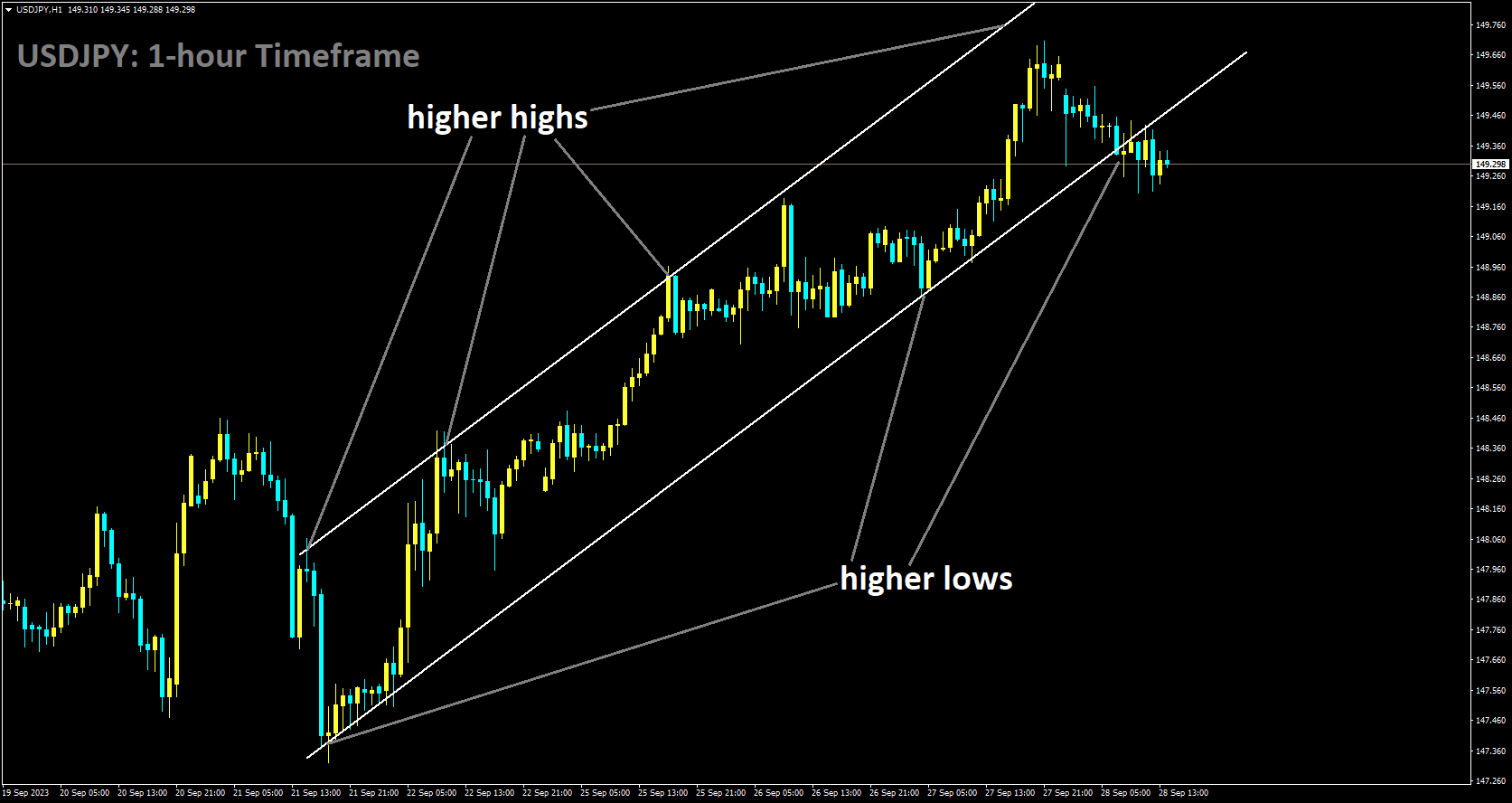

USDJPY Analysis

USDJPY is moving in Ascending channel and market has reached higher low area of the channel

Is USDJPY going to cross 150. is the question that has FX analysts enthralled right now. Commerzbank analysts examine the prospects for the pair. Although it is simple for me to say, I have sympathy for market participants who are not experiencing excruciating pain over interventions.

In the 1990s and early 2000s, many people considered betting against the MOF, and many of them lost money. Betting on the MOF’s patience is still risky. especially now that Shunichi Suzuki, the minister of finance, is tightening the screws on verbal interventions. He noted that the MOF was watching FX carefully with a sense of urgency.

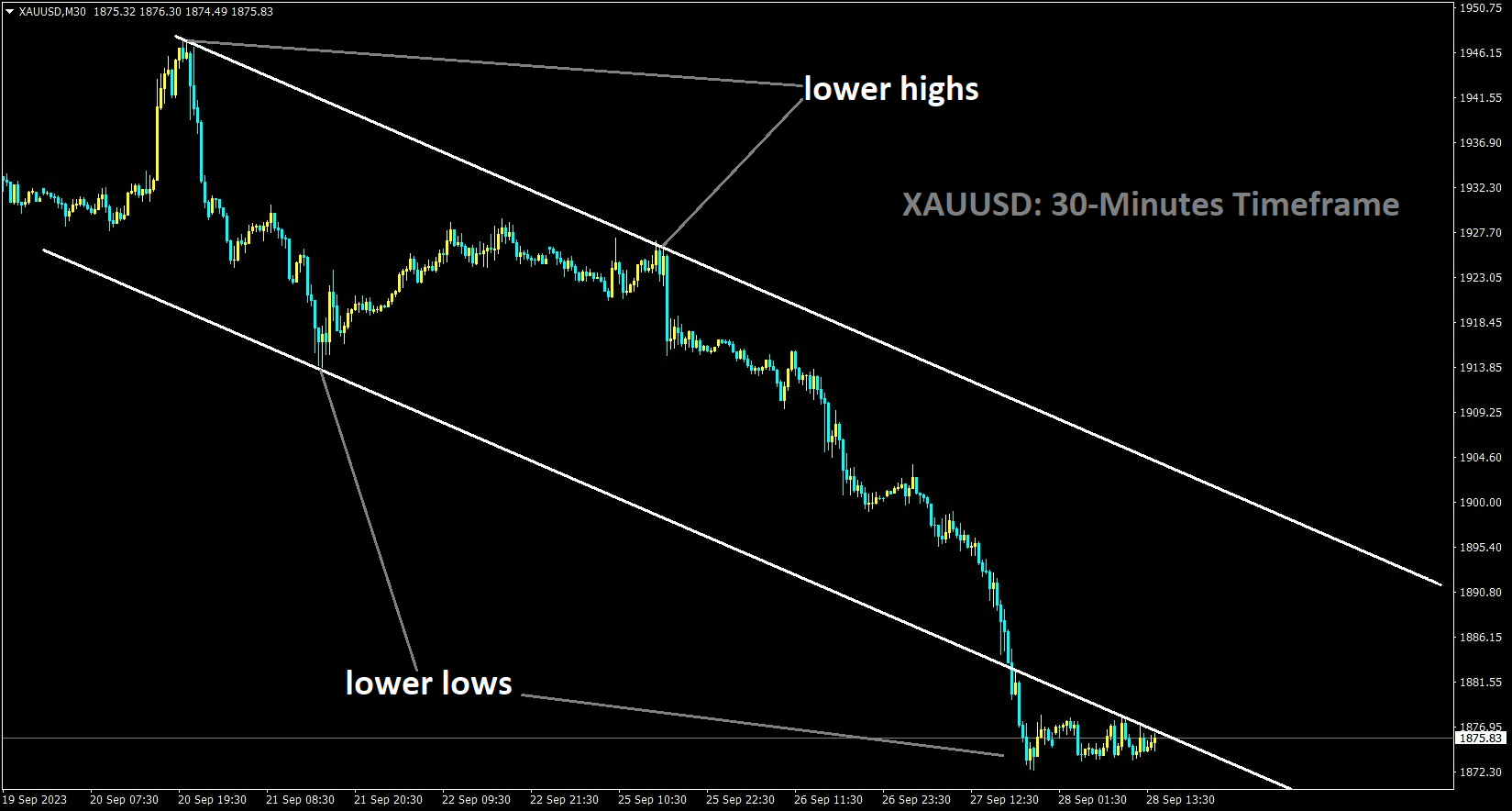

GOLD Analysis

XAUUSD is moving in the Descending channel and the market has reached the lower low area of the channel.

The price of gold moves into a bearish consolidation phase on Thursday and fluctuates within a small trading range close to the lowest point it has touched in over six months the day before. In light of concerns over China’s failing real estate market and the impending US government shutdown, the general risk-off atmosphere ends up playing a significant role in supporting the safe-haven precious metal. Additionally, declining US Treasury bond yields support the commodity and prevent aggressive bets from being made by US Dollar (USD) bulls, particularly in light of the recent surge to the highest level since November 2022. Despite growing expectations for additional policy tightening by the Federal Reserve (Fed), which should support the US dollar and bond yields, any significant rebound in the price of gold is still elusive. Ahead of Friday’s US Core PCE Price Index, which will offer new clues regarding the Fed’s future path of rate hikes and give the non-yielding yellow metal a new direction, traders may also choose to stay out of the market. The Weekly Initial Jobless Claims and the final US Q2 GDP print, which are released on Thursday, could have an impact on the USD later in the early North American session. In addition, the general risk sentiment may be a factor in generating opportunities for short-term trading.

The US dollar’s strengthening and rising US bond yields caused the price of gold to see its largest one-day decline in the past two months. Investors are still concerned about the real estate market in China and the challenges brought on by the sharply rising cost of borrowing. On Wednesday, US House Speaker Kevin McCarthy, a Republican, rejected a temporary funding bill that was making progress in the Senate. This lowers risk sentiment and moves the US government closer to its fourth partial shutdown in ten years. Neel Kashkari, the president of the Minneapolis Fed, raised expectations for at least one more rate hike by year’s end with his hawkish remarks. The Fed will maintain higher interest rates for a longer period of time due to the better-than-expected US Durable Goods Orders data. The US economic docket for Thursday includes the regular Weekly Initial Jobless Claims report and the final US Q2 GDP release. To get clues about the Fed’s potential future path of interest rate hikes, watch the US Core PCE Price Index, which is expected on Friday.

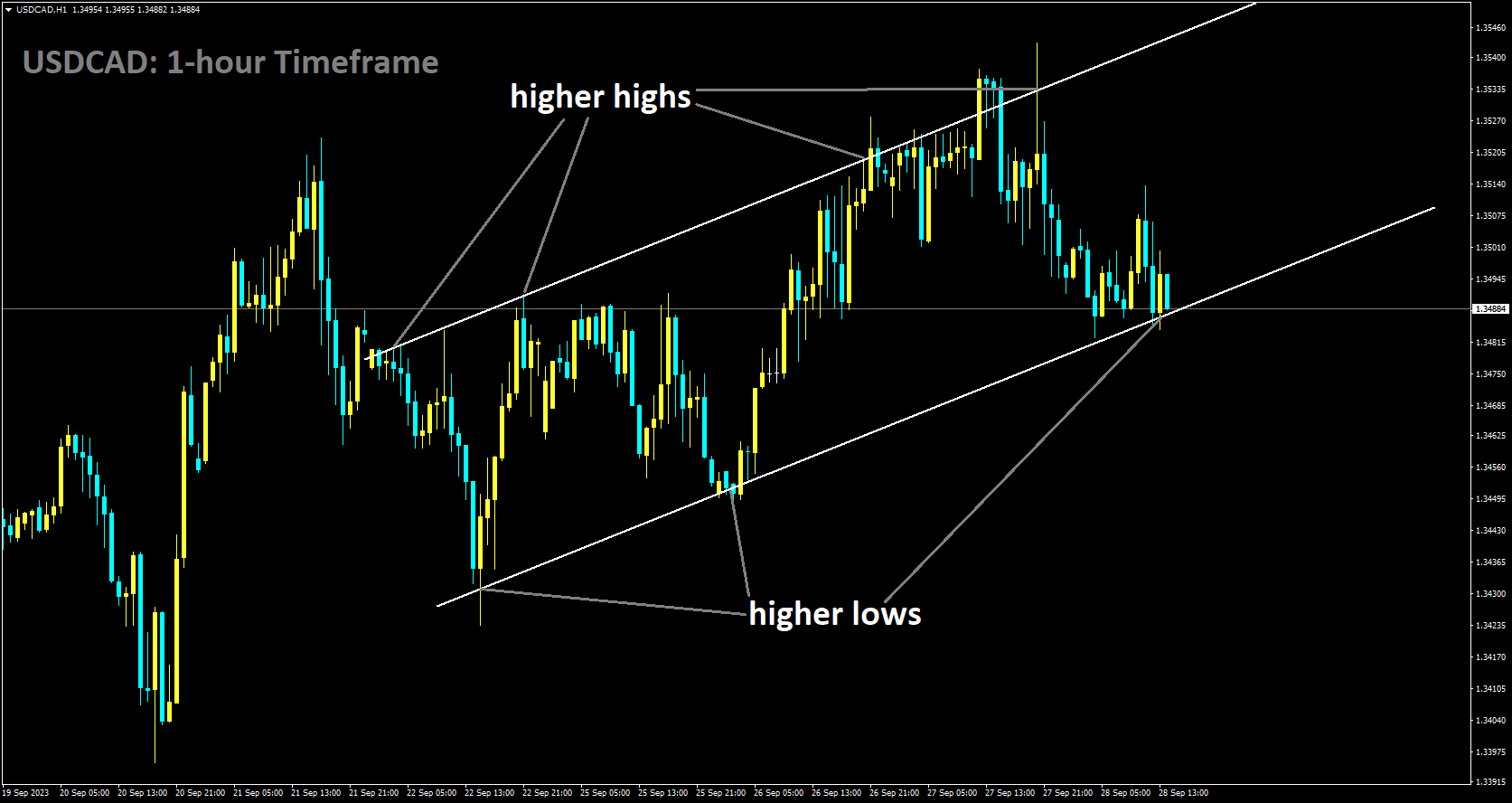

USDCAD Analysis

USDCAD is moving in Ascending channel and market has reached higher low area of the channel

With ongoing indications of a tighter global supply and some hope for an economic rebound in China, the world’s largest oil importer, oil prices have surged to levels above those of the previous year. In the week ending September 22, US crude inventories dropped by a greater amount than anticipated—2.2 million barrels (mb). This is the fifth week of draws out of the previous seven. As a result, concerns about economic headwinds brought on by sharply rising borrowing costs are outweighed by this, and the black liquid continues to benefit the economy and support the commodity-linked Loonie, which in turn weighs on the USD/CAD pair. Conversely, the US Dollar maintains its recent strong gains, reaching its highest level since November 2022, and has minimal impact on the USD/CAD pair. Notwithstanding, given growing expectations for additional policy tightening by the Federal Reserve , any significant corrective decline in the USD still appears elusive.

Investors have been pricing in the prospect of at least one more lift-off by the end of this year, as they now appear to be convinced that the Fed will maintain higher rates for longer. The hawkish remarks made by Minneapolis Fed President Neel Kashkari overnight confirmed the bets. Despite plenty of evidence of the economy’s continued strength, it is unclear at this point whether the central bank has finished raising rates, according to Kashkari. Furthermore, expectations for a stronger third-quarter GDP growth were heightened by the better-than-expected release of the US Durable Goods Orders, which should permit the Fed to maintain its hawkish stance. This sparked a protracted selloff in the US fixed-income market, which helped the benchmark 10-year US government bond’s yield reach a new 16-year high and surpass the 4.50% barrier. The yield should continue to support the US dollar.

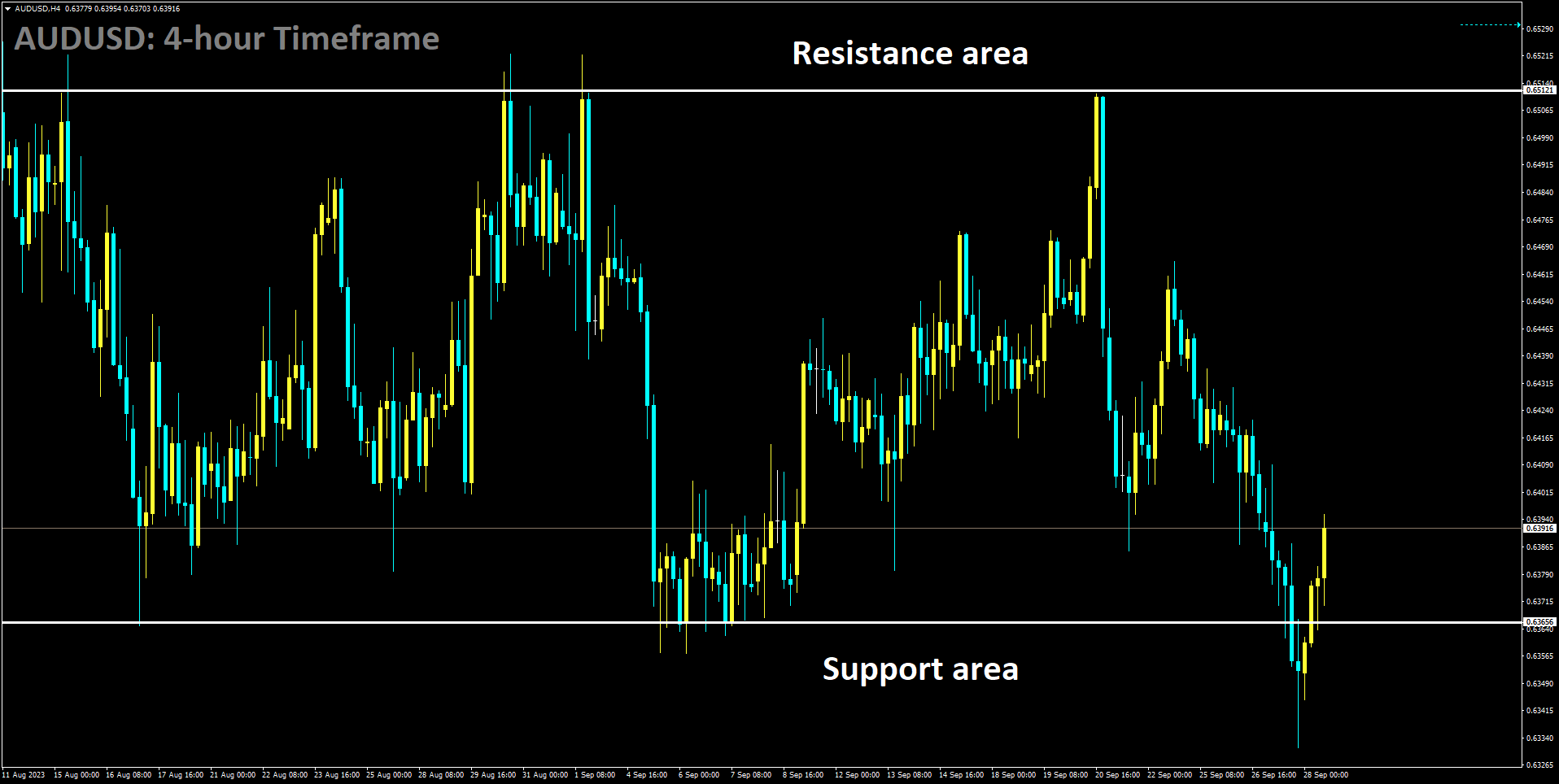

AUDUSD Analysis

AUDUSD is moving in Box pattern and market has rebounded from the support area of the pattern

Australia’s Retail Sales, a gauge of the nation’s consumer spending, increased 0.2% monthly in August compared to a 0.5% increase in July, according to official data released on Thursday by the Australian Bureau of Statistics. The market was expecting a 0.3% increase.

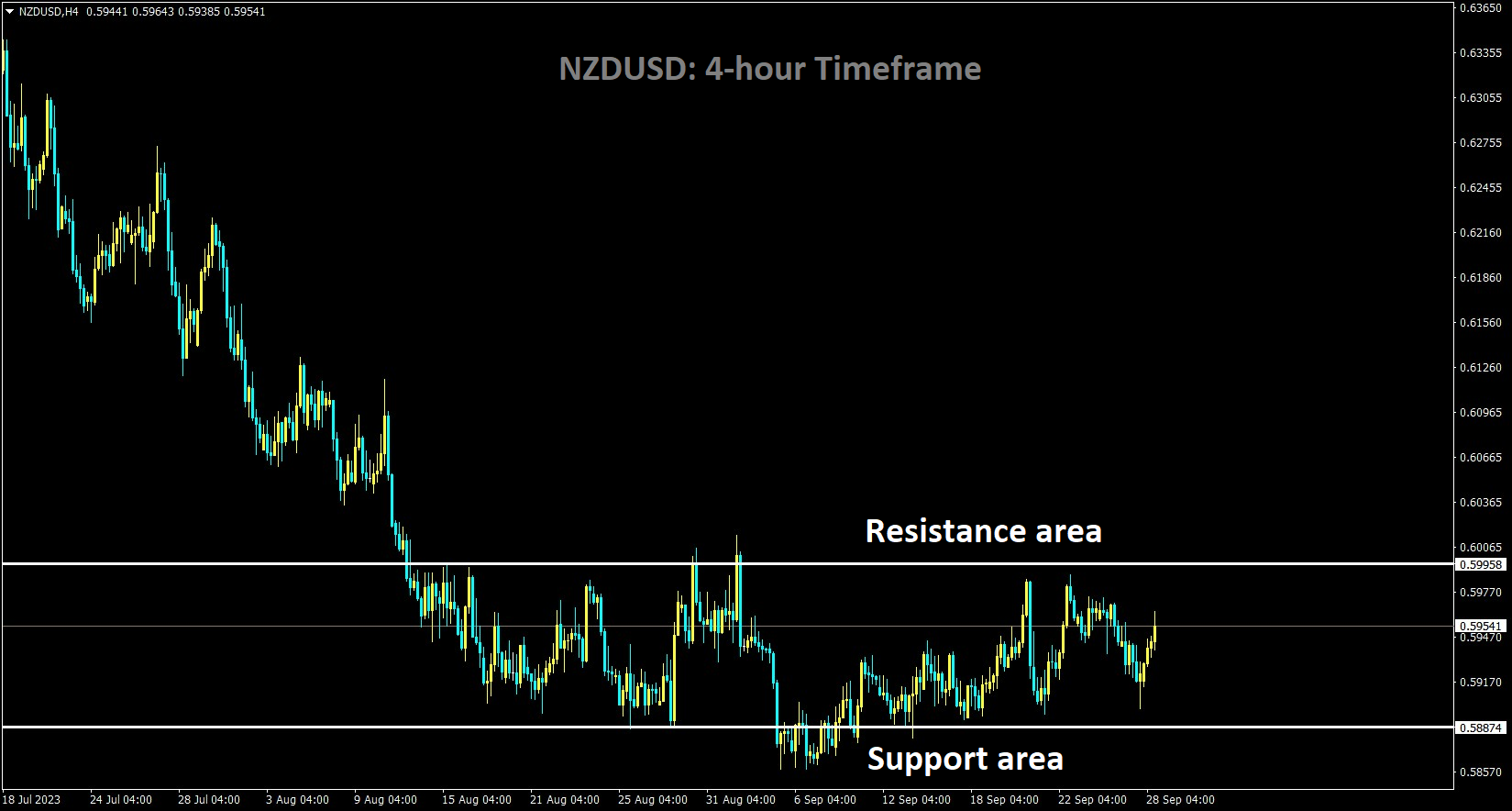

NZDUSD Analysis

NZDUSD is moving in the Box pattern and the market has rebounded from the support area of the pattern

The NZDUSD pair is limited during Thursday’s early European session above the psychological support level of 0.5900. The pair is up 0.25% on the day as of this writing, trading at 0.5937. Markets were dominated by risk aversion as investors weighed the story of a higher US interest rate against the growth risks associated with the potential for an impending government shutdown in the US. Nonetheless, market players will be attentive to Federal Reserve Fed Chair Jerome Powell’s speech this week. The officials’ less aggressive stance might restrict the USD’s potential gains over its competitors. Regarding the data, the US Census Bureau revealed on Wednesday that, contrary to projections of a 0.5% mm decline, US durable goods orders increased in August, rising 0.2% MoM from the previous reading’s 5.6% decline. In addition, Durable Goods Orders Excluding Transportation increased by 0.4% mm, surpassing the anticipated 0.1% increase. Orders for core capital goods increased by 0.9% from the 0.4% growth in the previous month, exceeding the 0% market estimate.

According to data released earlier on Thursday by the National Bank of New Zealand, the country’s ANZ Business Confidence increased to 1.5 in September after declining to 3.7 in August. Furthermore, the ANZ Activity Outlook increased from 11.2% in the previous reading to 10.9 in September. The market believes that the Reserve Bank of New Zealand RBNZ will keep the current monetary policy unchanged at its policy meeting next week, but it also believes that it will hike again in November.

Aside from this, the New Zealand Dollar NZD, a stand-in for China, is under some pressure due to worries about China’s real estate market. China’s Evergrande Group Chairman Hui Ka Yan was under police observation, according to Reuters on Thursday. This development raised concerns about the future of the cash-strapped developer given the growing risk of liquidation. It is important to remember that Evergrande is the most indebted real estate developer in the world and that the property market crisis it is at the centre of is impeding China’s economic growth. Next up for traders to watch is the US weekly Jobless Claims data, the third revision to the second quarter growth number, and the Pending Home Sales data, which is expected later on Thursday during the American session. On Friday, the focus will be on the Core Personal Consumption Expenditure PCE Price Index report. The yearly percentage is anticipated to decrease from 4.2% to 3.9%. These numbers may provide a clear path for the NZDUSD exchange rate.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% FLAT OFFER for Signals 😍 GOING TO END – Get now: forexfib.com/discount/