inflation moving toward the 2% target before considering any interest rate cuts.

In its most recent decision, the Bank of Canada opted to maintain benchmark rates at a 22-year high but left the possibility of additional rate hikes open, citing the potential for inflation to exceed its target for another two years. Meanwhile, financial markets are currently pricing in a very slim probability of another rate increase at the next meeting scheduled for December.

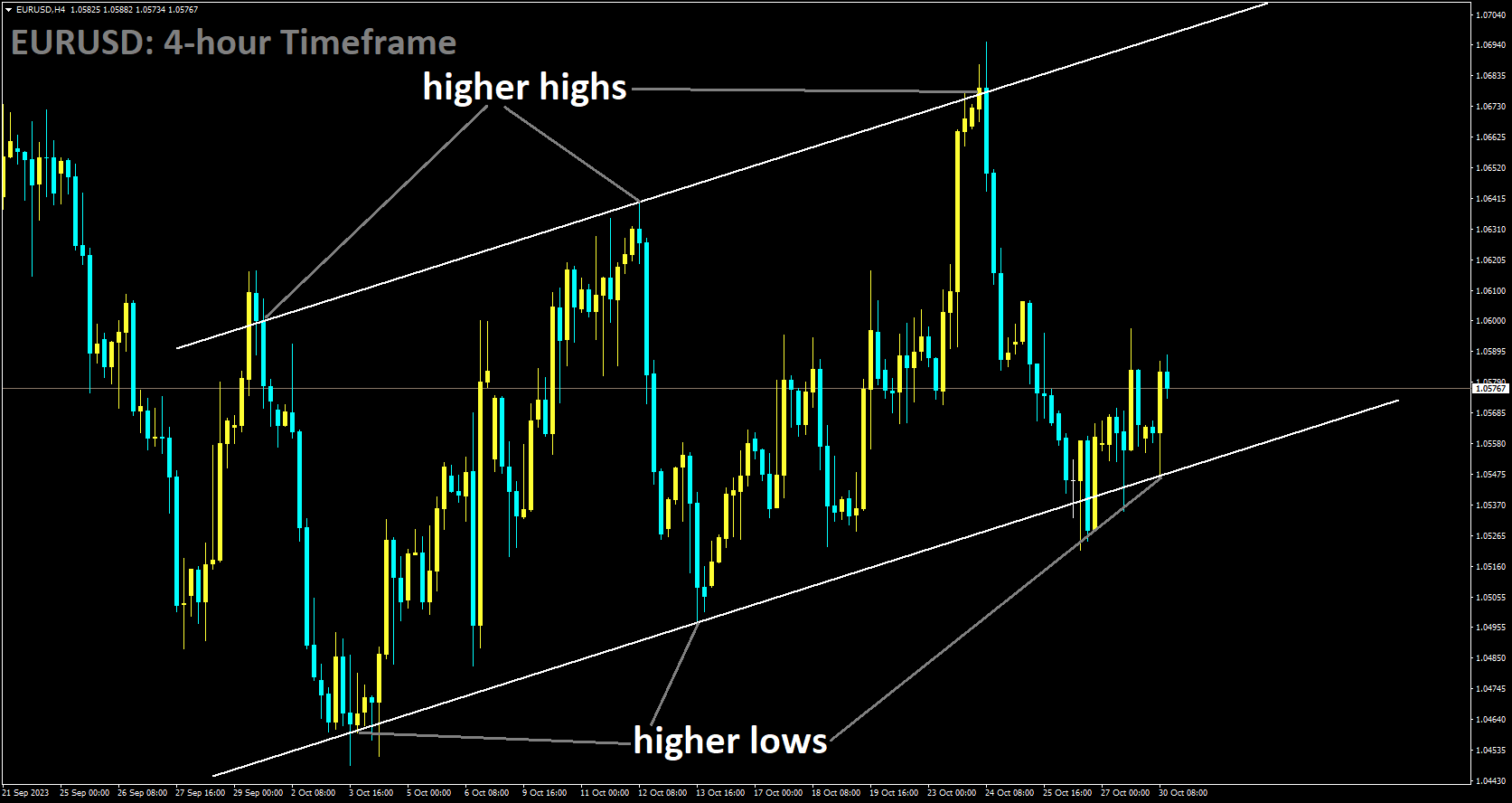

EURUSD Analysis:

EURUSD is moving in Ascending channel and market has reached higher low area of the channel

Boris Vujčić, a member of the ECB Governing Council, has stated that there won’t be any further rate hikes at this point. Instead, the focus will be on bringing inflation in line with the 2% target by 2025.

Boris Vujčić, a member of the ECB Governing Council and the Governor of the Croatian National Bank, shared in a television interview that the recent news regarding the end of rate hikes has been anticipated for several weeks. Vujčić expressed confidence that inflation would align with the ECB’s target by 2025.

He noted that the process of increasing interest rates has concluded for the time being. Currently, there is a trend of falling inflation, characterized by disinflation. Vujčić also highlighted that after implementing measures to curb lending, inflation has decreased.

EURJPY Analysis:

EURJPY has broken the Ascending channel in downside

In tomorrow’s meeting, the Bank of Japan is expected to consider raising the Yield Curve Control (YCC) target from 1% to 1.5%. If this adjustment occurs, it could lead to a strengthening of the Japanese yen against other currencies.

Next week, the Federal Reserve, the Bank of England, and the Bank of Japan will all announce their latest monetary policy decisions. Among these central banks, it is the Bank of Japan that is expected to potentially trigger a fresh wave of market volatility.

While the Fed and the BoE are anticipated to maintain their current policy settings, the BoJ might make adjustments to its yield curve control policy, potentially allowing Japanese Government Bond (JGB) yields to rise. Presently, the Japanese central bank sets a cap on the 10-year bond yield at 1% and intervenes if this level comes under pressure. However, there is speculation in the market that the BoJ may consider allowing market yields to increase to 1.5%, a move with a hawkish undertone that could lead to yen strengthening.

Today, the latest Tokyo Consumer Price Index (CPI) reading exceeded market expectations, indicating rising price pressures. This CPI reading is often viewed as a proxy for nationwide inflation trends and might push the Bank of Japan towards recognizing that inflation in Japan is gradually becoming more entrenched. If the BoJ revises its inflation outlook upward, it could lead to a strengthening of the Japanese yen against other currencies.

GBPUSD Analysis:

GBPUSD is moving in the Descending channel and the market has reached the lower high area of the channel

The GBP is facing weakness against the USD due to escalating tensions in the Middle East. Moreover, domestic data from the UK is showing vulnerability, and the Bank of England is expected to keep interest rates unchanged in the upcoming meeting.

The recent escalation of the conflict in the Middle East has had a significant impact on the financial markets, with increased volatility being the prevailing theme. Notably, gold prices have surged past the $2,000 mark for the first time since May 16, 2023, in response to news of Israel’s intensified ground offensive in Gaza. This development has prompted reactions from around the world, with the United States urging Israel to refrain from a “full-scale” invasion.

Furthermore, recent economic data from the United States indicates that inflation continues to moderate but is struggling to drop below the 3% threshold. The Federal Reserve’s preferred inflation gauge, the Core Personal Consumption Expenditures (PCE) Index, declined slightly from 3.8% to 3.7% year-on-year in September, while the overall PCE remained unchanged compared to August at 3.4%.

In addition, the University of Michigan’s Consumer Sentiment Index showed a slight improvement in overall consumer sentiment but revealed deteriorating expectations regarding inflation. Americans now anticipate a 4.2% increase in prices over a one-year period and expect prices to remain at a 3% level over a five-year period.

Looking ahead to next week, the economic calendar in the UK will feature the FS&P Global/CIPS PMIs along with the Bank of England’s monetary policy decision. On the US front, upcoming data releases include the Conference Board Consumer Confidence Index, S&P Global and ISM Manufacturing PMIs, US Nonfarm Payrolls report, and the monetary policy decision from the US Federal Reserve.

AUDUSD Analysis:

AUDUSD is moving in the Box pattern and the market has reached the resistance area of the pattern

Stronger-than-anticipated retail sales data for September has boosted the Australian Dollar, and economists anticipate a 25 basis points (bps) interest rate hike by the Reserve Bank of Australia (RBA) in the upcoming meeting next week.

The AUDUSD pair continues to strengthen, primarily due to a weakening US Dollar (USD) influenced by recent economic data releases from the United States (US). Moreover, there is growing anticipation that the Reserve Bank of Australia (RBA) will implement a policy rate increase in the upcoming meeting scheduled for November 7.

Australia’s Retail Sales s.a. (MoM) for September pleasantly surprised the market with a substantial increase, surpassing both market consensus and the previous figure. Additionally, during the previous week, Australia’s Consumer Price Index (CPI) exhibited growth in the third quarter of 2023, surpassing the uptick observed in the second quarter. This heightened inflation scenario increases the likelihood of a 25 basis points rate hike by the RBA during its upcoming policy meeting on November 7.

Reports suggest that the US and China have tentatively agreed to hold a meeting between Presidents Joe Biden and Xi Jinping in November, potentially opening the door for constructive dialogue between the two nations. The positive market sentiment stemming from this development could potentially boost the commodity-linked Australian Dollar. Furthermore, investors will closely monitor Chinese PMI data set to be released during the week.

In contrast, the US Dollar Index (DXY) is striving to regain lost ground following recent setbacks. The Greenback encountered resistance as the Core Personal Consumption Expenditures Price Index (YoY) showed a decline in September. However, the monthly data revealed an expected increase. The University of Michigan Consumer Index exceeded expectations in October but failed to give a favorable boost to the US Dollar. This suggests that the market is anticipating no changes to interest rates in the upcoming Federal Open Market Committee (FOMC) meeting.

Australia’s Retail Sales s.a. (MoM) for September posted a substantial increase of 0.9%, exceeding the market consensus of 0.3% and the previous figure of 0.2%. Australia’s Producer Price Index (PPI) exhibited a slight decline, with a yearly rate of 3.8% in the third quarter (Q3), down from the 3.9% recorded in the previous quarter. On a quarterly basis, the nation’s PPI surged to 1.8%, a notable rise from the previous reading of 0.5%. Australia’s Consumer Price Index (CPI) for the third quarter of 2023 reached 1.2%, surpassing the 0.8% uptick in the previous quarter and the market consensus of 1.1% for the same period.

Australia’s S&P Global Composite PMI for October declined to 47.3 from the prior reading of 51.5. The Manufacturing PMI experienced a slight dip to 48.0 compared to the previous figure of 48.7, and the Services PMI fell into contraction territory, dropping to 47.6 from the previous month’s reading of 51.8. The RBA expressed heightened concerns regarding the inflationary impact resulting from supply shocks. RBA Governor Michele Bullock stated that if inflation persists above projections, the RBA will take appropriate policy measures. There is also an observable deceleration in demand, with per capita consumption on the decline.

The US Core Personal Consumption Expenditures Price Index (YoY) decreased to 3.7% in September from the previous reading of 3.8%. However, the monthly index increased to 0.3%, as anticipated, up from 0.1% previously.

The University of Michigan Consumer Index exceeded expectations in October, reporting a figure of 63.8, higher than the anticipated 63.0. Market sentiment currently leans towards the expectation of no changes to interest rates by the US Federal Reserve (Fed) in the upcoming meeting scheduled for Wednesday. The preliminary US Gross Domestic Product (GDP) Annualized data showed growth in the third quarter, expanding by 4.9%, a significant improvement from the previous reading of a 2.1% expansion and surpassing the market expectation of 4.2%. However, there was a decrease in US Core Personal Consumption Expenditures, declining to 2.4% in the third quarter from the 3.7% recorded previously. Investors will be closely monitoring the US ADP Employment Change, ISM Manufacturing PMI for October, along with the Fed Interest Rate Decision on Wednesday.

AUDCHF Analysis:

AUDCHF has broken the Descending channel in upside

Negotiations for a Free Trade Agreement between Australia and the European Union are currently on hold, according to Australian Trade Minister Don Farell. While differences on key issues have led to challenges, there remains optimism for a future agreement.

Australian Trade Minister Don Farrell has indicated that discussions regarding a Free Trade Agreement with the European Union have come to a standstill due to differences on several key issues. Despite these challenges, negotiations will continue, and there remains optimism that an agreement mutually beneficial to both Australia and the European Union can be reached in due course.

NZDUSD Analysis:

NZDUSD is moving in the Descending channel and the market has reached the lower high area of the channel

In the upcoming week, there is an expectation that the Q3 Employment Change data for the New Zealand Dollar will show a slowdown, decreasing to 0.40% from the 1.0% reported in the previous quarter. Additionally, there is an anticipation that the unemployment rate will edge up slightly to 3.9%, up from the expected 3.6%.

This week, the New Zealand Dollar (Kiwi) touched a new low for the past eleven months, hitting 0.5772 on Thursday. Currently, the NZDUSD pair is encountering resistance that is hindering a successful rebound. The US Personal Consumption Expenditure (PCE) Index figures met expectations, and now the focus is shifting to the Federal Reserve (Fed) meeting scheduled for next week.

It is widely anticipated that the US central bank will refrain from raising interest rates. Investors will closely monitor Fed Chairman Jerome Powell’s speech, scheduled half an hour after the Fed’s rate announcement, and will be attentive to any changes in the Fed’s communication. Despite the expected rate hold, markets are increasingly factoring in the possibility of one final rate hike from the Fed in December, as inflationary pressures persistently remain higher than initially anticipated by the markets.

Furthermore, the upcoming week includes the release of New Zealand labor market data on late Tuesday. The expected scenario is that the NZ Unemployment Rate will edge up from 3.6% to 3.9% for the third quarter, and there is an anticipation of a hiring slowdown, as reflected in the NZ Employment Change, with Q3 new job additions expected to increase by only 0.4%, a decline from the 1.0% growth seen in the previous quarter.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% FLAT OFFER for Signals 😍 GOING TO END – Get now: forexfib.com/discount/