GBP: UK Retail Sales Fall 2.3% MoM in April, Surprising Expectations

The UK retail sales for the month of April came at -2.3% MoM versus -0.40% decline expected and -0.20% decline in the last month, Core Retail sales came at -2.0% MoM versus -0.60% in the March. YoY decline to -2.7% in the April month versus 0.40% increase in the March month and Core YoY data declined to -3.0%. GBP Down after the Retail sales figures tremendous sharp fall in the market.

GBPUSD is moving in Symmetrical Triangle and market has reached lower high area of the pattern

According to the latest data released by the Office for National Statistics (ONS) on Friday, retail sales in the UK experienced a notable decline in April. Specifically, retail sales dropped by 2.3% over the month, a significant deviation from the expected decrease of 0.4%. This decline follows a smaller decrease of 0.2% recorded in March.

When excluding auto motor fuel sales to analyze core retail sales, the situation remained bleak. Core retail sales fell by 2.0% month-on-month in April, compared to a decline of 0.6% in March and against market expectations of a decrease of 0.6%.

On an annual basis, retail sales in the United Kingdom saw a substantial decrease of 2.7% in April compared to the previous month’s increase of 0.4%. Similarly, core retail sales experienced a decline of 3.0% in April, contrasting with the previous month’s flat growth. Both of these figures fell short of market expectations.

GBP: Rain Drives Sharp Drop in UK Retail Sales for April

UK retail sales for April saw a sharp decline, coming in at -2.3% month-on-month (MoM), significantly worse than the anticipated -0.4% drop and following a revised -0.2% decline in March. Core retail sales, excluding auto motor fuel, fell by 2.0% MoM compared to a 0.6% decline in March. Year-on-year (YoY), retail sales decreased by 2.7% in April, a dramatic shift from the 0.4% increase recorded in March. Core retail sales also saw a YoY decline of 3.0%.

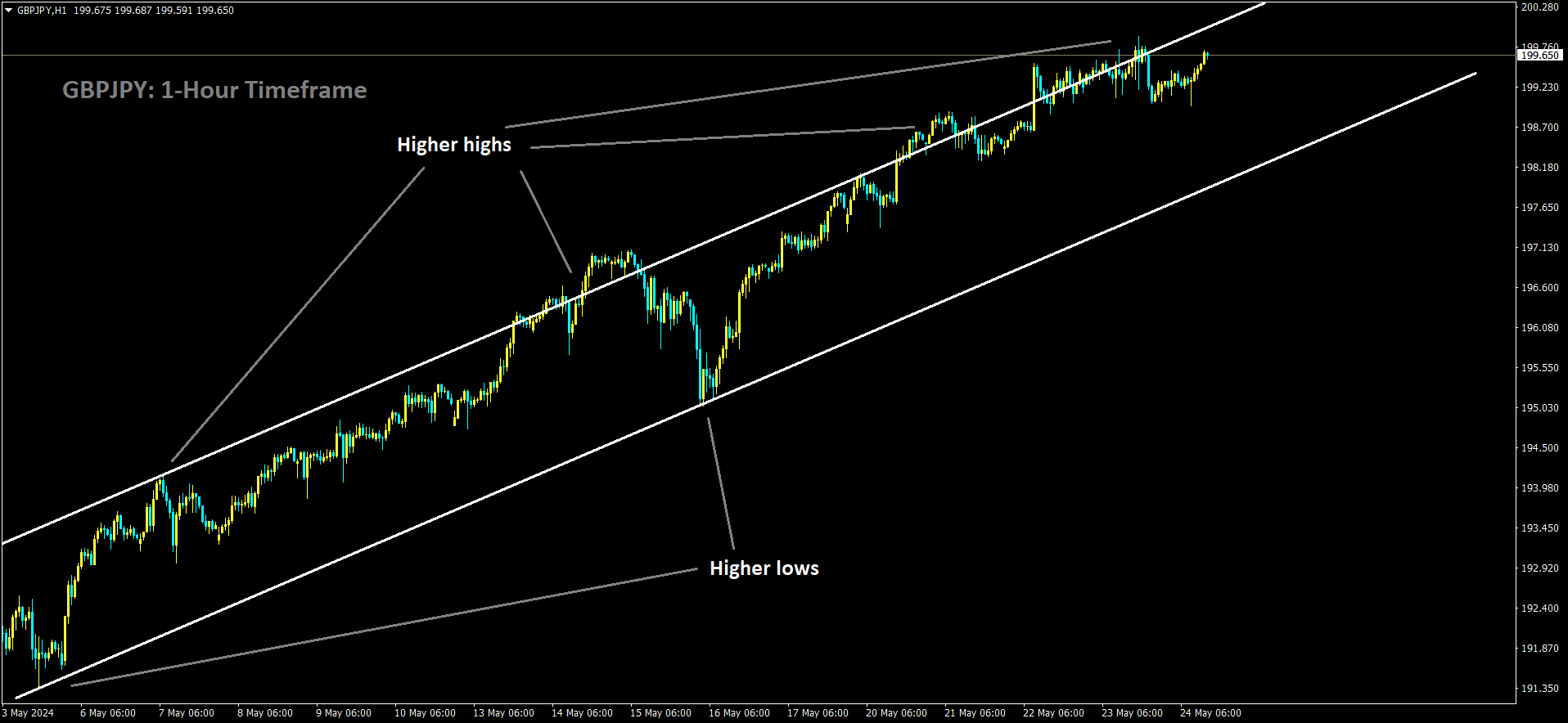

GBPJPY is moving in Ascending channel and market has reached higher high area of the channel

The British Pound (GBP) dropped sharply in response to these figures, reflecting market disappointment over the unexpectedly steep fall in retail sales. This downturn highlights the economic challenges the UK is currently facing, impacting consumer confidence and spending.

British retail sales fell sharply in April, far exceeding expectations, as rainy weather kept shoppers away. This presents a mixed economic picture for Prime Minister Rishi Sunak ahead of the national election, according to data released on Friday. Sales volumes decreased by 2.3% in April, following a revised 0.2% decline in March, which had initially been reported as flat, according to the Office for National Statistics (ONS). The drop was more severe than any economist had predicted in a Reuters poll, which had forecast a 0.4% decline.

Despite this setback, there were some positive economic indicators. Market research firm GfK reported that consumer confidence rose in May to its highest level in nearly two and a half years, though business surveys released on Thursday were less encouraging. Sunak, whose Conservative Party is trailing in opinion polls ahead of the July 4 election, is trying to convince voters that the economy is recovering after a recession in the latter half of 2023.

“Sales volumes fell across most sectors, with clothing retailers, sports equipment, games and toys stores, and furniture stores doing badly as poor weather reduced footfall,” the ONS reported. The agency adjusted the figures to account for the earlier Easter holiday this year, which shifted some spending to March.

Analysts remain hopeful for future months. “Retailers will be hoping that the better weather in May and the start of a summer of sport with the Euros, Wimbledon, and the Olympics will boost trading after a disappointing start to 2024,” said Lisa Hooker, leader of Industry for consumer markets at PwC.

Despite the gloomy April data, some major retailers have shown positive results. Marks & Spencer reported a 58% rise in annual profit, and Next expressed optimism about future prospects after predicting a recovery in consumer sentiment.

However, home improvement stores reported weakening demand. Compared to a year ago, April sales were 2.7% lower, far below the consensus forecast of a 0.2% drop. Surveys from Barclays and the British Retail Consortium earlier in the month indicated that consumers remained cautious with their spending in April. Excluding petrol, sales volumes fell by 2.0% in April, according to the ONS.

GBP: British Retail Sales Drop 2.3% in April, Miss Estimates

UK retail sales for April showed a significant decline, dropping by 2.3% month-on-month (MoM), far worse than the expected 0.4% decline and following a 0.2% decline in March. Core retail sales, which exclude auto motor fuel sales, fell by 2.0% MoM, compared to a 0.6% decrease in March. On a year-on-year (YoY) basis, retail sales decreased by 2.7% in April, a stark contrast to the 0.4% increase seen in March. Core retail sales also saw a YoY decline of 3.0%.

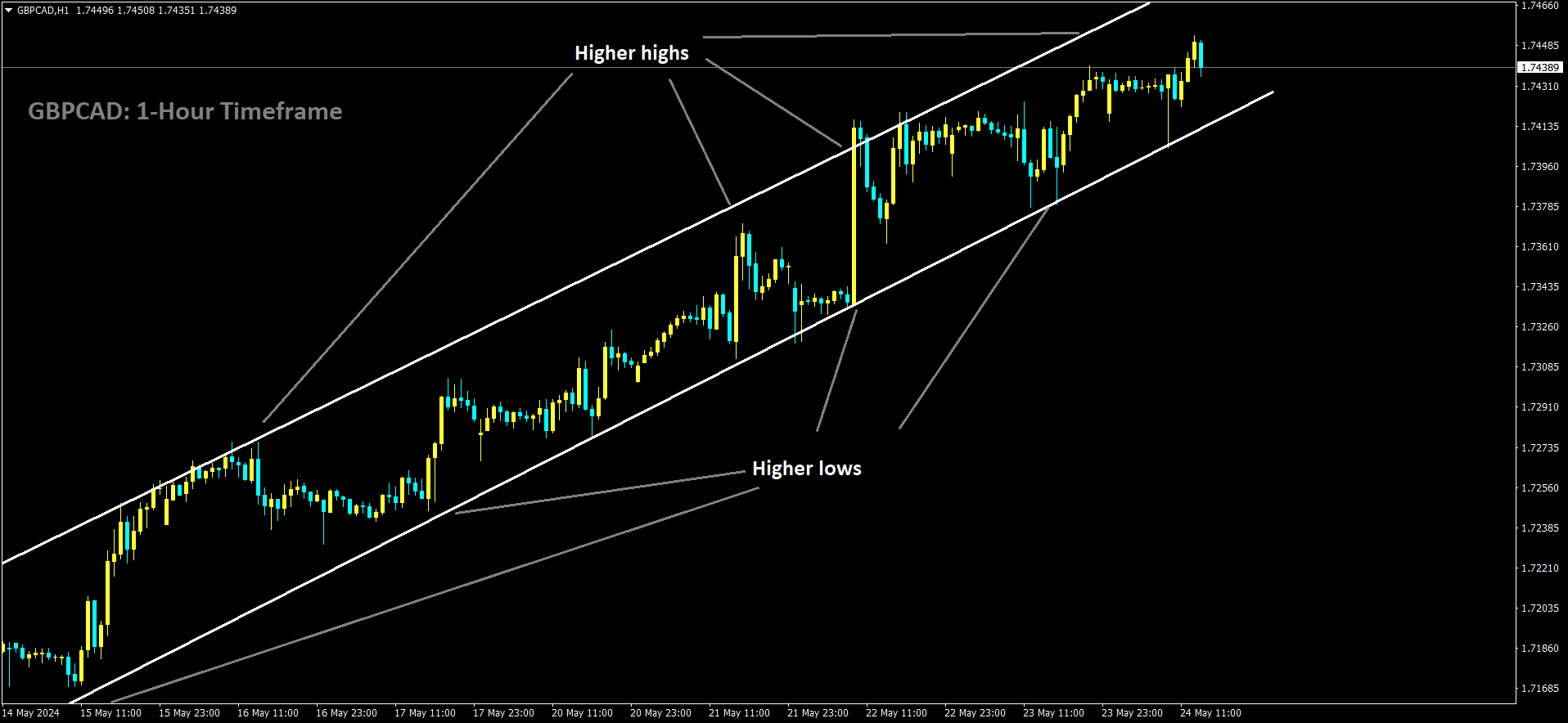

GBPCAD is moving in Ascending channel and market has reached higher high area of the channel

The British Pound (GBP) reacted negatively to these figures, experiencing a sharp fall in the market following the release of the disappointing retail sales data. This significant downturn in retail performance underscores the challenges facing the UK economy and has added pressure on the currency.

U.K. retail sales volumes dropped by 2.3% in April due to wet weather that deterred shoppers, the Office for National Statistics (ONS) reported on Friday. Economists surveyed by Reuters had predicted a smaller decline of 0.4%.

According to the ONS, “Sales volumes fell across most sectors, with clothing retailers, sports equipment stores, games and toys stores, and furniture stores performing poorly as poor weather reduced footfall.” The figure for March was revised from flat to a 0.2% decline.

Over the three months leading up to April, sales were up by 0.7% compared to the previous three months, following a weak December and holiday season. However, sales were down 0.8% compared to the same period last year.

Kris Hamer, director of insight at the British Retail Consortium, highlighted some positive trends in the data, specifically in the sales of cosmetics and computers. “With summer around the corner, and inflation fast approaching the Bank of England’s 2% target, retailers are hopeful that consumer confidence will improve, and spending will pick up once again,” Hamer stated in a note.

Consumer confidence did indeed improve in May, both in terms of personal finances and the broader economic outlook, according to a survey released by GfK on Friday.

Headline inflation in the U.K. decreased to 2.3% in April from 3.2%, as reported on Wednesday. However, persistent core and services inflation led markets to postpone expectations for the first Bank of England interest rate cut from June to August or September.

Phil Monkhouse, U.K. country manager at financial services firm Ebury, commented that the surprise General Election announced for July 4 might introduce “fresh uncertainty” for consumers who are already grappling with higher interest rates. Preparing for the warmer weather, ensuring ready access to finance, and establishing hedging arrangements will be essential for retailers wanting to navigate any future sales volatility.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% OFFER for Trading Signals 😍 GOING TO END – Get now: https://forexfib.com/offer/