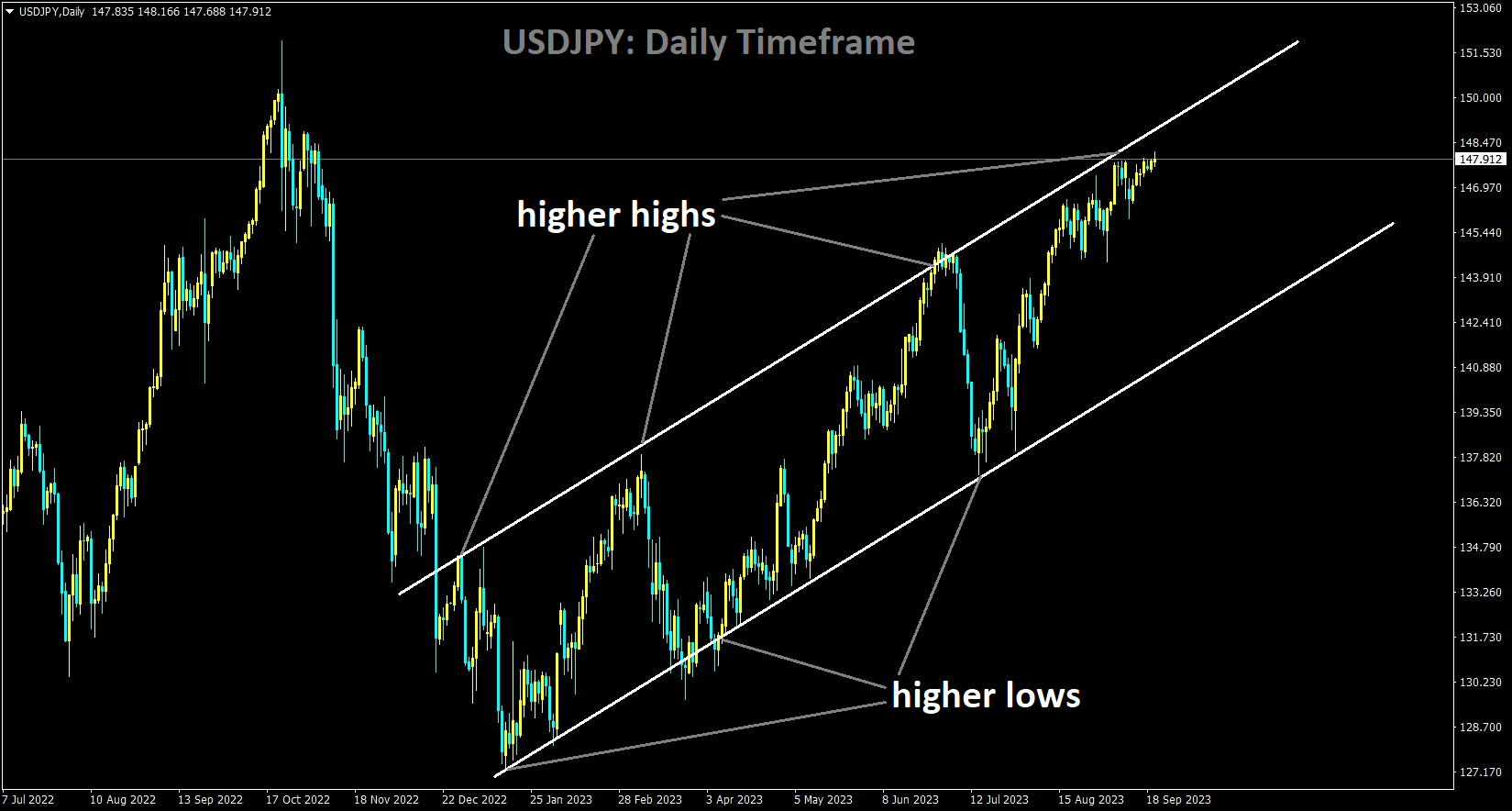

USDJPY Analysis

USDJPY is moving in an Ascending channel and the market has reached the higher high area of the channel

For the second straight day, the USDJPY pair sees some follow-through positive traction on Wednesday, reaching a new high during the early European session that has not been seen since November 2022. However, as traders begin to realign for the much-awaited FOMC monetary policy decision, spot prices retreat a few pip in the final hour and are currently trading just above the 148.00 round-figure mark, up about 0.15% for the day.

The US Dollar USD is being supported by growing acceptance that the Federal Reserve Fed will maintain its hawkish stance and leave the door open for at least one more rate hike by the end of this year. However, conjectures regarding a potential change in the Bank of Japan’s dovish outlook and worries that policymakers will step in to support the Japanese Yen JPY limit any additional strengthening of the USDJPY pair.

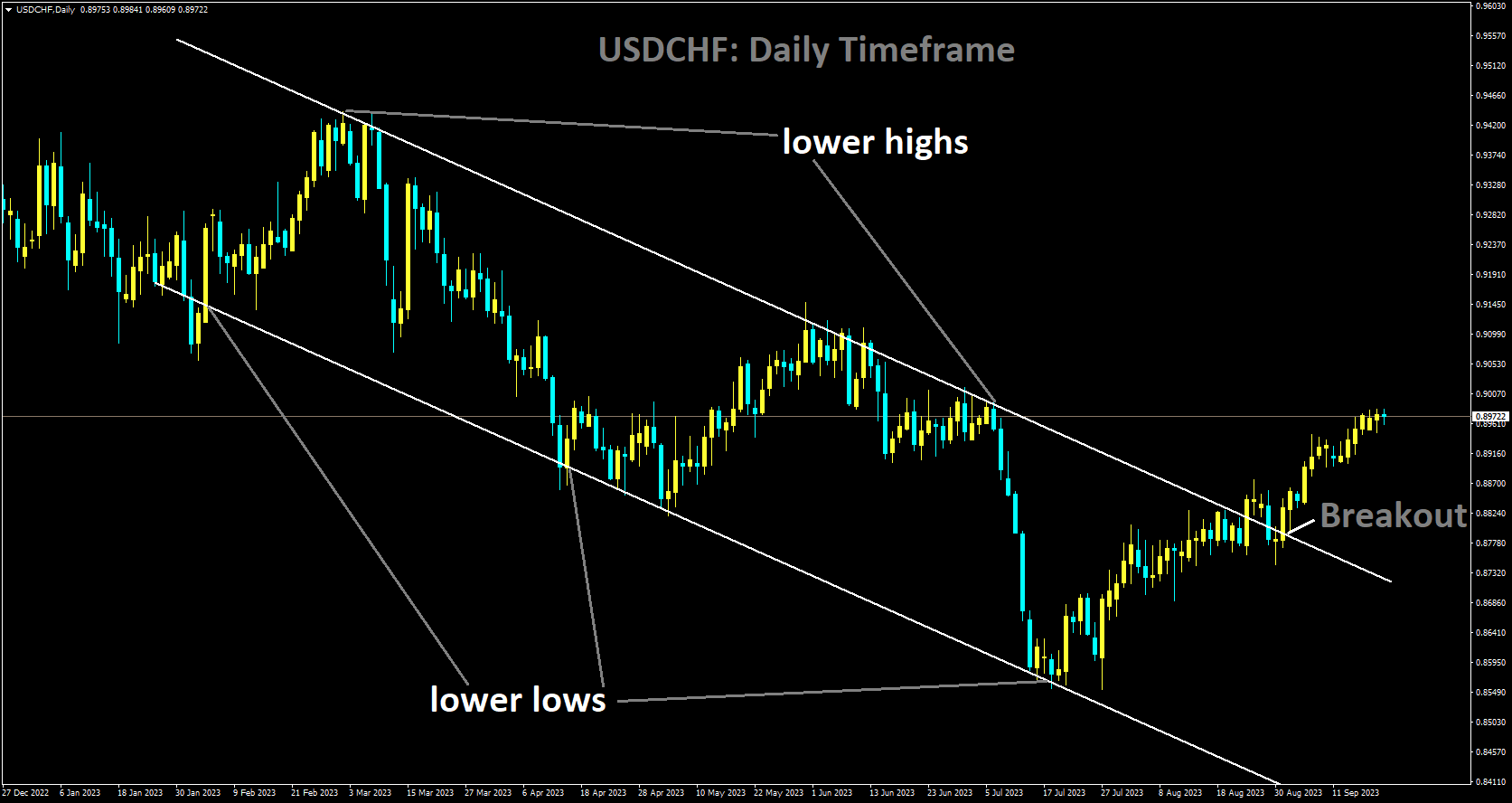

USDCHF Analysis

USDCHF has broken in Descending channel in upside

Ahead of the Federal Reserve’s (Fed) interest rate decision on Wednesday, the markets become cautious. The interest rate range of 5.25% to 5.5% is widely expected to persist when the Federal Reserve (Fed) announces its two-day monetary policy meeting on Wednesday. The CME Fedwatch Tool indicates that there is a 99% chance of maintaining current rates. Because of the resilience of the US economy and the recent spike in inflation data, which may lead to more rate hikes, markets are still wary of the Fed’s outlook. According to data, the US housing market had a mixed August performance. US Housing Starts decreased marginally to 1.283M in August, while US Building Permits increased to 1.543M, above estimates and the previous reading, according to data released by the US Census Bureau on Tuesday.

According to data made public by the Swiss Federal Customs Administration on Tuesday, the country’s trade surplus increased from 3,132 million to 4,054 million in August. In the meantime, August’s exports increased from $20,713 million to $20,735 million. From 17,584 million in the prior reading, imports increased to 17,603 million. On Thursday, it is anticipated that the Swiss National Bank (SNB) will increase additional interest rates by 25 basis points (bps), from 1.75% to 2%. Since the country’s most recent inflation report indicated a 1.6% YoY increase, which is still below the 2% target, the Swiss central bank is expected to maintain its strict stance in order to maintain price stability. But the differences in US and Swiss monetary policy could keep pushing the pair higher if SNB gives clues about its most recent hike.

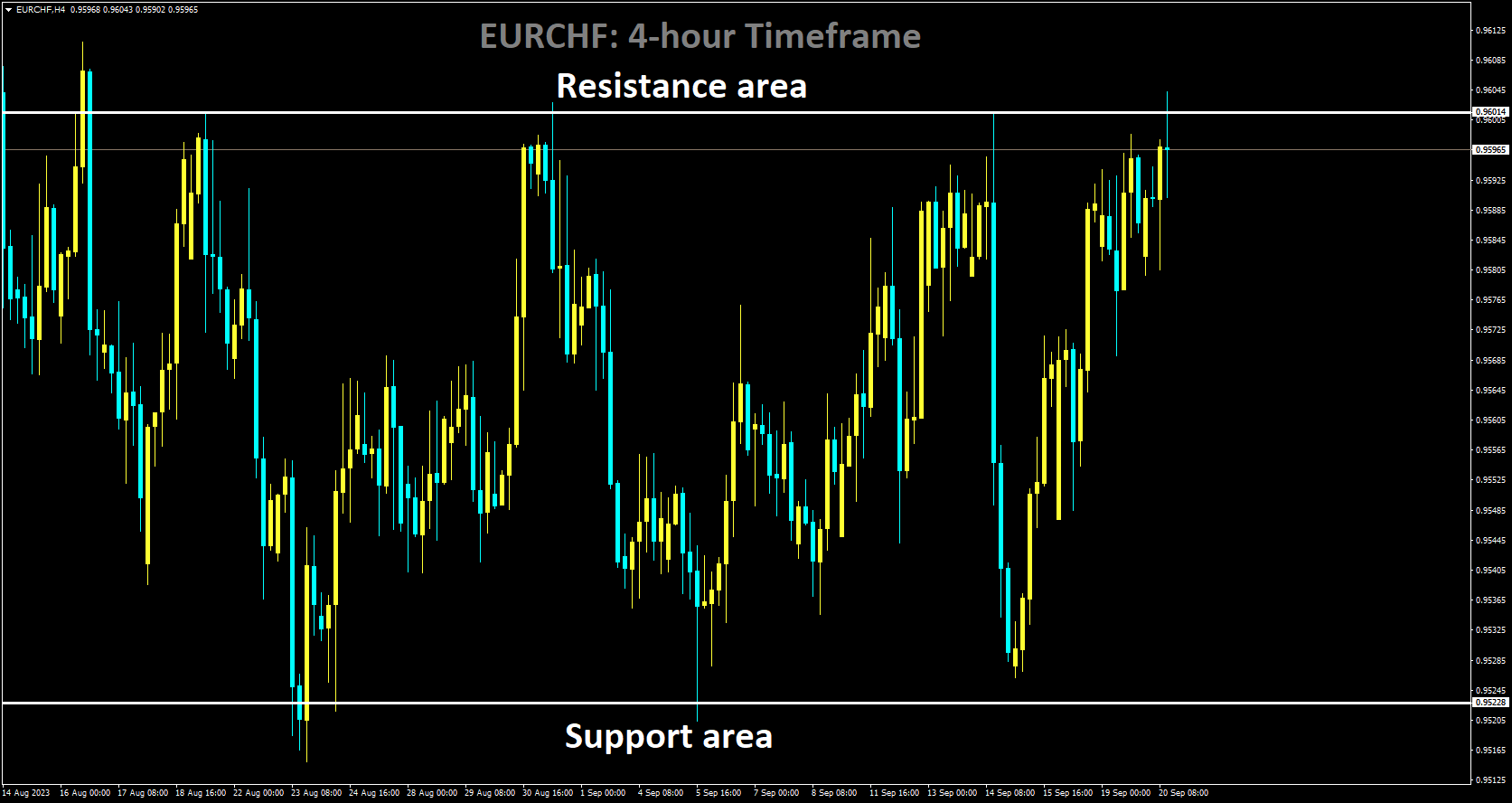

EURCHF Analysis

EURCHF is moving in Box pattern and market has reached resistance area of the pattern

The EURCHF should gain some strength due to a narrowing inflation differential, according to Erste Group Research economists. From a fundamental standpoint, the current interest rate differential favours the Euro only marginally, and the Franc continues to benefit from a much lower level of inflation than the Eurozone.

But in the upcoming months, the inflation gap should gradually close, which should help the EUR, if only momentarily. In the upcoming months, we expect the Euro to slightly strengthen versus the Swiss Franc. Should geopolitical tensions intensify, the Franc could potentially appreciate significantly in relation to the Euro at any point in time.

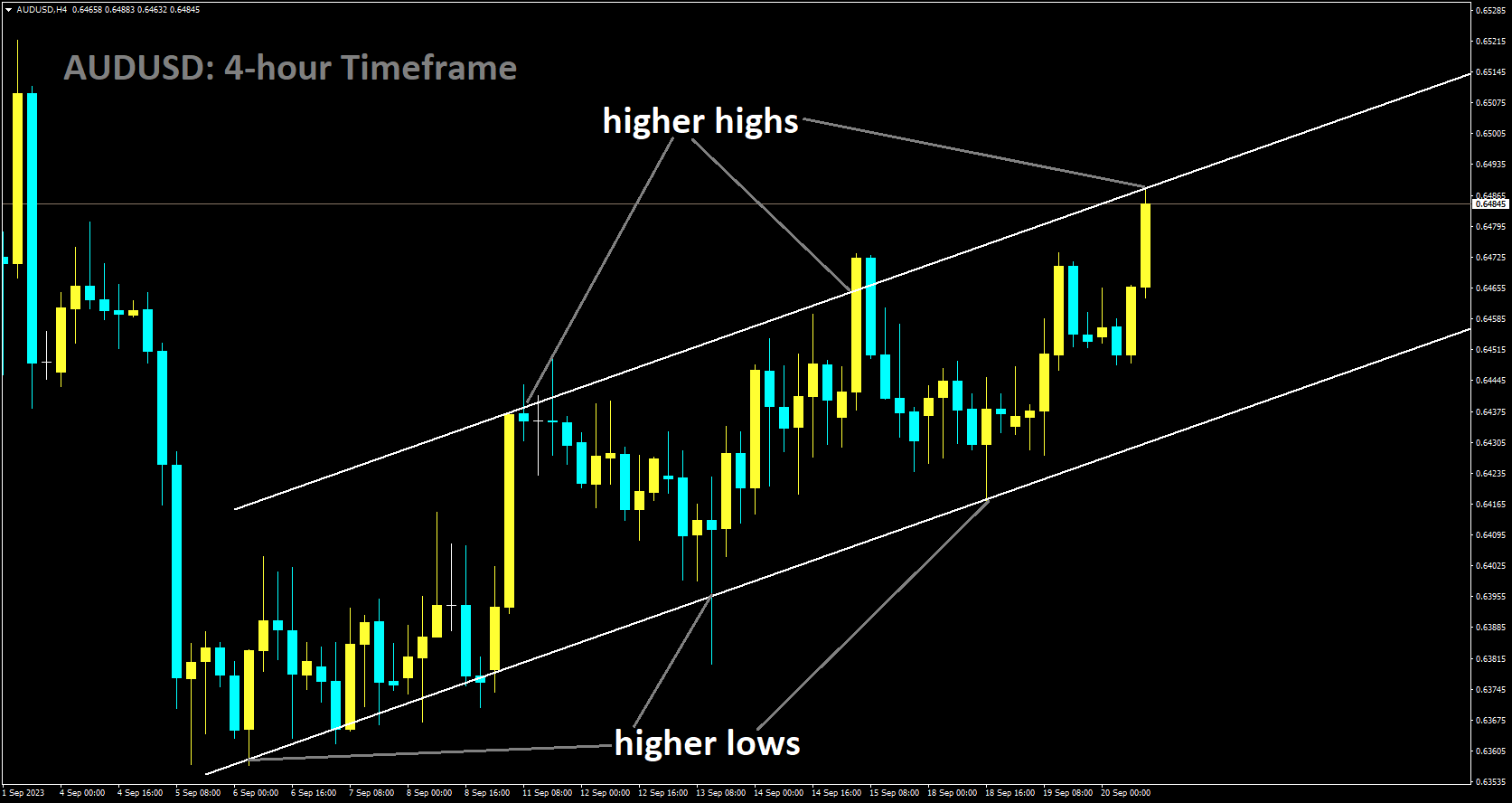

AUDUSD Analysis

AUDUSD is moving in Ascending channel and market has reached higher high area of the channel

The minutes of the September monetary policy meeting of the Reserve Bank of Australia (RBA) were made public on Tuesday, offering a glimpse into the central bank’s discussions. The minutes state that during the meeting, the RBA did take into consideration raising interest rates by 25 basis points. The central bank ultimately decided to maintain the current interest rate, nevertheless. The fact that recent economic data did not materially change the outlook for the economy was the main factor in the decision to keep things as they were. The central bank is prepared to tighten monetary policy further if inflation turns out to be more persistent than first anticipated, according to the meeting minutes. In spite of this readiness, the lack of any fresh signs of hawkishness in the minutes might work as a depressant for the Australian Dollar (AUD) relative to the US Dollar (USD). In line with market consensus, the People’s Bank of China (PBoC) chose to maintain the benchmark lending rates at their monthly fixing. In particular, the five-year Loan Prime Rate (LPR) is still 4.20%, while the one-year LPR, which was lowered by 10 basis points last month, is still 3.45%.

Additionally, on Wednesday, a significant state planner, the Vice Chairman of China’s National Development and Reform Commission (NDRC), declared that “the economy faces a lot of difficulties and challenges.” The key personnel also indicated that they will work to meet annual economic growth targets and that the government’s domestic macro-control policies, which are intended to manage and regulate the domestic economy, are effective. As of this writing, the US Dollar Index (DXY), which gauges how well the USD performs in relation to the other six major currencies, is trading lower, close to 105.10. Trades are expecting the Fed to keep interest rates where they are, focusing instead on the additional direction the central bank will provide. The markets have been accounting for the possibility of an additional rate hike of 25 basis points by year’s end, considering the robust performance of US macroeconomic data and the ongoing pressures of inflation.

The economic outlook for the United States (US) is still favourable for higher US Treasury bond yields, which is supporting the USD and hurting the AUD/USD currency pair. As of this writing, the US 10-year Treasury yield is 4.35 percent, which is less than it has been in 16 years. As investors look for fresh clues about the Fed’s intentions to raise interest rates in the future, the downside potential seems to be somewhat protected. The pursuit of lucidity will be pivotal in determining the immediate trajectory of the US dollar. Nonetheless, the mood of the markets appears to indicate that the Fed is inclined to keep policy rates higher for an extended amount of time. The accompanying monetary policy statement and Fed Chair Jerome Powell’s comments during the press conference following the meeting will be the main points of interest for the market.

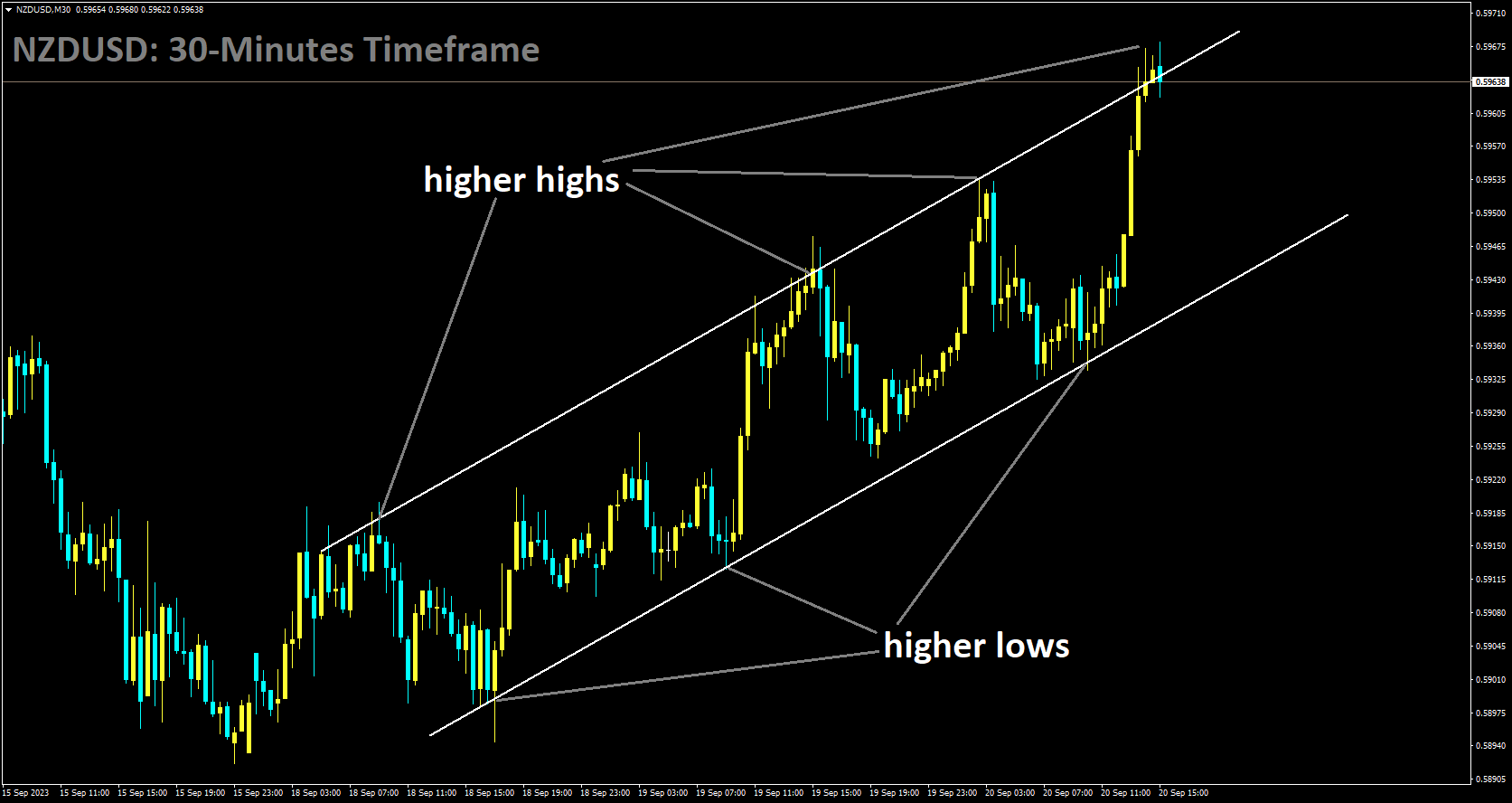

NZDUSD Analysis

NZDUSD is moving in Ascending channel and market has reached higher high area of the channel

Tuesdays American session saw a sharp increase in the US Dollar Index (DXY) as market sentiment declined and US Treasury yields rose. At 104.80, the DXY recovered and crossed above the 105.00 mark. As of this writing, DXY is still trading at 105.10 thanks to rising US Treasury bond yields. There is a challenge for the Kiwi pair as the yield on the US 10-year Treasury note is currently at 4.36%, which is lower than its highest level in 16 years. According to market expectations, the Fed will maintain interest rates in September in the current range of 5.25% to 5.50%, which might put pressure on the value of the dollar. As per the CME Fed Watch Tool, there was a decrease in the likelihood of another rate hike during the meetings in November and December. But as long as there is a chance of maintaining higher policy rates for an extended period of time, the USD might find support. This is because of the US economy’s resilience, which is demonstrated by stable labour growth and a reduction in inflationary pressures.

The dot plots will be the centre of attention for market participants as they evaluate the projected trajectory of interest rates. As per the latest Summary of Economic Projections (SEP), the median estimate of the Federal Reserve suggests that rates may escalate to a maximum of 5.6%. US Treasury Secretary Janet Yellen reportedly said on Tuesday, as reported by Reuters, that in order to return inflation to target levels, US growth must slow down to a pace consistent with its potential growth rate because the economy is currently experiencing full employment. Additionally, Yellen stated, “I believe the Chinese would try to avoid a slowdown of significant proportions by using the policy space they have.” The US may experience economic repercussions from Chinas problems.”

Conversely, New Zealand’s current account data showed a figure of $-4.208 billion for the second quarter, which was lower than both the prior figure of $-5.215 billion and the market consensus of $-4.800 billion. Conversely, the GDP to Current Account Ratio fell by 7.5% in the same quarter as opposed to an 8.5% decline the previous quarter. In keeping with market expectations, the Peoples Bank of China (PBoC) left the benchmark lending rates unaltered at their monthly fixing on Wednesday. The five-year Loan Prime Rate (LPR) remained stable at 4.20%, while the one-year LPR—which had been lowered by 10 basis points the previous month—remained at 3.45%.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% FLAT OFFER for Signals 😍 GOING TO END – Get now: https://forexfib.com/discount/