GBP: UK GDP Flat at 0% MoM in April, Meeting Expectations

The UK Economy shows stagnation in the April month, came at 0.0% YoY Versus 0.40% printed in the March month. Services index came at 0.90% on 3 month basis well above 0.70% printed in the March month. Manufacturing sector sharp decline to -1.4% from -0.20%, Industrial production decline to -0.90%. Trade Balance came at -19.6 GBP Billion in the April versus -13.96 Billion GBP in the March month, -14.2 Billion is expected.

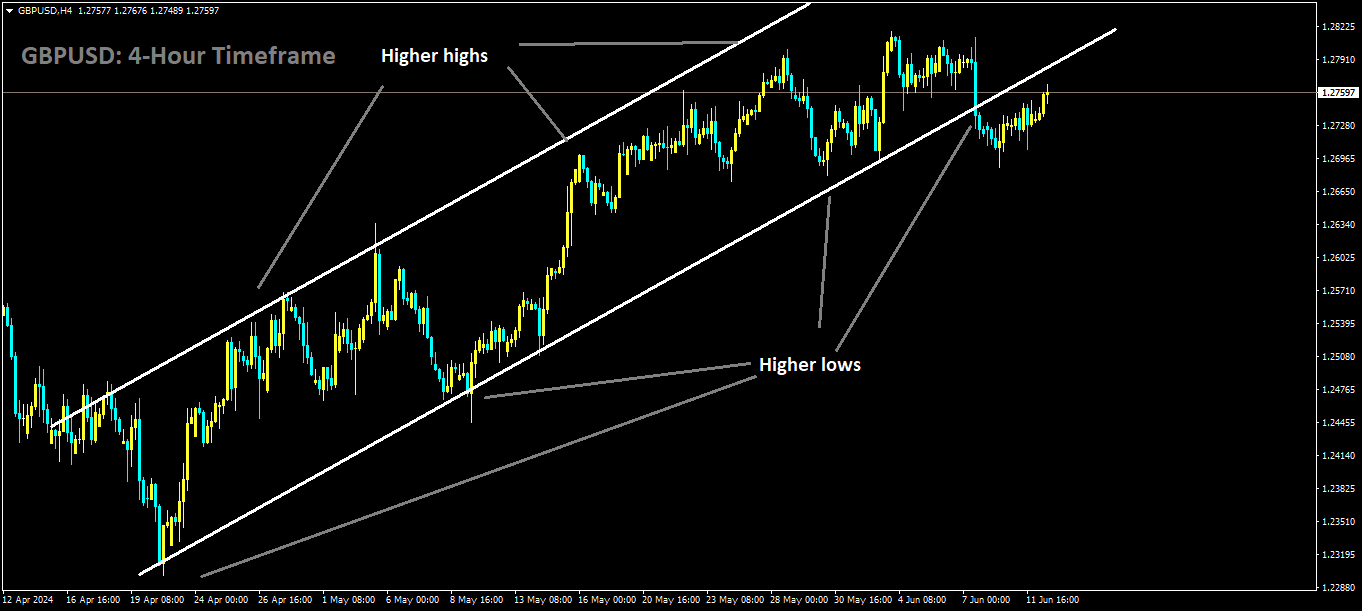

GBPUSD is moving in Ascending channel and market has reached higher low area of the channel

The UK economy stalled in April, with Gross Domestic Product (GDP) coming in flat at 0% after expanding by 0.4% in March, according to data published by the Office for National Statistics (ONS) on Wednesday. This aligns with market expectations of no growth for the reported period.

Additional highlights from the ONS data include:

Index of Services (April) : Increased by 0.9% on a three-month basis (3M/3M) compared to the 0.7% growth recorded in March and the 0.8% forecasted by markets.

Industrial Production (April) : Dropped by 0.9% month-on-month (MoM), reflecting a decline in industrial activity.

Manufacturing Production (April) : Fell by 1.4% MoM, indicating a sharper contraction in manufacturing output.

Moreover, the UK Goods Trade Balance for April showed a significant deficit, coming in at GBP-19.607 billion MoM, compared to the expected GBP-14.20 billion and the previous GBP-13.967 billion.

This mixed set of economic data highlights ongoing challenges in the UK economy, with stagnant growth, declining industrial and manufacturing output, and a widening trade deficit.

GBP: UK GDP Flatlines as PM Sunak Focuses Election Campaign on Economy

UK Economy Stagnates in April

The UK economy showed no growth in April, registering 0.0% year-on-year (YoY), following a 0.4% expansion in March, according to data released by the Office for National Statistics (ONS).

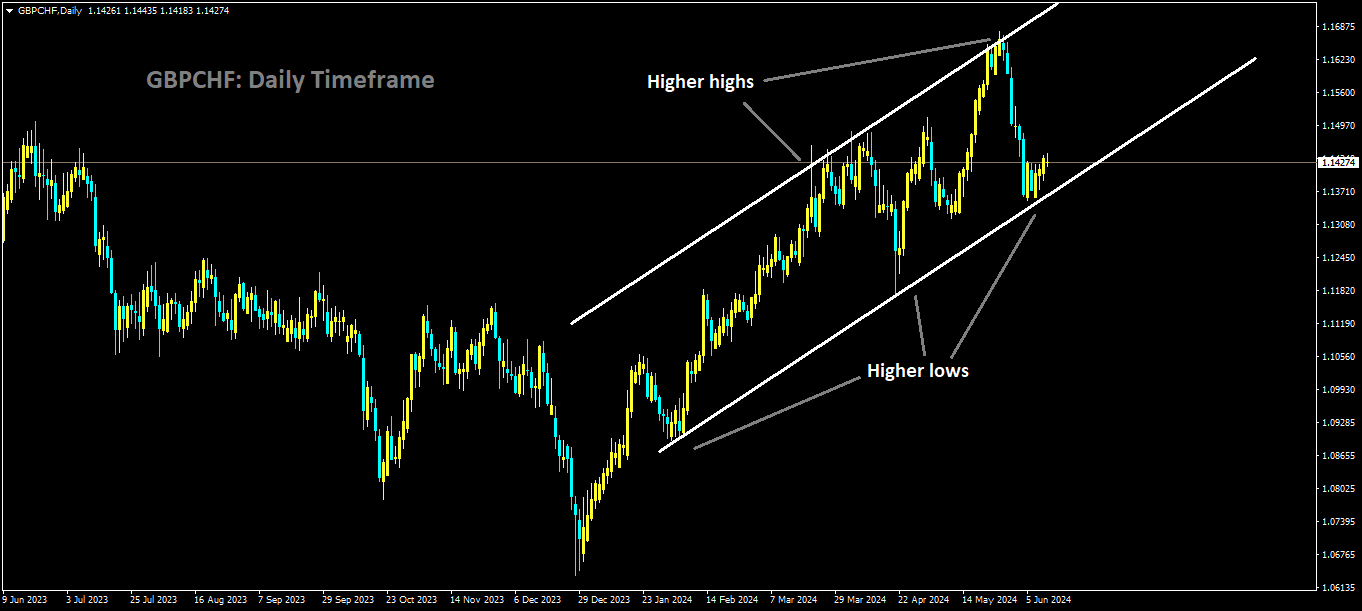

GBPCHF is moving in Ascending channel and market has reached higher low area of the channel

GDP Growth : 0.0% YoY in April, down from 0.4% in March.

Services Sector : Index rose to 0.9% on a three-month basis, up from 0.7% in March.

Manufacturing Sector : Sharp decline to -1.4% from -0.2% in the previous month.

Industrial Production : Decreased by 0.9%.

Trade Balance : Widened to a deficit of -£19.6 billion in April from -£13.96 billion in March, missing the expected -£14.2 billion.

GDP and Services Sector:

The stagnation in GDP highlights the UK’s economic struggles in maintaining momentum after the modest recovery observed in March.

The services sector showed resilience, with the services index rising to 0.9% on a three-month basis, indicating continued growth in this dominant sector of the UK economy.

Manufacturing and Industrial Production:

The manufacturing sector experienced a significant downturn, with a sharp decline to -1.4%, suggesting substantial challenges within this sector.

Industrial production also saw a decline of 0.9%, further indicating broader issues in the production industry.

Trade Balance:

The trade deficit widened significantly to -£19.6 billion, compared to -£13.96 billion in March, and much worse than the expected -£14.2 billion. This widening trade gap reflects increased imports and stagnant exports.

Implications

Monetary Policy:

The stagnation in economic growth could influence the Bank of England’s (BoE) monetary policy decisions. While the central bank is set to meet on June 20, expectations for immediate rate cuts have diminished given the mixed economic signals. Traders now anticipate potential rate cuts in August or September.

Political Impact:

The latest GDP figures are likely to become a significant point of contention in the upcoming general election, just over three weeks away. Prime Minister Rishi Sunak’s claims of economic recovery may be challenged by these stagnant figures.

Market Reactions:

The UK economy’s flat performance in April, coupled with significant declines in manufacturing and industrial production, may weigh on investor sentiment. The widening trade deficit adds to the economic concerns, potentially impacting the currency and financial markets.

Conclusion

The UK’s economic stagnation in April underscores the challenges facing the economy as it attempts to recover from previous downturns. With crucial economic data and political stakes at play, the coming weeks will be pivotal for both the economic outlook and the political landscape in the UK.

UK Economy Stalls in April Amid National Election Run-Up

The UK economy ground to a halt in April, according to flash figures published on Wednesday, stalling the muted rebound from last year’s recession just weeks ahead of a national election. Economists polled by Reuters had anticipated no growth for April, following a 0.4% expansion in March.

Key Data Highlights:

GDP: The UK’s Gross Domestic Product (GDP) remained flat in April, aligning with market expectations and indicating a stagnant start to the second quarter.

Three-Month Growth: On a longer timeframe, GDP rose by 0.7% in the three months leading up to April.

Sector Performance:

Construction: Output declined by 1.4%, marking the third consecutive monthly fall.

Production: Decreased by 0.9%.

Services: Continued to grow, expanding by 0.2%.

Factors Influencing the Economy

Lindsay James, investment strategist at Quilter Investors, attributed the April slowdown to persistent rain, which dampened consumer spending. However, she noted that improved weather conditions in May might boost economic performance for the month.

Monetary Policy Outlook

The moderate growth observed in the first quarter had initially fueled speculation about the Bank of England (BoE) beginning interest rate cuts in June. However, market expectations have shifted, with traders now anticipating potential rate cuts in August or September.

Bank of England Meeting: The BoE is set to decide on its next monetary policy steps on June 20, with a rate cut announcement unlikely for this month.

Labor Data: Recent figures showed an unexpected rise in UK unemployment to its highest level in two and a half years, coupled with higher-than-expected wage growth of 6%, presenting a mixed outlook for policymakers.

Political Implications

The economic data arrives at a critical juncture, as the UK heads into a general election in just over three weeks. The performance of the incumbent Conservative Party’s economic record versus Labour’s proposed tax and spend plans is a key campaign battleground.

Prime Minister Rishi Sunak: Highlighted the recent decline in UK inflation in his speeches, yet the flat GDP growth and challenging trade figures could pose a political challenge.

Trade Figures: Showed an 8.2% increase in the value of goods imports in April, with export values remaining flat. George Roberts, head of dealing at Ebury, remarked that these figures would be a setback for Sunak, given the financial challenges exporters have faced since Brexit, the COVID-19 pandemic, and the Ukraine war.

Labour’s Response: Rachel Reeves, Labour’s economy spokeswoman, criticized Sunak’s economic claims, pointing to the lack of growth and the economy’s stalled state.

As the election approaches, the fresh economic data will likely be leveraged by political parties to bolster their campaigns and address the nation’s economic concerns.

GBP: UK GDP Stagnates in Wet April; Global Economy Heading for Oil Glut – Business Live

Analysis of UK Economic Stagnation in April

In a disheartening development, the UK economy exhibited no growth in April, registering a 0.0% year-on-year (YoY) change, a stark contrast to the 0.4% expansion observed in March, as delineated by the Office for National Statistics (ONS).

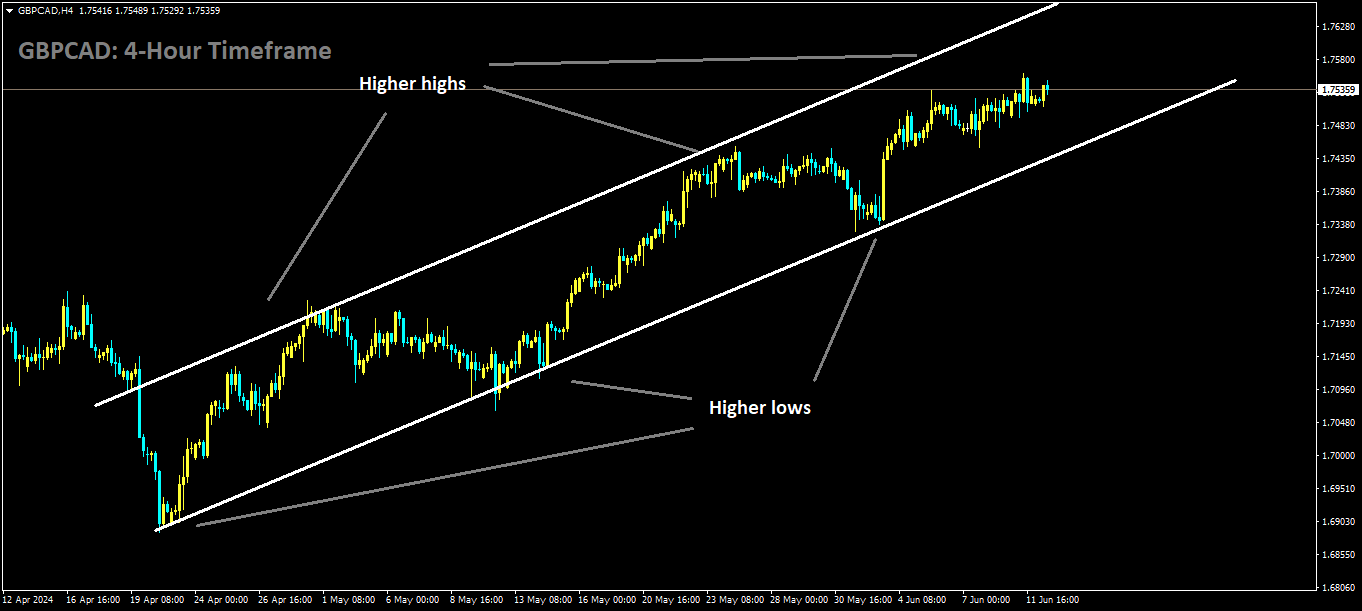

GBPCAD is moving in Ascending channel and market has rebounded from the higher low area of the channel

Key Economic Indicators:

GDP Growth: 0.0% YoY in April, down from a 0.4% increase in March.

Services Sector: The index ascended to 0.9% over a three-month period, surpassing the 0.7% recorded in March.

Manufacturing Sector: Experienced a precipitous decline to -1.4%, a substantial drop from -0.2% the prior month.

Industrial Production: Contracted by 0.9%.

Trade Balance: Expanded to a deficit of -£19.6 billion in April, a significant increase from -£13.96 billion in March, and notably worse than the anticipated -£14.2 billion.

Analytical Dissection

GDP and Services Sector:

The stagnation in GDP signifies profound economic inertia, undermining the modest recovery trajectory noted in March.

Conversely, the services sector demonstrated resilience, with the index climbing to 0.9% over a three-month timeframe, indicative of continued expansion within this pivotal sector of the UK economy.

Manufacturing and Industrial Production:

The manufacturing sector witnessed an acute downturn, plummeting to -1.4%, indicative of deep-seated structural challenges.

Similarly, industrial production experienced a decline of 0.9%, reflecting broader industrial malaise.

Trade Balance:

The trade deficit widened dramatically to -£19.6 billion, up from -£13.96 billion in March, and substantially missing the forecasted -£14.2 billion. This burgeoning trade gap underscores an imbalance driven by escalating imports juxtaposed against stagnant exports.

Ramifications

Monetary Policy:

The economic stasis could precipitate recalibrations in the Bank of England’s (BoE) monetary policy stance. The central bank’s forthcoming meeting on June 20 will be pivotal, though immediate rate cuts seem improbable amid the prevailing economic ambiguity. Market prognostications now orient towards potential rate reductions in August or September.

Political Consequences:

The latest GDP figures are poised to become a focal point of contention in the imminent general election, a mere three weeks away. Prime Minister Rishi Sunak’s narrative of economic recovery is now vulnerable to scrutiny in light of these stagnant figures.

Market Dynamics:

The economic stagnation in April, compounded by significant contractions in manufacturing and industrial production, is likely to exert downward pressure on investor sentiment. The pronounced trade deficit exacerbates economic apprehensions, with potential reverberations across currency and financial markets.

Conclusion

The UK’s economic inertia in April accentuates the formidable challenges besetting the economy in its quest for recovery from antecedent downturns. With critical economic data and heightened political stakes in play, the forthcoming weeks are poised to be decisive for both the economic trajectory and the political milieu in the UK.

UK GDP Report: April Stagnation Deals Blow to Economic Recovery Hopes

Newsflash: The UK economy stagnated in April, challenging Prime Minister Rishi Sunak’s claim that it has turned a corner.

Key Highlights:

GDP: The UK’s Gross Domestic Product (GDP) was unchanged month-on-month in April, following a 0.4% growth in March, according to the Office for National Statistics (ONS).

Expectations: This stagnation aligns with City expectations, indicating that the economy struggled to maintain momentum after exiting a recession in the first quarter of 2024.

Sector Performance:

Services : The services sector experienced growth.

Production : There was a contraction in production, which includes manufacturing.

Construction : The construction sector also saw a decline.

The April stagnation underscores the fragility of the UK’s economic recovery post-recession. Despite moderate growth in the services sector, which is the dominant component of the UK economy, contractions in production and construction indicate underlying weaknesses.

Sector Breakdown:

Services Sector: Continued to expand, contributing positively to the GDP.

Production Sector: Contracted, reflecting challenges in manufacturing and other production activities.

Construction Sector: Declined, marking a significant setback for this part of the economy.

Implications for Monetary Policy

The recent data could influence the Bank of England’s (BoE) monetary policy decisions. The central bank is set to meet on June 20 to decide the next steps.

Interest Rates : Initially, there were expectations for the BoE to consider rate cuts in June. However, given the mixed economic signals, such as the rising unemployment rate and persistent wage growth, the likelihood of immediate rate cuts has diminished. Traders now anticipate potential rate cuts in August or September.

Political Ramifications

With the general election just over three weeks away, the latest GDP figures are likely to be a focal point in political debates.

Rishi Sunak’s Claims: The stagnation in April presents a challenge to Prime Minister Sunak’s assertions that the economy is on the mend.

Opposition’s Response: Labour’s economy spokeswoman Rachel Reeves criticized the lack of growth, highlighting the need for stronger economic measures.

Trade Data

Additional data showed a mixed trade picture:

Goods Imports: Increased by 8.2% in April.

Exports: Remained flat, underscoring ongoing trade challenges.

George Roberts of Ebury pointed out that the trade figures could be a setback for the government’s efforts to boost exports post-Brexit and amid other global disruptions.

Conclusion

The latest GDP report highlights the delicate state of the UK economy as it tries to recover from recent recessions. With crucial economic data and political stakes at play, the coming weeks will be pivotal for both the economic outlook and the political landscape in the UK.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% OFFER for Trading Signals 😍 GOING TO END – Get now: https://forexfib.com/offer/