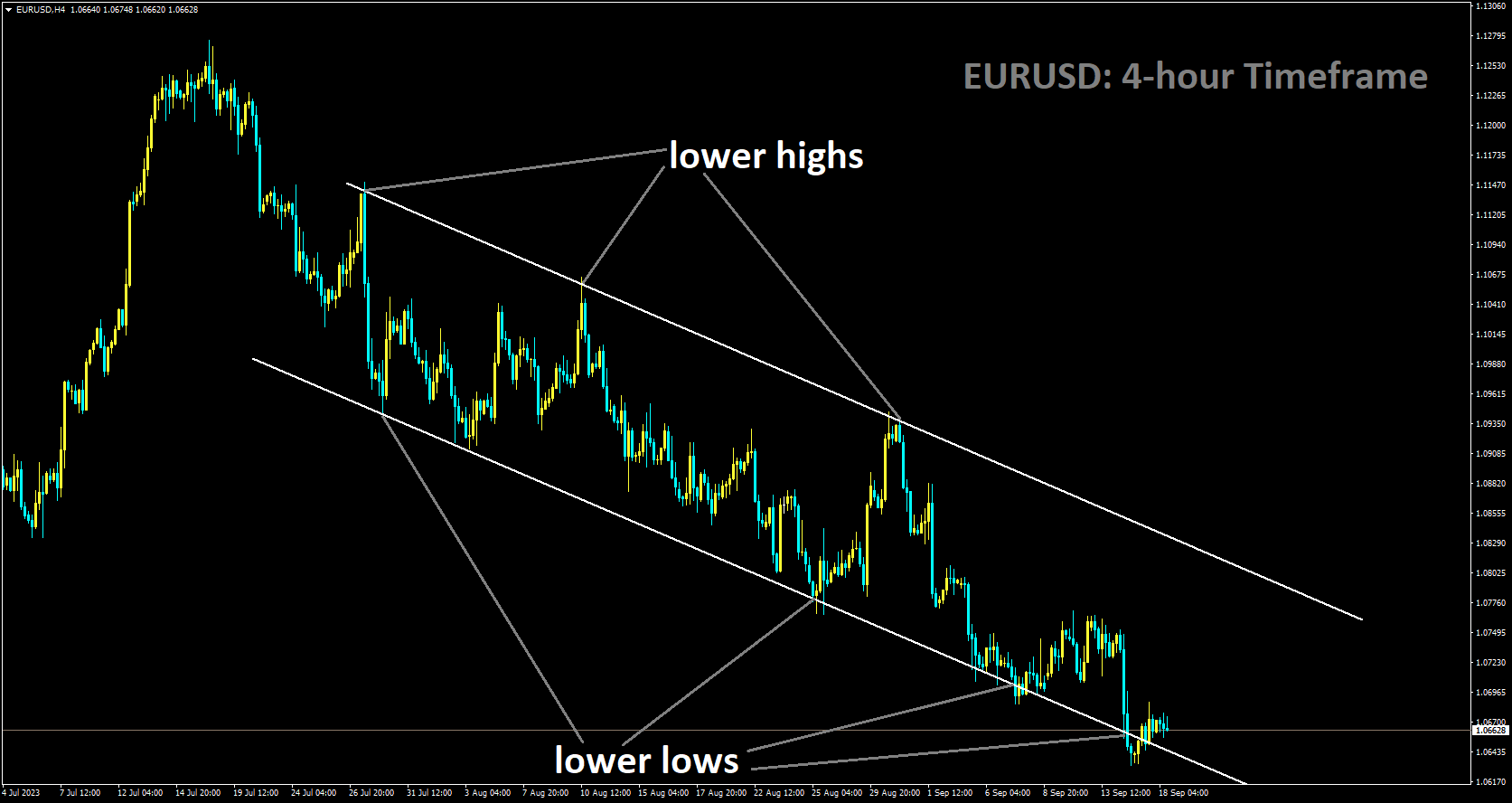

EURUSD Analysis

EURUSD is moving in Descending channel and market has reached lower low area of the channel.

Markets began to anticipate an ECB rate hike ahead of this week’s rate meeting after a Reuters source article revealed that the ECB’s inflation forecasts were rising. The ECB hiked by 25 basis points to 4%, meeting these expectations. However, because of the ECB’s communications, this hike was perceived as a “dovish hike.” Following the announcement, Christine Lagarde stated in the press conference that the eurozone’s economy is likely to have a weaker third quarter. Now, considering the recent weak run of Eurozone economic data, this is not all that surprising. On September 7, the Eurozone’s GDP growth fell short of expectations; in July, industrial production came in significantly below expectations, at -2.2%; and starting in late August, there have been a number of weak PMI prints.

Key ECB interest rates have reached levels that maintain for a sufficiently long duration will make a substantial contribution to the timely return of inflation to target, was the line in the ECB statement that caught investors’ attention. This suggests that the ECB has most likely reached terminal rates for the time being. The euro sold off sharply in response to Christine Lagarde’s statement during the press conference that “we are not saying we are currently at peak rates,” but you sense that was just so she was not being pinned down on specific timescales. To truly support the ECB’s peak rate stance, we now need to look for a Eurozone growth outlook that continues to slow down and declining inflation. Looking ahead to next week, we have the next set of PMI Prince on Friday and the final inflation reading, which is not expected to reveal any surprises. That prediction will be strengthened if the PMI prints continue to decline the following week. For the time being, this has created a sell bias in the EUR, with the expectation that it will decline against stronger currencies like the AUD.

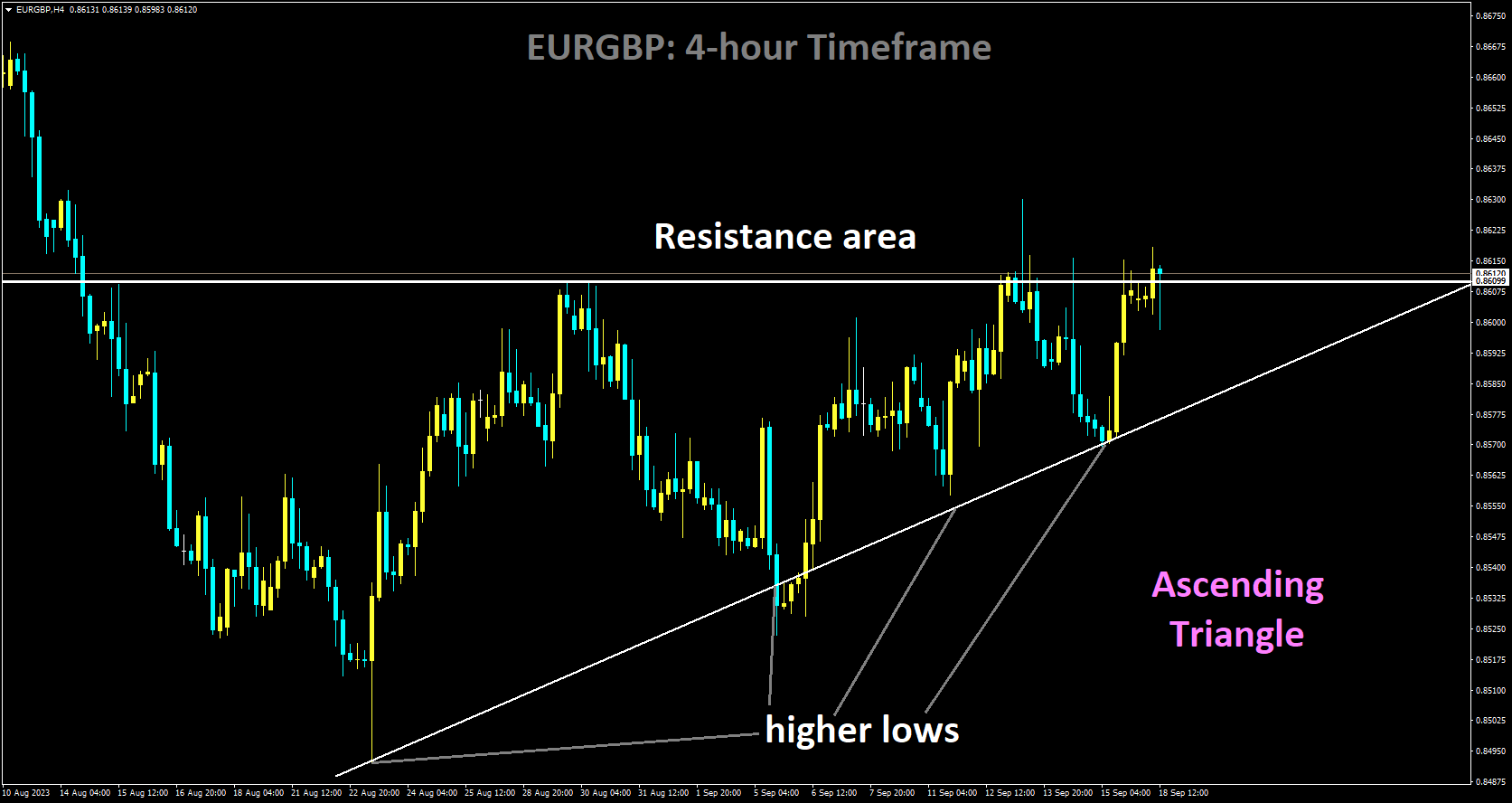

EURGBP Analysis

EURGBP is moving Ascending Triangle and market has reached Resistance area of the pattern.

During the European session on Monday, the EUR/GBP pair traded higher, attempting to build on its gains from the previous day. Following the remarks made on Friday by Christine Lagarde, the president of the European Central Bank (ECB), the pair may strengthen. Lagarde said that the possibility of further rate cuts had not occurred to ECB policymakers. The president of the European Central Bank also hinted that the bank was prepared to raise interest rates if it was thought necessary and that its goal was to keep them high for a considerable amount of time. Commerzbank economists have examined the Euro’s (EUR) future after the ECB raised interest rates last week. Their analysis indicates that the central bank’s move to indicate that rate hikes will be temporarily suspended was mostly expected by the market. There is some risk associated with this ECB action, though, as it suggests that the bank may be less aggressive with its monetary policy.

Conversely, cross-pair traders believe that the Bank of England (BoE) will increase interest rates by 25 basis points at its upcoming meeting on Thursday. The BoE’s possible rate increase is a reflection of its attempts to manage inflationary pressures and stabilise the British economy. Nonetheless, BoE Governor Andrew Bailey has hinted that the end of the central bank’s rate-hike cycle is drawing near. This claim could put more pressure on the BoE to halt its rate-hiking cycle, along with worries about a possible recession and indications that the labour market in the UK is cooling. There are important events planned for the Eurozone in the coming week. Tuesday will see the release of the August Eurozone Harmonised Index of Consumer Prices (HICP), and Friday will see the preliminary release of the HCOB Composite PMI for September. The EUR/GBP traders may find support for their wagers from these datasets, which may offer insights into inflation trends within the Eurozone bloc.

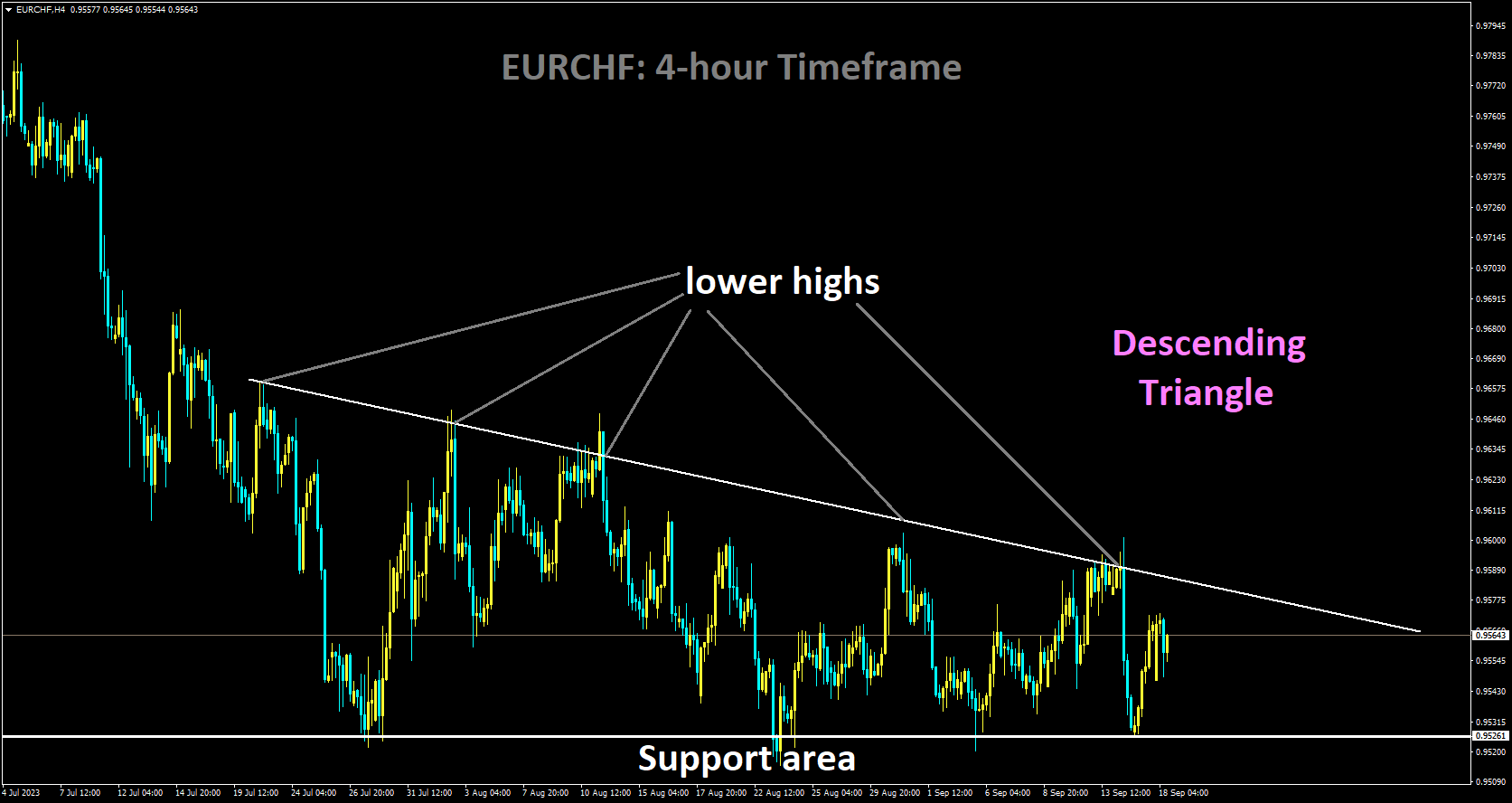

EURCHF Analysis

EURCHF is moving in Descending Triangle and market has rebounded from the support area of the pattern.

The Swiss National Bank (SNB) is one central bank that appears to have already nearly prevailed in the war against inflation. Commerzbank economists examine the EUR/CHF outlook. The fact that Switzerland has already made progress towards deflation should work to the Swiss Franc’s advantage. Still, we anticipate a weaker CHF. This is due to the fact that there is more information regarding the Franc. It is likely that the current CHF exchange rate will be distorted in favour of a stronger Franc as a result of the SNB’s interventions.

Higher levels of EUR/CHF should be accepted by SNB members once more, and speculative distortions should decrease, if inflation in Switzerland continues to decline as we anticipate and as the SNB is likely to expect as of Thursday. We predict that for the foreseeable future, this effect will probably predominate.

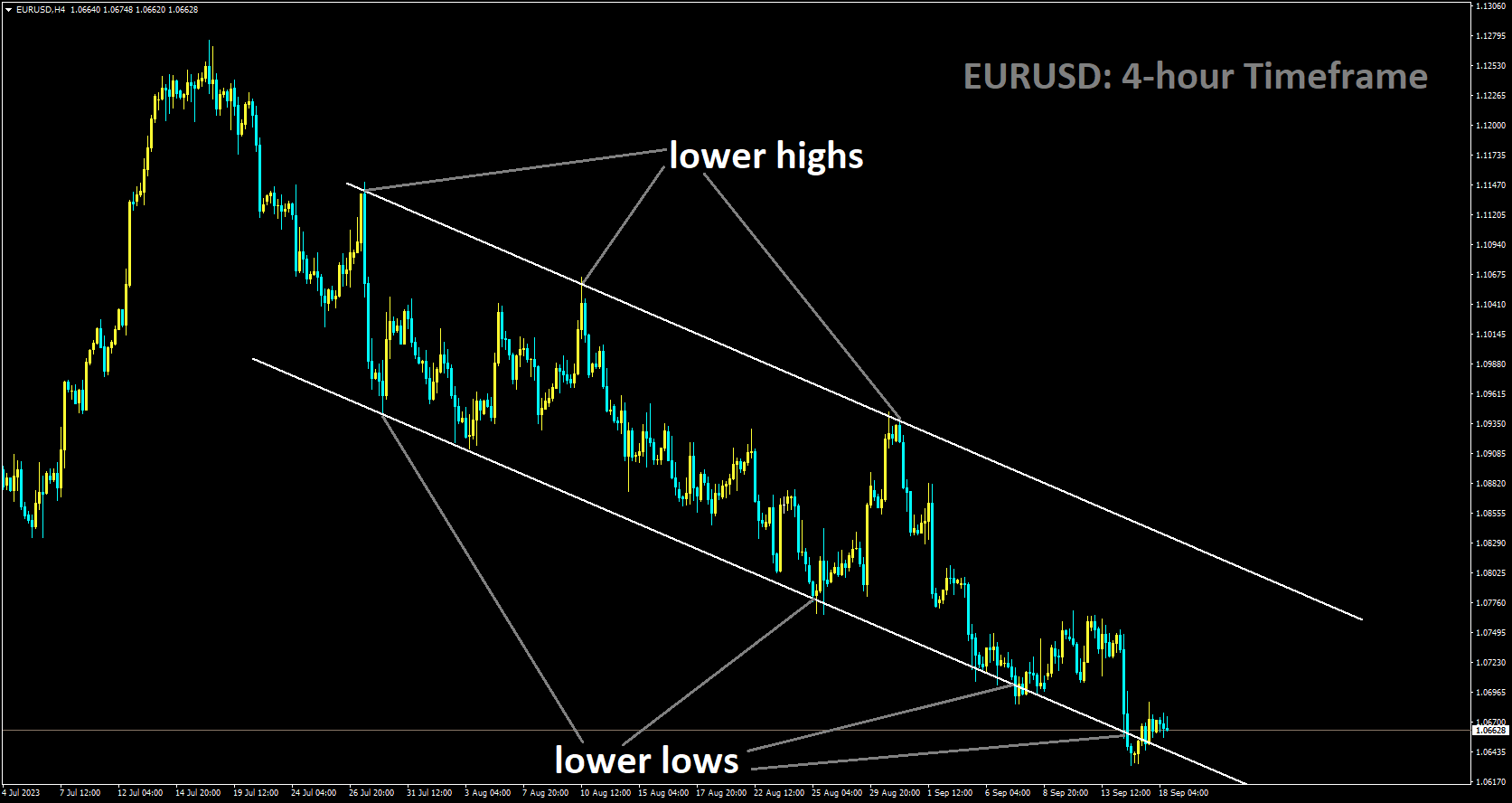

GBPUSD Analysis

GBPUSD is moving in Descending channel and market has reached lower high area of the channel.

The Bank of England (BoE) will raise the Bank Rate and the main policy rate by 25 basis points, to 5.50%. We anticipate an 8-1 vote in favour of raising the bank rate by 25 basis points as opposed to holding it steady. As of right now, markets are pricing this week’s meeting at about 18bp. Notably, neither the press conference that follows the announcement nor the updated projections during this meeting will be provided. We anticipate the MPC to adopt a dovish stance by Thursday, suggesting that a peak in the Bank Rate is imminent, if not already achieved, despite the likelihood of limited forward guidance. In a similar vein, we anticipate the MPC restating that they will ensure that Bank Rate is sufficiently restrictive for sufficiently long and that their current monetary policy stance is restrictive. A number of MPC members have recently reaffirmed the last point, most notably Pill, the chief economist at the Bank of England, who recently declared that he favours a table mountain strategy in which interest rates are maintained for an extended period of time.

The data releases since the last monetary policy decision in August have been inconsistent. The unemployment rate rose to 4.3% in July, and the number of open positions kept going down, suggesting that there was growing slack in the labour market. Similarly, the steepest drop in permanent placements in over three years was observed in the RECKPMG report. August PMIs were unexpectedly low and indicated that growth would continue to deteriorate in the coming months, with the composite and service indices both falling below 50, at 48.6 and 49.5, respectively. Nevertheless, wage growth is still high, growing at a rate of 7.8% 3MYoY (excluding bonuses). The private sector’s pay growth slowed slightly, indicating that a peak may be approaching. Since wages make up the majority of input costs in the service sector and are thus a major factor in determining service inflation, further increases in the bank rate are encouraged by the persistence of high wage growth. Although August inflation data will not be released until the day before the rate announcement, headline and core inflation numbers from July exceeded forecasts, with service inflation, in particular, reaccelerating. We stand by our prediction that the Bank Rate will peak at 5.50% following a 25bp hike at the next meeting, which will be the last hike of this cycle. This roughly corresponds to the pricing on the market right now. Rate reductions are not anticipated until 2024. As previously announced in the monetary policy report from August, the MPC is going to announce a goal for reducing gilt stock levels over the next twelve months.

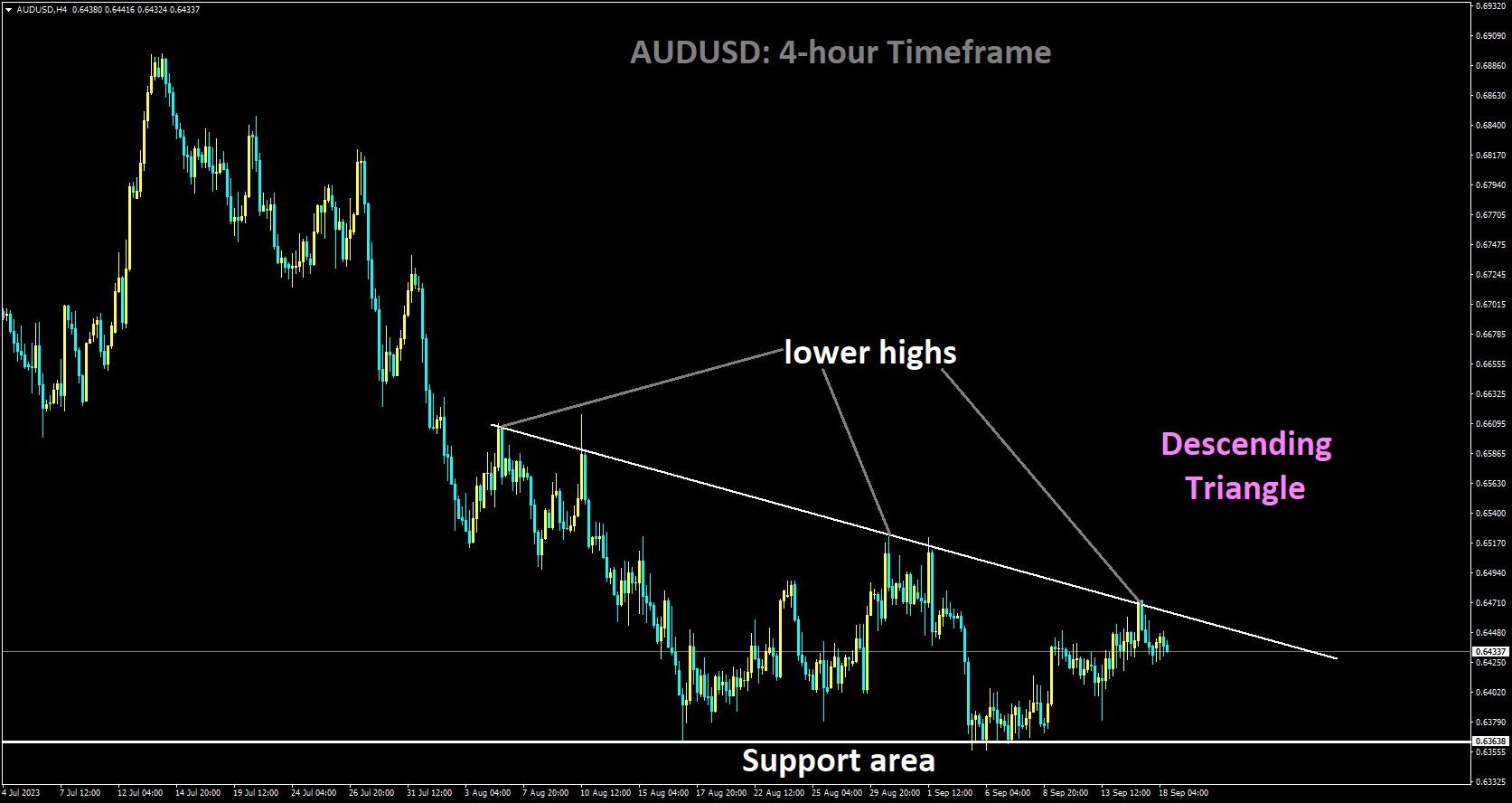

AUDUSD Analysis

AUDUSD is moving in Descending Triangle and market has reached lower high area of the pattern.

The markets expect the Australian central bank to keep its cash rate at 4.10% for a third consecutive month when the RBA releases its minutes on Tuesday. According to the most recent Reuters report, Michele Bullock will become the first female head of the Reserve Bank of Australia (RBA) on Monday. She will take over an economy that is experiencing steady job growth, moderate inflation, and steady employment. The markets anticipate that Bullock will uphold them at her first meeting as governor next month, and some economists predict that a rate cut will be her first change in policy. Regarding the US dollar, the market anticipates that the Fed will maintain its current level of interest rates during its September policy meeting, but it may still raise rates once more. Afterwards, Fed Chairman Jerome Powell will give a press conference, and no significant changes are anticipated from the Fed. A dovish official position, however, could lead to a drop in the US Dollar (USD) and benefit the AUDUSD pair. The markets have fully priced in the possibility that the Fed would forego raising rates in September, according to the CME Fedwatch tool. Meanwhile, the likelihood of a 25 basis point (bps) hike at the November meeting has decreased to 27%.

The Empire State Manufacturing Index increased to 1.9 in August from -19 in the previous reading, exceeding the market estimate of a 10 decline, according to a report released by the Federal Reserve Bank of New York on Friday. Furthermore, Industrial Production exceeded market expectations, increasing by 0.4% MoM from 1% in July. According to the University of Michigan, the preliminary Consumer Sentiment Index for September decreased from 69.1 to 67.7. Lastly, the Consumer Inflation Expectation over a five-year period decreased from 3% to 2.7%. It is anticipated that the RBA will decide on interest rates on Tuesday. On Wednesday, the focus will turn to the Fed’s monetary decision. These occurrences might be the cause of the pair’s volatility. The statement will serve as a guide for traders as they look for trading opportunities around the AUDUSD pair.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% FLAT OFFER for Signals 😍 GOING TO END – Get now: https://forexfib.com/discount/