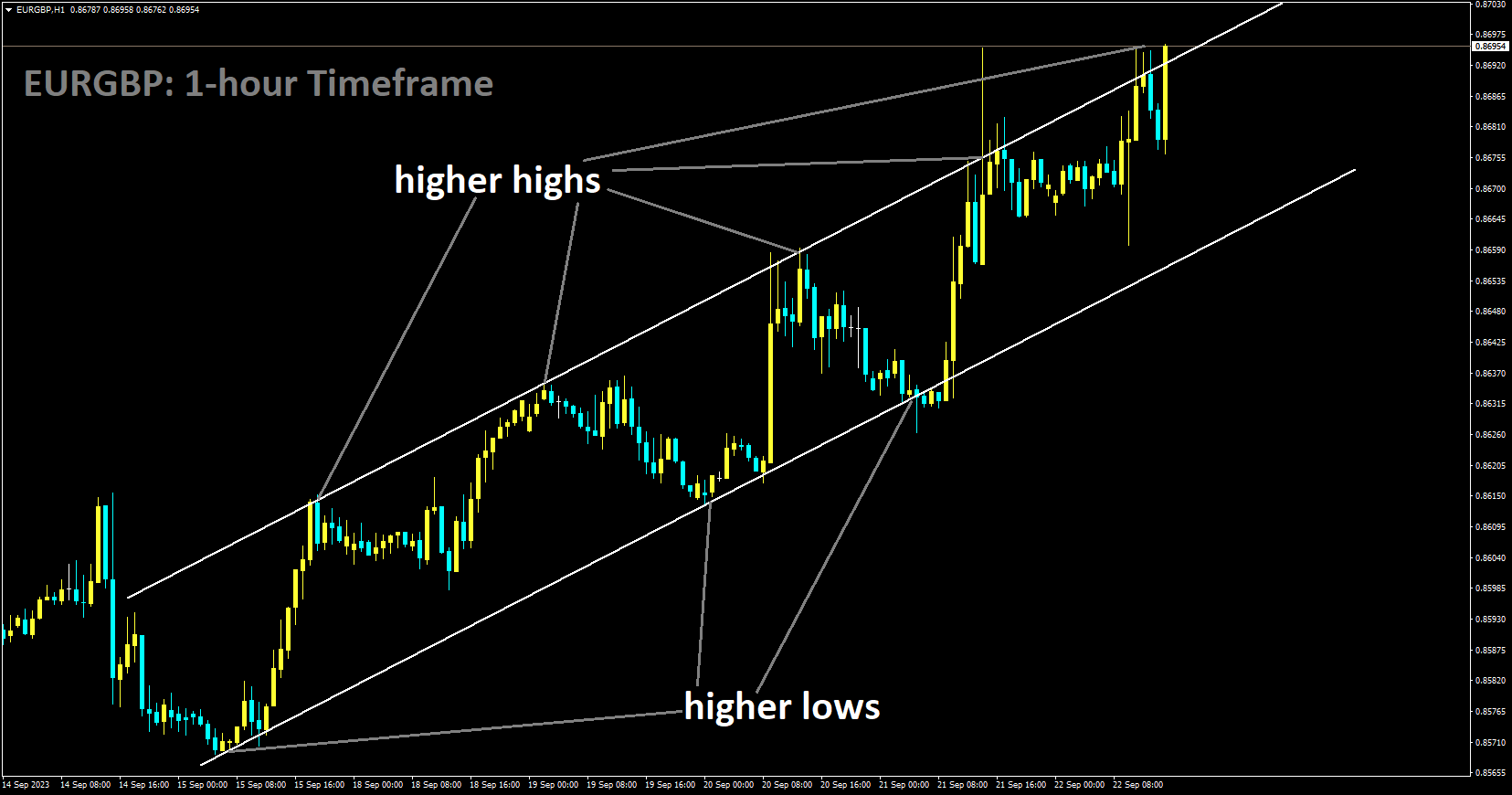

EURGBP Analysis

EURGBP is moving in Ascending channel and market has reached higher high area of the channel

The surprise pause by the Bank of England on Thursday may have contributed to the relative underperformance of the British Pound, but it also created a tailwind for the EURGBP cross. In fact, the recent slowdown in inflation signs that the UK labour market is cooling and reigniting recession fears prompted the UK central bank to halt a string of 14 consecutive interest rate hikes. The BoE’s Monetary Policy Committee decided to keep the main policy rate at 5.25%, which has been high for 15 years, by a vote of 5 to 4. Furthermore, weaker-than-expected UK macrodata released today further weaken the value of the pound and strengthen the EURGBP cross. Following a sharp 1.1% decline the previous month, the UK Office for National Statistics reported that the headline Retail Sales increased by 0.4% in August. Still, the increase fell short of the 0.5% growth that was projected. Nevertheless, any significant upward movement in the EURGBP cross is restrained by the European Central Bank’s dovish rate decision from last Thursday.

By choosing to raise rates for the tenth consecutive time, the European Central Bank (ECB) brought its main rate to an all-time high of 4%. However, the downgrade of GDP growth and CPI estimates for 2024 and 2025 indicated that the 14-month cycle of policy tightening may have already peaked. In addition, a confidential survey revealed that German business activity decreased for the third consecutive month in September, adding to concerns about a severe economic downturn and raising the possibility that additional hikes may not be possible for the time being. In contrast, the EURGBP cross does not respond much to the rather weak Eurozone PMI readings. Spot prices, however, are expected to post gains for a third straight week, which will be the fifth positive week out of the previous six. Before putting new bets, bullish traders will probably wait for a sustained strength that moves above the 0.8700 round figure and approaches a technically significant 200-day Simple Moving Average SMA.

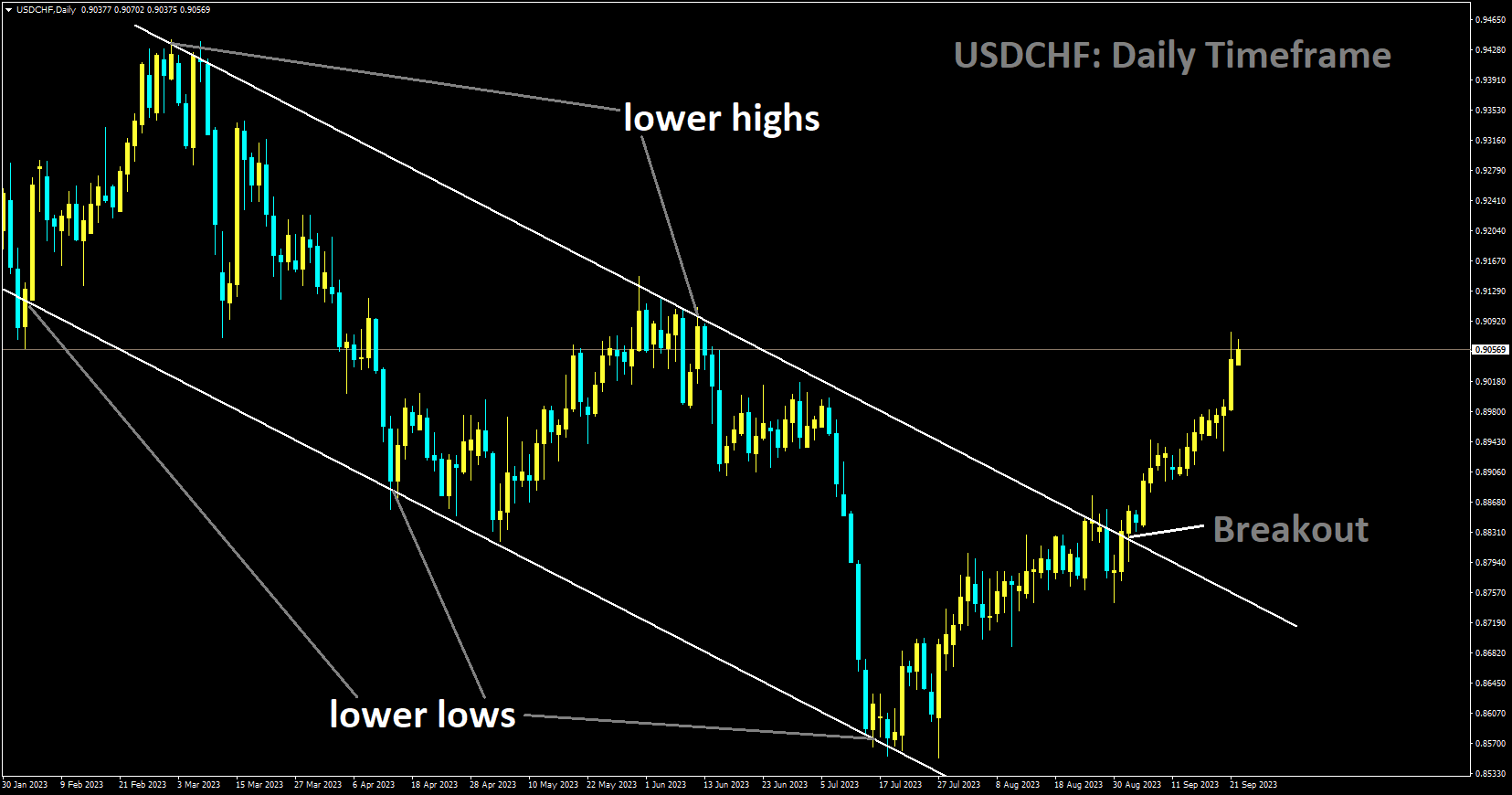

USDCHF Analysis

USDCHF has broken Descending channel in upsideDuring Friday’s Asian session, the USDCHF pair draws some dip buying as it attempts to build on the momentum from the previous day’s breakout above the psychological 0.9000 mark. Spot prices are presently trading in the mid-0.9900s, still quite close to the peak reached on June 13 following the unexpected pause announced by the Swiss National Bank (SNB) on Thursday. At the conclusion of the quarterly monetary policy meeting, the SNB broke its five-year upward trend and decided to maintain its benchmark interest rate unchanged, defying expectations of a 25 basis point lift-off. The SNB said as much in the statement that went along with it that the recent significant tightening of monetary policy is reducing the amount of inflationary pressure that is still there. This is in addition to a recent barrage of dismal real economy data and headline and core inflation readings that were below 2%. These developments put significant pressure on the Swiss Franc (CHF) and gave the USDCHF pair a slight boost.

The Federal Reserve’s (Fed) hawkish outlook has caused the US Dollar (USD) to hold steady, just below a new six-month high touched the day before. This is seen as another factor supporting the USDCHF pair. The Federal Reserve made the decision to maintain interest rates at a 22-year high of 5.25%–5.50%, but issued a warning that sticky inflation would probably lead to at least one more rate hike in 2023. The ‘dot-lot’ also revealed that policymakers anticipate the benchmark rate to be 5.1% in the upcoming year, implying only two rate cuts in 2024 instead of the four previously anticipated. Reaffirming market expectations, this will prolong the US central bank’s policy of higher interest rates. In addition, the US Weekly Jobless Claims unexpectedly declined, which set off another round of selling in the US fixed-income market and drove the yield on the rate-sensitive two-year US government bond to a new 17-year high. The US Treasury yield on the 10-year note continued to support the US dollar and rose to its highest level since November 2007. Nevertheless, a generally down tone in the equities markets may help the safe-haven CHF and prevent any significant intraday increase in the USDCHF pair.

However, the aforementioned fundamental environment appears to be strongly biassed in favour of traders who are bullish. The positive outlook is further supported by the overnight breakout through a technically significant 200-day Simple Moving Average (SMA), which also implies that the USDCHF pair’s path of least resistance is upward. The global flash PMI prints, which could affect the overall risk sentiment and give the major some momentum, are now anticipated by market participants. Meanwhile, spot prices are still expected to close higher for a tenth straight week.

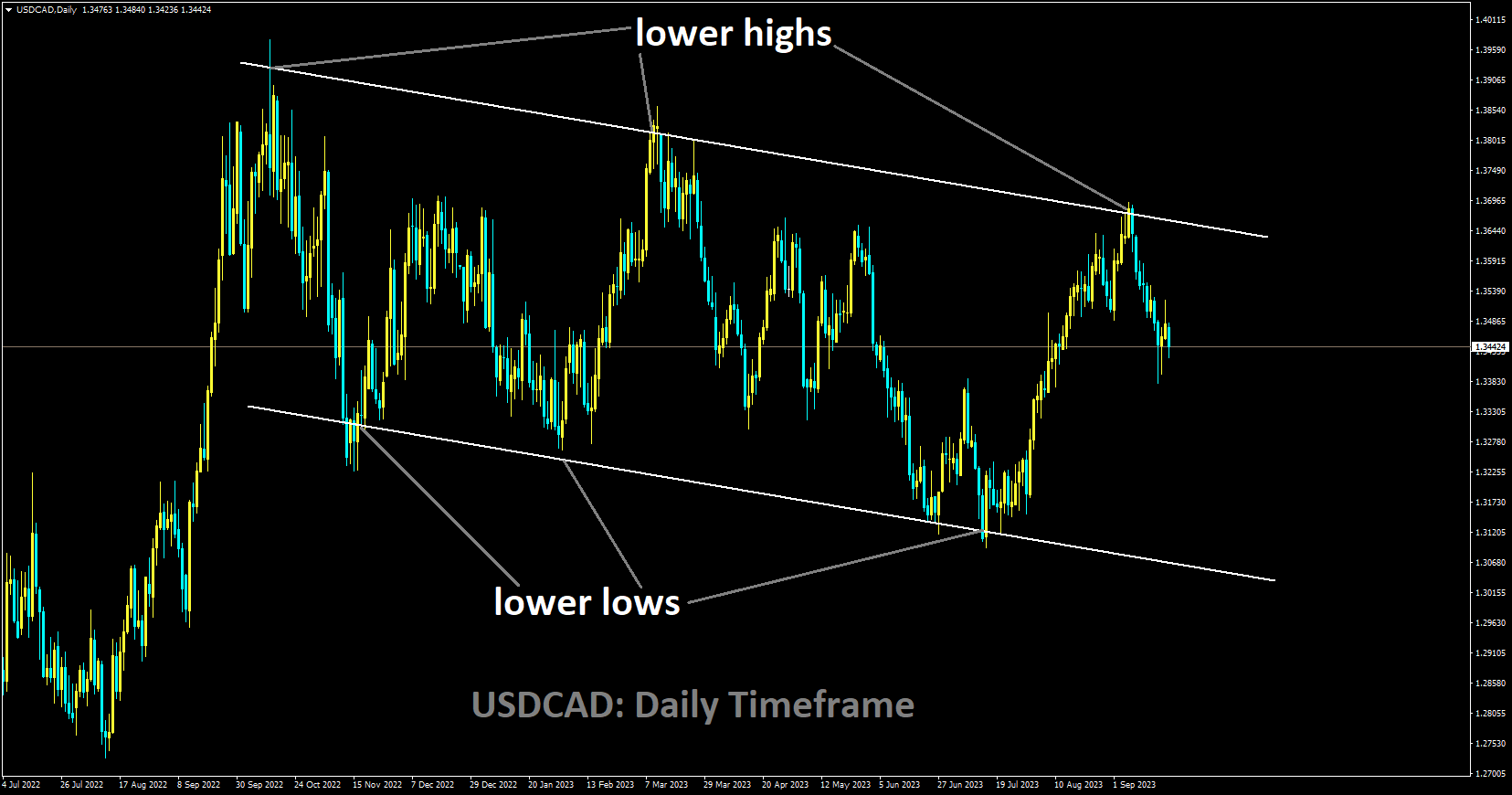

USDCAD Analysis

USDCAD is moving in Descending channel and market has fallen from the lower high area of the channel

During Friday’s European session, the USDCAD pair breaks its two-day winning streak by trading sideways close to 1.3470. The positive price of crude oil combined with the US Dollar USD trimming some of its intraday gains caused the pair to experience downward pressure. The US Dollar’s USD gains may have reached a ceiling due to the decline in US Treasury yields. The US 10-year bond’s yield is currently 4.46% as of this writing. As of the time of writing, the US Dollar Index DXY, which compares the performance of the US dollar to the six other major currencies, is trading at about 105.50. The price of a barrel of West Texas Intermediate WTI crude oil is currently around $89.90. Due to the intentional production reductions made by OPEC+ producers, there has been an upward trend. These producers are actively working to maintain oil prices and maintain a balance between the world’s supply and demand dynamics by lowering the amount of crude oil available on the market.

Investors are awaiting the economic data releases that are scheduled for release on Friday, which include Canada’s retail sales for July and the preliminary US S&P Global PMIs for September. These data may offer insightful information about the state of both economies and help traders spot possible trading opportunities centred on the USDCAD pair. For its Wednesday meeting, the Fed kept interest rates between 5.25 and 5.50%. In a later press conference, Fed Chairman Jerome Powell reaffirmed the Fed’s commitment to hitting its 2% inflation target. Powell also stated that, should the need arise, the Fed is ready to raise interest rates. The hawkish outlook of the Fed may support the US Dollar USD.

USDJPY Analysis

USDJPY is moving in Ascending channel and market has rebounded from the higher low area of the channel.

The USDJPY retraces the Thursday’s losses due to a decision by the Bank of Japan BoJ regarding policy rates. The BoJ kept its current interest rate at -0.1%, as was widely anticipated. In the early trading hours of Friday’s European session, the spot price is up, hovering around 148.30. The press conference for the post-September policy meeting was led by BOJ Governor Kazuo Ueda on Friday. When the BOJ feels that 2% inflation is within reach, the governor of the BOJ has indicated that the BOJ may consider lifting yield curve control and changing its negative interest rate policy. The policymaker has made it clear that there has been “no change to the way of the policy decision-making process,” meaning that each monetary policy meeting at the BOJ involves a thorough analysis of fresh data. Ueda went on to say that they have not yet seen inflation stabilise at 2%. Additionally, he stated that data, including the government’s decision to extend petrol subsidies, will be the primary factor in the next monetary policy decision in October. Should more easing measures be judged necessary, the BoJ is ready to put them into effect. Regarding price trends, currency, financial markets, and economic conditions, Ueda admitted that there is a great deal of uncertainty. In contrast to the previous rate of 3.3%, the National Consumer Price Index YoY report for August in Japan showed a reading of 3.2%. Against the expected 3.0%, the National CPI ex-Fresh Food YoY stayed stable at 3.1%.

The US Dollar Index DXY is up around 105.40, and the rise in US Treasury yields is partially responsible for these gains. As of this writing, the yield on the US 10-year bond has increased to 4.49%, the highest since 2007. Investors wait for the release of economic data, such as the preliminary September US S&P Global PMIs. In addition to helping traders find possible US Dollar USD trading opportunities, these numbers may offer insightful information about the state of the US economy. The US released its latest economic data on Thursday, and the results painted a mixed picture. At first, it gave the Greenback more strength and indicated a strong labour market. But then there was a correction to it.

The US reported 201,000 initial claims for unemployment benefits for the week ending September 15, which is lower than the 221,000 reading from the previous week and the lowest since January. This data was better than expected, since 225,000 was expected to be a higher number. September’s Philadelphia Fed Manufacturing Survey reading of 13.5 was lower than anticipated. Analysts had anticipated that the previous positive reading of 12 would drop by just 0.7. In terms of Existing Home Sales MoM, August saw a drop from the previous figure of 4.07 million to 4.04 million. There was a projected rise to 4.10 million. The Federal Reserve Fed decided to keep interest rates in the 5.25–5.50% range during its meeting on Wednesday, as was widely expected in the market. In a later press conference, Fed Chairman Jerome Powell reaffirmed the Fed’s commitment to hitting its 2% inflation target. Powell also stated that, should the need arise, the Fed is ready to raise interest rates.

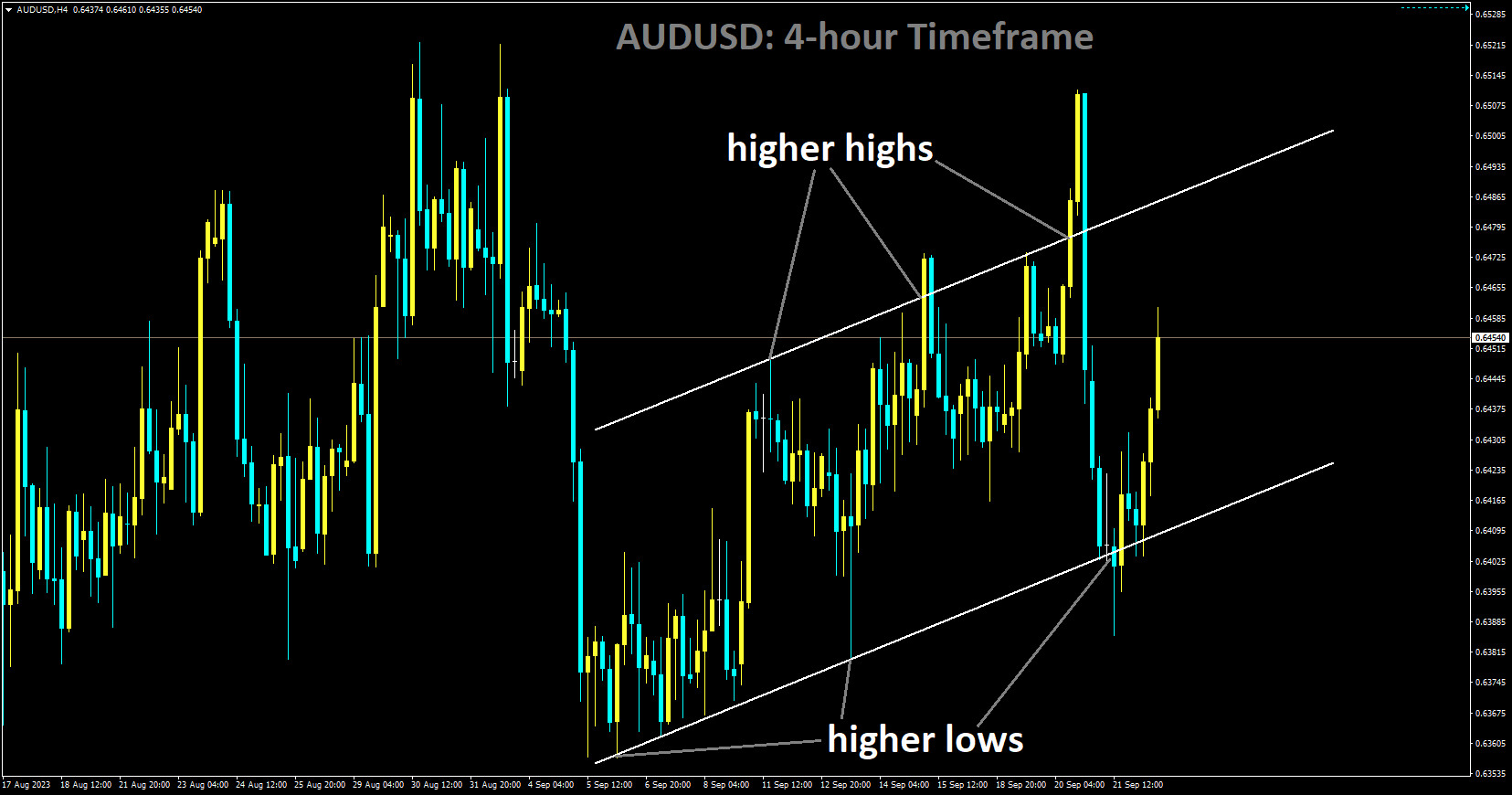

AUDUSD Analysis

AUDUSD is moving in Ascending channel and market has reached higher low area of the channel

The AUDUSD pair seesaws through the Asian session on Friday, struggling to sustain the gains from the previous day’s bounce from the 0.6385 region, or over a one-week low. Spot prices are currently trading slightly above the 0.6400 level, but there is a good chance for further near-term depreciation given the underlying conditions. According to a survey, after two consecutive months of decline, business activity in Australia’s private sector resumed growth in September, which provides some support for the AUDUSD pair. During the reported month, the Judo Bank Flash Australia Composite PMI increased from 48.0 in August to 50.2. Furthermore, the Australian Services PMI increased from 47.8 in August to 50.5 in September, a four-month high. Bulls were restrained from making aggressive bets on the Aussie as the Manufacturing PMI fell to 48.2 from 49.6 in the previous month, staying in contraction territory. Additionally, the Federal Reserve’s Fed hawkish outlook and the general bullish sentiment surrounding the US Dollar USD work to contain any significant upside for the AUDUSD pair. As anticipated, the Fed decided on Wednesday to maintain rates at a 22-year high, ranging from 5.25% to 5.50%. In response to sticky inflation, the Fed hinted at the possibility of at least one more rate hike by year’s end in the policy statement that went along with it. Furthermore, policymakers anticipate that the benchmark rate will be 5.1% in 2019 rather than the four that were previously anticipated, and they propose only two rate cuts in 2024.

The forecast and an unanticipated decline in the US Weekly Jobless Claims are driving up the yields on US Treasury bonds. As the yield on the US Treasury bond, which is linked to interest rates, rises to its highest level since November 2007, the yield on the rate-sensitive two-year US government bond actually reaches a new 17-year high. This continues to support the US dollar. Simultaneously, worries about economic headwinds resulting from rapidly rising borrowing costs are fueled by the Fed’s higher-for-longer narrative. The sentiment of investors is then perceived to be affected, further strengthening the safe-haven currency and undermining the risk-averse Australian Dollar. The release of the flash US PMI prints, which is anticipated later in the early North American session, is now anticipated by traders. This will affect the USD price dynamics and give the AUDUSD pair some momentum, along with the US bond yields and the general risk sentiment. However, spot prices appear set to post slight weekly losses and stay well within striking distance of the lowest level since November 2022, which was touched last week in the 0.6355 region.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% FLAT OFFER for Signals 😍 GOING TO END – Get now: https://forexfib.com/discount/