Importance of Central Banks in the Forex Market: Here, we highlight the significance of central banks in the forex market and why their actions and decisions have a substantial impact on exchange rates and overall economic stability.

1) Exchange Rate Management by Central Banks

Exchange rate management refers to the actions and policies implemented by central banks to influence the value of their country’s currency relative to other currencies in the foreign exchange market. Central banks have various exchange rate regimes to choose from, including flexible exchange rates, fixed exchange rates, and managed float exchange rates. They use monetary policy tools, such as interest rates, as well as fiscal policy measures and capital controls, to achieve their exchange rate objectives.

1.1 Flexible Exchange Rate Regime

This section describes the flexible exchange rate regime, where exchange rates are determined by market forces without direct intervention from central banks.

1.2 Fixed Exchange Rate Regime

In contrast, a fixed exchange rate regime involves central banks pegging their currency to a specific value against another currency or a basket of currencies.

1.2 Managed Float Exchange Rate Regime

A managed float exchange rate regime is a hybrid approach, where central banks intervene occasionally to influence exchange rates while still allowing market forces to play a role.

1.3 Advantages and Disadvantages of Different Exchange Rate Regimes

This part discusses the pros and cons of each exchange rate regime, including their impact on trade, economic stability, and policy flexibility.

2) Central Bank Policies Affecting Exchange Rates

Central banks have a range of policies at their disposal that can impact exchange rates. Monetary policy, through changes in interest rates or money supply, can influence the attractiveness of a currency to investors and traders, affecting its value in the forex market. Capital controls and exchange restrictions are used to manage capital flows and stabilize the exchange rate during times of economic volatility.

2.1 Monetary Policy and Interest Rates

This section explains how central banks use monetary policy tools, such as interest rates, to influence exchange rates and overall economic conditions.

2.2 Capital Controls and Exchange Restrictions

Capital controls and exchange restrictions are measures taken by central banks to manage capital flows and stabilize their currency. This part explores their role in exchange rate management.

2.3 Fiscal Policy and Exchange Rates

Here, we discuss how fiscal policy decisions, such as government spending and taxation, can impact exchange rates.

2.4 Inflation Targeting and Exchange Rate Implications

Inflation targeting is a strategy employed by central banks to maintain price stability. This section examines its effects on exchange rates.

3) Foreign Reserve Accumulation and Management

Foreign reserve accumulation refers to the process of central banks acquiring foreign currencies and other assets denominated in foreign currencies. These reserves serve as a cushion against economic shocks and help stabilize exchange rates. Foreign reserves can be accumulated through various strategies, such as trade surpluses, foreign direct investments, or borrowing. Central banks must carefully manage their foreign reserves to ensure they are adequate to maintain financial stability and to diversify their holdings to mitigate risks.

3.1 The Importance of Foreign Reserves

Foreign reserves are assets held by central banks, primarily denominated in foreign currencies. This section elaborates on their significance for economic stability.

3.2 Reserve Accumulation Strategies

Different approaches to accumulating foreign reserves are discussed here, along with the reasons behind reserve accumulation.

3.3 Diversification of Reserve Holdings

Central banks may hold various foreign currencies as part of their reserves. This part explains the rationale behind diversifying reserve holdings.

3.4 Challenges in Managing Foreign Reserves

Managing foreign reserves comes with challenges, such as determining the optimal level and handling risks associated with reserve holdings.

4) Central Bank Interventions in the Forex Market

Central bank interventions in the forex market refer to the deliberate actions taken by central banks to influence exchange rates. These interventions can be of two types: sterilized and non-sterilized. Sterilized interventions involve offsetting the impact on domestic money supply to prevent inflationary or deflationary effects. Non-sterilized interventions do not offset the impact on money supply.

Types of Intervention

This section presents various intervention strategies employed by central banks to influence exchange rates, such as direct market interventions or verbal interventions.

4.1 Sterilized and Non-Sterilized Interventions

Central bank interventions can be sterilized or non-sterilized, depending on whether they offset the impact on domestic money supply. We delve into the differences between the two.

4.2 Impact of Interventions on Exchange Rates

Here, we analyze the effectiveness of central bank interventions in achieving their exchange rate objectives and their short-term and long-term effects.

4.3 Effectiveness and Limitations of Interventions

This part discusses the effectiveness of central bank interventions and the challenges they may face in achieving desired outcomes.

5) Case Studies of Central Bank Interventions

In this section, we delve into specific case studies of central bank interventions in the forex market, focusing on real-world examples of how central banks have intervened to influence exchange rates in different countries. The case studies may include

5.1 Swiss National Bank and the Swiss Franc

A case study of the Swiss National Bank’s efforts to manage the appreciation of the Swiss Franc and its impact on the Swiss economy and export competitiveness.

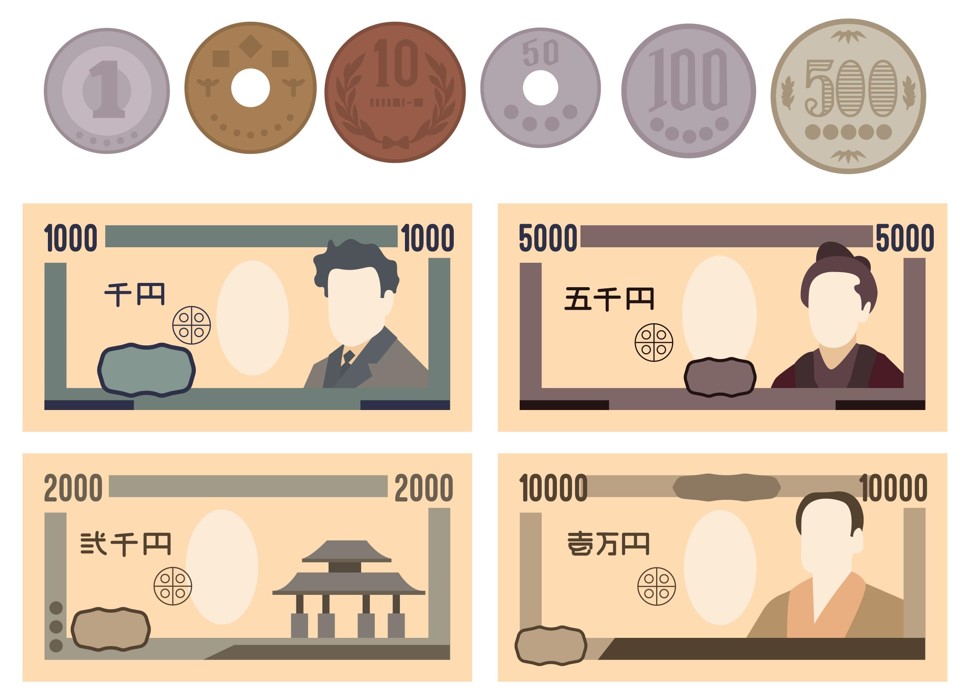

5.2 Bank of Japan and the Yen

An examination of the Bank of Japan’s interventions to control the volatility of the Japanese Yen and stimulate economic growth.

5.2 People’s Bank of China and the Renminbi

This case study looks at the actions taken by the People’s Bank of China to manage the value of the Renminbi and its implications for China’s trade and global economic dynamics.

5.3 European Central Banks and the Euro

An analysis of the European Central Bank’s interventions in the forex market to stabilize the Euro and address economic challenges within the Eurozone.

6) Central Banks and Exchange Rate Volatility

In this section, we explore the role of central banks in managing exchange rate volatility, which can have significant implications for trade, investment, and economic stability.

6.1 Controlling Excessive Volatility

How central banks use various policy tools to curb excessive exchange rate fluctuations that could disrupt economic conditions.

6.2 Financial Stability Concerns

The potential risks posed by exchange rate volatility to financial institutions and overall financial stability, and how central banks address such concerns.

6.2 Cooperation among Central Banks to Manage Volatility

The importance of coordination and collaboration between central banks in managing global exchange rate volatility and addressing systemic risks.

7) Central Banks’ Role in Currency Crises

This section examines the central banks’ response to currency crises, which occur when there is a sudden and severe devaluation of a country’s currency.

7.1 Identifying Currency Crises

How central banks and policymakers identify early warning signs of currency crises.

7.2 Crisis Management and Containment

The actions taken by central banks to stabilize exchange rates and restore market confidence during a currency crisis.

7.2 Lessons Learned from Past Currency Crises

An analysis of past currency crises and the lessons central banks have gleaned from these events to better manage future crises.

An analysis of past currency crises and the lessons central banks have gleaned from these events to better manage future crises.

8) The Impact of Central Banks Communication on Exchange Rates

This section explores the influence of central bank communication on exchange rates and market expectations. The subheadings might include

8.1 Forward Guidance and Market Expectations

How central banks’ forward guidance on future policy actions can shape market expectations and impact exchange rates.

How central banks’ forward guidance on future policy actions can shape market expectations and impact exchange rates.

8.2 Verbal Interventions and Their Effects

The use of verbal interventions by central bank officials to influence exchange rates and the potential outcomes of such communications.

8.2 Transparency and Predictability in Central Bank Communication

The importance of transparent and predictable communication from central banks to enhance market confidence and stability.

9) Implications of Central Banks Actions in the Forex Market

This section examines the broader consequences of central bank actions in the forex market, including their effects on the economy and financial markets.

9.1 Effects on Trade Balance

How central bank interventions impact a country’s trade balance and international competitiveness.

9.2 Capital Flows and Investment

The influence of central bank policies on capital flows and foreign investment in the country.

9.2 Global Currency Market Dynamics

The role of central banks in shaping global currency market dynamics and their relationships with other major currencies.

10) Challenges and Criticisms of Central Banks Involvement in Forex Markets

This section examines the criticisms and challenges faced by central banks in their role in the forex market. The subheadings may include

10.1 Moral Hazard Concerns

The risk of moral hazard associated with central bank interventions and their potential implications for market participants.

10.2 Manipulation Accusations

Instances where central banks have been accused of currency manipulation and the controversies surrounding such claims.

10.2 Independence and Credibility

The importance of central bank independence and credibility in their actions within the forex market.

10.3 Critiques of Exchange Rate Policies

Different perspectives on central bank exchange rate policies and the debates surrounding their effectiveness and appropriateness.

Conclusion

In the concluding section, we summarize the key points discussed in the paper and offer insights into the future challenges and directions for central banks’ roles in the foreign exchange market.

❌ Stop trying to catch every 📊 movement in the market 😎 Look for the best entry – Get more best entry signals at premium or VIP plan

🎁 60% OFFER for Signals 😍 GOING TO END – Get now:forexfib.com/offer/