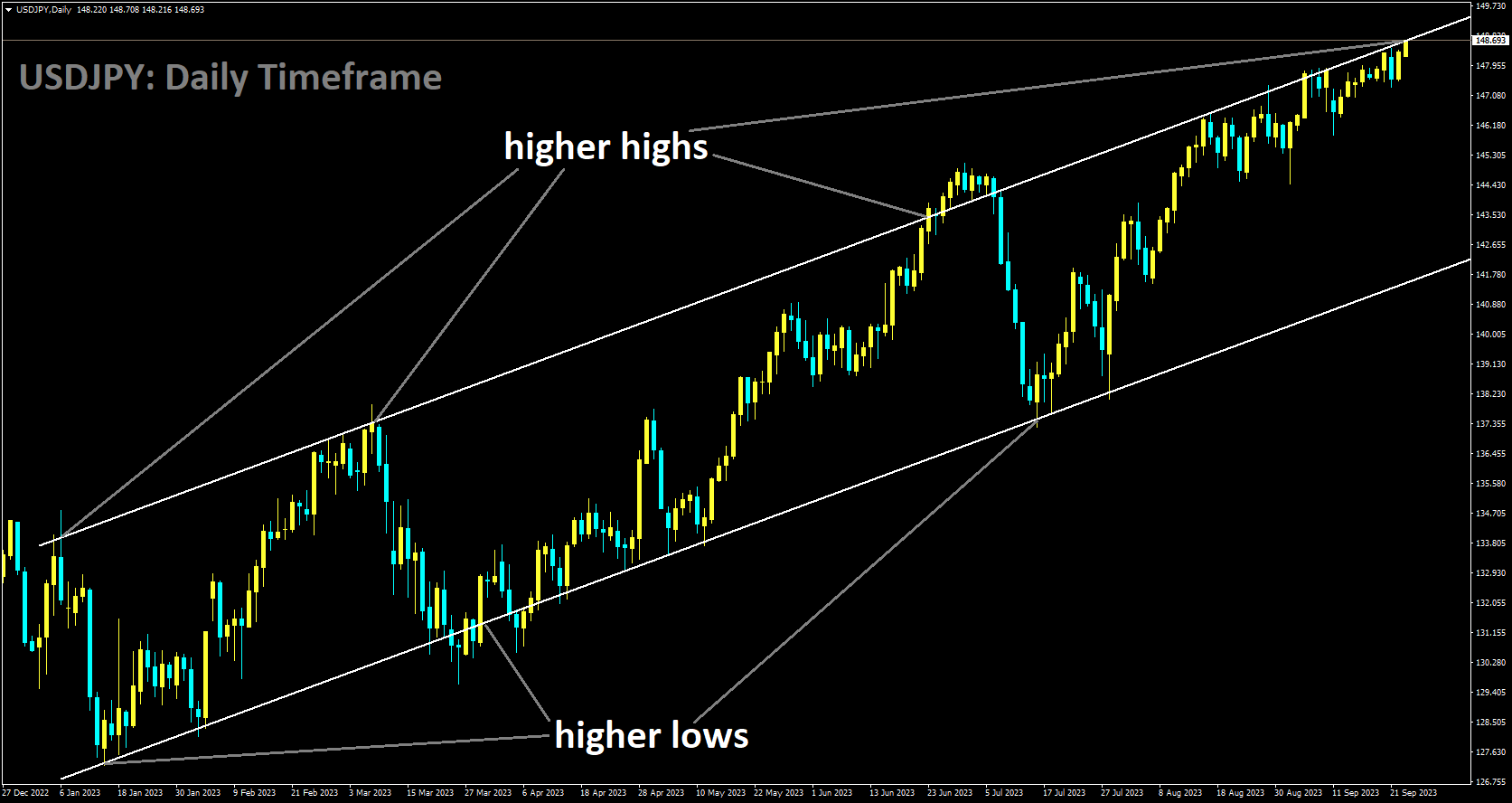

USDJPY Analysis

USDJPY is moving in Ascending channel and market has reached higher high area of the channel

The USDJPY pair does not move during Monday’s early European session below the mid-148.00s. Fearing that the Japanese authorities may interfere with foreign exchange, markets become cautious. The pair is down 0.01% for the day as of right now, trading at roughly 148.35. Governor of the Bank of Japan BOJ, Kazuo Ueda, said on Monday that the country’s economy is recovering somewhat and that the central bank’s basic position is that monetary easing must be maintained gradually. Furthermore, Shunichi Suzuki, Japan’s Finance Minister, made some customary verbal interventions last week. According to him, authorities will be keeping a close eye on FX movements and will not rule out any options for responding to unusually high FX volatility. In a similar vein, Governor Ueda of the Bank of Japan BoJ stressed the importance of taking more time to evaluate data before hiking interest rates. Consequently, this could limit the US Dollar’s USD upside potential and exert pressure on the USDJPY exchange rate. Aside from this, economic data that was made public on Friday showed that the National Consumer Price Index CPI for Japan decreased from 3.3% in July to 3.2% YoY in August. Furthermore, the National CPI ex Food, Energy came in at 4.3% as opposed to 4.3% in prior readings, while the National CPI ex Fresh Food improved from 3.0% in July to 3.1% in August.

Regarding the USD, the Purchasing Managers Index data released on Friday raised questions about how demand would develop in the US economy as a result of the cycle of interest rate hikes and high inflation. Business activity in the manufacturing sector is still declining, as evidenced by the US S&P Global Manufacturing PMI, which increased to 48.9 in September from 47.9 in August. The Composite PMI dropped to 50.1 from 50.2, while the Services PMI dropped to 50.2 from 50.5 the previous month. Officials from the Fed still believe that the additional rate will increase later this year. The presidents of the Federal Reserve Banks of Boston and San Francisco, Susan Collins and Mary Daly, stressed that more rate increases would be required even though inflation is starting to decline. Additionally, Neel Kashkari, the president of the Minneapolis Federal Reserve, stated that he would have considered raising interest rates by 500 basis points bps or 525 bps since they would have severely curtailed consumer spending, which has not happened.

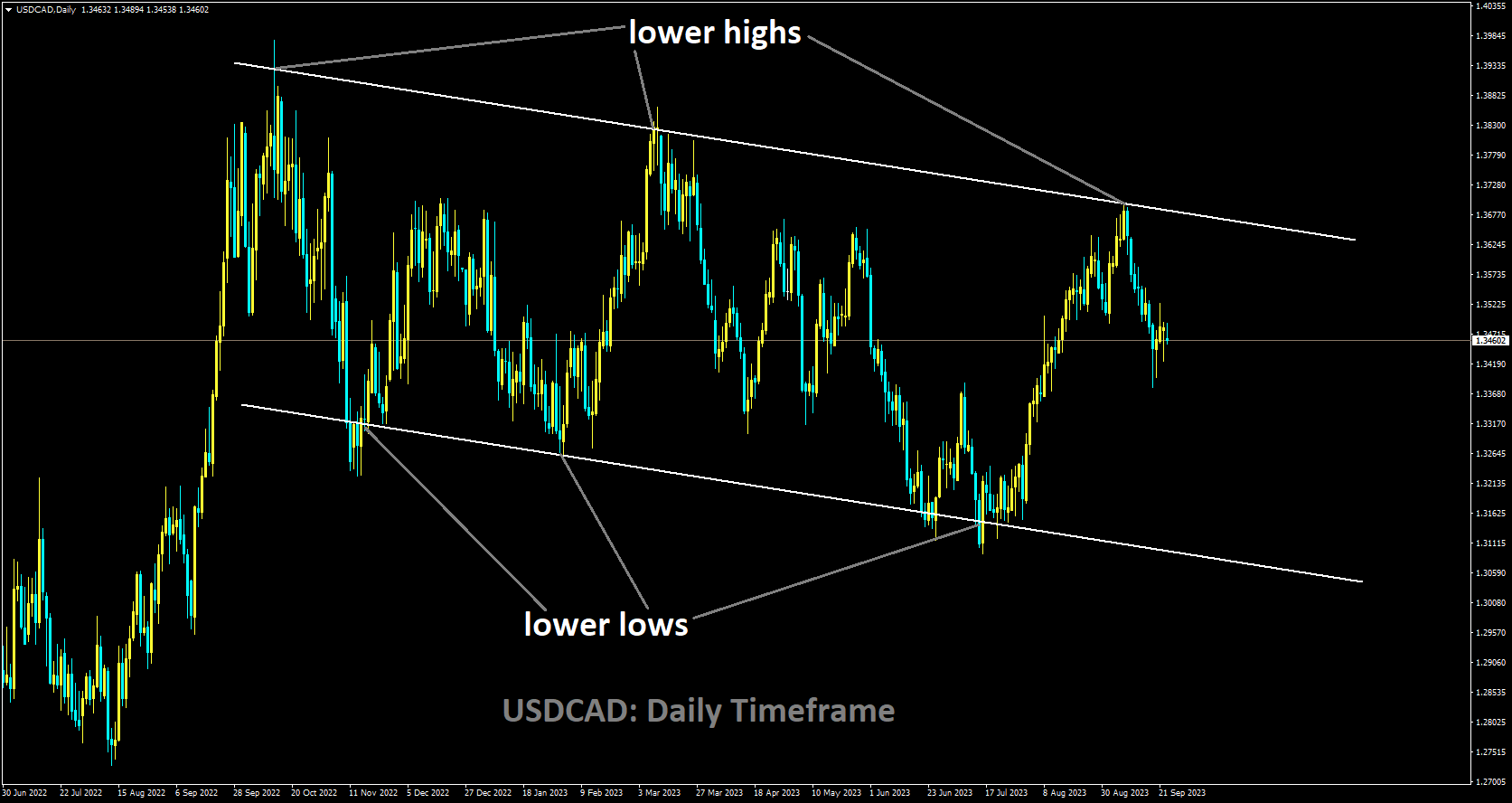

USDCAD Analysis

USDCAD is moving in Descending channel and market has fallen from the lower high area of the channel

On Friday, Statistics Canada reported that July’s Canadian Retail Sales increased by 0.3% over the previous reading of 0.1%, which was less than the 0.4% market expectation. In contrast, Core Retail Sales increased 1.0% from a 0.7% decline in the prior reading, exceeding the 0.5% market estimate. Furthermore, since Canada is the top oil exporter to the US, a surge in oil prices supports the commodity-linked Loonie and may limit further gains for the USDCAD pair.

However, Mary Daly and Susan Collins, the presidents of the Federal Reserve Banks of Boston and San Francisco, noted that even though inflation is declining. Still, more rate increases would be required. Nevertheless, the story of higher rates for longer periods of time has helped the US Dollar outperform its competitors and could benefit the USDCAD pair. According to data released on Friday, the US S&P Global Manufacturing PMI increased from 47.9 in August to 48.9 in September, suggesting that the manufacturing sector’s business activity is still declining. In the meantime, the Services PMI dropped from 50.5 to 50.2 in the prior month. Ultimately, the Composite PMI decreased to 50.1 from 50.2 in August, a slight decline.

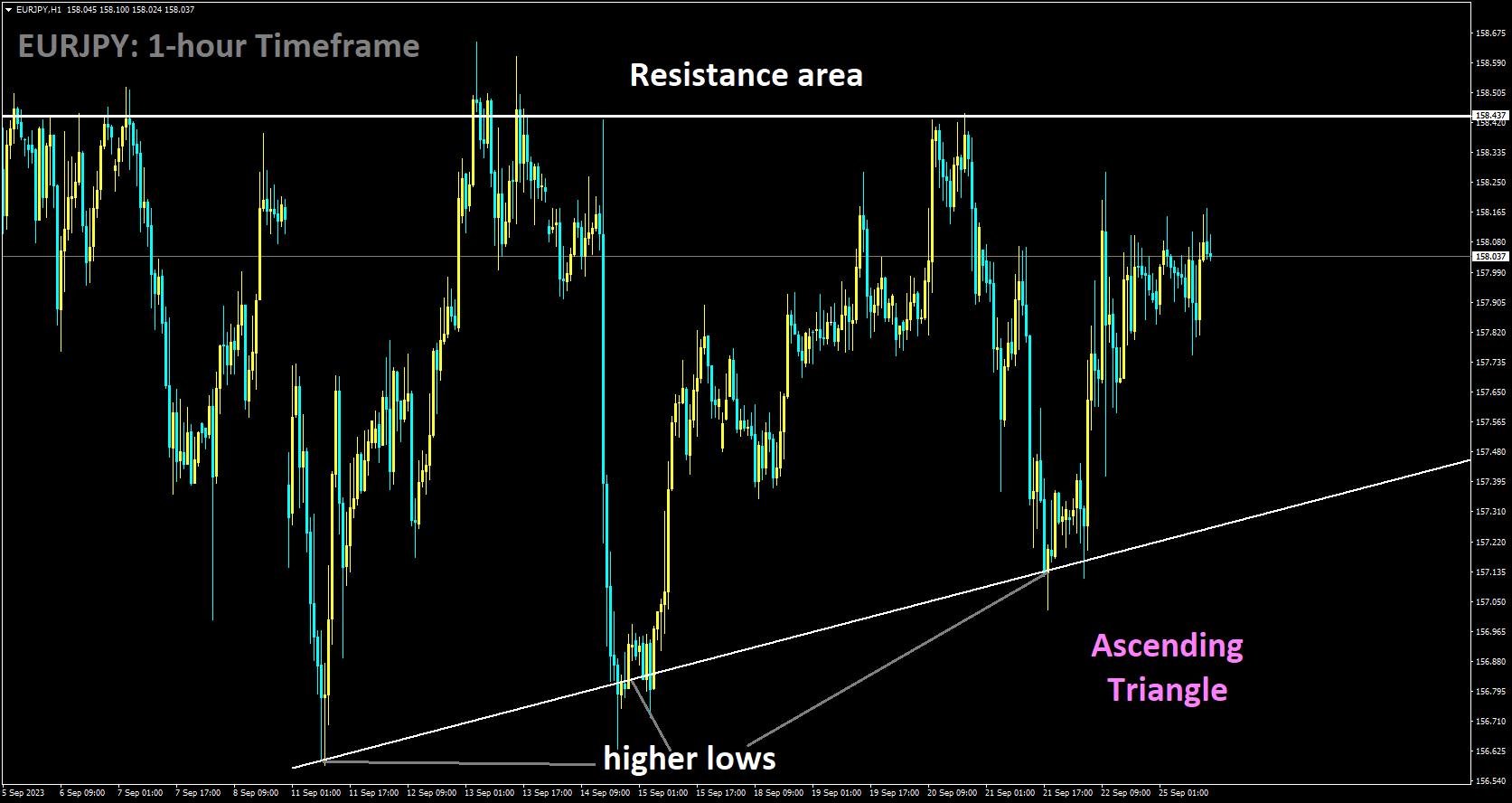

EURJPY Analysis

EURJPY is moving in Ascending Triangle and market has rebounded from the higher low area of the pattern

Governor of the Bank of Japan BOJ, Kazuo Ueda, met with business executives on Monday in Osaka, western Japan. He is now holding a press conference. It is still not clear when 2% inflation will be stable and sustainable. The Japanese economy is currently in a pivotal state regarding its ability to attain a positive wage-inflation cycle. Past significant rate increases in the US may have had a delayed impact on the financial system and economy, so one must remain cautious. The slow rate of recovery in the Chinese economy is also concerning. While it is true that inflation has been above 2% for a while, this does not bring Japan any closer to reaching its target in a stable and sustainable manner. Whether wage growth results in a moderate increase in inflation will determine how close Japan is to reaching our target.

More often than in the past, Japanese businesses are adjusting their prices, which is a significant indication that wages and inflation may rise simultaneously. BoJ is aware that profits are affected differently by growing raw material costs, a weaker yen, and different industry sizes. The recommended course of action for combating inflation would differ based on the cause of price increases. Since the cost-push inflation that we have so far witnessed harms Japanese businesses and households, we have supported the economy with an easy monetary policy. Want to keep carefully considering the costs and advantages of our policy.

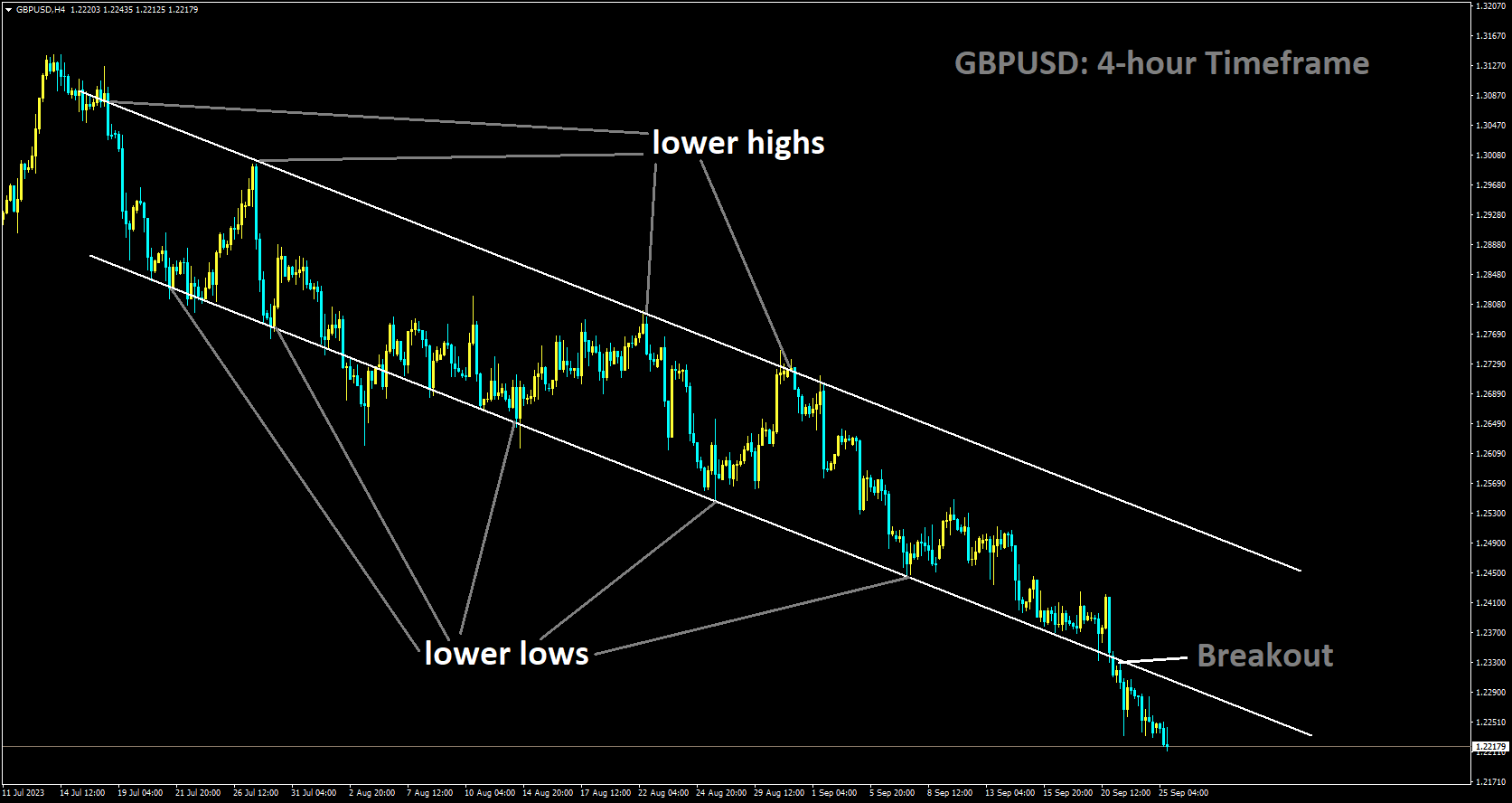

GBPUSD Analysis

GBPUSD has broken Descending channel in downside.

Market participants are awaiting the release of the second-quarter GDP of the United Kingdom and the much-awaited Core Personal Consumption Expenditure PCE Price Index data from the United States, which is scheduled for release on Friday. With a daily gain of 0.02%, the major pair is currently trading close to 1.2242. Nevertheless, the Federal Reserve Fed officials’ aggressive posture helped to strengthen the US dollar USD versus the British pound GBP.

The presidents of the Federal Reserve Banks of Boston and San Francisco, Susan Collins and Mary Daly, stressed that even though inflation is declining, more rate increases will still be required. Thus, the GBPUSD pair may experience headwinds as a result.

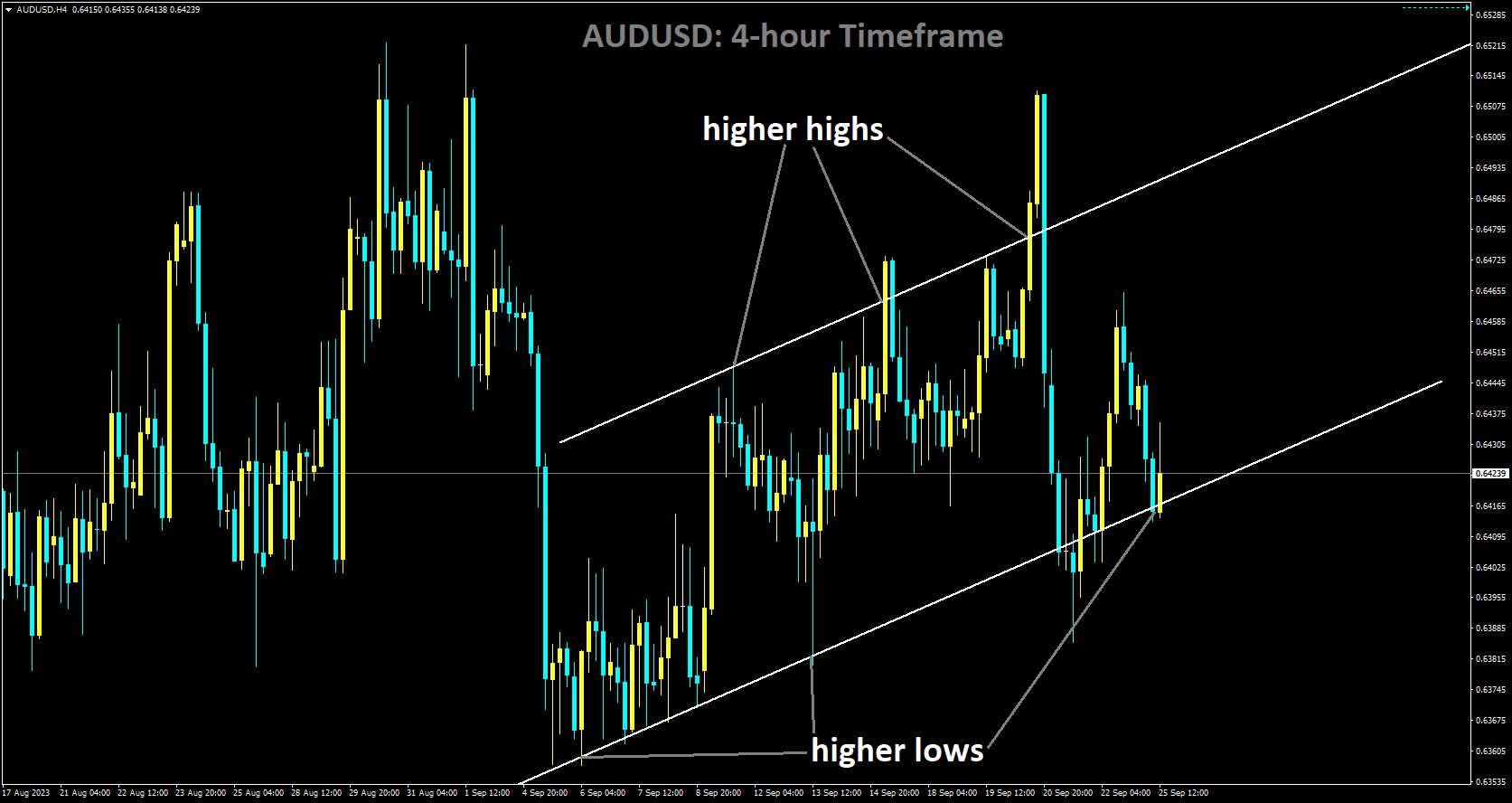

AUDUSD Analysis

AUDUSD is moving in Ascending channel and market has reached higher low area of the channel

Following the release of Australian PMI data on Friday and the weak US dollar USD, the AUDUSD pair saw upward support. On Friday, Australia’s PMI data showed a slight improvement. September’s preliminary S&P Global Services PMI was 50.5, up from August’s 47.8. The Manufacturing PMI, however, fell from 49.6 to 48.2 in the preceding reading. The Composite Index improved as well, going from 48.0 to 50.2 previously. The case for maintaining the current policy was stronger, according to the Reserve Bank of Australia’s RBA minutes from the September monetary policy meeting, even though further tightening might be necessary if inflation persists. Moreover, the overall economic outlook has not changed significantly in response to recent economic data. It is possible that the RBA’s dovish attitude is hurting the Australian pair. Also, later this week, traders will be watching Australia’s Retail Sales data and Monthly Consumer Price Index CPI.

As of this writing, the US Dollar Index DXY, which compares the value of the US dollar to six major currencies, is trading at about 105.60. The index is having difficulty gaining momentum, which may be related to market caution prior to the release of US economic data. The US economic calendar, which includes important data releases like Consumer Confidence, Durable Goods Orders, Initial Jobless Claims, and the Core PCE, the Fed’s preferred inflation indicator, will be closely watched by investors. It is anticipated that Core PCE will drop from 4.2% to 3.9% annually. These datasets will offer perceptions into the inflationary pressure and US economic conditions, which will impact the AUDUSD pair’s trading choices. But as of the time of publication, the yield on the US Treasury note maturing in 10 years had increased to 4.46%, a 0.63% increase. It is possible that the rising yields are helping the US dollar.

Additionally, remarks made by US Federal Reserve Fed Governor Michelle W. Bowman and Boston Fed President Susan Collins emphasise the need for patience and more rate hikes to control inflation, suggesting that further interest rate tightening may be necessary. Pressure on the AUDUSD pair could come from rising interest rates. There will likely be at least one more rate hike of 25 basis points by the end of the year due to the Federal Reserve’s commitment to keeping interest rates higher for an extended period of time in order to bring inflation back to its target of 2%. Furthermore, the Fed’s “dot plot” now shows only two rate hikes in 2024, as opposed to the previous prediction of four.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% FLAT OFFER for Signals 😍 GOING TO END – Get now: https://forexfib.com/discount/