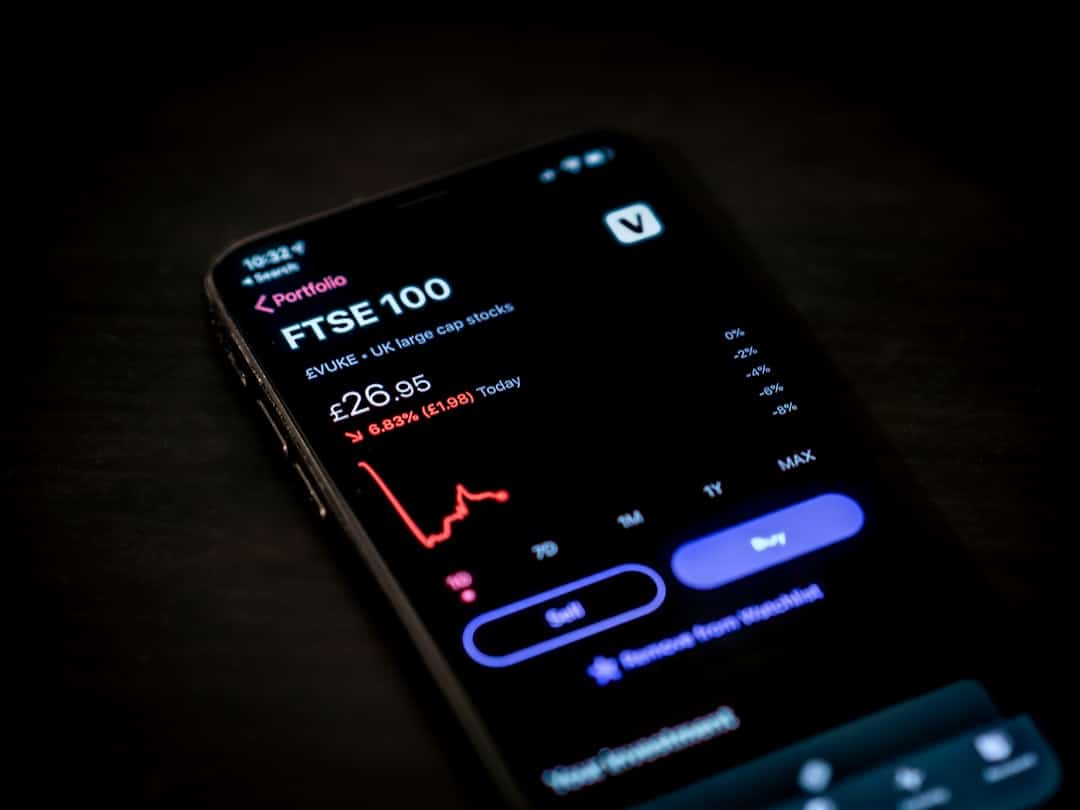

Currency in Chaos: Unveiling the Impact of Political Events on Forex Markets

In the complex and ever-evolving world of finance, the foreign exchange (Forex) market stands out as a dynamic arena where currencies from around the globe engage in a perpetual dance of value fluctuations. The Forex market is highly sensitive to a myriad of factors, with political events playing a pivotal role in shaping its landscape. Political upheavals, elections, trade agreements, and geopolitical tensions can send shockwaves through the Forex market, causing significant volatility and impacting the value of currencies worldwide. Understanding how political events influence Forex markets is crucial for traders, investors, and anyone seeking to navigate the intricate web of global finance.

The Political Pendulum: Shifting Tides in Forex Markets

Political events have a profound impact on Forex markets, often serving as catalysts for rapid and substantial changes in currency values. Elections, for instance, are a prime example of how political uncertainty can trigger volatility in the Forex market. As voters head to the polls to elect their leaders, currency traders brace themselves for potential turbulence. The outcome of an election can lead to a shift in economic policies, trade agreements, and overall market sentiment, all of which reverberate through the Forex market.

Moreover, political instability in a country can significantly weaken its currency. When governments face internal strife, protests, or leadership crises, investors lose confidence in the country’s economic prospects, leading to a sell-off of its currency. This phenomenon is often referred to as “flight to safety,” where investors flock to more stable currencies, such as the US dollar or the Swiss franc, during times of political turmoil. The depreciation of a nation’s currency due to political instability can have far-reaching consequences on its economy, trade relationships, and overall financial health.

The Domino Effect: Global Ramifications of Political Events

Political events are not isolated occurrences; they have a domino effect that ripples across borders and continents, influencing Forex markets on a global scale. Trade agreements, for example, play a crucial role in shaping currency values. When countries engage in trade negotiations or impose tariffs on each other, the Forex market reacts swiftly to assess the potential impact on economic growth, trade volumes, and currency valuations. The ongoing trade tensions between the United States and China, for instance, have sent shockwaves through the Forex market, with the US dollar and Chinese yuan experiencing significant fluctuations in value.

Geopolitical tensions also have a profound impact on Forex markets. Conflicts, diplomatic crises, and military confrontations can create uncertainty and risk aversion among investors, leading to a flight to safe-haven currencies. The recent geopolitical tensions in the Middle East, for instance, have caused fluctuations in oil prices, which, in turn, have influenced the value of currencies in oil-exporting countries. Understanding the interconnected nature of political events and their impact on Forex markets is essential for traders seeking to navigate the complexities of the global financial system.

Navigating the Storm: Strategies for Trading in Turbulent Times

In the midst of political chaos and market uncertainty, Forex traders must employ strategic approaches to mitigate risks and capitalize on opportunities. Risk management is paramount in volatile market conditions, as sudden fluctuations in currency values can lead to significant losses if not managed effectively. Setting stop-loss orders, diversifying portfolios, and staying informed about political developments are essential strategies for traders looking to weather the storm of political events.

Moreover, fundamental analysis plays a crucial role in understanding how political events influence currency values. By monitoring economic indicators, political developments, and central bank policies, traders can gain insights into the factors driving currency movements. Technical analysis, which involves studying historical price data and chart patterns, can also help traders identify potential trends and entry/exit points in the Forex market. Combining fundamental and technical analysis provides traders with a comprehensive toolkit for navigating the complexities of political events in the Forex market.

The Power of Perception: Market Sentiment and Political Events

Market sentiment, often driven by perceptions of political events, plays a significant role in shaping Forex markets. Traders’ attitudes towards political developments, such as elections, policy announcements, or geopolitical tensions, can influence currency values in profound ways. Positive news, such as a successful trade agreement or a stable political environment, can boost investor confidence and strengthen a country’s currency. Conversely, negative news, such as a leadership crisis or escalating conflict, can lead to risk aversion and a depreciation of the country’s currency.

Understanding market sentiment and the psychological factors that drive currency movements is essential for Forex traders seeking to anticipate market trends and make informed decisions. Sentiment analysis, which involves gauging the collective mood of market participants through social media, news sources, and economic indicators, can provide valuable insights into how political events are shaping investor perceptions. By staying attuned to market sentiment and adapting their trading strategies accordingly, traders can position themselves to capitalize on opportunities in the Forex market.

The Ripple Effect: Economic Indicators and Political Events

Economic indicators play a critical role in assessing the impact of political events on Forex markets. Key indicators, such as GDP growth, inflation rates, employment data, and central bank policies, provide valuable insights into the health of an economy and its currency. Political events, such as elections or policy announcements, can influence these economic indicators, leading to fluctuations in currency values.

For example, a country’s central bank may adjust its interest rates in response to political developments, which can impact the value of its currency. Similarly, changes in government policies, such as fiscal stimulus measures or trade agreements, can have ripple effects on economic indicators and currency values. By monitoring economic indicators in conjunction with political events, traders can gain a comprehensive understanding of the factors driving currency movements and make informed trading decisions.

The Balancing Act: Hedging Against Political Risk

Hedging against political risk is a key strategy for Forex traders looking to protect their investments in the face of uncertainty. Political events, such as elections, referendums, or geopolitical tensions, can trigger unexpected market fluctuations, leading to potential losses for traders. Hedging involves taking positions that offset the risk of adverse movements in currency values, thereby safeguarding against potential losses.

One common hedging strategy is to use options contracts, which give traders the right, but not the obligation, to buy or sell a currency at a specified price within a set timeframe. By using options contracts to hedge against political risk, traders can limit their exposure to market volatility and protect their investments from adverse currency movements. Hedging strategies can vary in complexity and risk tolerance, so it is essential for traders to assess their individual risk profiles and financial goals when implementing hedging techniques.

Conclusion

In conclusion, political events exert a profound influence on Forex markets, shaping currency values and market sentiment in complex ways. Elections, trade agreements, geopolitical tensions, and economic indicators all play a role in driving volatility and opportunity in the Forex market. By understanding how political events impact currency values and employing strategic approaches to navigate market turbulence, traders can position themselves to capitalize on opportunities and mitigate risks. The interconnected nature of political events and Forex markets underscores the importance of staying informed, adapting to changing conditions, and leveraging tools and strategies to navigate the complexities of global finance.

FAQs:

- How do political events impact Forex markets?

Political events, such as elections, trade agreements, and geopolitical tensions, can trigger volatility in Forex markets by influencing market sentiment, economic indicators, and currency values. - What strategies can traders use to navigate political events in the Forex market?

Traders can employ risk management techniques, fundamental and technical analysis, sentiment analysis, and hedging strategies to mitigate risks and capitalize on opportunities during turbulent times. - Why is market sentiment important in Forex trading?

Market sentiment, driven by perceptions of political events and economic indicators, influences currency values and trader behavior, shaping market trends and opportunities. - How can traders hedge against political risk in the Forex market?

Traders can hedge against political risk by using options contracts, diversifying portfolios, setting stop-loss orders, and staying informed about political developments that could impact currency values. - What role do economic indicators play in assessing the impact of political events on Forex markets?

Economic indicators, such as GDP growth, inflation rates, and central bank policies, provide valuable insights into the health of an economy and its currency, helping traders gauge the impact of political events on currency values.