Unveiling the Truth: Is Forex Trading a Scam or A Gateway to Financial Freedom?

In the vast ocean of financial opportunities, Forex trading stands out as a beacon to many aspiring traders, promising a path to financial independence with the allure of flexible hours and the potential for significant profits. However, this same allure also raises questions and skepticism. Is Forex trading a genuine opportunity for financial freedom, or is it cloaked in the guise of a scam? This article dives deep into the heart of Forex trading, exploring its intricacies, challenges, and potential rewards, all while maintaining a conversational tone to demystify the complex world of currency trading.

Understanding Forex Trading

Before we unravel the mystery, let’s get grounded in what Forex trading actually entails. Forex, short for foreign exchange, is the marketplace where currencies are traded 24 hours a day, five days a week. It’s a global, decentralized arena that sees a staggering daily volume, making it the largest financial market in the world.

Why Forex Attracts Traders

The appeal of Forex trading lies in its accessibility. With a computer and internet connection, anyone from anywhere can potentially profit from the fluctuations in currency values. The market’s vast liquidity means trades can be executed quickly and at a desired price, which is a big tick for those looking to dive in. Moreover, the ability to leverage allows traders to control large positions with a relatively small amount of capital, magnifying potential gains (and losses).

The Promise of Financial Freedom

A Dream for Many

The prospect of financial freedom is a powerful motivator. Forex trading, with its round-the-clock operation and global reach, promises just that. Stories of traders turning modest investments into substantial wealth feed the dream, painting Forex trading as a gateway to breaking free from the 9-to-5 grind.

But, Is It All Roses?

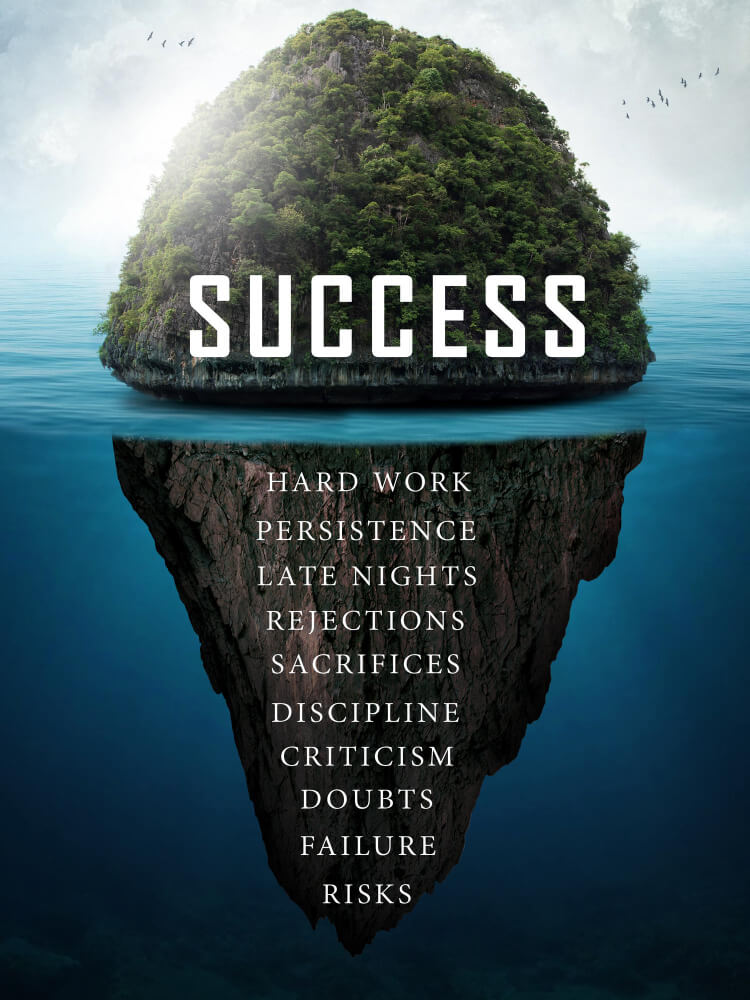

However, achieving financial freedom through Forex is not as straightforward as it may seem. The market’s volatility can turn fortunes just as quickly as it makes them. Successful trading requires a deep understanding of market trends, economic factors, and a solid trading strategy. It’s not a lottery ticket but a serious undertaking that demands time, education, and emotional discipline.

The Scam Perception

Where the Skepticism Stems From

Forex trading’s scam perception doesn’t emerge from thin air. The market is rife with unscrupulous brokers and misleading get-rich-quick schemes that prey on the uninformed and the hopeful. This, coupled with high leverage options that can lead to rapid losses, paints a target on Forex trading for scams.

Separating Wheat from Chaff

The key to navigating the murky waters of Forex is due diligence. Regulated brokers, transparent operations, and a commitment to educating oneself significantly reduce the risk of falling prey to scams. It’s about separating legitimate trading opportunities from the too-good-to-be-true promises.

The Reality of Forex Trading

A Double-Edged Sword

Forex trading is a double-edged sword. On one edge, it offers the potential for significant profits through strategic trades. On the other, it harbors the risk of substantial losses, especially for those who dive in without proper preparation or understanding of market dynamics.

The Importance of Education and Strategy

The difference between success and failure in Forex trading often boils down to education and strategy. Understanding market analysis, risk management, and emotional control are foundational to navigating Forex successfully. It’s not just about making trades; it’s about making informed decisions.

Success Stories: The Other Side of the Coin

Real People, Real Profits

Amidst the tales of losses and scams, there are genuine success stories. Individuals who have taken the time to learn the ropes, practice discipline, and develop a clear trading strategy have seen remarkable returns. These stories serve as a beacon, illustrating that while Forex trading is not a guaranteed pathway to riches, it is a viable one to financial freedom for those who approach it wisely.

What Sets Them Apart

The common thread among successful Forex traders is their approach. They treat trading as a business, investing in their education, meticulously planning their trades, and adhering to strict risk management rules. Patience, persistence, and a willingness to learn from mistakes are their trademarks.

Forex Trading Tools and Resources

Leveraging Technology

Technology plays a pivotal role in modern Forex trading. Trading platforms, analytical tools, and educational resources are more accessible than ever, leveling the playing field for individual traders. Utilizing these tools effectively can enhance decision-making and strategy development.

The Role of Community

The Forex trading community is an invaluable resource. Forums, webinars, and social media groups offer opportunities to learn from experienced traders, share strategies, and gain support. This sense of community is vital, especially when navigating the highs and lows of trading.

Risk Management: The Key to Longevity

Understanding Leverage

Leverage can be a powerful tool, allowing traders to amplify their trading capacity. However, it’s a double-edged sword that can also amplify losses. Understanding and managing leverage is crucial to maintaining a sustainable trading career.

Diversification and Limits

Diversification across currency pairs and setting strict stop-loss orders are fundamental risk management strategies. They help mitigate losses and protect profits, ensuring that traders can stay in the game for the long haul.

The Path to Becoming a Successful Forex Trader

Education is the Foundation

The journey to becoming a successful Forex trader starts with education. Understanding the market’s mechanics, how to analyze currency movements, and the impact of global economic events are crucial. Numerous online courses, books, and workshops are available to build this foundation.

Practice Makes Perfect

Utilizing demo accounts to practice trading strategies without financial risk is a valuable step. These accounts simulate real trading conditions, providing a sandbox for honing skills and building confidence before committing real capital.

Conclusion

Forex trading is neither a guaranteed scam nor a surefire ticket to financial freedom. Like any investment, it comes with its risks and rewards. The difference lies in the approach. Armed with education, a solid strategy, and a disciplined mindset, Forex trading can be a legitimate pathway to achieving financial independence. However, entering the market with unrealistic expectations or without preparation opens the door to disappointment and potential financial loss. As with any endeavor, success in Forex trading is achieved through hard work, patience, and continuous learning.

FAQs

1. Can anyone start Forex trading?

Yes, anyone with a computer, internet connection, and a small amount of capital can start Forex trading. However, succeeding in Forex trading requires more than just opening an account; it demands education, strategy, and risk management.

2. How much money do I need to start Forex trading?

The amount of money needed to start Forex trading varies. Some brokers offer accounts that can be opened with as little as $50, but trading effectively typically requires more capital. Starting with a few thousand dollars is more realistic for managing risk and applying meaningful trading strategies.

3. Are there regulated Forex brokers?

Yes, there are many regulated Forex brokers. These brokers are overseen by regulatory authorities that ensure they adhere to specific standards and practices, offering traders a layer of protection. Always choose a regulated broker to reduce the risk of scams.

4. How do I avoid Forex trading scams?

To avoid Forex trading scams, choose regulated brokers, be wary of promises of guaranteed returns, and invest in your Forex education. Remember, if something sounds too good to be true, it probably is.

5. Can Forex trading be a full-time job?

Yes, Forex trading can be a full-time job for some individuals. However, making a consistent income through trading requires significant knowledge, experience, and discipline. It’s not an easy path and involves considerable risk.